Actual and legal address - what is it?

The registered address of an LLC and other forms of company represents the location of its governing body, which is listed in their articles of incorporation. According to it, this organization will be registered in the Unified State Register of Legal Entities.

If in the future the address of the legal entity is changed, it will be necessary to make appropriate adjustments to the constituent documents and to the register. The law obliges organizations, when the legal address of an LLC changes, to notify the Federal Tax Service about this within three days.

The legal address for registering an LLC can be indicated at the location of the property of the future company, residence or registration of one of the founders, rental of premises, etc. Moreover, in the latter case, it must be confirmed by issuing a document such as a letter of guarantee for the provision of a legal address.

The company may have an actual address for carrying out its activities. This is where the workplaces of the organization's employees are located. It is selected based on many factors, the main of which is a convenient location for carrying out activities. The organization can change it, but it does not need to make any changes to the registration data.

A company can have several factual ones, but this cannot be said about the legal one - there must be one.

Registration of an NPO at the home address of the founder

Home / Articles / Registration of an NPO at the home address of the founder

Published: 04/15/2018

Registration of any organization at a specific address is its integral feature and a prerequisite for inclusion of a legal entity in the state register. The Law on Non-Profit Organizations established provisions according to which the location of an NPO is determined by its state registration address. And the address of a non-profit organization must be indicated in its constituent documents.

According to the Civil Code of the Russian Federation, Art. 54, paragraph 2, the location of a legal entity is determined by the place of its state registration on the territory of the country by indicating the name of the corresponding locality. That is, there is no need to specify the full address of its registration in the charter of a non-profit organization. It is enough to indicate the name of the locality where the organization is registered. The advantage of this option of indicating the address is that there is no need to change the charter of the NPO in terms of the provisions on the location in cases of change of address within the boundaries of one city, town, or other locality.

But we must not forget the following. When filling out form P11001, the exact address of the non-profit organization must be indicated, which includes, accordingly, not only the name of the subject and locality, but also the number of the house, building, apartment or office.

Quite often, when opening an NPO, the question arises: is it possible to register an organization at the home address of its founder? The answer is yes, registration at the founder’s home address is possible. This is confirmed, in particular, by the laws on state registration and non-profit organizations. And the law “On charitable activities and charitable organizations” in Art. 9 directly states that it is not permitted to refuse state registration of a charitable organization because a citizen has provided it with a legal address at his home address.

According to regulatory requirements, as part of the set of documents for state registration of a non-profit organization, it is necessary to provide information about the address of the permanent body of the non-profit organization at which communication with it is carried out. In this case, the type of data provided depends on the type of registration - initial registration or change of legal address.

So, if the founder has just created an NPO and registers it at his home address, when submitting an application to the regulatory authority P11001, he only needs to provide a copy of his passport data, thereby confirming that the legal address of the non-profit organization is his registration address. There is no need to provide any additional documents.

When changing the legal address of an NPO and transferring it to the home address of the founder, when filling out form P14001, it is necessary to submit to the regulatory authority documents substantiating the ownership of the premises located at the declared address. This could be, for example, an extract from the Unified State Register. You will also need a copy of the lease agreement concluded between the owner of the premises and the non-profit organization. The following must be taken into account. If, according to Rosreestr data, the owner owns only part of the premises (for example, both spouses own an apartment in equal shares), then written consent will be required from his other co-owners to register an NPO at their home address.

Back to articles

Similar articles:

Requirements for the name of a non-profit organization

The name of a non-profit organization is one of its main individualizing features. It is enshrined in the charter of the NPO, its registration and other corporate documents. It also distinguishes the organization from many others in the relevant field of activity.

More details

What to do if an account is blocked under 115-FZ

Blocking an account under 115-FZ means temporarily freezing all transactions on it. It entails a number of negative consequences for business. The main one is the inability to make transactions on a frozen account.

More details

What to do to avoid blocking your account by the bank under 115-FZ

Blocking an account under 115-FZ as part of combating the laundering of illegal capital and the financing of terrorist structures is a situation that requires the prompt adoption of a number of specific actions by the management of the organization in order to resolve it.

More details

Mass registration addresses

A mass registration address is an address where more than 10 companies are registered. However, it is not necessarily considered fictitious. Very often, at the place of such registration there are business centers with a large number of offices that are rented out to various companies.

The following addresses will be considered fictitious:

- If a large number of companies that are registered there cannot be contacted.

- The address does not exist.

- At the address there is a destroyed, unfinished building, a “closed” institution.

Typically, a company cannot be refused registration at an address where a large number of companies are registered, if it is legal. However, tax authorities will pay close attention to such companies, or counterparties will become suspicious of their partner. But usually, when all the necessary documents are provided, the questions that arise will be resolved.

Attention! There is a free address check for mass registration on the Federal Tax Service website. There you can get information about all similar addresses in the region, or check whether a certain address meets the mass criteria.

What to pay attention to

When registering an LLC, you should take into account various subtleties related to the responsible persons, the address itself and the documents drawn up.

Director and other participants

The legislator allows the registration of enterprises by registration not only of the director, but also of the founder, who must perform his duties, which is especially important for persons who are the sole owners of the business. It is not necessary that the director be a founder.

For the future, it is necessary to take into account that if the director and founder are different persons, then if the former changes, the procedure for registering a legal address will have to be completed again. Therefore, it is preferable to immediately opt for the founder’s registration.

Another nuance includes the residence of responsible persons not at their place of residence, or, for example, when they are constantly away. In some cases, the director may not have permanent registration for various reasons, and the legislator does not allow the registration of enterprises at a temporary or actual residence address.

Where and how to submit

The tax office registers new enterprises at the location of the legal entity. person, i.e. at his legal address. Therefore, a package of documents is submitted to the regional tax service. The package of documents must include those that confirm the existence of residential/non-residential premises and the right to use them.

The application is submitted by f. P11001, the form can be filled out not only by the founder, but also by the director, then it is notarized. When filling out the form, there are special requirements for font, capitalization, ink color, and others.

The form must be filled out without errors and additional explanations, so it is better to immediately contact a company that deals with various legal issues, including business registration. When filling out the form yourself, it is recommended to first study the sample; it can be found on the NS website. The form consists of 24 sheets, but only those that are necessary for entering data are filled out.

The LLC must enter information about:

- legal address;

- authorized capital;

- founders, indicating their shares;

- director or manager;

- OKVED codes;

- applicant for registration.

https://youtu.be/p_USRScP4YY

Documents for registering a legal address

The provisions of legislative standards do not regulate the list of forms that are necessary to confirm receipt of the registration address of the subject.

But there is a list of documents requested by Federal Tax Service inspectors in this situation:

- If registration takes place in a building or structure owned by the company - copies and originals of certificates of ownership.

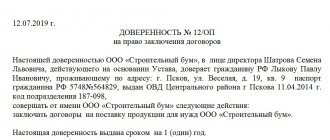

- When using rented premises, the company must present a letter of guarantee from the owners of the building that a lease agreement will be concluded with it after the company registration procedure.

- When using the home address of the owner - copies and originals of the ownership of this premises, as well as appropriately drawn up consents of other owners (family members) of the premises for registering a company on it.

“Purchase” of a safe legal address

Next in order of increasing risks are various options for purchasing addresses. The safest of them is to buy a legal address according to the scheme “lease agreement for a workplace + secretarial, forwarding and postal services.” In this case, a lease agreement is concluded for a small office space in which the director’s workplace will formally be located. At the same time, the landlord assumes responsibilities for receiving mail (both received through communication organizations and from couriers) and for receiving telephone calls and transferring them to your real number.

Of course, all these responsibilities should be spelled out as clearly as possible in the contract. Also pay attention to the issues of organizing the tenant's access to the premises formally rented by him - you may need this during tax audits. Ideally, the rented premises will have real workspaces that the tenant can use if desired.

Similar services in the capital market (this is where the problem of legal addresses is most acute) are provided, for example, by. She is the owner of more than 200 office premises in Moscow and offers services according to the scheme we described.

How to obtain a legal address for LLC registration

There are several options for using addresses as legal ones. Individuals who decide to create a company need to know all of them in order to make the right decision.

Using the address of a building or other property made as a contribution to the management company

This option for obtaining a legal address is considered the most optimal. However, it requires the presence of certain property in the company being created or funds to purchase a building or premises.

But the founders, transferring these funds as a contribution to the authorized capital, lose ownership of this property. Therefore, this option is currently used quite rarely.

Using the registration address of the founder of the organization

This option for using an address is the most popular at present, as it is easy to obtain and does not require significant costs.

A significant disadvantage of this option is that the legal address of the organization is publicly available information, so the founder’s residence or registration address will be known to a wide range of people, and it will not be difficult to find out.

Letters from controlling structures, company partners, etc. will constantly be sent to the above address.

Attention: if the founder’s registration address is used, then the organization may encounter certain difficulties when drawing up an agreement for settlement services or obtaining a loan from a bank, obtaining a license, or other permitting forms.

Rent of non-residential premises, office, etc.

This is one of the popular opportunities to obtain a legal address for the activities of a company. Currently, there are many business centers available in cities that offer offices of various sizes at an affordable price. This method of obtaining a legal address usually does not require significant financial costs.

If the future owner wants to register his company in a rented office, he needs to obtain a letter of guarantee from the owners.

It must indicate that a lease agreement will be concluded with the company after its actual registration with a government agency, as well as written permission to use the specified address as a legal one.

Attention: the requirement for this document is based on the fact that until the moment of its registration, the company is not yet a legal business entity, and therefore cannot enter into legally significant documents.

Leasing a legal address

This is one of the new ways for companies to obtain a legal address. In this case, it is necessary to distinguish between renting an address and renting premises to house an organization.

In fact, nothing will be posted at this address, and all incoming correspondence will be forwarded to the specified address.

There are already several companies operating on the market for this service with a large number of addresses available for registration.

When completing a package of documents, you must obtain a letter of guarantee from the landlord regarding the provision of a legal address. It is advisable to include a clause in the lease agreement stating that the subject has the right to receive inspectors from regulatory authorities at the leased address.

Typically, such an agreement is drawn up for a period of up to 11 months inclusive. This period is set in order not to register this document with government agencies.

Important: renting an address is associated with one problem - the selected address can be included in the list of mass addresses. If this fact is discovered, the Federal Tax Service may refuse registration altogether, or establish closer control over the company.

Ways to obtain a legal address

Home address of the director or founder

To register an LLC for residential premises, the general director or one of the founders must have permanent or temporary registration. If the property belongs to a third party, the owner’s consent to create an enterprise and carry out business activities at the specified address is issued. An object whose owner is not registered at this address cannot be used to register an organization.

A home address is the optimal solution for small businesses that do not have the funds to rent an office or their activities do not involve working on the premises. The advantages of this option include the organization of convenient reception of postal correspondence and zero probability of representatives of executive authorities entering the home without a court decision. But there are many risks that experts will tell you about.

What documentation will be needed?

Experienced lawyers recommend checking with the Federal Tax Service for a detailed list of documents required for the procedure. This will help prevent possible quibbles from tax authorities and still open a company at the home address of the founder or director. Below is a sample list:

- Passport of the citizen at whose address registration is carried out, with registration.

- Certificate of ownership.

- Consent of the direct owner (all owners) in any form.

- If the housing is not privatized, the consent of the government agency will also be required.

- Other mandatory documents required to open an LLC.

Legal basis

According to the Civil Code of the Russian Federation, namely Article 54, registration of enterprises is carried out at the location of the head and/or executive body. In turn, the Housing Code of the Russian Federation states that citizens have the right to use their residential premises to conduct business activities in them, subject to the interests of other residents (Article 17, paragraph 2). Numerous court decisions fully recognize the legality of registering a company at a home address if the founder or director is registered there.

What in practice? The lack of clear regulatory interpretations leads to the fact that everything depends on the position of a particular tax authority. In particular, you may be faced with a refusal to register a company based on the article. 288 Civil Code and stat. 671 Civil Code of the Russian Federation. They describe that registering a company in an apartment is possible only after assigning the residential premises the status of non-residential and subject to the rights of neighbors. It is also impossible to locate production in residential buildings, and other activities are permitted subject to fire, environmental and sanitary safety standards.

If letters don't arrive

Inspectors often conclude that the legal address does not correspond to the actual location of the organization on the basis that letters sent to the legal address are returned due to their non-receipt by the legal entity. However, in practice, this fact does not mean that the legal address is incorrect. The fact is that, according to the current Rules for the provision of postal services (Government Decree No. 221 dated April 15, 2005), the procedure for delivering postal items to a legal entity is determined by an agreement between it and the telecom operator. In the absence of such an agreement, notices of registered postal items are placed in mailboxes. After the expiration of the established storage period, postal items not received by the addressees are returned to the senders at their expense at the return address.

So it turns out that even if an organization is actually located at the address indicated in the Unified State Register of Legal Entities, but has not entered into an agreement with the post office, it may well not receive correspondence.

What is LLC

A limited liability company (LLC) is a form of business in which a legal entity is registered. In other words, this is a full-fledged company: it has employees, a legal address and a current account. An LLC is allowed to engage in any type of activity, unlike an individual entrepreneur, who is not allowed to produce alcohol, weapons and medicines, or engage in security and investment activities.

An LLC can be opened by an individual or several - up to 50 founders in total.

If there is more than one founder in a society, they make all decisions by voting. And profit Article 28. The distribution of the company’s profit among the company’s participants is received in proportion to their investments or as agreed.

If something goes wrong and the business goes bankrupt, the company's participants primarily risk Article 2. Basic provisions on limited liability companies not with personal property, but with the organization's property: computers, furniture, transport and money in the company account. But if the debt is large, the court may seize the personal property of the founders to cover it.

Registering an LLC is more difficult than registering an individual entrepreneur, but it is quite possible to do it yourself.

Legal and actual addresses - differences and features

As mentioned above, in accordance with Russian legislation, each company must have a legal entity. the address (location address) at which its state registration is carried out. At the same time, in reality, the enterprise must be located at this address. However, in modern business conditions, quite often there is a discrepancy in practice - i.e. discrepancy between legal and actual addresses.

Meanwhile, it must be emphasized that if these requirements of the Law are not observed in practice and the business owner does not take any measures, then in the future he will face very serious negative consequences, up to and including the complete liquidation of the established enterprise.

What documents are needed

When such a procedure is carried out in practice, it should be borne in mind that the package of papers when submitting for registration of an LLC at the personal address of a member of the Company may differ slightly from the submission of documents under other circumstances.

So, in addition to the standard documents that are usually submitted when registering a legal entity (Charter, application form No. P11001, decisions, minutes of a meeting of LLC participants, power of attorney for a representative of a legal entity, etc.), the following papers should be prepared in advance:

- certificate of ownership of the apartment, house where the founder lives (a copy is prepared);

- written consent of the owner of the residential premises for the company to be registered at this address, even if the owner is the founder himself;

- written consent of all persons living and registered at this address (may be required in exceptional cases by tax officers when reviewing the package of documents submitted for LLC registration);

- written consent of the municipal or state housing authority in the event that the apartment or house is non-privatized (in practice, there are frequent hiccups and even refusal of government agencies to issue such consent for the use of non-privatized residential premises for business activities).

In the case of registering the home address of a Company member as a legal address, the owner of the residential premises does not issue any letters of guarantee for registration of the address.

This is all because such paper is usually issued by the owners of non-residential premises who lease or otherwise lease the premises for LLC registration.

Written consent can be drawn up in any form. The main thing is that the owner of the property confirms that he does not object to a legal entity being registered at his address.

The owner must also indicate in written consent that he does not object to the fact that business activities will be conducted at his address on behalf of the legal entity.

Written consent should be notarized by the notary whose office is located close to the place of registration of the owner of the premises.

In the case where the apartment or house at the residence address of the founder or general director is recorded as non-privatized, then written consent must be obtained from a government agency.

As a rule, these are municipal or other government agencies. If in this case it is possible to obtain consent from such institutions, then there will be no need to notarize the written consent. There will be enough details and resolutions of the government agency.