Maintaining a register of documents

It is convenient to fill out the document register in the “Smart Table” of Excel if you do not intend to use merged cells.

Next, we will look at a registry with employee data, which can be used to store this data and print various documents. In practice, this was a register of Employment contracts, from which the following were printed: Employment contract, Appendix to the employment contract, Agreement on financial liability, Order for employment, Amendments to the employment contract, Agreement on termination of the employment contract.

In the example, the register is significantly reduced; only the Liability Agreement is left from the printed forms to show the very principle of maintaining the register and filling out the printed form with data.

Example of a document register in Excel Smart Table

To fill the registry with data, you can use an autoform, more about which you can read in the Working with Smart Table section.

For what and by whom is the form used by order 52n?

The document of the specified sample is used by budgetary organizations. In this case, pay slips are filled out for the purpose of transferring wages to the employees' account.

The OKUD form 0504403 is used in situations in which one-time amounts of wages paid in the event of vacation or dismissal do not coincide with the time of drawing up the general calculation.

In other words, it is used in the inter-settlement period.

The form can be drawn up either in the name of one specific employee or simultaneously in the name of several employed citizens.

The issuance of funds can be carried out using cash orders and pay slips. The second option is used when paying salaries, as well as other one-time payments due to employees as compensation for their work.

For example, such a document is drawn up when paying vacation pay and other similar amounts.

Non-budgetary organizations fill out a payroll form T-53.

For the calculation and payment of wages by budgetary institutions, the OKUD form 0504401 can also be used, and for calculations - the form 0504402.

Instructions for filling out for budget organizations

A statement of this sample was introduced into the document flow in 2015.

The rules for filling it out are enshrined in the Approval of the Ministry of Finance of the Russian Federation. The payroll includes 2 parts. The first contains general information - information about the company, full names of its managers, security number, its name, etc.

The second part of form 0504403 displays data about each employee who is paid the amount of money due to him as payment for his work.

Form OKUD 0504403 involves sequentially filling out the paper:

- A cap.

It is located in the upper right corner of the form. The first line has the following name - “To the cashier for payment on time.”

The exact date of payment of salary or other similar amount is indicated here. It is possible to specify a time period. Its duration should not be longer than 3 days.

After this, the amount calculated for issuance is noted in words. Next, indicate the full name of the director of the organization and the chief accountant. They leave their signatures next to their initials.

- Title part.

It includes the name of the document and the serial number assigned to it.

The following information about the enterprise is noted:

- full title;

- codes - OKPO, OKUD, KPP, OKEY, INN.

The date of registration of the payroll and the name of the structural unit are indicated if the amounts of money must be issued to several employees.

An order is drawn up for the amount of wages issued, information about which - number and date - is also entered into form 0504403.

Data on debit and credit are entered in the correspondence column of accounts.

- Main part.

Implies a table. It contains data about each employed citizen to whom a monetary amount of wages is paid. Numbering is in alphabetical order.

In the payroll table f. 0504403 multiple columns.

In each of them the following information is noted:

- serial number;

- Full name of the employee;

- Personnel Number;

- SNILS;

- calculated amount;

- employee signature.

After filling out the table, the final information is indicated below - how much money has been issued, how much is left, as well as the amount of the deposited amount.

- Conclusion.

This part must contain the cashier’s signature and its transcript. If another person responsible for this procedure was involved in issuing money, information about him is entered in the “Distributor” column.

In most cases, the documentation is drawn up by an accountant, and the verification is carried out by the chief specialist of the accounting department.

The names and signatures of the latter must be included in the statement. In addition, at the end of form 0504403 the date of paper issuance is indicated.

Download free form and sample

payroll form according to OKUD 0504403 – link.

A sample of filling out a payroll form for budgetary institutions -.

This is what the completed sample looks like:

Creating a Printable Form

To fill out a printable form using formulas, it must be created in Excel. If you cannot find the desired file in Excel, its text can be transferred from a file in another program to the worksheet, taking into account the maximum number of characters that fits in the cell, otherwise the text will be cut off.

In our example, we use a printed form of the Liability Agreement, the text of which is copied onto an Excel worksheet from a Word document:

Liability Agreement

If the printable form on the Excel worksheet is ready, all that remains is to move (or copy) it to the workbook with the register. If the register has not yet been created, you can simply add a new sheet to the book with the printed form and name it “Register...”.

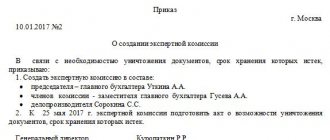

budgetary and autonomous institutions

The data of the primary accounting documents verified and accepted for accounting are systematized in chronological order (according to the dates of transactions, the date of acceptance of the primary document for accounting) and are reflected in a cumulative manner in the following accounting registers (clause 11 of Instruction No. 157n, Appendix No. 5 to the Order of the Ministry of Finance of Russia N 52н):

— Journal of transactions on the “Cash” account (f. 0504071);

— Journal of transactions with non-cash funds (f. 0504071);

— Journal of settlement transactions with accountable persons (f. 0504071);

— Journal of settlements with suppliers and contractors (f. 0504071);

— Journal of transactions with debtors for income (f. 0504071);

— Journal of settlement transactions for wages, salaries and scholarships (f. 0504071);

— Journal of transactions on disposal and transfer of non-financial assets (f. 0504071);

— Journal for other transactions (f. 0504071);

— General ledger (f. 0504072);

- other registers provided for by Instruction No. 157n, as well as approved as part of the formation of its accounting policies.

If necessary, an institution has the right to independently develop additional forms of accounting registers, for which the legislation of the Russian Federation does not establish mandatory document forms for their execution, and approve them in its accounting policy.

In this case, the accounting register must contain the following details (Part 4, Article 10 of Federal Law No. 402-FZ, Clause 11 of Instruction No. 157n):

1) name of the register;

2) the name of the accounting entity that compiled the register;

3) the start and end date of maintaining the register and (or) the period for which the register was compiled;

4) chronological and (or) systematic grouping of accounting objects;

5) the amount of monetary and (or) natural measurement of accounting objects, indicating the unit of measurement;

6) names of positions of persons responsible for maintaining the register;

7) signatures of the persons responsible for maintaining the register, indicating their surnames and initials or other details necessary to identify these persons.

Entries in transaction logs and other accounting registers are made as transactions are performed, but no later than the next day after receipt of the primary (consolidated) accounting document. In terms of transactions on off-balance sheet accounts, the transaction is reflected, depending on the nature of changes in the accounting object, by a record of the receipt (increase) or disposal (decrease) of the accounting object. Accounting registers are signed by the accountant responsible for its formation. The correctness of reflection of business transactions in accounting registers according to the primary accounting documents submitted for registration is ensured by the persons who compiled and signed them.

At the end of the month, data on account turnover from transaction journals and other accounting registers must be transferred to the General Ledger, and primary (consolidated) accounting documents related to the relevant transaction journals must be selected in chronological order (by dates of transactions, date of acceptance to the accounting of the primary document) and bound together.

The cover of the transaction log indicates (clause 11 of Instruction No. 157n):

— name of the subject of accounting;

— name and serial number of the folder (case);

— period (date) for which the accounting register (Journal of Transactions) was formed, indicating the year and month (date);

— name of the accounting register (Journal of Operations), indicating its number if available;

— the number of sheets in the folder (case).

The formation of accounting registers is carried out in the form of an electronic register, and in the absence of technical capabilities - on paper.

The formation of accounting registers on paper is carried out at the frequency established within the framework of the formation of accounting policies, but not less than the frequency established for the preparation and presentation of budget (financial) statements generated on the basis of data from the accounting registers.

When transferring accounting registers to paper media, it is allowed that the output form of the document differs from the approved form of the document, provided that the details and indicators of the output form of the document contain the mandatory details and indicators of the accounting registers (clause 19 of Instruction No. 157n).

When storing accounting registers, they must be protected from unauthorized corrections (clause 14 of Instruction No. 157n).

In case of discovery of the loss or destruction of accounting registers, the procedure for the actions of officials is similar for cases of loss of primary documents (for more details, see

Card for recording material assets (form 0504043)

Form 0504043 was approved by Order of the Ministry of Finance of the Russian Federation dated March 30, 2020 No. 52n and is used for accounting in places where assets are stored (usually in warehouses), and must be filled out by the financially responsible employee himself based on warehouse accounting data. The accounting form is used in government institutions where there is a small number of MCs.

Important!

A quantitative and total accounting card is generated separately for each material value. In this case, a separate sheet of such a card is created for each name of the MC.

A card in form 0504043 is generated to reflect information about the following material assets of the institution:

- library items;

- various materials;

- various types of dishes;

- soft equipment;

- finished products.

Important!

The accountant or other responsible person must put a mark on the last page of the accounting card f. 0504043 as a sign of confirmation that the information specified by the financially responsible person was verified (and verification is a mandatory procedure).

You can download the Form for filling out the MC accounting card according to form 0504043, as well as a Sample for filling out the MC accounting card according to f. 0504043.

Example of a register for sick leave in the Social Insurance Fund ()

On our website you can register, which reflects all the necessary information on sick leave. In addition, we recommend that this register also include information about other benefits paid to employees: child care for children up to 1.5 years old or social benefits for funerals, since these types of benefits are paid from the Social Insurance Fund.

registry can be found here:

For information on what to do if an employee has presented a fictitious document, read the article “Actions of an employer with a fake sick leave certificate.”

What documents, in addition to the register, must the employer submit to the Social Insurance Fund? What sanctions are expected for failure to submit documents for granting benefits? The answers to these and other questions were considered by ConsultantPlus experts. Get trial access to the system and upgrade to the Ready Solution for free.

Form and sample for filling out the register of sick leave in the regions of the FSS pilot project

The form for the register of information necessary for the appointment and payment of benefits for temporary disability (in other words, the register of sick leave) and the procedure for filling it out, was approved by Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 579.

you can follow the link below.

All employers participating in the FSS pilot project, whose average number of employees for the last billing period was more than 25 people, are required to submit this register. If the indicator is 25 or less, then the policyholder can create such a register, but this is not required.

The sick leave register is submitted to the Social Insurance Fund electronically in the established format within 5 calendar days after receiving the benefits payment papers from the employee.

A register of sick leave may also be needed in regions where the pilot project is not yet in effect. Read more about the pilot regions here . For example, when Social Insurance conducts an inspection or when a company transfers several sick days to the Social Insurance Fund for reimbursement of expenses. Let's look at how to fill out such a register and give a sample of how to fill it out.

When checking sick leave, the FSS may request additional documents from the employer. In what cases and what documents the inspectors might need, E.M. Plekhova, chief specialist-auditor of the Belgorod regional branch of the Social Insurance Fund of the Russian Federation, told us. Get trial access to ConsultantPlus and find out the reviewer’s opinion for free.

For which organizations is it valid?

A note-calculation on calculating average earnings was developed for use by public sector organizations:

- authorities;

- local government;

- off-budget funds;

- other recipients of budget funds.

This is the primary document that serves as an accounting register for wages (vacation pay and other payments) for government agencies - based on its results, the accounting department makes entries in the debits and credits of the corresponding accounting accounts.

Despite the fact that the form approved by Order of the Ministry of Finance of March 30, 2015 No. 52n is relatively new, when filling it out one should, among other things, be guided by Government Decree on the calculation of the average salary No. 922 of December 24, 2007 - this is confirmed by the letter of the Ministry of Finance dated October 27, 2017 No. 02-06-10/70870.