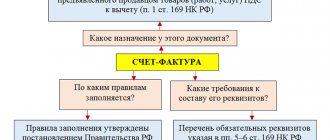

An invoice is a necessary document not only in accounting, but also in the office work of an organization in general. There are many nuances in filling out this document, ignorance of which can lead to problems with the Tax Inspectorate.

This is a form confirming the fact of shipment of goods or provision of services at a set cost. This is not the only function of this form. What is an invoice? An accounting form required to confirm the amount of VAT both on the sale of goods (services) and input VAT to prove the right to a tax deduction in order to avoid double taxation. The presence of an invoice is a prerequisite for crediting the amount of VAT on material resources (work, services) that were purchased by the taxpayer.

This is a very important document, often used in legal disputes, so it must be filled out correctly.

Who makes up

An invoice is issued by the seller (contractor, performer) to the buyer or customer. Drawing up this form is mandatory for business entities engaged in the sale of goods, performance of work or provision of services.

Why an invoice is needed has already been said (let us repeat briefly: it confirms the issuance and payment of VAT), accordingly, you need to fill out such a form:

- individual entrepreneurs and enterprises subject to the general taxation system (unless their services fall under the exceptions established by clause 2 of Article 149 of the Tax Code of the Russian Federation);

- Individual entrepreneurs and companies that partially work on OSN (for relevant types of activities), also combining it with UTII.

Taxpayers who have chosen UTII, the simplified tax system, or the patent system as their taxation system are exempt from paying VAT, with the exception of certain cases.

Why do you need an invoice if companies and individual entrepreneurs do not have to pay VAT? This may be required if there is commercial interaction with organizations and individual entrepreneurs that are VAT payers. In addition, the parties may decide to apply the invoice on their own initiative.

The importance and necessity of issuing invoices.

VAT is an integral part of accounting and tax reporting for enterprises using the standard taxation system. To apply the right to deduct this tax, the tax agent (company) must have a correctly completed invoice. This document is considered the main one for obtaining such a right, although it does not confirm the fact of acceptance - transfer of material assets specified in it. For this purpose, a consignment note and an act of acceptance and transfer of goods, services and other valuables are intended.

An invoice is recognized as a primary accounting document, since it contains the necessary features specified in the Federal Law “On Tax Accounting”, as well as in the Tax Code of the Russian Federation. Records of all issued and received invoices must be kept in special journals. Both buyers and sellers should have such magazines. The summing VAT figures entered in these journals are subsequently taken into account in tax reports (declarations) for a certain period. Based on these reports, the total tax is calculated, which is required to be paid to the budget.

Since 2020, entrepreneurs and commercial companies whose responsibilities include working with invoices must follow the filling standards and apply the form specified in the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, as amended in 2014.

Exposure deadlines

The general rule is as follows: an invoice is issued within 5 days from the date of transfer (shipment) of goods, performance of work or provision of services. In this case, calendar days are taken into account. This norm is enshrined in paragraph 3 of Art. 168 Tax Code of the Russian Federation. The rules are the same for both paper and electronic invoices. Also, according to paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, when preparing advance documents, this form must be issued within the same 5 calendar days, but from the moment of receipt of payment for future deliveries, performance of work, provision of services.

https://youtu.be/JCF2mvwqDDw

Features of using invoices.

According to the Tax Code of the Russian Federation, it is allowed to fill out the invoice form both by hand and using office equipment. But a prerequisite for this is that all data specified in the document must be absolutely accurate. No errors are allowed, either in the names of goods or services, in the details of counterparties, or in numerical values of any nature.

When making transactions between parties that are not VAT payers, issuing invoices is not required.

When an invoice is not needed

The legislation specifies cases when an invoice is not a mandatory document, and the completion and execution of a transaction is confirmed by other data: an invoice, an invoice for payment. Based on the regulations, the invoice is not filled out under the following circumstances:

- the transaction is not subject to VAT (Articles 149 and 169 of the Tax Code of the Russian Federation);

- when selling goods for cash (in this case, a check or a strict reporting form is sufficient);

- when applying simplified taxation regimes;

- a legal entity - an employer transfers goods to its employee without providing counterpayment, that is, free of charge (according to Letter of the Ministry of Finance of the Russian Federation dated 02/08/2016 No. 03-07-09/6171);

- when sending goods for export, taxed at a zero rate, if the buyer is not a VAT payer, if the shipment took place no later than 5 calendar days from the date of receipt of the advance payment (according to Letter of the Ministry of Finance of Russia dated January 18, 2017 No. 03-07-09/1695).

Reason for payment

- details of the supplier - the recipient of the payment, namely name, INN, KPP, bank details (it is assumed that it is on the basis of the invoice that the buyer will draw up a payment order in the form approved in Appendix 1 to the Regulations of the Central Bank of the Russian Federation dated October 3, 2002 N 2-P “O” non-cash payments in the Russian Federation");

- buyer's details (usually only name);

- basis for payment (name, quantity of goods, details of the supply agreement);

- the amount to be paid (if a product is paid for, the sale of which is subject to VAT, the “input” tax is highlighted in the invoice);

- the deadline for paying the invoice (for example, “pay the invoice within 20 calendar days”);

- invoice expiration date (usually in prepaid invoices);

- date and account number (to identify the document);

- signature of an authorized person and seal of the supplier organization.

Interesting read: Inventory value of the apartment Rosreestr at the address

One copy of the application, together with the first copy of the payment request, is placed in the documents of the day as a basis for debiting funds from the client’s account; another copy of the application, no later than the business day following the day the application was received, is sent to the issuing bank for transfer to the recipient of the funds.

Kinds

There are three main types of invoice:

- ordinary, shipping. This document confirms that the goods have been transferred. This is the most common type of invoice, but legislation provides for more than just one;

- advance payment, written out and drawn up upon concluding a contract and receiving an advance payment for work performed or services rendered. This form does not confirm the fact of transfer;

- adjustment, filled in when the price or quantity of shipped products changes.

Is the invoice proof of payment?

The invoice is issued within 5 days from the SALE DATE and is in no way linked to the payment date. Although, of course, if the fact of payment was at the time of issuing the account, then it is necessary to indicate the details of the payment document, but only

Continuing the topic. Is the invoice proof of payment? Or suppose I have no cash receipts left. So can the tax office accept a reconciliation report as a document confirming the fact of payment? (This situation arose in body 2)

Reason for payment

- payment terms;

- deadline for acceptance;

- the date of sending (handing over) to the payer the documents provided for in the contract if these documents were sent (handing over) to the payer;

- name of the goods (work performed, services rendered), number and date of the contract, numbers of documents confirming the delivery of the goods (performance of work, provision of services), date of delivery of the goods (performance of work, provision of services), method of delivery of the goods and other details - in the field “ Purpose of payment".

Payment requests are placed by the executing bank in the file cabinet of settlement documents awaiting acceptance for payment until the payer's acceptance is received, the acceptance is refused (full or partial), or the acceptance period expires.

The basis for payment is

In the event that the impossibility of performance arose due to circumstances for which neither party is responsible, the customer reimburses the contractor for the expenses actually incurred by him, unless otherwise provided by law or the contract for the provision of paid services (Article 781 of the Civil Code of the Russian Federation).

The contract for the provision of paid services is regulated by Chapter 39 of the Civil Code of the Russian Federation. Currently, the practice of concluding such agreements has become widespread. Within the framework of this agreement, such a variety of services can be provided that the general provisions regarding the provision of paid services are minimally reflected in the legislation.

Features of payment by invoice - all important information about this procedure

- Serial number and extracts.

- Names that are only individual entrepreneurs and LLCs on the general taxation system, that is, those entities that work with VAT.

- Buyer's names.

- Name of the goods or services provided.

- Number of units of goods indicating units of measurement.

- The cost of one unit of goods.

- Total purchase amount.

- VAT level as a percentage.

The question is raised: “Is it possible to pay for anything with it?” Such a receipt is used as payment in Russia and many CIS countries.

That is why it is important to understand how to pay for it.

What is the difference between an invoice and an invoice?

Unlike an invoice, an invoice does not relate to the VAT obligations of the seller or buyer. There are also no specific deadlines for issuing an invoice (unless specific deadlines are provided for in the contract).

An invoice is a document issued by a supplier to a buyer with an offer to pay for goods, work or services.

At the same time, it can be exhibited both for goods already delivered, work performed or services rendered, and to receive an advance payment from the buyer.

There is no single, mandatory form of invoice for payment. Each organization has the right to develop it independently. However, given that with this document the seller invites the buyer to make a certain payment, the invoice usually contains at least the following information:

To answer this question, it is necessary to turn to civil law. There is a general requirement of Part 4 of Art. 203 of the Civil Code, according to which the transaction must be completed in the form established by law. In accordance with Part 1 of Art. 208 of the Civil Code, transactions between legal entities must be concluded in writing.

https://youtu.be/y8b-7Jfhbko

Therefore, if the SPD agreement is recognized as concluded orally, tax authorities may argue that he did not have the right to reflect the EOI for the first event in the event of an advance payment, but this does not in any way refute the very fact of the contractual relationship between him and the supplier.

Is an invoice proof of proper provision of services?

The delivery of the work result by the contractor and its acceptance by the customer are formalized by an act signed by both parties.

If one of the parties refuses to sign the act, a note to this effect is made in it and the act is signed by the other party.

A unilateral act of delivery or acceptance of the result of work can be declared invalid by the court only if the reasons for refusing to sign the act are recognized by it as justified (clause 4 of Article 753 of the Civil Code of the Russian Federation).

Source: https://lawcapital.ru/razdel-nedvizhimosti/yavlyaetsya-li-schetfaktura-podtverzhdeniem-oplaty

Requisites

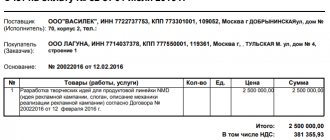

What does an invoice look like? This is a table with columns about the product and a header providing information about the parties to the contract.

Required details:

- number and date;

- name, address and tax identification number, checkpoint of the buyer and seller, as well as the shipper and consignee, if any (please note, according to the new rules, the address must be written strictly as it is indicated in the Unified State Register of Legal Entities, you can check it on the Federal Tax Service website in the “Check yourself and the counterparty” section) );

- number of the payment document if an advance was received for future deliveries;

- product name and unit of measurement;

- quantity;

- currency (ruble code - 643, US dollar - 840, euro - 978);

- price per unit of measurement;

- full cost;

- excise tax amount;

- tax rate;

- the amount of tax to be paid;

- total cost including taxes;

- country of origin of the goods (codes are set in accordance with the OK classifier (MK (ISO 3166) 004-97) 025-2001); if goods are produced in Russia, a dash is added;

- customs declaration number (if the goods were not produced in Russia);

- signatures of the manager and chief accountant (or an authorized person - by order or power of attorney) - on a paper document; enhanced qualified digital signature - on electronic.

Among the latest changes is the line

“Identifier of a government contract, agreement (agreement).” Applies to deliveries under government contracts. The Filling Rules specifically indicate that the line is filled only if there is an identifier. If absent, the line remains blank (there is no need to put a dash).

Do I need the original invoice for accounting purposes?

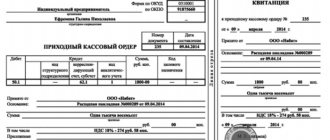

An invoice for payment is a document that absolutely all entrepreneurs use in their work, regardless of what level they work at and what area of business they belong to. As a rule, an invoice for payment is issued after a written agreement is concluded between the parties, as an addition to it, but sometimes it can be issued as an independent document.

It is the invoice for payment that gives the buyer of goods or consumer of services grounds to pay for them. The invoice can be issued for both prepayment and post-factum payment.

FILES Download a blank invoice form for payment .xlsDownload a sample of filling out an invoice for payment .xls

Is an invoice required?

The legislation of the Russian Federation does not regulate the mandatory use of an invoice in business documentation; payment can be made simply on the terms of an agreement. However, the law calls the conclusion of an agreement an indispensable condition of any transaction.

An invoice does not exist separately from the contract; it is a document accompanying the transaction.

https://youtu.be/nMnE7Ua-diw

It represents, as it were, a preliminary agreement on payment according to the conditions established by the seller - the price that the buyer of the product or service must pay.

The invoice makes calculations much more certain, so entrepreneurs prefer to use it, even if this condition is not specified in the terms of the contract.

IMPORTANT! Since the requirement for an account is not legally required, it does not relate to accounting reporting documents, but is intended for internal use.

When is an account absolutely necessary?

The legislation specifies the moments when issuing an invoice is mandatory support for a transaction:

- if the text of the agreement did not specify the amount to be paid (for example, for communication services, etc.);

- for transactions involving the payment of VAT;

- if the selling organization is exempt from VAT;

- a selling company located on OSNO sells goods on its own behalf or provides services under agent agreements;

- if the customer made an advance payment to the seller company or transferred an advance payment for a product or service.

So, an invoice for payment is not a mandatory document , just like an accountable document.

It cannot in any way influence the movement of financial funds, it can be suspended or not paid at any time - such phenomena occur quite often and do not have any legal consequences.

However, this document is equally important for the parties to the transaction, as it allows them to enter into a kind of preliminary agreement on the transfer of funds.

Who issues invoices for payment?

An invoice for payment is always issued by an employee of the accounting department. After the form is completed, the document is handed over to the head of the organization, who certifies it with his signature. It is not necessary to put a stamp on the document, since individual entrepreneurs and legal entities (since 2020) have the right not to use the seal.

An invoice for payment is drawn up in two copies , one of which is sent to the service consumer or buyer, the second remains with the organization that issued it. You can fill out the invoice either on a regular A4 sheet or on the organization’s letterhead. The second option is more convenient, since you do not need to enter information about the company each time.

This document does not have a unified template, therefore organizations and individual entrepreneurs have the right to develop and use their own template or issue an invoice for payment in free form.

As a rule, for long-established organizations and individual entrepreneurs the form of the form is standard; only the information about the invoice recipient, the name of the product or service, as well as the amount and date change.

Sometimes organizations additionally indicate in the invoice the terms of delivery and payment (for example, percentage or prepayment amount), the validity period of the invoice and other information.

If any errors are made in the document during registration, it is better not to correct them, but to issue the invoice again.

It should be remembered that in some cases, when resolving disagreements between the parties in court, the invoice for payment is a document of legal force and can be presented in court.

How to send invoices for payment

We issue the invoice electronically. We keep one paper copy with us, the other can be sent to the counterparty by regular letter.

Most often, the invoice is filled out electronically and sent to the recipient via email. But experienced accountants always print out a document on paper, and send one “live” signed copy to the counterparty via regular mail, and keep the second one, filing it in a folder usually called “accounts.”

Instructions for preparing an invoice for payment

From an office management point of view, this document should not cause any particular difficulties in developing and filling out.

At the top of the document information about the recipient of the funds is indicated. Here you need to indicate

- full name of the company,

- his TIN,

- checkpoint,

- information about the bank servicing the account,

- account details.

Next, in the middle of the line, write the name of the document, its number according to internal document flow, as well as the date of creation.

https://youtu.be/1zcOuCrG7Io

Then the payer of the invoice (also the consignee) is indicated: here it is enough to indicate only the name of the company that received the goods or services.

The next part of the document concerns the services directly provided or goods sold, as well as their cost. This information can be presented either in a simple list or in the form of a table. The second option is preferable, as it avoids confusion and makes the score as clear as possible.

In the first column of the table of services provided or goods sold, you must enter the serial number of the product or service in this document. In the second column - the name of the service or product (without abbreviations, concisely and clearly).

In the third and fourth columns, you must indicate the unit of measurement (pieces, kilograms, liters, etc.) and quantity.

In the fifth column you need to put the price per unit of measurement, and in the last column - the total cost.

If the company operates under the VAT system, then this must be indicated and highlighted in the invoice. If there is no VAT, you can simply skip this line. Then, below the right, the full cost of all goods or services is indicated, and under the table this amount is written in words.

Finally, the document must be signed by the organization’s chief accountant and manager.

Invoice for VAT payers

Legal entities and other VAT payers use an invoice : a responsible financial document that is issued not in advance, but upon completion of work, services provided or goods shipped.

It is no longer needed to speed up payment, but to confirm that excise duties and VAT have been paid in full, so that VAT can be withheld from the payer (buyer).

This document has a prescribed form; it may also contain information about the origin of the goods, and if it is imported, then the number of the customs declaration for it.

The invoice is issued in two copies.

Account elements

There is no specific form for drawing up an invoice, but there are mandatory components that must be contained in it.

- Requisites individual entrepreneur or LLC (both seller and buyer):

- name of the enterprise;

- legal form of organization;

- legal address of registration;

- Checkpoint (for legal entities only).

- Information about the bank servicing the transaction:

- name of the banking institution;

- his BIC;

- numbers of current and correspondent accounts.

- Payment codes:

- Account number and date of its registration (this information is for internal use of the company; numbering is continuous, starting from the beginning every year).

- VAT (or lack thereof). If VAT is present, its amount is indicated.

- Last name, initials, personal signature of the compiler.

FOR YOUR INFORMATION! According to the latest legal requirements, printing on the invoice is not required.

For a product or for a service?

An invoice may be issued as an arrangement to pay for a product or service provided, or for a type of work performed. The difference lies in the “Purpose of payment” column that the invoice contains.

To pay for goods, this column must contain a list of all types of goods sold, as well as the units in which they are measured (pieces, liters, kilograms, meters, rubles, etc.). It is necessary to indicate the quantity of goods and the amount for them (separately without VAT, if any, and the full amount).

When paying, you must indicate the type of service or work performed. Don't forget to mark the required quantity, as well as the amount with and without VAT.

REFERENCE! If the entrepreneur does not want, he may not fully decipher all types of supplies, indicating only the number of the contract under which the transaction is carried out. However, this information must still be reflected in detail in the delivery note or in the estimate. Therefore, it is in the interests of the entrepreneur to indicate in the invoice a complete list of paid goods or services.

Don't make mistakes!

Let's look at the most common inaccuracies that entrepreneurs can make when registering an invoice.

- The signature has not been decrypted. A painting alone is not enough: there must be information about who signed it. In the online version of the document, such an error cannot be made, since it requires an electronic signature.

- Missing invoice deadlines. The date of issue of the invoice must coincide with the date of issue of the invoice and not exceed 5 days from the date of release of the goods or provision of the service.

- Delay in receiving an invoice for VAT deduction. The tax deduction for tax purposes must be claimed in the same tax period in which the document confirming this, that is, the invoice, was received. To prevent this problem, it is necessary to store evidence of the date of receipt of invoices (mail notices, envelopes, receipts, entries in the incoming correspondence journal, etc.).

- The dates on the invoice copies are mixed up. Both parties to the transaction must have identical copies, otherwise the invoice does not prove the legality of the transaction.

- "Hat" with errors. If there are inaccuracies in the names of organizations, their tax identification numbers, addresses, etc. the document will be invalid.

Source: https://sudar-buh.com/nuzhen-li-original-scheta-dlya-buhgalterii/

Filling by lines

Rules for filling out an invoice line by line:

- the first line is the serial number of the document in accordance with the established document flow rules;

- the date of preparation should not be earlier than the date of the original document;

- date and correction number are filled in if necessary;

- in the line “Seller” the full or abbreviated name is indicated in accordance with the constituent documents;

- the postal address is indicated in the “Address” line;

- in line 3, “same person” is entered if the seller and the shipper are the same person. Otherwise, you must provide the shipper's mailing address. When filling out an invoice for services and property rights, a dash is placed in this line;

- in term 4, according to the same rules, the data of the consignee is written;

- in line 5 “to the payment and settlement document” a dash is placed if the form is drawn up upon receipt of payment, partial payment or for upcoming deliveries using a non-cash form of payment;

- for line 7, the currency codes are given above.

The columns are filled in as follows:

- Column 1 indicates the name of the product or service provided;

- in column 2 - unit of measurement, if possible. A dash is placed upon receipt of payment or partial payment for upcoming deliveries. Columns 2 and 2a are filled out taking into account the All-Russian Classifier of Units of Measurement, introduced by Decree of the State Standard of the Russian Federation dated December 26, 1994 No. 366;

- Column 3 indicates the quantity or volume of the goods. If this indicator is not defined or is missing, you must put a dash. A dash is also added when payment or partial payment is received for upcoming deliveries;

- Column 4 (product price) is filled out according to similar rules;

- in column 6, if there is no excise tax amount, a corresponding note is made;

- in column 7 (tax rate) for transactions specified in paragraph 5 of Article 168 of the Tax Code of the Russian Federation, an entry “without VAT” is made;

- Column 8 is filled out according to similar rules;

- columns 10-12 are filled in if the country of origin of the goods is not Russia, in accordance with the OK of the world (MK (ISO 3166) 004-97) - 025–2001.

This is what the completed document looks like.

If the form is an advance or correction form, this must be indicated, as well as what changes are being made to the form and on what basis. The signature of authorized persons is required: manager (trustee), chief accountant. A seal is not a mandatory requirement, but can be supplied (for example, at the buyer’s request).

All forms are stored in chronological order for at least 4 years, recorded in the Journal of received and issued invoices, in the Book of Purchases and Sales in order to be able to verify the calculation and payment of VAT.

Sales book fragment

| Date and invoice number | Name of the purchasing organization | Total sales cost | Sales cost without tax | VAT 18% |

| 25; 30.07.2018 | LLC "NNTTZ" | 4 522 340,00 | 3 832 491,53 | 689 848,47 |

| 26; 31.08.2018 | LLC "Korund" | 2 322 664,53 | 1 968 359,77 | 354 304,76 |

| 27; 30.09.2018 | LLC "Keramika" | 1 701 195,47 | 1 441 691,07 | 259 504,40 |

| Total: | 8 546 200,00 | 7 242 542,37 | 1 303 657,63 |

During the reporting period, the organization purchased materials and used the services of subcontractors and other enterprises. Suppliers and contractors also issued invoices, which were recorded in the Purchase Ledger.

Seller's invoice date and number | Name of the seller organization | Total cost of purchases | Purchase price excluding tax | VAT 18% |

| 16 01.07.2018 | LLC "Invest" | 160 000,00 | 135 593,22 | 24 406,78 |

| 44 16.07.2018 | Telecom LLC | 6 500,00 | 5 508,47 | 991,53 |

| 210 16.08.2018 | LLC "Metal" | 1 000 000,00 | 847 457,63 | 152 542,37 |

| ….. | ||||

| Total: | 7 950 000,00 | 6 737 288,14 | 1 212 711,86 |

At the end of the quarter, the accountant summed up the results and calculated the amount of tax payable:

1 303 657,63 – 1 212 711,86 =90 945,77.

Construction Technologies LLC must pay VAT in the amount of RUB 90,945.77 for the 3rd quarter of 2020.

https://youtu.be/L8f58QRFlko

Common Mistakes

Errors that are most often encountered when filling out an invoice and their consequences:

- if the name, TIN, and address of the organization are incorrectly indicated or missing, it is difficult to establish the authorship and addressee of the document, so it may be declared invalid;

- if it is impossible to determine from the document what goods were transferred or service was provided, VAT will not be refunded;

- incorrect indication of currency, incorrect indication of the quantity of goods, errors in prices, incorrect calculation of cost lead to the fact that the exact cost of the goods cannot be determined. Thus, the document becomes uninformative;

- incorrect calculation of VAT. The absence of a VAT amount may also raise questions from regulatory authorities.

Minor errors in the form of missing characters, capital letters, or inaccuracies in payment details are usually not pursued by the tax authorities. It is also possible to abbreviate names if such an abbreviation allows you to identify the enterprise or product.

The form of the invoice, the procedure for filling it out, as well as the accounting of invoices

Tax rules establish several types of invoices, each form of which has its own characteristics and nuances. The first form is the usual, printed one .

A printed form is a familiar document , which is created on a computer and then stamped and signed by an authorized person. In most cases, tax reporting and documents are in printed form.

electronic invoices , which also represent full-fledged tax reporting , are also gaining increasing popularity . This reporting is submitted via an electronic communication channel, the calculation , processing , reconciliation , verification and export of which is carried out by an authorized person.

In this case electronic documents will not have a seal signed using an electronic signature. Electronic invoices and their export can be carried out in relation to any product, work or services .

Processing and reconciliation of invoices also includes such a stage as their accounting, which is financial reporting, the maintenance of which is a prerequisite.

Data on each invoice is entered into the appropriate accounting book, which bears the seal and signature of the organization.

The list of information may include the following: documents relating to the invoice, name of services and agent , goods or work , corrective percentage of cost, if any, extract , export , current account, VAT agent , mandatory invoice details , etc. .d.

In addition, the type to which the document , for example, return invoice , corrected invoice , etc.

Adjustment invoice

When making adjustments, the following rules must be observed:

- changes are made to both copies;

- changes must be endorsed by the seller’s manager or an authorized person (the signature of the chief accountant is not required) and certified by a seal;

- it is necessary to set a date for making corrections;

- erroneous data is crossed out and new ones are entered, indicating the column, and the explanation “Corrected” must be included.

If there are too many errors, it is better to make a new document. The norms of the Tax Code of the Russian Federation do not contain a ban on such an action.

Relevance

The 2020 sample invoice is a transfer document that must be drawn up taking into account the above rules. It must take into account changes made since 10/01/2017.

Let's summarize: invoice - what is it in simple words? In short, this is confirmation of payment and payment of VAT. There are peculiarities of filling out this form, advance or corrective, but the essence does not change. It is in this form that there are signatures of authorized persons who actually confirm the execution of the contract. Therefore, this is an extremely important document that it is advisable to include in contractual obligations. Payers on the general taxation system will also need proof of payment of value added tax.

Relevance of documents

Until July 1, 2020, the document forms introduced by Decree of the Government of the Russian Federation No. 1137 of December 26, 2011 as amended by Decree of the Government of the Russian Federation No. 1279 of November 29, 2014 are valid.

From July 1, 2020, amended forms of documents are put into circulation on the basis of Decree of the Government of the Russian Federation No. 625 of May 25, 2020.

ATTENTION: Please note that the use of new forms of accounting reporting is mandatory from July 1, 2020. Outdated forms will not be accepted for reporting. Be careful and careful!

New uniform in 2020

In connection with the increase in the basic VAT rate to 20%, a new form of invoice was introduced in accordance with the order of the Federal Tax Service of the Russian Federation dated December 19, 2018 No. ММВ-7-18/ [email protected] Changes were made to the electronic format of documents used for exchange via telecommunications communication channels. The order of the Federal Tax Service provides for a long transition period; until December 31, 2019, the right to apply the old format remains. Documents created using old formats must be accepted until December 31, 2022. Tax authorities recommend switching to the new format now in order to improve work efficiency.

Invoice form in Word format

Differences between invoices and a regular invoice and delivery note.

A certain category of novice businessmen do not see the difference between invoices and invoices. Although all these documents can be interconnected by the execution of one transaction, they have fundamental differences.

Difference between invoices and invoices.

Only sellers or suppliers of any services who are VAT payers are required to fill out an invoice. An invoice is a mandatory accounting document for all business representatives and is filled out by a representative of the accounting department on the basis of a service agreement or a purchase and sale agreement.

The supplier needs an invoice to report and obtain the right to a tax deduction, and the buyer needs an invoice to pay (return) the funds given for the goods or services received.

Difference between invoices and delivery note.

The invoice and invoice are filled out in the process of completing one transaction. But their form, purpose and content differ. The invoice must be drawn up strictly in accordance with the approved sample, and the invoice can be drawn up in any (unified) form.

The difference in their purpose is that an invoice is filled out upon payment for a product or service and is the main confirmation for deducting VAT, and an invoice is filled out upon the shipment of goods or services and is a documentary confirmation of this action. In addition, on the basis of the invoice, the purchaser, if necessary, can make claims to the supplier, which cannot be done on the basis of an invoice.