Customs declaration number: decoding and what is it?

CCD - cargo customs declaration - is a mandatory document when moving (import/export) goods between states. Issued by the owner of the goods and processed by an inspector of the Federal Customs Service (FCS).

The customs declaration registration number is assigned to the document by a customs officer upon acceptance. Until October 1, 2020, this detail in the invoice had a different name - the customs declaration number. The addition to the name of the detail made the content of column 11 clear: not the serial number of the declaration, but the registration number.

In accordance with the adopted changes to the procedure for filling out an invoice (RF Government Decree No. 981 of August 19, 2017), in 2020 the TD registration number became a mandatory detail of the shipping document (column 11).

Read our article about what information about the recipient and sender of the cargo should be indicated in the invoice.

Topic: Customs declaration in invoices

Just write Russia and that’s it? The name will be in Russian, only the codes in front will be in English letters, for example DTP 609. In short, this is how you need to drive the goods so that it is not possible to track its flows. And this, as I understand it, is possible if you do not specify the gas customs declaration. I had an export check. There she checked the customs declaration numbers upon receipt of goods. There, my headless predecessor managed to sell the goods on the 10th, but in fact it arrived on the 18th. It is clear that export for this item has not been confirmed. But it was obvious. What will happen if the line of the customs declaration is completely empty, Russia is not even written in?

The tax office checks the filling procedure (i.e., if you received an invoice from suppliers with a customs declaration number, you wrote out your invoice with this no.). And the customs committee checks the compliance of filling in with valid CCD numbers. Theoretically, but in practice I have not heard this. M.b. someone knows more.

What to do when reselling?

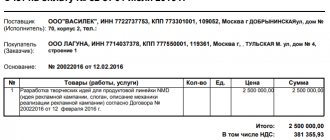

A Russian importer (legal entity or individual entrepreneur) planning further resale of imported goods is obliged to enter in column 11 of his invoice the registration number of the accompanying document registered by customs (subclause 14, clause 5, article 169 of the Tax Code of the Russian Federation).

Letter of the Federal Tax Service No. AS-4-3/15798 directly indicates the seller’s obligation to write down the TD registration number for each product item in the invoice. This applies to goods imported into the Russian Federation and cleared through customs.

Goods that were produced outside the Russian Federation, passed customs registration, and then were packaged, packaged or bottled in Russia continue to have import status. When selling them, you must indicate the TD registration number in the invoice (letter of the Ministry of Finance No. 03-07-08/257 dated 08/23/12).

Based on clause 5 of Article 169, the taxpayer-seller of imported goods is responsible for the compliance of the mandatory information specified in the sales documents (Federal Law No. 150 of May 30, 2016) with the information contained in the incoming invoice (clauses 13, 14 as amended by Federal Law No. 119 of July 22, 2005).

Processing or bundling goods imported into the Russian Federation deprives them of their connection to the direct manufacturer, establishing Russia’s right to be considered a supplier. In this case, there is no need to indicate the customs declaration in the shipping document.

Important! In 2020, the basis for refusal of a deduction may be a discrepancy between the customs declaration number in the customs declaration and the contents of column 11 in the invoice.

When exporting, you need to indicate the customs declaration if you bought it from a Russian supplier

quoted1 > > One remains at customs, two are returned to the declarant - they will be required at customs control when crossing the border. Each copy must bear a mark from the customs office where the clearance took place and a mark from the border customs authority. This confirms the legality of the export of cargo.

Simultaneously with the acceptance of the customs declaration, mandatory payments are made.

These include export customs duties and customs duties. The objects of customs duties and taxes are goods exported outside the Customs Union. The basis for calculation is customs value and (or) physical characteristics in kind (quantity, weight). The amounts are calculated in the currency of the country - a member of the Customs Union where the declaration is submitted.

Special rates are used to calculate amounts.

It is impossible to establish for certain under which declaration the sold goods were imported.

This reason, perhaps, can only be called conditionally valid. Yes, the Ministry of Finance did explain that it is acceptable not to fill out columns 10, 10a and 11 of the invoice, for example, when, after mixing and packaging seeds imported into our country from different countries, it is impossible to determine their country of origin and customs declaration numbers. Letter from the Ministry of Finance dated 05.02. 2015 No. 03-07-09/4572.

The Letters from the Ministry of Finance mentioned in the article can be found in the “Financial and Personnel Consulting” section of the ConsultantPlus system. However, in other similar situations, financiers recommend doing things differently. Or even loss of information (and the reasons for this may be quite valid).

To verify the data of the received invoice, does the reseller need to require a copy of the declaration for the import of goods? Is there any risk of an error in the declaration number indicated in the incoming invoice? And what should you do if the goods are clearly imported, but this is not visible from the invoice?

To deduct input VAT, you need an invoice that contains all the required details. These include, in particular, p.

2, sub. 13, 14 paragraph 5 art. 169 Tax Code of the Russian Federation:

- Number of customs declaration.

And when filling out an invoice, this number is supplemented with the serial number of the product. But perhaps you will come across an invoice, in column 11 of which the following number is indicated, for example: 10226010/220215 ABOUT 003344.

It's not a mistake. The customs simply released the goods you purchased before submitting the customs declaration on the basis of the obligation for the declarant to submit a customs declaration and provide the necessary documents and information.

1 tbsp. 197 TC TC. And it is the number of this obligation (and not the number of the customs declaration) that is indicated in the invoice. Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137):

- digital code of the country of origin of the goods;

Box 11

The requisite in column 11 of the basis document for VAT calculations in 2018 became mandatory (a dangerous SF requisite).

The registration number of the customs declaration in accordance with Government Decree No. 981 of 08/19/2017 must be indicated in column 11 of the tabular part of the document. The name of the column has undergone changes - the word “registration” has been added to the previously used name. Now the wording of the name of column 11 is “Registration number of the customs declaration.”

Request from the supplier of the customs declaration

Customs declaration in the VAT return The acquisition of inventory items produced abroad is a common occurrence in modern economic conditions. Most often, goods are purchased from wholesale companies that operate in foreign markets. And at the transaction stage, it is important to establish the legality of importing goods into Russia.

To carry out such a transaction, the parties may enter into an agency agreement. In accordance with it, the agent undertakes to buy goods for a fee on his own behalf, but at the expense of the principal, or on behalf and at the expense of the principal. In pursuance of the contract, the intermediary enters into a supply agreement with a foreign supplier and pays customs duties for goods imported into Russia, including VAT. In the published Letter, the Ministry of Finance explains the procedure in which the principal can deduct VAT paid by the agent during customs clearance of imported goods. As financiers note, deduction of input VAT on goods imported into the customs territory of Russia is possible if a number of conditions are met. So, these goods must be:

How to apply correctly?

To fill out column 11, the registration number is formed according to the following scheme: 8 characters / 6 characters / 7 characters / 3 characters (letter of the Ministry of Finance No. 03-07-09/6 dated 02/18/2011).

- 8 digits – code of the customs authority that accepted the customs declaration for goods. The list of codes can be found on the FCS website (ved.customs.ru).

- 6 digits – date of acceptance of the TD in the format “hhmmyy”. For example, 160318 means that the document was registered on March 16, 2018.

- 7 digits – AP serial number. Numbering starts from the beginning of the year, a 7-digit number is provided. If the serial number contains less than 7 characters, then zeros are entered first. For example, 0005678.

- 3 digits – product number in the declaration.

Example registration number:

10604118/16022018/0005678/315.

It is important to remember that clause 2 of Article 169 of the Tax Code of the Russian Federation allows for errors in the invoice , which cannot cause a refusal to provide a tax deduction, provided that these errors make it possible to identify the seller, buyer, goods and VAT rate (letter from the Ministry of Finance No. 03-07-08/67893 dated December 26, 2014).

The organization bought imported goods, the invoice was issued without indicating the customs declaration number

The organization should also keep in mind that, in accordance with paragraph 2 of Art. 169 of the Tax Code of the Russian Federation, an invoice drawn up in violation of the procedure established by paragraph 5 of this article cannot be the basis for accepting the amount of VAT presented to the buyer by the seller for deduction. Therefore, the organization has the right to require the supplier of the goods to issue an invoice in accordance with the requirements of tax legislation.

According to paragraph 5 of Art.

Attention

And most often, tax authorities make claims against exporters who sell imported goods purchased in Russia abroad and claim VAT reimbursement on invoices with unreliable (missing) information in columns 10-11 cm., for example, Resolution of the AS SZO dated 03/01/2016 No. F07 -2449/2016, dated 02/19/2016 No. A52-655/2015. Which is not surprising, since when refunding export VAT, inspectors check more carefully. TIP If the invoice for imported goods does not contain information in columns 10-11 (or “unformatted” data is indicated), a biased inspection is not excluded.

Therefore, you can immediately contact the supplier with a request to clarify these points. Perhaps your supplier's written response will satisfy both you and the reviewers.

Taxpayer liability

Information about the registration number of the document that is the basis for the movement of goods between states is mandatory in the document that serves as the basis for VAT calculations (Article 169 of the Tax Code of the Russian Federation).

What happens if you do not indicate the number in column 11? The absence of data in column 11 of the invoice is recognized as a reason for tax inspectors not to accept such a primary document for accounting when providing a VAT deduction.

Judicial practice confirms the unequivocal position of the tax inspectorate: the taxpayer is responsible for indicating the customs declaration number (resolutions of the Federal Antimonopoly Service of the Volga Region dated May 16, 2012 No. F06-2967/12, FAS East Siberian District “F20-477/12 dated March 6, 2012, FAS North-Siberian District Western District No. F07-1879/11 dated 02/01/2112).

The Federal Tax Service Inspectorate recommends not interacting with a supplier who is unable to confirm the origin of the goods sold.

How to find out the customs declaration number and reflect it on the invoice?

Declarations are drawn up in the form approved in Appendix 2 to the Decision of the Customs Union Commission dated May 20, 2010 No. 257. Their numbers are reflected in Column A of the specified document.

The reference number recorded in column 7 of the DT should not be mistakenly mistaken for the customs declaration number. The fact is that in this column a code is recorded that reflects the specifics of declaring property according to a special classifier - it has nothing to do with the customs declaration number for tax documentation. The DT number should be entered in column 11 of the table, which is included in the invoice form.

If the property was imported to Russia from the EAEU, then a dash is placed in column 11 of the document in question. Columns 10 and 10a do not need to be filled in.

Letter from the Federal Tax Service about unl invoice of the supplier 2020

;- reflection of the number of the declaration, according to which goods were imported into Russia in a volume less than indicated in the invoice itself <10; - reflection of the number of the customs declaration, according to which goods other than those indicated in the invoice were imported into our country < 11;- the customs declaration number consists of more than 21 digits, since it contains, through a fraction, an additional digit reflecting the number of the imported goods, although the Federal Tax Service recommends indicating the customs declaration number <12. If the tax office has refused the deduction solely on the grounds that In the invoice for purchased imported goods, columns 10 - 11 are not filled in, there is a chance to challenge this decision. (+) Tax legislation is based on the presumption of good faith of the taxpayer. They evaluate the reality of financial and economic relations with the supplier, and the very possibility of conducting a transaction for the purchase and sale of imported goods, in particular from the point of view of the availability of the goods themselves, personnel, warehouse space, and vehicles. Also, a VAT deduction may be recognized as an unjustified benefit if the tax authorities prove that the organization acted without due diligence and caution and should have known about violations of tax obligations by the counterparty (for example, due to interdependence or affiliation between the taxpayer and the counterparty) <15.(+) If the supplier is unproblematic and the reality of the delivery of goods does not raise any doubts, then it is likely that the courts will consider the deduction legitimate, despite the shortcomings in filling out columns 10 - 11 of the invoice <16.

NoteBut at the same time, do not forget that certain operations are expressly designated as not meeting the criteria for sufficient processing <34. This is, for example: - mixing of goods (components), which does not lead to a significant difference in the resulting product from the original components; - simple assembly operations and operations for disassembling goods; - bottling, packaging in cans, bottles, bags, boxes, boxes and other simple packaging operations; - sorting, classification, selection, selection (including compiling sets of products); - division of goods into components, which does not lead to a significant difference in the resulting components from the original product. That is, not every set or a set of goods formed in our country from several goods imported to Russia from other countries. Reason 4. The necessary information can be found, for example, in column 16 of the goods declaration <6. As we can see, when selling foreign goods, the importer himself can fill out an invoice based on the customs declaration. But this primary source is not available to the reseller. He can only operate on the invoice data received from the supplier. Which, by the way, may not be an importer. (+) Therefore, in Ch. 21 of the Tax Code of the Russian Federation directly states that the seller of foreign goods is responsible only for the compliance of the data that he reflects in outgoing invoices with the information contained in incoming invoices and shipping documents received from the supplier <7.

When exporting, you need to indicate the customs declaration if you bought it from a Russian supplier

Russian Federation, in invoices issued to customers, columns 10, 10a, 11 must be filled in. They indicate (clauses 13, 14 p.

5 tbsp. 169 Tax Code of the Russian Federation, paragraphs. "k", "l" p.

2 Rules for filling out an invoice, approved. Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137):

- Number of customs declaration.

- digital code of the country of origin of the goods;

- short name of the country of origin of the goods;

The norms of Chapter 21 of the Tax Code of the Russian Federation and the Rules for filling out an invoice do not provide for any exceptions in relation to cases when imported goods are supplied by a Russian counterparty.

- Question answer

- home

- 07/09/2010 Question Our company (a resident of the Russian Federation) purchases imported goods from a Russian organization.

Olga Tsibizova, Deputy Director of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia 2. Article: How to fill out a purchase book and a sales book in difficult situations The company bought imported goods from a Russian supplier.

When checking deductions for imported goods, inspectors pay the most attention to two details - the country of origin and the numbers of customs declarations. This data is entered in column 6 of the purchase book.* Difficulties may arise if the supplier's invoice contains several names of imported goods imported into Russia under different customs declarations. Info NK). Otherwise, inspectors may refuse a VAT deduction.

And if this entails incomplete payment of tax, the company will be fined 20 percent of the amount of unpaid tax (clause 1 of Article 122 of the Tax Code). What do the tax authorities say? Experts believe that the absence of these items does not threaten buyers of goods.

Controllers are unlikely to check your invoices against the importer's customs documents.

But our readers advise our colleagues to try to get this data from the seller. Add to favoritesSend by mail The customs declaration number in the invoice for the resale of goods imported into the territory of the Russian Federation is intended to facilitate the identification of the transaction by the Federal Tax Service when the importer issues a VAT deduction.

Let's study in more detail how to find such a number as part of the declaration and how to correctly reflect it in the documentation.

Customs declaration, on the basis of which the goods were imported. Turn on the fool.

Say that they have threatened to send customs officers to you, and you will be forced to redirect them to suppliers. Let them move. Responsibility, of course, lies with the suppliers, but you may also have problems. Lidia Matveeva, accountant at JSC Tirla Opinion of colleagues As practice shows, tax inspectors require that the customs declaration be indicated in the invoice for all indicators. Advice: try to find out this information from your suppliers.

Question: Please tell me: the other day I received an invoice from the supplier, and not a single item in it indicated the CCD (cargo customs declaration) number of the goods. I called to find out what was the matter, they said we don’t know anything, we don’t have a gas turbine declaration.

But at the same time, they explain that the absence of the serial number of the goods from column 32 of the main or additional sheet of the customs declaration or from the list of goods (if it was used instead of additional sheets) cannot be a basis for refusal to deduct VAT Letter of the Ministry of Finance dated 02.18.2011 No. 03- 07-09/06.

Cases when it is not necessary to issue a customs declaration

Labor Code of the Russian Federation):

- information about the goods transported and their price;

- data of the vehicle involved in the transportation of goods;

- information about the sender and recipient of the cargo.

The role and significance of the customs declaration when moving products across the border comes down to the following functions: Actual inspection of the cargo by customs authorities and its passage across the border Establishing the fact of compliance with the Requirements of the customs legislation of the Russian Federation Confirmation that the movement of cargo across the border is lawful and legal Formation of an array of information for the invoice Which subsequently become the basis for charging VAT. What you need to know As mentioned earlier, the customs declaration is a document that allows you to declare the movement across the border of any cargo and vehicles that are the objects of foreign trade transactions of entrepreneurs and organizations.

Customs declaration number on the invoice. how and when it is entered. answers on questions

Similar to the case described above, everything will be overestimated depending on whether the manufactured goods differ from the purchased raw materials. If the first four digits of the product correspond to the data of imported raw materials, then the manufactured product is considered imported, and, therefore, the customs declaration must be included in the invoice.

The same rule should be used to issue an invoice for imported goods purchased in Russia:

- if the product has been changed (replenished, modified), as a result of which its code according to the foreign economic activity classification has changed, then it is recognized as domestic, which means there is no need to enter the GDT into the invoice;

- If an imported product is purchased in the Russian Federation and resold without changes, then when issuing an invoice, the buyer must enter the details of the Russian supplier’s invoices.

Example No. 3. In March 2020, Sokol JSC imported a batch of women's shoes from Italy.

How to fill out a customs declaration (CCD) and when is it needed?

Do not indicate Import of goods not declared In certain cases, the law allows not to fill out a declaration when importing goods (the conditions are described in the Customs Code).

If the goods are imported into the territory of the Russian Federation without a customs declaration, then its number does not need to be entered into the invoice Question and answer about the customs declaration number Question: In November 2016, Pharaoh OA imported a batch of upholstered furniture into the territory of the Russian Federation. In the same month, the furniture was sold in favor of Pyramida LLC.

When shipping the furniture, “Pharaoh” issued an invoice to “Pyramid”, in column 11 of which the customs declaration number 53874251 is indicated.

The customs declaration must be drawn up legibly

Invoices are documents that are generated for the purpose of calculating VAT and receiving deductions for it. Since most often such operations take place in line with the movement of goods across state borders, the CCD (customs declaration) number is written in these payment papers issued by sellers to their buyers.

- General information

- Features of filling SF with gas turbine engine

In 2020, general changes in tax and customs legislation did not ignore this issue.

A cargo customs declaration or cargo customs declaration is a paper that is required for registration in the event that goods are moved across the border, regardless of whether we are talking about import or export. The main information that is prescribed in the customs declaration is (Art.

CCD (customs declaration) in the invoice in 2020

This number is necessary in order to control the legal movement of goods across the border. Is it always necessary to fill out a customs declaration and additional documents? It should be remembered that the cargo customs declaration contains both main and additional sheets.

A mandatory attachment to the customs declaration is a declaration of customs value (DTV). This document is assigned to all goods that are subject to VAT, excise taxes and customs duties.

The point regarding the registration of a customs declaration for a car has already been indicated above. But we should clarify whether it is necessary to fill out a DTS for a vehicle transported across the border? The answer, of course, will be yes.

Of course, it is mandatory to fill out a vehicle registration certificate for a car that is imported into the Russian Federation.

How and when to fill in the customs declaration number in the invoice

This written document must be drawn up in any form and contain information about the property that the owner of the vehicle intends to transport across the border.

This method is applicable only in cases where the total value of the goods available does not exceed 100 euros.

Attention You should also remember that goods should not be subject to taxation, nor have any restrictions on transportation. What you need to indicate in the application:

- The name of the person who transports the declared property across the border, as well as an indication of its legal address;

- Name of all available products.

In this case, it is mandatory to indicate their quantity and codes;

- Customs regime;

- The second method will be discussed in more detail in this article, since this is where the registration of a customs declaration will be required.

Sample filling (example) After the customs declaration number is established and reflected in the registration journal, it is important to correctly transfer it to the Federation Council. This is done as follows (Art.

169 of the Tax Code of the Russian Federation): In field 11 of the invoice, the CCD number indicated on its main and additional sheets is written down. The serial number of the goods is written next to it, which is usually contained in the 32nd column of the document. Both requirements are mandatory; any inaccuracies and errors may lead to the refusal of the customs authorities to provide VAT deductions.

Important

It should be emphasized that when a company uses the general taxation regime, it should always indicate the customs declaration number in the Federation Council, even if it is not an importer. This will save the VAT subject a lot of unnecessary questions from the tax and customs departments.

What is a cargo customs declaration and how to fill it out correctly

Documents for registration of a customs declaration Together with the cargo customs declaration, the following package of documents must be submitted to the customs authorities of the Russian Federation:

- Declarant's certificate (confirmation of the declarant's authority to submit a customs declaration on his own behalf);

- Declaration of customs value;

- Documents for the vehicle (for each, if there are several);

- Documents for monitoring the delivery of goods;

- A copy of the passport certified by a notary;

- Confirmation of payment of customs duties or their future payment;

- The original electronic copy of the customs declaration on electronic media.

If the filling rules are followed, the cargo customs declaration must be submitted to the customs authorities within 15 (fifteen) days from the date of arrival of the goods at the temporary storage warehouse or customs warehouse.

Declaration of goods: who to give and who to refuse? (Manokhova S.V.)

GTD. Not many people pay attention to this. In addition, there is often a chance of seeing this combination of three letters in some documents. In practice, every car owner can encounter these mysterious three letters, so it would be useful to find out what they are and what they represent.

- 1 How does GTD stand for and what is it?

- 2 How to declare goods transported across the border?

- 3 Features of filling out a cargo customs declaration

- 4 Customs clearance and control

- 5 Cargo customs declaration for the car

- 6 Number of cargo customs declaration

- 7 Is it always necessary to fill out a customs declaration and additional documents?

How does GTD stand for and what is it? First, we should move on to deciphering the abbreviation itself, which may simply be incomprehensible to many.

https://youtu.be/sJpZ8P9BYTY

Read the article ⇒ “How to issue an invoice” The form must be filled out in Russian. It is preferable for the form to be filled out electronically, then printed and certified.

If you fill out the form by hand and enter the data illegibly, they may not be accepted for clearance at customs. It should also be taken into account that errors, blots, and corrections cannot be made in the document - such a declaration is considered invalid.

If the data in the document is entered incorrectly, then it is better to rewrite the declaration. If this cannot be done, make the necessary corrections in the document, and then have the customs declaration certified by the declarant.

The legislation establishes the time frame within which a customs declaration must be issued - no more than 14 days from the date of import/export of goods.

Cases when you do not need to issue an unl

Secondly, the number of the declaration itself, which is subsequently transferred to the invoice. The customs declaration also includes the number of goods in the batch, their cost, as well as a list of additional papers attached to the declaration (invoice, specification, quality certificate, etc.).

Specifics of the declaration The customs declaration consists of standard 4 sheets, among which TD1 is the main one, and TD2 is additional.

The procedure for filling them out is as follows (Federal Customs Order No. 1057): The first sheet Remains at customs and stored in a special archive The second is filed in a folder in the customs statistics department The third is handed over to the person declaring the cargo The fourth Acts as a shipping document If one product is moved across the border, from one shipper, in a single batch, at one time - then only the main sheet of the customs declaration is filled out for him.

If we are talking about the transportation of several consignments of goods, from different suppliers, at different times, then one sheet is filled out for each individual type. The customs declaration is usually presented not only in paper, but also in electronic form. In this case, the document should not contain blots or errors. Along with the declaration, the following accompanying papers are submitted to the customs department:

- a document confirming the powers of the declarant;

- papers establishing the customs value of the goods and certifying the vehicle;

- certificates confirming the payment of customs duties.

It is worth noting that the electronic customs declaration is provided on disk along with the general package of papers. After issuance, the customs declaration is registered in a special journal, which becomes the final basis for the legal crossing of the border by cargo.

Source: https://advokat-burilov.ru/sluchai-kogda-ne-nuzhno-oformlyat-gtd/

Filling out an invoice for the resale of imported goods in 2020

In paragraph 5 of Art. 169 of the Tax Code of the Russian Federation states that a taxpayer selling imported goods is responsible only for ensuring that the data indicated in the invoice corresponds to the information contained in the invoices and shipping documents received from suppliers.

Thus, a Russian supplier selling imported goods on the domestic market fills out an invoice based on the data available to him received from the importer (another Russian supplier when reselling imported goods in the Russian Federation). If there is no customs declaration number among the information, he issues an invoice without indicating this number.

Filling out an invoice for the resale of imported goods from the main

Then all this is multiplied by the rate (0, 10 or 18%). Compare this code with the lists of the Government of the Russian Federation, in which the listed goods are taxed at a rate of 10%.

There are 4 lists in total, which include food products, products for children, medical products and books on education, science, and culture. You need to pay VAT before the goods are released from customs.

The tax is paid directly to the customs authority.

A number of transactions specified in paragraph 2 of Article 146 of the Tax Code of the Russian Federation are not recognized as objects of VAT taxation; carrying out construction and installation work for own consumption; transfer for one's own needs of goods, works, services, the costs of which are not taken into account when calculating income tax; importation of goods into the territory of the Russian Federation. Goods and services listed in Article 149 of the Tax Code of the Russian Federation are not subject to VAT.

For resale of imported goods in 2020, customs declaration invoice

For them, this is a significant reason for refusing to accept tax refunds from the buyer. In accordance with the adopted changes to the procedure for filling out an invoice (RF Government Decree No. 981 of August 19, 2017), in 2020 the TD registration number became a mandatory detail of the shipping document (column 11).

Correct execution of an invoice is part of the task of reflecting in accounting and accepting for offset VAT amounts issued by the supplier. During an audit, tax inspectors meticulously study primary documents in order to identify violations in the procedure for drawing up the basis document.

Accounting subtleties: all information about invoices for import and export goods, sample document

Shipment means the transfer of material assets by the seller directly to the buyer , or to the carrier with further transfer to the buyer.

To accompany this transaction, a standard invoice is issued in a standard form (clause 5 of Art.

169 of the Tax Code of the Russian Federation), and in case of receiving an advance payment for the goods, an advance invoice is issued, which indicates the number of the payment document (clause 5.1 of Article 169 of the Tax Code of the Russian Federation).

The most important indicator for any company selling goods is turnover. The sale of goods is the primary stage of commercial activity of trade organizations and enterprises.

A significant role in the process of goods circulation is played by the high-quality preparation of accompanying documents. The legislation of the Russian Federation provides for a list of documents that accompanies the process of selling goods.

Purchase of imported goods without an invoice and further resale of customs declaration

dated 02/16/2004 N 84) The necessary information can be found, for example, in column 16 of the goods declaration. (+) Therefore, in Ch. 21 of the Tax Code of the Russian Federation directly states that the seller of foreign goods is responsible only for the compliance of the data that he reflects in outgoing invoices with the information contained in incoming invoices and shipping documents received from the supplier.

When selling goods whose country of origin is not the Russian Federation, columns 10, 10a, 11 must be filled in invoices issued to customers. They indicate (clauses 13, 14, clause 5, article 169 of the Tax Code of the Russian Federation, clauses “k ", "l" clause 2 of the Rules for filling out an invoice, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137):

How to fill out an invoice when selling an imported OS purchased in Russia

In this case, a taxpayer selling goods whose country of origin is a foreign state is responsible only for the compliance of information about the country of origin of goods and the customs declaration number in the invoices presented to him with the information contained in the invoices and shipping documents received by him (clause 5 of Article 169 Tax Code of the Russian Federation).

The letter states that, in accordance with subparagraphs 13 and 14 of paragraph 5 of Article 169 of the Tax Code of the Russian Federation, invoices issued for the sale of goods must indicate the country of origin of the goods and the number of the customs declaration for goods whose country of origin is not the territory of Russia.

The Ministry of Finance clarified some of the features of filling out an invoice for the resale of imported goods purchased from a “simplifier”

The authors of the letter recall the provisions of paragraph 5 of Article 169 of the Tax Code of the Russian Federation. It states that when selling imported goods, the taxpayer is responsible only for the compliance of information about the country of origin of the goods and the customs declaration number in the invoices presented to him with the information contained in the invoices and shipping documents he received.

We recommend reading: Benefits for Russian Railways Tickets for Pensioners 2019

Source: https://sibyurist.ru/litsenzionnyj-dogovor/zapolnenie-schet-faktury-pri-pereprodazhe-importnogo-tovara-v-2019g

Blog

There should be no spaces between elements. Thus, an organization (individual entrepreneur, individual) should not have the question of how to fill out the registration number of the customs declaration. This is done exclusively by a customs official.

It is only important to know where the registration number of the customs declaration is indicated in order to quickly find it. Also see “Full list of customs codes: table”.

Where to get About where to get the registration number of the customs declaration, it is said in the same paragraph 43 of the rules for filling out the declaration for goods. There is no need to search for a long time to find the registration number of the customs declaration.

It is located immediately in the first line of column “A” of the first and each additional sheet of the declaration. To clearly understand where to look at the customs declaration registration number, refer to the figure above and below. We have highlighted column “A” in red. That's not all.

Customs declaration number on the invoice. how and when it is entered. answers on questions

The organization purchased a computer, the invoice for which contains data on the country of origin and the number of the cargo customs declaration (CCD). The organization has dismantled the computer and is selling a number of imported components.

What information should be indicated in the column “country of origin of goods” and “customs declaration number” in the invoice issued by the organization to the buyer? In accordance with paragraph 3 of Art.

169 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), the taxpayer is obliged to draw up an invoice, keep logs of received and issued invoices, books of purchases and sales, unless otherwise provided by clause 4 of Art. 169 of the Tax Code of the Russian Federation.

Sample filling (example) After the customs declaration number is established and reflected in the registration journal, it is important to correctly transfer it to the Federation Council. This is done as follows (Art.

169 of the Tax Code of the Russian Federation): In field 11 of the invoice, the CCD number indicated on its main and additional sheets is written down. The serial number of the goods is written next to it, which is usually contained in the 32nd column of the document. Both requirements are mandatory; any inaccuracies and errors may lead to the refusal of the customs authorities to provide VAT deductions.

It should be emphasized that when a company uses the general taxation regime, it should always indicate the customs declaration number in the Federation Council, even if it is not an importer. This will save the VAT subject a lot of unnecessary questions from the tax and customs departments.

Rules for filling out unl in an invoice 2018

Customs Declaration If the goods belong to a single product group (according to the Customs Classifier), then it is permissible to compile a general list of them on one sheet of the customs declaration. For different product groups, it is necessary to fill out separate pages of the customs declaration. The more diverse the range of goods, the greater the number of pages of the document will have to be filled out. When it comes to the issue of forming a number The customs declaration, as mentioned earlier, it must include three numeric values separated by a fractional line, namely: xxxxxxxxxx (8 digits) Identifier of the customs authority to which the document is submitted xxxxxxx (6 digits) Date, which has the following form - day, month, year ( for example, 010215) xxxxxxxx (7 digits) Paper number, which is established depending on the order of registration in the customs department register. The customs declaration number is affixed on all pages of this document, filled out for individual categories of goods.

Source: https://civilist-audit.ru/pravila-zapolneniya-gtd-v-schet-fakture-2018/

How taxpayers got out of the situation

VAT reports for the first quarter of 2020 with such short customs declaration numbers were not uploaded. Therefore, some organizations and individual entrepreneurs decided in these cases not to fill out line 150 of section 8 of the VAT return at all. And according to the Federal Tax Service specialist, this is the most correct approach.

Expert commentary. Line 150 of Section 8 of the VAT declaration for goods previously imported into the EAEU countries Irina Sergeevna Persikova, State Counselor of the Russian Federation, 1st class - The format for presenting information from the purchase book on transactions that are reflected in the VAT return provides that the indicator of line 150 of Section 8 of the declaration , where the customs declaration number is indicated, may either be absent (not filled out) or consist of 23 - 27 characters (Table 4.4 Format for presenting information from the purchase book, approved by Order N ММВ-7-3 / [email protected] ). And this is exactly the length that can be entered in column 11 of the invoice when selling imported goods, the registration number of the Russian customs declaration (Letter of the Federal Tax Service of Russia dated 08/30/2013 N AS-4-3/15798; subparagraph 30, paragraph 15, subparagraph 1 p 43 Instructions, approved by Decision No. 257). If column 11 of the invoice of a Russian supplier drawn up for the sale of goods imported from the EAEU member states contains the numbers of customs declarations issued in these states, the buyer does not need to indicate such numbers in lines 150 of section 8 of the declaration. When selling in Russia goods purchased from a supplier from the EAEU member states that were previously released for domestic consumption on the territory of these states, it is not necessary to fill out column 11 of the invoice at all (Letter of the Ministry of Finance of Russia dated September 15, 2016 N 03-07-13/ 1/53940).

However, some companies and entrepreneurs still filled out line 150 of Section 8 of the VAT declaration, adding the number of the customs declaration issued in another EAEU member state to the required length. Someone added zeros at the beginning of the number. Some - numbers corresponding to the state of the customs post, for example 112 - for Belarus, 398 - for Kazakhstan, 417 - for Kyrgyzstan. As a Federal Tax Service specialist explained to us, filling out a VAT return in this way will also not entail any negative consequences.

Expert commentary. Checking the data on line 150 of section 8 of the VAT declaration during a desk review Irina Sergeevna Persikova, State Counselor of the Russian Federation, 1st class - During a desk check of the VAT declaration, filling out line 150 of section 8 of the declaration regarding the correctness of filling in the number of the customs declaration issued in another member state EAEU, not verified.