Home / Taxes / What is VAT and when does it increase to 20 percent? / Invoice

Back

Published: 04/23/2018

Reading time: 5 min

0

49

An invoice is a universal payment document on the basis of which mutual settlements occur between participants in trade turnover or the market for works and services.

- When and who needs an invoice without VAT?

- How to fill out an invoice without VAT?

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

Some of these counterparties have the right to fill out this document without indicating value added tax as a result of using the appropriate tax regime or selling goods that are not subject to such tax.

Invoice from individual entrepreneurs with VAT in 2019-2020: what to consider?

Entrepreneurs often have a question: can an individual entrepreneur issue VAT invoices?

The answer “yes, it can” will be incomplete and may be misleading. The fact is that in some situations an individual entrepreneur is obliged to issue invoices, while in others he is not obliged to, but he can. At the same time, he has additional responsibilities for paying tax to the budget and filing a declaration. Entrepreneurs who use OSNO most often have to issue invoices. Despite the fact that the tax legislation provides for some relaxations for individual entrepreneurs (for example, tax holidays for start-up entrepreneurs, benefits for small businesses, etc.), entrepreneurs on OSNO need to perform the functions of a VAT payer on a general basis. What does this mean?

- Each sale of goods (work, services) must be issued with an invoice with a specified amount of tax (with rare exceptions).

- All invoices issued should be recorded in the sales ledger.

- You must submit your VAT return electronically to the tax authorities on a quarterly basis.

https://www.youtube.com/watch?v=zY_Ukq_sK2w

We tell you about the required invoice details here.

An individual entrepreneur can act not only as a seller or supplier, but also as a buyer. Then he has no obligation to issue an invoice. But the function of the recipient is no less responsible: if something is wrong with the invoice received, the individual entrepreneur may have problems with the deduction.

We draw your attention to two main points to protect yourself from possible claims against the invoice and reduce the risk of losing your tax deduction:

- Column “Seller” - check your seller in advance for tax integrity. If controllers have complaints about it, you may be denied a deduction. Tax authorities have many reasons to question a particular entity, for example: it does not submit tax reports, does not pay taxes, is located at a “mass” address, does not respond to requests from tax inspectors, has signs of a fly-by-night company, etc.

- Technical errors and errors when filling out - the compiler can make a mistake in any column or line of the invoice. Many deduction errors are not critical. But if you receive an invoice on the basis of which it is impossible to identify the seller or buyer, reliably determine the name and cost of goods (work, services), the tax rate and the amount of tax, problems with the deduction may arise. Ask the seller to correct critical defects.

But if an entrepreneur receives an invoice in which only his last name is indicated in the “Buyer” column and there is no status (IP), there is no need to worry. According to the Ministry of Finance (letter dated 05/07/2018 No. 03-07-14/30461), such a defect will not prevent the deduction.

An invoice for an individual entrepreneur is absolutely identical in composition and purpose to an invoice for a company of any legal form.

When do you need to generate an invoice without VAT?

The Tax Code of the Russian Federation provides for the only case in which a VAT payer is obliged to generate an invoice without tax; it is defined in Article 145 of the Tax Code of the Russian Federation. If a legal entity or individual entrepreneur meets the criteria established by this article, then they lose the obligation to charge and pay VAT when performing operations for the sale of inventory, work, and services.

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

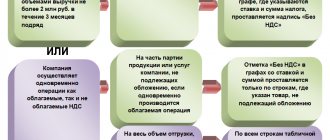

This article defines the conditions under which the seller does not charge VAT and does not highlight this amount in the invoice:

- Revenue is no more than 2 million rubles. (for 3 consecutive months);

- During this period, the seller did not sell goods subject to excise taxes.

Exemption from tax liability does not apply to transactions during which goods are imported into the Russian Federation. In relation to these transactions, the tax should be calculated based on paragraph 4, paragraph 1, article 146 of the Tax Code of the Russian Federation.

Example of filling out an invoice without VAT

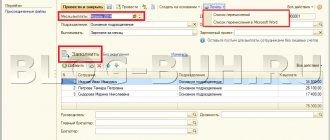

Let's see how to fill out an invoice from an individual entrepreneur with VAT using a sample.

Example

On May 13, 2020, individual entrepreneur Anatoly Viktorovich Kuznetsov, who uses OSNO, sold two machines to Moonlight LLC:

- screw-cutting lathe with PU (RUB 50,820, including VAT);

- tabletop drilling and milling machine (RUB 46,260 including VAT).

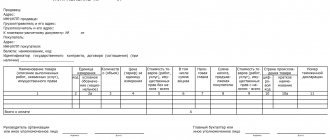

Resolution No. 1137 of December 26, 2011 has annexes, the first of which corresponds to the current invoice form. When issuing an invoice to your counterparties without VAT, you must use this form.

As usual, the form must contain information about the document number, current date, and parties involved. The change in filling out the invoice without VAT is noticeable only in the tabular part, where identical entries “without VAT” must be made in fields 7 and 8. This wording is entered in any convenient way - manually with a pen, using a ready-made stamp, on a computer.

Filling out the remaining columns and fields is no different from filling out the VAT form. In field 9, where the indicator about the total value of positions is reflected, the tax is not included, since it is not charged.

You cannot put zeros in fields 7 and 8, this will be a gross mistake that will entail unpleasant consequences for the seller.

Firstly, 0 in the field for indicating the rate may be perceived by tax authorities as a 0% rate, which is not applicable in the case under consideration. 0% is the tax rate for shipments of goods and materials for export, which must be confirmed by a significant package of documents.

Secondly, the tax office may take zeros as an error and charge VAT on the amount at a rate corresponding to the goods and services being sold.

The form is certified by the signatures of the chief accountant and manager. If there is no chief accountant, then the manager signs in this field. The form in question does not require printing. Drawed up in a single copy for presentation to the client.

We suggest you read: What to do if the second heir does not receive the right to inheritance

The client, having received such an invoice, will not find the corresponding amount in the field for indicating the tax, and therefore will not reimburse VAT on such a document.

has the right to be exempt from VAT due to compliance with the criteria of Article 145, and she promptly notified the Federal Tax Service of her right. When selling office supplies, she presents the buyer with an invoice in addition to the shipping documents; in fields 7 and 8 the wording “excluding VAT” is entered.

Invoice without VAT.

Completed sample When filling out an invoice, errors are often encountered when filling out column 7, where the tax rate is indicated. It is clear that VAT payers indicate there the rate they use. There are three main types of bets:

- 20% is a generally accepted rate, used in most cases

- 10% – applies to some categories of goods

- 0% – preferential rate, applies to goods from other countries

There are also fractional rates, but they are of little interest to us now.

Those entrepreneurs who do not work with VAT, but have decided to issue invoices for sales, should know that in column 7 there should be the inscription “Without VAT”. There is no other option.

If you enter a 0% rate in the column, then, most likely, unpleasant consequences for the entrepreneur will occur. The point is that 0% is still a full tax rate and when applying it, you must file a VAT return.

If the column is filled out correctly, then no questions will arise from the regulatory authorities.

An invoice without VAT has the same form and the same fields to fill out as a regular document used by taxpayers on the general system. The only difference is filling out columns 7 and 8. Such documents do not need to be entered into the accounting program, because their execution, by and large, does not make much sense.

By the way, there is no specific indication that such invoices should not be reflected in the purchase book. There are subtle hints that make it clear that such reflection is inappropriate.

A complete list of invoice details is given in clause 5 of Art. 169 of the Tax Code of the Russian Federation, suggests that this document should indicate:

- serial number, as well as date of formation;

- names of the seller and buyer, their addresses, TIN;

- names of the shipper and consignee, their addresses;

- number of the document used to make the prepayment (if any);

- list of goods sold, its total quantity (or volume);

- currency used in compilation;

- government contract identifier;

- unit of measurement of the volume sold (when possible), as well as its price excluding VAT;

- total cost of goods sold excluding VAT;

- the amount of excise tax (if any is charged);

- applicable VAT rate;

- the amount of VAT calculated at the specified rate;

- total cost of goods sold including VAT;

- in the case of importing goods from abroad - the state of origin of the product, the number of the declaration issued at customs;

- code of the type of goods according to the Commodity Nomenclature of Foreign Economic Activity of the EAEU.

There are few fundamental differences in filling out a document drawn up upon the provision of a service and an advance invoice:

- in the advance invoice you can give a general name of the service if the agreement between the supplier and the buyer, from where the Ministry of Finance of Russia orders this name to be taken, has not been signed by that time;

- the advance invoice must reflect the number of the document confirming the fact of receipt of the advance payment, but if it was received in non-monetary form, a dash is placed;

- When generating an advance invoice, there is no need to indicate the volume of services provided, their units of measurement, as well as their prices.

Thus, when generating an advance invoice for services, you can put dashes everywhere except for the paragraphs that contain:

- document number and date;

- names of the seller and buyer, their tax identification number, addresses;

- number of the document confirming the prepayment;

- name of the service;

- name of currency;

- prepayment amount;

- tax rate;

- the amount of VAT charged to the buyer.

IMPORTANT! The tax rate should be indicated in the advance invoice for services as 20/120 (18/118 - for advances received before 01/01/2019) or 10/110, and not as usual for many taxpayers 20 (18) or 10% (p 4 Article 164 of the Tax Code of the Russian Federation).

The adjustment invoice for services should reflect:

- the exact name of the document (i.e. “Adjustment Invoice”);

- number, as well as date of compilation;

- numbers and dates of generation of invoices, according to which the cost or volume of services provided is adjusted;

- names of the seller and buyer, their addresses, TIN;

- names of services for which price adjustments are made or volume indicators are clarified;

- indicators of the volume of services (if any) before and after adjustments;

- name of settlement currency;

- government contract identifier (if available);

- price per unit of measurement of service;

- cost of services provided without VAT - before and after adjustments to prices and volumes of services;

- tax rate;

- VAT amount - before and after adjustments;

- cost of services provided including VAT - before and after adjustments;

- the difference between the figures on the original invoices and those resulting from the adjustments.

For a sample of filling out an adjustment invoice created on a current form, see the material “Sample for filling out an adjustment invoice (2019 - 2020)”.

And about the differences between an adjustment and a corrected invoice, read the article “In what cases is a corrected invoice used?”

What VAT rate to indicate in the adjustment invoice from 2019, see here.

Registering Invoices: Nine Special Situations

Typically, companies do not have difficulty recording invoices in their accounting journal, purchase and sales books. Invoices are entered into the accounting journal at the time of issuance or receipt, into sales books at the time of shipment of goods, and into purchase books at the time of receipt of the right to deduction. But there are a number of situations in which an accountant may have difficulty recording invoices.

To begin with, let us recall the provisions on the registration of invoices enshrined in the Tax Code of the Russian Federation.

According to paragraph 3 of Art. 169 of the Tax Code of the Russian Federation, the VAT payer is obliged to keep logs of received and issued invoices, books of purchases and sales:

1) when performing transactions recognized as an object of taxation in accordance with Chapter 21 of the Tax Code of the Russian Federation, with the exception of transactions that are not subject to taxation (exempt from taxation) in accordance with Art. 149 Tax Code of the Russian Federation;

2) in other cases determined in accordance with the established procedure.

From paragraph 3.1 of Art. 169 of the Tax Code of the Russian Federation it follows that persons who are not VAT payers are required to keep logs of received and issued invoices if these persons issue and (or) receive invoices when carrying out business activities in the interests of another person on the basis of agency agreements , commission agreements or agency agreements.

According to paragraph 8 of Art. 169 of the Tax Code of the Russian Federation, the procedure for maintaining a log of received and issued invoices, books of purchases and sales are established by the Government of the Russian Federation.

Currently, there is a Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax” (hereinafter referred to as Decree No. 1137). Appendix 3 to this resolution contains the Rules for maintaining a journal of invoices (hereinafter referred to as the Journal Rules), Appendix 4 - Rules for maintaining a purchase book, Appendix 5 - Rules for maintaining a sales book.

The general rules for registering invoices are as follows.

In the accounting journal, outgoing invoices are recorded in part 1 according to the date of their issuance (composition). And received invoices are registered in part 2 of the journal according to the date of their receipt (clause 3 of the Journal Rules).

The purchase ledger records invoices received from sellers and registered in part 2 of the invoice journal, as the right to tax deductions arises (clause 2 of the Rules for maintaining the purchase ledger).

The sales book records issued (composed) invoices in all cases when the obligation to calculate VAT arises. Registration is carried out in the period in which the tax liability arises (clauses 2, 3 of the Rules for maintaining the sales book).

Now let's move on to special cases in which the registration of invoices has its own characteristics.

Registration of incoming invoices

Situation No. 1. The buyer received an invoice without VAT from an organization in a special mode

Organizations using the simplified tax system, UTII and Unified Agricultural Tax are not VAT payers (clause 3 of article 346.1, clause 2 of article 346.11, clause 4 of article 346.26 of the Tax Code of the Russian Federation). Therefore, they are not required to issue invoices when selling their goods, works or services. But in practice, some of these companies issue counterparties not only invoices and acts, but also invoices marked “Without VAT.”

The buyer, who is a VAT payer, is faced with the question: is it necessary to register such invoices in the accounting journal and purchase book?

We believe that the buyer should record such an invoice in Part 2 of the journal. There are two reasons for this. Firstly, Resolution No. 1137 does not contain a clause stating that only invoices received from VAT payers must be registered in the journal. Secondly, clause 9 of the Journal Rules contains a closed list of invoices that are not subject to registration. And it does not mention the invoice issued by the seller in a special mode without allocating the VAT amount.

As for the purchase book, in this case there is no need to enter an invoice into it. After all, it is conducted in order to determine the amount of VAT to be deducted (clause 1 of the Rules for maintaining a purchase ledger). And an invoice without VAT, issued by the seller in a special mode, does not contain the amount of tax and does not give the buyer the right to a deduction.

Situation No. 2. The buyer received an invoice with VAT from an organization in a special mode

Some organizations under special regimes, when selling goods, works or services, issue VAT invoices to their counterparties. Although these sellers are not VAT payers, when issuing an invoice with tax, they must transfer it to the budget (subclause 1, clause 5, article 173 of the Tax Code of the Russian Federation).

The buyer must register such an invoice in the accounting journal. The grounds are similar to those that apply in the previous situation (“The buyer received an invoice without VAT from the organization under a special regime”). Resolution No. 1137 does not say that only invoices received from VAT payers are recorded in the accounting journal. In the closed list of invoices that are not subject to registration, there is no invoice issued by the seller in a special mode.

As for the purchase ledger, it is risky to register an invoice there. After all, according to officials, an invoice issued by a seller who is not a VAT payer does not give the buyer the right to deduct tax (letters of the Ministry of Finance of Russia dated May 16, 2011 No. 03-07-11/126, dated November 29, 2010 No. 03-07 -11/456).

However, if the purchasing company registers the invoice in the purchase book and accepts VAT as a deduction, it has a good chance of defending its case in court. The judges in this matter are on the side of the buyers (resolutions of the Federal Antimonopoly Service of the Moscow District dated May 26, 2009 No. KA-A41/4585-09, the North-Western District dated August 7, 2008 No. A52-4037/2007, the North Caucasus District dated July 30, 2009 No. A53 -18001/2008-C5-46 (Determination of the Supreme Arbitration Court of the Russian Federation dated November 30, 2009 No. VAS-15346/09 refused to transfer the case to the Presidium of the Supreme Arbitration Court of the Russian Federation), Volga District dated October 20, 2011 No. A12-524/2011, dated December 11, 2008 No. A55-963/2008 (Determination of the Supreme Arbitration Court of the Russian Federation dated March 27, 2009 No. VAS-3617/09 refused to transfer this case to the Presidium of the Supreme Arbitration Court of the Russian Federation)).

Situation No. 3. The agent received an invoice for goods purchased for the principal

An agent who purchases goods, works or services for the principal receives an invoice from the seller of these goods (works, services). He then reissues this invoice to the principal, reflecting in line 2 “Seller” not his details, but the details of the actual seller (clause 1 of the Rules for filling out an invoice, approved by Resolution No. 1137, hereinafter referred to as the Rules for filling out an invoice). To this document, the agent attaches a duly certified copy of the invoice received from the seller (subparagraph “a”, paragraph 15 of the Journal Rules).

The agent must register the invoice received from the seller in part 2 of the accounting journal, and the re-issued invoice in part 1 of this journal (paragraph 6, sub. “a”, paragraph 7, paragraph 5, sub. “a”, paragraph 11 of the Journal Rules ). Agents do not register a copy of the invoice received from the seller in the journal (paragraph 2, subparagraph “a”, paragraph 15 of the Rules for maintaining an accounting journal). In addition, the agent does not need to reflect either the received or reissued invoices in the purchase book and the sales book (clause 19 of the Rules for maintaining the purchase book and clause 20 of the Rules for maintaining the sales book). This is confirmed by specialists from the Ministry of Finance of Russia (letter dated November 27, 2013 No. 03-07-14/51334).

What if the agent is not on the general taxation system, but on a special regime, for example, on the “simplified” tax system or UTII? The order will be the same. Intermediaries in a special regime must also re-issue invoices to the principals for purchased goods, because the Tax Code of the Russian Federation and Resolution No. 1137 do not provide for an exception for them. At the same time, agents in a special regime do not have the obligation to pay the VAT allocated in such an invoice to the budget. Officials also pay attention to this (letter of the Ministry of Finance of Russia dated July 20, 2012 No. 03-07-09/86). Accordingly, intermediaries in special modes are not required to register invoices in the books of purchases and sales.

At the same time, it is necessary to keep a logbook and register in it both invoices received from the seller and re-issued invoices to agents in special modes. From January 1, 2014, such an obligation is enshrined in clause 3.1 of Art. 169 of the Tax Code of the Russian Federation. And it must be implemented, despite the fact that the corresponding amendments have not yet been made to Resolution No. 1137.

Situation No. 4. The buyer received an invoice, exempt from VAT

A company exempted from VAT payer obligations on the basis of Art. 145 of the Tax Code of the Russian Federation, like an ordinary taxpayer, issues invoices to buyers. At the same time, she does not highlight the amount of tax in the invoice, and in columns 7 “Tax rate” and 8 “Amount of tax presented to the buyer” she puts the note “Without VAT” (clause 5 of article 168 of the Tax Code of the Russian Federation, subparagraph “g” , “z” clause 2 of the Rules for filling out an invoice). In addition, such a tax is deductible, but takes it into account in the cost of purchased goods (work, services) (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).

Is it necessary in this case, despite the absence of the right to deduction, to register incoming invoices from suppliers in the accounting journal? According to officials, yes (letter of the Ministry of Finance of Russia dated March 26, 2007 No. 03-07-11/73). After all, exemption from the duties of calculating and paying tax does not relieve the company of other obligations as a VAT payer, in particular, the obligation to maintain an accounting journal and register not only outgoing, but also incoming invoices.

At the same time, there is no need to register incoming invoices in the purchase book. This is confirmed by tax authorities (letter of the Federal Tax Service of Russia dated April 29, 2013 No. ED-4-3 / [email protected] ). The argument is this: only invoices that give the right to deduct tax are entered into the purchase ledger. And companies exempt from VAT payer obligations do not claim the deduction.

Situation No. 5. The buyer discovered an old invoice from the seller

Sometimes it happens that an invoice is included and it is discovered only in subsequent tax periods. It is not clear from Resolution No. 1137 how to register such an invoice in the accounting journal and purchase book.

The letter of the Ministry of Finance of Russia dated July 2, 2013 No. 03-07-09/25177 states the following: the company must independently determine the procedure in which it will reflect in the accounting journal invoices that were not registered in the period of their actual receipt, bearing in mind that in accordance with clause 3 of the Journal Rules, received invoices are subject to a single registration in chronological order by date of receipt.

In our opinion, the company can establish in its accounting policy the rule that if “forgotten” invoices are discovered, they are recorded in the journal for the quarter to which the date of their actual receipt refers. In this case, an entry about a “forgotten” invoice is made after all previously made entries about incoming invoices for the quarter, and in column 1 of part 2 of the journal, a fractional (additional) number is indicated.

Example

Let's say that in April a company discovered an invoice that was actually received on March 10th. In Part 2 of the magazine for the first quarter of 2014 there is one invoice received on March 10th. It is registered under number 45. This means that the company will enter the forgotten invoice in this journal as the last line, after all entries about invoices received in the first quarter, under number 45/1.

A “forgotten” invoice must be reflected in an additional sheet to the purchase book for the quarter in which this invoice is recorded in the accounting journal. Of course, provided that other conditions for the deduction were met at that time. In particular, the company already had primary documents for this operation, and it reflected the corresponding goods (work, services) in accounting (Articles 171, 172 of the Tax Code of the Russian Federation).

Situation No. 6. The incoming invoice reflects more goods than actually received

At the time of acceptance of goods (that is, even before they are reflected in accounting), the buyer may discover that in fact there are fewer of them than reflected in the documents, including the invoice. In this case, the seller needs to issue an adjustment invoice to reduce the cost of goods (clause 3 of Article 168 of the Tax Code of the Russian Federation). But the buying company has not yet claimed VAT on the goods received, so it does not need to record this adjustment invoice in the sales ledger, i.e., recover the tax attributable to the shortfall. Instead, the buyer must reflect the incoming invoice in the purchase book in the part that relates to the goods received (clause 1 of Article 172 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated February 10, 2012 No. 03-07-09/05).

But in part 2 of the journal, the buyer needs to register both the adjustment invoice and the incoming invoice in the full amount. Indeed, Resolution No. 1137 does not provide for partial registration of invoices in the event that the buyer does not claim a deduction for the entire cost of goods.

If the seller subsequently supplies the missing goods, he will be required to issue a new invoice to the buyer for their value. The buyer will be required to record this invoice in the journal and purchase ledger in the normal manner.

Situation No. 7: The supplier corrected a minor error on the invoice

Sellers should not draw up a corrected invoice if an error in the source does not prevent tax authorities from identifying the supplier and buyer, the name and cost of goods, the tax rate and the amount of VAT (clause 7 of the Rules for filling out an invoice). Nevertheless, buyers sometimes receive new copies of invoices from suppliers, in which, for example, an error in the department's checkpoint or some other minor defect has been corrected.

As a general rule, a buyer who has received a corrected invoice must cancel the entry on the original invoice from the purchase ledger, and register the corrected invoice on the date the right to deduct arises (clauses 4, 9 of the Rules for maintaining the purchase ledger).

But when it comes to a corrected invoice in which the seller has corrected a non-critical error, we believe that the buyer has the right not to reflect this document in the purchase book. Firstly, the seller, by issuing a corrected invoice in the absence of a critical error, violates Resolution No. 1137. Secondly, the buyer has the right to claim a deduction on the original invoice, so that receipt of a corrected document does not entail any consequences in terms of date and amount deduction.

In our opinion, the corrected document also does not need to be registered in the accounting journal. After all, the buyer has already reflected there the initial invoice, which contains all the necessary details and gives the right to a deduction.

Registration of outgoing invoices

Situation No. 8. A company issued an invoice with VAT using a special regime

Organizations using the simplified tax system, UTII and Unified Agricultural Tax when issuing invoices with VAT must pay this tax to the budget and report on it (subclause 1, clause 5, article 173, clause 5, article 174 of the Tax Code of the Russian Federation).

The Code does not require that an organization in a special regime register the issued invoice in the accounting journal and sales book. At the same time, from paragraphs 1 and 3 of the Rules for maintaining the sales book, it follows that invoices issued by the seller (namely the seller, and not just the VAT payer) are subject to registration in the sales book in all cases when the obligation to calculate VAT arises in accordance with the Tax Code. code. Therefore, from our point of view, a company in a special regime in this situation needs to create a sales book and register the issued invoice in it.

At the same time, you don’t have to keep a logbook, because from Resolution No. 1137 it follows that only taxpayers and VAT tax agents should do this (clauses 1, 2 of the Journal Keeping Rules).

Situation No. 9. A company in a special regime is a tax agent for VAT

If a company leases state (municipal) property under a special regime, it is a tax agent for VAT. This means that she must issue an invoice for the cost of rent, calculate and transfer to the budget VAT on this amount (clause 3 of Article 161, clause 5 of Article 346.11 of the Tax Code of the Russian Federation).

Tax agents for VAT who are not payers of this tax must keep part 1 of the log of received and issued invoices (“Issued invoices”) in those tax periods in which they register the corresponding invoices (clauses 2, 7 Logging rules). In addition, invoices issued by tax agents must be registered in the sales book (clause 3 of the Rules for maintaining the sales book).

As for the purchase book, it is not required to be completed. VAT tax agents leasing municipal property reflect in the purchase book invoices drawn up and registered in the sales book in order to determine the amount of tax to be deducted (clause 23 of the Rules for maintaining the purchase book). But only tax agents who are also VAT payers have the right to such a deduction (clause 3 of Article 171 of the Tax Code of the Russian Federation). A company in a special regime is not one; it includes agency VAT in expenses (clause 2 of Article 346.11, subclause 8 of clause 1 of Article 346.16 of the Tax Code of the Russian Federation). And since there are no deductions, there is no need to keep a purchase book.

Consequences of incorrectly registering an invoice

The Tax Code does not stipulate liability for incorrect maintenance of the invoice journal, purchase book and sales book.

Article 120 of the Tax Code of the Russian Federation provides for a fine of 10,000 rubles. for such gross violations of the rules for accounting for income and expenses and taxation objects as:

— lack of invoices;

— lack of tax accounting registers;

- systematic (twice or more times during a calendar year) untimely and incorrect reflection in the tax registers of business transactions, cash, material assets, intangible assets and financial investments.

At the same time, in Art. 120 of the Tax Code of the Russian Federation does not say which documents are tax accounting registers. In Chapter 21 of the Tax Code of the Russian Federation and Resolution No. 1137, the invoice journal, purchase book and sales book are also not called tax accounting registers. This concept is revealed only in Art. 314 Tax Code of the Russian Federation. In it, the analytical register of tax accounting is understood as a consolidated form of systematization of tax accounting data for the reporting (tax) period, grouped in accordance with the requirements of Chapter 25 of the Tax Code of the Russian Federation, without distribution (reflection) among accounting accounts. At the same time, under tax accounting in Art. 313 of the Tax Code of the Russian Federation is understood as a system for summarizing information to determine the tax base for income tax based on data from primary documents.

From the above, we can conclude that the invoice journal, purchase book and sales book are not tax accounting registers, since they are used exclusively for the purpose of calculating VAT. This means that the company cannot be fined for filling them out incorrectly.

At the same time, it must be taken into account that errors in the purchase book can lead to a dispute about the legality of VAT deductions. So, if the tax authorities discover that there is no invoice in the purchase book for which the deduction was claimed in the declaration, it can be removed and the tax recalculated.

Judicial practice on this issue is contradictory. Some judges believe that such an error is not critical, and therefore does not deprive the company of the right to deduction (Resolution of the Federal Antimonopoly Service of the Moscow District dated April 4, 2011 No. A41-21819/2010). But other arbitrators support the tax authorities. For example, the resolution of the Federal Antimonopoly Service of the East Siberian District dated June 29, 2009 No. A78-4566/2008 states the following. Recording invoices in the purchase ledger is the responsibility of the buyer, and making changes to the purchase ledger by issuing additional sheets when errors are identified is an opportunity to comply with such obligations. In the absence of registration of invoices in the purchase book, it is impossible to correlate (identify) the amount of tax deductions by size, tax period, and supplier.

In addition, tax authorities may charge additional tax if they discover that the amount of VAT in the sales book for a certain quarter is greater than in the corresponding declaration. In this matter, the judges are on the side of the taxpayer. They point out that a formal comparison by fiscal officials of the sales book and the declaration is not enough to identify the fact of a tax violation, since the sales book is not the primary document intended for calculating VAT (Resolution of the Federal Antimonopoly Service of the East Siberian District dated March 20, 2012 No. A58-6572/2010).

How to exercise the right to release?

If a taxpayer, having analyzed his activities over the past months, finds compliance with the VAT exemption criteria prescribed in Article 145, then the following actions should be taken:

- Fill out a standard form for notification of your right (its form is approved by Federal Law No. 58-FZ of June 29, 2004);

- Send a completed notification to the tax office - before the twentieth day of the month from which the company was able to exercise this right, the twentieth day is included here;

- Prepare extracts from the balance sheet (for legal entities), books of income and expenses (for individual entrepreneurs), books of sales and attach them to the notification when submitting documentation to the Federal Tax Service. The forms of extracts of these documents are not regulated by legislators.

We suggest you read: The girl deceived what to do

You can submit the indicated documents by visiting the tax office in person. You can also transfer the documentation through Russian Post by issuing a registered letter with an inventory and notification of delivery.

If all the listed actions and conditions are met by the taxpayer, then he can enjoy the right to tax exemption for 1 year (or until the conditions are violated). Throughout this period, the obligation to issue VAT-free invoices to customers remains.

If at the end of the year the company can still take advantage of the VAT exemption, then it must again inform the tax authority of its right - no later than the twentieth day of the next month. The list of documents is similar to the primary notification.

Legal dashes in the invoice

Dashes in the invoice are allowed in some cases by the rules for filling it out, approved by Decree of the Government of the Russian Federation No. 1137.

In the example we considered, the entrepreneur sold domestic goods on the territory of the Russian Federation. Therefore, he does not need to indicate on the invoice:

- code of goods according to the Commodity Nomenclature of Foreign Economic Activity (Gr. 1a) - this information is entered only in relation to goods exported from Russia to the territory of the EAEU;

- information about the origin of goods (columns 10 and 10a) and customs information (column 11) - these columns are filled in only for goods whose country of origin is not Russia.

Dashes are also allowed on other lines and columns of the invoice:

- on page 8 - if the delivery of goods does not take place within the framework of a government contract or its identifier is missing;

- in gr. 2 and 2a - you can put a dash in them if the unit of measurement and its code cannot be determined or they are not in the OKEI (classifier of units of measurement).

Putting dashes in other lines and columns may cause claims from inspectors and problems with deductions for the buyer.

Where to find a sample and form of an invoice

The invoice form was approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. The form is currently in effect as amended on October 1, 2017. The current invoice form can be downloaded from our website.

Also on the website you can find a completed sample invoice without VAT.

About the basic rules that should be followed when preparing documents in interaction with an organization operating without VAT, read the article “Basic rules when an organization without VAT works with an organization with VAT .

Does an entrepreneur need to issue an invoice without VAT?

PSN (patent taxation system) is a special taxation regime. Individual entrepreneurs on PSN in most cases are not recognized as VAT payers (Article 346.43 of the Tax Code of the Russian Federation). However, there are two groups of situations where an invoice:

- Must be completed mandatory due to the requirements of tax legislation.

- Can be registered by the entrepreneur voluntarily (for example, at the request of the counterparty);

If an individual entrepreneur voluntarily issues an invoice on PSN, VAT may be allocated as a separate amount in it, or the inscription “Without VAT” may be acceptable. This is not prohibited by the Tax Code of the Russian Federation. Officials do not object to this either (letter of the Ministry of Finance of Russia dated October 24, 2016 No. 03-07-14/61770). But there is one condition: the individual entrepreneur on the PSN must fulfill the requirement of clause 5 of Art. 173 of the Tax Code of the Russian Federation, namely, pay the VAT indicated in the invoice to the budget and submit a VAT return.

Example

Entrepreneur M.R. Khusainov, who uses PSN, assisted in the restoration of a carpet measuring 3.10 × 2.40 m. At the request of his customer, on May 14, 2019, he issued an invoice in the amount of 63,897 rubles. (including VAT RUB 9,747). The tax amount allocated in the invoice is RUB 9,747. IP Khusainov M. R.

Entrepreneurs and organizations have equal rights in terms of issuing invoices. The preparation of a document does not depend on who issues it and who accepts it. It is legally established that if a supplier works with VAT, then generating an invoice for the sale is his responsibility.

For those who work without VAT, the rules are slightly different. For entrepreneurs in special regimes, there is no obligation to issue invoices. Such taxpayers must provide the buyer only with a bill of lading or an act, which will confirm the fact of fulfillment of their duties. An invoice can be issued at the request of the seller or at the request of the buyer.

Both types of invoices (both with VAT and without VAT) are accepted by buyers without any problems.

An invoice without VAT is filled out according to the general rules.

| Part of the invoice | What information is contained |

| Document header | In this part of the document you need to indicate the name, address, tax identification number and checkpoint of the seller and buyer. Abbreviations when filling out are allowed, but within reasonable limits, without fanaticism |

| Tabular part | The tabular part of the document contains 11 columns. They indicate the name of the product or service, units of measurement and their code, the quantity of goods sold or services provided, their cost excluding the amount of tax. If there are no excise taxes, then the inscription “Without excise duty” is entered in the corresponding column. Columns 7 and 8 must contain the phrase “No tax”. Next, we write down the total cost, taking into account all taxes. The last three columns are filled in if the goods are imported from the territory of another country |

| Document footer | Signatures are required here. If an invoice is drawn up by a legal entity, the head of the company and the chief accountant sign the document. If the document is drawn up by an entrepreneur, he signs it himself. If there is a chief accountant, his signature is also affixed. Opposite the individual entrepreneur’s signature, information about his state registration is recorded |

Making closing documents

Closing documents (acts, invoices) are drawn up with the obligatory inclusion of the following details in their content:

- document creation date;

- name of the form (for example, “Invoice”, “Certificate of completed work”);

- name of the product supplier (work performer);

- characteristics of the subject of the contractual relationship (listing of goods, services, works);

- units of measurement of delivered products;

- cost of a unit of goods (service, type of work) and the total amount;

- signatures of responsible persons with descriptions of positions and full names.

It is necessary to receive closing documents only in originals. Copies have no legal force, even certified ones. Therefore, such forms are filled out in several copies at once.

This is important to know: Is it necessary to pay VAT on the advance received?

The agreement may stipulate what documents the counterparty must provide to complete the transaction. The agreement can describe the form of documents, their content, structure, deadlines for preparation (for example, “we will provide closing documents within 3 days after completion of the work”). There is no single mandatory sample of invoices, certificates of completion of work or other similar forms in Russian legislation; each business entity has the right to develop them independently, taking into account the requirements of the accounting law No. 402-FZ for primary documents. You can also use unified forms that were used before 2013, for example, consignment note TORG-12 (approved by Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132).

Is it possible for an individual entrepreneur on the Unified Agricultural Tax not to issue invoices from 2019?

| As desired (or as customer's request) | Necessarily |

| VAT defaulters using the simplified tax system, PSN, UTII, Unified Agricultural Tax | Payers exempt from VAT in accordance with Article 145 of the Tax Code of the Russian Federation when selling goods and materials, services, works |

| Payers carrying out transactions under Article 149 of the Tax Code of the Russian Federation | Payers exempt from VAT in accordance with Article 145 of the Tax Code of the Russian Federation upon receipt of an advance payment from the buyer |

Until the end of 2020, entrepreneurs using the Unified Agricultural Tax were not considered VAT payers, except for the cases listed in clause 3 of Art. 346.1 Tax Code of the Russian Federation:

- when importing goods into the Russian Federation;

- when carrying out operations listed in Art. 161 (when performing the duties of a tax agent for VAT) and in Art. 174.1 of the Tax Code of the Russian Federation (see the figure above).

But as of January 1, 2019, the situation has changed—those using the special agricultural regime will also have to pay VAT. Such amendments were made to paragraph 12 of Art. 9 of the Law “On Amendments to the Tax Code of the Russian Federation” dated November 27, 2017 No. 335-FZ.

We invite you to read: A crazy woman can claim an inheritance

Companies and individual entrepreneurs on the Unified Agricultural Tax will need to issue invoices to their customers and customers, maintain tax registers for VAT (sales books and purchase books), and also submit quarterly declarations for this tax to the inspectorate.

How an individual entrepreneur fill out a VAT return is described in this material.

Legislators have provided a benefit for Unified Agricultural Tax payers—from 2019, individual companies and individual entrepreneurs can maintain their VAT non-payer status. We will tell you what is needed for this in the next section.

Before answering the question whether it is possible for individual entrepreneurs on the Unified Agricultural Tax not to issue invoices since 2019, let us clarify how they can maintain their VAT non-payer status.

Exemption from VAT payer obligations since 2020 has been provided to companies and individual entrepreneurs on the Unified Agricultural Tax due to the provisions of Art. 145 Tax Code of the Russian Federation. The procedure for taxpayers to use this benefit is given in the letter of the Federal Tax Service of Russia dated May 18, 2018 No. SD-4-3/ [email protected]

However, exemption from VAT and relief from the need to report this tax is not provided to all payers of the Unified Agricultural Tax, but only to those who:

- meet special criteria for unified agricultural tax income;

- do not sell excisable goods;

- promptly provided the tax authorities with a package of documents to obtain exemption from VAT.

Having received an exemption from VAT, payers of the Unified Agricultural Tax must take into account the following:

- the benefit is not automatically renewed and requires annual confirmation;

- If the right to a benefit is lost, it cannot be used again.

Does this benefit give you the right not to issue invoices? No. When using benefits under Art. 145 of the Tax Code of the Russian Federation, taxpayers are required to issue invoices:

- without allocation of tax;

- indicating the inscription or stamping “Without VAT”.

Such rules are established in paragraph 5 of Art. 168 of the Tax Code of the Russian Federation and explained in the letter of the Federal Tax Service of Russia dated April 29, 2013 No. ED-4-3/ [email protected]

When else does an invoice without VAT apply?

The case discussed above is the reason for the mandatory generation of an invoice, despite the fact that there is no tax in it.

There are also situations in which a legal entity or individual entrepreneur has the right, on their own initiative, to fill out an invoice without VAT for presentation to the buyer:

- Transactions are carried out on which VAT is not charged (commodities, services, works are sold, the cost of which is not subject to tax under Article 149 of the Tax Code of the Russian Federation). The list of these operations is quite large and closed;

- The company is not a VAT payer due to the use of tax regimes different from the general system (STS, UTII, PSN, Unified Agricultural Tax).

In these cases, companies are not required to generate an invoice at all, but if clients ask, you can meet them halfway and write out a document in which you should write “without tax” in the fields dedicated to VAT (tax rate and amount).

It is difficult to say what motivates clients’ requests for an invoice in such situations. There is no tax allocated, there is nothing to reimburse the buyer. As a rule, such a request is related to the peculiarities of the counterparty’s document flow or an incomplete understanding of the situation. In the second case, an attempt can be made to explain to the buyer that the invoice is unnecessary in this case.

In such a situation, the seller can prepare an invoice without VAT or refuse this action; the choice remains solely with the seller. If the buyer is persistent in his desire to receive an invoice, even if it is without tax, then it is better to issue it; in this case, the seller loses nothing and does not acquire any obligations to pay tax.

If the invoice is filled out correctly, that is, in field 7 (rate), as well as in field 8 (VAT amount), the phrases “without tax” are entered, then the seller does not have the obligation to pay VAT; he also does not have to report to the Federal Tax Service using a VAT return. you won't have to. Moreover, there is no need to register the issued form in the sales book and other summary documents (unless the seller himself wishes to do so).

Registering an invoice without VAT

Persons who are exempt from tax due to the provisions of Article 145 of the Tax Code of the Russian Federation are required to issue an invoice without VAT and register it in the sales book with the note “without VAT”.

If the company is not a VAT payer or carries out transactions listed in Article 149, then it is not required to generate an invoice without VAT, but if it does, then it is not required to register it in the sales book. If, due to its personal reasons, the company wishes to make registration records of such documents, then this is its right.

Counterparties who have received such a document do not make a registration entry in the purchase book due to the absence of tax there. If there is no tax, then there is nothing to send to the buyer for reimbursement, and therefore there is no point in reflecting such a form in the purchase book - the buyer will not be able to take advantage of the deduction.

Can an individual entrepreneur operate without VAT?

/ Most often, an individual entrepreneur is a small business that works with the end consumer of goods and/or services, has low turnover and, accordingly, maintains simplified accounting. Such an enterprise does not need VAT payer status, since taking into account the tax base and tax deductions will still not give a tangible economic result, but will only cause another expense item (accountant’s salary). But in a dynamic market, it is not always profitable for an entrepreneur to remain on a simplified taxation system (see.

). It is necessary to consider in more detail the problem of individual entrepreneurs without VAT. Contents: In accordance with Article 145 of the Tax Code of the Russian Federation, individual entrepreneurs can be exempted from the obligation to maintain VAT accounting and pay this type of tax to the treasury. But not everything and not always. Based on this article, individual entrepreneurs whose quarterly revenue does not exceed 2 million rubles can operate without VAT.

Results

An invoice - regardless of whether it is drawn up by an individual entrepreneur or a company - is a document that allows the buyer to receive a VAT deduction. If an individual entrepreneur is a VAT payer, he is required to prepare invoices for each sale. If an entrepreneur applies a special regime, he is not recognized as a VAT payer and is not required to issue invoices (except in certain situations). Tax legislation does not prohibit him from issuing a VAT invoice, but in this case he must pay the tax to the budget and report.

Since 2020, the obligation of VAT payers has appeared for companies and individual entrepreneurs using the Unified Agricultural Tax. In this case, it is possible to obtain an exemption under Art. 145 Tax Code of the Russian Federation. But you will still have to issue invoices, albeit without tax.

A seller who does not pay VAT or is exempt from paying tax is not required to issue invoices. A buyer who is a defaulter or exempt from paying VAT takes into account input tax depending on the tax system he has adopted.

Invoices in connection with services are issued by VAT payers, using all 3 types of this document: main, advance, adjustment. The specificity of reflecting data on services in them is that not all of their details are required to be filled out.

Primary documents for individual entrepreneurs on the simplified tax system - agreements, acts

Updated: 08/23/2019 Oleg Lazhechnikov 7To receive income, you must have primary documentation, that is, you cannot receive money just like that, there must be a justification.

At first, this is very unusual, because when you work as an individual, there is no paperwork, but in practice everything is not as difficult as it seems. I am no longer at all afraid of issuing an invoice or sending a report, given that I always have all the templates at hand in the accounting service, from where they can always be downloaded. Contents of the article My post was written based on the fact that I chose the simplified taxation system (USN 6% ) and perhaps there are some nuances in other systems. Nevertheless, the contracts/acts/invoices/Kudir will be approximately the same for everyone and the essence of the primary documentation also does not change. Almost all forms and ready-made templates can be downloaded on the Internet if you need them.

Since I have been using the service for a long time, I download everything from there.