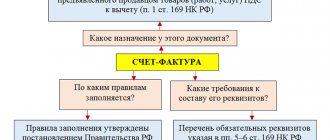

As follows from the provisions of Article 168 of the Tax Code, the seller of goods, works or services, if he applies the general taxation system and is a VAT payer, is obliged to issue invoices in the name of his buyer for goods shipped, work performed or services rendered. A similar obligation arises when receiving an advance payment - full or partial - for upcoming deliveries. In both cases, a 5-day period is given for issuing the document.

At the same time, anything can happen in business, and the shipped goods may be partially not accepted by the buyer, the total volume of work or services is reduced at the time of their acceptance, and the payer may request the advance received back, for example, by refusing the transaction. In this case, the originally executed document will lose its relevance, since it will simply contain incorrect data. An adjustment invoice will be a kind of replacement for it. Its design, as well as the reflection of this situation in accounting, will be discussed in our article.

Adjustment invoice for decrease or increase

The Tax Code provides for four cases where an obligation arises when it is necessary to issue an adjustment invoice from the seller. This is a change in the price of goods, works or services specified in the original document, a change in their quantity, simultaneous adjustments in both price and quantity, or the return of part of the goods from a buyer who is not a VAT payer.

If such changes occurred within 5 days from the date of initial shipment, and the original invoice has not yet been issued, then there is no need to issue a CSF. You can reflect the agreed changes in a regular invoice, because the deadline for its execution has not yet been violated. If, after shipment, a more impressive period of time has passed, and the buyer has already received all the required paperwork for the transaction, then paragraph 3 of the same Article 168 of the Tax Code prescribes issuing an adjustment invoice also within 5 days from the date of execution of the primary documentation on the basis of which the data changes are happening. The calculation is made from the date of registration, for example, of a new invoice or an additional agreement that changes the volume or cost of work, or provides a discount.

An adjustment invoice is not a document replacing the original invoice. This is a kind of annex to it, which reflects only changes. Its form, like the form of a regular document, was approved by Decree of the Government of the Russian Federation of the Government of the Russian Federation of December 26, 2011 No. 1137.

The CSF is also drawn up in two copies - for the seller and for the buyer. Indicate in detail the data for each transferred item of goods, works or services, the price or quantity of which has been changed. Moreover, the data is indicated in the context of changes, that is, the previous information about the cost or quantity is recorded, and its new, current version. The cost of goods, works or services, as well as the amount of tax on them before and after the changes agreed upon by the parties to the transaction, are separately summed up.

The seller has the right to make a consolidated adjustment, that is, to combine in one invoice data on changed items from different documents, if initially these items were billed at the same price, and changes in them occurred either in terms of quantity or at the same price same delta in price.

Introductory information

The procedure for filling out adjustment invoices is established by the Tax Code.

The composition of the indicators and the rules for filling out the adjustment invoice are given in Appendix No. 2 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax.” However, not all situations are spelled out clearly enough in these documents. To help you figure out whether the adjustment invoice is filled out correctly and to prevent possible conflicts with inspectors, we have compiled instructions. It combines legislative requirements, explanations of officials, and also takes into account court decisions in a convenient form.

For convenience, we will call the invoice that was drawn up when the goods were shipped (and for which an adjustment invoice was subsequently issued) the “original” invoice.

An invoice that has been corrected will be referred to as a “corrected” invoice. Accordingly, we will call an adjustment invoice with corrections a “corrected” adjustment invoice.

Finally, we will designate an adjustment invoice issued when the original delivery cost is changed again as a “repeated” adjustment invoice.

Automatic reconciliation of invoices with counterparties will reduce the risk of additional VAT charges Carry out reconciliation

Where is the adjustment invoice reflected for decrease and increase?

Issuing an adjustment invoice does not lead to the need to clarify an already filed VAT return, regardless of the tax period - in this case, the quarter in which the relevant changes were agreed upon.

The supplier's sales book does not reflect the adjustment invoice for the reduction. In this case, if there is a decrease in the total amount of the sale and the tax on it, then the CSF is reflected in the seller’s purchase book in the period in which the adjustment document was drawn up. On this basis, the right to deduct VAT arises. Conversely, if the totals of the original invoice were increased, then an additional entry is made in the sales ledger and tax must be paid additionally.

For the second party to the transaction, the situation is exactly the opposite. An adjustment invoice for a reduction from the buyer is reflected in the sales book; as a result, the amount of tax previously accepted for deduction must be restored. If the transaction price has increased, this is recorded in the purchase book and the buyer is entitled to an additional deduction. Both entries are also made in the quarter in which the supplier issued an adjustment invoice for a decrease or increase.

It is also worth noting that in cases where the seller or buyer has the right to deduct VAT, it is not necessary to realize it exactly in the quarter in which the adjustment invoice was issued. Such deductions can be applied within three years from the date of drawing up such a document (Clause 10, Article 172 of the Tax Code of the Russian Federation), and without reference to the time of initial shipment.

Invoice corrected

Despite the fact that both of these documents are corrective in nature, i.e. change already stated information, apply it in different cases.

An amended invoice (IF) is a new variation of the first document issued. But it is considered as an independent SF, existing instead of the initial one, with already changed data. The ISF is drawn up on a standard SF form, numbered and dated in exactly the same way as the primary one, only in line “1a” the serial number and date of corrections are recorded.

The ISF is issued in cases where an arithmetic error in calculations, a typo, incorrect reflection of the tax rate or other inaccuracies not related to changes in the terms of the transaction are detected. To correct such errors, the parties do not need to change the provisions specified in the contract by drawing up appropriate additional agreements. The legislation does not establish restrictions on the time frame for issuing an ISF, but according to the general rules, a rule is applied that defines a three-year period for the possibility of VAT refund.

How to reflect an adjustment invoice for a decrease in accounting

A change in the amount of tax billed upon initial shipment will entail the need for adjustments, including in accounting.

We will not dwell on situations with an increase in the sales amount: this is, in general, a standard situation in which, on the date of drawing up the adjustment invoice, the seller makes additional entries for the accrued VAT, and the buyer – for the deductible VAT.

In this case, it is worth dwelling on the question of how to carry out an adjustment invoice for a reduction. If the total amounts in the FSC turn out to be less than the initial ones, then the entries previously recorded in the accounting records must also be adjusted.

In this case, the seller will record the following entries in his accounting:

- REVERSE Debit 62 - Credit 90.1 - sales revenue is reduced by the agreed difference in the cost of goods, work or services;

- REVERSE Debit 90.3 - Credit 68 - accepted for deduction of VAT in the amount of the difference between the original and adjustment invoices

The buyer, after receiving the adjustment invoice for the reduction, will have the following postings:

- REVERSE Debit 20 - Credit 60 - the amount of debt to the supplier has been reduced;

- REVERSE Debit 19 - Credit 60 - reflects the difference in VAT on the original and adjustment invoices;

- Debit 19 – Credit 68 – the difference amount previously accepted for VAT deduction was restored.

When not needed

There is no need to compile a CSF in the following situations:

- The supplier offered the buyer a bonus for a large order. For example, a regular customer placed an order for 500 liters of milk. According to the contract, in this case, the farm is obliged to provide the wholesale buyer with a premium, which will not in any way affect the calculation of VAT or the price of goods. The agreed amount is usually transferred to the buyer’s account.

- If an incorrect address or name is found and a corrected invoice can be issued.

Invoice changes

Adjustments are made if clarification is required by the cost or quantity of goods. And corrections can be made if there is an error in the data that does not affect the price and amount of VAT.

https://youtu.be/iZxq2GYkMvE

Adjustment invoice and income tax

VAT payers, as is known, apply the general taxation system, and, therefore, are also payers of income tax (if we are talking, of course, about organizations). A change in the price of a product or its quantity also leads to a change in the tax base for this tax, which in most cases is determined on the basis of shipment, and is also calculated by companies on a quarterly basis.

Such changes, however, are reflected in tax accounting not according to the compiled adjustment invoice, but on the basis of new data in primary documents - invoices or acts. As for the date of making such amendments, here again the period in which documents with a new agreed price or with a quantitative change that led to an adjustment to the final value were issued plays a role. If the tax base for previous periods was determined on the basis of originally issued invoices or acts, then it is considered that it was calculated correctly. There is no need to recalculate past tax payments or file an amended return. All changes should be taken into account in the current period on the basis of primary scientific documents (letter of the Ministry of Finance of Russia dated June 29, 2010 No. 03-07-03/110. At the same time, based on the norms of Articles 54 and 81 of the Tax Code in such situations, the taxpayer has the right to adjust earlier submitted an income tax return voluntarily. Of course, in this case he will also have to revise the amount of tax paid.

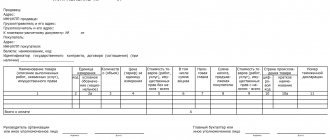

Filling out the table in the invoice

| № gr. | Name | Content | |

| 1 | Name of goods (description of work performed, services provided) property rights | The name of the goods indicated on the “original” invoice. | |

| 1b | Product type code | The code for the type of product is entered according to the Commodity Nomenclature of Foreign Economic Activity of the EAEU (approved by decision of the Council of the Eurasian Economic Commission dated July 16, 2012 No. 54). To be completed only by exporters exporting goods to the territory of the EAEU member countries. If there is no data, a dash is placed | |

| 2 | Unit code | line A (before change) | The unit of measure code shown on the "original" invoice. If there is no code, a dash is added. |

| line B (after change) | |||

| 2a | Unit symbol (national) | line A (before change) | The symbol of the unit of measurement indicated on the “original” invoice. If there is no designation, a dash is added. |

| line B (after change) | |||

| 3 | Quantity (volume) | line A (before change) | Quantity (volume) indicated in the “original” invoice (in the case of a single adjustment invoice - in several “original” invoices). If there is no indicator, a dash is added. In a “repeated” adjustment invoice, line A contains the quantity (volume) from line B of the previous adjustment invoice (letter of the Ministry of Finance of Russia dated May 26, 2015 No. 03-07-09/30177, letter of the Federal Tax Service of Russia dated December 10, 2012 No. ED -4-3/ [email protected] ). In a single adjustment invoice compiled for several “original” invoices, the quantity (volume) of goods with the same name and price can be indicated in total (letter of the Federal Tax Service of Russia dated September 17, 2014 No. GD-4-3 / [email protected] ) . |

| line B (after change) | Quantity (volume) after clarification (in the case of a single adjustment invoice - in several “original” invoices). If the quantity (volume) has not changed, the figure indicated in the “original” invoice is entered. | ||

| 4 | Price (tariff) per unit of measurement | line A (before change) | The price (tariff) indicated on the “original” invoice. If there is no indicator, a dash is added. In the “repeated” adjustment invoice, line A contains the price (tariff) from line B of the previous adjustment invoice (letter of the Ministry of Finance of Russia dated May 26, 2015 No. 03-07-09/30177, letter of the Federal Tax Service of Russia dated December 10, 2012 No. ED -4-3/ [email protected] ). |

| line B (after change) | Price (tariff) after change. If the price (tariff) has not changed, the figure indicated in the “original” invoice is set. | ||

| 5 | Cost of goods (works, services), property rights without tax - total | line A (before change) | The cost without VAT indicated in the “original” invoice (in the case of a single adjustment invoice - in several “original” invoices). In the “repeated” adjustment invoice, line A contains the cost without VAT from line B of the previous adjustment invoice (letter of the Ministry of Finance of Russia dated May 26, 2015 No. 03-07-09/30177, letter of the Federal Tax Service of Russia dated December 10, 2012 No. ED- 4-3/ [email protected] ). |

| line B (after change) | Price excluding VAT after changes. | ||

| line B (increase) | To be filled in when the cost increases. The difference between the indicators of line A and line B of this column is stated. If the difference is negative, it must be indicated with a plus sign. | ||

| line G (decrease) | Filled in when the value decreases. The difference between the indicators of line A and line B of this column is stated. If the difference is positive, it must be indicated with a plus sign. | ||

| 6 | Including the amount of excise tax | line A (before change) | The amount of excise tax indicated on the “original” invoice. If there is no indicator, it is set to “Without excise tax”. In the “repeated” adjustment invoice, line A contains the amount of excise tax from line B of the previous adjustment invoice (letter of the Ministry of Finance of Russia dated May 26, 2015 No. 03-07-09/30177, letter of the Federal Tax Service of Russia dated December 10, 2012 No. ED-4 -3/ [email protected] ). |

| line B (after change) | Excise tax amount after change. | ||

| line B (increase) | To be filled in when the cost increases. The difference between the indicators of line A and line B of this column is stated. If the difference is negative, it must be indicated with a plus sign. If there is no excise tax, a dash is added. | ||

| line G (decrease) | Filled in when the value decreases. The difference between the indicators of line A and line B of this column is stated. If the difference is positive, it must be indicated with a plus sign. If there is no excise tax, a dash is added. | ||

| 7 | Tax rate | line A (before change) | The VAT rate shown on the “original” invoice. For non-taxable transactions and when the taxpayer is relieved of his obligations in accordance with Art. 145 of the Tax Code of the Russian Federation is indicated “without VAT”. |

| line B (after change) | |||

| 8 | Tax amount | line A (before change) | The VAT amount indicated on the “original” invoice. For non-taxable transactions and when the taxpayer is relieved of his obligations in accordance with Art. 145 of the Tax Code of the Russian Federation is indicated “without VAT”. In the “repeated” adjustment invoice, line A contains the VAT amount from line B of the previous adjustment invoice, letter of the Ministry of Finance of Russia dated May 26, 2015 No. 03-07-09/30177, letter of the Federal Tax Service of Russia dated December 10, 2012 No. ED-4- 3/ [email protected] ). |

| line B (after change) | VAT amount after change. For non-taxable transactions and when the taxpayer is relieved of his obligations in accordance with Art. 145 of the Tax Code of the Russian Federation is indicated “without VAT”. | ||

| line B (increase) | To be filled in when the cost increases. The difference between the indicators of line A and line B of this column is stated. If the difference is negative, it must be indicated with a plus sign. For non-taxable transactions and when the taxpayer is relieved of his obligations in accordance with Art. 145 of the Tax Code of the Russian Federation is indicated “without VAT”. | ||

| line G (decrease) | Filled in when the value decreases. The difference between the indicators of line A and line B of this column is stated. If the difference is positive, it must be indicated with a plus sign. For non-taxable transactions and when the taxpayer is relieved of his obligations in accordance with Art. 145 of the Tax Code of the Russian Federation is indicated “without VAT”. | ||

| 9 | Cost of goods (works, services), property rights with tax - total | line A (before change) | The cost including VAT indicated in the “original” invoice (in the case of a single adjustment invoice - in several “original” invoices). For non-taxable transactions and when the taxpayer is relieved of his obligations in accordance with Art. 145 of the Tax Code of the Russian Federation, the figure indicated in line A of column 5 of this invoice is entered. In the “repeated” adjustment invoice, line A contains the cost including VAT from line B of the previous adjustment invoice (letter of the Ministry of Finance of Russia dated May 26, 2015 No. 03-07-09/30177, letter of the Federal Tax Service of Russia dated December 10, 2012 No. ED- 4-3/ [email protected] ). |

| line B (after change) | Cost including VAT after changes. For non-taxable transactions and when the taxpayer is relieved of his obligations in accordance with Art. 145 of the Tax Code of the Russian Federation, the figure indicated in line B of column 5 of this invoice is entered. | ||

| line B (increase) | To be filled in when the cost increases. The difference between the indicators of line A and line B of this column is stated. If the difference is negative, it must be indicated with a plus sign. For non-taxable transactions and when the taxpayer is relieved of his obligations in accordance with Art. 145 of the Tax Code of the Russian Federation, the figure indicated in line B of column 5 of this invoice is entered. | ||

| line G (decrease) | Filled in when the value decreases. The difference between the indicators of line A and line B of this column is stated. If the difference is positive, it must be indicated with a plus sign. For non-taxable transactions and when the taxpayer is relieved of his obligations in accordance with Art. 145 of the Tax Code of the Russian Federation, the figure indicated in line D of column 5 of this invoice is entered. | ||

Generate invoices and invoices in the web service for accounting and reporting

Making adjustments

Adjustment invoice

After commented resolution No. 1137 comes into force, taxpayers must use a new (permanent) form for an adjustment invoice.

The main difference from the temporary form* is as follows. Previously, the indicators “before the change”, “after the change”, as well as the difference between “additional payment” and “reduction” had to be indicated in special columns. Now such indicators are allocated not columns, but rows.

In particular, for each item of the adjustment invoice there are four lines: A (before the change), B (after the change), C (increase) and D (decrease). To calculate the indicators for lines C and D, you need to subtract the figure from line B from the number in line A.

If the resulting value is less than zero, then we are dealing with an increase. It must be reflected in line B with a positive value, that is, without the minus sign. Line D should have a dash.

If the resulting value is greater than zero, we are dealing with a decrease. It must be reflected in line G with a positive value, that is, without the minus sign. There should be a dash in line B.

After filling out all the lines of the adjustment invoice, you need to summarize the following indicators: cost without VAT (column 5), the amount of VAT (column and cost with VAT (column 9). To do this, you need to sum up all the numbers indicated in the line In the data column , as well as all the numbers indicated in line D of the data column.The obtained values will be needed when filling out the purchase book, sales book or additional sheets to them.

and cost with VAT (column 9). To do this, you need to sum up all the numbers indicated in the line In the data column , as well as all the numbers indicated in line D of the data column.The obtained values will be needed when filling out the purchase book, sales book or additional sheets to them.

Let us add that in the “header” of the adjustment invoice there are fields for its number and date, as well as fields for the number and date of the original invoice. Plus, there are fields for the number and date of corrections made to the adjustment and original invoices.

Reducing the cost: actions of the seller

If the original cost decreases, the seller is obliged to issue an adjustment invoice and register it in part 1 of the log of received and issued invoices.

Next, the adjustment invoice must be registered in the purchase ledger. This must be done during the period when the following conditions are met: the seller has an adjustment invoice drawn up no earlier than three years ago, and primary documents for changing the terms of delivery.

The supplier is then entitled to deduct the difference between the VAT amount before and after the adjustment.

Please note that the seller should not record the adjustment invoice in Part 2 of the journal, which deals with invoices received. This nuance is separately specified in the new Journaling Rules.

Cost reduction: buyer actions

If the original cost is reduced, the buyer must register an adjustment invoice in part 2 of the journal of received and issued invoices.

Then the buyer is required to register one of two documents in the sales book: either an adjustment invoice or a contract (agreement, etc.) to change the terms of the transaction. The document that was received earlier is subject to registration. Accordingly, an entry in the sales book must be made for the period in which the registered document was received by the buyer.

After this, the buyer should restore the previously accepted deduction in the amount of the difference between the amount of tax before and after the adjustment.

Increasing value: seller actions

If the original cost increases, the seller must issue an adjustment invoice and register it in part 1 of the log of received and issued invoices.

Also, the adjustment invoice should be recorded either in the sales ledger or in an additional sheet in the sales ledger.

If the shipment and adjustment took place in the same quarter, then registration must be made in the sales book for that quarter.

If the shipment occurred in one quarter, and the adjustment occurred in another, then registration must be made in an additional sheet of the sales book for the quarter when the shipment took place. In this case, recording the data on the adjustment invoice in an additional sheet must be done with a positive value, that is, without the minus sign.

Finally, the seller is required to charge VAT in the amount of the difference between the tax amount before and after the adjustment. The accrual must be dated to the quarter in which the shipment took place.

Increasing value: buyer actions

If the original cost increases, the buyer should register an adjustment invoice in part 2 of the journal of invoices received and issued.

Then you need to make an entry in the purchase book for the period in which the buyer will have both an adjustment invoice drawn up no earlier than three years ago and a primary document for changing the terms of delivery (contract, additional agreement, etc.).

As a result, the buyer receives the right to accept a deduction in the amount of the difference between the VAT amount before and after the adjustment.

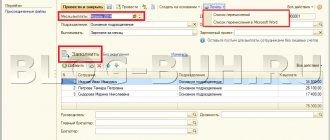

How to transfer data from an adjustment invoice to the journal, purchase ledger, and sales ledger

| From which field of the adjustment invoice? | In which column of the accounting journal? | In which column of the purchase book? | In which column of the sales book (additional sheet of the sales book) | |

| In part 1 | In part 2 | |||

| Line 1 | In columns 7 and 8 | In columns 7 and 8 | In column 2b | In column 1b |

| Line 1b | In columns 5 and 6 | In columns 5 and 6 | In columns 2 and 2a | In column 1 and 1a |

| When the original cost decreases | ||||

| Total reduction (sum of rows G) columns 5 | Not transferable | Not transferable | In column 8a (or 9a) | In column 5a (or 6a) |

| Total reduction (sum of rows G) columns 8 | In column 18 | In column 18 | In column 8b (or 9b) | In column 5b (or 6b) |

| Total reduction (sum of rows G) columns 9 | In column 16 | In column 16 | In column 7 | In column 4 |

| When the initial cost increases | ||||

| Total increase (sum of rows B) columns 5 | Not transferable | Not transferable | In column 8a (or 9a) | In column 5a (or 6a) |

| Total increase (sum of rows B) columns 8 | In column 19 | In column 19 | In column 8b (or 9b) | In column 5b (or 6b) |

| Total increase (sum of rows B) columns 9 | In column 17 | In column 17 | In column 7 | In column 4 |

Reflection of corrections in accounting and reporting

1. If the correction occurs in one quarter:

The seller cancels the entry for the erroneous invoice in the current period's sales ledger and records the corrected invoice. Cancellation will be carried out by re-registering the document in the sales book with negative indicators.

The buyer makes similar entries in his purchase book.

2. If an invoice drawn up in the previous period is corrected , then the seller and buyer make the same entries, but only in additional sheets to the sales book (purchase book) of the period in which the erroneous (initial) invoice was registered. And also two entries are made in the additional lists: the previous invoice is canceled and the corrected one is registered.

If, as a result of corrections, the final data of the sales book (purchase book) has changed, you must submit an updated declaration. And if the amount of VAT payable for the corrected period increases, you need to pay additional tax and penalties.

Reflecting adjustments - according to your own rules

So, documents on changes in the value of previously shipped goods have been drawn up, the buyer’s consent to the change in value has been received, and an adjustment invoice has been issued.

The task is to correctly reflect the adjustment in accounting.

And the basic rules are:

- The accounting reflects the difference .

- The tax base of the current period . Regardless of the period in which the goods were shipped. The tax base calculated at the time of shipment is not subject to adjustment.

If the cost of shipped goods has increased, then in the current period (adjustment period):

- the seller includes the resulting difference in the tax base of the current period, regardless of the period in which the goods themselves were shipped;

- the buyer declares for deduction the difference between the VAT amounts calculated before and after the adjustment.

If the cost of shipped goods has decreased, then in the current period (adjustment period):

- the seller declares for deduction the difference between the VAT amounts calculated before and after the adjustment;

- the buyer recovers the VAT amount in the amount of the difference between the VAT amounts before and after the adjustment.

Some people remember that before 2013, adjustment invoices had to be registered in additional lists. Moreover, for the period when the shipment took place. This necessitated the submission of updated tax returns to the tax authority for the period of shipment of goods. Pay the difference in VAT and penalties.

As of July 1, 2013, this is no longer required. Now the differences that arise are reflected in the tax base of the current period . Therefore, the declarations do not need to be clarified, and no penalties will be charged.

When is the document related to the adjustment issued?

The seller undertakes to issue an adjustment form in the following situations:

- When prices for products, services or work change. For example, if the price has decreased due to a decision to provide a discount to the buyer, which was made after the invoice was issued. Or vice versa - the tariff has increased when the cost is based on regulated prices. Fluctuation is also possible in agreements containing preliminary prices with the option of further clarification.

- In the case of specifying the quantity of goods supplied upon detection of defective products, mismatches, underdeliveries or surpluses that were not discussed in the contract.

- With simultaneous changes in supply volumes and tariff schedules.

For more information about when an adjustment invoice is needed and how to issue it correctly, read this material.

Important! The legislation indicates the need for mutual agreement of the parties with the changes that have occurred (clause 3 of Article 168 of the Tax Code of the Russian Federation). This must be confirmed by primary documentation - contracts and agreements.

If the counterparties to the transaction have reached a consensus on the necessary adjustments, an invoice is created strictly within 5 working days from the moment the agreement is verified (clause 10 of Article 172 of the Tax Code of the Russian Federation). You can also issue a generalized adjustment invoice for several shipments of one product at an identical price (Article 169 of the Tax Code of the Russian Federation).

The form is created in two copies - for the supplier and the buyer. They must be drawn up in accordance with Appendix No. 2 to the Decree of the Government of the Russian Federation No. 1137 of December 26, 2011 (as amended by Decree of the Government of the Russian Federation No. 981 of August 19, 2017).

If the enterprise chose to develop its own document, it is necessary to make sure that it contains all the points specified in clause 5.2 and clause 6 of Art. 169 of the Tax Code of the Russian Federation, - otherwise, presenting the tax difference for withholding will be impossible.

The adjustment invoice is certified by the head and chief accountant of the company (or their representatives who perform similar actions on the basis of a power of attorney). An individual entrepreneur personally signs the document, indicating the details of the state registration certificate (clause 6 of Article 169 of the Tax Code of the Russian Federation).

For more information on when an adjustment invoice is issued and how it is correctly issued, read here.

What happens if you issue an adjustment invoice instead of a corrected one?

Since the rules for registering adjusting and corrected invoices in the purchase books and sales books, as well as the procedure for applying tax deductions on them, are significantly different, both the buyer and the seller bear the risks.

Let's figure it out.

Yes, it’s possible that adjustments are convenient: you don’t need to plow through past periods, fill out additional sheets and prepare clarifications. In what period the document was received - in the same period it was reflected in the accounting.

But according to the rules established by law, an adjustment invoice can be issued subject to three conditions : 1) after shipment, the cost of the transaction changes 2) the parties have agreed on this 3) the primary document is available - the basis for the adjustment.

If one of the conditions is not met, the previously issued invoice must be corrected. Issuing an adjustment invoice will be illegal. And recognizing deductions on its basis is risky . The Ministry of Finance warned about this in a letter dated December 18, 2020 No. 03-07-11/84472. The same explanations are contained in numerous other letters from the controllers of the Ministry of Finance and the Federal Tax Service.

Seller's risks.

1. If, as a result of correcting the error, the cost of shipment has decreased - in the case of an incorrectly issued adjustment invoice - the seller faces refusal of a tax deduction for the amount of the difference between VAT, additional tax assessment, and penalties for tax liability for incomplete payment of tax.

2. If, as a result of correcting the error, the cost of shipment is increased - in the case of an incorrectly issued adjustment invoice - the seller faces additional tax, penalties and a fine due to underpayment of VAT for the shipment period.

3. For violation of the accounting procedure and the absence of corrected invoices, the seller may be brought to tax liability under Article 120 of the Tax Code and to administrative liability under Article 15.11 of the Code of Administrative Offenses for gross violation of the rules of accounting and taxation objects.

Buyer's risks.

If, as a result of correcting the error, the cost of shipment is increased , the buyer - based on an incorrectly issued adjustment invoice received from the seller - loses the right to deduct the positive difference between the VAT amounts in the period of making the adjustment.

Therefore, require the seller to correct errors by issuing corrected invoices rather than corrective ones. In compliance with the correct order of their reflection in accounting registers and tax reporting.

About a single (consolidated) adjustment

The Tax Code provides for the possibility of generating unified (consolidated) adjustment invoices - invoices. Naturally, they were issued to the same buyer.

The seller can collect invoices that are subject to adjustment and enter data on them into a single adjustment invoice. At the same time, there will be only one adjustment invoice, and there will be only one entry for it in the books of the seller and the buyer.

Issuing a single adjustment invoice is not an obligation, but the right of choice of the seller . For some this is convenient. To reduce the number of documents and simplify accounting.

You can combine both options for issuing adjustment invoices - separate or single. There is no need to fix the choice option in the accounting policy.

A single adjustment invoice may indicate that the cost has increased for some items and decreased for others. In this case, it is necessary to separately summarize the data and reflect them separately in the final lines “Total increase (sum of lines B)” and “Total decrease (sum of lines D)”. The seller and buyer register such an adjustment invoice twice : in the purchase books and sales books, respectively.