Order on organizing an archive at the enterprise

Free consultation by phone Contents To organize and conduct an examination of the value of documents, a permanent central expert commission (CEC) is created in the organization. Examination of the value of documents is carried out annually in the structural divisions of the organization with the involvement of relevant specialists. The final decision is made by the organization's Central Executive Committee.

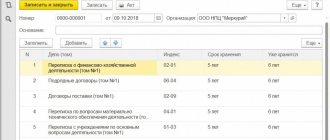

The functions and rights of the central expert commission, as well as the organization of its work, are determined by the regulations, which are approved by the head. The selection of documents for permanent storage is carried out on the basis of lists of documents indicating the periods of their storage and the nomenclature of the organization’s files through a sheet-by-sheet review of the files.

In cases of permanent storage, duplicate copies of documents, drafts, unformed copies of documents and documents not related to the issue with temporary storage periods are subject to seizure. Based on the results of the examination of the value of documents, inventories of cases of permanent, temporary (over 10 years) storage and personnel, as well as acts on the allocation of files for destruction. Cases of temporary (up to 10 years inclusive) storage are not subject to transfer to the central archive, as a rule - they are stored in structural units and, upon expiration of the storage period, are also subject to destruction in the prescribed manner with the drawing up of an act on the allocation for destruction documents not subject to storage. EXAMINATION OF THE VALUE OF DOCUMENTS FOR THE PURPOSE OF THEIR WRITE-OFF AND DESTRUCTION - 8 (495) 506-13-7 9 DETAILS ABOUT THE DOCUMENT DESTRUCTION SERVICE HERE Archival office work, archiving documents, archival storage of documents, binding of documents, disposal of documents, destruction of archival documents , binding of accounting documentsproektarhiv.ruIn each organization, over time, various kinds of papers, documents, files accumulate, from which an archive is subsequently formed. In order to keep it in order, a responsible person is appointed. Strictly defined standards for maintaining archives in commercial enterprises are not established at the legislative level.

https://youtu.be/FzC-dPTuWpk

How to draw up an order to create an expert commission - drafting rules and sample

Each document has its own storage period; upon its completion, destruction procedures are carried out. The function of carrying it out is assigned to an expert commission, which is appointed by the head with the help of an order.

This group can be created for a one-time documentation audit, or it is also possible to form a permanent group.

An order to create such a commission is an administrative document approved by the head, which determines the composition of the designated group and assigns responsibilities for the destruction of documents to it.

A sample order can be drawn up in free form, without using any standard form due to the lack of one.

The procedure for destroying documentation is carried out after the end of the calendar year in which the period allotted for the mandatory storage of paper in the archive of the enterprise has ended. The task of the expert commission is to conduct an examination of the papers available in the organization and to select documents that require disposal.

To carry out a competent sampling, you need to know what storage periods are established for various documentation. For example, accounting papers are typically kept in the archives for five years, and many personnel forms are kept for 75 years. Many documents are necessary for an enterprise to correctly fill out reports; they may be requested by regulatory authorities, and therefore it is necessary to know which paper can be destroyed and which cannot.

In connection with these features of the destruction procedure, an order is issued to create a commission, among the members of which there should be persons who know the deadlines established by law and understand the peculiarities of document flow in the company. As a rule, these are accounting employees, office workers, and secretaries.

Order on storage of documents in the organization

Home - Business Organization - Personnel - Documents - is one of the main local legal acts regulating the safety of papers of various contents within each enterprise and company.

The article will discuss the main elements of this document, highlight the main goals of its creation, and also provide a sample.

Contents: 1. Regulatory regulation of document storage in an organization, by whom and how it is carried out 2. Drawing up an order for document storage, mandatory elements 3.

Sample order on the storage of documents at an enterprise Regulatory regulation of the storage of documents in an organization, by whom and how it is carried out When considering this issue, it is advisable to turn to the legislation and understand what regulatory legal acts of the country regulate the safety of documents at the enterprise. According to the requirements of Federal Law No. 402 “On Accounting” and Federal Law No. 125 “On Archiving,” the manager must organize proper storage of accounting and tax reporting and prevent their destruction before the deadline established by law. This leads to an established list of documents that have a minimum shelf life, which, by the way, can reach 70 years or more.

Upon liquidation of an enterprise, all important papers are subject to expert evaluation and transfer to the Archival Fund of the country. To effectively manage documents that are not state property, entrepreneurs can create their own archive.

Analyzing Federal Law No. 125, it becomes clear that the creation of such a structural unit is the right, but not the obligation of the employer. If the director of the enterprise has allocated a special room allocated for the archive, then it is imperative to include a section on its work in the Regulations on the storage of documents, because this document represents a single source of information about exactly how and for how long this or that documentation should be stored within the company.

Tax accounting documents

Primary accounting documents, accounting registers, accounting (financial) statements, audit reports on them are subject to storage by an economic entity for periods established in accordance with the rules for organizing state archival affairs, but not less than five years after the reporting year (Part 1 of Art.

29 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, hereinafter referred to as Law No. 402-FZ). The storage periods for electronic documents (registers) are established in the same manner as for documentation generated on paper. At the same time, economic entities must store accounting policy documents, standards of an economic entity, other documents related to the organization and maintenance of accounting, including tools that ensure the reproduction of electronic documents, as well as verification of the authenticity of an electronic signature for at least five years after the year in which they were used to prepare accounting (financial) statements for the last time (Part 2 of Article 29 of Law No. 402-FZ).

When determining specific storage periods for individual accounting documents, one should be guided by the List of standard management archival documents generated in the process of activities of state bodies, local governments and organizations, indicating storage periods, approved by order of the Ministry of Culture of Russia dated August 25.

In accordance with clause 1.4 of the List, the storage periods for documents are calculated from January 1 of the year following the year of completion of their paperwork.

Please note that most accounting documents and financial statements have a retention period of 5 years. However, some documents have shorter storage periods, while others have longer storage periods. In addition, there are documents that must be permanently stored.

For example:

- accounting (financial) statements (balance sheets, profit and loss statements, reports on the intended use of funds, appendices to them, etc.) are stored (item 351 of the List): a) consolidated annual (consolidated) - permanently; b) annual - constantly; c) quarterly - 5 years (in the absence of annual ones - permanently); d) monthly - 1 year (in the absence of quarterly - constantly);

- tax returns (calculations) of legal entities for all types of taxes, declarations and calculations of advance payments for insurance contributions for compulsory pension insurance are stored for 5 years (clause 392 of the List);

- declarations and calculations of advance payments for insurance contributions for compulsory pension insurance are stored for 5 years, and in the absence of personal accounts or payroll records - 75 years (clause 395 of the List);

- tax cards for recording income and personal income tax (form No. 1-NDFL), information on the income of individuals is stored for 5 years, and in the absence of personal accounts or payroll records - 75 years (clause 394, clause 396 of the List );

- primary accounting documents and appendices to them, which recorded the fact of a business transaction and were the basis for accounting records (cash documents and books, bank documents, counterfoils of bank check books, orders, time sheets, bank notices and transfer requests, acts of acceptance, delivery, write-off property and materials, receipts, invoices and advance reports, correspondence, etc.), are stored for 5 years, subject to an inspection (audit) (Article 362 of the List);

- correspondence about the purchase of household property, office supplies, railway and air tickets, payment for communication services and other administrative expenses, and the provision of hotel accommodations is stored for 1 year (clause 367 of the List);

- registers of information on the income of individuals are stored for 75 years, as are personal cards and employee accounts (clause 397, clause 413 of the List);

- documents (protocols, acts, calculations, statements, conclusions) on the revaluation of fixed assets, determination of depreciation of fixed assets, assessment of the value of the organization’s property are stored permanently (Article 429 of the List);

- documents (applications, appraisal reports, correspondence, etc.) on the sale of movable property are stored for 10 years (clause 430 of the List);

- acts on the transfer of rights to real estate and transactions with it from the previous to the new copyright holder (from balance sheet to balance sheet) are stored permanently (Article 432 of the List).

Subclause 8 of clause 1 of Art. 23 of the Tax Code of the Russian Federation establishes a four-year storage period for accounting and tax accounting data and other documents necessary for the calculation and payment of taxes, including documents confirming receipt of income, expenses (for organizations and individual entrepreneurs), as well as payment (withholding) of taxes.

At the same time, paragraph 4 of Art. 283 and paragraph 7 of Art. 346.18 of the Tax Code of the Russian Federation, which are in relation to paragraphs. 8 clause 1 art. 23 of the Tax Code of the Russian Federation, by special rules, oblige payers of corporate income tax and tax paid in connection with the application of the simplified tax system with the object of taxation “income reduced by the amount of expenses”, respectively, to keep documents confirming the amount of loss incurred during the entire period of its repayment.

We also draw attention to the fact that some expenses for profit tax purposes are taken into account over a long period, for example, depreciation of fixed assets (fixed assets) and intangible assets (intangible assets), or are deferred in nature (taken into account not during the period of their incurrence, but at the time of sale of assets (Article 268 of the Tax Code of the Russian Federation).

Depreciation is a uniform accounting during the periods of use of fixed assets and intangible assets of expenses that form their initial cost (Articles 256, 257 of the Tax Code of the Russian Federation). Article 252 of the Tax Code of the Russian Federation indicates the possibility of accounting for expenses only if they are documented. In this regard, the Russian Ministry of Finance explains that the storage period for primary documents reflecting the formation of the initial cost of depreciable property, established by paragraphs. 8 clause 1 art.

23 Tax Code of the Russian Federation (4 years), should be calculated from the moment of completion of depreciation in tax accounting (accounting for expenses for the acquisition of such property) (letter of the Ministry of Finance of Russia dated 02/12/2016 No. 03-03-06/1/7604, dated 04/26/2011 No. 03 -03-06/1/270). That is, for tax accounting purposes, it is necessary to store primary documents confirming the formation of the initial cost of depreciable fixed assets and intangible assets for at least 4 years after their full depreciation. At the same time, specialists from the financial department also noted that, according to the List, documents on determining the depreciation of fixed assets are stored permanently.

The Ministry of Finance of Russia, explaining the procedure for applying paragraphs. 8 clause 1 art. 23 of the Tax Code of the Russian Federation, in letter dated March 30, 2012 No. 03-11-11/104, indicates that the four-year period begins after the reporting (tax) period in which the document was last used for preparing tax reporting, calculating and paying tax , confirmation of income received and expenses incurred. A similar position is set out in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 24, 2012 No. 3546/12.

We invite you to familiarize yourself with: Grounds and procedure for registering a land plot with cadastral registration. Nuances of the procedure

At the time of implementation, expenses are also taken into account in the form of:

- prices for the acquisition (creation) of other property, such as, for example, land plots, material assets (clause 2, clause 1, article 268 of the Tax Code of the Russian Federation);

- the cost of inventories, other property in the form of surpluses identified during the inventory, and (or) property received free of charge, and (or) property received during the dismantling or disassembly of decommissioned operating systems, repair, modernization, reconstruction, technical re-equipment or partial liquidation of the OS (clause 2, clause 1, article 268, paragraph two, clause 2, article 254 of the Tax Code of the Russian Federation);

- prices for the acquisition of property rights and expenses associated with their acquisition (clause 2.1, clause 1, article 268 of the Tax Code of the Russian Federation);

- the cost of purchasing purchased goods.

Consequently, when determining the storage period for documents confirming the costs of acquiring (creating) fixed assets and intangible assets, other property, property rights, purchased goods, it is necessary to take into account the provisions of Art. 268 Tax Code of the Russian Federation.

Expenses for the acquisition of securities are also deferred, since the date of incurring expenses for the acquisition of securities is the date of their sale or other disposal (clause 7, clause 7, article 272 of the Tax Code of the Russian Federation). Therefore, documents confirming expenses for the acquisition of securities must be kept for periods determined taking into account the provisions of paragraphs. 7 clause 7 art.

Sample order to create an archive in an organization

The order usually does not indicate specific job responsibilities for maintaining the archive.

They are usually provided for in the employment contract, job description or, for example, the Regulations on archiving in the organization.

An example of such responsibilities can be found in the job description of an archivist. The order to appoint the person responsible for the archive of the institution (organization) must be familiarized to the relevant employee against signature. We will provide a sample form for the order to appoint someone responsible for the archive. It is extremely important for organizations and individual entrepreneurs to ensure complete and reliable storage of documents in accordance with the retention periods established for them. During the inspection, the following is carried out: establishing the actual availability of documents stored in the Archives; identifying and eliminating deficiencies in document recording; identifying missing documents and organizing their search; identification and recording of documents requiring restoration, conservation, preventive and technical processing. 3.9. The results of the inspection are recorded in the act of checking the availability and state of affairs (Appendix No. 1 to these Rules), the act of irreparable damage to documents (Appendix No. 2 to these Rules).

3.10. If the audit reveals a shortage of files and documents, then the Archives staff will organize a search for them.

Attention Storage periods can generally be long-term or short-term.

It all depends on the type of document.

Orders must be checked for significance every 5 years, and even earlier. Since over such a period of time, in most cases, the company may change both the personnel itself and certain functions, tasks, and divisions.

In the process of asking about the relevance of each existing order, it is recommended to organize and interest in this the company’s accounting department and other departments responsible for issuing certain documents and carrying out instructions on these documents.

During general work on documents, employees and management of the company must decide on the further viability of the orders.

Order on the procedure for storing design and executive documentation at industrial production facilities

– Insurance law – Order on the procedure for storing and maintaining technical documentation at industrial facilities

Moreover, this responsibility is imposed on them regardless of the form of ownership of the enterprises and the sources of their financing.

If organizations of state or municipal subordination are by default the sources of acquisition of documents from state and municipal archives, then commercial structures can be classified as such sources on the basis of Part 2 of Art. 20 of the Law, after an agreement is concluded with one of such archives.

The manager is obliged, at least once a year, to organize an inspection of the condition and conditions of storage of seized items and documents in a special room, the correctness of maintaining documents for their reception, recording and transfer in accordance with these Instructions.

17. When a case of an administrative offense is terminated or a punishment not related to confiscation or compensatory seizure is imposed on a person in respect of whom the internal affairs body carried out proceedings on an administrative offense, the seized items and documents are subject to return to the owner.

III. Accounting for stored seized items and documents

18. To record seized items and documents, a department of the internal affairs body maintains a log of seized items and documents 6 (Appendix No. 2).

The employee appointed by the manager is responsible for maintaining the accounting journal.

- Order on the storage of gas masks Order of the Ministry of Emergency Situations of the Russian Federation dated April 19, 2010 N 186 “On amendments to the Rules for the use and maintenance of personal protective equipment, radiation, chemical reconnaissance and control devices, approved by Order of the Ministry of Emergency Situations of Russia dated May 27, 2003 N 285” Order of the Ministry of Emergency Situations of the Russian Federation dated April 19, 2010

N 186 “On amendments to [...]

- Plenum of the Supreme Council of the Russian Federation on the court decision ON THE APPLICATION OF ART. 61 of the Code of Civil Procedure of the Russian Federation and Clause 9 of the DECISION OF THE PLENAUM OF THE SUPREME COURT OF THE RUSSIAN FEDERATION OF DECEMBER 19, 2003 N 23 ON THE JUDICIAL DECISION OF THE PLENARY OF THE SUPREME COURT OF THE RUSSIAN FEDERATION OF DECEMBER 19, 2003 N 23 “ON THE JUDICIAL SOLUTIONS" L.I. GOLDAGolda L.I., Chairman of the Padunsky District Court

- monitoring the availability and timely verification of protective equipment in electrical installations;

- emergency response;

- checking the relevance of power supply diagrams (once every 2 years);

- revision of instructions and diagrams (at least once every 3 years);

- control of measurements of electrical energy quality indicators (at least once every 2 years);

- training and advanced training of electrical technical personnel (at least once every 5 years).

When a case of an administrative offense is transferred to a judge, another body, or an official, the seized items and documents are transferred along with the case of an administrative offense.

In the case specified in paragraph 3 of clause 5 of these Instructions, the covering letter about sending the materials of the case of an administrative offense indicates the place of storage of the seized items.

The relevant financial and economic unit of the internal affairs body is informed about the transfer of a case of an administrative offense for which funds were seized.

15. The use of seized items and documents for official and other purposes not related to the proceedings on an administrative offense is not permitted.

If an organization is engaged in production activities and has a significant staff, it is advisable to prepare several orders about those responsible for the electrical facilities in each specific area of the production area, for example, issue an order about the person responsible for the electrical facilities of the boiler room (in the case of operating electric boilers).

Gosenergonadzor can meet halfway. For example, in children's educational institutions the director will have to issue an order appointing someone responsible for electrical equipment in the school.

For violation of the requirements of the legislation regulating the rules of technical operation of electrical installations, including the absence of a responsible person, the employer may be held financially liable on the basis of Article 9.11 of the Code of Administrative Offenses in the amount of up to 40,000 rubles, or the employer’s activities may be suspended administratively for a period of up to 90 days.

Moreover, if these violations cause the death of workers (and electricity on an industrial scale does not forgive mistakes), the employer, on the basis of Article 5.27.1.

However, there are recommendations on its content, developed in practice. It must necessarily contain:

- full and short name of the organization;

- document's name;

- registration number;

- publication date;

- title;

- text;

- signatures and visas of the manager and interested employees.

- The order includes information about the execution procedure, who controls it, as well as the scope of action. The introductory part justifies the need to publish the document and its purpose. For example, the phrase is used: “For the purpose of organizing work to comply with the procedure for conducting office work.” You can use another motivation, but after it indicate the name of the enterprise, as well as the word “I order.” The text of the authorization part can be divided into several paragraphs.

Please note: If an enterprise is organized in the form of a joint stock company, that is, its activities are related to securities, the procedure and terms for storing documents in the organization must comply with the special requirements established by the FCSM Resolution No. 03-33/ps “On approval of the Regulations on the procedure and terms documents of joint stock companies."

Statutory documents are of paramount importance in the activities of the organization and are stored in a special way - in a separate folder, which is placed in a safe, access to which is available only to those officials whose list is approved by order of the head.

Approximate form of an order from a manager to determine the procedure and conditions for storing design and as-built documentation of the gas distribution and gas consumption system

Developed: April 2013

The current version of the document you are interested in is available only in the commercial version of the GARANT system. You can purchase a document for 54 rubles or get full access to the GARANT system free of charge for 3 days.

If you are a user of the Internet version of the GARANT system, you can open this document right now or request it via the Hotline in the system.

We invite you to read: Order on part-time work for a woman under 5 years old

Order of the Federal Service for Environmental, Technological and Nuclear Supervision dated June 2, 2014 No. 233 “On approval of the Safety Guide “Recommendations for the preparation and storage of documentation confirming the safety of the maximum permitted operating pressure during operation

hazardous production facilities of main pipelines”

Approve the attached Safety Guide “Recommendations for the preparation and storage of documentation confirming the safety of the maximum permitted operating pressure during the operation of hazardous production facilities of main pipelines.”

Safety Guide “Recommendations for the preparation and storage of documentation confirming the safety of the maximum permitted operating pressure during the operation of hazardous production facilities

objects of main pipelines”

(approved by order of the Federal Service for Environmental, Technological and Nuclear Supervision dated June 2, 2014 No. 233)

I. General provisions

The Safety Guide “Recommendations for the preparation and storage of documentation confirming the safety of the maximum permitted operating pressure during the operation of hazardous production facilities of main pipelines” (hereinafter referred to as the Safety Guide) was developed to facilitate compliance with the requirements of the Federal norms and regulations in the field of industrial safety “Rules” safety for hazardous production facilities of main pipelines”, approved by order of Rostekhnadzor dated November 6, 2013 No. 520 (registered by the Ministry of Justice of the Russian Federation on December 16, 2013 No. 30605).

2. The Safety Guide contains recommendations for the preparation and storage of documentation confirming the safety of the value of the maximum permitted operating pressure (hereinafter - RWP), during the operation of hazardous production facilities of main pipelines (hereinafter - HPF MT) and is not a regulatory legal act.

3. Documentation confirming the safety of the RDV value during the operation of HPF MT, drawn up before the entry into force of this Safety Manual, is recommended to be considered valid until the need arises to issue a new Form for confirming the safe value of RDV (hereinafter referred to as the Confirmation Form) in accordance with this Safety Manual .

to sections of the linear part of the HPF MT, located behind the security valves or valves of compressor and pumping stations. The recommended sample of the Confirmation Form is given in Appendix No. 1 to this Safety Manual;

to the pipelines of the compressor or pumping station of OPO MT. The recommended sample of the Confirmation Form is given in Appendix No. 2 to this Safety Manual;

to the pipelines of the gas distribution or automobile compressor gas filling station OPO MT. The recommended sample of the Confirmation Form is given in Appendix No. 3 to this Safety Manual;

to pipelines of loading and unloading terminals of OPO MT;

5. It is recommended to determine the safe value of the RRR at a hazardous production facility MT, entered in the Confirmation Form, in accordance with the regulatory and technical documentation.

Before issuing the Confirmation Form, it is recommended to restore the design and as-built documentation for the HPF MT to the extent sufficient to determine the RRD in accordance with the regulatory and technical documentation.

Sample order to create an archive in an organization

The main tasks that the enterprise record keeping system is designed to solve include not only documenting all production and organizational processes and recording incoming, outgoing and internal documentation, but also organizing its operational and archival storage.

At the same time, the need to store documents is explained not only by the needs of production and the desire of the employer to ensure confirmation of the legitimacy of its business activities, but also by the provisions of the law. Federal Law No. 125-FZ of October 22, 2004 “On Archiving in the Russian Federation” (hereinafter referred to as the Law) establishes the obligation of employers to ensure the safety of documents used in all areas of the enterprise.

Important These Rules have been developed in accordance with federal laws, including Federal Law dated October 22, 2004 N 125-FZ “On Archiving in the Russian Federation”, decrees and orders of the President of the Russian Federation, Regulations on the Federal Service for State Registration, Cadastre and Cartography, Regulations on the archive of the Federal Service for State Registration, Cadastre and Cartography, GOST R 51141-98 “Clerical work and archiving. Terms and definitions”, approved and put into effect by the Resolution of the State Standard of Russia dated February 27, 1998.

N 28, regulatory legal acts of the Russian Federation, methodological documents of the Federal Archive and the Civil Code of the Russian Federation.

- Completing the Archive

2.1.

Acquisition of the Archive - systematic replenishment of the Archive with documents from the structural divisions of the central apparatus of Rosreestr.

We recommend reading: FSM Sakharov how to find out that a patent is ready

2.2. An archive is created of the archival fund of the Russian Federation and documents for practical purposes completed by paperwork, their selection, recording, use and preparation for transfer to state storage. Rosreestr provides the archive with the necessary premises, equipment, and personnel. 1.4. The Rosreestr Archive (hereinafter referred to as the Archive) is part of the Rosreestr Administrative Department.

1.5. In its work, the Archive is guided by the legislation of the Russian Federation, Federal Law of October 22, 2004 N 125-FZ “On Archival Affairs in the Russian Federation”, legislative acts on archival affairs, orders, instructions of higher organizations, management of Rosreestr, rules and other normative and methodological documents Rosarkhiv, methodological documents of the State Archive of the Russian Federation (hereinafter - GA RF) and these Regulations.

10.1. creating an organization archive

Availability and need for computer, copying and other equipment. 5. Organization of document binding. Bottom line: thus, each organization, depending on the volume of documents, the main direction of its activities, material resources and other factors, determines for itself the need to create and operate an archive as an independent structural unit. If it is impossible to store documents at the place of operation of the organization itself, it has the right to consider outsourcing this functionality. If the archive fund contains documents that are significant not only for the organization itself, but also for society as a whole, it is advisable to conclude an agreement on cooperation with the state (municipal) archive. See Art. 50 Federal Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ, art. 89 Federal Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ, art.

Order appointing someone responsible for the archive

0 Regardless of industry or taxation regime, all business entities (organizations and individual entrepreneurs) are required to store accounting and tax records. In other words, keep an archive. An archival document is understood as a material medium with information recorded on it, which has details that allow it to be identified, and is subject to storage due to the significance of the specified medium and information for citizens, society and the state ().

We talked about the storage periods for accounting documents in a separate section, and about the storage of tax accounting documents and tax reporting in this one.

Let us remind you that for certain personnel documents (for example, personal cards, personal accounts, employment contracts), the storage period reaches up to 75 years (). In general, the head of an organization is responsible for maintaining an archive. However, by his order (instruction), he can appoint another employee responsible for the archive.

We will tell you how to draw up an order to appoint someone responsible for maintaining an archive in an organization in our consultation. organization is compiled in any form.

It indicates the full name. and the position of the employee appointed as responsible for the archive, the date from which “archival” duties are assigned to the employee or the corresponding period of responsibility. The order usually does not indicate specific job responsibilities for maintaining the archive. They are usually provided for in the employment contract, job description or, for example, the Regulations on archiving in the organization.

An example of such responsibilities can be found in. The order to appoint the person responsible for the archive of the institution (organization) must be familiarized to the relevant employee against signature. We will provide a sample form for the order to appoint someone responsible for the archive.

Order appointing someone responsible for the archive

6654 In each organization, over time, various kinds of papers, documents, files accumulate, from which an archive is subsequently formed.

It is extremely important for organizations and individual entrepreneurs to ensure complete and reliable storage of documents in accordance with the retention periods established for them. After all, for violation of the terms of storage of archival documents, the organization, individual entrepreneurs and their officials may be held accountable.

To ensure that it is kept in order, a responsible person is appointed.

There are no strictly defined standards for maintaining archives in commercial enterprises at the legislative level. This means that the management of each company has the right to independently develop these requirements, which are then included in the package of local regulations. It is in accordance with them that the supervision of the archive is carried out.

FILES The main conditions for proper archiving is its inaccessibility to unauthorized persons (among other things, the installation of metal cabinets and safes is used to implement this).

https://youtu.be/L9BOXevR7H0

All shelves must be numbered, documents are placed in separate folders. If the archive is very large, then the organization must develop and approve its scheme.

Regularly (at least once every five years, and preferably annually) documents stored in the archive should be checked. Those that are outdated and have lost their relevance are subject to disposal - a special procedure is established for this by law.

The rest continue to be archived until their storage period also expires.

The archive room must have a certain temperature and humidity. It is absolutely unacceptable for archival documents to be exposed to sunlight (they will fade and deteriorate as a result).

It is also strictly necessary to maintain fire safety here - the archive consists entirely of flammable items. As a rule, the company secretary, HR specialist or accountant is appointed as the employee responsible for maintaining the archive.

But if the organization is very large, then a separate position can be introduced, according to the instructions of which the main responsibility of the specialist will be maintaining archival affairs and the archive itself. First of all, the employee responsible for the archive must record all documents received by it.

They are subject to a mandatory detailed inventory (name, number of sheets, etc.).

What tasks are included in the functions of the employee responsible for the archive?

First of all, the employee responsible for the archive must record all documents received by it. They are subject to a mandatory detailed inventory (name, number of sheets, etc.). He must also formulate cases and put them into folders in a certain order, which is established by the company administration. He also controls the period of storage of papers, and if anyone needs an archival document, he issues it, but strictly against signature and only on condition of further return.

Business Innovation Agency

There are no strictly defined standards for maintaining archives in commercial enterprises at the legislative level.

This means that the management of each company has the right to independently develop these requirements, which are then included in the package of local regulations.

It is in accordance with them that the supervision of the archive is carried out.

FILESOpen these files online2 files The main conditions for proper archiving is its inaccessibility to unauthorized persons (among other things, the installation of metal cabinets and safes is used to achieve this). All shelves must be numbered, documents are placed in separate folders. If the archive is very large, then the organization must develop and approve its scheme.

Regularly (at least once every five years, and preferably annually) documents stored in the archive should be checked.

Those that are outdated and have lost their relevance are subject to disposal - a special procedure is established for this by law. The rest continue to be archived until their storage period also expires. The archive room must have a certain temperature and humidity.

It is absolutely unacceptable for archival documents to be exposed to sunlight (they will fade and deteriorate as a result). It is also strictly necessary to maintain fire safety here - the archive consists entirely of flammable items.

If you are tasked with drawing up an order to appoint an employee responsible for the archive, and you have never encountered such a document before, use the tips below.

Look at the example - taking it into account, you will be able to create your own form without much difficulty. Before giving a detailed understanding of this specific order, we will talk about some general information that applies to all such administrative acts. Firstly, if an organization has an order template recorded in its accounting policies, the document must be created according to its type.

Order on storage of documents

, issued by the manager, establishes the procedure for storing operational and archival documentation of the enterprise in the interests of the organization itself, as well as citizens, society and the state. The article discusses issues related to the organization of document storage in an enterprise. From the article you will learn:

- when an order to store documents is drawn up;

- which contains an order for the storage of documents.

- who draws up the document storage order;

should be published simultaneously with the start of the enterprise’s production activities, since ensuring the safety of documentation accompanying the organization’s activities is the responsibility of the manager.

and local regulations governing the use and storage of documentation will help standardize all document flow procedures of the company, ensure the accounting and safety of each document.

The main tasks that the enterprise record keeping system is designed to solve include not only documenting all production and organizational processes and recording incoming, outgoing and internal documentation, but also organizing its operational and archival storage. At the same time, the need to store documents is explained not only by the needs of production and the desire of the employer to ensure confirmation of the legitimacy of its business activities, but also by the provisions of the law. Federal Law No. 125-FZ of October 22, 2004 “On Archiving in the Russian Federation” (hereinafter referred to as the Law) establishes the obligation of employers to ensure the safety of documents used in all areas of the enterprise.

We recommend reading: How to write a request for a commercial proposal sample

Moreover, this responsibility is imposed on them regardless of the form of ownership of the enterprises and the sources of their financing. Therefore, the question of who draws up the order for storing documents in 2016 will be clear: the heads of all business entities, including state and municipal

Retention periods for LLC documents

Since February 18, 2020, the order of the Federal Archive (dated December 20, 2019 N 236) has been in effect, which replaced the previous document - Order of the Ministry of Culture of the Russian Federation dated August 25, 2010 N 558. The new order partially changed the storage periods for documents of an organization, including commercial . Some of the deadlines are given in the table, but for a complete study of the issue, we recommend that you refer to the original source.

| Documentation | Shelf life |

| Registration documents, licenses and certificates of conformity, annual financial statements, annual payroll statements in the Social Insurance Fund, inventory lists of liquidation commissions | Constantly |

| Employment contracts, personal files and employee cards, books, magazines, personnel records, | 75 years old |

| GPC agreements and acts on the performance of work, provision of services by individuals, calculations of insurance premiums, information about the employee’s work activity and length of service | 50 years |

| Accounting registers, general ledger, working chart of accounts, accounting policies, audit reports on financial statements, primary documents, tax returns, invoices, agreements, agreements, contracts (with the exception of some) | 5 years |

| Books of purchases and sales, customs declarations, BSO, documents on payment of excise duty | 4 years |

Order on organizing an archive at the enterprise

Over time, every company that has recently started operating may accumulate a large amount of documentation that needs to be stored somewhere. For such purposes, special archival departments are created, the organization of which will be discussed in this article.

From the article below you will learn:

- what checks must be completed before signing an order to place an archive;

- how the archive is organized at the enterprise and what rules must be followed;

- how the order on organizing an archive at the enterprise is issued and what information is displayed in it;

- who can be appointed responsible in the order to create an archive for monitoring the documentation.

When planning an archive department at an enterprise, it is necessary to take into account that long-term storage of documents must take place under certain conditions.

For this purpose, a separate room is allocated, in which it is necessary:

- maintain an acceptable level of air humidity and temperature;

- install cabinets and shelving;

- restrict access for third parties;

- competently organize the use of free space.

Documents are prohibited from being stored in establishments providing food services, food warehouses and organizations working with fire hazardous and chemical materials.

The archive is not allowed to be located near gas stations, parking lots or any other potentially dangerous points. The archive room must contain its own ventilation and not have pipes or other communication elements.

Air conditioning systems must also be designed in compliance with a number of rules:

- It is necessary to ensure stable and constant air purification from aggressive impurities and dust.

- temperature and humidity conditions must be stable, without sudden changes;

- air recirculation has an exchange rate of 2-3;

To minimize the risk of fire,

Order to create an archive

If necessary, the archive specialist can communicate to colleagues his recommendations for eliminating errors and improving the design. After the documents have already been deposited in the archive, they undergo scientific and technical processing, which also includes their binding into a hard cover. Usually, reformation is carried out in parallel, as a result of which the cases are re-registered in accordance with regulatory requirements.

This is done if errors or deviations from the rules were made in the current paperwork. Regulatory requirements are easy to understand, but specialists from various departments of an enterprise usually make many mistakes when filing cases. Therefore, the processor subsequently has to redo everything.

Attention: The extensive experience of our company’s archivists, including thanks to established contacts in departmental and municipal archives, allows us to submit documents to the archives promptly and on conditions favorable to our clients!

The cost of submitting documents of a liquidated organization to the state archive upon liquidation of an organization is calculated based on the period of existence of the organization, the number of employees, the level of staff turnover at the liquidated enterprise, and the scope of activity of the liquidated organization. https://www.youtube.com/watch?v=hmJGuauyLpw Under an agreement with TsGATO

Moscow, the cost of accepting documents on personnel from liquidated non-governmental organizations for storage is 310 rubles per 1 item. storage (1 case). Act on the acceptance and transfer of documents to the archive for state storage (the act is issued by the state archive that accepted the documents for storage). 4. A document confirming payment of the state fee for accepting documents for storage.

5. Certificate of completed work. 1. Constituent documents (certificate of registration or documents of creation, charter or regulations, document of liquidation, orders and / or instructions on creation, renaming, documents of liquidation); 2. Signature of the organization’s leaders or the chairman of the liquidation commission; 3.

Order to create an archive in the organization

Regulations on the Archive When developing the Regulations on the archive (archival service, work with archival documents) of an organization, you can take as a basis the Approximate Regulations on the Archives of a state institution, organization, enterprise (approved by order of Roskomarchiv dated August 18, 1992 No. 176) or use the Basic Rules for the work of archives of organizations (approved by the decision of the Rosarkhiv board dated 02/06/2002). Note ! If the organization does not have an archive, but only an archive storage facility, then the main directions of its activities are reflected in the Regulations on the structural unit within which it was created, but in all cases it is advisable to develop Regulations on the archival service, work with archival documents, etc. Local regulatory acts regulating the work of the organization's archive are created and provide targeted solutions to management problems in matters of organizing the organization's archival documents, ensuring their safety and use.

Candidate of Historical Sciences, Associate Professor, Head of the Department of Archival Studies at the Institute of Archives of the Russian State University for the Humanities E.M. will help us navigate this complex of official documents.

Burova In accordance with existing standards in the field of archival affairs, the organization develops and approves its local acts aimed at regulating the procedure for working with archival documents in office work and the archive or archive storage. Strict compliance with the requirements of instructions and regulations allows you to effectively solve problems of organizing archival documents, ensuring their safety and use. Determining the composition of archive documents. It is necessary to determine which documents will be stored in the archive, and which will subsequently be transferred to state storage.

Read more about organizational documents here. 5. Determination of the picking order.

Which structural units (branches, etc.) and in what order will transfer documents for storage to the archive. 6. In accordance with all current regulatory documents, only expert commissions make decisions on such

Preparation of personnel documents for archival storage

A number of articles of the Constitution of the Russian Federation guarantee the right of citizens to receive information and information affecting their social and legal interests. Such information is also contained in documents on personnel generated in the activities of organizations.

Some of these documents, in accordance with the List of standard management documents generated in the activities of organizations, indicating storage periods (hereinafter referred to as the List), approved by Rosarkhiv on October 6, 2000, have a long-term (over 10 years) storage period. The list is the main regulatory document for determining the storage period for management documentation, which includes personnel documents, and selecting them for further storage and destruction. The effect of the List articles for this category of documents applies to organizations of all forms of ownership.

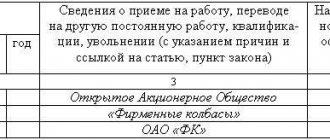

Personnel documents that have a long-term storage period include:

- administrative documents (orders, instructions, notes replacing orders for personnel, resolutions, etc.);

- lists of personnel, including lists of workers employed in production with hazardous working conditions;

- personnel registration cards, including temporary workers (form T-2);

- Personal things;

- personal payroll accounts of employees (salary statements);

- acts on accidents related to production;

- tariff sheets;

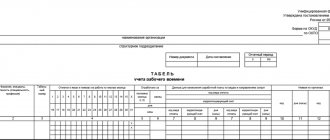

- report cards and work orders for workers in hazardous professions;

- employment agreements (contracts), labor agreements that are not included in personal files;

- minutes of meetings of commissions to establish length of service for the payment of bonuses for length of service;

- minutes of meetings, resolutions of certification and qualification commissions;

- documents (submissions, petitions, characteristics, autobiographies, extracts from decisions, resolutions, etc.) on the nomination of employees of the organization for state and departmental awards, conferring titles, and awarding bonuses;

- lists of employees retiring on preferential pensions;

- staffing arrangements;

- books (cards) recording the reception, movement (transfer), dismissal of employees.

The storage period for these documents in accordance with the List is 75 years. The exceptions are:

- acts on accidents related to production - 45 years;

- tariff sheets - 25 years;

- minutes of meetings of commissions to establish length of service for the payment of bonuses for length of service - 15 years;

- minutes of meetings, resolutions of certification and qualification commissions - 15 years;

- lists of employees retiring on preferential pensions - 50 years;

Within the established time limits, the organization is obliged to ensure their safety and provide citizens and organizations with the information and information contained in these documents in the manner prescribed by law.

The organization of work with documents in institutions is regulated by regulatory legal documents: instructions, rules, regulations, etc., which set out the procedure for compiling nomenclatures of cases, forming cases, registering cases and compiling a scientific reference apparatus for them, preparing cases for archival storage.

The main regulatory documents that establish general requirements on these issues are the Standard Instructions for Office Work in Federal Executive Bodies, approved by Order of Rosarkhiv No. 68 of November 27, 2000, and the Basic Rules for the Operation of Archives of Organizations, approved by the decision of the Rosarkhiv Board of February 6, 2002 G.

The preparation of personnel documents for long-term storage begins at the stage of compiling case lists and forming cases in office work.

At the end of each year, the institution draws up a consolidated list of cases for the next year, the corresponding section of which includes documents from the personnel service. The documents of the personnel service section are a systematic list of the titles of all cases opened in the course of its activities, indicating storage periods. The nomenclature of cases is compiled for the purpose of reasonable distribution of documents, their formation into files, systematization and recording of cases, and determination of their storage periods.

The storage periods for documents are determined in accordance with the List of standard management documents generated in the activities of organizations, indicating the storage periods (hereinafter referred to as the Standard List).

The nomenclature of cases is the basis for drawing up inventories, including documents on personnel.

When preparing documents for files, the following basic requirements must be observed:

- place in cases only executed, correctly executed documents, which in their content correspond to the title of the case according to the nomenclature of cases;

- include one copy of the document in the file;

- group documents from the same calendar year into a file (with the exception of personal files);

- place together all documents related to one issue;

- the case should not contain more than 250 sheets with a thickness of no more than 4 cm.

It is prohibited to group draft and doublet copies of documents, as well as documents subject to return, into files.

Documents are grouped into cases so that they cover specific issues in a consistent, logical order. As a rule, documents are arranged in files in chronological order.

Let us consider, as an example, the formation of administrative documentation for personnel - orders.

Orders for personnel are formed into files depending on their storage period. It should be remembered that it is prohibited to group documents with different retention periods into one file.

In accordance with the Standard List, orders for personnel have two storage periods: 75 years and 5 years.

Orders that have a 75-year shelf life include orders on hiring, dismissal, relocation, bonuses, promotions, long-term care leave, and long business trips. Orders that have a 5-year shelf life include: orders on regular and educational leave, duty, penalties, short-term business trips.

The practice of using documents on personnel shows that with significant volumes of orders on personnel having a 75-year shelf life, it is more expedient to form them into files on operational issues. For example, separately group into cases orders for the hiring, dismissal, and transfer of workers, that is, orders related to their length of service, and separately orders for bonuses, incentives, etc., that is, orders that contain information about wages. Moreover, in each case the orders have their own independent gross numbering.

Orders, instructions and other administrative documents on personnel are formed into files within one calendar year in chronological order and with related annexes.

In accordance with the Basic Rules for the Operation of Archives of Organizations, administrative documents are grouped into files by type; it is not allowed to form orders and instructions with a single number into one file. That is, orders, instructions, instructions are grouped into independent cases with their own numbering.

Personal accounts for employee wages are formed into independent files and are arranged in them alphabetically by last name.

Documents in personal files are located as they are received.

Employees' personal cards are also compiled into files according to the alphabetical order of surnames.

After one year after the completion of the formation of cases in the office work, work is carried out to prepare them for transfer to storage in the archive of the institution. In accordance with the Basic Rules for the Operation of Archives of Organizations, the archive receives documents, including those on personnel, no later than three years after the completion of their formation in office work.

Cases are transferred to the archive in an orderly state according to the delivery inventory. Documents on personnel are allocated to a separate group, systematized separately and included in a separate inventory.

Preparation of documents for long-term storage includes:

- conducting an examination of the value of documents;

- registration of cases;

- compilation of inventories and scientific reference apparatus for them (indexes, tables of contents).

When conducting an examination of the value of documents, the personnel service selects cases with a long-term storage period (over 10 years) for transfer to the institution’s archive, and selects for destruction documents whose storage periods have expired.

The selection of documents for further storage occurs through a sheet-by-sheet review of files. It is not permitted to examine the value of documents based solely on the headings on the covers of cases. At the same time, extra copies of copies of documents or documents not related to the issues on which the case was formed are removed from the cases; The correctness of the documents is taken into account.

Registration of cases involves systematization of documents in the case, filing or binding of the case, numbering of sheets of the case, drawing up a document certifying the case, drawing up (if necessary) an internal inventory of documents.

Documents in files containing orders, instructions on personnel are re-systematized in chronological order: at the beginning of the case there should be orders (instructions) for January, then for February, etc.

Similarly, according to a chronological principle, documents are systematized in cases containing acts of accidents, minutes of commission meetings, documents on nominations for awards, employment contracts (agreements), tariff sheets, time sheets and work orders for workers in hazardous professions.

Filing of formed cases is carried out only after completion of the examination of the value of the documents.

The documents of the case are filed, intertwined in four holes with harsh threads. At the same time, taking into account the intensity of the use of personnel documents for the social and legal needs of citizens and institutions, high-quality cardboard with increased density should be used when performing bookbinding work and filing files. Documents are filed and bound so that the text can be easily read.

If there are unclaimed personal documents in the personal file (identifications, certificates, work books, military IDs, etc.), they are placed in an envelope, which, together with other documents, is filed in the file.

At the beginning of each case, a blank sheet of paper is inserted, and at the end - a certification sheet in the prescribed form (Appendix 1).

The certification sheet indicates in numbers and in words the number of numbered sheets in the case, the presence of missing and lettered numbers, and the number of sheets of the internal inventory of the case. It is not allowed to place a certification inscription on the reverse side of the last document of the case or on the cover of the case.

After a blank sheet of paper, an internal inventory of the case documents is filed at the beginning of the case.

An internal inventory is compiled for personal files in the prescribed form (Appendix 2).

An internal inventory is compiled to keep track of case documents and contains information about the serial numbers of case documents, their indexes, dates, headings and sheet numbers of the case. A final record is drawn up for the internal inventory, which indicates in numbers and in words the number of documents included in it and the number of sheets of the internal inventory.

The internal inventory is signed by its compiler, indicating the position of the compiler and a transcript of the signature.

Changes in the composition of personal file documents (withdrawal, inclusion of documents, replacement with copies, etc.) are entered in the “Note” column with links to the relevant documents on the basis of which the withdrawal, addition, replacement with copies, etc. occurred. In case of significant changes in the composition of the personal file, the final entry to the internal inventory of the file and the certification note of the file are re-compiled.