Issues discussed in the material:

- Why destroy accounting documents?

- What are the storage periods for accounting documents?

- How to document the destruction of documents

- What are the most reliable methods for destroying accounting documents?

- Is it necessary to destroy accounting documents electronically?

At some point, every accountant begins to be interested in such a question as the procedure for destroying accounting documents. This happens because over time the volume of accounting papers begins to exceed all imaginable sizes. And due to age, there is no longer any need to store some of them. Our article today is devoted to the issue of organizing the storage of documents and the procedure for their liquidation.

What does the organization's document flow consist of?

Accounting papers are the responsibility of the accountant from the moment they are received until they are liquidated or archived. Since documents at any enterprise are always presented in large quantities, the order of their storage must be properly organized. This applies not only to paper media, but also to electronic ones.

Grouping of accounting papers provides for:

- Local, formed within the organization for its activities.

- Outgoing, generated within the company for third-party companies.

- Inbox. This is part of the documents that was created outside the company.

The procedure for interacting with documentation is the same at all enterprises:

- Admission. This point includes both the creation of your own acts and their transfer from a third party.

- Making entries, posting accounts.

- Checking for correct filling.

- Sending for storage.

A separate structural unit can be created for storing accounting papers or a place can be allocated in the accounting department.

The storage of accounting documents, seizure and procedure for their destruction are regulated by legislative acts of the Russian Federation, in particular:

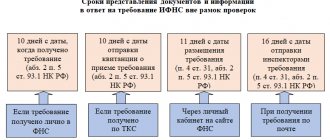

- The Tax Code of the Russian Federation, which in Articles 23, 24, 89 establishes temporary storage periods.

- Federal Law “On Archiving in the Russian Federation”, issued on October 22, 2004.

- By Order of the Ministry of Culture of the Russian Federation No. 558 of August 25, 2010.

- Resolution of Rosarkhiv.

Why destroy accounting documents?

Any business transaction in the company must be documented. Thus, the availability of supporting documents and easy access to them are essential for every organization.

The longer a company exists, the more papers it accumulates. Sooner or later, the manager faces the question of how to get rid of them.

But what documents and in what order can be liquidated? Let's look into this issue.

After the reporting period has been completed, the accountant must file the papers and organize their storage in accordance with the procedure established by legislative acts, as well as ensure access to them for five years. This period is established by the accounting law.

However, there are a number of papers whose safety must be ensured on an ongoing basis, for example annual reporting.

If the papers do not belong to the company’s archives, then the company itself can determine the procedure for their destruction by stipulating it in local regulations. This is possible because this aspect is not specified in legislative acts.

To store papers that cannot be destroyed, you can organize a separate archive. As for accounting papers, the shelf life of which is ten years, they are not transferred to the archive, but remain in the accounting department and are liquidated over time.

For some categories of securities, an individual storage procedure and its terms are established.

Often accountants are faced with the fact that different legislative acts specify different retention periods for the same documents. This may be due to their affiliation with both accounting and taxation.

In this situation, it is worth relying on the legislative act that designates a longer period.

How to destroy electronic documents

In this age of technology, many businesses store their materials electronically. They also have a time frame for mandatory preservation. For example, according to paragraph 2 of Art. 29 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ (hereinafter referred to as Law No. 402) papers related to the organization and maintenance of accounting, including means that ensure the reproduction of electronic documents, as well as verification of the authenticity of an electronic signature, are subject to storage for at least 5 years after the year of reporting on them.

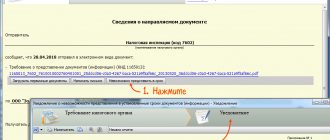

Note! EC is carried out in relation to all company documents posted on any storage media (clause 4.5 of the Rules). The entire electronic archive must also be reviewed by the commission.

The procedure for selecting such files for destruction is the same as for paper ones. An act is also drawn up in the form from Appendix No. 21 to Order No. 526. But their disposal can be done not only physically, but also by software and hardware (erasing information or rewriting it).

Note! Experts consider this method not the most reliable and recommend erasing or overwriting several times in a row in order to minimize the possibility of recovering deleted files.

The procedure for destroying accounting documents in an organization: preparation for the procedure

Since accounting documents belong to the category of supporting documents, they may be required during inspections initiated by various government bodies. Therefore, their unauthorized destruction or disposal in any other way is illegal.

If a company does not comply with the procedure for liquidating accounting papers, it may be subject to administrative or criminal liability.

The procedure for destroying accounting documents is strictly regulated for each category. Often entrepreneurs, not knowing the basic laws, either neglect the issue of getting rid of documentation or try not to liquidate it.

Thus, you can only get rid of papers whose shelf life has expired. This is also true for electronic files.

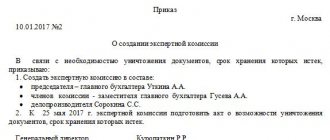

In order to correctly establish the procedure and storage period, the company must organize an expert commission. Its creation occurs on the basis of an order from the director of the company, which is signed once. If the composition of the commission undergoes changes, then issuing a repeat order is not necessary. You just need to change the composition itself.

The purpose of the expert commission is to determine the value of the paper and its shelf life.

In addition to the main composition of the commission, other employees of the organization may be involved for these purposes. For example, a chief accountant, a lawyer or an archive worker.

In addition, each company has the right to involve independent experts in this activity.

The expert commission is engaged in:

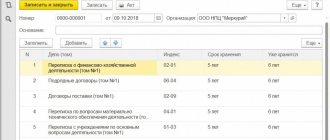

- creating an inventory of accounting papers in the archive;

- creating a list of securities that must be liquidated;

- issuance of an act;

- measuring the weight of papers;

- liquidation. The procedure for destroying accounting documents and methods of their disposal are determined in the organization on the basis of local regulations.

If the procedure for liquidating securities provides for different methods, then it is worth creating different acts - one for each of them.

The procedure for destroying accounting documents with an expired storage period

Let us consider in more detail the procedure for destroying accounting documents with expired storage periods. It provides the following sequence of actions:

- The head of the organization issues an order that regulates the procedure for forming an expert commission.

- The expert commission creates a list of papers and distributes them into groups based on their shelf life.

- Members of the expert commission and invited experts (if any) draw up an act for the destruction of papers, and the head of the company signs it.

- Accounting papers are transferred for destruction in the prescribed manner. There are several methods of elimination. Each company chooses which of them to resort to in each specific case.

- The expert commission records the fact of destruction of papers in the manner prescribed by law. The presence of acts confirming the liquidation procedure will allow the enterprise to avoid claims from supervisory authorities in the future.

Destruction of documents by burning, shredding, chemical treatment

Each organization has a well-established workflow scheme. Over time, it is allowed to get rid of information on paper or transfer sources to the archive. The procedure for destroying documents with expired storage periods is handled by an established commission.

Methods for destroying documents

The management of the organization chooses an accessible method of eliminating documentation. Papers are destroyed in-house or outsourced (sent to a third party). When destroying, 2 errors occur:

- breach of confidentiality;

- recycling of an incomplete set of media.

In this regard, when choosing an independent destruction method, there are a number of advantages:

- full compliance with data secrecy;

- no extra expenses;

- making a profit from waste paper.

Outsourcing requires investment, but in this way you can get rid of large volumes of documents with their immediate disposal.

Grinding (shredder)

With the permission of management, employees get rid of drafts containing data that are not valuable by manual tearing. But when working with valuable information media, complete destruction is required. Among the known methods, shredding is common. An office shredder shreds papers using different types of cutting.

Advantages of this method:

- a one-time purchase of the device eliminates future investments;

- no additional space is required for materials to be destroyed;

- shredder destroys top-secret information.

Burning

Large volumes of documents can be quickly destroyed by burning. This method of disposing of confidential information is not approved by environmentalists. Scientists are convinced of the harmful effects of combustion products on the environment.

In addition to the disapproval of the method from an environmental point of view, there are other disadvantages:

- to burn papers, an organization needs an equipped special site or its own boiler room, which is problematic in urban conditions;

- if combustion is not carried out in pyrolysis installations at high temperatures, then there is a possibility of storing information in tightly compressed folders;

- Taking into account transportation to the incineration plant and loading and unloading operations, this is a costly procedure.

Burying

The use of a previously popular method is becoming rare. It’s easy to bury papers in the ground, but this method is not completely reliable. In arid climates, buried materials are well preserved for many years. Therefore, accidental or deliberate digging leads to leakage of organizational data.

Mobile shredder

In case of document flow, which conventional shredding cannot cope with, it is rational not to transport the accumulated material for processing. You can solve the problem by calling a mobile shredder.

After the contract is concluded, a truck arrives at the organization at the appointed time. The machine comes with a forklift and a document shredder. Grinding takes place in the presence of the customer or commission members. The procedure time depends on the volume to be destroyed. On mobile complexes the processing speed reaches 3 tons per hour.

Chemical treatment

Leakage of classified information to competitors due to non-compliance with destruction rules can lead to financial losses. Therefore, the successful operation of each company is associated with the correct disposal of documentation containing trade secrets.

You can obtain a 100% guarantee of the destruction of valuable paper media by chemical treatment. From the point of view of maintaining secrecy, this is the most reliable method. Papers are eliminated using chemicals and water using special equipment. The resulting mass cannot be restored. The only drawback is the cost of the method.

Destruction of documents with expired storage periods in legislation

According to the state standard, document destruction is understood as the process of getting rid of information on paper without the possibility of its recovery.

Documents are stored within the established time limits in existing regulations and the Federal Law “On Archiving”. The fundamental factor for carrying out disposal work is considered to be the completion of the period of retention of papers, with the exception of force majeure situations. The organization retains the right to independently choose the available method of disposal of materials.

Legal regulations for proper disposal include:

- Federal Law No. 125 on the creation and operation of archives;

- orders of the Ministry of Culture (No. 1182 on storage periods and No. 558 on standard management documents);

- FCSM Resolution No. 03-33/ps on the affairs of joint-stock organizations.

Document Destruction Commission

When creating an archive, it is advisable for institutions with a large document flow to simultaneously organize a special commission. When registering it, the chief must be guided by the order of Rosarkhiv No. 2 “On approval of a permanent commission.”

The team includes at least three employees who are familiar with office work and understand the importance of maintaining confidentiality. The commission is usually headed by one of the deputy heads of the enterprise.

After the chairman, the expert secretary is considered second in importance. This becomes the head of the archive, and in his absence, the person responsible for archival documents.

The council sometimes includes the chief accountant, head of the human resources department, and legal adviser.

https://youtu.be/RqBgjaRjbCQ

Storing reports in the city archive requires the inclusion of a representative in the commission. In classified structures, the head of the security service and employees with access to confidential information are appointed to it.

Work of the expert commission

Meetings of expert commissions operating on a regular basis are held as scheduled at least twice a year. If necessary, in difficult situations, consultants and archival experts are invited.

CI functions include the following actions:

- selection of paper media for archival storage;

- determining the terms for storing accumulated documentation in accordance with the law;

- conducting a value examination;

- monitoring compliance with the storage period for strict reporting forms;

- sorting expired documents for destruction;

- extension of the storage period.

The fact of the meeting is recorded and signed by the head of the enterprise.

Act on the allocation of documents for destruction

When going through the disposal procedure, the main reporting is the act of allocating documents for destruction. It is compiled by an archivist or during an examination of the value of papers. The form was approved by Order No. 526 of March 31, 2020. The acts include cases whose storage period ended on January 1 of the current year.

Selection of documents is accompanied by the following actions:

- sorting of documentation;

- sampling of paper media with expired shelf life;

- page-by-page review of files in order to find materials for permanent storage;

- compiling an inventory and including selected papers in the act of destruction.

Order to destroy documents

The final stage of preparation for the destruction of documentation is the filling out of the order for destruction and its signing by the production manager. It indicates the grounds for disposal (a drawn up act on the separation of expired documents) and the chosen method of disposal.

Document destruction act

After signing the act on the allocation of documents and the disposal order, a destruction act is drawn up. Its registration is carried out by the person responsible for office work. The procedure for compiling is regulated by the Document Flow Rules of the Archive Fund of the Russian Federation.

The act is conditionally divided into 2 sections:

- the first contains a list of cases and documents sent for disposal, indicating storage periods. It can be indicated in the application with a detailed list of documents;

- the second contains data on the disposal method (filled in after getting rid of the documentation).

The act signed by the compiler and members of the commission is submitted to the head of the organization for signature.

One copy is kept in the records management department, the other in the department to which the destroyed documents belonged.

Retention period for document destruction reports

Recycling reports are stored permanently in accordance with current regulations. It is recommended to create a separate folder for them. When a company is reorganized, the file is transferred to the successor for safekeeping, and when liquidated, it is sent to the city archives.

Penalties are provided for violation of storage of documentation or unreasonable destruction. Therefore, full registration of the entire destruction procedure will protect the defendant from civil and administrative liability and maintain the confidentiality of information.

Source: https://bezotxodov.ru/makulatura/unichtozhenie-dokumentov

How to draw up an act of destruction of accounting documents with expired storage periods

When drawing up an act for the destruction of accounting papers, the expert commission must carefully check them for compliance with the storage period requirements. Based on legal norms, only documents whose storage period expired before January 1 of the current year are subject to entry into the act. In other words, if a paper subject to storage for five years was deposited in the archives in 2014, then it can only be included in the act in 2020.

The act of destruction is generated in any form, but must necessarily contain information about the documents being destroyed, including deadlines for submission to the archive and expiration dates for storage.

Each member of the commission, as well as the head of the organization, must sign the act, which is subsequently certified by a seal.

Methods for disposing of papers can be different: burning, manual destruction, shredding, recycling.

Having decided to destroy documents by burning, the company must make sure that it does not violate fire safety standards. For large volumes, it makes sense to contact processing organizations.

In addition, an organization can enter into an agreement with a waste paper collection point and deliver papers there. This method is most beneficial to the company, since it allows it to obtain additional financial resources that will be used in the future for its needs. The amount received by the organization depends on the weight of the papers and the price per kilogram.

Committee members can simply tear up documents or shred them. At the discretion of the commission, small pieces may be subjected to burning or exposure to chemicals to dissolve them. However, the use of chemicals is unprofitable for the company, since it requires money from it.

➤ Methods for destroying documents

We will tell you about the procedure and methods for disposing of documents whose storage period has expired.

Download useful documents:

Why and when to destroy documents

During the operation of an enterprise, a lot of paperwork is generated. Documents confirm all aspects of the company’s activities: financial, administrative, organizational, personnel.

Storage periods are established for each type of document

. For example, the storage periods for financial documents and primary accounting documents are established by the Tax Code of the Russian Federation and the Law “On Accounting”.

For the main part of business papers that make up the document flow of an enterprise, storage periods are established in accordance with the “List of standard management archival documents generated in the process of activities of state local government bodies and organizations, indicating storage periods”, approved by Order of the Ministry of Culture of the Russian Federation dated August 25, 2010 No. 558

.

Memo: storage periods for archival documents

At the end of the calendar year and as they lose relevance, documents are compiled into files and transferred from current storage to archival storage. All business papers, both in current and archival storage in the organization, can be divided into three groups:

- not subject to storage;

- temporary storage;

- permanent storage.

Destruction of paper documents classified as permanent storage is not possible. The head of the enterprise is personally responsible for the safety of such papers. In the organization they are stored in specially equipped premises to prevent damage or loss. If an enterprise is liquidated, files with permanent storage documents are transferred to municipal archives.

But papers that cannot be stored or have a limited shelf life must be periodically destroyed.

Groups of cases by shelf life and what to do with them: a hint from the magazine “Secretary's Handbook”

| Note! After an employee quits, the organization stores only those personnel documents that were created during the period of employment. All personal documents of the dismissed employee are subject to destruction. |

Procedure for destroying documents

The procedure for destroying documents whose storage period has expired is the same for all organizations, regardless of their form of ownership.

It is established by the Rules for organizing the storage, acquisition, recording and use of documents from the Archival Fund of the Russian Federation and other documents in government bodies, local governments and organizations (approved by order of the Ministry of Culture of Russia dated March 31, 2015 No. 526).

Every year, at the beginning of the new calendar year, a commission specially created by order of the head conducts an examination of the value of documents with an expired storage period.

Sample order for the creation of a commission to conduct an examination of the value of documents

The commission inspects files that are stored in the archives and seizes documents that are subject to disposal. At the same time, members of the commission determine whether these documents are of any value: practical, cultural, scientific or historical. These files and papers are stored separately and can then be transferred for storage to the municipal archive, library, or museum.

If the document, in the opinion of the commission, has not lost its importance, its storage period in the organization’s archive is extended. Employers have the right to increase storage periods compared to those established by law and industry regulations. But this needs to be specified in the LNA.

Form for the act of destruction of documents not subject to storage

Those documents that need to be disposed of are included in the list - an appendix to the act of destruction of documents that are not subject to storage. If the enterprise is large, such acts are drawn up in each structural unit. Then, based on them, a consolidated act is drawn up and approved by the head of the organization. After this, the selected papers can be destroyed.

| Note! Only those documents whose storage period expired before January 1 of the year in which the act was drawn up are subject to disposal and included in the destruction report. |

Memo: which documents are subject to destruction in 2020

| 2018 if the shelf life is 1 year; 2016 if the shelf life is 3 years; 2014 if the shelf life is 5 years; 2009 if the shelf life is 10 years; 1974 if the shelf life is 45 years; |

Basic methods of document destruction: which one to choose

The main task of recycling business papers with an expired shelf life is the impossibility of restoring them in the future. This task must be completed regardless of which document destruction method the company chooses. Currently, there are three methods for recycling business papers.

Method 1. Thermal.

Burning is the easiest and cheapest way to get rid of a document. It guarantees the impossibility of recovering information and does not require complex expensive equipment.

Disadvantages include the ban on burning papers in the open air, which is in effect in populated areas. In addition, burning a large number of documents will require time and vigilance on the part of the executor.

Documents bound into files do not burn very well and you need to make sure that all folders burn to the ground.

Memo: how long to store various organizational documents

2. Chemical.

This method of document destruction uses chemically active substances.

They act on the paper, decomposing it and turning it into a homogeneous mass. The advantages of this method include reliability - after processing, documents can no longer be restored.

But it is quite expensive - you need special equipment and reagents. In addition, the performer must strictly adhere to safety regulations.

3. Mechanical or shredding.

For this method of document destruction, special equipment is used - cutters that cut the paper into many thin strips from which it is no longer possible to restore the documents.

This method is environmentally friendly and safe for the environment and the performer; it can be used either by the company’s specialists or by concluding an agreement with a specialized organization.

Involving a third-party contractor is advisable for large volumes of documents that must be destroyed.

How is the fact of document destruction confirmed?

If a company disposes of expired papers on its own, the fact of their disposal is confirmed by a certificate of destruction. It is compiled in any form. The form is approved as an appendix to the Regulations or Instructions on office work.

Sample document destruction act

If a specialized company has been assigned to dispose of documents, the destruction of documents must also be confirmed by an act signed by the head of the executing organization.

When an employee resigns, his personal documents and copies thereof stored in his personal file must be disposed of using a shredder, without drawing up a destruction report.

To avoid conflict situations, such documents must be destroyed in the presence of the employee. After this, ask him to make a note on his personal card: “Copies of personal documents were destroyed in my presence.” He must also sign and indicate the date.

| Note! It is prohibited to destroy documents with an expired shelf life by simply tearing them into pieces and throwing them in the trash. You also cannot use them as drafts. |

Technology for destroying confidential and especially valuable documents

When destroying documents of limited access and especially valuable ones, it is necessary to exclude the possibility of unauthorized persons becoming familiar with them, as well as incomplete disposal, theft or substitution.

You can control the process, regardless of what methods of document destruction are used, if the following conditions are met:

- the decision to destroy was made collectively, members of the commission participate in the destruction process;

- at each stage of disposal, appropriate acts are drawn up;

- the commission makes a note of destruction in the act only upon the fact of physical and irrevocable disposal of the papers.

Without drawing up an act, but with the collegial participation of members of the commission, projects, drafts and damaged paper and electronic media of confidential information, and other unfinished and secondary materials generated during the execution of confidential documents can be disposed of.

| Bottom line When choosing a method for destroying expired documents, ensure that they are disposed of safely and cannot be recovered later. |

Source: https://www.sekretariat.ru/article/211347-sposoby-unichtojeniya-dokumentov-19-m10

When to issue an act of destruction of accounting documents if the storage periods for documents are unknown

Sometimes members of the expert commission are faced with documents whose storage period cannot be identified. This is possible in cases where this type of document is not provided for by legislative acts.

Faced with such a problem, the expert commission or the head of the company must formulate a request and send it to the archival organization. The archive staff will give an answer, on the basis of which the further storage period of such paper will be determined.

You cannot simply destroy a document with an unknown shelf life. The deadline will have to be determined in any case, otherwise the company may be held liable.

Who deals with document disposal?

Disposal of documents requires the creation of a special commission. It must consist of at least two people. As a rule, these are employees from different departments of the organization, including the department whose papers need to be destroyed. The commission must put its signatures on the document destruction act.

It is important to remember that committee members are responsible for the documentation to be disposed of. This issue must be approached with all responsibility and attention so as not to make a mistake and destroy important materials.

You also need to know that many papers must be kept for five years, otherwise there is a threat of facing serious sanctions.

How to draw up an act when destroying accounting documents in electronic form

Guided by Art. 5 Federal Law No. 125, it can be argued that in order to determine the procedure for storing and destroying accounting documents, it does not matter on what medium they are compiled. In other words, the destruction rules are the same for both paper and electronic files. Thus, electronic files:

- cannot be destroyed spontaneously by the organization. A commission should also be created for them and an act drawn up;

- are not subject to destruction if they may be required in court;

- may contain secret information;

- must be destroyed along with all possible copies.

Federal Law No. 402 provides for a storage period of five years for documents on electronic media. The retention period begins on the first of January of the year following the year of last use.

Electronic media greatly simplifies the storage of accounting documents, as they allow large volumes to be stored on a small item. Such media can be memory cards, disks and other storage devices.

External media must be destroyed along with the information contained on it. The destruction procedure and methods of disposal are similar to the procedure used for paper media. This may be incineration, mechanical or chemical destruction.

Specific techniques may be used for electronic files, such as erasing or rewriting. The possibility of using these methods is fixed by the order of Rostekhregulirovaniya dated March 12, 2007.

Thus, the destruction of electronic accounting documents occurs in the following ways:

- Mechanical . This method includes any means of physical and chemical influence on the media in order to damage it. This includes burning, the use of chemicals, breaking, etc. This method allows you to obtain visual confirmation of the fact of destruction of the media and, accordingly, the information that was stored on it.

- Demagnetization method . To destroy files in this way, a magnetic field is used, which, acting on external media, causes them to malfunction. This method can only be used for external media: flash drive, disk, floppy disk, cassette, etc.

- Erasing data . It is used when information is stored not on external media, but, for example, on a computer. It allows you to destroy accounting files without destroying the storage media. The order of the destruction process must be controlled by programmers or independent specialists. They will tell you how to erase both the document itself and its possible copies.

The procedure for destroying electronic accounting documents must be confirmed by the relevant act.

As already noted, the procedure for destruction and the timing of its implementation are established by an expert commission.

Instructions for filling out the act

On the right side of the sheet at the very beginning you need to place the full name of the organization, the date when the act was created, the document number, depending on the internal document flow.

On the left side of the sheet you must indicate information about the head of the organization: his position, last name, first name, patronymic. One line must be left blank. The manager will later put his signature on it.

Next, the title of the document is written in the middle.

The main part of the act must necessarily reflect:

- The grounds on which documentation can be liquidated (order, director’s order, etc.). It is also necessary to put a date, an inventory with serial numbers of documents.

- The composition of the commission, including its members and chairman, their positions, last names, first names, patronymics.

- Recorded expert assessment and selected papers for disposal with a detailed list of them. Under the list or table you need to indicate their number in numbers and words. It is also necessary to include in the document the method of recycling papers.

Upon completion of the drawing up of the act, it must be certified by all members of the commission with their signatures. The names of their owners must be indicated opposite the signatures.

Then you can transfer the act to the manager. Having examined it, he personally certifies it with his signature.