| Financial control |

| Control |

| Types of financial control |

| State control Internal control Audit |

| Financial control methods |

| Documentary audit Inventory Control measurement |

| Areas of financial control |

| Fixed assets Cash Cash Financial investments Settlements Business agreements Foreign economic. activity Profit |

| Financial control by industry |

| Retail trade Construction Motor transport Budget sector Banks |

| Audit and criminal procedure |

| Accounting |

| Template: view • discussion • edit |

The request for "revision" is redirected here; see also other meanings.

A documentary audit

(sometimes simply

an audit , from the Latin revisio - “I look again”)

is the most complete form of subsequent financial control. A documentary audit is understood as a system of control actions to verify the legality and validity of the business transactions of the audited organization, the correctness of their reflection in accounting and reporting.

Content

- 1 Documentary audit as a form of economic control

- 2 Main tasks of documentary audit

- 3 Classification of documentary audits

- 4 Powers of audit bodies 4.1 Regulatory framework

- 4.2 Rights of the auditor

- 4.3 The auditor has no right

- 5.1 Preparation of a documentary audit

- 6.1 Primary control actions

- 7.1 Revision of fixed assets

- 8.1 Audit of retail trade organization

- 9.1 Procedure for signing a documentary audit report

Completion of the cash register audit: act

The main document that must be drawn up based on the results of the cash register audit is an act in the INV-15 form strictly established by law. Information that should be indicated in it:

- about the specific amount of cash in the cash register;

- about the amount of funds according to documents;

- comparison of the two above positions and conclusion. If the data matches, then everything is normal and the enterprise or individual entrepreneur maintains the cash register in an exemplary manner and in strict accordance with the law, but if they differ, then it means that there is either a shortage or a surplus in the cash register, which is equally a deviation from the norm. At the end of the report, the audit team must propose measures to eliminate the detected violations.

Attention! When identifying surpluses, the cashier must explain in writing the reason for their occurrence, but if a shortage is discovered, then it is charged to the employee responsible for maintaining the cash register.

Important! Based on the results of the audit, auditors may well contact the investigative authorities if any major offenses, abuses, etc. are found. deeds.

To summarize what has been written, we can say that strict adherence to cash discipline guarantees not only the absence of problems within the company, but also prevents possible negative consequences that an audit of the cash register and cash discipline on the part of external control structures may cause.

Documentary audit as a form of economic control

Purpose of documentary audit

— monitoring compliance with legislation when carrying out business transactions, their validity, the availability and movement of property and obligations, the use of material and labor resources in accordance with approved norms, standards and estimates.

The essence of the audit

— verification, through the application of financial control methods based on documented accounting and economic information, of a number of issues that are mandatory controlled by management, owners of the business entity, and government bodies.

Assessing the state of control

Auditing the cash register and checking compliance with financial discipline acts as an effective way to supervise cash flow in an enterprise. In most cases, the use of this tool allows you to stop or prevent violations in the company in a timely manner.

There are certain signs according to which it is possible to assess the insufficiency or complete absence of internal supervision over the movement of finances in the cash register of an enterprise. These include, in particular:

- Lack of a clearly established system for performing sudden audits with a complete recalculation of cash and other valuables subject to control.

- The formality of carrying out such inventories.

- Assignment of the same individuals to the control group continuously.

- Carrying out inventory at a predetermined time - when the cashier has the opportunity to prepare for the audit.

- The financially responsible person lacks the skills to prepare for performing an inspection. This indicates that such an event is not usual for him.

- Absence of an agreement with the cashier establishing his full financial responsibility. If such an agreement is not concluded, then the identification of a shortage will not have any legal consequences.

- The presence of facts of signing orders instead of the accountant and manager by third parties not authorized by a written order from the director of the business entity to do so.

- Assigning the duties of a cashier in the event of his temporary absence (due to illness, vacation or other reasons) to an employee without the consent of the manager. In such situations, not only a written order from the director must be adopted, but also an appropriate agreement must be concluded with the employee on his full financial responsibility. Otherwise, such an appointment will be illegal.

Main tasks of documentary audit

The main tasks of the documentary audit:

- Checking compliance with financial discipline,

- Identification of abuses, the conditions for their occurrence, development of measures to prevent abuses,

- Checking performance discipline and assessing the effectiveness of the actions of the organization’s management personnel,

- Study of the internal control system, increasing the efficiency of its functioning.

- Checking the correct organization and setup of accounting.

- Checking the legality of business transactions.

- Monitoring the safety of property.

- Identification of cases of illegal spending, write-off of funds (material and monetary).

- Checking the quality of primary accounting documents and the accuracy of accounting records,

- Checking the correctness of profit determination and its distribution,

- Checking the completeness and timeliness of payments to personnel,

- Checking the completeness and timeliness of payments to the state budget.

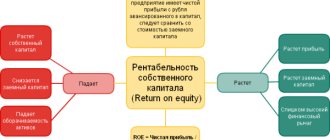

The tasks of a documentary audit in an enlarged form can be put in accordance with three main areas of financial control:

- Monitoring the compliance of the activities of the audited facility with regulations (including local ones).

- Monitoring the reliability of accounting and reporting.

- Monitoring the efficiency of resource use and capital management.

Unscheduled inspection

Management has the right to initiate an inventory whenever it considers it necessary. Such a check is considered sudden. Its difference from a planned procedure is only that the date for its implementation has not been determined. In some cases, such an audit of the cash register is caused by the wariness of the director or the presence of direct suspicions of abuse among employees who are responsible for maintaining financial discipline in the company. Inspections carried out by inspectors of the Federal Tax Service or Rosfinnadzor are usually always unscheduled. The instruction regulating the procedure for conducting audits does not directly establish the term “suddenness”. However, ensuring the unscheduled and non-disclosure stages of preparation of the inspection acts as one of the mandatory requirements for qualified employees.

Classification of documentary audits

- A documentary audit can be complete

or

partial

, that is, covering one or more aspects of the activity of the audited object. - A documentary audit can be continuous

,

selective

or

combined

.

During a complete audit, all primary documents are examined. During a selective audit, a part of documents selected randomly or based on the principle of materiality is subject to verification. With a combined approach, documents of some types (for example, cash orders)

are studied in a continuous manner, documents of other types

(for example, waybills)

are examined selectively. - A documentary audit can be accounting

- carried out only by financial specialists - or

comprehensive

- with the involvement of a wider range of specialists

(for example, economists, commodity experts, technologists, personnel officers) - A documentary audit can be planned

(assigned in accordance with the control and audit work plan of the inspection body) or

sudden

. - Finally, a documentary audit can be primary

,

additional

or

repeated

. The primary audit is carried out by the regulatory body for the first time on this issue in the audited period. An additional audit is appointed in order to clarify the conclusions of the primary audit and search for additional information on the issues considered; usually carried out by the same audit team. A repeat audit is appointed for the purpose of quality control of the primary audit, and is carried out on the same issues again by a different composition of the audit group. Appointment of a second audit is also possible if there are reasoned objections from the persons being audited to the conclusions of the initial audit.

Audit

What is the difference between inventory and audit? The definition of an audit states that it is the carrying out of unscheduled activities to verify the legality of actions at the enterprise. They are considered from the point of view of their validity, as well as their reflection in the accounting accounts. Here's an amendment: correct reflection.

An audit is a study of the legality of all operations carried out at an enterprise, taking into account current legislation. It is carried out without prior agreement with the management of the enterprise. That is, suddenly. Who conducts the audit? Controlling authorities.

Powers of audit bodies

Normative base

Auditor

is the responsible representative of the body conducting the documentary audit. In Soviet times, the rights and responsibilities of the auditor were determined:

- “Regulations on departmental control over the financial and economic activities of associations, enterprises, organizations and institutions”, approved by Resolution of the Council of Ministers of the USSR dated April 2, 1981 No. 325,

- Standard Instruction of the Ministry of Finance of the USSR dated September 14, 1978 No. 85 “On the procedure for conducting comprehensive audits of production and financial and economic activities of production associations (plants), enterprises and economic organizations carried out by the control and audit apparatus of ministries and departments.”

At present, there are no uniform, centrally adopted normative legal acts on the organization of control and audit work in the Russian Federation. The powers of audit bodies may be determined by:

- in case of state and departmental financial control - by regulations of the relevant ministries and departments authorized to exercise such control,

- for corporate and internal control - the charters of the relevant internal control services and other local regulations of business entities.

Experts in the field of organizing audit control recommend that the following rights and powers of the auditor be provided for in the process of documentary audit.

Auditor's rights

- Check the actual availability of inventory items from materially responsible persons, demand an inventory.

- Require managers and officials to provide all administrative (orders, instructions, instructions)

and primary documents, minutes of meetings, accounting registers, reporting forms. - Require oral and written explanations from employees of the organization, information on issues arising during the audit. It is acceptable to ask questions in writing.

- Seal or confiscate questionable documents in order to ensure their safety (in this case, it is advisable to replace the seized document with a copy with a note about who, when and on what basis seized the original document and where it is now located)

. - Require the submission of requests to counterparties on behalf of the audited organization on issues arising during the audit process; conducting reconciliations of mutual settlements; providing copies of documents.

- Inspect construction sites, territory, warehouses and other premises, and, if necessary, seal safes, cash registers and cash premises, warehouses, storerooms, archives, and other places where inventory items and documents are stored.

- Involve specialists from third-party organizations to carry out the audit.

- Involve employees of the audited organization in performing audit tasks.

- If signs of crimes are detected, transfer the audit materials to the investigative authorities on the spot and demand from management the immediate removal from work of persons who committed such abuses.

- Use the premises, communications and transport means of the audited organization to organize audit activities.

- Receive and consider applications and complaints from employees of the audited organization.

- Independently determine audit methods

.

During the audit process, the auditor has the right to use all methods of documentary and actual verification (with the exception of test purchases)

. The auditor bears criminal liability for concealing facts of theft and other criminal actions of employees of the audited organization discovered by the audit.

The auditor has no right

- Exert pressure.

- Use accusatory judgments.

- Threaten punishment.

- Evaluate the actions of officials.

- Make assumptions.

- Participate in entertainment events for employees of the audited organization; allow non-business relationships.

- Involve employees of the audited organization as experts.

- Request documents not related to the subject of the audit.

- Disseminate confidential information (disclose trade secrets).

- Exceed the established deadlines for conducting the audit.

A store manager's nightmare

What is the difference between an audit and an inventory count in a store? The latter is a nightmare for management and service personnel. It’s worth starting with the fact that to carry it out it is necessary to close the trading floor to customers. And this causes losses. Therefore, inventory is often carried out at night.

How is it carried out? The inventory instructions involve 4 stages.

- Preparatory. The manager draws up an order to conduct an inventory. It contains information such as the timing of the inspection, the scope of the inspection, and the composition of the commission. Sellers (materially responsible persons) prepare goods for inventory, if possible collecting them in one place. If we are talking about a grocery store, then on the day of inventory it is prohibited to remove goods from the warehouse to the sales floor. It may remain unaccounted for.

- Technical. Check the availability, storage conditions and condition of all inventory items. The information received is entered into the inventory act. When conducting an inventory, pay attention to goods that absorb moisture: their storage conditions must be observed. As for goods that lose weight during storage (meat, vegetables, fruits), for them there is such a thing as specific weight loss data.

- Analysis of the obtained data. After all goods have been counted, the accountant reconciles the accounting data with actual availability. Discrepancies are recorded in the statements. If inconsistencies are detected, it is necessary to once again recalculate the positions in which “disagreements” were found between the actual balance and the document balance.

- The final stage. All changes in the quantity of goods identified during the inventory are made. As for shortages and damage to goods, they are written off as production costs. If the shortfall amounts are large, they are distributed among all financially responsible persons at fault.

What is the difference between inventory and audit? Inspection in a store is the same necessary process as inventory. Its main goal is to determine the product in physical and value terms and to identify shortages. The audit is carried out by a permanent commission operating in this store. Its terms are agreed upon in advance with the managers of the retail chain.

How do the rules for conducting an audit differ from an inventory? If the first relates more to accounting, then the second relates to all store employees. To carry out inventory, employees usually stay in the store overnight. The goods are counted. Piece items – counted manually or using a special barcode. The weights are reweighed and summed up again.

Planning and preparation for a documentary audit

Preparation of a documentary audit

The preparatory stage includes:

- Issuing an order to conduct an audit.

- Determining the composition of the audit team and the timing of the audit (usually no more than 45 days).

- Drawing up and approval of the audit plan.

- If necessary, make copies of reporting documents located in a higher organization (government body). A situation is possible when an organization submits one version of reporting to a higher authority, but shows another to the auditor.

Planning a documentary audit

Any financial control exercise must be accompanied by mandatory documentation, that is, the information received must be reflected in documentation drawn up in accordance with the requirements of the regulatory authority. Materials of control activities are a source of information about the legality of the financial and economic activities of the audited organization. The documentation includes:

- Planning documents.

- Work documents.

- Copies of documents of the audited organization.

- Explanations, clarifications and statements from employees of the audited organization.

- Final documents.

Planning of control activities should be carried out in accordance with the general principles of control organization

, and also in accordance with the following particular principles:

- The principle of comprehensiveness

- ensuring consistency and interconnection of all stages of the audit and individual control actions by time frame and by object (structural divisions, etc.) - The principle of effectiveness

is the content in the plan of precise instructions of performers and deadlines, which allows you to monitor the effectiveness of the auditor’s work and the control activities carried out. - The principle of specificity

is the specification of the issues being checked to such a level that it is possible to determine the deadline for completing each task and the qualifications of the performer. - The principle of reality

is taking into account the real capabilities of the people and material resources allocated for the audit

(for example, for the inventory of a large warehouse, loaders are needed, possibly equipment)

. - The principle of flexibility

is the ability to improve, supplement and clarify the plan during the audit. Changes to the plan must be justified and determined by specific identified facts.

Documentary audit program

Specific audit issues are determined by the audit program approved by the head of the body that appointed the audit. The audit program may contain the following sections:

- The purpose of the audit

is a full or partial audit; if the audit is partial, then what issues are subject to inspection, which structural units are inspected. - Composition of the audit team

. - Timing of the audit

. - Questions to be verified

— directions of financial and economic activities of the organization

(for example, checking the cash register; checking transactions with fixed assets, checking performance discipline, etc.)

. In this case, for each issue it is determined:- within what time frame should the issue be checked,

- who specifically from the audit team is responsible for this issue,

- what methods of documentary and actual inspections are planned to be used,

- what type of verification is proposed - continuous or selective; if selective, then what is the sampling principle.

- Forms for documenting the audit

- samples of working documents, statements of statements, requests, etc.

A complete and correctly drawn up audit program concentrates the auditor’s attention on the main audit issues, reveals their content, that is, helps the auditor check each issue in detail. An insufficiently thought-out program can lead to a haphazard check of documents, the results of which will be reduced to the accidental detection of some violations.

Based on the assignments received, members of the audit team draw up work plans for conducting inspections of the areas of activity of the audited organization assigned to them, approved by the head of the audit team. The head of the control and audit unit, together with the head of the audit group, before the start of the audit, briefs the auditors, where he focuses their attention on those issues and areas that require a more thorough inspection.

To conduct an audit, all employees participating in it are issued a special certificate; in addition, employees of control and audit bodies must have permanent service certificates of the established form.

A documentary audit is appointed by the head of the organization's enterprise) or the head of a higher organization in relation to the audited one.

The order for the audit shall indicate:

— where the audit will be carried out;

- by whom;

- for what period of time the enterprise’s activity and for what period.

Before conducting an audit, the auditor is given a written assignment indicating the issues subject to mandatory inspection, the scope of audits and the procedure for carrying out audit actions. As a general rule, the duration of the audit cannot exceed one month. Extension of the audit period is permitted with the permission of the head of the organization that appointed the audit.

The content of the auditor's work is determined by the tasks facing the audit. Audit practice has developed the main tasks that an audit should solve.

These include:

1. Verification of the legality and economic feasibility of business transactions carried out by this institution or business organization, and compliance with financial, budgetary, and staffing discipline.

2. Identification of facts of damage to the organization from illegal expenditure of funds and materials. At the same time, the auditor is obliged not only to identify these facts, but also to find out the reasons for their occurrence, and to identify specific persons responsible for violations.

3. Checking the correctness of accounting, the quality of documents used to document individual business transactions and the correctness of accounting records.

4. Checking the correctness of accounting for materials in warehouses, the conditions for storing material assets, the correctness of documenting business transactions for the receipt and release of material assets.

For each audit, the employees participating in it are issued a special certificate, which is signed by the head of the control and audit body that appointed the audit, or a person authorized by him, and certified by the seal of the said body.

Employees of the control and audit body must also have permanent service certificates of the established form. If they permanently reside and carry out their official duties outside the location of this body, in exceptional cases (considerable remoteness, unfavorable weather conditions, etc.), in agreement with the body that requested to conduct an audit, it is allowed to carry it out using their official certificates with subsequent registration according to established order.

The timing of the audit, the composition of the audit team and its leader (controller-auditor) are determined by the head of the control and audit body, taking into account the volume of upcoming work arising from the specific tasks of the audit and the characteristics of the organization being audited, and, as a rule, cannot exceed 45 calendar days.

The extension of the originally established audit period is carried out by the head of the control and audit body upon a reasoned proposal from the head of the audit group (controller-auditor).

Specific audit issues are determined by the program or the list of main audit issues.

The audit program includes its topic, the period that the audit should cover, a list of the main objects and issues subject to audit, and is approved by the head of the control and audit body.

The preparation of an audit program and its implementation must be preceded by a preparatory period, during which the audit participants are required to study the necessary legislative and other regulatory legal acts, reporting and statistical data, and other available materials characterizing the financial and economic activities of the organization being audited.

Before the start of the audit, the head of the audit group familiarizes its participants with the content of the audit program and distributes questions and areas of work among its performers.

The audit program during its implementation, taking into account the study of the necessary documents, reporting and statistical data, and other materials characterizing the audited organization, can be changed and supplemented.

The head of the audit team (controller-auditor) must present the head of the audited organization with a certificate for the right to conduct an audit, familiarize him with the main tasks, introduce the employees participating in the audit, resolve organizational and technical issues of conducting the audit and draw up a work plan.

At the request of the head of the audit team (controller-auditor), if facts of abuse or damage to property are identified, the head of the audited organization, in accordance with current legislation, is obliged to organize an inventory of funds and material assets. The date and areas (volume) of the inventory are established by the head of the audit team (controller-auditor) in agreement with the head of the audited organization.

Having received an assignment to conduct an audit, the auditor, before proceeding with the audit, must prepare for its conduct. To do this, he must study the acts of previous audits and reporting materials. Based on the materials studied, the auditor draws up a program (plan) for the upcoming audit. When preparing for an audit, the auditor can make copies of reporting documents, which he can take with him, since they can be replaced (there are often cases when organizations present one version of reporting to a higher authority, and the auditor is given another).

Preparation for an audit for an auditor usually coincides with the issuance of an order appointing an audit, which determines the audit team and the timing of the audit. When conducting an audit, the auditor is guided by legislation, government regulations, as well as orders, instructions and other regulations in force in the system of the relevant department.

The auditor is obliged:

— develop a specific program for each audit, indicating the main issues and deadlines for their implementation. When preparing the program, you should use cost estimates, staffing schedules, accounting reports and conclusions on them, orders, operational and statistical data available in other departments and departments, acts of previous audits and conclusions on them. The program is drawn up by the chairman of the commission (auditor), approved by the head or deputy head of the ministry;

— conduct documentary audits in strict accordance with current legislation, instructions, regulations related to financial activities and accounting; upon arrival at the audited organization, present the authority (order or instruction) to conduct an audit; ensure that all violations are eliminated as they are discovered. If this is not possible, then the auditor, on the basis of the report, taking into account the explanations, draws up a draft proposal to eliminate the deficiencies identified during the audit and submits it, along with all materials on the audit, for consideration to the manager who appointed the audit;

— in addition, during the audit, the auditor is obliged not only to identify facts of violations, but also to provide all possible assistance to the audited organization in eliminating discovered deficiencies and violations;

— when auditing centralized accounting, conduct checks in bailiff services and notary offices regarding the reliability of the provision of relevant documents, etc.

During the audit process, the auditor should not evaluate the actions of the relevant officials, much less threaten them with punishment. In addition, the auditor should not allow non-business relationships with employees of the audited organization. In carrying out his functions, the auditor can involve the assets and public of the enterprise.

Along with responsibilities, the auditor is endowed with broad rights.

The rights of the auditor are usually specified in the organization's charter. As a rule, the auditor conducting the audit has the right:

1. Inspect all premises, warehouses, storage facilities containing monetary, property, inventory and other valuables of the audited organization, as well as conduct inventories of inventory and cash, and apply all other methods of actual control.

2. In cases of detection of theft and abuse, in agreement with the head of the audited organization, seal the premises.

3. Require audited organizations to submit primary accounting documentation, draw up the necessary certificates and calculations, as well as take written and oral explanations from employees of the audited enterprise on issues arising from the audit.

4. The auditor has the right to seal the places of storage of documents of the audited organization, as well as to seize documents containing confirmation of the identified facts of violations and abuses, formalizing the seizure by a bilateral act and leaving in the affairs of the enterprise copies of the seized documents signed by the chief accountant and the auditor.

5. Get acquainted with the originals of documents located in other organizations related to the audited entity, as well as request certified copies of the necessary documents from related organizations.

6. Inquire from various institutions regarding issues arising during the audit.

7. During the process of audits and inspections, take measures together with the heads of the audited organizations to eliminate identified violations of financial activities and inefficient use of funds, as well as give mandatory instructions to eliminate these violations, to compensate for the damage caused and to bring the perpetrators to justice.

8. Involve, in the prescribed manner, specialists from other organizations to participate in audits and inspections.

9. Send proposals to limit, suspend or terminate the financing of audited organizations when misuse of budget funds is identified, as well as in the event of failure to submit accounting and financial documents related to the use of these funds.

10. Based on the results of the audit and verification, make proposals to recover from organizations budget funds spent for other purposes and income from their use.

11. In cases of violation of the law, facts of theft of funds and material assets, as well as abuse, raise the issue of removing from work officials guilty of these violations, transfer the materials of audits and inspections to law enforcement agencies.

12. Inform the higher authorities of the audited organizations about violations identified during audits and inspections and raise the issue of taking measures to eliminate these violations and their consequences, as well as punish the perpetrators.

13. The auditor, at his discretion, during the audit may use all methods available to him for examining accounting documents.

During the audit and after its completion, the auditor may bear both disciplinary and criminal liability.

The auditor bears disciplinary responsibility for the completeness and quality of the audit and inventory, their completion within the established time limits, the correctness and objectivity of the facts stated in the audit reports and the validity of the audit conclusions.

An auditor may be held criminally liable if, during the audit process, the facts of theft of property and funds are concealed by introducing false information or corrections into the audit report that distort the contents of documents (for example, Article 292 of the Criminal Code of the Russian Federation - official forgery, etc.).

Upon arrival at the inspection site, the auditor immediately organizes an inventory of cash and inventory items. First of all, he checks the actual presence of money and securities in the cash register, and then the remains of other valuables. After conducting an inventory of funds and material assets, the auditor begins to audit the economic activities of the enterprise.

By analyzing the accounts of synthetic and analytical accounting, he studies the data of the latest balance sheet, as well as primary documents; checks their good quality both in form and in essence of the transactions reflected in them. The auditor formalizes the results of his activities with a document audit report.

The head of the audited organization is obliged to create appropriate conditions for the audit team members (controller-auditor) to conduct an audit: provide the necessary premises, office equipment, communication services, office supplies, provide typing work, etc.

If the employees of the audited organization refuse to provide the necessary documents or other obstacles arise that do not allow the audit to be carried out, the head of the audit team (controller-auditor), and, if necessary, the head of the control and audit body, reports these facts to the body on whose behalf the audit is being carried out.

In the absence or neglect of accounting in the audited organization, the head of the audit group (controller-auditor) draws up a corresponding act about this and reports it to the head of the control and audit body. The latter sends to the head of the audited organization and (or) to a higher organization or body exercising general management of the activities of the audited organization a written order to restore accounting records in the audited organization. Further auditing is possible only after restoration of accounting records in the audited organization.

The head of the control and audit body for the provision of audit materials within a period of no more than 10 calendar days determines the procedure for their implementation. Based on the results of the audit, a report is sent to the audited organization to take measures to suppress the identified violations, compensate for the damage caused to the state and bring the perpetrators to justice.

Organizing control over the implementation of the submission based on the results of an audit carried out as part of financial control is not only the final stage of verification activities, but also an important area of control and audit work, which contributes to the timely elimination of identified deficiencies and contributes to the efficiency of business activities.

Conducting a documentary audit

Priority control actions

Immediately at the beginning of the audit, the following actions must be taken:

- Sealing the cash register and those places where inventory items are stored where a sudden check of their availability is planned.

- Presentation of documents to the head of the organization, introducing him to the audit team.

- Familiarization with the report of the previous audit and verification of the implementation of proposals on it.

Audit control methods

Main article: Financial control methods

Direct verification of the financial and economic activities of the audited organization in accordance with the audit program is as follows:

- Checking constituent, registration, planning, accounting and reporting documents in form and content in order to determine their good quality, establishing the legality and correctness of business transactions.

- Checking the actual compliance of completed transactions with the data of primary accounting documents.

- Checking the accuracy of the reflection of transactions carried out in accounting registers; comparison of accounting records with data from primary accounting documents; checking calculations in accounting registers and generating reporting information.

Taking into account the study of data, the documentary audit program can be adjusted during its implementation.

The head of the audited organization is obliged to create appropriate conditions for the work of the audit team, provide premises, means of communication and office equipment, and transport. If you refuse to provide the audit group with the required documents, or create other obstacles that do not allow the audit to be carried out, the head of the group reports this to the body that appointed the audit to take action. In the absence or neglect of accounting, the auditor draws up a report on this and has the right to suspend the audit until the accounting is restored.

If signs of serious abuse are identified, the auditor has the right to draw up an interim act, which can serve as the basis for initiating a criminal case, without waiting for the end of the audit. All data reflected in such an interim act is subsequently included in the main audit act.

Working documentation of the auditor

The auditor's working documentation refers to documents describing the procedures used by the auditor and their results (mainly, this concerns methods of actual control). These documents must contain the following details:

- Title of the document,

- name of the organization being inspected,

- name of the unit where the control operation is carried out,

- date of control event,

- content of the event,

- last name, first name and patronymic of the person who compiled the document.

Practice shows that failure to comply with formal requirements for the execution of control procedures may be grounds for refusal to consider their results in court. Thus, the audit will not achieve its main goal - it will not provide evidence

information.

The materials of each audit in the records management of the control and audit body must be a separate file under the appropriate number.

Using audit results

Based on the results of the audit, the owners and management of the company may decide to change the accounting system. The depth of the reorganization depends on the severity of the identified violations:

- Making changes to accounting policies and document flow regulations.

- Reorganization of the accounting service, complete or partial change of personnel.

- Outsourcing of accounting.

Accounting maintenance by a third party

All of the above measures can be applied individually or together.

Example - not all accounting is given to the outsourcer, but only problem areas

The remaining part of the financial service is undergoing reorganization, mastering new regulations, etc.

Our experience

Staff accountants most often make mistakes when calculating salaries. During the audit, we identified deficiencies in 85% of cases. But violations related to wages are the most severe in terms of possible consequences. Not only tax authorities, but also labor inspectorates, as well as law enforcement agencies may be interested in an enterprise that has allowed them. We talked in more detail about the payroll audit here.

Audit of individual areas of the organization’s activities

Revision of fixed assets

Main article: Revision of fixed assets

Cash desk audit

Main article: Cash register audit

Audit of financial investments

Main article: Audit of financial investments

Revision of calculations

Main article: Revision of calculations

Revision of business contracts

Main article: Revision of business contracts

Audit of foreign economic activity

Main article: Audit of foreign economic activity

Audit of determination and distribution of profit

Main article: Revision of profit determination and distribution

Revision: concept and types

The concept of audit means checking the financial, economic and business performance indicators of an enterprise. Depending on the purpose of the audit, the audit may be:

- complex. In this case, all indicators of the organization’s activities are subject to verification (income, expenses, balances of inventory and fixed assets, cash in hand, etc.);

- thematic. Such checks are carried out in the direction of any activity (for example, auditing cash in the cash register, checking the availability of inventory items in the warehouse, etc.). Thematic audits are carried out, as a rule, if it is necessary to verify the authenticity of facts of theft, concealment of income, falsification of expenses, etc.;

- planned. The company has the right to conduct regular audits (both comprehensive and thematic). The regulations for conducting inspections, their frequency and documentation procedure must be enshrined in the company’s accounting policies;

- unscheduled. As a rule, unscheduled audits are carried out to check one of the areas of activity. In this case, the auditor is not obliged to notify the auditee about the audit in advance.

The difference between an audit and an inventory

Novice accountants often confuse the concepts of audit and inventory.

Features of audits at enterprises in various fields of activity

Audit of retail trade organization

Main article: Financial control in the consumer market

Construction audit

Main article: Financial control in construction

Audit at motor transport enterprises

Main article: Financial control at motor transport enterprises

Audit of a budgetary institution

Main article: Financial control in budgetary institutions

Audit in a commercial bank

Main article: Financial control in banks

The procedure for conducting and forms of recording the results of an audit or inspection

Purpose, task and timing of the audit or inspection

The most profound method of financial control is audit. An audit is a system of mandatory control actions for documentary and factual verification of the legality and validity of the organization’s economic and financial transactions carried out during the audited period.

Purpose of the audit

– exercising control over compliance with the legislation of the Russian Federation when organizations carry out economic and financial transactions, their validity, the availability and movement of property, the use of material and labor resources in accordance with approved norms, standards and estimates.

The main objective of the audit

is to check the financial and economic activities of the organization in the following areas:

1. compliance of the activities carried out with the constituent documents;

2. validity of calculations of estimate assignments;

3. execution of cost estimates;

4. use of budget funds for their intended purpose;

5. ensuring the safety of funds and material assets;

6. justification for the formation and expenditure of state extra-budgetary funds;

7. compliance with financial discipline and correct accounting and reporting;

8. validity of transactions with cash and securities, settlement and credit transactions;

9. transactions with fixed assets and intangible assets;

10. completeness and timeliness of settlements with the budget and extra-budgetary funds;

11. operations related to investments;

12. settlements for wages and other settlements with individuals;

13. justification of costs incurred related to current activities and capital costs;

14. formation of financial results and their distribution.

Duration of the audit (check), i.e. start date and date

the end of the audit (check) cannot exceed 45 working days.

An audit of the expenditure and receipt of federal budget funds, the use of extra-budgetary funds, and income from property is carried out both in a planned and unplanned manner. The audit of organizations of any form of ownership according to the requirements of law enforcement agencies is carried out in accordance with the established procedure in accordance with current legislation. Significant audit issues are specified in the program or list of main issues.

The audit program includes the topic, the period that the audit should cover, and is approved by the head of the control and audit body. The preparation of an audit program and its implementation must be preceded by a preparatory period, during which audit participants are required to study the necessary legislative and other regulatory and legal acts, reporting and statistical data, and other available materials characterizing financial and economic activities.

Before the start of the audit, the head of the audit group familiarizes its participants with the content of the audit program and distributes issues and areas of work among its performers.

Before the start of the audit, the head of the audited organization should present a certificate for the right to conduct an audit, introduce the audit participants and draw up a work plan. Based on the audit program, the necessity and possibility of using certain audit actions, techniques and methods for obtaining information, analytical procedures, and the volume of data samples from the audited population are determined.

The head of the audited organization is obliged to create appropriate conditions for conducting the audit, provide premises, office equipment, communication services, and provide typing work. The results of the audit are documented in an act signed by the head of the audit team, the head and chief accountant of the audited organization.

The procedure for implementing audit (inspection) materials.

Based on the materials of the audit (inspection), the head of the audited organization, after receiving the audit (inspection) report, issues an order (order) based on its results, and also develops measures with specific proposals aimed at eliminating identified violations, taking measures to compensate for the damage caused, preventing abuses, elimination of the reasons that caused the noted violations and shortcomings.

Information on eliminating violations of the financial and economic activities of the audited organization identified during the audit (inspection) is submitted to the control and audit department no later than one month from the date of issuance of the order (order) based on the results of the audit (inspection), unless other deadlines for its provision are established by this by order.

Planning and preparation of audits and inspections in budgetary institutions and non-profit organizations.

Based on organizational characteristics, audits are divided into planned and unscheduled. Audits of organizations of any form of ownership based on motivated decisions and requirements of law enforcement agencies are carried out in accordance with the established procedure in accordance with the current legislation of the Russian Federation.

Control and audit bodies develop long-term (for 5 years) and current (for the coming calendar year) audit plans. When drawing up the plan, it is provided that the enterprise is inspected at least once a year and that continuity of inspections is ensured (each audit covers the period from the end of the previous inspection to the date of drawing up the balance sheet in the period being inspected).

Audit planning is strictly confidential to ensure surprise audits.

The audit plans reflect the verification methods (usually the continuous method is used to verify cash and banking transactions and to determine the full amount of damage caused in identified cases of theft and other violations).

Drawing up a plan for conducting an audit at a specific enterprise is always preceded by preparatory work, which includes the study of the necessary legislative, regulatory acts, reporting and statistical data, and other available materials characterizing the financial and economic activities of the organization subject to audit. It is also necessary to familiarize the members of the audit team with the information collected about the enterprise, and distribute questions and areas of work among them.

Having arrived at the enterprise for an inspection, the head of the audit team (controller-auditor) must present to the head of the organization being audited a certificate for the right to conduct an audit, familiarize him with the main tasks, introduce the employees participating in the audit, resolve organizational and technical issues of conducting the audit and draw up a work plan.

Members of the audit team (controller-auditor), based on the audit plan, determine the need and possibility of using certain audit actions, techniques and methods for obtaining information, analytical procedures, the volume of data samples from the audited population, providing a reliable opportunity to collect the required information and evidence. The head of the audited organization is obliged to create appropriate conditions for conducting the audit.

If employees of the audited organization refuse to provide the necessary documents or other obstacles arise to conduct an audit, the head of the audit group (controller-auditor), and, if necessary, the head of the control and audit body, reports these facts to the body on whose behalf the audit is being carried out. Based on the audit plan, an audit program is drawn up, and each member of the audit team draws up his own work plan.

During the audit, they are reviewed and adjusted depending on the identified cases of violations, changes are made regarding audit methods, analytical procedures, sample size for verification, etc., and if accounting at the enterprise is not maintained or neglected, the audit may be suspended altogether and resumed after restoration in the audited accounting organization. To systematize the inspection materials, auditors draw up working documents in accordance with the current Instructions and developed methodological recommendations in order to record all violations discovered during the inspection; subsequently, information from the working documents is transferred to the inspection report, which is drawn up in accordance with a previously developed program or inspection plan.

The procedure for conducting and forms of recording the results of an audit or inspection

The following stages should be distinguished in the audit work:

1. preparatory;

2. conducting an audit;

3. registration of audit results;

4. implementation of the audit results;

5. control over the implementation of decisions made based on the results of the audit.

The result of the audit largely depends on its preparation before visiting the site. The preparatory stage of the audit consists of collecting information about the audited entity, i.e., acts of previous audits, memos, orders and resolutions based on the results of audits, in general, everything that relates to this enterprise are studied. The data from the annual and interim financial statements of the enterprise, tax reporting data (calculations and declarations) are also studied. Based on the collected information, the audit objectives are determined, an audit plan is prepared, the head of the audit team carries out familiarization work based on information about the enterprise, and also sets specific audit objectives for members of the audit team.

Upon arrival at the enterprise and presenting the order or instruction to conduct an audit to the head of the enterprise, they proceed directly to the stage of conducting the audit. Conduct a survey of the enterprise, inspect the premises, workshops, services of the management apparatus, departments and storage places for goods and materials, access roads, conduct an inventory of the cash register, study primary documents, consolidated registers, statements of synthetic and analytical accounting, collect explanations and certificates from employees, if necessary. If necessary, they conduct an inventory of settlements with debtors and creditors, suppliers and buyers (they send notices to enterprises with a request to report on the status of settlements or existing claims against the audited enterprise).

If accounting at the enterprise is neglected, the head of the audit group gives the task to restore the accounting. During the inspection, to systematize the materials, auditors draw up working documents that reflect all detected facts of violations. The results of the audit are documented in an act (in accordance with the current instructions and in accordance with the audit plan or program). The act indicates information about the organization and auditors, the results of previous audits and the facts of implementation of decisions on these audits, indicate the methods and methods used during the audit, methods of conducting an inventory, the results of checks in the areas of the audit, the amount of damage caused.

Already during the audit, the auditor must take measures to eliminate the identified violations, and also raise the question of the extent of responsibility of the perpetrators. In case of minor violations, the results of the audit can be implemented immediately after the end of the audit, as reported in the appendix to the audit report. And if facts of theft on a large scale are revealed, an interim report is drawn up and submitted to the investigative authorities. Based on the results of the audit, conclusions and proposals for eliminating deficiencies are drawn up, which are presented to the head of the organization. He reviews the findings and makes decisions to correct deficiencies. In the future, the implementation of these decisions should be monitored.

Control and audit bodies ensure control over the implementation of decisions made based on the results of the audit, and, if necessary, take other measures provided for by the legislation of the Russian Federation to eliminate identified violations and compensate for the damage caused, and also systematically study and summarize audit materials and, on the basis of this, make proposals for improving the system of state financial control, additions, changes, revision of legislative and other regulatory legal acts in force in the Russian Federation.

The audit materials consist of an audit report and properly executed annexes to it, which are referenced in the audit report (documents, copies of documents, summary certificates, explanations of officials and financially responsible persons, etc.).

The inspection report is the result of the painstaking work of a group of auditors and an official document for making decisions on the audit, up to the initiation of a criminal case. Entries in the act must be stated on the basis of verified facts arising from available documents, materials from counter checks, inventories and other data.

Acts must contain introductory, descriptive and effective parts.

The introductory part states the following:

1. full name of the institution in which the audit is carried out, its organizational and legal form and address;

2. names of officials of the audited institution participating in the audit, responsible for maintaining accounting records and submitting reports;

3. the basis for the audit, its type, reasons for its conduct;

4. the time of the previous audit, the period for which the audit is carried out, and the issues to be clarified;

5. start and end dates of audits, positions and names of officials conducting the audit.

The descriptive part reflects the following:

1. specific facts and actions indicating a violation of the procedure for maintaining accounting records, preparing reports, using budgetary funds and extra-budgetary funds, tax legislation, etc.;

2. each fact of violation is indicated in the act independently, indicating the time of its commission, valuation, accounting entries made and with links to the relevant primary documents;

3. when indicating facts of violations, a reference must be made to the violated legislative and regulatory acts, indicating their specific articles and paragraphs.

It is necessary to keep in mind that the regulatory documents of ministries and departments come into force only after they are registered with the Ministry of Justice of Russia. The effective part of the act summarizes the identified facts of violations in the form of conclusions and makes proposals for their elimination.

Data from interim acts are included in the consolidated act in a brief summary and only if there are identified violations. Interim acts are signed by auditing and relevant officials responsible for the safety of monetary and material assets. For the sake of maximum brevity of presentation, the act should not be cluttered with detailed information (tables of digital data identified during the verification process). In this case, it is enough to provide 1-2 examples and the general result in the act, and attach a detailed list of violations to the act signed by the auditor and the chief accountant of the institution.

Before signing the act, the auditor familiarizes the management of the institution and accounting employees with its contents and, if there are reasonable objections, makes corrections to the act before signing it.

For all violations, it is necessary to require an explanation from the manager, authorized and guilty persons during the inspection or, as appropriate, within 3 days after signing the act, which is recorded in the act before the signatures.

The inspection report is drawn up in two copies signed by the auditor, the head of the institution and the chief accountant.

If there are objections or explanations to the act, the signers make a reservation about this before their signature and submit written objections or explanations within 10 days from the date of signing the act.

In cases where the measures taken during the audit do not ensure the complete elimination of all identified violations, the auditor develops a draft order to eliminate the identified violations and submits it for consideration to the management that appointed the audit.

Recommended pages:

Use the site search:

Registration of the results of the documentary audit

The procedure for signing a documentary audit report

The results of the documentary audit are documented in an act. The audit report is signed by the head of the audit group, the head and chief accountant of the organization. The manager and chief accountant have the right to receive time to study the audit report in detail (usually up to five days). If there are objections and comments to the audit report, the manager and chief accountant sign the report and at the same time make a reservation (record) before their signature that the report is signed with disagreements. The list of objections is submitted to the auditor in writing (protocol of disagreements)

and is attached to the audit report, being an integral part of it. In turn, the auditor has the right to give an opinion on the objections and comments of the manager and chief accountant. If the manager and chief accountant refuse to sign the audit report, the auditor makes a note at the end of the report that they have read the report and refused to sign. In this case, the audit report is sent by mail with acknowledgment of delivery.

Contents of the documentary audit report

I. Introductory part

:

- Title of the revision topic.

- Date and place of drawing up the act.

- By whom and on what basis the audit was carried out.

- Verified period.

- Timing of the audit.

- Full name and details of the organization, departmental affiliation or information about the founders.

- The main goals and types of activities of the organization, the presence of a license to carry out certain types of activities.

- List and details of the organization's accounts in credit institutions.

- Who and when during the audited period performed the duties of the manager and chief accountant (including temporarily).

- Who carried out the previous audit and when, what was done to eliminate the identified violations.

II. Descriptive part

— consists of sections in accordance with the questions of the documentary audit program:

- A description of the available data on the current issue, which documents were studied and how.

- Description of violations identified during the audit:

- what was the violation?

- in which documents the violation was reflected,

- exactly which requirements of which regulations have been violated,

- when the violation occurred,

- who committed the violation,

- the amount of documented damage,

- other consequences of the violation.

III. Final part

:

- The auditor's conclusions on each of the issues of the documentary audit program.

- The auditor's proposals to eliminate identified violations and compensate for damage caused.

- (not mandatory now)

Generalization of the organization’s positive experience in effective management. - Attachments to the documentary audit report:

- intermediate acts, if they were drawn up,

- explanations received by the auditor during the audit from various persons, if they are the basis for any conclusions in the report,

- certificates, calculations, tables compiled by the auditor,

- documents seized by the auditor,

- explanations and objections of the manager and chief accountant and the auditor’s conclusion on them.

- Signatures of the auditor, manager and chief accountant of the organization.

Requirements for a documentary audit report

- The scope of the audit report is not limited, but the auditor must strive for brevity, clarity and structure of presentation.

- The conclusions in the act must necessarily be based on both primary accounting documents and data from accounting registers. The references in the act must contain an indication of both the date and number of the primary accounting document and the date and number of the accounting entry by which this document was accepted for accounting.

- The description of the facts of violations must contain a clear indication of which provisions of which legislative or regulatory acts were violated.

- It is not allowed to include assumptions that are not confirmed by documents and inspection results, or references to testimony and materials from law enforcement agencies in the documentary audit report.

- The audit report does not provide a legal assessment of the actions of officials, the qualification of their actions, intentions, and goals.

(Examples of phrases that are unacceptable to include in a documentary audit report:

- in violation of current legislation...

- contrary to the established order...

- regularly committed petty thefts...

- due to low qualifications...

- for selfish purposes...

- neglect …

- wanting to cover up the traces of a crime...

etc.)

It should be noted that the head of the audit team is not a superior to the head of the organization (division) being audited. Therefore, the auditor’s proposals to eliminate violations and compensate for damage are essentially recommendations. Some of these proposals can be carried out during a documentary audit (which is noted in the audit report). In order to give proposals on the audit act a normative status, the head of the body that appointed the audit issues an order based on the results of the audit. In this order, the superior manager approves the audit report, gives orders to eliminate violations and implement proposals for the report, and sets deadlines for implementation. After eliminating the violations and taking measures to compensate for the damage, the head of the audited organization (division) sends a report on the implementation of the proposals on the document audit report to the superior officer.

Documentation of the cash register audit

The legislation establishes a unified form in which information obtained during the inspection is entered. Registration of the results of the cash register audit is carried out according to f. No. INV-15. Enter on the form:

- Information about the amounts of funds according to the reports provided and actual availability.

- Information about the comparison of the above items.

- Comparison result.

Positions on reporting and actual status may coincide. In this case, the state of affairs at the cash desk is good. If the amount of funds reported is greater than the actual availability, then there is a shortage. If the situation is the opposite, and there is more money in the cash register than in the documents, then there is a surplus. All this information is summarized and entered into a form. The cash register audit report is drawn up in text form. The conclusion is a section on conclusions and proposals. It briefly lists the identified violations and provides recommendations for eliminating them.

Literature

- M. V. Melnik, A. S. Panteleev, A. L. Zvezdin.

Audit and control: textbook. - M.: KNORUS, 2006. - P. 92 - 112. - 640 p. — ISBN 978-5-85971-641-8. - Maloletko A. N.

Control and audit: textbook. - M.: KNORUS, 2006. - P. 130 - 151. - 312 p. — ISBN 5-85971-433-5. - Brovkina N.D.

Control and audit: textbook. - M.: INFRA-M, 2007. - P. 131 - 149. - 346 p. — ISBN 978-5-16-003022-7. - Control and audit: textbook for secondary vocational education / M. V. Melnik. - M.: Economist, 2007. - P. 63 - 93. - 254 p. — ISBN 5-98118-196-6.

- Forensic accounting: Textbook / S. P. Golubyatnikov. - M.: Legal literature, 1998. - P. 272 - 297. - 368 p. — ISBN 5-7260-0903-7.

- Dubonosov E. S., Petrukhin A. A.

Forensic accounting: A course of lectures. - M.: Book World, 2005. - P. 102 - 107. - 197 p. — ISBN 5-8041-0192-7. - Dubonosov E. S.

Forensic accounting: Educational and practical guide. - M.: Book World, 2004. - P. 158 - 166. - 252 p. — ISBN 5-8041-0161-7. - Forensic accounting / A. A. Tolkachenko. - M.: UNITY-DANA, 2005. - P. 133 -152. — 224 p. — ISBN 5-238-00929-1.

Answers on control and audit

- Who exercises external control??

- b) government financial authorities;

- What is the purpose of internal control??

- a) in order to ensure the safety of the property of the enterprise;

- What is departmental control?

- c) control by a higher authority on the principle of administrative subordination.

- What type of control is audit??

- a) to independent;

- What does the Federal Tax Service control??

- b) for the calculation and payment of taxes;

- Control can be exercised:

- d) all of the above authorities.

- Independent control in the Russian Federation is organized in accordance with:

- c) with the Federal Law “On Auditing Activities”.

- According to the methods of implementation, the following types of control are distinguished::

- a) consequence;

- b) expert assessment;

- c) economic analysis. (Everything is correct)

- The mobilizing function of control is:

- b) in encouraging enterprises to mobilize all the resources available to them to achieve

achievement of set goals and efficient management of production;

- Deduction is : _

- b) research into the state of the object as a whole, and then its components, that is, it is done

conclusion from general to specific.

- Based on the frequency of monitoring, we can distinguish:

- a) systematic;

- c) one-time.

- How many stages of economic reproduction are usually distinguished?:

- a) three;

- The principles of economic control include:

- b) objectivity;

- The principle of objectivity means:

- a) reliability of control results;

- b) availability of special professional training.

- Economic control performs the following functions:

???e) all options are correct.

- At the distribution stage, the subject of economic control is:

- a) all aspects of labor;

- Methods of actual control include:

- a) face-to-face survey;

- Techniques and methods of documentary control include:

- c) counting check.

- The purpose of current control is:

- c) prompt elimination of deficiencies, identification and dissemination of positive

experience.

- The list of information constituting a commercial secret of an enterprise determines :

- c) the head of the enterprise.

- Which statement most accurately reflects the difference between an external and an internal auditor ?

- a) the external auditor must be completely independent of the organization, while

the internal auditor works in the organization and prepares a report for its managers;

- The sales budget is:

- a) an integral part of the operating budget;

- The cash estimate is:

- b) an integral part of the financial budget;

- On-farm risk is:

- b) the likelihood of material misstatement in the accounting records of transactions in

overall reporting;

- The objects of intra-economic calculation are:

- a) the organization’s activity cycles;

- Subjects of internal control of the fourth level:

- a) carry out control and other functions (administrative and managerial functions);

sonal; personnel maintaining computer systems; employees of the accounting department

Terek accounting, commercial and physical security services);

- Property inventory means a method:

- c) documentary evidence of the actual availability of property in order to ensure

ensuring the reliability of accounting data.

- The working normative document for conducting an inventory is:

- a) Law “On Accounting”;

or

- b) Guidelines for inventory of property and financial obligations;

- Who appoints the composition of the inventory commission?

- a) the head of the organization;

- Based on the degree of coverage, the following types of inventories can be distinguished::

- a) complete;

- c) partial.

- Blank lines in inventory records:

- a) are crossed out;

- Records of actual data during the inventory are entered:

- c) in the inventory list.

- How is control over the execution of inventory orders carried out?:

- b) the organization maintains a special book for control of inventory orders;

- When preparing a matching statement, accounting data is entered:

- c) are displayed on the inventory date.

- Primary inventory documents must indicate:

- a) date of the administrative document;

- b) number of the inventory order;

- The matching statements are:

- b) employees of the organization's accounting department;

- In the comparison statements, the value of surpluses and shortages of commodity - material assets is given :

- a) in the valuation at which they are recorded in the accounting registers;

- Excess is subject to:

- b) posting.

- The shortage of __________ property is :

- a) the actual presence of valuables is less than according to accounting data;

- The order for damages must be signed no later than:

- b) one month from the date of final determination by the employer of the amount of damage caused;

damage caused by the employee;

- In case of theft , shortage , intentional destruction or damage, the damage is determined :

- b) at the market price in force in the locality on the day the damage was caused;

- When determining the amount of material damage, it is taken into account:

- a) direct damage;

- For each payment of wages, the amount of deductions cannot exceed:

- a) 20% of wages due to the employee;

- Damage not exceeding the employee's average monthly earnings is compensated :

- a) by order of the head of the organization;

- If misgrading is detected, the financially responsible persons :

- a) are required to give an explanatory note;

- As a result of the inventory, misgrading may be identified:

- c) for goods of the same name and equal quantity.

- Mutual offset of surpluses and shortages from mis-grading may be allowed if there is:

- b) at least two of the listed conditions;

- Shortage of property and its damage within the limits of natural loss rates includes:

- b) on production costs;

- The inventory of cash at the cash desk is entered into the inventory report in the form

- a) No. INV-15;

- The results of the inventory of the organization's fixed assets are entered into the inventory list according to the form:

- b) No. INV-1;

- During the inventory of fixed assets, separate inventories are compiled:

- b) for leased fixed assets;

- For what types of materials is the auditor required to draw up a separate inventory list?:

- c) for material assets in transit.

- At the end of the reporting year, the results of all completed inventories are summarized in a statement in the form:

- a) No. INV-22;

- The organization can conduct:

!!!a) one cash book;

- b) as many cash books as there are departments;

- Corrections in cash orders:

- c) are not allowed.

- The balance of funds in the cash register in the statement to the journal - order No. 1 is given :

- b) at the end of the month.

- The cash register must be audited:

- a) when changing the cashier;

- c) monthly.

- In the presence of the commission, money and other valuables are counted:

- c) auditor after cashier.

- The auditor records in the book of the cashier - operator :

- a) cash register readings;

- You can write off accounts receivable as a loss:

- a) based on the results of the inventory;

- c) by order of the manager.

- Business travel expenses include expenses:

- a) for renting residential premises;

- b) for meals in hotels;

- c) for travel to the place of business trip and back. (All correct)

- Documents for registration of entertainment expenses include:

- a) primary accounting documents;

- b) cost estimate;

- c) order of the director of the organization. (all are correct)

- Revision is : _

- a) a procedural action during which those responsible for violating the law are identified;

horsepower;

- b) an integral part of the control system designed to establish the legality, reliability

ity and economic efficiency of business transactions;

- Audit tasks:

- a) detection of abuse;

- b) development of measures to prevent abuse;

- Based on the depth of the audit, it is customary to distinguish the following types of audit::

- b) local;

- Based on the scope of issues and depending on the purpose of the audit, the following types of audit can be distinguished::

- a) solid;

- c) combined.

- Based on the coverage of individual control objects, the following types of audit can be distinguished::

- a) solid;

- c) combined.

- Depending on the source of control data, it is customary to distinguish the following types of audit::

- b) combined;

- Purpose of the audit:

- b) identification of shortcomings with a view to eliminating them and punishing those responsible (elimination of

consequences and prevention);

- Give the definition : “ planned audits - …”

- a) are carried out in terms not provided for by the approved plan and are carried out in force

the need that has arisen;

- The general disciplinary liability of the audited persons is contained:

a) in the personnel regulations;

- b) in the charter;

- The legality of decisions of officials is checked for their compliance:

- a) organizational documents;

- c) legislation on business activities.

- Techniques for checking several documents for similar or interrelated business transactions include:

- a) counter check;

- A counter check is a comparison:

- a) two different versions of the same document, as well as accounting registers, which

who are located in two different organizations or in two different divisions

yah of the same enterprise;

- Methods of formal legal verification of documents include :

- a) checking the entries in the accounting and reporting registers, the correctness of the

account correspondence;

- c) checking arithmetic calculations.

- Methods of actual control include:

- a) inventory;

- Define : “ a document is ...”

- b) an element of the information carrier that has a certain semantic meaning.

- The economic significance of the documents lies:

- b) that they play an important role in strengthening economic accounting in the organization

tion and in its individual centers of responsibility, based on the principles of self-conception

troll, self-sufficiency and self-financing.

79. Documents that in form reflect :

- a) such information which ultimately has a significant impact

on the reliability of financial results;

- b) real business transactions in an undistorted form and volume, but may not be

correctly formatted or incompletely formatted. (I don’t know the answer)