Who is the tax payer?

Value added tax was introduced to solve 3 main tasks:

- Minimizing the risks of tax evasion by enterprises. If at one production and commercial stage an organization somehow evaded paying tax, this is compensated at another stage (for example, upon resale);

- Distribution of tax payments to the budget between the stages of the commercial cycle. This prevents multiple entities from being charged the same value;

- The presence of VAT relieves exported products from local taxation. As a result, the national system does not affect the competitiveness of the domestic market.

For the convenience of consumers, the VAT amount is indicated on receipts

According to Art. 143 of the Tax Code of the Russian Federation, all organizations selling services or goods (own production or resold) must pay the budget in the form of VAT. The tax is calculated based on the cost of the product (service).

Legal entities also act as VAT payers. persons registered in Russia. Citizens who transported any products across the border must also pay tax. All these individuals must file a return with their local tax office at the end of each quarter.

According to Russian legislation, the following may not pay VAT:

- Organizations exempt from taxes due to small volumes (quarterly revenue less than 2 million rubles);

- Legal entities applying a preferential tax system. This definition includes: Unified agricultural tax, simplified tax system, UTII;

- Entrepreneurs operating under the patent system;

- Organizations participating in the Skolkovo state project;

- Companies and individual entrepreneurs engaged in the sale of goods that for other reasons are not subject to the taxation system.

Please note that organizations involved in the sale of foreign products pay VAT on them even if they belong to the list listed above.

Other conditions for accepting VAT for deduction

- A deduction for goods, work, services, property rights, as well as goods imported into the territory of Russia, can be claimed for up to three years after registration of the specified property and property rights.

- If goods, works, services, property rights are registered in one tax period, and the corresponding invoice is received in the next tax period, but before the deadline for submitting the VAT return, a deduction for such property and property rights can be claimed in period of registration of property/property rights.

Example 2.

The goods were received from the supplier on September 29, 2017, and the invoice was received on October 5, 2017.

Since the invoice was received before the deadline for submitting the VAT return (10/25/2017), a deduction for such a purchase can be claimed in the 3rd quarter of 2020.

What is the object of taxation

The object of taxation is the sale of goods (or provision of services) and import of products (to the territory of the Russian Federation). According to Article 149 of the Tax Code of the Russian Federation, the following types of activities will not be taxed:

- Funeral services;

- Resale of shares in the management company;

- Provision of preschool education services;

- Nursing;

- Transport services;

- Educational services;

- Babysitting services;

- Elderly care;

- Public utilities;

- Notary and lawyer services;

- Holding public events;

- Activities within the framework of government programs;

- Insurance agent services;

- Maintenance of aircraft and sea vessels.

Sales of the following types of goods are also exempt from VAT:

- Ores that contain precious metals (precisely ores, the sale of precious metals is subject to all kinds of taxes);

- Non-commercial premises;

- Some medications (included in the list of essential goods);

- Religious products.

All other types of activities are subject to mandatory VAT payment.

Different countries have their own taxation systems, so the amount of VAT varies. We present to your attention rates in the most developed countries of the world

Additional conditions for accepting VAT for deduction

Additional documents (in addition to invoices) that must be available to recognize the deduction are prescribed in Article 172 of the Tax Code of the Russian Federation. The most common cases are shown in Table No. 1

Table No. 1

| No. | Type of deduction | Required documents |

| 1 | Deduction when importing goods into the territory of the Russian Federation | Documents confirming payment of VAT when importing goods |

| 2 | VAT deduction withheld by the tax agent | Documents confirming payment of VAT |

| 3 | Deduction from advance payment paid to supplier | A supply agreement with conditions for prepayment (partial payment) |

| 4 | Deduction of VAT restored on property received as part of the authorized capital | Property registration certificate |

| 5 | Deduction for advances received from buyers at the time of sale | Document confirming the fact of payment |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

What are the tax rates according to the Tax Code?

Russian legislation provides 3 types of rates: 0, 10 and 18%. Settlement rates are also provided: 10/ and 18/118. They are used when the company carries out operations noted in paragraph 4, Article 164 of the Tax Code of the Russian Federation - i.e. upon receipt of an advance payment for products sold. The rate for each type of industry is regulated in accordance with Art. 164 NK. The 0% rate is provided for:

- Export of products;

- Laying of oil and gas pipelines;

- Electricity transmission;

- Transportation of goods and passengers carried out by air, sea or railway transport.

A 10 percent rate applies to the sale of the following types of products:

- Food (not essential);

- Products for children;

- Some medications that are not vital (dietary supplements, vitamins, etc.).

Many are dissatisfied with the current tax system, but not so long ago VAT was 10% higher than it is today. The photo shows a chronology of rate changes over the past 27 years

For all other goods and services provided, VAT is calculated at a rate of 18%. The tax base is determined based on the cost of the product (or service), taking into account excise taxes for excisable goods (according to Article 154 of the Tax Code). The legislation also defines the information required when determining the tax base in certain cases:

- When transferring rights to property;

- If there is income under a surety agreement;

- When providing transportation services;

- When performing repair and construction work;

- When importing products into the territory of the Russian Federation;

- When selling products (or providing services) to citizens of other states;

- When reorganizing a legal entity.

Some adjustments were made in 2020:

| Change | A comment | Normative act |

| For foreign companies providing Internet access services, VAT will be 15.25%. | The change applies to all service providers that are not registered in Russia. | Federal Law No. 244. |

| For publications with advertising volume up to 45%, VAT will be 10%. | Before 2020, the limit was 40%. | Federal Law No. 408. |

| Expanding the list of transactions subject to VAT at a flat rate of 10%. | This list includes operations for issuing guarantees and guarantees for non-banking organizations. | Federal Law No. 408. |

Reporting period – quarter. Accordingly, every 3 months the accounting department of the company (or individual entrepreneur personally) must provide the tax office with all the necessary information, having determined the tax base in advance. According to these data, the legal entity must make payments for the corresponding amount to the state treasury. When calculating, you can use special accounting programs.

The procedure for calculating VAT payable to the budget in 2020

Are you having difficulty determining the amount of VAT to be paid to the budget?

Then it’s worth studying the calculation procedure and the formulas used in 2020. Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

(Saint Petersburg)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Let us describe the main features of the calculation and give several examples for clarity. VAT is the most difficult tax to calculate and pay.

But if you don’t delve into the nuances, then at first it seems that it is not burdensome for entrepreneurs, because it is an indirect tax. And indirect taxes are passed on to final consumers.

General aspects

Anyone can look at the receipt that is issued in stores not only for the amount of purchases, but also for VAT. What difficulties arise when administering VAT? To find out, let’s consider the features of such a payment.

Definitions

VAT stands for value added tax. The main differences between this tax and others are determined by several factors.

VAT was introduced back in 1992. Added value occurs at any stage of production of a product and is subject to VAT when it is sold.

With the help of such a tax, the state can withdraw part of the added value at a set rate.

VAT payment is made exclusively in rubles. If a different currency is used, then it is necessary to recalculate in rubles at the current exchange rate.

The actual sale of products is the earlier date (the day the goods are shipped or the day they are paid for).

Payers of such tax may be:

- companies;

- IP;

- persons who transported goods across the border and are therefore recognized as payers.

Companies and individual entrepreneurs that work under special regimes - simplified taxation, UTII, Unified Agricultural Tax or have acquired a patent, as well as any participant in the Skolkovo project should not pay VAT.

Payers who have complied with the conditions of Art. receive tax exemption. 145 Tax Code of the Russian Federation - if they have a profit from sales for the last quarter, which is no more than 2 million rubles.

Companies that sell excisable goods do not have such a right.

What is the payment for?

Object of taxation:

| Sale of goods, works and services within the Russian Federation | Transfer of rights to property (rights to claim debts, intellectual rights, lease rights, etc.), transfer of ownership rights to goods and services free of charge. Some transactions (specified in paragraph 2 of Article 146 of the Tax Code) are not considered an object of taxation |

| Carrying out construction and installation work | For personal use |

| Transfer of goods and services for your needs | If the costs for them are taken into account when determining income tax |

| Import of goods | Within the Russian Federation |

Goods and services specified in Art. will not be taxed. 149 NK. This applies to socially significant goods and services of this type:

- sale of certain types of medical products and services;

- provision of patient or child care services;

- sale of items that have a religious purpose;

- Passenger Transportation;

- provision of educational services, etc.

VAT is not paid when providing:

- banking services;

- insurer services;

- lawyer services;

- utilities;

- services in the field of the securities market.

The VAT tax rate is 0, 10 and 18%. There are also settlement rates - 10/110, 18/118. Such indicators are used if the operation reflected in clause 4 of Art. 164 Tax Code - if they receive an advance payment for goods, work or services.

All features of the application of rates are described in Art. 164 NK. The 0% rate is set for:

- export operations;

- pipeline transport of oil and gas;

- transmission of electricity;

- transportation by rail, planes, ships.

The 10% rate is set on:

- a range of food products;

- goods for children;

- medications and other medical products that are not vital;

- breeding type of livestock.

All other goods and services are subject to VAT at a rate of 18%. The tax base is established as the cost of the goods or works sold, taking into account excise taxes for excisable products (Article 154 of the Tax Code).

Art. 155-162.1 of the Tax Code contain information necessary when determining the tax base in specific situations:

- if property rights are transferred;

- if there is income under an assignment agreement, commission or agency agreements;

- if transportation and international communication services are provided;

- if construction and installation work is carried out;

- if the company is being sold;

- if goods are imported into Russia;

- if the goods are sold in Russia by foreigners who act as taxpayers;

- if the company is being reorganized.

The tax period is a quarter. That is, every three months it is necessary to determine the tax base and make the necessary calculations of the value added tax, which must be paid to the budget.

Legal grounds

When calculating, it is worth referring to the norms of the Tax Code of Russia. Chapter 21 is relevant in this case.

The procedure for calculating VAT payable to the budget

Novice accountants do not quite understand how to correctly calculate VAT. But difficulties can be avoided if you know which formulas to use.

How to check yourself for debts before going abroad, read here.

First you need to determine which rate applies in your case. To do this, you should look into the Tax Code. Then the tax base is calculated.

The calculation date is chosen as follows:

- the day on which the products are shipped;

- the day the company received the advance payment;

- the day on which payment for the goods is received.

Formula applied

So, have you decided to calculate the amount of VAT accrued for the reporting period? then use this formula:

If over the last three months certain types of construction and installation work were carried out for one’s own needs, the sale of goods was adjusted, or there was a sale of companies (property complexes), then VAT on these transactions is included in the total VAT indicator that is accrued.

Video: counting VAT on your fingers If VAT, which was previously accepted for deduction, has been restored, then the amount of the restored VAT is added to the tax amount.

Value added tax, which is deductible, is the amount of the full tax payment that was previously paid by the enterprise when a certain product was purchased.

Use the form to determine the amount of VAT for the tax period to be deducted.

Typically, an accountant does not make such calculations. The only exception is if it is necessary to control incoming funds. The list of what is transferred along with the goods usually reflects the amount of tax deduction.

It is advisable to check any such invoice immediately to avoid any problems later.

How to determine the amount of VAT to be paid? The formula established at the legislative level should be used:

If, when applying this formula, you get a negative figure, this means that government agencies will still have to pay a certain amount to the company.

Formula for calculating at a rate of 18%

For most commercial activities, a rate of 18% is provided. The formula for VAT payable is as follows:

VAT amount = cost of sold products (or services) including excise taxes excluding VAT * 0.18

For clarity, let's look at a few examples:

- The cost of the product is 400 rubles. The VAT amount will be 72 rubles (400 * 0.18). The final price for the buyer will be 400 (organizational income) +72 (tax transferred to the budget) = 472 rubles;

- The product in the store costs 620 rubles. To determine the price of a product without VAT, you need to divide this amount by 1.18. The total is: 620/1.18 = 525 rubles. 40 kopecks We subtract the VAT amount: 620 – 525.4 = 94 rubles 60 kopecks.

It is not necessary to memorize the formulas by heart, as they are freely available.

Ready-made formulas for calculations

Let's sum it up

The process of calculating VAT payable to the budget is not as simple as it seems at first glance. You need to pay attention to many nuances - especially the availability and reliability of accounting documentation for each transaction, since it will not be possible to get a tax deduction for “beautiful eyes”.

See also: TIN - what the document looks like (photo)

It is worth understanding that there is a safe percentage of VAT deductions (about 88%). Today this figure varies depending on the region. Exceeding it is considered a tax risk, since the fiscal authorities will most likely be interested in why the company receives such large deductions and whether it is legal.

How to calculate VAT payable at rate 10

The formula in this case will be the same as in the previous paragraph. Let's look at an example:

The company was paid an advance for future supplies in the amount of 220 thousand rubles, taxed at a rate of 10%. To calculate input VAT, you must use the coefficient 10/110. Total VAT: 2200,000 * 10/110 = 20,000 rubles

Despite the apparent simplicity of the calculations, accountants often make mistakes. This may result in penalties being imposed on the company. Let's look at typical mistakes when calculating VAT.

| Error | Explanation |

| Advance payments are not taken into account in the tax base. | Advances are subject to VAT. |

| Incorrectly executed invoices are used in calculations. | This situation will lead to suspicion on the part of the tax service, and this will contribute to an extraordinary on-site inspection and, possibly, the imposition of a fine. |

| There is no separate accounting. | The company will not be able to count on VAT deductions. |

| Attempts to obtain a VAT deduction for a penalty or fine. | It is impossible to receive a VAT refund on a fine. |

The organization acts as a tax agent

There are cases when an organization is foreign and therefore cannot be registered for tax purposes. But, despite all this, it must pay VAT, like any other company located within a given country.

In such cases, they resort to the services of a tax agent:

- It is important to know that if a foreign organization is official, it had to go through the process of registration with the tax office, and therefore pay VAT and other payments itself. If it has not been registered, finding it becomes unrealistic for everyone. It is for this reason that the value added tax from a foreign organization must be paid by the one who is, as it were, the counterparty of this organization in this country.

- It is important to know that if both the sender and the recipient are foreign citizens who have not been registered with the tax service, the payment will have to be handled by an organization that is in some way connected with the details of one of them. So, for example, this could be the production and transfer of any materials, etc.

This method is quite strange. After all, on the one hand, in this way the Russian state is trying to force a foreign object to register. But, on the other hand, it does not do this itself, but with the hands of third parties who have absolutely nothing to do with the profits of this organization, but must pay their taxes for them.

Total amount

The amount of VAT payable to the state treasury is calculated using the following formula:

VAT payable = Accrued VAT – VAT accepted for deduction

If the calculation results in a value equal to zero, then the organization is exempt from paying to the state treasury. In situations where VAT turns out to be negative, you can count on reimbursement of value added tax from the state budget.

General rules for calculating VAT amount

VAT - basic definitions and formulas

Value added tax appeared in France about 60 years ago - it replaced the sales tax that existed at that time. The latter placed an exorbitant burden on the shoulders of entrepreneurs, since it was revenue, not profit, that was taken into account, which did not allow companies operating with small markups to develop. In Russia, VAT was introduced in 1992, and the procedure for calculating it today is regulated by Chapter 21 of the Tax Code.

The process of calculating VAT payable to the budget is not as simple as it seems at first glance

VAT is an indirect tax, through which part of the cost of work, goods or services goes to the state budget; it is created throughout the entire production process, and is included in the budget as goods and services are sold.

In accordance with the Tax Code of the Russian Federation (Article 164), the following VAT rates are currently applied in our country:

- 0% – applies to exported goods, as well as to specific products (postage stamps, duties, licenses, etc.).

- 10% – used in the case of the sale of certain goods for children, medical equipment, vital food products (for example, milk, bread and sugar), etc.

- 20% – valid from January 1, 2020, replacing the usual rate of 18%; is considered the main VAT rate and applies to all other goods, works and services.

Let's look at the formula used to calculate and allocate VAT.

See also: What skills should you include on your resume?

Calculation of VAT on the amount

It is logical that any person familiar with the basics of mathematics can cope with the task of calculating any percentage of the amount. Let's give the formula:

VAT = Amount excluding VAT × Tax rate / 100. This formula can be written shorter if you substitute a specific value for the tax rate, for example 20%. Then VAT = Amount without VAT × 20 / 100 = Amount without VAT × 0.2.

Example. Suppose a company sells furniture cabinets costing 15,000 rubles excluding VAT per piece. The tax rate is 20%. Let's calculate VAT and the final price of the cabinet along with tax:

- VAT (20%) of the amount = 15,000 × 20 / 100 = 15,000 × 0.2 = 3,000 rubles.

- Price of the cabinet including VAT = 15,000 + 3,000 = 18,000 rubles.

This is interesting: “Not children's secrets,” or the nuances of the toy trade

Of course, to calculate the amount including VAT, it is not necessary to perform two actions; it is easy to do with one: the amount without VAT × 1.2. That is, the cost of a furniture cabinet including VAT will be = 15,000 × 1.2 = 18,000 rubles.

VAT calculation including

The calculation of VAT also represents the allocation of tax already included in the amount. For example, all prices in regular grocery stores are already presented with VAT - they say that the product costs, for example, 2000 rubles including VAT. The formula for calculating tax is as follows:

VAT = Amount including VAT × Tax rate / (Tax rate + 100).

When we use a specific rate, the formula can be simplified. For example, at a rate of 20%: VAT = Amount including VAT × 20 / 120.

Example. The company sells gas stoves at a price of 24,000 rubles including VAT per piece. VAT rate is 20%. Let's determine the amount of tax and the cost of the slab without surcharge:

- VAT = 24,000 × 20 / 120 = 4,000 rubles.

- Price of the slab without VAT = 24,000 – 4,000 = 20,000 rubles.

Also, the price without tax is easy to determine differently: 24,000 / 1.2 = 20,000 rubles.

Features of safe deductions according to Russian legislation

Tax deduction refers to the amount of VAT that is presented by suppliers of products (or services). According to clause 3. Appendix No. 2 of the order of the Federal Tax Service dated May 30, 2007, if the share of deductions for the last year is 89% (or higher), then an on-site tax audit will be scheduled. What such an event promises is clear to everyone, so it is necessary to avoid such situations. The share of deductions is calculated using the following formula:

(VAT accepted for deduction/VAT accrued) * 100%

In other words, in order not to fall under unpleasant sanctions from the tax service, the VAT accepted for deduction must be less than the accrued amount by at least 11%. According to Russian tax legislation, the reporting period is a quarter, therefore, the calculation of the share must be made based on information for the last 4 quarters.

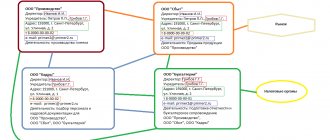

In different regions of our country, the loyalty of the tax service to organizations is very different. On the presented map, subjects are divided into 3 categories (the amount of safe deduction is indicated in the black rectangle)

In some regions of the Russian Federation, the size of the safe deduction may differ. For example, for the Republic of Adygea it is 85.7%, and for Kabardino-Balkaria – 93.4%. This indicator for each subject changes regularly (every quarter). Therefore, to avoid getting into an unpleasant situation, constantly check these values for your region on the tax service website.

Reflect correctly

As we can see, the correct and reliable reflection of VAT transactions in accounting plays an important role. Consequently, not only the assets must be capitalized accordingly and also confirmed by primary documentation, but it is also required to correctly reflect the transactions for accrual of the tax liability itself.

Accounting entries

| Operation | Debit | Credit |

| Receipt of materials reflected | 10 | 60 |

| Input VAT reflected | 19 | 60 |

| VAT accepted for deduction, posting | 68 | 19 |

| VAT charged on products sold | 90 91 | 68 |

Read more in the material “VAT Postings for Dummies.”

How to confirm VAT accrual and deductions

To confirm the deduction, you must have an invoice from the supplier. If we are talking about importing products, then to confirm the deduction you will also need a document that will show the payment of VAT at the customs point.

Reporting documents must be entered into the accounting journal and purchase book. If you don't do this, you may run into problems with the tax authorities. The most common “nit-picking” of inspectors during inspection is incorrect preparation of invoices. Typical violations:

- Filling in not all required fields (you cannot put dashes, checkboxes, etc.);

- Signature of an unauthorized person (including those working in the organization);

- Incorrect information about the legal address (inexperienced accountants confuse it with the actual one);

- The supplier details or other required information are incorrectly specified.

If one of these errors is made, the deduction will be canceled. To avoid getting into such a situation, accountants need to be attentive to the aspect of filling out invoices. If any deficiencies are discovered, you must immediately ask suppliers to correct them. You can also deduct VAT that was accrued upon receipt of an advance payment, return of goods, or as a result of a change in the original price of goods (or services provided).

The process of calculating VAT is labor-intensive, especially when selling a large number of different products. If you make mistakes, you can receive a fine from the tax office, so pay attention to this aspect. If all documents are filled out correctly and calculations are made correctly, there will be no problems with the Federal Tax Service.

VAT – tax deductions

Value added tax is a fee that is paid every month to the tax office, it is not constant, and therefore requires monthly calculations by the accountant in the company.

To do this, the object will need the amount to be accrued, the amount to be paid, as well as the exact tax rate that is in effect in the organization at the time of payment. It is for this reason that this process can take quite a long time. And it’s best to do it throughout the entire month.

It is important to know that despite the fact that payment is made once a month, it must be counted every quarter for the correct deductions.

So, this tax is indirect and builds part of the country’s budget. By law, value added tax is a percentage of what remains over and above your production of goods and services. That is, everything that remains above your standards is value added tax.

It is important to know that there is no clear framework for what this tax should be, since it depends on many characteristics of the product:

- His price.

- Cost price.

- The material from which it is made.

- Quantity and price of necessary resources.

- Necessary work for the production of a particular product.

If you are an employee of a small company, it will not be difficult for you to calculate VAT, since this indicator does not involve large calculations. But, if your organization employs a large number of people and produces many different goods, it will be better if you use special online calculators that offer many sites for calculating this indicator without errors.