Introduction

Wages are remuneration paid to an employee in cash. Its size is not constant and fluctuates depending on the worker’s skill level, his profession, working conditions and place of residence. That is, salary is the cash equivalent that an employee receives in his hands after paying various taxes. Its size is displayed in the “moth” or payslip issued by the accounting department at the end of the month.

Russian legislation does not provide for the division into “white”, “gray” and “black” salaries; moreover, payments of the latter two are a violation of regulations. Let's look at what these terms mean.

- White salary is completely legal. All contributions and taxes are paid from it, and the employee is entitled to certain privileges.

- Black wages are completely illegal. In most cases, the employee is not officially registered at all and receives money “in an envelope”. It is not subject to taxes and the employee is not protected by law, since he is not officially employed.

- A gray salary is something between black and white. The employee is usually paid the minimum wage and taxes are paid on this amount, and the rest is added in an envelope. This type of scheme is considered the most common in private business.

So, a white salary is an official payment under an employment contract, which is preferable for both parties - both for the employer (he is protected from the labor inspectorate and tax fines), and for the employee, who is protected by the labor code.

A gray salary allows the employer to save on taxes, so it is often slightly higher than a white salary, but the employee is less protected - in fact, the employer can control the size of the “envelope” at his own discretion. Black wages do not provide any guarantees - the employer can simply close the doors in the worker’s face and say that he is here illegally.

https://youtu.be/BLjX1AVfZFc

How to understand that the salary is white

So, you already know what a white salary means, so let's look at how to understand that this is what you are being paid. Firstly, clarify this issue when applying for a job - budgetary organizations and large corporations pay exactly this. The white salary meets the standards of the labor code. You can understand that you are receiving it by the following signs:

- Official employment. You are added to the staff, you receive rights and responsibilities equal to other employees, you sign an employment contract and job descriptions, an order is issued on enrollment, etc.

- The salary amount is specified both in the employment contract and in the order.

- The salary is issued to a bank card or at the company's cash desk. In recent years, cash registers have practically stopped working - everyone is given salaries on cards, which is much more convenient and practical.

- Payment of salary is carried out twice a month on certain dates - first an advance is issued (from the 5th to the 10th), then a salary (from the 20th to the 30th).

- Employees receive calculations that spell out the principles of salary formation: what was accrued, what was withheld, how much is due for payment.

- An entry is made in the work book, which indicates the date of admission, position, and company name. Upon dismissal, a stamp and the date of dismissal are affixed.

Advantages and disadvantages of white salary

Above we looked at the key features of white ZP. Now let's look at the pros and cons of white wages. Let's start with the minuses - in fact, there is only one. Since the employer has to pay taxes and contributions for the employee (and they reach 30–40%), then, accordingly, the employee receives less than under the gray work scheme, when the minimum wage is paid. Then the continuous advantages begin:

- Operation of the labor code. Since the employee is officially registered, the employer will have to comply with all the requirements of the Labor Code: working hours, amount of payments, etc.

- Prospects and opportunities for career growth. Firstly, if a company works in whitewash, then this means that it is reliable and is going to work for a long time. Secondly, you receive official work experience and an entry in the work book.

- Possibility to use credit and travel abroad. Many banks provide loans only upon proof of income. If you receive the minimum wage and the rest in an envelope, then you may be refused. The same situation applies to travel to Schengen and other countries - you need to confirm your income.

- Pension contributions. Accounting makes pension contributions, so in the future you can count on a decent pension. It depends on your salary, so the more you earn, the greater the pension.

- Paid sick leave, no questions from tax authorities. The official salary is the best choice for the employee.

Attention:

the white salary has one more disadvantage - if you are a debtor, then write-offs will occur in full. This applies to alimony workers, bank debtors, utility debtors, etc. - if the bailiffs discover an official document, then funds will be constantly written off from her to pay off the debt.

Taxes on white wages

As mentioned above, an employee receiving a white salary actually means that the employer pays for him absolutely all taxes provided for by modern legislation. The main deductions include the following:

- Taxes on compulsory health insurance. The standard amount of this deduction is 5.1%. This amount is deducted from the employee’s regular salary, the amount of which is established by the internal regulations of the enterprise.

- Taxes on compulsory pension insurance. It is these contributions that positively affect the size of an individual’s future pension. The regular contribution will be 22% of the subordinate’s total salary.

- Taxes for compulsory social insurance. The amount of this contribution will be 2.9% of the salary of each subordinate.

Based on the above, we can conclude that with a white salary, the employer will pay a truly large amount of contributions for each employee on a regular basis. That is why a huge number of employers are trying to transfer their subordinates to a gray or even black type of income.

How are taxes calculated?

Taxes on official salaries are paid by two parties - the employee and the employer. Let's take a closer look at this system. Thus, 13% income tax is automatically deducted from the employee (if the person is a non-resident, then the income tax is 30%). Next, the employer is charged:

- 22% to the pension fund. This amount is divided into mandatory and cumulative.

- 5.1% to the compulsory health insurance fund.

- 2.9% to the social insurance fund (spent on maternity or disability).

- 0.2% to the social insurance fund for injuries.

That is, in total, the employer pays at least 30.2% of the salary plus the employee himself 13%. That is, when paying a salary of 40 thousand, 17,200 are “eaten up” by taxes.

White salary - pros and cons

An employee who is on the staff and receives a salary has a lot of advantages over a person who is employed unofficially.

The main advantage is social security. After concluding an employment agreement, a formal relationship arises between him and the company. The citizen becomes their subject, which means that he is entitled to all basic rights and benefits, including a white salary. It, in turn, ensures the receipt of contributions to personalized accounts in a number of social funds, including the Pension Fund. Consequently, in old age, an employee will be able to receive not a minimum pension, but an insurance pension, the amount of which is noticeably higher.

The second pole is the ability to take out a loan from a bank at any time, where you need to submit a certificate of income. Many, of course, make fictitious documents, but if the fraud is discovered, then this fact seriously spoils the credit history.

It is also necessary to understand that for a person with an official salary, the employer is obliged to pay:

For an ordinary employee, a white salary has only one minus - personal income tax must be paid on income, the amount of which is 13%. That is, when money is given to a person quietly, this fee remains at his disposal.

Other deductions are the sole responsibility of the enterprise. In other words, there are disadvantages for employers. They should, at the expense of the individual entrepreneur, pay contributions to:

- Pension Fund (22 percent);

- Compulsory Medical Insurance (5.1%);

- FSS (2.9).

In total, 30 percent of the calculated white salary accumulates. The authorities understand that this is quite a lot, so they have taken several measures to mitigate the situation in a certain way. So, if for an employee, as officially stated in the state, more than 796,000 were contributed to insurance funds during the year, then the state allows the rate for these obligations to be set at 10% for the remaining months.

In addition, the government intends to restore the unified social tax, abolished in 2010, which means that employers’ expenses will decrease.

Delay in payments

Finally, we’ll look at what to do if the official PO is delayed. So, how to force an employer to pay white wages? According to the law, the employer does not have the right to delay salary payments without special reasons - if the delay is 30 days or more, the employee has the right to contact the prosecutor’s office and the labor safety inspectorate. The employee is also entitled to compensation in the amount of 1/300 of the refinancing rate per day. Moreover, if there is a delay, employees may not fulfill their obligations and not come to the workplace.

Attention:

Today, delays are quite rare, since the labor inspectorate and prosecutor's office impose serious fines on the company for delays.

But before contacting the relevant authorities, we recommend communicating directly with the employer and finding out why the delay occurred and when approximately it will be paid. Due to the crisis, many companies have serious accounts receivable, which lead to similar situations. If you contact the authorities, it can finish off a company that is not firmly on its feet, and you will lose your job. It is best to negotiate with management if payments have been postponed for only a couple of weeks.

Source: 101biznesplan.ru

What is white salary

Labor legislation does not contain any terms indicating the color of wages. “White salary” is the popular name for income paid in accordance with all accounting rules and displayed in all documents confirming the fact of labor relations.

If we consider popular names and what is meant by them, then it is worth highlighting the following basic nuances:

- White salary. The level of income for fully completed work, which is calculated according to all the requirements of labor legislation, is reflected in the accounting records and all types of taxes and contributions are fully paid from it. Simultaneously with the transfer of wages, the employee must be given a complete itemized breakdown of the accruals made.

- Black salary. It is also called salary in an envelope. This means that the citizen is registered at the enterprise as an illegal employee and if any troubles or incidents arise, he will not be able to prove the fact of working for the company. And payment of this type of income in full is not at all guaranteed. After all, the employer can simply “forget about the need to pay part of such income. And the worker will not be able to prove anything to him.

- Gray salary. This term occurs when part of the salary (usually about half) is paid legally and is displayed in accounting and personnel records, and the second part is paid “in an envelope” (illegally). On the one hand, such a scheme provides legal employment and social guarantees in case of possible troubles. On the other hand, no one guarantees the constant payment of the part of earnings hidden from accounting.

Remember, the essence of “black” and “gray” wages is to evade paying taxes and social contributions to the state. And part of the money saved in this way is paid to the employee as his remuneration.

Working with a white salary

White wages represent the official regular income of an employee, information about which is reflected in all main documents, including various financial statements.

First of all, the exact amount of such payment is indicated in the main document, namely, in the relevant agreement, which is concluded with the employee during his official employment.

During the calculation of white wages, the company’s accounting department independently makes all the necessary tax deductions. Of course, in this case, the company’s expenses will be significantly higher than when paying gray or black wages.

White wages are the most profitable type of income for each employee. Only in this situation will the employee fully have absolutely all the rights that can be granted to him by modern standards. The subordinate's future pension will gradually increase, as will his professional experience. These main advantages explain why an increasing number of modern citizens prefer to look for work with official employment and white wages.

How to understand that the salary is white

Determining that you receive a “white” salary is not difficult. To do this, you should analyze several types of documents to which the worker has access:

- The employment contract signed by the parties fully reflects the level of the citizen’s expected income. If the document contains reference standards for the Regulations on remuneration, a collective agreement, an order for enrollment in the company for a specific position, then you can easily familiarize yourself with these documents. And this information will be further confirmed monthly by appropriate payments.

- The company's accounting fully reflects all accruals and wage deductions, and the worker is given a pay slip where all this is visible.

- An employee, having documents on accrued wages at hand and using the company’s regulatory documents in this area, can independently easily check the correctness of accrual of earned income.

- All documents relating to remuneration have been agreed upon with the trade union organization, and it has the right to monitor how it all works in practice.

- All payments are made by transfer to a bank card, or through the company's cash desk.

It is worth noting that the type of salary will depend on the procedure for calculating income. If it is time-based (paid for a fixed time worked), then payments will depend on the hours actually worked. At the same time, with a piecework form of labor, the worker has the right to count on income calculated on the basis of the amount of product received from him. The time spent at the workplace will not play a role here.

It is formalized by signing an employment contract between the parties. A personal file is opened for the employee and a bank account is opened. All payroll calculations are carried out and displayed through accounting.

Remember, “white” salary is income that can be easily checked and recalculated based on the requirements of regulatory documents.

From “black” wages to “white” ones

In the last few years, thanks to the stabilization of the economic situation in the country and the strengthening of state control over organizations, the following trend has emerged. Paying remuneration for “black labor” is slowly but surely becoming a thing of the past. Of course, the pace of “whitewashing” is not the same in all areas of the economy - much depends on the specifics of the company’s activities.

Therefore, firms and entrepreneurs are looking for the most effective and painless way to move from the “old” salary to the “new” one.

The easiest way out is to close the previous company, which paid employees in unaccounted cash. After this, you need to create a new company in which the entire team will be paid only officially.

Unfortunately, this scheme is only suitable for small companies and those who maintain their reputation in the market mainly through personnel. For example, business connections between employees of such a company will allow them to maintain their customer base and income even if they simply move to another company.

It is much more difficult to “part with the past” for large organizations, whose business reputation largely depends on the name, marketing expenses, availability of licenses and other special permits for doing business. If such a firm ceases operations and starts from scratch, it will incur unreasonably high costs. Therefore, the described organizations can be recommended the following scheme for the transition to an official remuneration system.

Firstly, settlements with employees must be “whitewashed” as carefully and thoughtfully as possible. After all, the company does not cease operations. Therefore, controllers can make claims against it.

It makes sense to start by concluding new employment contracts with the administration. Contracts must take into account the requirements of current corporate legislation. In addition, it is necessary to re-register the constituent documents. To do this, you will have to convene a general meeting of shareholders or members of the company.

Secondly, the company must renew contracts with the rest of the employees in the hierarchy - “from top to bottom”. Please note: workers’ incomes need to be “whitened” gradually. After all, a sharp increase in official salaries can attract the attention of inspectors. Enterprises located in the Far North and similar areas are luckier than others in this regard. They will be able to bring salaries to the “real” level faster than everyone else due to percentage increases and regional coefficients.

Thirdly, expenses for which “black” wages were previously actually written off must be reduced slowly. In this regard, it is necessary to initially issue wages through the company’s cash desk, without using alternative forms of payment (for example, bank cards, checks).

Fourthly, taking into account the legislation of the Russian Federation on combating the legalization of proceeds from crime and the secret cooperation of bank security services and law enforcement agencies, it is reasonable to open new current accounts.

The company will withdraw money from them to pay wages. This will save her from unnecessary suspicion and will negate any reason for law enforcement agencies to check the work of the enterprise.

Difference from “gray” and “black” schemes

Why do citizens agree to “salary in an envelope”? It's simple. They are promised an increased level of wages due to savings on taxes that they must pay when legally employed. But this advantage can very soon become a major disadvantage. After all, the following types of social payments directly depend on the legal accrual of income:

- Calculation of vacation pay. It is carried out based on their average income level. At the same time, the number of rest days is determined by law and cannot be reduced. You must pay money for them. Even if the worker earns leave, but does not take time off until he is fired.

- Accrual of sick leave. Another area that is directly related to the legality of wages. If it is not officially confirmed, and, therefore, there were no social contributions, the Social Insurance Fund will not transfer money for the period of illness. But the employer will not compensate an illegal worker for such periods.

- Additional payments, allowances, compensation payments. With hidden wages, you won’t see all this. As a consequence, if work is carried out in hazardous work, there will be no reason to receive any preferences for earlier retirement.

- Full payment upon dismissal. Termination of labor relations in an illegal status immediately “cuts off” all the employer’s obligations to the worker. And even if they promised to pay you something, it will depend solely on the integrity of the employer. No one can force him to do this. Even in court.

Thus, an increased level of income while working illegally very quickly becomes a problem if a citizen gets sick, wants to go on vacation or quit. And future pension payments, due to the lack of transfers to the state treasury, are becoming under threat.

Remember, all illegal payments sooner or later become a real problem. Especially in cases where the level of performance of a hired employee, for reasons beyond his control, begins to decrease temporarily or permanently.

The concept of “black wages”

“Black” is a salary that is awarded to a person who is employed completely unofficially. This term appeared in the mid-90s of the last century and has since become firmly established in everyday use. It means a salary that is not documented anywhere.

Black income is received by people who are informally employed. They are greatly more beneficial to employers. The advantage for them is the absence of the need to pay taxes and fulfill social obligations. For ordinary employees, there are some disadvantages, among which the most obvious are the following:

- lack of all rights;

- inability to go on vacation;

- unpaid sick leave.

In addition, the company can fire an unofficial employee at any time and certainly will not pay him if any accident occurs at the enterprise. It is very difficult to ignore such disadvantages.

Advantages and disadvantages of white salary

Now a little about the positive and some negative aspects of legal wages. Among the advantages of official income, it is worth dwelling on the following:

- All salaries are fully calculated and controlled by the employee. He can calculate in advance the amount of income due to him. Taxes are calculated from this salary and transfers are made to insurance and pension funds. This means that the worker will be compensated for the entire period of incapacity for work (if such occurs), benefits will be paid to the pregnant woman before and after the birth of the baby, and payment for the due leave will be calculated correctly and guaranteed, the duration of which cannot be less than that established by law (28 days).

- If the employment relationship is terminated, the worker will receive full payment for all periods of non-vacation leave, severance pay (in case of layoff), and in some cases even additional financial assistance. The latter will depend on the terms of the company's collective agreement.

- The ability to confirm your level of regular official income with a certificate from your employer allows you to apply for a loan from a bank and get money for a mortgage. After all, financial institutions use government databases for inspections. They can make requests to the company to confirm the level of solvency of the employee.

- Considering that personal income tax is also deducted from wages, in some cases a citizen can claim tax deductions and return part of this amount from the state budget. For example, when paying for your own training.

Of course, official wages also have some disadvantages, which is why some citizens agree to illegal income:

- the employer will pay exactly as specified in the employee’s employment contract;

- of the total accrued amount of income, more than a third will have to be paid as taxes and various social payments;

- any additional payments must be reflected in the company's regulations and regulations.

Remember, the official salary guarantees the full amount of social protection for a citizen in the event of illness, disability, dismissal, or retirement.

Which salary is more profitable?

Accrual of legal or illegal wages can be assessed differently. It is clear that legal accounting of everything a citizen has earned and received for his work increases the level of his social security and provides additional guarantees of protection against unlawful actions on the part of the employer.

In addition, the white salary guarantees:

- timely and full payments for days worked;

- fully paid vacation, sick leave, maternity leave, full payment upon dismissal;

- the ability to control the accuracy of income accrual;

- obtaining loans, credits, mortgages;

- the opportunity to defend your rights through a trade union, labor inspectorate, prosecutor's office, or court.

At the same time, “black” wages in some cases are beneficial to both the employer and the employee. Especially when you need:

- Incentivize workers to work using the ruble.

- Pay official debts accrued on the legal portion of income.

- There is no need for strict accounting of all payments.

Remember, “black” and “gray” salaries are tax evasion to the state. If such a fact is proven, the enterprise and its managers will face legal liability.

What is meant by gray salary?

Not all citizens understand how a black salary differs from a white one, much less from a gray one. Let's understand the last term. Here, a person is officially given only part of the money he actually earned. The remaining amount is obtained, as they say, “in an envelope.”

Simply put, a person is hired for the lowest position with a minimum salary, but in fact performs completely different duties and, accordingly, earns much more. The amount indicated in the contract goes through the accounting department and goes to the card, and the rest of the money is transferred in cash.

The gray salaries that are awarded to employees are a kind of compromise that has advantages for both the employer and the subordinate. The latter, for example, thus makes it possible to hide their income from former spouses collecting alimony. By law, the amount paid cannot be more than a certain percentage of income.

The downside to this form of salary is obvious - meager income to the Pension Fund, which means a very modest pension in old age.

What does white salary consist of and how is it paid?

The legal level of income is based on the accepted regulations on remuneration in companies. By default, this salary is divided into the following subtypes:

- Basic income. Calculated based on the established salary (rate). Indicated in the employment contract (order of admission to the position). It is prohibited to reduce this part of payments.

- Additional salary. This part will contain all additional bonuses, allowances, and additional payments provided for by the payment system, paid on an ongoing basis. They are established at the state level, as well as by local documents and can be modified (up or down). Paid in addition to salary.

- Other incentives and compensation payments. This includes compensation payments (sick leave, financial assistance), as well as individual one-time bonuses for performing particularly important job functions.

The employer is obliged to pay legal wages twice a month - in advance for the first half, and the final payment after the end of the monthly period. Legal (administrative) liability is provided for late payment of wages.

Remember, the main advantage of a white salary is complete certainty in the calculation, as well as a guarantee of receiving it in full.

White salary: is it always good for the employee?

When issuing black and gray income to employees, the employer clearly wins, and the employees are at risk.

But there are times when people are specifically looking for a job where their official earnings will be underestimated or completely hidden from other people. For them, white wages are a disadvantage. These include debtors. For example, a person did not repay loan debts and interest on them on time and in full, did not pay for housing and communal services, etc. The creditors, in turn, sued the citizen and proved they were right. Bailiffs look for debtors and write off funds from their income in favor of creditors on the basis of writs of execution and court orders. And the defendants are trying in various ways to hide their income or most of it.

There are citizens who do not want to pay alimony in favor of their children, ex-spouses, parents and other relatives. For them, a black or gray salary is a way out of the situation, since alimony is calculated only from official income.

White wages are unprofitable only for those workers who have violated or are going to violate the current legislation of the Russian Federation.

vseobip.ru

Today I will tell you about what is meant by the concepts of white, gray and black salary . After reading this article, you will learn what white salary, gray salary, black salary are, how these concepts differ, where they are most often found, what are the pros and cons of receiving this or that type of income. Let's talk about everything in order.

Let me start with the fact that in the legislation there is no concept of “white, gray, black salary”. These definitions were invented by people, and they are already firmly entrenched in our everyday life. In the Labor Code there is only the concept of “wages”, which, in everyday words, means exactly the white salary. Gray and black wages are a violation of labor laws, and employers using such wage schemes may be subject to administrative and even criminal penalties if they are detected.

White salary.

White wages are accruals and payments to the employee, which are fully reflected and taken into account in the accounting department and official reporting of the enterprise, from which all necessary taxes are paid as provided for by current legislation.

The white salary is indicated in the employment contract, employment order, regulations on wages at the enterprise and other official documents. An employee receiving a white salary is on the staff of the enterprise or works for it under an employment agreement.

By calculating and paying white wages, the enterprise’s accounting department independently withholds and pays all due taxes and payments to the budget and extra-budgetary funds. Moreover, the accrual and payment of taxes and contributions are carried out both at the expense of the employee and at the expense of the enterprise (as provided by law).

Thus, it turns out that when paying a white salary, the company’s expenses are higher than when paying a gray or black salary, since the expenses include deductions from wages paid at the expense of the employer.

When receiving a white salary, an employee’s length of service is fully taken into account, and his pension savings are also fully formed. The employee has all the rights provided for by labor legislation (to go on sick leave with pay, receive payments due in the event of a layoff, register for unemployment after dismissal and receive benefits, etc.).

Ideally, the salary of any employer should be white, but in fact this is far from the case. White wages are found mainly in budgetary and state-owned enterprises, industrial enterprises, leading banks, large corporations, and companies with foreign capital.

To be 100% sure that your salary is white, you need to compare deductions for taxes and fees transferred by the company (you can find them out at the tax office, pension fund, etc.) with the calculated values of such deductions at current rates. For example, in Russia this can be done by ordering a certificate in form 2-NDFL, through personal accounts on the websites of the tax service and pension fund. If the data matches, it means your salary is white.

Gray salary.

Gray salary is a method of calculating and paying remuneration to employees for wages, in which a certain part of this remuneration is officially taken into account, and the rest is not taken into account anywhere and is paid in “black cash”.

Gray wages are used by enterprises to optimize taxation. This way, the employer pays less taxes and contributions both at his own expense (from the payroll fund) and at the expense of his employees. At the same time, workers can actually receive even more in their hands than with a white salary.

With a gray salary, the employee is officially listed on the staff of the enterprise, but taxes and deductions from his salary are paid only from that white part of the amount that is officially recorded in the accounting department.

This has a negative impact on the subsequent calculation of his pension, sick leave, vacation pay, unemployment benefits (in case of dismissal) and other payments: he will receive all this not from the full amount of the gray salary, but only from its white part.

Also, if an employee needs a certificate of income (for example, to take out a loan, and not only), the certificate will indicate only that part of the salary that is reflected in the accounting department.

As a rule, with a gray salary, an employee is registered at the minimum wage or slightly higher, but in fact can receive even several times that amount.

Gray wages are practiced in construction companies, large and medium-sized retail enterprises, real estate agencies, microfinance organizations, etc.

Black salary.

A black salary is a monetary remuneration to an employee for work performed, which is not reflected at all in any accounting, reporting or other official documents.

With a black salary, the employee is not listed on the company’s staff at all, has no entry in the work book and is legally unemployed (or at the same time works at another enterprise where he is officially registered).

The rights of workers receiving unpaid wages are not protected at all. Such an employee has no right to sick leave, paid or unpaid leave, or anything else provided for by the labor code. All such issues are resolved only by negotiations with the employer or immediate superior: if he gives the go-ahead, the employee receives something, if he does not give, he does not receive.

Moreover, black wages create the maximum risk of not receiving even this very salary. It often happens that unofficial workers work for several months, they are paid some minimal money or nothing at all, promised payment later, and at some point they are simply kicked out without having been paid. In this case, you can complain about the employer, but it is unlikely to receive the promised salary: relations with the employer are not regulated in any way, and it is very difficult, almost impossible, to legally prove the fact of work and the level of the promised salary.

For workers receiving black wages, their length of service is not taken into account; they can only count on pensions and other social benefits to the minimum amount established by law; they cannot count on some types of payments at all.

Black wages are practiced when working for small entrepreneurs, in retail trade, on construction sites, in agricultural work, and in other companies with a large cash turnover.

Now you have an idea of the difference between white, gray and black salaries. In conclusion, I would like to note that the entire blame for paying gray or black wages cannot be placed solely on the employer: this is an agreement between two parties, one of which is the employee. If the employee agreed to such conditions, this is his fault.

If the employer misled the employee (for example, he promised a white salary, but pays a gray or black one), then you can file a complaint against him (I wrote more about this in the article How and where to complain about an employer?). However, it is necessary to understand that in this case the relationship with the employer will be completely damaged and it will be very problematic to continue working for him.

In the next article I will look in more detail at what advantages and disadvantages the so-called. “salary in an envelope.” Stay tuned to Financial Genius for more updates. See you again!

fingeniy.com

How are taxes calculated?

To understand what tax burden an employer faces when paying legal wages, let’s consider the amount of contributions that must be paid as taxes (social contributions).

The employer's responsibility includes the calculation and transfer of taxes (contributions) in the following amounts:

- 13% tax on personal income. If non-residents, then its size increases to 30%;

- 22% contributions to the pension fund;

- 5.1% transfer to the medical insurance fund;

- 2.9% for social insurance;

- from 0.2% to 8.5% (depending on the hazard of production) for injuries.

It is important to note here that income tax is calculated and collected from the employee’s salary (income). Transferred by the employer. Other social contributions are calculated on the full salary. Paid from the employer's funds. This way the payment burden is shared.

In other words, for a salary of 20,000 rubles, 13% will be deducted as taxes, and another 30.2% (maximum 38.5%) will be transferred by the employer to various funds from his own money. Thus, the worker will receive 17,400 rubles. For the employer, it is necessary to create a payment fund at the level of 26,040 rubles (maximum 27,700 rubles).

Results

Payments of white wages are based on the following important principles:

- The amount of wages indicated in the subordinate’s employment contract, as well as in other local documents of the company, must necessarily coincide with the real state of affairs. That is, the indicated amounts must be equal to the amounts that subordinates receive.

- When paying this type of income, the employer’s responsibilities will include the calculation of all taxes that are established by current regulations. These taxes go to the pension fund, as well as to other similar organizations.

- If an employee receives a white salary, he will have absolutely all the full rights that are guaranteed to him by current laws. In the event of a violation of these rights, absolutely every employee will have a full opportunity to file formal claims against their employer.

Employer's responsibility to pay wages

At the legislative level, the terms and procedure for paying the income due to the worker are clearly defined. Failure to comply with such conditions entails legal liability. It could be as follows:

Material. If the salary is paid late, the employee has the right to compensation for such delay in the form of a penalty. Calculated for each day. It is 1/300 of the refinancing rate introduced by the Central Bank.

Administrative. In this case, administrative registration of such a violation is carried out. Based on the results of its consideration, the employer (the manager) faces a fine of up to 5 thousand rubles. The company may be subject to penalties of up to 50 thousand rubles. If such actions are repeated, the manager may be additionally suspended from work for up to 3 years.

Criminal. Can be used in cases of malicious violation of workers' rights. As a rule, this is a deliberate disregard, without any reason or limitation, for payment of wages for a period of three or more months. The punishment starts from a fine of 120 thousand rubles. Maximum – 3 years in prison. If this still leads to serious consequences, then the culprit may face 5 years in prison.

As an intermediate punishment (if there is a higher authority over the organization), disciplinary liability may be applied to the heads of such branches and divisions.

Remember, usually the reason for holding an employer accountable is the worker’s statement to law enforcement. The fact of non-payment will need to be documented.

Gray salary and salary in envelopes. Unofficial salary. How the tax office will find you:

Source: naimtruda.com

A little about salary in general

Wages are remuneration for an employee’s labor expressed in monetary form.

Its level depends on the complexity and amount of work, conditions, and qualifications of the performer. If work is paid based on a time period, the salary is time-based. If it is possible to keep track of the work performed, piecework payment is often used.

Salary is a broad and collective concept; it consists of several points that may differ in different organizations. But in general, salary refers to the total amount that the performer receives after deducting all taxes. All items can be easily tracked in the payslip, or “settlement”, which is issued to the employee every month.

What does white wages consist of?

White salary means official. What does it include? Let's consider.

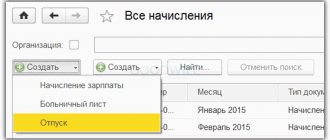

| Wage component | Peculiarities |

| Salary | Appears in the employment contract and order. It is for this amount that the employee “sells” his labor to the employer. This amount is a lower threshold, but guaranteed. Depends on the level of qualifications and work experience of the person hired |

| Prize | Individual or collective - as an incentive for fulfilling bonus conditions prescribed by the company in internal documents, for example, in the regulations on remuneration |

| Income in kind | Present if the company provides the employee with housing or food free of charge. The calculation must indicate the value of such income calculated for a given employee. For what? Despite the fact that the company pays for the employee’s housing and food, he is required to pay 13% income tax on this income. |

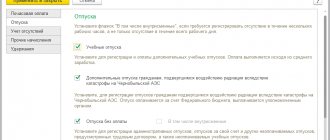

| Sick leave | The calculation takes into account a percentage of average earnings, depending on the employee’s length of service and earnings. If the employee manages to provide sick leave, sick leave is accrued and paid in the same billing period in which he was sick |

| Vacation pay | Calculated based on average earnings for the previous 12 months. Vacation pay must be included in the calculation for the period in which the employee went on vacation |

| Compensation bonus | Additional payment for some inconveniences in work activities. For example, working at night and overtime, on public holidays |

| Incentive bonus | It is added to the salary individually for length of service, academic degree, and contribution to the company. For example, an employer can set a salary increase of a fixed amount for every six months of experience in order to “fix” experienced workers |

| Regional coefficient | Otherwise – “northern coefficient”. Legally guaranteed indexation of certain wage points for work in difficult climatic conditions. The coefficient depends on the region. For example, in the Sakhalin region, salaries are multiplied by a factor of 2.0 (the highest), and in Novosibirsk - only by 1.15 (the lowest possible) |

How the white salary is formed

It is not superfluous to understand what is included in the salary itself. According to the law, its components are:

- salary (fixed or formed at the expense of daily, hourly rates);

- incentive payments (bonuses);

- allowances (for length of service, academic degree, military rank);

- increasing coefficient (relevant for northern regions);

- sick leave;

- vacation pay.

In a word, the totality of all amounts that are accrued to employees is called wages.

Signs of white wages

Official wages must meet the requirements stipulated by law. They represent mandatory characteristics of legal remuneration for work. It is not for nothing that the white color symbolizes the honesty and transparency of all the activities of the enterprise.

| Item characteristics | Description |

| Employment | An employee is hired officially, that is, he is on the staff. Has rights and obligations documented in the employment contract, employment order, salary regulations |

| Salary | Fully reflected in all of the above documents |

| Payment method | It is issued either in cash through the cash desk in the organization itself, or transferred to a bank card. As a rule, a large organization enters into a service agreement with a bank, and all employees are issued cards to avoid queues in the accounting department on payday. |

| Payout frequency | By law, payments must be made at least twice a month. This is an advance and the salary itself. The exact dates are set by the employer himself |

| Pay slip | All employees are given pay slips along with their salaries, where all payments are spelled out in detail and each bonus is spelled out. The sheet also shows the amount of income tax deducted. The employer is obliged to withhold income tax from salaries and pay it to the budget. The very presence of a detailed payslip indicates transparent accounting and that the organization is not hiding anything. |

| Employment history | The book is filled out in full accordance with the Labor Code: indicating the terms of work, position and reason for dismissal |

The essence of the phenomenon

What does the so-called “white salary” mean? This popular and unofficial term means that remuneration is official and complies with the laws and regulations of the Russian Federation. You can recognize the white scheme by several signs:

- The amount of wages is fully reflected in the employment contract, regulations on remuneration, employment order and other official documents.

- All payments are reflected in the organization's accounting records.

- When receiving a salary, an employee has the opportunity to track how calculations, accruals and deductions were made.

- The salary amount is agreed upon with the enterprise trade union.

- The employee receives money through a cash register or to a bank card.

White wages can be time-based or piece-rate. Time-based is accrued according to the time sheet and consists of a fixed salary and bonus. Piecework depends on the fulfilled production standards. Salary is calculated based on the number of units completed.

In general, the official salary consists of components determined by law:

- Salary.

- Prize.

- Regional coefficient (if there is one).

- An allowance (for example, for experience or an academic degree).

- Vacation pay (if the employee goes on vacation).

- Payment of sick leave (respectively, if the employee went on sick leave).

- Other payments provided for in a specific organization.

In contrast to the above, let’s put “gray” and “black” wages (they are also called “salaries in an envelope”). In this case, the employer partially or completely hides the amounts paid to the employee from the state. This is done for a number of reasons, but mainly to avoid paying taxes. The difference between them is that “gray” schemes are conditionally legal and do not formally contradict the law, while “black” schemes are completely illegal.

Advantages of white wages

| Item characteristics | Description |

| Security | The employee has all the supporting documents in his hands; the employer will not be able to infringe on his rights, for example, by groundlessly depriving him of payments. Employee-employer relations in the financial aspect are as transparent as possible for both parties, manipulations are kept to a minimum |

| Prospects | The “whiteness” of salaries indicates the solidity and reliability of the company. Such companies value their reputation and are aimed at long-term cooperation with both partners and employees. Therefore, you can think about a career in this organization |

| Credit history | With the active development of lending systems, the issue of income confirmation, in particular, the 2-NDFL certificate, has become acute. It lists the person’s income by month for the requested period; on the basis of this certificate, the bank makes a decision on granting a loan or mortgage. A certificate that corresponds to reality can only be issued by the accounting department of “white” employers |

| Decent pension | The official employer, among other social contributions, makes payments to the pension fund, and at its own expense. Their size directly depends on the amount of accrued wages |

| No questions from the tax authorities | All purchased goods with a white salary will be easily explained - otherwise the origin of expensive purchases will be difficult to justify |

| Guaranteed minimum wage | According to the law, the employer will not be able to pay less than the minimum approved by the state. The minimum wage differs in different regions of the Russian Federation. The federal minimum wage since January 2020 was 11,280 rubles. |

Types of wages

Salaries can be divided into types:

- Nominal salary is the amount of money that is paid to an employee for his activities in the organization.

- The real wage is the amount of goods and services that can be purchased for a nominal wage.

The real salary directly depends on the nominal one, that is, the higher the remuneration a person receives at work, the higher his purchasing power, and accordingly, the higher the real salary. This indicator also depends on the tax contributions that citizens transfer to the state from their income. Accordingly, the higher they are, the lower the real salary. Prices for goods and services are also important for calculating this indicator. The higher they are, the lower the real wage.

There is another popular division of salaries into types:

- white;

- black;

- gray

This division is of an everyday nature. It is unlikely that you will come across paragraphs in economics textbooks with the title “White salary”. Therefore, let's understand the terms in more detail.">

Insurance premiums for a white salary - where and how much

An employee costs the employer much more than the amount of his salary. Why? As you know, the employee pays an income tax of 13% from his salary - only the responsibility for transferring these funds to the budget lies with the employer (non-residents of the country pay a 30% income tax).

But the employer himself must transfer a certain amount for his employee to state extra-budgetary funds in addition to the amount that he has already paid to the employee as salary. It is not surprising that salaries are in fact the largest expense item for most employers.

Until 2010, there was the so-called Unified Social Tax (UST). Now the single tax has been replaced by several contributions - to the Pension Fund and social insurance funds, but the essence has not changed - only now the payments are split.

The tax rate for each deduction is calculated for all employees separately.

If we assume that the enterprise does not have the right to use reduced rates, then the employer transfers the following percentages of accrued wages to the funds:

| Fund | % deduction from salary | Example with a salary of 40,000 rubles. – deduction amount, rub. |

| Pension Fund of Russia (PFR) – insurance and savings part | 22% | 8 800 |

| Federal Compulsory Medical Insurance Fund (FFOMS) | 5,1% | 2 040 |

| Social Insurance Fund (SIF) – ability to work, maternity | 2,9% | 1 160 |

| FSS – injuries. From 0.2% to 8.5% depending on the class of professional risk | 0,2% | 80 |

| Total | 30,2% | 12 080 |

The taxable base is all the employee’s salary accruals before deduction of income tax.

However, a business may qualify for the calculation of these deductions at reduced rates, or may stop paying these taxes altogether. This is possible if the employee’s cumulative salary for the year has reached the legal limit. For each fund they are presented in their own amounts.

A little about taxes and contributions

It’s no secret that 13% of the total amount of payments to the employee is deducted from the employee’s official salary to the state fund. This is the so-called income tax. By law, these are all tax contributions that an employee must pay to the country's budget. Additionally, the employer transfers about 30% of the total amount of payments to the employee to extra-budgetary funds:

- Contributions to the pension fund – 22%.

- Contributions to the Social Insurance Fund – 2.9%.

- Contributions to the Compulsory Health Insurance Fund – 5.1%.

All of the above deductions are made every month and are reflected in all financial documents of the employer.">

What are black and gray salaries

Black wages mean monetary remuneration that is not reflected in the company’s accounting records. At the same time, the employee not only has no official income, but also does not appear on the company’s staff at all.

He receives his salary in an envelope based on a verbal agreement with the employer. The use of such labor is illegal and risks administrative and, in some cases, criminal liability.

Workers on black wages are not socially protected in any way and are completely dependent on the employer. All the benefits provided for in official employment - paid sick leave, vacation, contributions to the pension fund - are lost here.

Gray wages are an intermediate option between black and white wages; they are also illegal. Its peculiarity is that a worker on a gray salary is officially employed, receives part of his salary officially, and part is given to him in person.

A common option for unscrupulous but fearful employers: they are afraid of openly breaking the law by doing dirty work, but at the same time they want to cut costs.

Advantages and disadvantages of gray salaries

There is only one advantage of gray and black wages - saving money on taxes and fees. Some employers share part of the money saved with the employee, but this does not always happen. In addition, illegal schemes have a large number of disadvantages:

- In case of conflict situations and labor disputes, the amount of material incentives from the company owner may be significantly reduced.

- Upon dismissal or parental leave, the amount of payments is calculated only in accordance with official income. That is, their amount will be significantly less.

- When applying for a loan, only the official part will be indicated in the documents. There is a high probability that you will be denied a loan or approved for an amount that will not be enough.

- Contributions to the Pension Fund are minimal, which means you shouldn’t count on a decent old age.

Payroll fraud results in audits, fines and criminal liability for both employer and employee.