The subsistence minimum is one of the main guidelines of the state’s social policy, including in the matter of determining the minimum wage, pensions, and benefits.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The value of this indicator changes quarterly under the influence of inflation trends in the national economy.

Wages change less frequently, and therefore many citizens ask a completely appropriate question: can a salary be less than the subsistence minimum?

It is advisable to consider the intricacies of resolving this issue in 2020.

Minimum wage may vary

The minimum wage for the monthly labor standard worked is set at the state level. Once a year it is reviewed and increased in proportion to the level of inflation. The “minimum wage” in 2020, adopted by Federal Law No. 421-FZ of December 28, 2017, is 9,489 rubles.

FOR YOUR INFORMATION! Compared to last year, the minimum wage increased by 1,689 rubles. – from the amount of 7800 rubles.

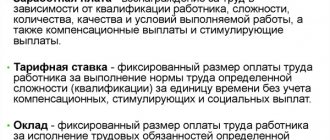

The wage below which the employer does not have the right to set wages set by the state is called the federal minimum wage (Article 133 of the Labor Code of the Russian Federation) .

Local authorities have the right to revise the minimum wage depending on the parameters of specific constituent entities of the Russian Federation, but only upward. This minimum wage is called regional . The largest “local” minimum wage is rightly set in the northern regions of the country, for example, in the Magadan region in 2020 it will range from 19,500 to 21,060 rubles, including compensation and incentive payments. This remuneration figure will be adopted if agreement is reached between the three interested parties:

- regional authorities;

- associations of trade unions;

- local union of industrialists and entrepreneurs.

The adoption of a regional minimum wage means that all employers in the region are obliged by default to adhere to this minimum limit. But, unlike the federal minimum wage, employers have a choice: within a month they can refuse to recognize the increased value established in the region. To do this, you need to publish a reasoned refusal in the local media within this period. In such cases, they must adhere to the requirements regarding the federal minimum wage.

Minimum wage

The minimum wage is a specialized indicator that is used only for the working population when determining the level of individual wages. The minimum wage is the minimum wage limit. He defines below what indicator cannot be paid for work performed.

The size of the minimum wage differs by region, as it is based on the general standard of living in a particular area. One of the highest minimum wages is observed in Moscow, it is 18,742 rubles. But this figure is not the largest, for example, in the Magadan region it is 21,060, and in the Murmansk region - 21,842. Meanwhile, the average figure for the country is 9,489 rubles, below which the minimum wage is not established.

The established minimum wage affects many figures. It not only clearly outlines the lower limit beyond which the employer cannot go, but is also the starting point for establishing many contribution payments. For example, taking it into account it is calculated:

- The amount of insurance premiums from individual entrepreneurs.

- Survivor benefits.

In some cases, alimony payments are also tied to this figure, for example, when the alimony payer does not have official or stable income.

https://youtu.be/eV88S0YPPjo

For which relationships is the minimum wage required?

Not every employer who employs other people is subject to minimum wage requirements. This government regulation guarantees a minimum limit for employees only when entering into an employment relationship. In civil cases, in which another form of contract is concluded, in particular, a contract for the provision of paid services, it is not necessary to comply with this requirement. In such relationships, payment is agreed upon by agreement; it may turn out to be lower than the minimum established by the power.

Can wages be below the subsistence level?

The Labor Code of the Russian Federation establishes that wages should not be less than the subsistence minimum. But this is a theory. Since this indicator is revised quarterly, the comparison is made with the minimum wage, which is determined for the current year on the basis of the subsistence minimum in force in the second quarter of the previous year. Therefore, when comparing, it is assumed that the salary will be less than the subsistence minimum for the selected period.

In addition, it must be taken into account that the salary for comparison should be summed up, and not for any part of it. Thus, in the presence of bonuses and additional payments, the answer to the question - can the salary be less than the subsistence minimum - becomes clear - yes.

You might be interested in:

Dismissal of an employee due to death: what date is the order issued, how to issue it

It is also taken into account whether the salary was paid for the entire standard duration of the month, or whether it is due to the employee at a certain rate, for example, 50%. That is, when working part-time, it is allowed that the accruals made to the employee may be less than the subsistence level.

Attention! It is necessary to understand the difference between accrued and paid wages. Therefore, when determining whether an employer can legally pay its employee less than the cost of living, the answer is yes.

Minimum wage or subsistence minimum

These two indicators should not be confused. The law states that the minimum wage should not be lower than the subsistence level. But in practice these values have not yet become equal. Labor Code of the Russian Federation in Art. 421 says that they will gradually be reduced to one total amount, this will happen in several stages. Until this moment comes, the employer should focus exclusively on the minimum wage, which, unfortunately, is still somewhat lower than the subsistence level.

The cost of living in Russia

At the beginning of 2020, the cost of living is the result of calculations for the 3rd quarter of 2020. The figures will be revised only by April 2020 based on the results of the 4th quarter of 2020. Since PM depends on the needs of the citizen, it is divided into three main categories - minor children, people of working age, and pensioners. There are different consumer baskets for each category, so the output numbers are different from each other.

The PM value at the beginning of 2020 in Russia is:

- The total figure per citizen is 10,328 rubles.

- Minors – 10,181.

- Able-bodied people – 11,160.

- Pensioners – 8,496.

This indicator was adopted by the Government of the Russian Federation as a general indicator from which regions should build, but at the federal level it is recalculated taking into account individual standards and needs.

It is obvious that the basic conditions of a resident of the Primorsky Territory and the Northern region differ from each other, and therefore a single figure cannot be applied throughout the vast Russian Federation.

Legal salaries are below the minimum wage

So, according to the law, it is impossible to assign payment below the established minimum. But there are several situations when the amount received in hand may be below this limit:

- work under a civil law contract (the employer is considered the customer, and the employee is the contractor);

- during the month, the employee did not work the calculated standard hours due to illness, administrative leave or other reasons (the monthly standard of working time is not developed);

- in addition to the small salary, the employee receives additional mandatory payments: bonuses, bonuses, additional payments, etc., which in total amount to the required amount;

- special work schedules or remuneration systems (hourly, piecework, part-time - day or week);

- part-time work (payment depending on hours worked).

IMPORTANT! When working part-time or on special schedules, it is necessary to conclude an additional agreement to the employment contract, which, among other conditions, stipulates payment for part-time work. Without written consent, the employer does not have the right to establish part-time working hours or send people on indefinite unpaid leave.

Can they pay less than the living wage ↑

In general, the labor legislation of the Russian Federation determines that it is impossible for an employee to receive a salary below the subsistence level if this place of work is the main one for the employee, and he works within its framework for the entire working day, which is 8 hours (Article 133 of the Labor Code of the Russian Federation).

This situation is quite natural - the money an employee receives as remuneration should be enough to support his or her livelihood.

For a living wage per person, see the article: living wage. What is the difference between the subsistence level and the minimum wage and what is it, read here.

The relationship between the cost of living and the level of wages should also be reflected in the internal regulatory documentation of enterprises, namely in the regulations on wages.

However, there are a number of cases when, on completely legal grounds, an employee receives a salary less than the amount established by law.

Circumstances of the situation

The situations in which a citizen can receive payment for work below the subsistence level include the following:

| Firstly | Typically, the employee’s salary, which is stated in the employment contract, does not take into account taxes, contributions to the enterprise’s trade union fund, etc. As a result, the contract specifies an amount that exceeds the subsistence level, and the employee receives a salary that is less than the specified standard. |

| Secondly | If an employee does not fully cover the required working hours (works part-time, works within a flexible schedule), in other words, does not work the standard 40 hours a week, then his salary may quite naturally be less than the subsistence level |

| Third | During the month, an employee can take leave without pay or remain on sick leave. This affects both the monthly salary and the average salary for the quarter. |

| Fourth | The rule that wages exceed the subsistence level applies only to the remuneration of main workers—this rule does not apply to part-time workers |

| Fifthly | If an employee carries out activities in an organization not on the basis of an employment contract on the basis of signing a civil contract (performs certain work or provides temporary services), then the norm prescribed in the labor legislation of the Russian Federation (Article 133) does not apply to him in any way |

In all of the above cases, an employee’s salary may be below the subsistence level or below the minimum wage quite legally.

In other cases, a hired employee who works full-time in a company, who is the main employee, who works the full time limit, has the right to receive a salary above the subsistence level.

What to do

Many citizens who do not fall into one of the above categories ask a completely logical question - if the salary is less than the subsistence level, where to go?

If an employee has discovered the fact of an illegal understatement of his wages, he has the right to file a claim on this matter in a court of general jurisdiction or in an arbitration court.

In this situation, there are two offenses on the part of the employer:

| On the one side | The standards for fair remuneration for workers, which are established by Rostrud, are violated |

| On the other side | There is a fact of deliberate understatement of personal income tax, which the employer, as a tax agent, is obliged to pay to the treasury for each of its employees |

In both the first and second cases, the company will be obliged to pay a fine, as well as compensate for material damage to the employee that arose as a result of a deliberate understatement of wages.

An employee can also file a complaint against an employer with the regional labor commission. In this case, all issues in court and out of court will be settled by representatives of this department.

Less than the minimum wage on hand

Sometimes it turns out that an employee receives less than the minimum wage, and this is legal. In this case, the salary includes the figure established by federal law. This may happen when:

- the amount issued is reduced due to accrued personal income tax (the “dirty” salary corresponds to the minimum level, and a smaller amount is obtained by deducting 13%);

- other mandatory deductions are deducted from the salary - the amount of the minimum wage issued can be reduced by insurance, membership dues to a trade union, etc.;

- the employee has arrears in alimony payments (up to 70% of wages can be written off under a writ of execution).

basic information

The salary set by the employer below the minimum wage in 2020 is a violation of the requirements of current legislation. An employee who conscientiously and properly performs official duties for an established period in accordance with the approved work schedule has the right to expect to receive a salary in an amount not less than the established subsistence level.

A manifestation of the state’s social policy is the analysis and determination of the consumer basket, on the basis of which the cost of living is formed. In turn, the minimum wage is established based on the approved PM.

It is important to know the key criteria by which the minimum wage is formed:

- the basis is the PM applied to the working population;

- wages mean the total set of payments, including salary, allowances, bonuses, etc.;

- Regional authorities have been delegated powers to adjust the minimum wage and monthly wages upward.

For this reason, to determine the amount of earnings in relation to the cost of living, regional indicators are taken.

What should an employee do if the minimum wage is low?

- First of all, carefully read the employment contract before officially applying for a job. This document must indicate wages and work hours, as well as clarify the nuances regarding additional charges and deductions. If the specified amount is less than the minimum wage, you should not get a job with such an unscrupulous employer.

- If your salary suddenly turns out to be less than usual, ask the payroll department about the reason for the decrease. If the reason is legitimate (see above), the employer is within his rights.

- If the employer has reduced the payment illegally (unilaterally), it is worth applying for protection of your rights to the labor inspectorate in the territorial affiliation of the employer or to the prosecutor's office. To do this, you will need to write a written statement, to which you will need to add written confirmation of the infringement of your rights regarding wages:

- certificates from the accounting department;

- an extract from a salary card account;

- written explanation from the employer (if he provided it), etc.

- Going to court is the last resort for all those unfairly offended. For such claims, you do not need to pay a state fee. If the court decision is in favor of the employee, the employer will be obliged to comply with it. In practice, most often the employee in these cases is forced to resign.

The regulatory authorities will initiate an inspection of the employer and issue an order to eliminate the identified violations.

IMPORTANT! It makes sense to first contact management directly. It is better to do this in writing or in front of witnesses. Most often, employers prefer to resolve the issue amicably with employees who know their rights.

Where and how to complain about low wages

What to do if your salary is less than the minimum wage? This situation is quite possible, since the amount of the salary specified in the employment contract and the amount given to the employee differ, and to a lesser extent. This is due to the calculation of mandatory tax rates for pension and insurance funds.

A small salary is a problem not only for the employee, but also for the employer, because in accordance with Article 133 of the Labor Code of the Russian Federation, the salary must be no lower than the officially established minimum wage. At the same time, the Labor Code of the Russian Federation provides a clear definition of the fact that the calculation refers to payment for the fully worked period. If for some reason an employee did not work all the shifts assigned to him, then he has no reason to complain about underpayment.

If an employer violates Article 133 of the Labor Code, namely setting a salary below the minimum wage, a person can seek protection from the Labor Inspectorate and the prosecutor’s office. To contact one of these institutions, the victim should write a statement describing the events as accurately as possible. Copies of documents confirming the violated citizen’s right to receive the minimum must be attached to the application.

What does a reduction in the minimum wage mean for an employer?

Responsibility for underestimating the minimum wage implies punishment under Art. 5.27 Code of Administrative Offenses of the Russian Federation. Administrative liability provides for fines (1-5 thousand rubles for individual entrepreneurs, 30-50 thousand rubles for an organization, more for repeated violations) or even disqualification of officials. If the underpaid salary has not been paid for long, the employer may only receive a warning and an order to increase it.

Criminal liability may arise if it is discovered that the employer has embezzled legitimate money from employees. In this case, the fine may be up to 500 thousand rubles. for complete non-payment and up to 120 thousand rubles. – for partial non-payment of wages.

Illegally used alternative forms of employment, in addition to an employment contract, threaten the employer with a fine of up to 100 thousand rubles, and up to 200 in case of repeated violation.

In what cases is a salary below the minimum wage allowed?

Salary and minimum wage: what is the difference? - to answer this question, let’s return to the regulatory laws, namely to Article No. 129, which contains a clear distinction between wages - the monthly income of employees and salary. But in addition to it, there is an advance and incentive payments, such as bonuses, additional payments for overtime and interest, if they are specified in the employment contract. These standards oblige enterprises to provide employees with the necessary minimum when paying wages, but on the other hand, the salary is lower than the minimum wage. The difference between the minimum wage and the living wage is allowed when other factors influencing the amount of total payments to the employee are equal to or exceed the established guaranteed minimum. Let's look at cases in which wages do not necessarily comply with the established minimum wage, and wages may be below the established minimum. Such an exception is allowed in the following situations:

- deduction of income tax from salary is a natural procedure when transferring money to employees. When the salary is equal to or higher than the established minimum wage, but after paying the tax it becomes lower, this does not violate the norms issued by the legislative bodies of the Russian Federation;

- deduction from salary - if, before deducting the required amount, payment of alimony or other conditions in the employment contract, the law will not prevent the employee from earning a salary above the minimum wage. If an employee receives money in hand below the established minimum after such transactions, the company is not violating the laws;

- The organization abandoned the regional agreement and pays workers according to the federal standard. In 2020, the minimum wage is 11,280 rubles. When the employer provides staff with this amount, having found reasons to justify his decision, there are no penalties or consequences for him. By making such a decision, the businessman incurs additional expenses, and the result may be dissatisfaction with the authorities and trade unions;

- a citizen combines employment - if at the second job the hours per month do not exceed half the time worked in the main organization. In this case, the minimum wage will not be lower than the minimum established by law, but the number of hours spent on site will decrease;

- part-time work - with such a schedule, the businessman is not obliged to pay the amount in accordance with the laws. As in the previous case, the calculation is made according to the time worked, wages change in proportion to the hours worked;

- time tracking - when in a company one of the indicators of personnel efficiency is hours worked and the employee spent less time at the workplace than expected. If an employee spent fewer hours at work than specified in the standards and requirements of the enterprise, reducing the amount of payments will not violate the laws of the Russian Federation. For example, many companies working with EDI have time-based programs. Staff start the countdown at the start of the workday and close the app before going home. All information is stored in the cloud. The head of the department can check the hours worked at any time;

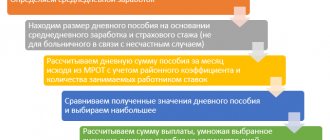

- period of temporary incapacity for work - if an employee falls ill and cannot attend the enterprise, the time spent on sick leave is paid. At the same time, the money is considered compensation and does not relate to wages, and it comes from the Social Insurance Fund, but the employer is responsible for calculating the amount of payments;

- downtime in production - if an employee’s work is suspended, and the fault is not due to the actions of the employer, this period is paid in the amount of 66 percent of the salary. It turns out that during downtime the employee will receive less than the minimum wage;

- skipping work - when a citizen skips work and does not notify management, and also does not provide compelling reasons to explain his absence, the day is not paid;

- absence of an employment contract - if a citizen gets a job without official registration, for example, by signing a document on the provision of services or a contract, a citizen is not protected by the Labor Code of the Russian Federation.

Employees of budgetary organizations, who do not always share the concepts of salary and wages, are interested in the question of whether the salary can be less than the minimum wage in a budgetary organization. This is possible, given that the salary part in government agencies does not include additional payments, bonuses, advance payments and allowances.

What should an employer do if the salary is below the minimum wage?

If the employer wants to comply with the law, then when paying an employee below the minimum wage, he needs to equalize these figures. You can do this in different ways:

- Recalculation. It is necessary to first analyze salary accruals for underpaid allowances. Sometimes the indicator changes due to length of service and other unaccounted for criteria, and the salary becomes higher than the previously established value.

- Accrual of additional amount. This is done by signing an additional agreement to the employment contract and issuing a special order. If the minimum wage increased after the conclusion of such an agreement. The law does not have retroactive force - accruals are made for the minimum wage current at the time of signing.

- Transfer of an employee to another schedule. With the consent of the employee, you can transfer him to part-time work or set him up to work part-time or a week. You can also conclude a civil contract with him instead of an employment contract. The consent of the parties must be secured by an additional agreement or a new contract.

General information

The concept of a living wage

The subsistence level is usually understood as the amount of money per person that he needs to finance his basic needs.

That is, this is the minimum cost of the subsistence basket, which includes food and non-food products, as well as the cost of services (utilities, transport costs, etc.).

The composition of the consumer basket is periodically reviewed (every five years). This indicator is set by the federation and local authorities, taking into account the living conditions in each region. This value is calculated quarterly for each category of citizens (able-bodied, pensioners, children).

Attention! Its value is used in determining the minimum wage, minimum amounts of benefits and pensions. The cost of living indicates the well-being of citizens and how effectively the state implements social policy in the country.

The cost of living in Russia

The cost of living is calculated based on existing prices for goods and services, taking into account established inflation rates. The formula for determining this value includes the norms of consumption of goods and basic services established

Rosstat price index, as well as the existing demand for this product among citizens. Initially, a federal calculation is made, and then local authorities form a local minimum based on it.

The cost of living is determined after a quarter. Therefore, the value currently in effect is that which was calculated based on data from the 3rd quarter of 2020.

The following federal values of this indicator can be distinguished:

- for the working population - 11,310 rubles;

- for a pensioner - 8846 rubles;

- for minors - 10,302 rubles.

Attention! These values are all-Russian. Each subject sets its own values.