Cash fiscal receipt - new changes

In 2020, amendments were made to the law of the Russian Federation on the use of cash registers, according to which entrepreneurs must switch to the use of online cash registers.

This method simplifies the transfer of data to the tax service about completed payments. The main goal of the changes is to give consumers the opportunity to protect their rights, as well as to prevent the unsavory activities of organizations - according to data for past years, the budget did not receive more than two billion rubles in tax payments. In addition, cases of counterfeiting of payment checks are not uncommon. The process of selling goods and providing services will be controlled at every stage - from filling to issuing, through data operators. Also, changes were made to documents on income and expenses, data displayed on the check. According to the new rules, instead of seven points, twenty-four will be required to be filled out. Details have been added that contain personal data and information about the operation performed. According to the law, the items are required to be filled out, regardless of the type of payment receipt - online invoice, paper check.

In addition, the validity of the payment will also be confirmed by additional information - the surname, name and patronymic of the cashier, the cash register number of the manufacturer, the location of the department where you can obtain confirmation of the authenticity of the payment. It will be useful for consumers to know the basic details and their meaning, as this will help them navigate their own rights as a buyer and avoid unpleasant situations.

What details of a cash receipt are established by the format of fiscal documents

The specified regulatory act establishing FFD and the procedure for their application (one of the aspects of which is the regulation of the reflection of details on a cash receipt) is huge in volume and very complex in structure. It is intended more for technical specialists responsible for setting up and ensuring the functionality of online cash registers than for ordinary cash register users. At the same time, it will be useful to become familiar with the key principles for reading and applying those rules that are defined in the formats of fiscal documents.

Additional information about fiscal document formats can be found in THIS ARTICLE.

If we are faced with the task of determining what details should be on the cash receipt of our enterprise, then we will need to have on hand:

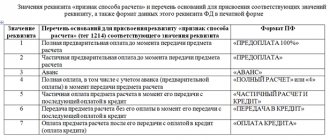

1. Table 3 in Appendix No. 2 to Order No. MMV-7-20/ [email protected].

It contains the rules for the key attribute of the FDF - it sounds like “Mandatory.” That is, an attribute that determines whether it is necessary to include one or another requisite provided by the FFD in the composition of a cash receipt of one type or another.

The rules reflected in Table 3 operate in relation to a specific version of the FDF. There are 3 such versions installed, and in each of them the rules for using the “Mandatory” attribute are installed. can be very different.

So, if the online cash register is configured to generate receipts according to FFD 1.0 (this format will be used until the end of 2020), then the dependencies will be as follows:

- if the attribute is "Required" according to FFD is equal to 1, then the details must be included in the cash receipt;

- if the attribute is equal to 2, include only in cases reflected in the notes to the corresponding attribute;

- if the attribute is 3 or 5, it is recommended to enable it;

- if the attribute is 4 or 6, it is recommended to include it in the cases reflected in the notes;

- if the attribute is equal to 7, you don’t have to include the details in the check.

For comparison, in the case of using FFD 1.05 (the format does not yet have restrictions on the period of application), the rules will be as follows:

- if the attribute is 1 or 3, the details must be included in the check;

- if the attribute is equal to 2 or 4, the attribute must be included if provided for in the notes;

- if the attribute is equal to 5, it is recommended to include the details in the check;

- if the attribute is equal to 6, it is recommended to include the attribute in the check if it is provided for in the notes;

- if the attribute is equal to 7, the attribute may not be included in the check.

2. Table 19 of Appendix No. 2.

Table 19 contains a complete theoretical list of cash receipt details (column “Name of details”). Of these, you need to select those that must be recorded on the check. For these purposes, the table shows specific values for the “Mandatory” attribute. in relation, in fact, to the details of a cash receipt.

The table also has a noteworthy “Form” column, which reflects the specific format of the check - printed (shown by the letter P) and electronic (shown by the letter E), for which the rules for displaying details apply. If in the "Form" column If a combination of PE is indicated, this means that the rules apply to both types of checks simultaneously.

At the same time, in some cases, letters indicating the type of check are included in the “Obligatory” column. and show the obligation to use the details only for a certain type of check - printed or electronic.

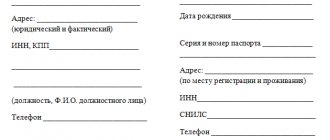

From July 1, 2020, when making payments between organizations and (or) individual entrepreneurs, payment for which was made in cash or by card, a cash receipt must be generated containing the mandatory details “buyer (client)” (tag 1227) and “TIN of the buyer (client)” (tag 1228). Read more about this in THIS ARTICLE.

The remaining columns of Table 19, in principle, are not interesting to us - they are already for technical specialists.

Having at our disposal Tables 3 and 19 of Appendix No. 2, we can easily determine whether it is necessary to include this or that detail in a cash receipt - paper or electronic, at our enterprise.

For example, we are interested in whether it is necessary to include the cashier’s TIN in the cash receipt (it is included in the list of theoretical details in the column “Name of details” in Table 19). What to do?

First of all, we need to find out which FFD the online cash register uses. It’s better to ask technical specialists about this - usually solving the issue takes minutes. Let's agree that our cash registers operate on FFD 1.05.

Next, look at the attribute value in the “Required” column. opposite the “Cashier INN” detail in table 19. We see that it has a value of 7 - and this means (in accordance with table 3 - if we talk about FFD 1.05) that indicating the corresponding details in the check is not necessary, but is possible at the request of the owner online - cash desks.

In addition, in table 19 we look at the adjacent column “Form.” and we see the letter E there, and this means that the rules are established only for an electronic check. There is no need to include the “Cashier INN” details in the printed receipt.

Let’s take some “obvious” detail - let it be “Settlement Amount”. Attribute "Mandatory" for this attribute has a value of 1, which means the attribute is required according to FFD 1.05. In the "Form" column PE is indicated, and this means that the rule is established for both printed and electronic checks.

In Table 19 there is a notable detail “Additional check details”. Attribute "Mandatory" it has a value of 7 (that is, it can be applied or not applied at the discretion of the user), the rule is applicable to both printed and electronic checks. This detail officially gives the user of the online cash register the opportunity to include certain additional information in the check.

They could be, for example:

- store website address;

- advertising message;

- personal greeting to the buyer.

A small nuance: the maximum length of the props in question, in accordance with the formats, is 16 characters. If more space is needed for the required message, then it makes sense for the store to place information “outside the details” on the cash register receipt - that is, simply by printing it in the free space. This is possible based on the norm contained in paragraph 7 of Article 4.1 of Law No. 54-FZ. It says that the check can be supplemented with other details not provided for by federal law, taking into account the specifics of the trade enterprise’s field of activity.

Information “outside the details” can, in principle, be anything. This may not necessarily be text - it is quite possible to place, for example, a store logo or more detailed information about a promotion. It is important that the “mandatory” details are clearly visible on the check.

It is important not to confuse the concept of “Additional details” in the context of Table 19 (and paragraph 7 of Article 4.7 of Law No. 54-FZ) and the term “Additional details of fiscal documents” given in Appendix No. 1 to Order No. MMV-7-20 / [email protected ] In this case, we are talking about the mandatory details of those fiscal documents that are generated at the online cash register along with regular cash receipts - for example, these could be correction checks, reports on the opening and closing of a shift.

By the way, it is also important to comply with the FFD requirements established for such documents. Lists of details for specific types of FFD can also be determined in a “tabular way” (for example, details for a correction check are given in Table 30 of Appendix No. 2 to the order) - by analogy with the rules we discussed above in relation to determining the list of details for a regular check.

In cases provided for by law, an enterprise has the right to use details in a shortened list - let’s take a closer look at such cases.

New details

Already today, in any store, a consumer may encounter a hand-delivered receipt with a bunch of numbers and symbols. From the set, abbreviations such as RN and ZN, FD and FDP stand out. At first glance, letters that do not carry any semantic load can turn out to be useful when it comes to protecting consumer rights. Deciphering the points on a fiscal receipt will help you not only prove that you are right, but also avoid purchasing low-quality goods and protect yourself from scammers.

Also in common use, thanks to automation and technology, are concepts such as electronic check, fiscal data operator. The consumer cannot rely on a standard sales receipt, since it is not an official payment document. A fiscal check has legal force, so it is important to know the intricacies of its preparation.

Lost cash receipt

Until recently, in such a situation, it was possible to prove the fact of purchase only if there were documents issued along with the lost receipt. Modern devices, thanks to a built-in memory unit that provides long-term storage of information, allow, if the need arises, to issue a duplicate to the buyer as many times as required. The legislative framework does not contain prohibitions on carrying out such operations.

But it is worth remembering that check forgery is punishable by law and can lead to fines and even criminal liability.

What is ZN?

Online cash registers, regardless of the date and place of issue, have a personal license plate, which is applied directly during assembly at the enterprise. The numbers are a sign of the authenticity of the machine; they are placed in the passport documents for use and separately on the casing of the device. The set of characters must match; it is entered into the database when registering with the tax office. In addition to cash registers, numbers are assigned to vending machines and fiscal drives.

This serial number (SN) will be reflected on the fiscal receipt after the transaction. In addition, if the cash register is built into another device, its number will also be displayed on paper. If the consumer does not find the equipment license plate number on the payment receipt after a monetary transaction, then the online cash register has been unofficially assembled and installed, and any financial transfers made with its help are illegal.

The Internet resources of the Federal Tax Service indicate the authentication method not only by number, but also by model of the cash register. The method is suitable if for some reason there is no registration number, the model and the data obtained will help to verify the originality of the installed device, since when registering, the name of the model is also entered into the register, along with the number.

In the fiscal receipt, the license plate is located in the list of required details, after the subscriber’s TIN. Finding the indicator is simple - in front of the two capital letters ZN there is an arrow pointing upward. And the fiscal drive number supplied by the manufacturer is located at the very bottom, above the QR code.

Cash register receipt: the main document for the operation

For several years now, there has been a norm in the country that establishes the mandatory presence of a cash register for all business entities. After each transaction of selling goods, the individual entrepreneur must issue a cash receipt. It is this document that confirms open activity. On its basis, the cash discipline of individual entrepreneurs is checked, as well as compliance with all fiscal norms established by the legislation of the Russian Federation. For a failed cash receipt, the entrepreneur is expected to be punished in the form of a fine.

The check issued by

the cash register is a fiscal document that is printed on a special tape and must have a set of

mandatory details . The latter include:

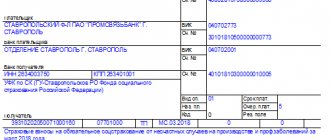

- name of the individual entrepreneur according to registration documents;

- taxpayer identification number - individual entrepreneur;

- serial number that was assigned to the cash register at the manufacturer;

- serial number;

- date of purchase;

- time of the transaction shown on the receipt;

- price of purchase or service provided;

- type of fiscal regime.

All these parameters can be indicated on this fiscal document during issuance in any order. That is, there is no single structure for a cash register receipt. The main thing is that the required details are indicated.

How to decipher cash register pH

RN is an abbreviation meaning cash register registration number. This is a sign that the device has been registered with the Russian Tax Inspectorate according to all the rules. In the cash desk service, they undergo a fiscalization procedure, after which they can be used in the trade sector. On the receipt, this position can be found at the top of the barcode; it is designated as RN KKT or KKT with a number icon. The procedure for registering cash register equipment is strictly regulated and includes the following stages:

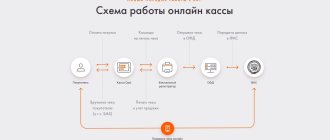

- A private entrepreneur signs an agreement with a fiscal data operator. The OFD plays the role of an intermediary between the apparatus and the tax office, since payment statements and data on the goods and services being sold pass through this organization. Their responsibilities include processing information, transferring it to the appropriate authority, and subsequent storage for five years. Also, the OFD can identify forgery in reporting documentation and send a message about this case to the tax service.

- Submitting a petition to the tax office from an entrepreneur. The service carries out appropriate checks, the information about which is received by the individual entrepreneur.

- During the period of registration of equipment, its fiscalization is carried out, after which it is necessary to submit a financial document to the tax office.

- Issuance of a registration card to the entrepreneur, which contains a number.

According to new amendments to the law on cash registers, OFDs must report to the tax office about the provision of services to entities. In their reports, operators indicate the serial and registration numbers of the equipment, therefore, upon completion of the registration procedure, the owner of the devices is obliged to provide the license plates of the fiscal drive and cash register, their registration numbers to the fiscal data operator.

Online cash register receipt sample

Figure No. 1. Paper version of the check

Table No. 1. List of details of a new sample cash receipt

| Line number | Required details |

| 1 | Name of the company or individual entrepreneur that issued the payment document |

| 2 | Individual Taxpayer Number (TIN) |

| 3 | Tax system |

| 4 | Address at which payment is made to the buyer |

| 5 | Number of the shift in which the document was issued |

| 6 | Check number |

| 7 | Position and initials of the employee or other person who issued the document |

| 8 | Type of calculation |

| 9 | Time and place of document issue |

| 10 | Name of purchased product |

| 11 | Product price including VAT |

| 12 | Indication of the tax included in the cost of goods (services) |

| 13 | Total purchase amount |

| 14 | Total amount of VAT included in the price |

| 15 | The amount of funds received from the buyer by bank transfer |

| 16 | Amount of cash transferred by the buyer |

| 17 | A website where you can check the authenticity of the issued document |

| 18 | CCP registration number |

| 19 | Fiscal storage number |

| 20 | Fiscal document number |

| 21 | Fiscal sign of the document |

| 22 | Name of fiscal data operator |

| 23 | Fiscal data operator website |

You can briefly familiarize yourself with the changes made to Law No. 54-FZ of May 22, 2003, including how checks issued through an online cash register differ from checks issued previously, in the following video:

FD - what is it and what is it indicated for?

Fiscal checks are an official confirmation on paper of a completed trade or monetary transaction. Having received it in hand, the consumer, if necessary, can prove that he has paid for the service or product in full. This paper is reporting documentation that displays all data on transactions through the cash register. During settlements, the check displays the total amount of expenses and receipts for the reporting period.

The Federal Tax Service strictly controls reports on the provision and execution of checks, therefore the employee who uses cash register equipment retains administrative responsibility in the event of non-issuance of a receipt or its untimely submission to the inspecting authority. An employee receives a fine for improper use of cash register equipment.

The check issued to the consumer and submitted in the report must be original. Its authenticity is based on a number of specified details. Columns such as shift and shift receipt numbers, fiscal data and document attributes help to distinguish receipts.

Fiscal data, signs and check number are different positions that differ not only in signs and location on paper:

- fiscal data (FD) – these are documents, their number, that are submitted to the operator during the operation of equipment with a license plate;

- document features (DFD) - this is a code designation that is generated with a key to encrypt information on the service performed and transmit it to the tax office;

- the number of the pay slip for a shift indicates the order in which it is generated during one shift from the moment the enterprise starts operating until it closes. By analogy, the first forms will receive number one, subsequent ones - two, three, etc.

A check, as a reporting document, contains a set of characters and codes that carry specific information not only about payment, but also data about the cash register, cashier, and so on. The fiscal details show the registration number for payment for the service, which is registered with the tax office.

In addition to the above-mentioned designations, during the year it will be mandatory to enter the product code into the corresponding receipt. The code must be affixed to products that have received identification markings - tobacco products, medicines, textiles, shoes, fur goods. Also, based on the amendments to the law on apparatus, separate clauses may be added for special areas of service provision and calculations for them, which are not regulated by clause 1.

Are individual entrepreneurs required to issue cash receipts?

The obligation to use CCP does not depend on the organizational and legal form, but on the taxation system used.

You can learn about the need to use a cash receipt in different taxation systems from the visual table.

Thus, individual entrepreneurs who pay UTII can, at the time of payment, issue not a CC, but another document replacing it. In addition, UTII payers whose activities are included in the list presented in Article 2 No. 54-FZ have the right not to use cash registers and not to issue any other documents.

In other cases, individual entrepreneurs on UTII can choose between cash register and registration of documents replacing a cash receipt.

Individual entrepreneurs located on the PSN, like UTII payers, have the right to refuse to use cash registers. And use BSO as confirmation of payment.

https://youtu.be/6R7LB1PKMQc

Why do you need an online check and how to get it

Another innovation for consumers is the ability to receive a fiscal receipt in electronic format. Benefit for buyers:

- storing the receipt on an electronic storage device safe from damage for a long time;

- optimization of cost accounting for services and goods - a self-created database on gadgets frees you from the need to store paper coupons and makes viewing them faster;

- If any troubles arise - the return of goods, accusations of non-payment of services, the buyer can at any time provide the authorities or the entrepreneur with a complete copy of the payment document.

Any consumer can receive a receipt in several ways:

- When checking out, the buyer indicates his email or mobile phone number. The seller sends a check electronically by letter or SMS message.

- Applications on a smartphone. Installed programs help you read the barcode on a paper ticket using the camera. Free services from PlayMarket help collect and organize received electronic copies. This method is convenient, it helps to save coupons from different organizations, stores, etc. in one place.

- The official portal of the fiscal data operator on the network. This option can be used if the consumer knows the address of the operator’s page from an existing receipt. There is a search system on the site through which you can get a copy after entering the number of the payment receipt, FP, ZN of the online cash register.

An entrepreneur may not provide a printed document to the consumer if the product or service was paid for via the Internet. Also, you don’t have to print out the receipt if vending equipment is used for sales.

In such situations, the seller retains the opportunity to use the cash register without a printed supplement. Such machines are automated, some of them can be mounted directly into the casing of vending equipment. They can also be used for online payments between consumers and sellers, as they have specially installed software. The transfer of the receipt in electronic form occurs automatically after payment for the goods, provided that the buyer indicates a mobile phone number or email address.

How to check check details?

The Tax Service provides this opportunity on its official website for those who have installed the appropriate mobile application. With it you can:

- receive and store online cash register receipts;

- check their authenticity;

- inform tax authorities about detected violations.

To use this application you will have to register your data. You will be prompted to do this the first time you access the program.

For verification purposes, the user can enter the check details required by the program manually or scan the QR code of the check. After sending the data and processing it by the application, the user will be provided with the results of the verification. After reviewing the corresponding results, the user will be able to inform the tax authorities about the violation. It is also possible to send a violation report in cases where:

- the receipt was not issued by the seller;

- the check details are incorrect;

- e-receipt from the seller was not received.

The address of a website on the Internet where the user can check the existence of a record of this calculation and its authenticity must be indicated on the receipt.

In addition, we suggest that you read the article “How to indicate the name of services on a cash receipt?”

What is a correction check?

In accordance with the law, another type of cash documents is generated by the online cash register - a correction check, which is used in emergency cases . It helps the seller in a situation where, for technical reasons, when accepting payment from the buyer, it is not possible to use the cash register online, for example, as a result of a power outage. A check for the amount must be issued later, at the first technical opportunity.

Correction checks contain standard information, with the exception of product names and buyer contact information. The key point is the payment amount, which must exactly correspond to the amount paid for the goods when the online checkout is not working - errors in this case are unacceptable.

The generation of this type of document can be carried out at the initiative of the store and in the event of an inspection based on unsatisfactory results or identified violations.

Comparative characteristics of new and old checks

The list of basic check details is fundamentally different from that used in similar documents before the official obligation of sellers to use the new online cash register equipment.

The new document has become much more complex in structure, and as a result, requires the use of high-tech devices. In practice, many positions can only be reflected using sophisticated equipment that can reproduce graphic images of QR codes, generate links and translate contact information into a standard format that is easy to read.