Required check details in 2020: list

Mandatory details in the online cash register receipt for 2020 are determined by Law No. 54-FZ dated May 22, 2003 and Order of the Federal Tax Service of Russia dated March 21, 2017 No. MMV-7-20/

The required details of a cash receipt are listed in paragraph 1 of Article 4.7 of the Law of May 22, 2003 No. 54-FZ. All details of the check must be clear and easy to read for at least six months after issue (Clause 8, Article 4.7 of Law No. 54-FZ of May 22, 2003).

Here is a list of required online cash register receipt details for organizations and individual entrepreneurs:

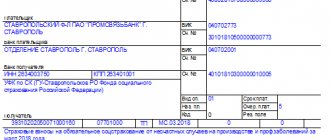

- Title of the document;

- serial number of the document for the shift;

- date, time of calculation;

- the place, address where the calculation is carried out depending on the place where it is carried out (postal address of the building, or the name, number of the vehicle and address of the organization (IP), or the address of the website on the Internet);

- name of the organization (last name, first name, patronymic individual entrepreneur);

- TIN of the organization (IP);

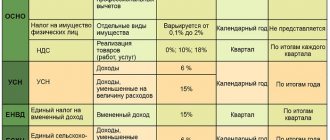

- the applied taxation system;

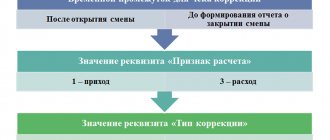

- calculation attribute (receipt, return of receipt, expense, return of expense);

- name of goods, works, services, their quantity, unit price, cost, VAT rate (except for cases when the calculation is made by a user who is not a VAT payer or exempt from VAT, as well as when making payments for goods not subject to VAT);

- the calculation amount with a separate indication of VAT rates and amounts (except for cases when the calculation is made by a user who is not a VAT payer or exempt from VAT, as well as when making payments for goods not subject to VAT);

- form of payment (cash, electronic payment), amount of payment in cash and (or) electronically;

- the position and surname of the person who made the settlement with the buyer, issued the cash receipt and issued it to the buyer (with the exception of settlements made through automatic devices, including those used for non-cash payments on the Internet);

- CCP registration number;

- serial number of the fiscal drive;

- fiscal sign of the document;

- serial number of the fiscal document;

- the address of the OFD website on the Internet, where in the future it will be possible to check the fact of recording this calculation and the authenticity of the fiscal indicator;

- phone number or email address of the buyer (in case of transfer of a cash receipt to him in electronic form);

- email address of the sender of the cash receipt in electronic form (in case of transfer of the cash receipt to the buyer electronically);

- shift number;

- fiscal sign of the message (for cash receipts stored in a fiscal storage device or transmitted by the OFD);

- QR code;

- FDF version number (for electronic form);

- fiscal document form code (for electronic form);

- product code.

Online cash register since 2020

Time moves inexorably forward, every day the next milestone in the implementation of Federal Law 54 is getting closer.

The stage of voluntary transfer of fiscal data to the tax office is quickly ending. Despite all the difficulties, businessmen are one way or another forced to accept all the rules of the game of Russian legislation. For most owners, the information that now each cashier’s workplace must be equipped with new cash register equipment capable of transmitting fiscal data online is no longer news (online cash register from 2020 - 54-FZ - read details).

It would seem that there is nothing difficult in choosing a cash register online, just focus on its cost and key technical characteristics, but alas, not everything is so simple! In order to make the right choice, you need to take into account the nuances.

Online cash register - what is it?

The first thing you need to understand is the basic differences in the technical basis of cash registers - online.

There are three types of cash registers capable of transmitting FDO data in real time: 1) Online - cash register, which is based on an autonomous cash register, let's call it a mobile cash register - online. This type of cash register already contains cash register software on board, and therefore does not need to be connected to the host equipment.

2) Cash register - online, developed on the basis of a fiscal registrar, let's call it an online fiscal registrar, which only works in conjunction with a cash register program installed on the POS system / PC / laptop.

3) Universal online - cash register, capable of acting as both an independent stationary and connected online cash register.

Before we begin to describe each type of cash register, it is necessary to dwell on the key requirements of 54-FZ for cash registers: 1) transmission of data on OFD sales online; 2) generation and printing of QR codes; 3) transfer of an electronic check to the buyer’s mail or phone; 4) displaying the name of the product in the receipt, its quantity, as well as its price taking into account the discount.

If the first two points, as a rule, are fulfilled by all online cash registers, then the last two are not supported by all types of online cash registers, and this is a direct violation of the law.

Is online mobile cash register so good?

The online cash register, developed on the basis of an autonomous cash register, has on board not only a receipt printing device with a fiscal drive, but also a cashier’s monitor, a keyboard for entering information, cash register software, tools for generating and printing a QR code, as well as data transfer modules OFD at the time of the transaction.

Disadvantages: - not all mobile cash registers online are capable of transmitting an electronic version of the receipt to consumers (check with the manufacturers); — many mobile cash registers online DO NOT support the ability to print the name of the product on the receipt, as well as prices including discounts (!!!); - stationary independent cash registers - online, as a rule, they work only on a narrow 57mm receipt tape (which is not very convenient when selling more than 5 types of goods - the length of the receipt becomes indecently large); — low receipt printing speed (from 45 to 75mm/sec); — lack of automatic receipt tape cutter; — the cash register software installed on the cash register has extremely limited functionality; - an inconvenient way to create an item using buttons on a cash register. If there are more than 100 positions, then this is an almost impossible task. Sometimes online mobile cash registers come with software for creating items using a PC/laptop. — a limited number of interfaces for connecting peripheral equipment (customer display, programmable keyboard, cash drawer), barcode scanner, scales and banking terminal, if the latter is not provided structurally. Often, an independent stationary online cash register is limited to one USB and RS-232 input.

Pros: - relatively low cost of the cash register - online (no need to additionally purchase a POS system / PC, cash register software); — compactness of the device.

KKT ELVES-MF KKT YARUS M2100F KKT Pioneer 114F

Fiscal registrar - online - is it worth the expense?

The online cash register, where the fiscal registrar is taken as a basis, is a “smart” receipt printer with a fiscal drive, endowed with “brains” that allow you to generate and print a QR code, transmit fiscal data online to the authorized OFD, send an electronic version of the check to the buyer by cell phone and email.

Such cash registers cannot work independently; they are part of the system. For full operation, a connected online cash register must be paired with a POS system or a PC with an installed cash register program, which actually controls the receipt printing device. The online fiscal registrar does not have buttons, and therefore is not a full-fledged cash register in itself.

Disadvantages*: — a third-party cash program is required; — there is no possibility of working without connecting to additional equipment; — higher cost due to the need to work together with a POS system / PC with installed cash register software

Pros: - printing on 57mm or 80mm receipt tape; — high speed of receipt printing (from 75mm/sec to 300mm/sec); — the ability to select a cash register — online with an automatic receipt tape cutter; — connection interfaces are required only for pairing with a POS system/PC, cash drawer and the Internet; peripheral equipment is connected not to the cash register - online, but to the control computer; — the ability to maintain full accounting of goods (in conjunction with cash register software and inventory accounting); — support of a huge nomenclature database; — ease of establishing commodity items; — support for the loyalty system (bonus, savings systems, etc.); — ample opportunities to provide flexible systems of discounts to customers; - etc.

(*) All restrictions on the functionality of the online fiscal registrar are related to the capabilities of the cash register and/or merchandise accounting program, and not the online cash register system.

KKT RETAIL-01F KKT RR-01F KKT RR-02F KKT SHTRIH-ON-LINE KKT SHTRIKH-M-01F and other fiscal registrars - online. Compare fiscal registrars online and choose the best one

Universal online cash register - what is special?

The universal online cash register is capable of operating as an independent stationary cash register, or as part of an integrated model with a connection to a POS system / PC with pre-installed software.

Universal cash desks inherit all the vulnerabilities and advantages of independent stationary cash registers - online, at the same time, they acquire the ability to work like a fiscal registrar - online.

Disadvantages: - mobile cash registers - online, as a rule, only work on a narrow 57mm receipt tape (which is not very convenient when selling more than 5 types of goods - the length of the receipt becomes indecently large); — low receipt printing speed (from 45 to 75mm/sec); — lack of automatic receipt tape cutter.

Pros: — the possibility of a phased transition to full-fledged store automation; - relatively low cost of cash register - online.

KKT SHTRIH-MPEY-F

It’s up to you to decide which cash register to choose online, if the material presented was not enough, pay attention to the following material: Connected cash registers, fiscal registrar - online comparison Store automation in Novosibirsk - ready-made solutions or contact the managers of the Outtrade online store - we are happy to help you!

What if the product is marked?

The government approved a new mandatory detail for a cash receipt - “product code” (Government Decree No. 174 dated 21.02.2019). Receipts with the new details will need to be punched when selling goods that require mandatory labeling. The details will contain an identification code - a sequence of characters representing a unique number of a product instance.

Government Decree No. 174 comes into force on March 8, 2019. However, the obligation to indicate the “product code” on the receipt will arise only three months after the regulatory legal act on mandatory labeling of goods comes into force (subclause 1 of Government Resolution No. 174). Also see “Which products are subject to mandatory labeling“.

Online cash registers without nomenclature: who is allowed

However, there is a certain group of companies and entrepreneurs who are given the opportunity to defer the requirement for the mandatory inclusion of such details as nomenclature in online cash registers until February 1, 2021. These include individual entrepreneurs on a patent, simplified tax system, unified agricultural tax and UTII, with the exception of businessmen involved in the sale of excisable goods (paragraph 9, paragraph 1, article 4.7 of Law No. 54-FZ on CCP). Please note that the law clearly states that the benefit applies only to individual entrepreneurs. Organizations are required to register nomenclature when issuing a cash receipt using an online cash register from July 1, 2020.

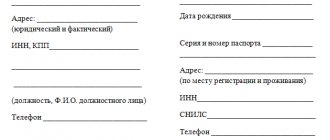

New details of cash receipts from July 1, 2019

| When making payments between organizations and individual entrepreneurs in cash or using electronic means of payment | When paying winnings and insurance premiums |

| 1) name of the buyer (client): name of the organization, last name, first name, patronymic (if any) of the individual entrepreneur; 2) INN of the buyer (client); 3) information about the country of origin of the goods (when paying for the goods); 4) the amount of excise tax (if any); 5) registration number of the customs declaration (when paying for goods and if available) | 1) name of the client or policyholder (name of the organization, surname, first name, patronymic of an individual entrepreneur or individual); 2) TIN of the client or policyholder (if the individual does not have a taxpayer identification number - the series and number of his passport) |

Additional details are not required:

- on a paper check – if you use FFD 1.1;

- paper and electronic check – if you use FFD 1.05.

This is discussed in the letter of the Ministry of Finance dated November 28, 2018 No. 03-01-15/86080.