From July 2020, most companies selling retail and providing services to citizens will have to use online cash registers. It is possible to ensure the functioning of these devices only with the help of specialized operators who process fiscal data from cash register equipment (CCT) and transmit it to the Federal Tax Service. Permission to conduct such activities is given to legal entities by the tax office. It is not difficult to find out whether a company has the right to process fiscal information: to do this, just study the updated list of OFD on the Federal Tax Service website. Let's find out how organizations get into this register, what services they provide to taxpayers, and what they will have to face when choosing a suitable operator.

Legislative norms

The legal basis for the operation of a new type of cash register was Law No. 54-FZ of May 22, 2003, which prescribed the procedure for using cash registers in cash and electronic payments. The regulation states that information on all retail sales must be transmitted to the tax office online, and the transfer of fiscal data to the Federal Tax Service is possible only through the mediation of a specialized operator.

According to Art. 4 of Law No. 54-FZ, a fiscal data operator is an intermediary organization that has received permission in the manner prescribed by law to process information from online cash registers. The main task of FD operators is to receive, process, transmit and store information about payment transactions. To solve it successfully, the FDO interacts:

- with taxpayers, helping them to properly operate cash register systems and use additional opportunities for fiscalization of information;

- with the Federal Tax Service inspections, transmitting information about the revenue received.

Which operator is better

Currently, 19 companies are officially registered that have the right to work with online cash registers for the transfer and storage of data. Therefore, many are trying to determine which fiscal data operator is better.

It should be noted that in general, the essence of the work is the same for everyone. Also, the cost of their services is the same - 3,000 rubles per year for one cash register. But some companies provide the opportunity to pay for services per day, month, or several years in advance. In the latter case, however, you can get a small discount on services.

The service of all companies is excellent, since each of them is not new to the field of telecommunications services.

Attention: therefore, you can choose any operator to connect. If in doubt, you can consult your service company or service center.

Surely, they have already tried several operators and can tell exactly where the connection is easier and where it is difficult. Some cash register manufacturers recommend a specific company to use.

https://youtu.be/vcaE-V_vpyY

Functions of the OFD

Each fiscal data operator, being an intermediate link between the taxpayer and the regulatory authority, is obliged to provide interested users with round-the-clock access to fiscal information online. This is convenient for both businessmen and tax authorities. Entrepreneurs regularly study reports on cash register operation, finding out which cash register opened a shift, which one stopped serving customers, why the equipment is inactive, and how much revenue is reflected for the selected time period.

Federal Tax Service specialists now have access to information about tax amounts and the dates of their receipt. The installation of cash registers in stores that have a fiscal data recorder allowed tax officials to refuse to check primary documentation. Accordingly, taxpayers got rid of the unpleasant obligation to collect accounting documents confirming compliance with cash discipline.

Online checkouts are beneficial even for customers. They can check the received receipt at any time, make sure that all purchases are correctly reflected in it, and if violations are detected, contact the tax office with a complaint about the dishonest retail outlet.

In addition to the basic function, OFD has the right to provide clients with additional services:

- act as a lessor of equipment for online stores;

- generate analytical reports on sales with varying degrees of detail;

- send SMS notifications to customers;

- if necessary, register, supply or deregister a cash register.

What functions does the OFD perform?

The FDO must continuously perform the following functions:

- Receive receipts, BSO, shift opening and closing reports and other documents from the cash register;

- Check the fiscal characteristics of each received document;

- If the received document turns out to be counterfeit, immediately report this fact to the tax office;

- Submit to the tax office all documents received from the cash register. Provide access to them at any time during the established storage period;

- Process incoming data continuously 24/7/365;

- Protect all fiscal data received by it from hacking, theft, and misuse;

- Store all incoming information for 5 years;

- Provides the buyer with the opportunity to verify the authenticity of the received check;

- Sends checks to customers by email.

List of OFD companies with permission from the Federal Tax Service

For organizations using an online cash register, concluding an agreement with the FD operator is mandatory. In this case, the choice of a specific operator remains with the taxpayer. The list of OFD is periodically updated, so before concluding a service agreement, make sure that the organization you like is included in it.

As of April 2020, there are 21 registered operators in the country with official permission to process FD. The full list of OFD on the Federal Tax Service website can be seen by following the link. If you carefully study the list of fiscal data operators, it becomes clear that the legal entities included in it are conditionally divided into four groups:

- organizations that are simultaneously operators of electronic document management with the tax inspectorate: JSC PF SKB Kontur, LLC, Taxkom LLC, CJSC KALUGA ASTRAL, LLC Electronic Express;

- companies providing services for accepting and processing electronic payments: Yandex.OFD LLC, Multikarta LLC;

- leading industry players: Tander JSC (retail), Vympel-Communications PJSC, NVision Group JSC (mobile communications);

- others.

The Tax Service regulates the work of the above organizations. It also “accepts” interested organizations as fiscal data operators in Russia. The list is formed on the basis of relevant orders of the Federal Tax Service.

Table: list of parameters of some OFDs

| Name | Name registered in CCP | Website address |

| JSC "Kaluga Astral" | Astral OFD | ofd.astralnalog.ru |

| Yarus LLC | OFD-Y | connect.ofd-ya.ru |

| LLC "Company Tensor" | Tensor Company | kkt.sbis.ru |

| LLC "Kontur NTT" | NTT circuit | ofd.kontur.ru |

| Taxkom LLC | Taxi | f1.taxcom.ru |

What services do OFD offer?

The transfer of checks itself is a low-profit business. Therefore, OFD is trying to develop in other directions. “Over the three years of work, the needs of the business have increased, and new responsibilities have been added to the previous ones. They are not so much regulated by law as they are determined by commercial activities and the wishes of clients. Today, the OFD client’s personal account is the point at which the client receives information not only about how the tax service sees him, but also about himself, about his position in the market,” says Alexey Barov , CEO of the OFD Platform.

OFDs strive to offer customers a wide variety of services, develop the direction of big data, which allows them to analyze the retail market as a whole, identify trends, make forecasts and offer solutions. Another important area is the integration of data available from the OFD with data from other companies, such as telecom operators, banks, etc. in order to jointly ensure the development of new directions and services. Fiscal data operators are also quite successfully mastering a new direction for themselves - becoming operators of electronic document flow and reporting to government agencies.

Fiscal data operators continue to develop in the area related to the introduction of a national labeling system. “It became clear that OFD, as an obligatory element of business processes when disposing of goods, can and should offer clients tools for working with markings and marked goods, starting with analytics, monitoring the correctness of the transfer of receipts to a ready-made comprehensive solution that allows the client to order and receive codes labeling, integrate with systems and do everything that is necessary along the entire path of needs from input to output of goods from circulation, in one interface,” says Alexey Barov.

Large businesses are interested, in addition to the uninterrupted operation of the OFD, primarily in refining existing and developing new reporting based on cash receipts. “For large businesses, uninterrupted transmission of fiscal data is not as interesting as additional services and technical capabilities of the OFD. The most popular services are the ability to gain API access to all transferred data and sent receipts via SMS and e-mail,” says Kaluga Astral (“Astral.OFD”).

Large businesses are already taking steps towards deeper integration of CRF data into their CRM and accounting systems. “The synthesis of systems and data that we are now seeing will allow us to solve both the traditional problems of large companies with a wide network of representative offices, holdings of dozens of legal entities, franchises, etc., and to identify management and accounting errors accumulated by complex systems,” Egor Sergeenko is sure . “All this will lead to a reduction in risks and will affect the operating costs of large companies.”

Medium and small businesses are experiencing a painful transition from the previous style of work to a new reality, which is filled with new entities, for example, such as CRF and product labeling, ecosystems, entrepreneurship development programs and government support. According to representatives of Kaluga Astral, for now, only the main functionality of the OFD is important to small businesses - the uninterrupted sending of fiscal data to the Federal Tax Service and the registration of cash registers.

Nevertheless, according to Yegor Sergeenko, there are entrepreneurs who have already integrated into the new system and have accepted all the advantages of the new order, as well as the costs of maintaining it. For this kind of businessman, any OFD, bank, EDI operator and other market participants have a lot of useful tools for opening and running a business. Now you can open a business from scratch in a very short time, and the costs are minimal. Competition in the market of business ideas, competition between technical teams to create business management systems, inventory programs and other services is now higher than ever, and this leads to lower prices and improved quality of products and services. And also to the emergence of new solutions that have not yet been seen - mobile, cloud systems, systems with artificial intelligence, self-learning neural networks. This means that the task of creating a comfortable environment for entrepreneurs has been completely solved and is currently being solved by all participants in this market.

Will the list of operators be expanded?

The OFD register compiled by the tax office is not closed: it is constantly updated with new companies. Over the two years since Law No. 54-FZ came into force, the number of FD operators has increased from 16 to 21, that is, 1.3 times. Despite the fact that the main market players have already been named, experts expect that in the near future the largest retail companies will follow the example of Tander JSC (Magnit retail chain) and receive appropriate permission from the Federal Tax Service. Therefore, the answer to the question of how many fiscal data operators there are in Russia will probably change by the end of this year.

The opposite situation is also possible: if a company repeatedly violates the requirements of the law, it may be deprived of the right to engage in activities related to the processing of fiscal information and be excluded from the list. A company can also stop its FD processing activities on a voluntary basis.

Which organizations are included in the OFD register on the Federal Tax Service website

By August 2020, 12 companies were included in the register. Everyone provides the same service at approximately the same price - 3 thousand rubles. The companies differ only in additional services: advanced statistics, sending receipts to customers or their own software.

All organizations from the list of fiscal data operators (August 2017)

"First OFD"

They are developing technologies for secure information transfer. One of the very first online cash register operators. In 2014, we took part in experimental work with online cash register systems. One of the advantages is a convenient testing platform. If the account runs out of funds, the cash desk will be able to operate for another 5 days, which will be enough to pay.

Subscribe to our channel in Yandex Zen - Online Cashier! Be the first to receive the hottest news and life hacks!

"Takscom"

They are developing secure channels for transmitting information. The largest center for issuing digital signatures. They have their own training center, so they conduct seminars and training courses for their clients. They cooperate with the Russian Ministry of Foreign Affairs. Became an accredited OFD in the top three (Evotor OFD)

Joint development of Sberbank and Atol. They are engaged in automation of small businesses. For those who use Atol.Online or acquiring from Sberbank, they provide the services of an online cash register operator at a discount or even free of charge. We have introduced the ability to pay per day, month, quarter or year, which is convenient for seasonal businesses. They were among the first to be included in the OFD list, like “Takskom” and “First OFD”.

"Tier"

They have been developing software for banks since 2007. Collaborate with.

OFD.RU (PETER-SERVICE Special Technologies)

We have been creating programs for telecommunications services for 20 years. The advantage is easy connection, since the cash register itself downloads all the necessary data. When paying for services, the company provides a month of free service.

To get on the list of organizations of fiscal data operators, you need to pass a check at the FSB and receive a certificate from the Ministry of Communications and Communications.

- Equipment setup 1,000₽ 1,000₽ 1000 https://online-kassa.ru/kupit/nastrojka-oborudovaniya/ OrderBuyIn stock

- Firmware VAT 20% Mercury 185F 1,000₽ 1,000₽ 1000 https://online-kassa.ru/kupit/proshivka-nds-20-merkurij-185f/ OrderBuyIn stock

- Firmware VAT 20% Elves MF 1,000₽ 1,000₽ 1000 https://online-kassa.ru/kupit/proshivka-nds-20-elves-mf/ OrderBuyIn stock

"Yandex.OFD"

Search engine and developer of more than 50 Internet services and portals. When working as FDOs, they use their technologies in the field of big data processing.

"Electronic Express"

The creators of the legal system GARANT. Their service has been used by lawyers, accountants and executives since 1990. To sign an agreement with this operator, you do not need to have a cash register.

"KALUGA ASTRAL"

One of the three largest special communications operators in the country. They provide services for VTB24, TinkovBank and AlfaBank. Participated in the experimental use of online cash registers. Dreamkass partner.

"Tensor"

They issue certificates for digital signatures, deal with electronic document management and business automation. Developers of VLSI network communications. So far, OFD does not have a test site, and the support service works only with partners and clients. There is a mobile application for clients.

"KORUS Consulting CIS"

Owned by Sberbank companies. One of the leaders in electronic document management. They have a network of partners throughout Russia.

"SKB Kontur"

They have been developing accounting software since 1988. They issue digital signatures and handle electronic document management. Create information security systems. We have developed about 30 products for business.

"Thunder"

An online cash register operator created by the Magnit retail chain for its stores. Initially, the network connected to the First OFD, but then registered a personal operator. Other businesses can also join Thunder. The company has already been included in the OFD list on the Federal Tax Service website and has developed a personal account, but has not yet made a website.

These are all fiscal data operators in Russia, but the list of organizations will continue to grow. In 4 months, 7 new companies entered it. Therefore, follow the updates on the Federal Tax Service website.

Technical support of equipment. We will solve any problems! Leave a request and receive a consultation within 5 minutes. Rate how useful the information in the article was?

How to choose OFD

Today, the annual service fee for one online cash register is fixed - 3,000 rubles, so it will not be possible to find a “cheap” operator. The quality of the service provided also does not differ significantly, since almost all organizations on the Federal Tax Service list are experienced players in the telecommunications market. You will have to choose based on other criteria: the company’s reputation, ease of use of your personal account, quality of technical support, flexibility of interaction with the client. It is also useful to study the list of additional options provided by FD operators.

Therefore, if you are only interested in connecting an online cash register, choose any company that has permission from the Federal Tax Service. When you need to use additional services, check whether the chosen organization will provide them to you.

Criterias of choice

In order not to be disappointed in the chosen operator, before concluding a contract, evaluate the organization according to the following criteria:

- Universality - OFD must support the operation of online cash registers of all models.

- Easy to connect to the service - for the “right” operator, the cash register appears in your personal account after the first successful transaction.

- Availability of fast payment by invoice and by bank card. This is important if the company constantly issues invoices to clients.

- Possibility of choosing tariff plans of various durations. Relevant for entrepreneurs engaged in seasonal business.

- "Single window" mode. A big plus is the ability to receive several services through one official OFD website.

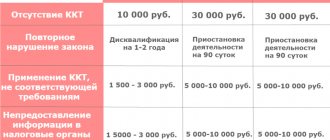

- Reliability - the presence of negative reviews about the operator may indicate that the service is not functioning properly. For the taxpayer, this is fraught with large fines for late transfer of checks to the Federal Tax Service.

Compliance of the OFD with the stated requirements guarantees the uninterrupted transmission of fiscal data, and therefore minimizing the risk of claims from the tax authorities.

Rating methodology

CNews wrote about the growth of the market not “in width”, but “in depth” a year ago. In 2020, this trend began to play an even greater role in the OFD business, which forced us to once again adjust the methodology for creating the third rating. The key indicator remains the number of connected online cash registers, which is estimated based on data provided by the OFDs themselves and expert assessments. However, it was decided to reduce the weight of this indicator from last year’s 0.7 to 0.6, and to pay even more attention to additional services offered by market participants.

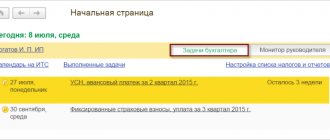

These services were divided into 4 groups, each of which has a weight coefficient of 0.1. Thus, the points scored by the rating participants in each group are taken into account in the overall indicator with a coefficient of 0.1. The first group - “Document exchange services” - includes the services of an EDF operator, an operator for submitting electronic reports to government agencies and the availability of applications for accounting: working with 1C, uploading, reconciling reports, etc.

The second group is “Analytical and recommendation services”, such as basic analytical services (analytics on goods sold, etc.), recommendation services (comparison of company indicators with general market indicators by industry and territorial basis (revenue, average bill, assortment, number of purchases) and built-in partner services (providing reporting to banks, landlords, etc.).

Today, the list of the most popular analytics services includes: comparison of own sales with the market, brand analytics, reports on sales volume at a retail outlet, and information on client revenue for the landlord in order to introduce a sliding scale of rent. As Alexey Barov said, recently landlords have begun to use the latest service to manage the entire sales center: measuring the number of purchases and other indicators makes it possible to determine the dynamics of development and evaluate the effectiveness of marketing campaigns.

The third group is “Working with the labeling system,” namely monitoring the transfer of checks to the CRPT and their correctness, analytics on labeled goods, EDI with the CRPT.

And the fourth group is “Comprehensive solution for working with labeling”, the development of which has just started, but brings with it new opportunities both for the OFDs themselves and for their clients. We are talking about the acceptance of marked goods, their entry and exit from circulation, including ordering, receiving, printing codes, integration with the international GTIN (Global Trade Item Number) code, order management station (OMS), personal account “Honest Sign”, etc.

Checking for legality

To make sure that the OFD has the right to provide the declared services, that the purchased cash register and the received fiscal drive are registered properly, go to the Federal Tax Service website using the links:

- Checking the OFD.

- Checking the cash register.

- Examination .

This operation will take 1–2 minutes and will protect the entrepreneur from cooperation with unscrupulous companies posing as FD operators, as well as the use of inappropriate cash register equipment.

How to connect to the system

If a suitable FD operator is found, to connect you need:

- Receive a qualified electronic signature (CES). Typically, the company whose service you plan to use will be happy to produce you a CEP, which costs 1000–1500 rubles. If the OFD does not provide such a service, you can contact a certification center for a signature.

- Conclude an agreement to connect to the system with the OFD.

- Ensure a stable Internet connection at the retail point of sale.

- Purchase an online cash register with a fiscal drive. This can be done in specialized companies.

- Register a cash register on the Federal Tax Service website (get a registration number).

Procedure for connecting to the fiscal data operator

In order to use the services of one of the registered operators, you must perform a certain sequence of actions:

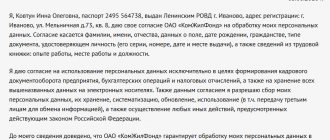

- Receive a qualified digital signature. It will be necessary in two cases - when registering a cash register in the personal account of the tax service, and when concluding an agreement with the OFD. In order to receive it, you need to contact any special operator. If the company participates in government tenders, then you can use an existing signature, since according to the new law, it is now also necessary to use a qualified signature for these purposes.

- Register in your OFD personal account. This procedure is quite simple, and usually only requires indicating the TIN and company name, as well as contact information.

- Sign an agreement with the OFD. Immediately after registration, the OFD functions will not be available until a contract for services is concluded electronically. Some of the information for the contract will be received directly from the digital signature, the rest will need to be specified manually - banking information, information about the manager, postal address, etc. The digital signature mark is placed as a signature.

- Complete the procedure for registering a cash register in your personal account of the Federal Tax Service. After all actions are completed, the cash register will be assigned a personal number. It will need to be further indicated in the OFD personal account.

- Connect the device to the OFD. For this procedure, you need to enter the model of the device, its registration number, as well as the number of the fiscal drive. Some OFDs allow you to assign a personal name to the cash register to make it easier to understand the connected cash registers.

- Pay your data bill. In your personal account, you need to select a tariff for using a cash register. After this, an invoice for payment will become available. After the funds are credited, the cash register will be ready to transfer information to the Federal Tax Service.

Tags: Online cash registers

How to become an OFD

Current legislation allows only legal entities to obtain permission to work with fiscal data (Article 4.4 of Law No. 54-FZ). An individual entrepreneur cannot become a FD operator at the moment.

To be included in the list of fiscal data operators, the applicant company must submit an application to the Federal Tax Service. When checking the information provided, the tax office is obliged to make sure that the applicant:

- complies with current legal requirements on the use of cash register systems;

- has the necessary licenses to provide telematic communication services to legal entities;

- will ensure the confidentiality and safety of the processed information.

Fiscal data operator (FDO) - what is it?

Let's take a closer look at the OFD, what it is.

A fiscal data operator is a business entity accredited by the Federal Tax Service, created in accordance with the relevant provisions of regulations, the direction of validity of which is:

- Reception, processing and storage on a specific server of information about checks recorded on cash registers;

- On the receipt of cash proceeds to a specific organization;

- It also transfers the received data to the tax authorities.

The requirements of the law establish that the operator can only be a legal entity that has been properly verified by the FSB, after which these authorities issued a special license for this business entity to work on encrypting operations.

In addition, this business entity must be geographically located in our country, it must have specialized equipment that must be used for the purposes provided for by this activity.

Thus, the operator is the receiver and custodian of information about the amount of cash proceeds of the companies with which he has an agreement. At the same time, the capabilities of OFD have recently expanded.

Now this is not only a repository of necessary information, but also the ability to transmit checks to the company’s clients electronically. To do this, the latter must indicate their email, to which the OFD will send an electronic version of the punched check.

Operator platforms also provide the ability to generate various reports in order to process the information received to them.

Attention: the legislation provides for the possibility of terminating the activities of an FD operator, however, the regulations require it to notify its clients in advance of the fact of its closure.

As soon as it ceases activity, information from cash registers will begin to accumulate on fiscal media. In this case, companies and entrepreneurs are given a period of 20 days to find a new OFD and draw up an agreement with it. After the agreement is signed, all accumulated information from the fiscal drive will be transferred to the server of the new operator, where it will be stored in the future.

Requirements for applicants for OFD status

In addition to restrictions on the organizational and legal form, the applicant company is obliged to:

- conduct activities in non-residential premises owned by it or leased. In this case, the premises must be reliably protected from unauthorized access, equipped with an alarm and video surveillance system, and serviced by a certified security company;

- have at your disposal ultra-powerful modern equipment that allows you to process more than 10 thousand checks per second, a dedicated server, and a backup power system in case of power outages;

- use only certified software;

- have your own website with a first-level domain name;

- obtain licenses from the FSB and FSTEC for cryptographic processing of confidential information.

Obviously, not every applicant company will receive the right to work as a fiscal data operator. The list of organizations authorized by the Federal Tax Service to process this type of information shows that only a large company can comply with all the requirements of the law.