The concept of an object or subject of material liability

In order to understand the concept of a “materially responsible person” and what list of positions they can hold under the Labor Code of the Russian Federation, you must first understand what is the object of financial responsibility and who such a subject is.

The object of liability should be understood as specific property that was transferred to a person and which belongs to the organization. A fact that confirms that a person will be held financially responsible for the loss or damage of this object is its registration.

The subject of financial liability is always an individual who is assigned, in accordance with the established procedure, the responsibilities for preserving the object. An individual may be recognized as a subject if the following requirements are met:

- This person has reached the age of majority;

- An agreement was concluded with this person, which stated that his position in the organization implies the possibility of being held accountable.

What work does the responsible person perform?

The mentioned Resolution contains not only a list of positions, but also a list of works. That is, even if the profession is called differently, performing certain functions makes it possible to become an MOL employee. Among these works:

- trade;

- depository activities;

- accepting payments;

- expert activity;

- reception, storage and processing of inventory items;

- repairs in the cultural and domestic sphere;

- cargo delivery;

- any work with precious and semi-precious stones;

- animal services;

- production, transportation and servicing of hazardous substances and items.

For example, a financially responsible person in a warehouse is not only a manager (by position), but also a receiver (by type of work). The areas of his responsibility should be specified not only in the employment contract, but also in the job description.

The hiring of a materially responsible person to the workplace is necessarily accompanied by an explanation to this person of his labor functions. Also, for an employee who starts work related to the maintenance of inventory and monetary assets, the employer is obliged to ensure their correct transfer.

https://www.youtube.com/watch?v=ytpressru

After concluding a contract on full individual MO, the manager issues an order to appoint a financially responsible person, if such a responsibility is assigned to him by a local regulatory act, an employment agreement or a collective agreement.

Article 282 of the Labor Code of the Russian Federation gives a clear definition of part-time work. This is the performance of regular work under the terms of an employment contract during time free from main employment. A person can work part-time both at his main place of employment and in other companies.

Can a part-time worker be a financially responsible person?

If a person performs financially responsible work, then in any case he enters into an agreement on financial responsibility.

This also applies to part-time workers. Only persons under 18 years of age are exempt from financial liability. They are not accepted for responsible positions at all.

The concept of financial liability is fully defined by the laws of the Russian Federation. The legislation contains lists of positions and jobs in which financial liability arises. When hiring a person for such a position, it is necessary to conclude a financial liability agreement.

If a liability situation arises, you first need to determine whether the employee is really at fault.

If there is a causal connection between his actions and the damage caused, then the damage will have to be compensated in full.

The procedure for compensation can be voluntary, administrative or judicial.

The terms of compensation are usually set individually - by the employer, the court or by agreement of the parties.

Appointment of financially responsible persons

Persons who are financially responsible for property owned by the organization must be appointed in the appropriate manner. First of all, an employment agreement must be concluded with the new employee. This agreement should indicate in more detail the entire list of responsibilities that will be assigned to the person in the performance of his duties.

In addition to the main employment agreement, it is necessary to conclude an agreement on the full financial responsibility of the person. The approximate form of such a document is established by Resolution of the Ministry of Labor No. 85 of 2002 . In such an agreement, in addition to general information about the employee and employer, the following information must be indicated:

- The type of responsibility that is imposed on the person (collective, individual);

- Type of object for which the person is responsible;

- General provisions for the activities of a new employee;

- Reporting procedure;

- Procedure for compensation of damages.

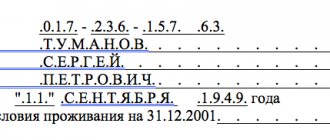

The appointment itself occurs on the basis of an order issued by the manager. At the federal level, the form of such an order is not established, but it must contain the following information:

- Number and date of the order;

- Information about the organization hiring the person;

- Information about the new employee;

- A list of employee actions aimed at preserving the organization’s property;

- A list of objects that are valuable to the organization;

- Signature of the head, date and seal of the organization.

Next, an entry is made in the person’s labor document. After this, the person must be familiar with the job description. Such instructions must include the following information:

- Requirements for the employee (age, specialty of the employee, length of service, level of education, availability of additional training);

- A list of regulatory and legal documents that an employee must know in the process of performing his official duties;

- Report forms and methods for employees to submit reports on work performed;

- Rules for using equipment;

- Workplace safety rules;

- A list of actions that a person must take in the event of damage to property or its loss;

- In the case of working with values, a list of actions that a person is obliged to carry out.

Next, the objects are transferred to the employee, and he can begin to perform his duties.

The legislative framework

A financially responsible employee can become such either by law or on the basis of a contract. In the first case, this is, in accordance with Article 277 of the Labor Code of the Russian Federation, the head of the company. Article 243 allows deputies and the chief accountant to be included in the same category if the corresponding clause is specified in the employment contract.

In other cases, an employee can assume such a responsibility only on his own initiative; there can be no forced assignment. He expresses his consent by signing an agreement on full individual medical treatment. Its form, as well as the list of suitable positions, can be found in Resolution of the Ministry of Labor No. 85 of December 31, 2002.

The Resolution lists all financially responsible persons under the Labor Code. An agreement on financial responsibility had to be signed with them; without an agreement, it would be possible to ask in the future only through the court.

There are several legislative acts that in one way or another affect the issue of financial liability:

- Article 21 of the Labor Code of the Russian Federation. It obliges workers to take care of the property of their employers.

- Articles 22,212 and 239 of the Labor Code of the Russian Federation. They oblige the employer to create a safe environment for workers and provide them with tools and information on how to carry out work correctly.

- Article 232 of the Labor Code of the Russian Federation. It specifies the mandatory nature of compensation for damage caused. The article places this responsibility on both the employee and the employer. The article also specifies that the reimbursement process must take place in accordance with the law.

Labor Code of the Russian Federation, Article 232. Obligation of a party to an employment contract to compensate for damage caused by it to the other party to this contractThe party to the employment contract (employer or employee) who caused damage to the other party shall compensate for it in accordance with this Code and other federal laws.

- An employment contract or written agreements attached to it may specify the financial liability of the parties to this contract. At the same time, the contractual liability of the employer to the employee cannot be lower, and the employee to the employer – higher, than is provided for by this Code or other federal laws.

- Termination of an employment contract after damage has been caused does not entail the release of the party to this contract from financial liability provided for by this Code or other federal laws.

Mentions of financial liability are also found in other legislative acts of the Russian Federation, but those listed above are considered the main ones.

It is impossible to single out the most important one among them, because in order to resolve the situation with the damage caused, one must be guided by each of the legislative acts.

Responsibilities

Persons who are financially responsible are assigned the following list of responsibilities:

- Preservation of the organization’s property, preventing its damage;

- Timely informing the organization’s management about the threat of property damage;

- Accounting for values and reporting on the organization’s property;

- Participation in activities related to verification of the organization’s property, as well as its condition.

In addition to these responsibilities, the law provides individuals with the following list of rights:

- Participation in resolving issues related to the implementation of the financial liability agreement;

- The requirement from the immediate supervisor and the head of the organization to create conditions that allow the fulfillment of responsibilities for the preservation of the objects entrusted to the person;

- Familiarization with the results of inspections and reports on the remains of valuable objects;

- Participation in the procedure for accepting and processing objects that are valuable to the organization;

- Requirement from managers to remove persons who interfere with the fulfillment of duties to preserve entrusted property.

The enterprise, namely its managers, in turn, also has the following responsibilities:

- Management must provide the employee with the necessary conditions for him to perform his duties;

- Management must familiarize the employee of the enterprise who is financially responsible with the laws and regulations that are directly related to the performance of his duties;

- The management of the enterprise is obliged to check the availability of property owned by the enterprise, as well as to check the condition of this property.

Features of full financial liability

In practice, there are several types of financial liability that can be established at an enterprise. The establishment of a specific one is contractual in nature, that is, it is established on the basis of an agreement between the employee and the employer.

The following types :

- Collective (when transferring property to a group of workers);

- Limited (limited by the limits specified in the Labor Code of the Russian Federation);

- Full (not limited to the average monthly salary).

Full financial liability is a type of liability, in the presence of which the employee is obliged, in the event of damage to the organization, to compensate it in full.

Labor legislation establishes the following cases of full financial liability:

- When the type of such responsibility is assigned to an employee in accordance with the Labor Code of the Russian Federation or other regulatory legal acts;

- Loss of valuables that were issued to the employee on the basis of a written agreement, as well as under another one-time document;

- In the case where the employee intentionally caused damage to the employer;

- The damage to the organization was caused as a result of the person being in a state of alcohol, drug or other type of intoxication;

- The damage was caused by the employee in connection with his criminal actions (criminality is established on the basis of a decision made by the court;

- The damage was caused as a result of an administrative offense, which was established by an authorized state body;

- The employee revealed a secret that was protected in accordance with the law;

- The occurrence of damage in the event of an employee’s failure to fulfill his official duties.

Cases of full financial liability are specified in the law. Other cases of bringing to responsibility are not allowed, even if an agreement on full individuality is concluded between the employee and the organization.

It should also be noted that persons who have not reached the age of majority can be brought to full financial liability only if the following mandatory conditions are met:

- The damage was caused intentionally;

- The damage was caused while under the influence of alcohol, drugs or any other type of intoxication;

- The damage was caused in connection with the commission of a crime by a person or an administrative offense.

Cases in which the employee’s MO does not occur

Regardless of whether the employee is a financially responsible person or not, regardless of the amount of damage, he will be financially liable only in cases where:

- values were transferred to the employee and he received them;

- the fact of loss of valuables has been established in the manner prescribed by law;

- during the investigation, it was established that the employee was guilty of the loss of material assets (Articles 233 and 248 of the Labor Code of the Russian Federation);

- there are no circumstances mentioned in Art. 239 of the Labor Code of the Russian Federation, as excluding the financial liability of the employee. Such circumstances include: force majeure, normal economic risk, extreme necessity or necessary defense, failure by the employer to fulfill the obligation to provide adequate conditions for storing property entrusted to the employee;

- the employer decided to recover damages from the employee. The fact that an enterprise has suffered material damage does not automatically mean a subsequent penalty for the employee. After all, Art. 240 of the Labor Code of the Russian Federation provides for the right of the employer to refuse to recover damages from the employee;

- The statute of limitations for claims has not expired. The law limited the employer’s right to collect to short periods: to collect an amount not exceeding the average earnings by order of the employer - one month (Article 248 of the Labor Code of the Russian Federation); for recovery in court - one year from the date of discovery of the damage (Article 392 of the Labor Code of the Russian Federation).

It should be remembered that the employer can go to court with a claim to recover material damages from the employee beyond the deadline. Moreover, the court does not have the right to refuse to accept a “overdue” statement of claim. But in this case, the judge has the right to apply the consequences of missing a deadline (refuse the claim) if, before making a decision, the defendant-employee claims it and the plaintiff does not provide evidence of valid reasons for missing the deadline, which can serve as a basis for its restoration (Part 3 of Article 392 Labor Code of the Russian Federation).

Valid reasons for missing a deadline may include exceptional circumstances beyond the will of the employer that prevented the filing of a claim (see explanations in paragraph 3 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated November 16, 2006 No. 52 “On the application by courts of legislation regulating the financial liability of employees for damage caused to the employer" (hereinafter referred to as Plenum Resolution No. 52)).

The mandatory conditions for the occurrence of financial liability in the full amount of damage caused are listed in Art. 243 of the Labor Code of the Russian Federation and are not subject to broad interpretation. These are the cases:

- when, in accordance with the Labor Code of the Russian Federation or other federal laws, the employee is charged with financial liability in full for damage caused to the employer during the performance of the employee’s job duties;

- shortage of valuables entrusted to him on the basis of a special written agreement or received by him under a one-time document;

- intentional causing of damage;

- causing damage while under the influence of alcohol, drugs or other toxic substances;

- causing damage as a result of the employee’s criminal actions established by a court verdict;

- causing damage as a result of an administrative violation, if established by the relevant government body;

- disclosure of information constituting a secret protected by law (state, official, commercial or other), in cases provided for by federal laws;

- causing damage not while the employee was performing his job duties;

- when the employment contract of the deputy head of the organization, the chief accountant contains a condition regarding this.

As a rule, until the above moments occur, the employer does not think about the responsibility of employees and formalizing relations with financially responsible persons according to the rules. And in vain. It is highly advisable to study the practice of disputes in advance in order to analyze which errors in registration entail the risk of refusal to recover the amount of damage from the employee. Below we will look at mistakes in formalizing relationships with financially responsible persons.

The worker’s medical insurance is excluded if the damage arises as a result of:

- insurmountable circumstances (natural factors - floods, hurricanes, etc., man-made factors - fires, accidents, etc., factors of social life - war, epidemics, etc.);

- natural (normal) economic risk;

- necessary defense;

- extreme necessity (causing harm in order to avoid a danger that directly threatens the person and rights of the perpetrator, the interests of society and the state, which are protected by law, in cases where this danger could not be eliminated by other means);

- failure by the employer to fulfill obligations to organize appropriate conditions for storing property entrusted to the employee.

Normal business risk includes situations when:

- the employee performed his job duties properly, taking measures to prevent damage, showing care and diligence;

- the objectives set could not be achieved in any other way;

- actions were consistent with current experience and knowledge;

- the object of risk was material wealth, not human health and life.

A financially responsible person-employee can avoid MO if his employer completely refuses to recover the damage caused to him. And also the Labor Code of the Russian Federation provides for the right of the employer to demand only partial compensation for losses from the worker.

Release of an employee from liability

The law provides for cases in which the financially responsible person is exempt from liability, even in the event of damage or destruction of the enterprise’s property.

The following cases of releasing an employee from liability are distinguished:

- Damage or damage to property due to a hurricane, earthquake or other natural disaster;

- In the event of a threat to the life of an employee or other citizens, as well as to the state as a whole, if such a danger could not be eliminated otherwise;

- In the event of defense, when it was necessary due to the situation that arose;

- In the case of performing tasks that were assigned to the employee by the management of the enterprise, when such tasks could not be completed in any other way;

- The head of the enterprise did not create the necessary conditions for the safety of the enterprise's property.

The enterprise may establish other cases of releasing an employee from liability; such a possibility is provided for by the norms of the Labor Code of the Russian Federation.

Collective MO

In the Labor Law of the Russian Federation, there are two types of MO depending on the number of its subjects: individual financial responsibility and collective.

Team (collective) financial liability is established when workers jointly perform any type of activity related to the storage, sale, processing, transportation or other use of assets transferred to their control and provided that it is not possible to differentiate the responsibility of each worker for damage and enter into an agreement with him for compensation of losses in full.

With this type of financial liability, a written contract is concluded between the employer and all members of the team. Material assets are given for storage to a predetermined group of people, who are assigned full responsibility for their shortage. The agreement may specify the degree of guilt of each participant.

After concluding an agreement on collective medical organization, the manager must necessarily issue an order appointing a financially responsible person.

Recovery of damages

The basis for collecting the shortage identified by the management of the enterprise is the recorded fact of such a shortage.

In the event that the employer has identified the fact of damage to property or its destruction by a person who has entered into an agreement on full financial responsibility, it is necessary to create a special commission. The duties of the commission include establishing the following facts:

- Causing real damage to the organization;

- The presence of guilt in the employee’s actions (the employee acted intentionally or the property was damaged due to negligence);

- The employee has committed an offense;

- Establishing a cause-and-effect relationship between the actions of a person and the presence of damage to the enterprise.

The person must provide written explanations regarding the identified fact. If the employee refuses to give explanations in writing, then a special act is drawn up in which a corresponding note is made.

Based on the results of its activities, the commission draws up a conclusion, which must be signed by all its members.

Next, the employer will have the right to recover the amount of the identified shortfall from the person’s wages. The amount of deductions cannot be more than 20% of the monthly salary.

The law establishes limits for the recovery of damages, no more than the average monthly earnings of a person, unless an agreement on full liability has been concluded. Withholding of funds is carried out on the basis of an order issued by the head of the enterprise.

The law allows compensation for damage by an employee voluntarily. In this case, the person contributes the amount of damage caused without deductions from wages.

When a person’s guilt is established on the basis of a court decision that has entered into legal force, and the employer has received a writ of execution, the amount of the monthly penalty reaches 50%.

Remember that deductions based on the manager’s order are allowed only in the event of a shortage. After this period, the guilt of the person is established only on the basis of a court decision. It should also be noted that if a person holds a second job, he or she may be held to limited liability.

Conditions of attack

Financially responsible persons, the list of which is approved by a separate order in the organization, are held accountable only if two conditions are met:

- proven guilt of the employee in causing the damage;

- the presence of an agreement signed by the parties on full financial liability.

The last circumstance is very important because The inclusion of a position in the list of the Ministry of Labor of the Russian Federation does not mean the automatic establishment of an obligation to compensate for damage in full. This obligation arises only if there is an agreement on full financial responsibility signed by the employee. In the absence of such, compensation for damage is carried out in accordance with the general procedure.

At the same time, an employee whose position is included in the list of MOL (materially responsible persons) must, at the request of the employer, sign the specified agreement, and if he refuses to do this, he may be subject to disciplinary action and even dismissal in the manner prescribed by law.

Who is financially responsible?

Most often it is based on an offense.

Therefore, an explanation is taken from the guilty person - just as in case of disciplinary violations.

In order to bring a person to financial responsibility and force him to compensate for the damage, the elements of the offense must be present.

Without a violation, prosecution is impossible.

For matrimonial liability to occur, 4 mandatory conditions must be met:

- the injured party suffered real (actual) damage;

- the person who caused the damage is really guilty;

- there is a causal connection between the culpable act and the damage caused;

- There are no circumstances that could exempt the culprit from compensation for damage.

Important! Financial liability occurs both after the action and inaction of the culprit. If he did nothing personally, but neglected the opportunity to prevent the damage, he is still considered guilty.

List of positions of financially responsible persons according to the Labor Code of the Russian Federation

The list of positions of financially responsible persons is established by Resolution of the Ministry of Labor of the Russian Federation dated December 31, 2002 No. 85 .

In accordance with this document, the following positions are identified, when filling which persons bear full financial responsibility:

- Managers, as well as their deputies;

- Directors, managers, administrators;

- Warehouse and storeroom managers, as well as their deputies;

- Laboratory assistants, department methodologists.

In budgetary institutions

The list of financially responsible persons in a budgetary institution coincides with the previously specified list. Thus, the following may be held liable:

- Laboratory assistants;

- Methodists;

- Persons who are heads of libraries;

- Warehouse managers;

- Castellans;

- Nurses.

Basic Concepts

The financially responsible persons are the employees of the organization.

Financial liability implies responsibility for money, documents, goods or other items that are the value of the company. A financially responsible employee differs from the rest in that he is responsible for entrusted items, as well as those that he uses for activities in the enterprise.

In legislation, all information about financially responsible persons is contained in Chapter 39 of the Labor Code of the Russian Federation. It describes in detail all the nuances relating to this category of workers.