The 3-NDFL personal income tax return is submitted to the Federal Tax Service by entrepreneurs who do not apply special tax regimes, private lawyers and notaries, as well as individuals who received income from which tax was not withheld by tax agents, or who wish to receive a tax deduction. The deadlines for filing tax returns 3-NDFL are established by law. Let's look at them in more detail, and also find out the dangers of submitting 3-NDFL at the wrong time and when the declaration can be submitted in violation of the deadline.

Deadlines for filing different types of tax returns

For each type of tax return of a taxpayer, certain deadlines are established by law, before which documents must be submitted to the tax office.

Every company or person should understand the current deadlines so as not to be late in submitting any document:

- 3-NDFL. It is the most common declaration, which indicates the income of an individual for the calendar year. Based on it, the tax authorities will be able to find out what cash receipts a particular citizen had. It is important to submit this document before April 30 of the year following the reporting year.

- 4-NDFL. This document must be created and submitted to the inspection by individual entrepreneurs and other people working for themselves and conducting private practice. This document must be submitted monthly. It contains information about what expected income a citizen can receive. Based on this information, tax officials determine what advance payment taxpayers must pay. Initially, this declaration is submitted 5 days after registration.

- 6-NDFL. This document is submitted to the inspection by tax agents, so it is used exclusively by entrepreneurs who officially employ employees. These documents are filled out quarterly, every six months, 9 months and every year.

- VAT report. Submitted exclusively by companies that use VAT in the course of their activities. It is submitted to the inspectorate within 25 days from the end of the last tax period.

- Income tax report. Can be surrendered within 28 days from the end of the tax period.

- About the water tax. This documentation is submitted at the same time that the applicable tax is paid. The tax period is quarterly, so you must pay tax and submit a declaration by the 20th day of the month following the end of each period.

You can find out when you need to submit (submit) the 3-NDFL tax return in this video:

- Land tax report. This tax must be paid within a year, and the tax form must be completed and submitted to the inspectorate by February 1st.

- Property tax declaration. Must be submitted to the Federal Tax Service by March 30.

- Mineral extraction tax report. It is compiled and sent to the tax office on a monthly basis.

- Declaration on Unified Agricultural Tax. Must be submitted to the Federal Tax Service annually, and before March 31.

- Report on the simplified tax system. Also transferred annually until March 31st.

- Gambling business tax declaration. Submitted monthly before the 15th day of the month following the month for which the report is submitted.

- Reporting on UTII. This imputed tax is considered quite popular among many entrepreneurs, as it has many advantages. The report on it must be submitted quarterly, but before the 20th day of the month following the last month of the quarter. You can learn how to correctly prepare a tax return for a single imputed income here.

- Declaration on the use of animal resources. It is submitted to the inspectorate monthly, and the date depends on the date on which the entrepreneur issued a license to carry out this activity. It is important that the document is submitted no later than 10 days after receiving the license.

- Transport tax report. In each region, the rules for submitting this document have their own differences. For example, in the Moscow Region the tax must be paid by February 5 by companies, and by individuals by December 1. Rates in Moscow differ significantly from other regions, for example, for passenger cars whose power does not exceed 100 hp, the rate is set at 12 rubles.

Additionally, there are many different payments that entrepreneurs must pay, and they are set at the local level.

These payments are not considered taxes, but citizens are required to report on them with special reports submitted to the Federal Tax Service in accordance with the conditions specified in local regulations.

Deadlines for filing different types of tax returns.

Deadlines for document verification by the tax inspectorate

After submitting a certain document to the inspection, an entrepreneur or individual must wait for verification, as it is important to make sure that there are no significant errors in it.

Important! The legislation clearly states that a month is given for the audit, but in practice, tax officials delay the audit.

How long is the declaration kept by the Federal Tax Service?

Order No. 558 clearly states that different types of reports for various taxes are stored for five years.

Important! Digital documents should be retained for the same amount of time as paper documents.

There are often situations when, during legal proceedings, it is different declarations that can act as undeniable arguments and evidence, so the taxpayer himself and the Federal Tax Service must have them.

Information obtained as a result of a tax audit is additionally stored for five years.

What is the liability for late submission of a document?

Unified simplified tax return: sample completion in 2019

A single simplified tax return is one of the types of tax reporting forms.

Who files a single simplified tax return and when? Who files a single simplified tax return and in what situations can this be done? Business entities that for some reason did not conduct financial and economic activities during the reporting period have the right to submit one single simplified tax return (SUD) instead of several “zero” returns.

- absence of transactions in the reporting period, as a result of which there is a movement of funds in the accounts or at the cash desk of an organization or individual entrepreneur;

- absence of objects of taxation for those taxes the payer of which is an organization or individual entrepreneur.

In fact, the conditions outlined above may apply to taxpayers who have just been registered and have not had time to carry out any transactions. In practice, a single simplified tax return is submitted extremely rarely due to the fact that there are practically no organizations that meet the above conditions.

Some business entities mistakenly believe that they have the right to file a single simplified tax return if they have no profit or did not provide services, but this is not true. Indeed, in this case, cash flow also includes the organization’s expenses.

Example 1

Let’s say that Ogonyok LLC, located at OSNO, did not provide services in the 1st-3rd quarters of 2017, and no funds were received into the company’s current account or cash desk. Ogonyok LLC has no assets on its balance sheet.

However, during the reporting period, it paid utility bills from its current account, and wages were also accrued and paid to its only employee - the manager. In this case, Ogonyok LLC does not have the right to file a single simplified tax return due to the fact that the movement of funds in the current account occurred despite the fact that there was no income in this period.

Example 2

Borisov A.I. was registered as an individual entrepreneur from 01.02.2020, he chose the simplified tax system as the taxation system. However, due to unforeseen circumstances, Borisov A.I. did not provide a single service for the entire 2020.

He did not open a current account, there was no receipts at the cash desk. In this case, Borisov A.I. has the right to submit a single simplified tax return for 2020 no later than January 22, 2018.

Confirmation of the above example is contained in the letter of the Federal Tax Service dated 08.08.2011 No. AS-4-3/ [email protected]

Example 3

Temp LLC is located on OSNO. In the 1st-3rd quarters of 2020, no funds were received into the current account or cash desk, and no payments were made; Temp LLC is not a payer for property, transport and land taxes due to the lack of taxable items.

In this case, the organization has the right to file a single simplified tax return, which will include income tax and value added tax.

When is the unified simplified tax return submitted? The deadline for filing a single simplified tax return is set to the 20th day of the month following the reporting period: quarter, half-year, 9 months, calendar year.

NOTE! Monthly reporting cannot be replaced by a single simplified declaration.

- individual entrepreneurs - at the place of registration of the individual entrepreneur;

- organizations - at the location of the head office (legal address).

- 01/22/2018 - for 2020 (the deadline has been moved to the 22nd, because 01/20/2018 is a Saturday);

- 04/20/2018 - for the 1st quarter of 2020;

- 07/20/2018 - for the first half of 2020;

- 10/22/2018 - for 9 months of 2020 (the deadline has been moved to the next working day, since 10/20/2018 falls on a public holiday).

The question of when a single simplified tax return for 2020 is filed will also be resolved taking into account the existing rule on moving deadlines that fall on a weekend forward (to the nearest weekday). For filing a single simplified tax return for 2020, this date will correspond to 01/21/2019.

Today, there are 3 options for submitting a single simplified tax return to the tax authority:

- By mail with a description of the attachment. The payment receipt in this case will be a document confirming the submission of the declaration.

- You can personally bring the declaration to the tax authority - in this case it is provided in 2 copies, on which an acceptance stamp is affixed; 1 copy remains with the tax office, and the 2nd copy is returned to the taxpayer and serves as confirmation of delivery.

- The third option is to submit the declaration electronically through specialized operators or through the website of the Federal Tax Service of Russia.

How to fill out a single simplified tax return? The form and procedure for filling out a single simplified tax return were approved by Order of the Ministry of Finance of Russia dated July 10, 2007 No. 62n. The procedure for filing a single simplified tax return in 2017-2018 is also subject to the rules contained in this document.

- filled out by hand in black or blue ink or printed;

- it is prohibited to make corrections using a correction agent;

- organizations and individual entrepreneurs fill out only the 1st page, the 2nd is filled out by individuals.

Now let's look at the procedure for filling out page 1 of the simplified declaration.

In the “TIN” and “KPP” fields, organizations indicate the TIN and KPP according to the certificate of registration with the tax authority. Individual entrepreneurs indicate only the TIN, also on the basis of the received certificate.

- in the case of the initial filing of the declaration - “1”;

- in the case of submitting a corrective report - “3” and separated by a fraction the number of the correction: “1”, “2”, “3”, etc.

The “Reporting year” field indicates the year for which the declaration is being submitted.

The name of the recipient tax office is indicated in the “Provided to” field, and its code is indicated in the “Code” field.

The OKTMO code is entered in the OKATO field (letter of the Federal Tax Service of Russia dated October 17, 2013 No. ED-4-3/18585).

In the field “Code of type of economic activity” the OKVED code of the reporting organization or individual entrepreneur is indicated.

Now we will tell you how to fill out the tax table.

- in the case when the tax period for the tax is a quarter, column 3 takes the value 03, and column 4 is filled in according to the quarter number: 01, 02, 03 and 04;

- in the case where the tax period for a tax is a year, and the reporting periods are determined by an accrual total, column 4 is not filled in, and in column 3 the number corresponding to the reporting (tax) period is indicated:

- 3 - quarter;

- 6 - half a year;

- 9 - 9 months;

- 0 - year.

Below are the contact phone number, the number of pages of the declaration and the number of pages of supporting documents.

- for an organization, a power of attorney on the organization’s letterhead with the seal and signature of the director is sufficient;

- For individual entrepreneurs, a notarized power of attorney is required for an authorized person.

Page 2 is filled out only by individuals - standard data about the person is indicated there, so there should be no problems when filling out this page.

However, it may also be useful to become familiar with a sample of filling out a single simplified tax return. Especially in light of the question of whether it is possible to have a sample for filling out a zero unified simplified tax return.

A single simplified declaration was initially created as a zero declaration (i.e., in addition, it reflects information about the absence of grounds for paying several taxes at once. A regular zero declaration is drawn up on the form of a specific tax used to enter into it the initial information for calculating the base for this tax, which, in the absence of this information, are replaced with dashes.

To summarize, we note once again that not all taxpayers can submit a single simplified tax return. In order for the right to submit such a declaration to arise, a business entity must meet certain conditions: there should be no movement of funds in its account and cash register, and it must not have objects of taxation.

Companies and private entrepreneurs are required to submit a tax return for the types of tax for which they are payers. But in a number of situations they submit a single simplified tax return. When is this form applicable, who needs to submit it, and when?

EUND - what is it?

The need to submit a tax return is assigned to organizations and individual entrepreneurs by the Tax Code of the Russian Federation (subparagraph 4 of paragraph 1 of Article 23). But there are situations when taxpayers do not conduct business for a certain time and, therefore, they do not have the data to fill out such a report.

In order not to submit a separate declaration for each type of tax, a single simplified declaration was developed.

The right to use it is also enshrined in the Tax Code of the Russian Federation. All payers are not required to submit reports.

In essence, the EUND is a special declaration form that includes information on various forms of tax. Its main task is to reduce the number of documents submitted by payers. But it can only be used under certain circumstances.

Such a declaration does not imply the indication of tax amounts, since they are absent due to the temporary cessation of activity by the payer. It is quite fair to call this reporting zero.

Clause 2 of Article 80 of the Tax Code of the Russian Federation gives the right to submit a single simplified declaration if two conditions are met:

- there are no objects of taxation for taxes in respect of which the EUD is submitted;

- in the reporting period there was no movement in bank (cash) accounts.

If such conditions are met, both organizations and individual entrepreneurs can submit the EUD.

Submitting a single simplified return is a taxpayer’s right. You can submit declarations separately for each tax.

A single simplified declaration is submitted no later than 20 days from the end of the reporting period (quarter, half-year, 9 months or year). The form is old, but valid. The unified simplified declaration is submitted according to the KND form 1151085, approved by Order of the Ministry of Finance dated July 10, 2007 No. 62n.

Due to the fact that the form was approved a long time ago, there is still a field for OKATO. Write OKTMO there.

Late filing of a return - what is it?

Even being late by one day is grounds for talking about late submission of documentation.

Important! Federal Tax Service employees are especially careful to ensure that tax agents submit documents on time.

Liability for failure to submit a document within the prescribed period may be mitigated in the case of certain circumstances that are officially confirmed.

Also, many tax officials accommodate taxpayers halfway, so if they are only a few days late, they may only be given a warning, but serious delay is certainly accompanied by penalties.

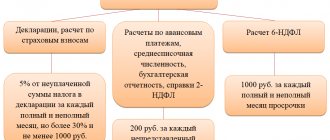

Penalty for late filing of a return

If the taxpayer is late in submitting this document, then special penalties will be applied to him. They are presented in the form of fines. Their size depends on the amount of tax calculated in the declaration.

I haven’t submitted my tax return, what will happen and what will happen? The answer is here.

However, this fine is assessed only if mandatory declarations are not submitted on time, but for document 4-NDFL such a significant monetary sanction is not expected to be assessed. Typically, a warning is initially used, and then a fine is allowed, the amount of which is 200 rubles.

If any optional declarations are submitted to the Federal Tax Service, which include documents for obtaining a social deduction, it does not imply the accrual of any sanctions for them. This is due to the fact that they can be submitted at absolutely any time.

What are the deadlines for submitting a tax return for personal income tax? Find out in this video:

Important! Taxpayers claim that the difficult thing is not filling out the declaration or even submitting it to the tax authorities on time, but waiting for a decision from the employees of this service, since they often delay the deadlines, so they have to fill out the document again after its deadline has passed. submissions.

Thus, there are many types of different declarations that must be submitted to the tax office within a strictly prescribed time.

fbm.ru

Deadline for filing a tax return

As a general rule, for all citizens who file a tax return for 2020, a general deadline is set - until 05/02/2017. The current legislation determines the official filing deadline - until April 30 of the year following the reporting year. But since this date fell on official holidays, the official filing deadline was also postponed.

Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

This rule applies to citizens who received income from the sale of property that was owned for at least 3 years. And for real estate - a minimum of 5 years, if the property was transferred into ownership after 01/01/2016. Also from business activities, from renting out real estate, as well as income received as a win or gift.

Those individuals who file 3-NDFL tax returns solely for the purpose of obtaining a tax deduction are not included in the number of such persons. They are not subject to the above deadline and returns filed to obtain the deduction can be submitted at any time of the year, without any tax consequences.

At the same time, if an individual submits a declaration on income received in 2020 and also claims to receive a tax deduction, then the previous deadline is valid for him - until 05/02/2017.

In what cases are individuals required to submit a 3-NDFL report to the tax authorities?

Those individuals who must submit Form 3-NDFL include persons who received income in the previous year:

- from renting out property;

- sale of property owned for less than 3 years, and for real estate purchased after January 2020 - 5 years;

- sale of a share in the authorized capital;

- lottery winnings;

- deposits in banks (interest);

- sales of securities, etc.

The deadline for submitting the form is similar to the deadline set for self-employed persons: April 30 of the year following the one for which they are reporting.

In addition, physicists should take into account the following nuances when drawing up a declaration for 2020:

- If the price of the sold housing is less than the cadastral price, the declaration does not indicate the income actually received, but the value of the real estate reduced to 70% by the cadastral service as of January 1 of the year in which ownership transferred to the taxpayer (clause 5 of Article 217.1 Tax Code of the Russian Federation).

- Individuals from whose income the employer (tax agent) for some reason did not withhold income tax do not need to submit a declaration. Tax officials will independently print receipts and send them to taxpayers.

Let us now study who submits a declaration in form 3-NDFL at their own request.

Deadline for filing a declaration when selling an apartment

Before filing a 3-NDFL declaration when selling real estate, you need to decide on three important points regarding real estate:

- If an individual has been the owner of an apartment for 3-5 years or longer, then the income received from the sale of real estate will not be taxed and, accordingly, there is no need to file a declaration.

- If the cost of the sold real estate was less than 1,000,000 rubles, then when calculating the tax, an individual has the right to reduce the proceeds from the sale of real estate by deduction in the same amount.

- If an individual’s expenses for purchasing an apartment exceed 1,000,000 rubles, it is possible to reduce the apartment’s revenue by the amount of actual expenses. This can only be done if there is documentary evidence of the transaction.

When filing a 3-NDFL declaration, the same deadlines that were written about earlier remain the same - the deadline for filing is 05/02/2017.

Deadline for filing 3-NDFL declaration for individual entrepreneurs

Similar deadlines described above also apply to individual entrepreneurs. Please note that provision of interim reporting is not mandatory, however, entrepreneurs must make quarterly advance payments, which are calculated by the tax authority.

In case of late filing of reports and payment of tax, the fine will be 1,000 rubles. If the tax has not been paid, the fine will be 5% of the tax amount for each month of delay. But the final amount cannot exceed the tax amount by more than 30% of the total amount and be less than 1,000 rubles.

Reporting can be submitted both electronically and on paper, depending on the preferences of the taxpayer. Documents in electronic form can be transmitted either through the Federal Tax Service website or through electronic document management operators. Submission of reports and submission of declarations in paper form is carried out only if the number of individual entrepreneurs is no more than 100 people.

buhspravka46.ru

Who submits and in what cases

Civil servants, individual entrepreneurs, persons receiving income from private practice (this includes notaries, lawyers, etc.), as well as citizens who received funds must submit a declaration by force.

Funds can be received in the following cases :

- sale of property owned for more than five years;

- income received from renting out an apartment, house, cottage, garage or car;

- as a result of a donation, if it did not come from family members;

- if the employer, for justified reasons, did not withhold tax from the employee’s income, and the employee’s obligation to file a declaration and transfer payment to the budget begins from the moment he receives information about this in writing from the director of the organization;

- if the citizen’s source of income is lottery winnings or a gift;

- inherited works of culture, science, art.

When purchasing real estate

Regardless of its cost, the state will reimburse no more than 260,000 rubles (13% of 2 million). If the property was purchased under a mortgage loan agreement, then the amount of interest paid is also refunded. In addition to the above 260,000, it is possible to return 390,000 (13% from 3 million).

This right has no statute of limitations. Even when an apartment was purchased 10 years ago, a citizen can submit a declaration at any time, and immediately for 3 calendar years preceding the year of filing. This is called a property tax deduction.

Social tax deductions

The most common in this category is a 13% refund of tuition fees paid.

Moreover, both your own and your children, until they reach the age of 24, subject to full-time education. It is also possible to get a refund for treatment and medications. Even for the purchase of medicines you can get your money back, but this requires a doctor’s prescription and receipts, so many simply do not want to waste their time. But it is much easier to collect documents for dental treatment and prosthetics.

The main thing is to choose a good clinic for the procedure, and they will provide everything you need to submit to the tax office. There is a statute of limitations here - 3 years. Upon expiration, the right to reimbursement of spent funds expires.

Many do not even suspect that when children attend additional educational institutions (dance, gymnastics, speech therapist), when studying at a driving school or other courses, they can also apply for a social deduction and get back 13% of the amounts spent.

To exercise your rights to property or social tax deductions, you must confirm your official income .

Methods

- Through the portal www.gosuslugi.ru. This method is gaining more and more popularity - without leaving home, without queues. The only negative is that you will have to spend a little time registering. Through this site you can not only submit documents to the tax office, but also to all government agencies: passport office, pension office, social protection.

- Taxpayer’s personal account on the Federal Tax Service website nalog.ru. Login to it is possible only with a password and login, to obtain which you just need to contact the tax office at your place of registration. You can not only send a document, but also track every stage of its verification.

- You can also submit your declaration in person by calling the tax office in advance or checking the opening hours on the website. It is very convenient that inspections sometimes work on Saturdays.

- By post. The oldest and no less reliable method. It is necessary to send not just a letter, but as a valuable one, with an inventory of the attachments. On the Russian Post website www.pochta.ru you can trace its path, and if lost, file a claim. The downside to this method is that there is no way to track the verification process; all you have to do is wait for notification of the results from the tax office.

Until what date do you have to submit 3-NDFL in 2020?

The income declaration must be sent to the tax office at the place of residence, and if this is not the case, then at the place of residence of the individual. 3-NDFL can be brought to the Federal Tax Service in person, sent by mail (necessarily with a list of attachments and notification of receipt), or sent through the “Taxpayer Personal Account” on the website of the Federal Tax Service of Russia.

Individuals who are required to declare their income submit a 3-NDFL declaration before April 30 of the following year (clause 1 of Article 229 of the Tax Code of the Russian Federation). The last day for submitting 3-NDFL in 2020 has been postponed to May 2, since April 30 fell on a day off, and also due to the spring holidays. During this period the following must report their income for 2020:

- Individuals who calculate and pay personal income tax on their income independently - individual entrepreneurs, privately practicing lawyers and notaries (Article 227 of the Tax Code of the Russian Federation).

- Individuals who have received income under employment and other contracts (including rent and hire) from organizations and citizens who are not tax agents (clause 1 of Article 228 of the Tax Code of the Russian Federation),

- Foreign citizens who work in Russia for hire on the basis of a patent (Article 227.1 of the Tax Code of the Russian Federation).

All others who wish to declare their income voluntarily must also do so within the period established by law.

In 2020, the deadline for submitting 3-NDFL for 2020 is postponed, since the submission day falls on a weekend - this time on May 2 (Resolution of the Government of the Russian Federation dated 08/04/2016 No. 756).

In the case when an individual entrepreneur or a private practitioner decides to stop his business, a different deadline applies for reporting income. They should submit the 3-NDFL declaration within five days from the date of termination of activity, without waiting for the end of the tax period (clause 3 of Article 229 of the Tax Code of the Russian Federation).

Filling out the declaration

For many years now there has been a “Declaration” program, with the help of which it is quite easy and simple to fill out this document. It is on the Internet, freely available. It is necessary to download in accordance with the reporting year.

If documents are provided for 2020, the program will be called “Declaration 2018”. It has several tabs:

- Setting the conditions - the basic data is already set here, you only need to enter the number of the inspection to which the citizen belongs at his place of registration.

- Information about the declarant - to fill out this section, all personal information is required (passport data, place and year of birth, residential address, telephone number, full name, Taxpayer Identification Number, etc.).

- Income received in the Russian Federation - the tab is filled out on the basis of a certificate received from work.

- Deductions are the last category. If the income certificate indicates deductions for children in the amount of 1,400 rubles, then in the “Standard Deductions” tab you must indicate the “Provide” deductions and enter the number of children. If the employee does not have dependents, you should skip this item.

OKTMO, inspection number, index - all this can be found on the Internet, at the citizen’s address.

If you don’t have time to fill it out yourself, you need to seek help from an accountant, who will help with this for a small fee. The average cost of the service is 500 rubles. As a rule, right next to the tax offices, there are offices that do this.

Is it possible to get a deduction for an apartment for previous years?

A frequent situation is when a person purchased his own apartment or other housing several years ago and either did not know about the possibility of receiving a deduction, or neglected this opportunity for some reason. At the same time, many people think that it is too late to claim the deduction now, and they are not entitled to it.

In fact, there is no statute of limitations in this sense; you have the right to apply for a tax deduction and get your 13% income tax back right now, even if you bought the apartment many years ago.

Moreover, the deduction can even be issued in a sense “retroactively”, returning the tax for previous years. True, not for all the years that have passed since the purchase of the apartment, but only for the last three.

So, if you completed a transaction to purchase housing in 2014, and six years have already passed, it is not too late to issue a deduction today, and they will even be able to return the income tax paid to the treasury not only for 2019, but also for earlier years. Although not starting from 2014, when the apartment was purchased, but only starting from 2020. That is, for the three years that precede 2020 - from 2020 to 2020.

If you bought an apartment recently, then remember a simple rule - taxes are refunded starting from the year you completed the transaction. If you purchased a home in 2020, you can now apply for a tax refund only for 2018-2019.

There is one exception - pensioners. If you retired due to old age, then you are allowed to issue a personal income tax refund for the three years that preceded the transaction. For example, an apartment was purchased in 2019, and taxes can be returned for 2016-2018. If, of course, during this period you received such income from which 13% income tax was deducted from you.

With the help of such a benefit, the state allows pensioners to more fully enjoy the right to deduction.

Causes of violation and consequences

If a citizen violates the deadline for submitting a declaration, according to which it is necessary to pay funds to the budget, then punishment will follow in accordance with the norms of Russian legislation.

When the 3-NDFL is not submitted before the specified date, but there is no obligation to pay tax, and it was compiled simply for information, then this violation is not punishable by law.

Also, taxpayers who submitted a 3-NDFL declaration for social and property deductions after April 30 are not liable. There are no deadlines for such documents. This process can be carried out throughout the year.

The Tax Code of the Russian Federation provides for a number of penalties for failure to submit a declaration or violation of filing deadlines. Even the fact that 3-NDFL contains only zero indicators does not exempt entrepreneurs from fines. It is 1000 rubles.

If the document reflects the amount of tax required for payment, but the funds have not been transferred, a fine of 5% is charged for each month of delay, but not less than 1000 rubles and not more than 30% of the payment amount.

You can find out more about the deadlines in this video.

znaybiz.ru

Types of tax returns

According to the types of taxes declared, the following types of declarations are distinguished:

- VAT declaration;

- Income tax return;

- Personal income tax declaration;

- Declaration of tax paid in connection with the application of the simplified taxation system;

- Declaration of tax on imputed income for certain types of activities (UTII);

- Declaration on the unified agricultural tax;

- Property tax declaration;

- Transport tax declaration;

- Land tax declaration;

- Declaration of mineral extraction tax (MET);

- Water tax declaration;

- Excise tax declaration, etc.

Who can submit a single simplified tax return for the 2nd quarter of 2020

Read about the EUD form here.

Submission of the EUD replaces the submission of declarations for VAT, income tax, simplified tax system and unified agricultural tax.

IMPORTANT! Entrepreneurs on OSNO do not have the right to take the EUD.

In order to be able to submit a single declaration instead of all of the above, taxpayers need to meet the requirements set forth in the Tax Code (clause 2 of Article 80):

- During the reporting (tax) period, no object of taxation should arise.

- During the period, no transactions related to the cash register or current account should be carried out.

That is, in order to be able to report on the EUD for the 2nd quarter of 2019, a business entity for the entire first half of 2020 must have no objects of taxation for taxes corresponding to the chosen regime, and payments in cash or non-cash funds.

The EUD cannot be non-zero. This follows both from the meaning of this type of reporting and from the form of the declaration. It does not provide columns where you could enter numerical data.

EUD is a confirmation of the absence of a taxable object. As an example, let’s look at different opinions on the possibility of filing a EUD with UTII. The Ministry of Finance believes that a zero declaration for UTII cannot be formed, since when in this special regime, the tax is calculated from the basic profitability and physical indicators.

The courts object to the Ministry of Finance. For example, the Arbitration Court of the West Siberian District, in its resolution dated August 17, 2016 No. F04-3635/2016, summarized that if there was no physical indicator in the period (for example, a store lease agreement was terminated before the start of the period), then the taxpayer has the right to return the zero amount for UTII.

Let's figure out what kind of zero this will be? Declaration for UTII, in which there is a zero payable, or EUD? Essentially, this hypothetical UTII declaration should indicate:

- physical indicator;

- basic return;

- coefficients (K1 and K2);

- tax rate.

These are all numeric values. It’s just that the physical indicator in the event of its disposal will be equal to 0. As a result, there will be no tax to pay. But from the point of view of correctly filling out the report, it will not be possible to “shove” numerical values into the EUD.

That is, you cannot submit a EUD instead of a UTII declaration. Simply because the procedure for calculating tax requires the presence in the declaration of numerical values other than zero.

NOTE! A similar rule applies when choosing what to submit for VAT. If during the period there were turnovers not subject to VAT, which must be recorded in the VAT return, you can only submit a VAT return. In this case, you cannot submit the EUD.

Tax return forms

The forms and procedure for filling out forms of tax returns (calculations), as well as the formats and procedure for submitting tax returns (calculations) and documents attached to them in accordance with this Code in electronic form are approved by the federal executive body authorized for control and supervision in the field of taxes and fees, in agreement with the Ministry of Finance of the Russian Federation.

The federal executive body authorized for control and supervision in the field of taxes and fees does not have the right to include information in the tax return (calculation) form, and tax authorities do not have the right to require taxpayers (payers of fees, tax agents) to include information in the tax return (calculation) , not related to the calculation and (or) payment of taxes and fees, with the exception of:

- type of document: primary (corrective);

- name of the tax authority;

- location of the organization (its separate division) or place of residence of an individual;

- surname, name, patronymic of an individual or full name of the organization (its separate division);

- taxpayer contact telephone number;

- information to be included in the tax return.

Making changes to your tax return

If the taxpayer discovers in the tax return submitted by him to the tax authority the fact of non-reflection or incomplete reflection of information, as well as errors leading to an underestimation of the amount of tax payable, RSP°P»PsPiRѕPїP»P°C‚PµP»SЊC‰РеРє is obliged to make the necessary changes in the tax return and submit an updated tax return to the tax authority.

If a taxpayer discovers inaccurate information in the tax return submitted to the tax authority, as well as errors that do not lead to an underestimation of the amount of tax payable, the taxpayer has the right to make the necessary changes to the tax return and submit an updated tax return to the tax authority in the manner established by this article .

In this case, an updated tax return submitted after the expiration of the established deadline for filing the return is not considered submitted in violation of the deadline.

If an updated tax return is submitted to the tax authority before the deadline for filing a tax return, it is considered submitted on the day the updated tax return is submitted.

If an updated tax return is submitted to the tax authority after the deadline for filing a tax return, but before the deadline for paying the tax, the taxpayer is released from liability if the updated tax return was submitted before the taxpayer learned that the tax authority had discovered the fact of non-reflection or incompleteness of information. in the tax return, as well as errors leading to an underestimation of the amount of tax payable, or the appointment of an on-site tax audit.

If an updated tax return is submitted to the tax authority after the deadline for filing a tax return and the deadline for paying the tax, the taxpayer is released from liability in the following cases:

1) submission of an updated tax return before the taxpayer learns that the tax authority has discovered non-reflection or incompleteness of information in the tax return, as well as errors leading to an understatement of the amount of tax payable, or about the appointment of an on-site tax audit for a given tax for a given period, provided that before submitting an updated tax return, he paid the missing amount of tax and the corresponding penalties;

2) submission of an updated tax return after an on-site tax audit for the corresponding tax period, the results of which did not reveal non-reflection or incompleteness of information in the tax return, as well as errors leading to an understatement of the amount of tax payable.

The updated tax return is submitted by the taxpayer to the tax authority at the place of registration.

The updated tax return (calculation) is submitted to the tax authority in the form that was in force during the tax period for which the corresponding changes are made.

Which tax office should I file my return with?

The 3-NDFL declaration is always submitted to the tax office at the address of permanent registration/registration (clause 3 of Article 228 of the Tax Code of the Russian Federation, clause 2 of Article 229 of the Tax Code of the Russian Federation, clause 1 of Article 83 and Article 11 of the Tax Code of the Russian Federation). In this case, the location of the purchased apartment, the place of your residence, work, study do not matter.

Example : Kupreev A.A. registered in Samara, but has been living in Moscow for several years with temporary registration. In Moscow, Kupreev bought an apartment and decided to get a property tax deduction. Despite the fact that Kupreev has temporary registration in Moscow, and the fact that the purchased apartment is located there, in order to receive the deduction, Kupreev must submit a 3-NDFL declaration at the place of permanent registration - to the tax office of Samara.

Only in the absence of permanent registration, the 3-NDFL declaration is submitted at the place of temporary registration. Before filing a tax return, the taxpayer must come to the tax authority and register.

Example : If in the situation described in the previous example, Kupreev A.A. If he were to leave his apartment in Samara and lose his permanent registration, he could come to the tax office at the place of temporary registration in Moscow, register there and then file a 3-NDFL tax return there.

If you do not know the address of your tax office, it can be found on the website of the Federal Tax Service of Russia.

Trust the professionals!

An expert will help!

To get a consultation

Methods for filing tax returns

A tax return (calculation) can be submitted by a taxpayer (payer of a fee, tax agent) to the tax authority personally or through a representative, sent by mail with a list of attachments, transmitted in electronic form via telecommunication channels or through РЅРёС‡РСыРNo. кабРенет налогоплательщРеРєР°.

When sending a tax return (calculation) by mail, the day of its submission is considered the date of sending the postal item with a description of the attachment.

When transmitting a tax return (calculation) via telecommunication channels or through the taxpayer’s personal account, the day of its submission is considered the date of its dispatch.

Penalties for late filing of tax returns

Failure to submit a tax declaration to the tax authority at the place of registration within the deadline established by the legislation on taxes and fees entails the collection of a fine in the amount of 5 percent of the amount of tax not paid within the period established by the legislation on taxes and fees, subject to payment (additional payment) on the basis of this declaration, for each full or less than a month from the date established for its submission, but not more than 30 percent of the specified amount and not less than 1000 rubles.

Example. Calculation of the fine for late submission of income tax returns

The income tax return for 2020 was submitted by the organization on April 1, 2020 (the last day of the deadline established by law is March 28, 2016). The declaration indicates the amount of tax to be reduced.

Under such conditions, the amount of the fine for late submission of the declaration for 2020 will be 1,000 rubles. (since there is no need to pay additional tax on the basis of the annual declaration, the fine is paid in the minimum amount regardless of the time of delay).

www.audit-it.ru

Personal income tax is usually paid automatically - it is withheld from wages. But in some cases, individuals must independently calculate the amount of tax and submit a personal income tax return to the tax authority (form 3-NDFL).

The 2020 declaration campaign began on January 1, 2018, which means that individuals must report income received in 2017 by May 3, 2018 .

We remind you that you should submit a 3-NDFL declaration:

- when receiving income from the sale of property (for example, an apartment owned for less than the minimum period of ownership), from the sale of property rights (assignment of the right of claim);

- when receiving a gift of real estate, vehicles, shares, interests, shares from individuals who are not close relatives;

- when receiving remuneration from individuals and organizations that are not tax agents, on the basis of concluded contracts and agreements of a civil law nature, including income from property lease agreements or lease agreements of any property;

- when receiving income in the form of winnings paid by the organizers of lotteries and other risk-based games;

- when receiving income from sources located outside the Russian Federation.

Individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices and other persons engaged in private practice must also declare income received in 2020.

At the same time, submitting a tax return does not mean the need to immediately pay tax. The tax payable calculated in the declaration must be paid no later than July 16, 2018.

For citizens submitting a tax return for 2020 solely for the purpose of obtaining tax deductions for personal income tax (standard, social, investment, property when purchasing a home), the established deadline for filing a return - May 3, 2020 - does not apply . Such returns can be submitted at any time throughout the year, without any tax penalties .

At the same time, a taxpayer who declared in the tax return for 2017 both the income subject to declaration and the right to tax deductions is obliged to submit such a declaration within the prescribed period - no later than May 3, 2020.

Please note that the penalty for failure to submit a declaration on time is 5% of the amount of tax not paid on time for each month, but not more than 30 percent of the specified amount and not less than 1,000 rubles.

The fine for non-payment of personal income tax is 20% of the amount of unpaid tax.

To fill out the 2020 income tax return, it is most convenient to use the special computer program “Declaration 2017”, which is freely available on the website of the Federal Tax Service of Russia and will help you correctly enter data from the documents, automatically calculate the necessary indicators, check the correctness of calculation of deductions and tax amounts, and will also generate a document for submission to the tax authority.

Also, for users of the “Taxpayer’s Personal Account for Individuals” service, it is possible to fill out a personal income tax return online in an interactive mode without downloading a program for filling it out with the possibility of subsequently sending the generated declaration, signed with an enhanced non-qualified electronic signature (which can be downloaded and installed directly from the “Personal Account” "), as well as a set of documents attached to the tax return to the tax authority in electronic form directly from the website of the Federal Tax Service of Russia.

For the convenience of citizens wishing to submit a tax return, before the end of the declaration campaign (until May 3, 2020), the work schedule of tax inspectorates is changed (including on Saturdays), additional consultation points and hotlines are provided, and “Open Days” are held. ", seminars and trainings for taxpayers - individuals, etc.

Tax returns must be submitted to the tax authority at your place of registration (place of residence). You can find out the address, telephone numbers, as well as the exact opening hours of your inspection in the section “Address and payment details of your inspection”.

The information below depends on your region (64 Saratov region)

Opening hours of operating rooms of all tax inspectorates during the declaration campaign

| Working hours | |

| Monday | from 9.00 to 18.00 (except Open Days) |

| Tuesday | from 9.00 to 20.00 |

| Wednesday | from 9.00 to 18.00 |

| Thursday | from 9.00 to 20.00 |

| Friday | from 9.00 to 16.45 (except Open Days) |

| All Saturdays of the month | from 10.00 to 15.00 |

| Sunday | day off |

Open days to inform citizens about tax legislation and the procedure for filling out personal income tax returns

| the date of the | Location |

| March 23 | View events |

| March 24 | View events |

| April 23 | View events |

| April 24 | View events |

For questions regarding the declaration of income of individuals, you can contact the Federal Tax Service of Russia for the Saratov Region

| +7 |

www.nalog.ru

Should an entrepreneur report on Form 3-NDFL?

Who submits 3-NDFL - the answer to this question is regulated by the norms of the tax legislation of the Russian Federation. Let's study the provisions of Art. 227 of the Tax Code of the Russian Federation, answering the question about those entrepreneurs who must submit 3-NDFL.

Only entrepreneurs who are under the general taxation regime are required to submit Form 3-NDFL to the tax authorities for verification. In this case, income tax replaces the profit tax paid by legal entities.

Individual entrepreneurs on OSNO, even in the absence of activity, are required to submit a zero 3-NDFL declaration.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Individual entrepreneurs using special regimes do not file an income declaration, since VAT, personal income tax and property tax (calculated at book value) are replaced by one tax corresponding to the regime: simplified tax system, unified agricultural tax, UTII, PSN. Moreover, if an entrepreneur receives income from activities that do not fall under the special regime, then he is obliged to file a declaration of income as an individual, taking into account the provisions of Chapter. 23 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated April 23, 2013 No. 03-04-05/14057).

Form 3-NDFL was approved by order of the Federal Tax Service of Russia dated October 3, 2018 No. ММВ-7-11/ [email protected] . Starting with reporting for 2020, the document is filled out using an updated form (taking into account the order of the Federal Tax Service of Russia dated October 7, 2019 No. ММВ-7-11/506).

The form can be presented:

- the taxpayer personally;

- through a representative by proxy;

- via telecommunication channels with the electronic signature of the entrepreneur;

- through the taxpayer’s personal account on the department’s website.

The deadline for submitting the document should not be later than April 30 of the year following the reporting year. Otherwise, tax authorities will impose penalties in the amount of 5% of the calculated tax, but not more than 30% and not less than 1,000 rubles. The deadline, provided it falls on a weekend, may be postponed to the next working day.

You can familiarize yourself with Form 3-NDFL in this article.

Art. 227 of the Tax Code of the Russian Federation contains a list of those self-employed persons who are required to submit 3-NDFL. In addition to individual entrepreneurs, these include:

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

- notaries;

- lawyers;

- other persons engaged in private practice.

Art. 207 of the Tax Code of the Russian Federation talks about who is recognized as a taxpayer and, accordingly, who must submit 3-NDFL. Let's study its features in more detail.