In the Republic of Belarus, starting from March 23, 2020, there are new requirements for registration of business trips for employees and reimbursement of expenses for business trips.

The changes apply to employees sent on business trips after March 23, 2020. Payments to employees sent on business before March 23 are made according to the old rules and regulations. Link to the official document of the Ministry of Labor: https://www.mintrud.gov.by/ru/news_ru/view/-o-porjadke-i-razmerax-vozmeschenija-rasxodov-garantijax-i-kompensatsijax-pri-sluzhebnyx-komandirovkax-_3169 /

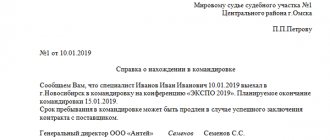

Procedure for documenting a business trip

Before sending an employee on a business trip, an order is issued on the basis of which an advance is paid to the employee. Depending on the purpose of the trip, the employer himself decides whether to issue a task to the employee, and also determines the need to submit a report on its completion and in what time frame the report should be submitted.

There is no need to issue a travel permit for the employee. There is also no need to keep a log of employees going on business trips.

However, this rule does not cancel travel certificates. Certificate forms can be filled out by hand on printed form or downloaded from the Internet - for example, from the Belforma website: (https://belforma.net/forms/Ministry of Finance/Travel_certificate)

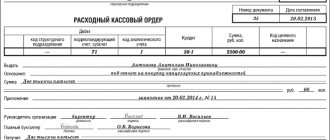

As before, all travel expenses (travel, rental accommodation, daily allowance, etc.) are reimbursed to the employee based on an advance report. The advance report can be filled out either by hand on printed form or using technical means.

A little about advance payments

The employer gives the employee an advance amount, which he can spend on paying for transport tickets and hotel reservations (the company employee must travel to the train station or airport at his own expense). The advance is issued to the employee a few days before the trip (this period is discussed in more detail with the accounting department in person), however, the person will have to take personal funds with him on the trip, from which he will pay for those services that were not taken into account in the advance payments. Subsequently, it draws up a report according to which the accounting department will return the money spent to the person.

If the advance funds are not fully spent, the accounting department, based on an application from the employee, returns the funds to the company’s accounts. The official standard for daily travel expenses may be exceeded, because this is not prohibited by law, but if the amount is more than 700 or 2500 rubles (for a trip abroad), then it is subject to 13% tax. Typically, employers do not want to pay extra taxes to the state, so full-time employees have to be content with what the accounting department gives them or compensate for the differences from their own budget.

How to create a report?

Knowing what the amount of travel expenses will be in 2020, the daily allowance for which is indicated above, it is easy to draw up a report to submit to the accounting department. The report must begin by filling in the primary data regarding travel expenses. The title page is filled in with the data of the employee sent on a business trip (confirmed by the employee’s personal documents). Next, the amount that was spent during the trip is written down, supported by a personal signature, and the personal data of the person accepting the document is indicated on the spine of the report. Then the amount is checked against the advance payment that was issued, and if there were enough funds, then the report is accepted, and if not, then the accounting department specialists reimburse the person for the money spent within the daily limit. However, first they check all checks and financial documents, and only then they carry out all financial transactions.

As a conclusion, we can once again say that the amount of daily travel expenses in 2020 will remain the same, and the rules for their provision will remain unchanged. Today, very often the media discusses information that travel expenses may be canceled because during the crisis this measure seemed necessary. However, this information has not been officially confirmed by the authorities, so no one should worry about this.

Compensation of expenses

For travel

The employee is compensated for all travel expenses by any type of transport, except taxi, based on supporting documents.

If the employee does not have travel documents, then travel costs are compensated in the amount of 0.1 BV in each direction. This rule does not apply to international drivers.

If, when traveling abroad, an employee is forced to get to the place of stay by several vehicles, then, if he has supporting documents, he will also be reimbursed for the costs of transfers and taxis.

The new rules determine that an employee can use a taxi or a rental car if he is outside the Republic of Belarus. Such expenses are reimbursed only by agreement with the employer.

For accommodation

From March 23, 2019, when traveling in the Republic of Belarus, the amount of compensation for rental housing costs has been increased if there are no documents confirming the actual payment for accommodation per day:

- Minsk and regional centers - 50.00 rubles.

- for regional centers - 25.00 rubles.

- for others - 20.00 rub.

Costs are reimbursed from the date of arrival inclusive.

By the way, before I forget.

In Belarus there are very few competent websites and Telegram channels dedicated to the topic of Finance. Our channel @FinBel is among them. We publish interesting materials about everything related to money in Belarus: investments, real estate, business, individual entrepreneurs, taxes and a little accounting, financial life hacks. All articles are based on the personal experience of the authors.Subscribe so you don’t have to search later - @FinBel

For example: an employee left for Minsk from March 25, 2019 to March 28, 2019. He lived with relatives, and he does not have documents for renting housing. In this case, he draws up an advance report only within the established norms. The amount to be reimbursed for housing costs according to the report will be: 4 days (25.03, 26.03, 27.03, 28.03) x 50.00 = 200.00 rubles.

A similar method for calculating the amount of reimbursement for housing costs is also used for business trips abroad. Cost reimbursement standards are established for each country (Appendix 2 to the Resolution of the Council of Ministers of the Republic of Belarus dated March 19, 2019 No. 176).

Housing rental costs are not reimbursed when the employee has the opportunity to return home every day or is on a business trip for no more than one day.

Who sets the size

The amount of daily allowance is determined directly by the company. She can approve the amount of payments with the following documents:

- by order of the chief executive;

- local regulatory act (for example, Regulations on business trips);

- collective or labor contract.

There are limits on amounts that are not subject to tax. For trips within Russia the maximum amount is 700 rubles, for business trips abroad – 2500 rubles. Below these values, amounts are not subject to the personal income tax rate (clause 3 of Article 217 and clause 2 of Article 422 of the Tax Code of the Russian Federation).

If the amount of compensation is greater than the maximum abroad, for example, by 200 rubles, then they are subject to tax. The same situation applies to business trips around Russia.

The Russian Ministry of Labor states that the amount of daily allowance may depend on the position of the employee. The higher the status, the greater the payout. And vice versa. The amount of compensation for each position is established by the local regulatory act of the institution.

Regardless of the amount of daily allowance, alimony cannot be withheld from them, since they relate to compensatory payments. They are deducted only from income.

Daily allowance

From March 23, 2019, the daily allowance rate within the Republic of Belarus has increased and is 9.00 rubles.

Daily expenses are paid at the rate of 100%, regardless of the location and duration of the trip. The daily allowance also includes travel time, regardless of the provision of food.

Two examples:

1. The employee was sent to Dzerzhinsk for one day on March 25, 2019. On this day he returns home. The daily allowance for reimbursement is 100% of the norm: 1 day x RUB 9.00. = 9.00 rub.

2. The employee was sent on a business trip to Riga (Latvia) for the period from March 25 to March 28, 2020. He was on the road for two days: March 24 and 29. The daily allowance amount will be: 6 days (24.03, 25.03, 26.03, 27.03, 28.03, 29.03) x 50 EUR (daily allowance according to Appendix 2) = 300 EUR.

Housing rental costs and daily allowances are not reimbursed for those days on which the employee is at the location of the business trip before it begins or at the end for personal purposes (weekends, public holidays, etc.). Only travel is paid.

Amount of daily allowance for business trips in budgetary institutions in the Russian Federation

| Document date | 01.08.2014 |

| Tags | Article |

DAILY ALLOWANCE IN STATE AND MUNICIPAL INSTITUTIONS: WHAT'S NEW?

M.A. Kozlov, lawyer, Moscow

Currently, legislation is changing quite quickly. However, there are a number of “eternal” problems that cannot yet be solved. One of these problems is the amount of per diem for federal institutions. Federal Law No. 55-FZ dated April 2, 2014 (hereinafter referred to as Law No. 55-FZ) introduced a number of changes to the Labor Code of the Russian Federation, including regarding the procedure for reimbursement of expenses associated with business trips of employees of state and municipal institutions. However, these amendments have not yet led to a significant improvement in the situation.

Regulatory situation

A daily allowance of 100 rubles per day for institutions financed from the federal budget was established by Decree of the Government of the Russian Federation dated October 2, 2002 No. 729 (hereinafter referred to as Resolution No. 729). And this norm has been in effect for more than 10 years. Obviously, this amount of daily allowance no longer corresponds to the real state of affairs. And, for example, according to paragraph. 13 clause 3 art. 217 of the Tax Code of the Russian Federation exempts daily allowances in the amount of up to 700 rubles from personal income tax. inclusive for each day of a business trip in Russia. Let us recall that the procedure for providing guarantees and compensation when sending employees on business trips is regulated by Chapter 24 of the Labor Code of the Russian Federation. In this case, a business trip is understood as a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. Article 167 of the Labor Code of the Russian Federation establishes that when an employee is sent on a business trip, he is guaranteed to retain his place of work (position) and average earnings, as well as reimbursement of expenses associated with a business trip, which include: – travel expenses; – expenses for renting residential premises; – additional expenses associated with living outside the place of permanent residence (per diem); – other expenses incurred by the employee with the permission or knowledge of the employer (Part 1 of Article 168 of the Labor Code of the Russian Federation). Please note that the above list has been supplemented by paragraphs. 12 clause 1 art. 264 of the Tax Code of the Russian Federation, which classifies as business trip expenses: – payment for additional services provided in hotels (except for expenses for service in bars and restaurants, expenses for room service, expenses for using recreational and health facilities); – registration and issuance of visas, passports, vouchers, invitations and other similar documents; – consular, airfield fees, fees for the right of entry, passage, transit of automobile and other transport, for the use of sea canals, other similar structures and other similar payments and fees. Please note that these expenses are included in expenses when determining the taxable base for income tax. The norms of the Labor Code of the Russian Federation are reflected in the Regulations on the peculiarities of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 (hereinafter referred to as Regulation No. 749), according to which additional expenses associated with living outside the place of residence (per diems) are reimbursed to the employee for each day of being on a business trip, including weekends and non-working holidays, for days of travel (clause

Note. Access to the full contents of this document is restricted.

In this case, only part of the document is provided for familiarization and avoidance of plagiarism of our work. To gain access to the full and free resources of the portal, you just need to register and log in. It is convenient to work in extended mode with access to paid portal resources, according to the price list.