What has changed in accounting for insurance premiums?

Information on insurance premiums from January 1, 2020 must be submitted to the tax office and the Funds. Enterprises will submit a single calculation for maternity and the following contributions: social, medical, and pension. For the social insurance fund, a new form 4 of the Social Insurance Fund has been introduced, created for contributions for injuries. It is appropriate to add about the change in the deadlines for submitting reports to the pension fund.

The maximum bases for pension contributions and maternity contributions have increased. If an enterprise calculates contributions based on a preferential tariff, then it does not pay pension and social contributions for income above the limited amount. A resolution is introduced on fines if the enterprise does not confirm the previously specified main activity within the specified time frame, then the Social Insurance Fund independently sets the maximum tariff for accounting for contributions for injuries.

Enterprises and individual entrepreneurs using the simplified tax system in 2020, as in the previous year, are provided with benefits provided that total income does not exceed 79 million rubles. In the new year, the possibility of offset between different contributions will disappear. It is now possible to credit overpaid contributions for contributions only to future payments, penalties and fines for the corresponding insurance premiums, and the overpayment for the latter is returned by the Federal Tax Service. There is a high probability that if reporting is delayed, the tax office will block accounts.

https://youtu.be/Zs0ZlYX6qPI

Online cash registers

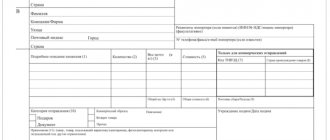

The “Online-KKT” terminal is a cash register that instantly transmits sales information to the OFD via the Internet. Its use makes it possible to increase the transparency of financial transactions, reduce the number of checks and the amount of accounting costs, which forms the expenditure side of the budget of any enterprise.

In 2020, certain groups of taxpayers were able to work without online cash registers, since their presence was not a prerequisite for carrying out commercial activities. But from July 1, 2019, this will be a permanent requirement for all businesses operating in the catering and retail sectors.

Another innovation will concern check details. Previously, such a document did not indicate the product code. But starting next year, it will be added to the details and will be indicated when selling certain groups of labeled goods.

Changes in minimum wage and salary

On January 1, 2020, another increase in the federal minimum wage and the cost of living is planned. This is caused by an increase in the cost of certain groups of goods, which is the main prerequisite for revising the size of these indicators. According to the provisions of Law No. 421-FZ, for the working-age population the cost of living will be set at 11,280 thousand rubles, which means that this figure will be increased by 4%.

The list of preferential categories of personnel whose dismissal is contrary to current legislation has been expanded. If in 2018 these were only pregnant women and women with young children (under 3 years of age), then news for the accountant in 2020 will be that these categories have been supplemented by employees of pre-retirement age, who have no more than 2 years left before end of work.

If an employer cooperates with foreign specialists, he will now have to monitor their timely departure from the Russian Federation (previously there was no such provision in the current law). In case of violation of the period of legal stay of a foreigner in Russia, his enterprise will have to pay a fine of 500 thousand rubles.

For chief accountants, legislators also provided for stricter personal responsibility. If previously for violation of deadlines or refusal to transfer wages to the payment card specified by the employee, one could receive a fine of 5 thousand rubles, then from 2020 the amount of such a penalty will be 20 thousand rubles. In addition, having received a writ of execution for forced collection, the accounting department can deduct up to 100 thousand rubles from the employee for debts, which is allowed by the new amendments.

Permanent and visiting accountant: who can work on a self-employment basis

A permanent accountant works on the basis of an employment contract. All taxes and deductions are made by the employer.

A visiting accountant can work on a self-employment basis. Labor relations with him are concluded on the basis of a GPC agreement, and the employee makes all taxes and deductions independently through the “My Tax” application.

In addition to an accountant, the following can comfortably conduct business, pay taxes independently and not depend on an employer:

- seamstresses;

- nannies;

- cleaners;

- tutors;

- freelancers;

- food producers and sellers.

Representatives of professions whose work requires travel, no need to obtain a license to carry out activities, and the possibility of remote cooperation can become self-employed.

Important! Self-employment will not be possible for people with a direct employer, as well as civil servants, lawyers and appraisers.