Reporting options

Modern legislation establishes several options for transferring a declaration:

- In electronic form through special portals and Internet communication channels.

- In person or via mail in the form of regular paper.

The choice of one option or another is not free. For example, an enterprise or company with more than 100 employees and a large taxpayer is required to submit reports exclusively electronically.

Small organizations and individuals are allowed to submit reports in paper form - in person or via mail; they are allowed to use the electronic version.

These rules are spelled out in clause 3 and paragraph 1 of clause 4 of Art. 80 of the modern Tax Code of the Russian Federation!

How to send reports by mail to the tax office - Legal collections of BSR-groups

20.07.2018

The Tax Code of the Russian Federation provides several ways by which you can submit a tax return to the Federal Tax Service. One option is to use postal services, namely sending documents by letter via Russian Post. We'll talk more about how to send a letter to the tax office later.

In accordance with Art. 80 clause 4 of the Tax Code of the Russian Federation, the declaration can be submitted by the taxpayer to the tax authority in the following ways:

- In person or through a representative. To do this, you need to contact the Federal Tax Service office and submit documents on paper. The date of acceptance is the date of transmission. At the taxpayer's request, copies of the declaration will be marked with an acceptance mark and the date of receipt.

- Transfer by sending by email or through the taxpayer’s personal account. In this case, the date of acceptance is considered to be the date of sending the documents electronically. Confirmation of acceptance by the Federal Tax Service will be an electronic receipt sent to the sender's address.

- Sending by mail. The date of submission is the date of dispatch! For this reason, when sending papers by mail, you don’t have to worry too much that delivery will take a week, two, or longer.

Article 80 of the Tax Code of the Russian Federation states that the postal item must be sent with an inventory of the contents. Other nuances are not regulated.

The attachment inventory is a special postal document f.107, in which the sender indicates the contents of the postal item. Since documents are sent, you can only indicate their names (if desired, you can add a short description in free form). F. 107 is filled out in two copies: one form remains in the hands of the sender, and the second is attached to the letter and sent along with it. An example of filling is below:

Upon receipt, the addressee (in our case, a representative of the Federal Tax Service) may ask a postal employee to open the mail item and check its contents to ensure that the contents of the envelope correspond to the inventory form.

At his own request, the taxpayer can use an additional paid service of the Russian Post - notification of delivery. The receipt notification, in turn, will be evidence confirming that the letter was actually received by the addressee, since the recipient’s signature will be on the notification.

Generally speaking, having in hand a receipt of delivery, an inventory of the contents and a receipt for payment of postal services, the sender has practically nothing to worry about.

How to send a letter to the tax office

As we found out above, in accordance with the code, a tax return can be sent by mail by letter or parcel post. These two types of postal items are suitable for sending paper products. The only difference is that with the first type of written correspondence you can send paper weighing up to 100 grams, and for heavier items (from 101 grams to 2 kilograms) parcels are intended.

Submission process:

- Buy an envelope of the appropriate size. The envelope can be paper or plastic.

- Take a form f. from the Russian Post office. 107 “Inventory of attachment” and, if you decide to send with notification, form f. 119 “Notification of delivery”. You must fill out the forms yourself. Blank f. 107 can be created on the official website pochta.ru and then printed out, but fill out f. 119 online will not work.

- Provide information on the envelope's address label: write the address, zip code, and name of the recipient organization and your return address.

- Hand over the envelope, documents and forms to be sent to the operator. Say that you want to send a valuable letter with an inventory of the attachment. You should not seal the envelope yourself. The operator must make sure that the form f. 107 actually indicates what will be sent.

- Pay for postal services.

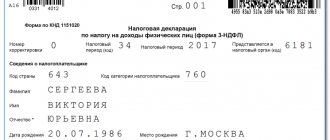

Requirements for filing a paper declaration

All currently accepted tax reporting forms are fully adapted for convenient and quick reading of information. This process is carried out using scanners. It is for this reason that special requirements are imposed on the forms on which income data is filled out:

- The form must be printed on A4 sheet;

- The width of the margins on the paper should not exceed the permitted boundaries - the left margin is from 5 to 30 mm, the right and bottom edges are from 5 mm;

- Information is written strictly on one side of the paper;

- The main text is printed in black font, the font category is Times New Roman, as well as Arial;

- Letter size should be 10-11 for titles and 9 for body text. It also sets single spacing between lines;

- There must be a special barcode on the sheet of paper.

These requirements are established by the standard for the form of documents. It was approved by order of the Federal Tax Service of Russia No. ММВ-7-17/535!

If a company or individual entrepreneur submits an income report on paper, copied on special equipment, these rules and requirements must be observed.

Report submission deadlines

There are several report options. The most common options are:

- A single simplified form of declaration on the activities of a non-operating company;

- Special final declaration for the quarter;

- Standard report for the year worked.

All versions of reports are submitted strictly to the location of the company or to the person’s residential address. The main thing is to respect the date. Delivery must be made no later than the 20th day of the month immediately following the reporting quarter, half-year or year.

If the document is sent by mail, the exact time of delivery will be the date of sending the letter and the enclosed inventory!

Options for sending via mail

The subject independently chooses how to send the report. The main condition is that if a post office is selected, an inventory must be attached. When deciding to act via mail, the taxpayer must choose one of the options - valuable, registered or regular letter. Each option should be considered in more detail.

Regular shipping

This is the cheapest method of reporting. You will only have to pay for the envelope and the light weight. The disadvantage of this option is that the envelope does not have an official stamp. That is, the shipment is not registered, and if it is lost, nothing can be proven.

Ordered letter

This is another more or less cheap method of sending a declaration. The sender is given a receipt that can be used as evidence if lost. If the sender loses the receipt, it will be quite difficult to prove the fact that the report was sent and the date. The inventory here is made by the sender himself. No official stamps are placed. This can also become a problem if papers are lost.

Valuable letter

Another option for registered shipment. If documents are lost, the sender will be able to assign a price to the letter. This amount will be paid if the letter cannot be found. The advantage is the fact that the inventory is compiled by a department employee.

The information is written down on the form and stamped. In the valuable letter, the inventory itself will act as confirmation of the shipment and the date of the operation. To further protect the letter, you can use a special notification of delivery.

Based on all of the above, we can conclude that:

It is recommended to send the tax return in the form of a valuable letter with mandatory notification of receipt!

What is a “postal form” and why is it needed?

A postal form is a document that is necessary for registering postal items. Its format depends on the category of the item. In the Russian Federation, this issue is regulated by the Rules for the provision of postal services. Paragraph 30 describes that Form 103 is used for closed international parcels. In this case, it is necessary to additionally fill out the customs declaration CN 23 and the accompanying address CP 71. If the shipment is with delivery within Russia, then only one form is enough.

Form 103 can be filled out independently, according to the approved sample. The same applies to forms 119 and 107. F.107 is used to list the contents of the parcel so that, without opening it, it is obvious what is inside.

Important! You can make an inventory at home, but the parcel must be taken to the post office unopened. Employees must be able to verify that what is written matches what is actually sent.

F. 119 is filled out by the sender. A notification form is needed so that he is notified that the recipient has picked up the parcel. Information about receipt can also be sent to another person, in f. 119 then his details must be indicated.

Violation of reporting method

If the reporting person files the return incorrectly or fails to provide required documents, he or she will face tax liability. Here are the main penalties:

- 200 rubles for violating reporting deadlines.

- 200 rubles for a missing additional document.

- From 300 to 500 rubles for late submission of a report on an official tax application.

To avoid such penalties, it is necessary to track the sending of reports using the stamp issued by the post office.

The declaration will be considered sent on time if it was sent by mail 24 hours before the due deadline!

If problems arise related to violation of deadlines and a fine issued, you can go to court. If the taxpayer is sure that he did not violate the deadlines, he will need to present a postal receipt. If it indicates the date of dispatch, at least one day before the due date, the fine will be automatically removed.

It turns out a similar receipt without problems. If a valuable or registered letter is sent, it must be registered and a special receipt is issued. In addition, when issuing a valuable letter, the postal employee takes a receipt from the addressee that the letter has been received.

Inventory of attachment

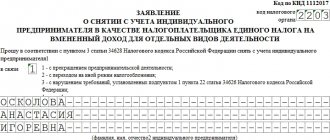

If the declaration is sent by mail, there must be a special inventory of the attachment. This is stated in paragraphs 1 and 3 of paragraph 4 of Art. 80 NK!

There are several rules for how to correctly compose an inventory:

- Information must be entered on letterhead.

- At the top is written the full name of the company or the name of the entrepreneur, as well as checkpoint codes, INN, OGRN, official bank details and legal address.

- In the middle part the name of the paper is written, that is, Inventory of the Attachment.

- Next, the list contains all declarations and documents enclosed in the registered letter.

- After the list, responsible and management persons put their signatures.

This type of inventory is suitable for enterprises. If the declaration is submitted by an individual, you can use standard forms drawn up in Form 107. You can obtain a sample of such a form at the post office itself.

The paper with the inventory must be prepared in two copies. One is placed in the envelope with the declaration. The second sender keeps it for himself. It must be accompanied by a receipt that the letter has been sent and a special notification with a postmark has been issued.

How to register a parcel for shipment and fill out a declaration

How to register a parcel for shipment and fill out a declaration

How to fill out the declaration correctly and is it difficult? These are the most frequently asked questions when placing an order through our service.

The answer is - it will take some time, but it is not difficult to do. The declaration is filled out by the client independently (both for and for “Full support”). Fill out the declaration carefully - for submitting knowingly false information, you (and we) face a fine and even confiscation of the parcel by customs.

Parcel registration

So, the necessary goods have arrived at the warehouse and you are ready to form a parcel for shipment. Let's get started:

Step 1: Mark the required products by checking the box on the left and add them to the parcel by pressing the button.

Step 2: If you want to remove one of the added products, you will need to tick it inside the package being generated and click the “Remove from package” button. Please note that you can only remove the item from the parcel BEFORE sending it for assembly.

Step 3: Choose a delivery method. Click on the “Select a delivery service” field and scroll through the list to see all available delivery types.

These first steps are the same for all delivery services. Further processing of the parcel is slightly different, depending on the requirements of a particular delivery service.

If you choose Econom or USPS shipping

Step 4: Fill in the recipient's details (pay attention to the prompts highlighted in red)

Step 5: Select additional options. IMPORTANT: Please note that the "If something doesn't fit" option is only available in Econom, Econom Lite or USPS. When choosing Econom or Econom Lite shipping, you can choose from the options "Collect what fits" or "Change to USPS."

We choose additional packaging and/or add pre-prepared sets of sweets or Coca-Cola to the parcel. Be careful, sweets and cola increase the weight of the parcel. Don't add them unless you're sure you want to buy them.

Step 6: Fill in your insurance information. Econom's shipment insurance is mandatory. Shipping cost insurance is optional.

Step 7: Add goods to the declaration. Click “Add” and open the “Declaration” window, where there are three lines: “Name”, “Quantity” and “Cost”. We carefully fill out this information for each product.

For USPS and Econom delivery, you can combine items into groups or categories when filling out a declaration. For example, you can combine your products into the category “Baby clothes” or “Men clothes”, that is, without specifying each product in detail in the parcel. Or you can group products into the “Women watches” category. It is important that there are no more than 10 products in one category.

If you chose Express or FastBox delivery

Step 4: Fill in the recipient's details (pay attention to the prompts highlighted in red)

In some browsers, to find a parcel terminal or pick-up point in your city, you need to zoom out on the map using the minus button so that other cities are visible, and move on the map to your city. And then zoom in on the map again.

Step 5: Select additional options. IMPORTANT: Please note that the “Requests for parcel assembly” option is only available for Express delivery. This option is not available for FastBox delivery.

We choose additional packaging and/or add pre-prepared sets of sweets or Coca-Cola to the parcel. Be careful, sweets and cola increase the weight of the parcel. Don't add them unless you're sure you want to buy them.

Step 6: Enter your passport details, series and number, country and date of issue, as well as the TIN of the parcel recipient.

Step 7: Add goods to the declaration. Click “Add” and the “Declaration” window opens, where there are lines: “Name in English”, “Name and description in Russian”, “Quantity”, “Cost”, “Product URL”, “Product Article”, “Brand” .

IMPORTANT: The declaration must be filled out separately for each item in your parcel. It is necessary to fill out all the lines in the “Declaration” window. After filling out all the lines, click the “Save” button, and then click the “Add” button again and enter data about another product. And so on for each unique product in the parcel.

If you cannot find the product article, enter a link to the product in this window.

If the product is no longer in the store or you bought the product at a discount, take a screenshot of your order (usually the store sends it by email), upload the picture to the cloud and attach a link to it instead of a link to the product from the store.

If you chose delivery by Nova Poshta (Ukraine)

Step 4: Fill in the recipient's details (pay attention to the prompts highlighted in red)

Step 5: Select additional options. IMPORTANT: Please note that the "If something doesn't fit" option is only available in Econom, Econom Lite or USPS.

We choose additional packaging and/or add pre-prepared sets of sweets or Coca-Cola to the parcel. Be careful, sweets and cola increase the weight of the parcel. Don't add them unless you're sure you want to buy them.

Step 6: Fill in your insurance information.

Step 7: Add goods to the declaration. Click “Add” and open the “Declaration” window, where there are three lines: “Name”, “Quantity” and “Cost”. We carefully fill out this information for each product.

If you chose SuperFast delivery

You need to fill in all the data necessary for sending in advance, before the parcel arrives at the warehouse. The parcel will fly to you without repacking and without the possibility of consolidation with other parcels

Step 1: Enter the tracking number of the parcel before it arrives at the warehouse. Add tracking for the expected parcel - add only tracking numbers and letters.

Correct: 9361289681090727416320

Incorrect: Tracking ID: 9361289681090727416320

Step 2: Select your delivery region. For SuperFast, delivery is available only within Russia.

Step 3: Fill in all fields: name, passport and contact information, Taxpayer Identification Number and select the parcel pickup point. All fields are required!

Important! All data is filled in Russian in Cyrillic alphabet.

Important! Fill in the information for the person who will receive the parcel!

Step 4: Fill out a declaration for each item in the parcel. It is necessary to indicate the Russian and English name, quantity, price, brand name and provide a link to each of the goods in the order.

Important! If the cost of goods in the parcel exceeds the duty-free threshold, the interface will definitely remind you of this. Payment of duties occurs online after the parcel arrives at customs.

Step 5: Add additional packaging or gift baskets of American sweets. If you don't need anything, just skip this step. Remember that the weight of sweets, drinks and additional packaging is added to the weight of the parcel.

Step 6: Confirm data. Check if you filled out everything correctly, the address of the point of issue, additional services.

Step 7: The parcel is processed. To speed up the sending of the parcel even more, you can add to your balance the approximate amount that will be required to pay for delivery.

That's all. We bet you spent more time reading this material than you will need to fill out the declaration. Happy and comfortable shopping!

Methods for submitting tax reports

The legislation of the Russian Federation provides for the following methods of filing tax returns (calculations):

- in electronic form via telecommunication channels;

- on paper.

In the first case, a legal entity is required to submit tax reports only in electronic form if:

- if the average number of employees exceeds 100 people (in an existing organization - for the previous year, in a newly created (reorganized) organization - in the month of creation (reorganization));

- regardless of the number, if such an obligation is expressly provided for by the provisions of the second part of the Tax Code for a specific tax. Since 2014, the obligation to submit tax returns only in electronic form via telecommunication channels has been provided for VAT, regardless of the number (clause 5 of Article 174 of the Tax Code of the Russian Federation);

- if the organization is recognized as the largest taxpayer.

In other cases, the organization has the right to submit reports both on paper (for example, through an authorized representative of the organization or by mail) and electronically via telecommunication channels.

This procedure follows from the provisions of paragraph 3 and paragraph 1 of paragraph 4 of Article 80 of the Tax Code of the Russian Federation.

The simultaneous submission of tax reporting in electronic form via telecommunication channels and on paper is not provided for by law (Article 80 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated March 26, 2010 No. 03-02-07/1-130).

A population indicator that influences the way the calculation is presented

Enterprises with an average workforce of up to 25 people have the opportunity to choose the method of presenting data. Organizational forms of enterprises with more than 25 employees must submit calculations only in electronic form. The condition for limiting the number of employees when choosing a reporting method applies to existing, reorganized and newly created enterprises. Failure to comply with the form for submitting the calculation will result in a fine of 200 rubles being imposed on the enterprise.

The average number of employees is determined taking into account the following features:

- The indicator is calculated according to the rules established by statistical authorities.

- The number of employees is calculated within a calendar year, on an accrual basis.

- Data is determined for all days of the month on the basis of orders and information from time sheets.

- In case of receipt of data on exceeding the maximum limit, the submission of a report in electronic form is carried out from the period when the right to use paper media is lost.

Calculation forms for electronic and paper forms are used in the same form. When filling out an electronic form, you must comply with regulations that allow you to undergo formal control when sending payments through communication channels and combining them with FSS databases. A paper form sent by mail will be accepted even if it is not filled out properly. After accepting the calculation, the inspector must send a letter to the enterprise indicating the identified inaccuracies.

Requirements for paper tax reporting

All tax reporting forms are currently adapted to read information using scanners (they are machine-oriented). In this regard, additional requirements are imposed on paper forms. In particular:

- the form must be printed on A4 paper;

- The width of the fields should not exceed the permissible limits. For example, for a book form of a form, the width of the left margin should be from 5 to 30 mm, and the top, bottom and right should be at least 5 mm;

- information should be on only one side of the sheet;

- the text should be printed only in black, font – Times New Roman or Arial;

- font size for the name of the document form, its sections and subsections – 11 or 10 points high, for text fragments – 9 points high;

- line spacing – single;

- the form must contain a bar code, etc.

This procedure is provided for by the Standard of Document Forms, approved by Order of the Federal Tax Service of Russia dated July 6, 2020 No. ММВ-7-17/535. Therefore, if an organization submits declarations on forms copied using copiers, this procedure must be followed.

TYPES OF REPORTING

Information about the number, average number

Before January 20 of the current year, all organizations are required to submit to the tax office at their place of registration information on the average number of employees for the past year. Newly created (reorganized) organizations must submit information on the average number of employees no later than the 20th day of the month following the month of creation (reorganization).

To submit information, use the form approved by order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25/174. Recommendations on the procedure for filling out this form were communicated by letter of the Federal Tax Service of Russia dated March 26, 2007 No. CHD-6-25/353.

This procedure is provided for in paragraph 3 of Article 80 of the Tax Code of the Russian Federation.

For non-operating companies you can submit a single simplified declaration

To report on the results of the quarter using such a declaration (Appendix No. 1 to Order of the Ministry of Finance dated July 10, 2007 No. 62n) can be those taxpayers who during the tax period had no movement of money in bank accounts and in cash, as well as objects of taxation in any from taxes.

The declaration is submitted to the tax authority at the location of the organization or place of residence of the individual no later than the 20th day of the month following the expired quarter, half-year, 9 months, or calendar year.

The simplified Declaration is submitted on paper or in “electronic form”. It can be submitted by the taxpayer to the tax authority in person or through a representative, sent in the form of a postal item with an inventory of the contents, or transmitted via telecommunication channels.

When sending a declaration by mail, the day of its submission is considered to be the date of sending the postal item with a description of the attachment. When transmitting a declaration via telecommunication channels, the day of its submission is considered the date of its dispatch.

Filing a single declaration is a right, not an obligation. If you prefer, you can instead submit zero returns for each of your taxes that require reporting at the end of the next quarter or year.

Reporting by mail: more convenient and faster?

Published:

magazine "Calculation"

Margarita KRIMSKAYA

On the last day of reporting, when it becomes clear that it will no longer be possible to hand over the reports to the inspector in person, there is only one option left - to the post office. But can you completely rely on postal delivery?

| The tax return can be submitted to the tax authority in person or sent by mail. In the latter case, the day of its submission is considered to be the date of sending a registered letter with a list of attachments. (Article 80 of the Tax Code of the Russian Federation) |

| (Article 80 of the Tax Code of the Russian Federation) |

Mail to help

Sending reports by mail is provided for the convenience of both taxpayers and tax inspectors themselves. After all, on the days when reports are submitted, the tax office works very hard: lack of time often does not allow tax officers to give any comments on filling out reporting forms. In fact, the tax office becomes the post office - it accepts the report, puts a stamp, so many people think that it is better not to come to the tax office these days, and actively use postal services. Marina Nechaeva, an accountant from Orenburg, considers postal delivery very convenient: “In my opinion, sending a report by mail is a big time saver. I think it’s stupid to spend hours on something that can be solved in minutes.” Moreover, many organizations whose branches are located in other cities cannot do without the services of the postal service. Lyubov Novikova, chief accountant of a Moscow holding, says: “We send a bunch of reports to different cities by mail every month. We have 22 branches, and VAT, salaries - everything is calculated in the parent organization. On the 20th of every month, we put the reports into envelopes and send them. How else?" Of course, mail is more convenient and faster. True, if there are a lot of addresses for sending reports, preparing for sending (printing addresses, sticking them on an envelope, inserting documents into the envelope) turns into a rather tedious procedure. Unfortunately, there is a more significant problem.