document

Information about open bank accounts

- Information: samples (Full list of documents)

- Search for "Information" throughout the site

- “Information about open bank accounts.”doc

- Documents downloaded

Entered into the database

Corrections have been made to

- Treaties

- All documents

- Holidays and weekends calendar for 2020

- Small business registration is useful

- How to draw up a contract yourself

- OKVED code table

On our website, everyone can find a contract or a sample document of interest for free; the database of contracts is updated regularly. Our database contains more than 5,000 contracts and documents of various types. If you notice an inaccuracy in any agreement, or the impossibility of the “download” function of any agreement, please contact us using the contact information. Have a good time!

Today and forever

— download the document in a convenient format! A unique opportunity to download any document in DOC and PDF absolutely free of charge. Only we have many documents in such formats. After downloading the file, click Thank you,” this helps us form a rating of all documents in the database.

Certificate from the Federal Tax Service

Each entrepreneur, when registering a business activity, must open a bank account to receive funds during trade operations or other actions that must be paid. These accounts can also be used to pay for services and various goods that are necessary for running a business.

Opening a current account

Information about open current accounts is collected by the tax authority to exercise control over the activities of the entrepreneur, so if you need to obtain written confirmation of open bank accounts, you can go to the Federal Tax Service, where, after making an official request, this document is issued to the entrepreneur or his authorized representative . To confirm the existence of a bank account, you can contact a credit institution, but such a document is not always permitted when carrying out certain types of financial activities.

It will also not be entirely rational to use the time to obtain the necessary documents when current accounts are opened in various credit institutions, the branches of which may not be in a given locality, so in many cases when a certificate of current accounts is needed, it is more advisable to immediately apply for it to the tax office inspection.

You must provide a certificate in the following situations:

- When applying for participation in tenders or auctions.

- If the company is liquidated or reorganized.

- When negotiating the investment of large sums of money that are provided as long-term investments.

- If opening a legal entity requires the development of a detailed business plan.

- When going to court.

- Upon requests from the prosecutor's office.

In addition to the listed cases, there may be a need to obtain this document in the event of bankruptcy of an enterprise. This procedure has been used for many years in relation to enterprises that cannot pay their bills, therefore, after an organization is declared bankrupt, the bailiff service supervises the company's current accounts.

Why do you need a certificate of current accounts?

A certificate of the company’s existing account may be needed in different situations:

- If the organization becomes a participant in auctions, trades and other similar events.

- When a company acts as a plaintiff or defendant in a lawsuit.

- Upon receipt of a request from law enforcement agencies.

- During the reorganization of the enterprise.

- In the process of forming a new business plan.

- When attracting investors.

If a company wants to get a loan, the bank will also request such a certificate.

Receipt procedure

Each tax office not only enters into its database data about legal entities and companies regarding their deductions, but also stores information about accounts. That is why any enterprise has the right to receive from this department a document such as a certificate of account opening.

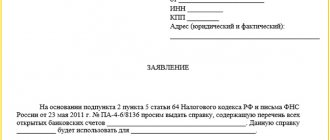

To become the owner of such information, a company must contact the tax authority at the place of its location or residence (if a certificate is required by an individual entrepreneur) with a corresponding request. It must be presented in the form of a statement, which can be drawn up in any form. When writing it, you should indicate information about the company:

- Full name of the individual entrepreneur or full name of the company.

- Taxpayer INN and OGRN of the organization.

- Address of the location of the enterprise or place of residence of the individual entrepreneur.

- Request for information.

- Full name of the credit institution where the accounts were opened.

- The date that must be included in the certificate.

- Reasons required to obtain company account information.

- Addressee of the certificate (his full name).

- Date of preparation of the corresponding application for obtaining information.

- The desired method for submitting the document.

- The affixed signature of an authorized person and, if necessary, a seal (applies to legal entities).

It is necessary to pay special attention to the following:

- if the taxpayer does not indicate the date on which the certificate form must be filled out, then it will be dated on the date the request was received by the tax authority;

- If the applicant does not indicate the method in which he would like to receive the document, it will be sent to him by mail.

This is interesting: How to get a certificate of maternity capital balance

Compilation deadlines

There is no clear deadline for the production of this document. The approximate duration of preparing a certificate is usually from 1 to 2 weeks, but sometimes it takes a month.

All information relating to the accounts of companies or individual entrepreneurs is provided strictly free of charge. If the certificate is needed in a shorter time, additional financial investments will be required, the payment of which is made directly to the tax office.

When a certificate from the Federal Tax Service about open accounts is already in your hands, it is recommended to pay special attention to its contents. The document must include the following information:

- Listing of all accounts (for individual entrepreneurs, only those through which he conducts his activities are required). Full name of the credit institutions in which the accounts were opened.

- Information about non-banking companies may also be provided.

- Identification information about the taxpayer: full name, company address (place of residence), contact details.

- The currency of funds in which an individual entrepreneur or legal entity opened their account.

Features of obtaining a certificate from banks

Currently, a certificate of open bank accounts is not required to be submitted to the tax authorities by individual entrepreneurs or legal entities. All information is received by inspection staff directly through the banks themselves. This condition also applies to electronic wallets of companies, as well as to their personal accounts.

A certificate of all open accounts can also be obtained by contacting the financial institution itself where this procedure was carried out. To become the owner of the document, the company will have to send a corresponding request to the financial institution. If you do not know how to correctly send a request, you should first seek the help of a specialist who will tell you all the main points of this procedure.

When applying for a certificate from a bank, you must remember that you will have to pay for such a service in accordance with the institution’s tariffs. Therefore, before you go for such a document, it is better to find out how much it costs: sometimes it will be cheaper to do everything through the fiscal services. It is worth noting that all government agencies accept such documents, which is why it is recommended to send the request directly to the tax office.

Help for the judiciary

If the debtor fails to pay any material obligations to the state, bailiffs have the right to request information about his accounts. This information can be obtained by contacting both a financial institution and the tax office.

In addition to bailiffs, information may also be requested by debt collectors. Their requirements must necessarily be located in the relevant judicial acts or acts from other departments.

Despite the fact that, in accordance with the legislation of the country, this information constitutes confidential data, if the appropriate documents are provided to obtain it, the bank is obliged to provide information regarding the debtor’s accounts in an amount that amounts to the amount to fulfill his obligations to the court.

This is the position of the Prosecutor General's Office. Taking this into account, we can conclude that if an organization provides a debtor’s writ of execution to a tax authority or credit institution, then the agency or bank is obliged to provide this data. The duration of drawing up a certificate of accounts of an individual entrepreneur or legal entity in this case should not exceed 7 days from the date of receipt of the request.

Sample certificate of existing accounts

Certificates of account are issued on the basis of an application written to the bank or the territorial body of the Federal Tax Service. The finished document typically displays the following information:

- List of existing accounts.

- Identification data of the owner of the account.

- Account currency.

- Names of the banks that opened the account.

- Date of issue of the document.

How much does a certificate of opening a current account cost?

At the tax office. When applying for a certificate from the Federal Tax Service, all data in most cases is provided free of charge .

In the bank. When sending a request to a banking institution, the situation is somewhat different: the cost of issuing a certificate directly depends on the urgency of its issuance. In general, the cost varies from 3 to 10 thousand rubles. If you want the certificate to be delivered to your office, you will have to pay about 300 rubles more (depending on the region of registration of the company, as well as the bank’s policy).

We advise you to read: Bank tariffs for opening a current account for individual entrepreneurs and LLCs with the most favorable conditions in Russia

Online receipt procedure

You can issue a certificate of settlement via the Internet in a few steps:

- Go to the Federal Tax Service website and fill out an online application.

- Confirm your request with a digital signature.

- Prepare and submit to the tax office the required papers (extract from the Unified State Register of Legal Entities, as well as a copy of the passport of the company director).

- Receive the certificate by mail or pick it up at the territorial Federal Tax Service. The electronic version can be received by email.

This is interesting: Sample application to the Pension Fund for pension recalculation

Documents to be received

If you contact a banking organization, you need to provide:

- TIN/KPP;

- your company name;

- contact information to contact you;

- address for sending the document;

- information about the person who will collect the completed certificate.

If you apply to the Federal Tax Service, prepare:

- Your passport;

- extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs;

- application filled out in any form (see sample above).

In the application, you must indicate for what purpose you are asking for the certificate to be issued, as well as provide the legal basis for its issuance.

Why do they ask the bank for information? Rules for registration and sample document

In relations with the bank, one of the main points is information recorded in writing, in official responses to requests and the presence of a signature from the organization’s employees. In what cases is a request submitted, what cannot be demanded, document execution, how to send, what kind of response to expect, this is discussed in our article.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

Request from the Federal Tax Service regarding the availability of accounts

The Federal Tax Service can send a request for the availability of accounts both electronically and on paper through its employee or by registered mail with notification.

The request form was approved by order of the Federal Tax Service of Russia dated July 25, 2012 No. ММВ-7-2/ [email protected] and contains:

- name of the bank, its details;

- name (full name) of the person whose accounts are of interest to the Federal Tax Service;

- the motivational part, for example, an indication of the details of the decision of the Federal Tax Service on the collection of tax;

- signature of the head of the tax authority, seal.

The Federal Tax Service has the right to request information not only about the presence/absence of accounts, but also information about cash balances and transactions made through these accounts. For each type of required information, the same order established different forms of requests.

What cannot be demanded?

A person contacting a bank may request various information that directly relates to his relationship with the bank.

- Courts and arbitration courts.

- Tax authorities.

- Accounts Chamber of the Russian Federation.

- Pension Fund.

- Social Insurance Fund of the Russian Federation.

- Bodies of compulsory execution of judicial acts.

Banking secrecy includes information about accounts, transactions and deposits of clients and correspondents. If bank secrets are disclosed, a person has the right to demand compensation from the bank and damages.

How to request a certificate

A request for a certificate of open accounts must be drawn up in accordance with the type of document you require. It could be:

- information about the status of your current account;

- account closure data;

- data indicating that you have no debt to the credit institution;

- information about the quality of loan servicing.

If you need to receive a certificate of cash flows in your account, you should indicate in your application the period for which you would like to receive information. The request must be made in writing and must be addressed either to the department for working with legal entities/individual entrepreneurs, or directly to the head of the branch of the financial institution.

The document drawn up must be certified using the company’s seal, as well as the signature of an authorized person must be affixed to it. After this, you need to indicate the outgoing certificate number, date and transfer it to the tax service - personally in the hands of an employee of the institution or using the mail. Individual entrepreneurs who do not use a seal in their work can limit themselves to only a signature.

After the document is prepared and received by the bank, a specialist from a credit institution first registers it in the appropriate journal and then sends it to an employee who belongs to the department for working with individual entrepreneurs and companies. A certificate from the Federal Tax Service regarding open accounts is prepared within 1-3 days; it can be done faster, but such a service will cost more.

Document preparation

A request to a bank relates to business documentation and does not have a uniform form of preparation, but when writing it it is necessary to comply with generally accepted norms of correspondence.

The document is drawn up on the company’s letterhead for legal entities or on a regular A4 sheet. The letter can be written either by hand or in printed form.

The document must be sent signed by the person who compiled it or on behalf of whom it was compiled. The date is also an important attribute of document design.

Content

A letter to the bank should not be filled with unnecessary information. The content of the document should consist of a description of the reason for the request. The request structure looks like this:

Corner fill

- The name of the banking organization must be indicated in the upper right corner.

- Last name, first name and patronymic (full name) of the specialist to whom the request is sent, the director of the department or institution.

- Organizations applying to the bank must also comply with the corner filling of the document in the upper left part, where the name of the sender’s company, contact details of the responsible person, and actual address are indicated.

- Contact information for individuals is indicated in the right corner under the name and position of the specialist. A private individual may not indicate the details of a specific employee. If there is no information about to whom the letter should be sent, under the name of the bank, a note “For an authorized person” is made.

Main part

It indicates the reason why the person applied to the institution. The appeal must be written in a respectful manner and not contain incorrect demands.

Date, signature, seal

The request is endorsed by the sender's signature. For enterprises, the signature must include a transcript and indication of the position. Provided that if the organization uses a stamp when certifying documents, the request to the bank must also be stamped.

Writing rules

By adhering to the basic rules for drawing up written requests to the bank, you can competently and correctly fill out the application and obtain the necessary information.

We talked in more detail about how to write a request for information here.

Compilation rules

The letter does not have a strict, mandatory, unified template, so it can be written in free form, taking into account the needs and objectives of the sender. However, you still need to adhere to some norms and standards.

- At the beginning of the letter, it is necessary to indicate the sender and addressee, and if we are talking about the addressee, you should enter not only the name of the company, but also the position of a specific employee.

- Next comes the informational part of the message. Here you need to convey to the recipient a message about the change in details, indicate new ones, and also state requests related to the changes made.

Read more Loan to large families for building a house

The tone of the letter should be polite, not too dry, but in no case cheeky. It is necessary to follow a business style and carefully monitor compliance with the rules of the Russian language, especially in terms of vocabulary, grammar and punctuation.

A letter about changing details can be written either by hand or printed on a computer, but in any case, it must contain a “living” signature of the head of the sending organization or another authorized person. It is not necessary to put a stamp on the document, because from 2020, legal entities have the right not to put stamps on paper documentation.

You can write a letter

- on a regular standard A4 sheet of paper

- or on the organization’s letterhead.

The last option is preferable, because it gives the document solidity and indicates the official nature of the message.

The letter may have as many copies as required to notify all interested parties. Each sent message must be recorded in the outgoing registration log, so that in case of disagreements with the counterparty, the sender has information about the date the message was sent.

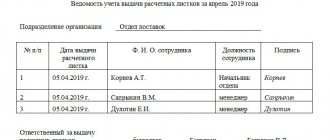

For account statement

Adhering to the structure of the document, an application to the bank to receive a statement of cash balances must contain the following information:

- Number and date of the current agreement with the bank.

This information is indicated in the first paragraph of the content: “The date of conclusion of Agreement No. 1567 between Streamline LLC and Promstroy Bank.” For individuals and individuals, instead of the name of the enterprise, the full name is indicated. Statement of reason.

This is interesting: Rko for issuing wages according to a sample statement

“I ask you to issue a statement of account No.___, in accordance with the current legislation of the Russian Federation, for the entire period from the opening of the account to the present.” The frequency may vary depending on the needs of the requester. Also, the need for extracts from auxiliary or attached accounts to the agreement may be indicated here. Links to laws if necessary.

For example, you can refer to the Law on Consumer Rights, as well as paragraph 14 of Information Letter No. 146 of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 13, 2011, which states that account statements should be issued free of charge.

- Date, signature with transcript, seal (if any).

To provide documents

If there is a relationship with a bank, in particular a credit relationship, an organization, individuals or individuals can make a request to provide documents on existing debt: fines, penalties, outstanding loan payments. For example, “Please provide a document confirming the absence (presence) of debt for the period of validity of the loan agreement No. 5678 dated October 3, 2017.” The provision of documents will be required in case of loss of the latter.

More information about writing a letter requesting the provision of documents can be found here.

About the availability of open accounts

The content of the document should consist of a polite address and the reason for this request, as well as a reference to the law, for example: “Based on the letter of the Federal Tax Service of Russia dated May 23, 2011 No. PA-4-6-b/8136, we ask you to provide a certificate of the availability of all open accounts.

Here you should indicate the purpose of obtaining the document: “This certificate will be used to apply to the courts.” The originator's details must be indicated in the corner of the document.

You can learn more about certificates of open accounts here.

Who can receive

The list of persons authorized to request certificates of current accounts includes:

- the account holders themselves;

- representatives of the judiciary;

- representatives of the Accounts Chamber of the Russian Federation;

- representatives of the Pension Fund and the Social Insurance Fund;

- bailiffs - executors;

- representatives of the Investigative Committee of the Russian Federation;

- other officials who are specified in the Law “On Banks”.

In addition, your representative can receive the certificate using a power of attorney. Some experts say that there is no need to have a power of attorney certified by a notary, but there are cases where, due to the lack of a notarized power of attorney, a representative was refused to issue a certificate.

In addition, persons who are debt collectors under a court decision can also send a request. Such a request can be sent to any branch of the Federal Tax Service.

As for the companies themselves, the following persons have the right to receive this certificate:

- supervisor;

- Ch. accountant;

- a number of other employees who are indicated in the constituent documentation.

We also note that the certificate of open accounts has its own validity period - 1 month from the date of issue.

How to send?

You can send a request in several ways:

- Bring it to the office of the institution. When transmitting a request to an employee or authorized person, the latter must register the document in a special journal. The sender should have a copy of the request, on which the office employee must duplicate the registration number and certify the copy with a seal. This will be direct confirmation that the letter has been transmitted to the bank in case the sender does not wait for a response.

- Send a notification letter by mail. Notification of receipt of the document will also serve as a guarantee that the bank will receive the request directly.

- Send by email. Most banks have electronic application forms on their official websites. The sender should take care of a copy of the email. If the letter is sent to a specific email address, the request must be certified by an electronic signature.

How to get

If you contact a banking organization , the receipt procedure is as follows. Bank employees, as soon as they receive your request, register it in a special journal. The document is assigned an incoming number, and the request is transferred to specialists working with individual entrepreneurs and companies.

When contacting the tax department : your request will be assigned an incoming number, then a responsible employee will be assigned who works with individual entrepreneurs and legal entities. persons. You can check all the information with him and then pick up the completed certificate.

Get it online on the Federal Tax Service website

You can apply for a certificate online via the Internet. This will save a lot of time.

You can order the document on the Federal Tax Service website; just enter your data in a special form. Let us immediately clarify that a certificate received in electronic form is equal in legal force to a paper sample.

Let's take a closer look at the steps of how to obtain this certificate using the Federal Tax Service website.

- Step 1. Go to the official website of the tax authority.

- Step 2. If you already have a personal account, then submit a request through it. If not, register on the site (in the future, an electronic signature will be required to send a request).

- Step 3. Enter your data in a special form.

- Step 4. Confirm the signature using an electronic signature.

- Step 5. We are waiting for a response from the Federal Tax Service specialists.

What answer should I expect?

There are no laws or regulations regarding response times. It is not correct to indicate any deadlines in the appeal. Similar deadlines for official responses may be specified in the agreement or an appendix to it. The response from the bank must be in the form in which the request was sent, preferably in writing, only then will it have legal force.

Read about how to correctly write a response to a request for information here, and you can find a sample letter here.

Requests to the bank are official in nature and are documents. It is important to comply with all official requirements for signing and registering a document. Requests must be in writing, as must the responses provided by the bank. To resolve disputes or other issues, having a written request and response may be decisive.

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

How to submit a request

If you apply to a banking organization to receive this document, prepare your request in writing. In it, indicate what kind of certificate is needed: about the existence of an account, about the balance of funds, about the absence of debts, and so on. If you need information about account turnover , indicate for what period the certificate should be drawn up.

To summarize, we note that your request must contain the following data:

- company name/your last name and initials (if you are an individual entrepreneur);

- TIN and OGRN of the company;

- legal company address;

- request text;

- the purpose for which the request is made;

- information about persons entitled to receive a certificate;

- date of the request.

Certify the written request with the company seal and assign an outgoing number for internal reporting.

The process of obtaining a certificate from the Federal Tax Service about a settlement account

The head of the company, his representative or other persons (arbitration manager, bailiff) have the right to contact the territorial division of the tax inspectorate to obtain data on the company's current accounts.

To do this, a corresponding request is issued , upon receipt of which, the Federal Tax Service employees will prepare the necessary certificate - how a certificate of open accounts is issued.

To do this, you need to go to the official website of the tax service and go through authorization through the taxpayer’s personal account . If the registration record has not yet been made, then you should go through the registration procedure on the site.

But when sending a request for open accounts, a legal entity must prepare an electronic digital signature; its presence is mandatory when sending a document.

also possible to send a request by mail . It would be more correct to draw up the document in 2 copies with a description of the contents in the envelope.

Similarly, the request is transmitted through the office, the second set with an acceptance mark remains with the applicant.

A similar certificate can be obtained from a bank. This option is suitable for applicants who need information as quickly as possible. But this service is paid.

To obtain information from different banks, you must send a request to each of them.

The certificate from the Federal Tax Service will collect all available information about the organization’s open accounts.

Some government agencies (prosecutor's office) only accept documents issued by the tax office.

The disadvantage of contacting the tax authority is the long waiting time.

Claimants must take into account that upon completion of the deadline for presenting the writ of execution for satisfaction, information about the accounts will not be provided.

How to fill out an application for the release of information?

An application for obtaining information about company accounts is drawn up on the basis of generally accepted standards on paper in A4 format. It is possible to draw up a document using a computer or by hand.

The upper (right) part of the application must contain information about the Federal Tax Service branch number. The document begins with the phrase “To the Head of the Federal Tax Service No...”. Below is information about the applicant: name of the legal entity, TIN, KPP, registration address.

Next, the word “application” is written in the center of the page, and then a request for the issuance of a certificate containing information about open accounts is recorded.

Having described the requirements, the method of receiving it is then prescribed: in person, by email or regular mail. If the applicant does not indicate this moment, the certificate is sent by mail to the address indicated in the application.

The application is signed by the director of the enterprise or another person authorized to carry out such operations.

To justify sending a request to the tax authority, the debtor must confirm his right to a positive court decision to repay debts.

A copy of the writ of execution is attached to the petition , which is certified by the court. For bailiffs, the legality of the application is enforcement proceedings, for arbitration managers - bankruptcy proceedings.

The certificate is produced within 5 working days. But if the application is submitted in person, it is better to ask a Federal Tax Service specialist for information about the readiness of the document.

Situations arise where the duration of response ranges from 14 to 20 days. The general period for issuing such papers is 30 days.

Certificate of open bank accounts - legal regulation and content

It is necessary to distinguish certificates of bank accounts, which banks submit to the tax authorities, from certificates of similar content, which are provided by banks and the Federal Tax Service to applicants who make a corresponding request. First, let's look at the certificates that banks are required to submit to the Federal Tax Service.

Opening accounts for organizations and individual entrepreneurs in accordance with Art. 5 of the Federal Law “On Banks and Banking...” dated December 2, 1990 No. 395-1 is one of the banking operations. At the same time, the following categories of persons can open and use bank accounts:

- Individual entrepreneurs who are registered in the manner prescribed by law, which is confirmed by the availability of registration information in the Unified State Register of Individual Entrepreneurs.

- Russian organizations created and registered in accordance with current legislation, which is confirmed by the presence of an entry in the Unified State Register of Legal Entities.

- Branches of foreign legal entities accredited on the territory of the Russian Federation and registered with the tax authority - information about them is also contained in the Unified State Register of Legal Entities.

- Notaries.

- Lawyers.

- Individuals who are not registered in the prescribed manner as individual entrepreneurs. The main feature of opening an account by an individual is the use of funds for personal purposes.

After completing a banking operation to open an account for a credit institution, clause 1.1 of Art. 86 of the Tax Code of the Russian Federation imposes the obligation to notify the tax authorities. Information must be sent to the Federal Tax Service department no later than 3 days from the date of provision of the service.

Business entities, individual entrepreneurs and individuals have the right to independently notify the tax authorities about the opening of bank accounts, but this is not mandatory.

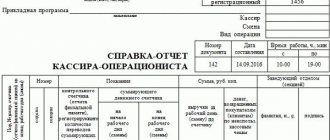

Contents of the certificate of availability of accounts submitted by banks to the Federal Tax Service

The content of the certificate containing information about the presence of business entities with accounts in credit institutions is regulated by clause 6 of Appendix 1 to the Order of the Federal Tax Service dated July 25, 2012 No. ММВ-7-2/ [email protected] (hereinafter referred to as the Order). If the tax authority sends a request, the credit institution, by virtue of clause 2 of Art. 86 of the Tax Code of the Russian Federation is required to submit the relevant certificate within 3 days (working days).

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Please note that the request can be sent by tax authorities both as part of a separate control measure, and in conjunction with other forms of tax control. In addition, by virtue of clause 1.1 of Art. 86 of the Tax Code of the Russian Federation, banks are required to send information about the opening of any bank account by any client to the Federal Tax Service at their location.

A certificate from the bank, in accordance with clause 6 of Appendix No. 1 to the Order, must contain:

- Name of the bank that provided the information, TIN, KPP, BIC.

- Information about the tax authority to which the information is sent, information about the request from the Federal Tax Service.

- Information about the business entity in respect of which information is provided, including:

- for legal entities - full name, TIN (for foreign - KIO) and KPP;

- for individual entrepreneurs - full name, tax identification number.

- Information about the availability of accounts indicating the number, type and digital designation of currency, opening and closing dates (if the accounts were closed).

- Indication of the date as of which the information was generated.

- Signature and seal of an authorized person of the credit institution (as a rule, information about the person who generated the information is also indicated).

The form of the document is approved by Appendix 2 to the Order and registered in the KND (classifier of tax documentation) under number 1114305. This form is mandatory for credit institutions when providing information at the request of the Federal Tax Service. Its form can be downloaded from the link:

If other persons request information, credit institutions have the right to either follow internal regulations and instructions or draw up a certificate in any form.