Loan and interest forgiveness: accounting entries

The parent organization forgave its daughter the obligation to repay the loan and interest. Will the subsidiary have taxable income, and the founder - an expense? What transactions are used to record transactions in the accounting records of the founder and subsidiary?

The most common way to redistribute money in a group of companies is to forgive debt obligations. Let's consider what entries both parties to the transaction must make if the main founder has released the company from repaying the loan and interest.

Short-term and long-term loans

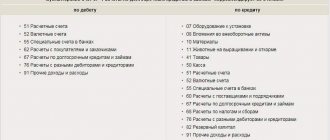

Accounting for loans in accounting depends on the time of use by the borrower. To make payments on short-term loans (issued for a period of up to 1 year), account 66 is used. For long-term loans (issued for a period of more than 1 year), account 67 is used. If it happens that long-term loans are repaid in less than 365 days, then they must be transferred to score 66.

Accounting for loans in accounting should be divided into analytics:

- by type of funds received;

- by sources of funds;

- for basic and additional costs.

https://youtu.be/puwVIJpSMho

Accounting for a subsidiary

The main founder of Meteor LLC is Jupiter LLC. Its share in the authorized capital is 52 percent.

Carefully! It is safer to issue loans at interest. Otherwise, inspectors may assess additional income tax to the founder.

On March 20, 2014, Jupiter LLC provided a loan to its subsidiary in the amount of RUB 300,000. at 9 percent per annum for a period of three months. According to the terms of the agreement, interest is paid along with the return of the principal amount on June 20, 2014.

Meteor LLC did not fulfill its contractual obligations on time. On June 20, the management of Jupiter LLC decided to forgive the debt, including the amount of interest on the loan.

The accountant of Meteor LLC made the following accounting entries. On the day of receipt of borrowed funds, March 20:

DEBIT 51 CREDIT 66

- 300,000 rub. — a loan was received from the founder.

Guided by the letter of the Ministry of Finance of Russia dated February 17, 2014. No. 03-03-06/1/6387), the accountant takes interest into account evenly at the end of each month. The same procedure is established in the accounting policy for accounting purposes. Therefore, on March 31, the accounting entry was as follows:

DEBIT 91 subaccount “Other expenses” CREDIT 66

- RUB 813.70 (RUB 300,000 x 9%: 365 days x 11 days) - interest accrued for March.

On April 30 and May 31, the postings were the same. But the amount of interest for April amounted to 2219.18 rubles. (RUB 300,000 x 9% / 365 days x 30 days). And for May - 2293.15 rubles. (RUB 300,000 x 9% / 365 days x 31 days). Meteor LLC was supposed to return the money to the founder on June 20.

Getting a loan: transactions

An organization can receive a loan from three sources:

- from a banking institution;

- from a counterparty registered as a legal entity;

- from individuals.

The appearance of accounts payable is displayed on account 66 (for short-term loans) or 67 (for long-term loans). Subaccounts are added to synthetic accounts - for example, 66.1 may indicate the principal amount of debt, and 66.2 may indicate the costs of servicing it.

Correspondence when receiving a property loan:

- when the loan is received, the entry will have the form D41 - K66/1 - according to the act, goods designated as the subject of the transaction under the loan agreement were accepted for accounting;

- D19 – K66.1 – “input” VAT has been charged;

- D91.2 – K66.2 – interest liabilities have been accrued according to the accounting certificate;

- D66.2 – K51 – interest obligations are repaid;

- D41 – K60 – commercial products were purchased to repay the loan;

- D19 – K60 – VAT is reflected upon purchase;

- D68/VAT – K19 the amount of VAT is accepted for deduction in accounting;

- D66.1 – K41 – purchased goods were transferred to the lender to repay the loan;

- D66.1 – K68/VAT – VAT is displayed.

Money loan

In the case of monetary lending, correspondence will be different. For example, if a loan is received from a legal entity, the entries look like this (provided that the loan is long-term):

- D51 – K67.1 – borrowed funds received;

- D91.2 – K67.2 – interest accrued;

- D67.2 – K51 – interest charges paid;

- D67.1 – K51 – full or partial repayment of the loan.

The expenses will be classified as other in accounting, and in tax - as non-operating costs.

Loan agreements containing instructions for an interest-free type of loan do not create grounds for calculating material benefits for an individual - the lender. When receiving borrowed funds from individuals at interest, accrued and paid interest obligations for the lender are income from which personal income tax must be withheld. The credited enterprise acts as a tax agent. If a loan is received from an individual, postings are made with the participation of 66 or 67 accounts.

For example, a third-party individual deposited 38,000 rubles into the company’s cash desk as an interest-bearing short-term loan (for 3 months). The interest rate is 5% per annum. Accounting entries:

- D50 – K66.1 – 38,000 rub. – borrowed funds received;

- D51 – K50 – 38,000 rub. – cash from the cash register is deposited into the current account (to avoid exceeding the cash register limit);

- D91.2 – K66.2 – 158.33 rub. – interest accrued for one month of using money (38,000 x 5% / 12);

- D66.2 – K51 – payment of interest.

When transferring interest, an individual receives income. Until the payment order is issued, the enterprise must withhold personal income tax from this income - the amount of withholding for the first month is 21 rubles. (158.33 x 13%). When paying interest income, the accountant will make two payments - to the budget for personal income tax in the amount of 21 rubles. and to a card for an individual in the amount of 137.33 rubles. (158.33 – 21).

Accounting entries for accounting for short-term loans

On this day, the accountant will record interest in the amount of 1,479.45 rubles. (RUB 300,000 x 9%: 365 days x 20 days).

Meteor's accounting policy states that interest on borrowed obligations is included in the tax base based on the refinancing rate increased by 1.8 times (clause 1.1 of Article 269 of the NKRF). When calculating income tax, the accountant has the right to take into account the entire amount of interest, since in the loan agreement the rate is less than the maximum permissible - 14.85 percent (8.25% x 1.8).

Note! Interest on loans and borrowings in tax accounting is standardized. The limit value is calculated based on the refinancing rate increased by 1.8.

On the date of debt forgiveness, June 20, the following entries appeared in the accounting records:

DEBIT 66 CREDIT 91 subaccount “Other income”

- 300,000 rub. — the amount of forgiven debt on a loan received is included in the organization’s other income;

DEBIT 66 CREDIT 91 subaccount “Other income”

- 6805.48 rub. (813.70 2219.18 2293.15 1479.45) — interest on the forgiven debt was included in other income.

When calculating income tax, Meteor LLC does not take into account the forgiven loan on the basis of subparagraph 11 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation. Therefore, a permanent difference arises, as well as a corresponding permanent tax asset:

DEBIT 68 subaccount “Calculations for income tax” CREDIT 99 subaccount “Permanent tax assets”

- 60,000 rub. (RUB 300,000 x 20%) - a permanent tax asset is reflected.

The company will include the amount of interest in non-operating income. And since Meteor LLC previously reflected them in expenses, the company will not overpay income tax in the end.

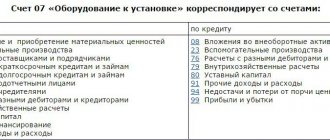

Features of a loan in kind

When receiving a loan in kind, an enterprise is forced to purchase consumables or fixed assets associated with the use of the loan received. They should be taken into account in the amount of actual costs without including VAT. When returning, the cost of the property must be calculated equal to the expenses at the time of purchase. Thus, there will be a price difference between the assets received and the assets reimbursed to the borrower.

The accountant must include this difference in other expenses or income:

- Debit 91-2 Credit 66, 67 - the price difference that arose as a result of an increase in the value of property was written off;

- Debit 66, 67 Credit 91-1 - the price difference resulting from a decrease in the value of the property is written off.

Founder's postings

On the date of loan issuance, March 20, the accountant of Jupiter LLC will make the following entry:

DEBIT 58 subaccount “Granted loans” CREDIT 51

- 300,000 rub. — reflects the amount of the loan provided.

The interest that the lender must receive is recognized as other income in accounting. They must be reflected monthly on the last day of the reporting month. And also on the loan repayment date. This procedure follows from paragraphs 7, 10.1, 16 of PBU 9/99.

On March 31, 2014, the accountant of Jupiter LLC reflected the following transaction in accounting:

DEBIT 76 subaccount “Interest payments” CREDIT 91 subaccount “Other income”

- RUB 813.70 (RUB 300,000 x 9%: 365 days x 11 days) - reflects the borrower’s debt to pay interest on the loan.

Note! In accounting, income in the form of interest on loans issued must be reflected on the last day of each month.

On April 30, May 31 and June 20, the accountant will reflect the same transactions. But the amount of interest for April will be equal to 2219.18 rubles, for May - 2293.15 rubles, and for June - 1479.45 rubles.

On the date of debt forgiveness, June 20, the accountant made the following entries:

DEBIT 91 subaccount “Other expenses” CREDIT 58 subaccount “Loans provided”

- 300,000 rub. — the amount of the forgiven debt to repay the principal amount of the loan is recognized as part of other expenses;

DEBIT 91 subaccount “Other expenses” CREDIT 76 subaccount “Interest payments”

- 6805.48 rub. (813.70 + 2219.18 + 2293.15 + 1479.45) - the amount of the forgiven debt to pay interest on the loan is recognized as part of other expenses.

Since the amount of the forgiven debt along with interest is not taken into account in expenses when calculating income tax, a permanent difference and a permanent tax liability arise in accounting (clauses 4, 7 of PBU 18/02):

DEBIT 99 subaccount “Fixed tax liabilities” CREDIT 68 subaccount “Calculations for income tax”

- RUB 61,361.10 ((RUB 300,000 RUB 6,805.48) x 20%) - reflects a permanent tax liability.

The company took into account the amount of interest as part of non-operating income. After the debt is forgiven, Jupiter LLC will not have to recalculate taxes.

June 2014

Question: Are there tax risks when applying for an interest-free loan between legal entities? What entries need to be made in accounting if an interest-free long-term loan is issued?

Answer: Accounting To reflect the issued interest-free loan, is it correct to use account 76 “Settlements with various debtors and creditors”, opening a separate sub-account for it, for example, “Provided interest-free loans” according to the chart of accounts approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000? 94n.

In the reporting, these long-term receivables are reflected in line 230 “Accounts receivable (payments for which are expected more than 12 months after the reporting date)” of the balance sheet in accordance with clause 73 of the Regulations on Accounting and Accounting Reports in the Russian Federation, approved.

Providing a loan to a legal entity from a legal entity at interest

In accounting entries, the issuance of a loan to a legal entity at interest will be reflected with the appearance in the debit part of account 58, one of the subaccounts of which is allocated by the Chart of Accounts of the Accounting (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) to reflect the funds issued as a loan. Analytics on it are organized by recipients of borrowings and each of the concluded agreements. Debts secured by bills of exchange should be reflected separately.

In the credit part of the transaction, a cash account will appear corresponding to its type:

- 51 - for non-cash transfers in rubles;

- 52 - when transferring funds in foreign currency.

Thus, the entry for accounting for a loan issued with interest will look like: Dt 58 Kt 51 (52).

Interest accrued monthly on the loan is not shown on account 58. Another account is intended for their accounting - 76, the debit of which will record the amount of income calculated at the rate stipulated by the agreement. The linking of entries for accounting for a loan issued by an organization and entries for reflecting interest accrued on it to different accounts is due to the different nature of the debt arising: on account 58 this is the amount of income-generating investments, and on account 76 - current settlements on payments associated with these investments.

In the credit part of the record reflecting the accrual of interest, a financial result account will appear:

- 90, if the issuance of loans in the accounting policy of a legal entity is designated as one of its usual types of activities;

- 91, if the provision of borrowed funds is not one of the usual activities.

That is, the fact of accrual of interest will be recorded as Dt 76 Kt 91 (90). The receipt of payment for them will be reflected by the entry Dt 51 (52) Kt 76.

When repaying the principal amount of the loan, a posting will occur Dt 51 (52) Kt 58.

The procedure for recording transactions for issuing a loan to another organization in accounting

By Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n.

If an organization receives an interest-free long-term loan, then the accounting entries will be as follows: Debit 51 Credit 67 - funds received under the loan agreement. Account 67 “Settlements for long-term loans and borrowings” will be closed as funds are returned: Debit 67 Credit 51 - loan repayment is reflected.

Income tax When providing an interest-free loan, tax authorities often classify the absence of interest as an economic benefit , which is generated as a result of the service provided free of charge. And the provision of such a service, from the point of view of clause 8 of Art. 250 of the Tax Code of the Russian Federation, entails the emergence of non-operating income .

However, this position of the tax authorities does not find support in the courts. The courts proceed from the fact that the cost of a service received free of charge (interest savings under an interest-free loan agreement) is not determined by Ch. 25 of the Tax Code of the Russian Federation as income subject to taxation, and the rules for its recognition and accounting for calculating income tax are not established, which does not allow any way to assess income under interest-free loan agreements. In addition, the Presidium of the Supreme Arbitration Court of the Russian Federation, in its Resolution No. 3009/04 of August 3, 2004, indicated that the use of funds under a loan agreement without the lender charging interest cannot be considered as a legal relationship for the provision of services, since it does not correspond to the definition of the concept “Loan” of Chapter . 42 “Loan and Credit” of the Civil Code of the Russian Federation. According to Art. 807 of the Civil Code of the Russian Federation, under a loan agreement, the lender transfers ownership of money or other things determined by generic characteristics to the borrower, who undertakes to return the same amount (loan amount) or an equal number of other things received by him of the same kind and quality.

How to reflect a loan in accounting

This is due to the fact that there are a certain number of conditions under which financial transactions can lead to an increase in the amount of investment and interest on the loan is not provided for. They can be taken into account in settlements with creditors and debtors when issuing funds to other persons or in settlements with personnel.

The interest payment schedule must be determined by the lender and specified in the agreement. In the absence of such conditions, the borrower is forced to pay interest monthly until the loan is fully repaid. In the case of issuing an interest-free loan, such a condition must be specified in the agreement.

Registration of a transaction for the issuance of an interest-free loan to another organization

When providing an interest-free loan to another organization, such financial investment is not taken into account. This happens due to the fact that in this case the condition for obtaining economic benefits and income is not met. Thus, a loan on interest-free terms is accounted for in the expense account with debtors and creditors.

A loan on interest-free terms is reflected by posting debit 76 and credit 51, depending on the subject of the issue - cash, materials or goods. The size of such an in-kind loan is based on the value of the assets issued to a third party. The price of assets is determined at the average amount on the actual date of signing the agreement by the parties.

By default, loans issued in kind are considered interest-free. This condition is suitable for all transactions in which the lender did not indicate the borrower’s obligations to pay interest for use. Loans without interest are not accounted for as financial investments, but are reflected as short-term or long-term in the balance sheet.

Loans received by an organization from employees

In ch. 42 of the Civil Code of the Russian Federation does not define the form of a loan agreement concluded between a legal entity and an individual, under which the borrower is an organization, therefore the general procedure provided for in Art. 161 of the Civil Code of the Russian Federation, according to which it is drawn up in simple written form.

Accounting for a loan, depending on the period for which it was received, is carried out on accounts 66 “Settlements for short-term loans and borrowings” and 67 “Settlements for long-term loans and borrowings” in correspondence with cash accounts. Short-term loans are issued for a period of no more than 12 months, long-term - for a longer period.

The receipt of a loan deposited in the organization's cash desk, depending on the period for which it was received, is reflected by the posting: Debit 50 “Cash” Credit 66 “Settlements for short-term loans and borrowings” (67 “Settlements for long-term loans and borrowings”).

According to PBU 10/99 “Expenses of the organization” <1> interest on the loan is recognized as part of other expenses.

<1> Order of the Ministry of Finance of Russia dated 05/06/1999 N 33n. Please note: Orders of the Ministry of Finance of Russia dated 09/18/2006 N 115н, N 116н “On amendments to regulatory legal acts on accounting” in order to improve legal regulation in the field of accounting accounting and financial statements, amendments were made aimed at simplifying the classification of income and expenses: the concepts of “operating”, “non-operating”, “emergency” were replaced by “other”. The changes come into force from the submission of the annual financial statements for 2006.

At the end of the reporting period, the debt on the loan received is reflected with interest due for payment in accordance with the terms of the agreement, regardless of the moment of their actual payment. Thus, unless otherwise provided by the agreement, it is necessary to prepare the following accounting entries: Debit 91, 08... Credit 66, 67 - interest accrued for the use of borrowed funds.

When the loan amount is paid to the employee through the cash register, as well as the interest due, the following entry is drawn up: Debit 66, 67 Credit 50 - funds were issued from the cash register to cover the loan debt.

Accounting for issued and received interest-free loans from individuals

Accounting. Taxes. Audit On the topic Read all materials (127) on the topic “Interest-free loan (loan)” subscribe. There is an update (+103), including:

- Personal income tax from interest savings has a chance to be seen in the tax notice

- About personal income tax and benefits from savings on interest on an interest-free loan provided to an employee

February 09, 2010 16:09 E-mail Archive GARANT Company

How is accounting carried out for issued and received interest-free loans from individuals who are not employees of the organization?

Relations under the loan agreement are regulated by Chapter 42 “Loan and Credit” of the Civil Code of the Russian Federation.

In accordance with paragraph 1 of Art. 807 of the Civil Code of the Russian Federation, under a money loan agreement, one party (the lender) transfers money into the ownership of the other party (borrower), and the borrower undertakes to return the same amount of money (loan amount) to the lender. The loan agreement is considered concluded from the moment the money is transferred.

According to paragraphs. 1 clause 1 art. 161 of the Civil Code of the Russian Federation, transactions of legal entities between themselves and with citizens must be concluded in writing.

In accordance with paragraph 1 of Art. 162 of the Civil Code of the Russian Federation, failure to comply with the simple written form of a transaction deprives the parties of the right in the event of a dispute to refer to witness testimony to confirm the transaction and its terms, but does not deprive them of the right to provide written and other evidence. Therefore, a written loan agreement should be concluded between an individual and an organization.

The norm enshrined in Art. 809 of the Civil Code of the Russian Federation, the loan agreement is compensated, which is expressed in the payment by the borrower of interest on the loan amount. The condition that the contract is free of charge must be specified in the text of the contract itself.

Therefore, if the agreement does not contain a reference to the type of loan - interest-free or interest-bearing, then the loan will automatically be considered interest-bearing. Consequently, the lender will have to charge the borrower interest at the refinancing rate.

Based on Art. 814 of the Civil Code of the Russian Federation, a loan agreement can be concluded with the condition that the funds received are used for certain purposes (for example, for the purchase of fixed assets). In this case, the borrower is obliged to ensure that the lender can control the intended use of the loan amount.

At the same time, establishing in the agreement a specific purpose for using the loan is not a mandatory condition for the parties. The agreement may also provide for a broader use of funds received (for example, replenishment of working capital).

In addition, the agreement can provide for other terms of the relationship that arise between the parties to the loan agreement (for example, the procedure for repaying the loan, repaying the debt in parts, etc.)

1. Loans received

From January 1, 2009, the features of accounting for expenses associated with obtaining loans and credits are determined by the new PBU 15/2008 “Accounting for expenses on loans and credits,” approved by Order of the Ministry of Finance of Russia dated October 6, 2008 N 107n.

According to clause 2 of PBU 15/2008, the principal amount of the obligation for the loan received is reflected in the accounting records of the borrowing organization as accounts payable in accordance with the terms of the loan agreement in the amount specified in the agreement. And the repayment of the principal amount of the obligation on the loan received is reflected by the borrower organization as a reduction (repayment) of accounts payable (clause 5 of PBU 15/2008).

According to the Chart of Accounts, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n (hereinafter referred to as the Chart of Accounts), settlements under short-term loan agreements (for a period of 12 months or less) received by the organization are reflected in account 66 “Settlements on short-term loans and loans”, for settlements on long-term loans, account 67 “Settlements on long-term loans and borrowings” is intended. It does not matter from whom the funds were taken - from another organization, an employee or a third-party individual. At the same time, analytical accounting of short-term and long-term credits and borrowings is carried out by type of credits and loans, credit institutions and other lenders who provided them.

When you receive a loan, you must make the following entries:

Debit 50 (51) Credit 66 (67) - a loan was received from an individual.

At the time of debt repayment:

Debit 66 (67) Credit 50 (51) - partial or full repayment of debt in accordance with the terms of the agreement.

For your information:

If an individual provides funds to a legal entity under an interest-free loan agreement, then the material benefit determined in accordance with Art. 212 of the Tax Code of the Russian Federation does not arise for an individual.

Funds received by an organization under a loan agreement are not taken into account either for profit tax purposes or for VAT purposes on the following grounds.

An individual who is not an individual entrepreneur does not become a VAT payer. Therefore, the individual providing the loan (reimbursable or gratuitous) does not calculate VAT. The organization in this case, on the basis of the provisions of Art. 161 of the Tax Code of the Russian Federation is not a tax agent and also does not calculate VAT.

According to paragraphs. 10 p. 1 art. 251 of the Tax Code of the Russian Federation, when calculating income tax, income in the form of funds or other property received under credit or loan agreements (other similar funds or other property, regardless of the method of registration of borrowings, including securities under debt obligations), as well as funds or other property received to repay such borrowings.

The return of an interest-free loan is not reflected by the organization as part of the expenses taken into account when taxing profits, in accordance with clause 12 of Art. 270 Tax Code of the Russian Federation.

Saving on interest under interest-free loan agreements does not entail the emergence of an object of taxation for profit tax for the borrower (letters of the Ministry of Finance of Russia dated 03/14/2007 N 03-02-07/2-44, dated 02/20/2006 N 03-03-04/1/ 128).

2. Loans issued

In accordance with the Chart of Accounts, amounts of cash and other loans provided by the organization to individuals who are not employees of the organization should be reflected in account 76 “Settlements with various debtors and creditors”, subaccount “Settlements on loans provided”.

Operations for issuing and repaying a loan will be reflected in the following transactions:

Debit 76 Credit 50 (51) - reflects the issuance of a loan to an individual (basis - loan agreement);

Debit 50 (51) Credit 76 - reflects the repayment of the loan (part of the loan) in accordance with the terms of the agreement.

Let us note that the amount of material benefit received by an individual from savings on interest for the use of borrowed funds received from an organization is not subject to reflection in the accounting accounts of the lending organization. Let's explain why.

In accordance with paragraph 5 of Art. 8 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting” (hereinafter referred to as Law N 129-FZ), all business transactions are subject to timely registration in accounting accounts without any omissions or exceptions.

In this case, a business transaction is considered an event that characterizes individual business actions (facts) that cause changes in the composition of property (for example, the outflow of funds as a result of a transfer from the organization’s current account to the employee’s account) and liabilities, their placement and the sources of their formation.

A business transaction is reflected in accounting by an accounting entry indicating the debited and credited account and the amount of the transaction.

Thus, only a certain operation can be reflected on the relevant accounting accounts, as a result of which, first of all, a quantitative change in the composition of the organization’s property and liabilities will occur.

In the situation under consideration, the calculation of the material benefit of an individual borrower does not entail any changes in the composition of the property or obligations of the lending organization, except for the obligation of the tax agent, which consists in the need to calculate, withhold and pay to the budget the amount of personal income tax on the income generated by the borrower .

Moreover, the calculation of the amount of material benefit and the amount of tax subject to withholding should be documented in an accounting certificate in accordance with clause 2 of Art. 9 of Law No. 129-FZ.

Thus, for accounting purposes, a business transaction is not the calculation of the amount of material benefit, but the calculation of the amount of personal income tax to be withheld from the borrower.

It should be taken into account that material benefit is a separate type of income of an individual, which recognizes economic benefit in monetary or in-kind form, taken into account if it can be assessed and to the extent that such benefit can be assessed. In the case under consideration, income is associated with savings on interest for the use of borrowed funds and is determined in accordance with Art. 212 of the Tax Code of the Russian Federation.

Since the organization does not have the ability to withhold personal income tax from individuals who are not its employees, it should be guided by clause 5 of Art. 226 Tax Code of the Russian Federation. According to this paragraph, if it is impossible to withhold the calculated amount of tax from the taxpayer, the tax agent is obliged, no later than one month from the end of the tax period in which the relevant circumstances arose, to notify the taxpayer and the tax authority at the place of his registration in writing about the impossibility of withholding the tax and the amount of tax.

The form of notification of the impossibility of withholding tax and the amount of tax and the procedure for submitting it to the tax authority are approved by the federal executive body authorized for control and supervision in the field of taxes and fees.

Today, by order of the Federal Tax Service dated October 13, 2006 N SAE-3-04 / [email protected], tax agents are recommended to report the impossibility of withholding tax in Form N 2-NDFL.

Answer prepared by: Expert of the Legal Consulting Service GARANT Member of the Chamber of Tax Consultants Ananyeva Larisa

The answer was checked by: Reviewer of the Legal Consulting Service GARANT auditor Vyacheslav Gornostaev

January 15, 2010

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service. For detailed information about the service, contact your service manager.

it's time to study!

- January 15, 2020 / Internet “International Standards in Auditing”, Qualification “Specialist in International Standards in Auditing” (IAPBE)

- January 22, 2020 / Internet Taxation of the Russian Federation

- January 25, 2020 / Internet Business fragmentation: legal problems, protection from claims of tax authorities

- January 29, 2020 / Internet Certified chief accountant according to IFRS (IAB). January set

- January 29, 2020 / Internet How to read management reporting. Free webinar.

- February 06, 2020 / Internet Currency regulation and currency control in the Russian Federation, taking into account the latest changes in legislation

- February 11, 2020 / Internet Unscrupulous suppliers: how to maintain tax deductions and prevent violations of laws

- February 13, 2020 / Internet “Business Project Management System”, Qualification “Project management” (IAPBE)

- March 13, 2020 / Internet CIMA Program “Operations Performance Management”. Level P1 (preparation for the May 2018 session)

- January 14, 2020 / St. Petersburg Professional internal auditor: modern organization, management and methodological support (according to the professional standard program “Internal Control Specialist” level 5)

- January 15, 2020 / Moscow Training course “IPFM:IFRS.Basis”

- January 15, 2020 / St. Petersburg Latest changes in international financial reporting standards (IFRS)

More seminars and courses

Personal income tax

The interest received by the employee, according to Art. 41 of the Tax Code of the Russian Federation are its economic benefits, therefore they are recognized as an object of taxation and are included in the tax base. Regardless of the taxation regime (general, special or other), if an organization pays interest to its employee, it is recognized as a tax agent, which follows from Art. 226 Tax Code of the Russian Federation. She must calculate, withhold from the taxpayer’s income and pay the amount of tax to the budget. Paid income is taxed at a rate of 13%.

The tax agent withholds the tax amount directly from the taxpayer's income upon actual payment, for example, through a cash register. No later than the day of actual receipt of funds from the bank, including for the payment of interest, the organization transfers the tax to the budget.

Unified social tax

According to paragraph 1 of Art. 236 of the Tax Code of the Russian Federation, the object of UST taxation for organizations is payments and other remuneration accrued in favor of individuals under employment and civil law contracts, the subject of which is the performance of work or the provision of services. Since the loan agreement is a civil law agreement, interest paid under it to the employee is recognized as subject to UST taxation. According to paragraph 3 of Art. 238 of the Tax Code of the Russian Federation, the tax base in terms of insurance contributions to the Social Insurance Fund does not include payments under civil law contracts. Consequently, the interest accrued to the employee will not be taxed at the full UST rate, but minus the part that is payable to the Social Insurance Fund.

Example 1 . The employee's tax base for the first quarter of 2006 amounted to 100,000 rubles, including interest accrued on the loan provided to the organization in March - 1,000 rubles.

For employees whose tax base does not exceed 280,000 rubles, the Unified Social Tax rate is applied in the amount of 26%, 2.9% for contributions to the Social Insurance Fund. Since no tax is levied on contributions to the Social Insurance Fund, the amount of accrued interest is taxed at a rate of 23.1%, which is 231 rubles. Of them:

- to the federal budget (20%) - 200 rubles;

- in the Federal Compulsory Medical Insurance Fund (1.1%) - 11 rubles;

- in TFOMS (2%) - 20 rubles.

Loans issued to employees by the organization

If the lender is a legal entity, according to the Civil Code of the Russian Federation, the loan agreement must be drawn up in writing.

When making payments to employees on loans provided to them, account 73 “Settlements with personnel for other operations”, subaccount 1 “Settlements on loans provided” is used. The issuance of a loan to an employee is most often carried out through the cash register, which is reflected by the entry Debit 73/1 Credit 50.

According to clause 7 of PBU 9/99 “Income of the organization” <2>, interest is taken into account as part of other income. Interest accrual on the interest-bearing loan provided is reflected monthly in accordance with the terms of the agreement. In this case, the following entries are made: Debit 73/1 Credit 91/1 - interest was accrued on the loan agreement, Debit 50, 70 Credit 73/1 - the amount of interest on the loan was received (paid through the cash register, deducted from the salary). A similar entry is made when the employee repays the loan.

<2> Order of the Ministry of Finance of Russia dated 05/06/1999 N 32n.

If an organization is an authorized representative of an employee for the purpose of calculating personal income tax, then it calculates and withholds the amount of tax (usually from his salary). The following entries are made in accounting: Debit 70 Credit 68, subaccount “Calculations with the budget for personal income tax.”

Personal income tax

When an employee receives a loan from an organization, he may receive material benefits from savings on interest, which is subject to personal income tax in a special manner. If the amount of interest is expressed in rubles, then the material benefit is defined as the excess of the amount of interest calculated from 3/4 of the current refinancing rate of the Central Bank of the Russian Federation established on the date of receipt of the loan over the amount of interest calculated based on the terms of the agreement.

The calculated material benefit is taxed at a rate of 35% (clause 2 of Article 224 of the Tax Code of the Russian Federation) except for cases where the loan is actually spent by the employee:

- for new construction on the territory of the Russian Federation;

- for the acquisition of a residential building, apartment or share(s) in them on the territory of the Russian Federation.

When confirming targeted expenses with relevant documents, material benefits are taxed at a rate of 13%.

The issue of documentary confirmation of the intended use of borrowed funds is considered in Letter of the Federal Tax Service of Russia dated December 24, 2004 N 04-3-01/928: documents confirming the intended use by the taxpayer of borrowed funds received after January 1, 2005 may be, firstly, the the agreement on the basis of which the taxpayer received borrowed funds, as well as those documents that the taxpayer must submit to confirm his right to receive a property tax deduction provided for in paragraphs.

2 p. 1 art. 220 of the Code in connection with new construction or acquisition on the territory of the Russian Federation of a residential building, apartment or share(s) in them.

Documents confirming the right to a property tax deduction, in particular, are:

during the construction or acquisition of a residential building (including unfinished construction) or a share(s) in it - documents confirming ownership of the residential building or share(s) in it;

when purchasing an apartment, share(s) in it or rights to an apartment in a house under construction - an agreement on the acquisition of an apartment, share(s) in it or rights to an apartment in a house under construction, an act of transfer of the apartment (share(s) in it) to the taxpayer or documents confirming ownership of the apartment or share(s) in it;

payment documents drawn up in the prescribed manner and confirming the fact of payment of funds by the taxpayer for expenses incurred (receipts for receipt orders, bank statements on the transfer of funds from the buyer’s account to the seller’s account, sales and cash receipts, acts on the purchase of materials from individuals indicating they contain the address and passport details of the seller and other documents).

The tax base when receiving a material benefit is formed by the taxpayer on the date of actual payment of interest. However, the organization is not a tax agent. She can become an authorized representative of the taxpayer if he issues a notarized power of attorney for her (Article 29 of the Tax Code of the Russian Federation). In this case, the organization will perform the functions of a tax agent, that is, calculate and withhold the amount of tax from the taxpayer’s income and transfer it to the budget.

Example 2 . In March 2006, the organization issued loans for housing improvement to its employees I.I. Golubev and A.A. Lebedeva - 50,000 rubles each. each for a period of 60 days. Both must repay the loan and repay interest at the end of the contract.

Loans issued transactions

I.I. Petrov received a loan at 10% per annum, A.A. Lebedev - at 5%. The refinancing rate of the Central Bank of the Russian Federation is 12% per annum.

First, the organization’s accountant needs to determine how much 3/4 of the refinancing rate of the Central Bank of the Russian Federation will be. This figure is 9% (12% x 3/4).

Next, we compare the resulting figure with the interest on loans issued.

In Golubev I.I.

no material benefit arises, since he pays 10% under the loan agreement, that is, more than 3/4 of the refinancing rate.

The interest rate on the loan provided to A.A. Lebedeva is below 3/4 of the refinancing rate of the Central Bank of the Russian Federation. Therefore, it is necessary to determine the amount of material benefit.

The amount of interest under the agreement amounted to 410.96 rubles. (RUB 50,000 x 5% / 365 days x 60 days).

The amount of interest based on 3/4 of the refinancing rate is equal to 739.73 rubles. (RUB 50,000 x 9% / 365 days x 60 days).

The amount of material benefit is 328.77 rubles. (739.73 - 410.96).

Based on the statement of Lebedeva A.A. the organization represents its interests in relations with the budget, being an authorized representative. The amount of personal income tax that the organization will withhold and transfer to the budget amounted to 115 rubles. (RUB 328.77 x 35%).

A.E. Krasotkina

Journal expert

"Salary:

Accounting

and taxation"

Accounting account “Loans issued” - what includes, accounting features

Business lawyer > Accounting > Accounting and reporting > What is the accounting account “Loans issued”

Obtaining a loan can be done in various ways, but you need to understand that each of them has its own strengths and weaknesses. What is the accounting account “Loans issued”, read in the article.

Loan concept

A loan is a type of relationship in which one party transfers values to the other with the aim of returning it after a certain period of time. The key point is that the transferred values must have generic characteristics: weight, measure, number, etc. The borrower, as was said, must return these funds after a time period agreed individually with the lender.

Note: the occupied property is in the full possession of the borrower for the period of a personally determined period - he has the full right to dispose of this property as he sees fit.

It is important to note that if we consider a loan from the point of view of an MFO or other financial organization that is ready to provide funds, then from a legal point of view such a process is called the movement of funds on a fee basis. It is such due to the presence of interest, which the debtor undertakes to pay when the principal debt becomes due.

Short-term and long-term loans

If we talk about types, there are only two main ones: short-term and long-term. Let's take a closer look in Table 1.

| Name | Description |

| Short term | They imply a loan for up to 1 year for small amounts. Their main feature is that the vast majority do not require collateral or guarantors, and the only requirement is a minimum package of documents. |

| Long-term | A more serious debt, which is provided for a period of 3 to 30 years. It also provides for a thorough check of the borrower for unpaid loans and information that can prove the lack of profitability of issuing a loan: criminal record, low income, etc. Although the interest rate for such a loan is lower, the minimum threshold amount is several times higher than for short-term ones. |

However, there is a division not only by time, but also by forms, payment methods, receipt, etc.

about the intricacies of using accounting account 66:

Accounting for borrowed funds

Each organization has the right to provide a loan to another organization; entries reflecting borrowed funds for individuals and legal entities have a number of differences. First of all, the condition is taken into account whether the loan provided is interest-bearing or is it issued without interest.

The provision of a loan is regulated; the entries are given in the article by the Civil and Tax Codes of the Russian Federation, 402-FZ of December 6, 2011 “On Accounting” and PBU 19/02.

According to the current civil legislation, the loan agreement (postings - below) is drawn up in such a way that the lender provides the borrower with tangible or intangible assets, united by generic characteristics, under the conditions of mandatory return of the funds received (clause 1 of Article 807 of the Civil Code of the Russian Federation).

The operation of issuing a loan (posting) is documented with appropriate primary accounting documents. The type of primary documentation depends on the type of assets loaned (clause 1 of Article 9 402-FZ).

Loans issued, transactions for which are formed as part of financial investments, must meet the following requirements (clause.

Providing a loan to another organization - postings

Tax-tax November 16, 2020 625 When providing a loan to another organization, the postings may be different. Read about what this is connected with and what kind of accounting entries arise for the party lending funds in our material.

Conditions for issuing money in debt, affecting the accounting of transactions on this debt

Providing a loan to a legal entity from a legal entity at interest

An interest-free loan was issued - how to reflect this in transactions

Results

Typical accounting entries for loans

2 PBU 19/02):

- For a transaction, an agreement must be drawn up that secures the institution’s rights to make financial investments.

- Possible financial risks are calculated.

- There is the ability to generate profitability in the form of interest for the use of loaned assets in future periods.

Thus, to reflect borrowed tangible and intangible objects in the context of financial investments, account 58 “Financial investments”, subaccount 3 is used. If an interest-free loan is provided, such an operation will be reflected as part of expense accounting.

In the case where funds are lent to an individual, the accounting entries for the lending organization will be similar to those above. Interest must be reflected in Dt account 73 “Settlements with personnel for other operations”, subaccount 1.

Loan issued: accounting entries

If a loan is issued to another organization, the postings will be as follows:

Dt 58.3 Kt 51.

Interest-free borrowing:

Dt 76 Kt 51, 52.

Issuing a loan to the founder, posting:

Dt 76 Kt 50, 51.

Such an accounting entry is prepared if the founder is not an employee.

Issuing a loan to an employee (the postings will be similar for the founder-employee of the organization):

Dt 73.1 Kt 50, 51.

If an organization issues an interest-bearing loan to an employee, then interest is calculated as follows (clause 7 of PBU 9/99):

Dt 73.1 Kt 91.1.

If interest is accrued on a loan issued to another organization, the accounting entry will be as follows:

Dt 76 Kt 91.1.

You can issue funds to an employee as follows:

Dt 58.3 Kt 50, 51 - a loan was issued to an employee (postings).

Borrowed assets can be not only in the form of money. Accounting entries for such cases:

- Dt 58.3 Kt 10, 41 - interest-bearing loan to another organization or employee;

- Dt 76 Kt 10, 41 - interest-free loan.