What taxes are paid under the simplified tax system?

Operating business entities, whether legal entities or entrepreneurs, have the right to independently choose the applicable taxation system.

If the approved conditions for income level and the number of employees are met, organizations and individual entrepreneurs can switch to a simplified taxation system (STS), which provides for the following procedure for paying taxes:

- “Simplified” are recognized as single tax payers and are exempt from paying VAT, income tax, and property tax. Also, the single tax replaces the payment of personal income tax for individual entrepreneurs for themselves.

- The tax amount is determined based on the chosen tax scheme. Organizations and individual entrepreneurs using the “STS 15%” scheme determine their total income as the tax base without taking into account expenses and pay tax at a rate of 15%. Business entities operating under the “STS 6%” scheme pay tax in the amount of the product of the 6% rate and the tax base (income minus expenses).

- Enterprises and individual entrepreneurs using the simplified tax system are required to transfer tax advances during the reporting year (quarterly), and at the end of the billing period make final tax payments.

Please note that the use of the simplified tax system does not exempt business entities from paying insurance contributions to the Social Insurance Fund and the Pension Fund of the Russian Federation.

How to make a credit if you overpaid tax?

An overpayment under the simplified tax system for the year is formed when the amount of tax accrued for the year is less than the total amount of advances paid for the same period. You can deal with the resulting overpayment in the same way as with an overpayment for any other tax: leave it against future payments, return it to your current account, or offset it against the payment of another tax. For the last 2 options, you will need to fill out an application.

Calculate whether you will lose extra money if you first return the overpayment from the budget, and after a few months again transfer the money to the budget as an advance payment under the simplified tax system. This is especially true for small overpayment amounts.

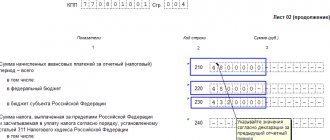

In the declaration under the simplified tax system for 2013. Is there a tax amount to be reduced for the tax period? How can this overpayment according to the simplified tax system be taken into account in the future? Or should it be reimbursed from the budget?

As evidence, they point out that these taxes have different BCC codes. This discrepancy in the distribution of taxes between budgets is what causes the tax authorities’ fierce reluctance to offset advance payments against the payment of the minimum tax.

The overpayment is offset based on the taxpayer’s application. It can be transmitted both in paper form and electronically, certified with an electronic digital signature (electronic digital signature), through TCS (telecommunication channels).

The procedure for refunding (offsetting) taxes (advance tax payments, fees, penalties and fines) depends on the reason why the organization overpaid the budget and the method in which it is returned.

Currently there are standard samples of applications for tax credits and refunds. They were approved by order of the Federal Tax Service dated March 3, 2020 No. ММВ-7-8/

The chief accountant advises: if an organization plans to offset the overpayment against current payments for another tax, submit an application for offset in advance. At least 10 working days before the deadline for paying the tax against which the overpayment is planned to be offset.

At the same time, paragraph 5 of Art. 78 of the Tax Code of the Russian Federation provides for the direction of the amount of overpaid tax to fulfill obligations to pay taxes or fees, pay penalties, repay arrears, if this amount is sent to the same budget (extra-budgetary fund) to which the overpaid amount of tax was sent.

Attach to the application documents confirming the overpayment of tax, for example, payment documents, documents confirming the availability of tax benefits, etc. To return the over-withheld personal income tax, you may need to submit a 3-NDFL declaration to the tax authority (paragraph 10, clause 1, clause 1.1 Article 231 of the Tax Code of the Russian Federation).

They are wrong: the tax is considered paid from the moment the bank accepted your payment order for its transfer.

The deadline for filing an application for the return of an overpayment is three years from the date of payment of the excess amount (Clause 7, Article 78 of the Tax Code of the Russian Federation).

The monthly refund period expired on April 4, but the money was credited to the account only on April 20, that is, the delay was 16 days.

Operating business entities, whether legal entities or entrepreneurs, have the right to independently choose the applicable taxation system.

When does an overpayment occur under the simplified tax system?

In order to understand the peculiarities of overpayment of single tax for a “simplified” person, let’s look at a few examples:

Option #1. Overpayment on advances.

Individual Entrepreneur Gavrilov is a payer of the simplified tax system 15% income minus expenses. During 2020, Gavrilov made prepayment tax calculations and transferred the following amounts to the budget:

- 01.18 – 23.606 rub.;

- 04.18 – 38.516 rub.;

- 10.18 – 32.714 rub.

At the end of the year, Gavrilov compiled and submitted a tax return to the Federal Tax Service, in which he reflected the amount of annual income (584,990 rubles) and the amount of tax for the year (584,990 rubles * 15% = 87,748.50 rubles).

Since the total amount of advance payments (23,606 rubles + 38,516 rubles + 32,714 rubles = 94,836 rubles) exceeded the amount of Gavrilov’s tax obligations at the end of the year (87,748.50 rubles), the entrepreneur had an overpayment according to the Tax Code in the amount of 7,087.50 RUB (94,836 RUB – 87,748.50 RUB).

Option #2. Error when transferring payment.

Based on the tax return filed by Factor-5 LLC (payer of the simplified tax system) to the Federal Tax Service, at the end of 2020, the enterprise is obliged to make a final payment for the single tax in the amount of 104,770 rubles.

When filling out the payment order, the accountant of Factor-5 LLC made a mistake, and as a result, the amount of 107,770 rubles was paid to the budget, and an overpayment of 3,000 rubles arose. (RUB 107,770 – RUB 104,770).

Option #3. Overpayment based on an updated declaration.

Mustang LLC is a payer of the simplified tax system 15% income minus expenses. During 2020, the accountant of Mustang LLC made calculations and transferred the following advance amounts to the budget:

- 01.18 – 45.002 rub.;

- 04.18 – 48.108 rub.;

- 10.18 – 49.100 rub.

In January 2020, the accountant of Mustang LLC submitted a declaration to the Federal Tax Service, according to which the tax amount for 2020 was 203,050 rubles. Thus, for the final calculation, the Mustang accountant should pay the amount of 60,840 rubles to the budget. (RUB 203,050 – RUB 45,002 – RUB 48,108 – RUB 49,100). The final payment was made on January 12, 2019 (the debt was transferred).

On January 25, 2020, the accountant of Mustang LLC submits an updated tax return to the Federal Tax Service, according to which the total amount of tax liabilities for 2020 is 181,405 rubles. Thus, Mustang LLC incurred an overpayment of tax in the amount of 21,645 rubles. (RUB 203,050 – RUB 181,405).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

When can you return an overpayment using the simplified tax system?

The overpayment of the single tax incurred by the “simplified” person is subject to return to the current account if the payer has no debt on this tax. It should also be noted that the overpayment is not refundable if the payer has an outstanding fine or penalty accrued for a single or other federal tax.

If there is an arrears according to the Tax Code, or an unpaid fine or penalty, the amount of the overpayment is taken into account towards the repayment of the debt, thus only the balance of the amount (overpayment minus the withheld arrears/fine/penalty) must be returned to the current account.

Forced offset

However, no matter what kind of overpayment we are talking about, if the taxpayer has an arrear, the amount of “surplus” will first of all be used to repay it. Moreover, in order to cover the debt with an overpayment, tax authorities do not have to wait for the taxpayer’s request (his application). In accordance with paragraph 5 of Article 78 of the Tax Code of the Russian Federation, inspectors have the right to do this independently within ten working days from the moment of detection of the tax surplus or from the date of execution of the act of reconciliation of settlements with the budget. The controllers are required to notify the taxpayer of such a decision in writing within five days from the date of its adoption. With regard to funds excessively collected in favor of the treasury, exactly the same procedure applies (Clause 1, Article 79 of the Tax Code).

Moreover, if part of the overpayment was forced by the tax authorities to pay off the debt, the amount of the excess will change. This means that in order to return or offset it, the taxpayer will need to submit a new application indicating the amount of the tax overpayment after its partial offset against the arrears (letter of the Ministry of Finance dated September 20, 2012 No. 03-02-07/1-226).

It should be borne in mind that such offset is possible at the initiative of the tax authorities until the expiration of the period for forced debt collection. At the same time, in the ruling dated 02/08/2007 No. 381-O-P, the Constitutional Court of the Russian Federation indicated that the tax authority does not have the right to independently offset the overpaid tax to pay off arrears and debts on penalties, the possibility of forced collection of which has been lost. The Ministry of Finance and the Supreme Arbitration Court of the Russian Federation share this approach (letters of the Ministry of Finance of the Russian Federation dated July 14, 2009 No. 03-02-07/1-357 and dated July 1, 2009 No. 03-02-07/1-334, resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 20 2009 No. 10707/08 and dated September 15, 2009 No. 6544/09).

Overpayment under the simplified tax system: how to return money to the organization’s account

If a tax overpayment has occurred for a legal entity using the simplified tax system, then, according to the general procedure, the amount of the overpayment can be returned to the organization’s current account only if there is no tax debt.

Below are step-by-step instructions that will help the company’s accountant understand the procedure for returning an overpayment according to the simplified tax system.

Step 1. Confirmation of overpayment

Before contacting the Federal Tax Service for a refund, you must confirm the existence and amount of the overpayment.

If the overpayment arose due to incorrectly reflected amounts in the tax return, then the organization should submit a “clarification” with the correct data to the Federal Tax Service. Next, you need to carry out a reconciliation with the fiscal service and sign the corresponding act (the form can be downloaded here ⇒ Reconciliation report with the Federal Tax Service (form)).

How to offset an overpayment according to the simplified tax system

The entrepreneur (organization) retains the right to offset the amount of overpayment arising under the single tax of the simplified tax system against upcoming payments. Let's consider the accountant's procedure in this case:

- The organization's accountant carries out a reconciliation of mutual settlements with the Federal Tax Service, signs a reconciliation report, on the basis of which the amount of the overpayment is approved.

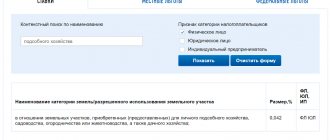

- The payer applies to the Federal Tax Service with an application to credit the overpayment to future payments. The application must be drawn up on an approved form (Appendix No. 9 of the Federal Tax Service order NММВ-7-8/9 dated 03/03/2015). The application form can be downloaded here ⇒ Application for offset of overpayment of tax.

- After reviewing the application and conducting a desk audit, the Federal Tax Service notifies the payer of the offset of the overpayment.

In what cases is a refund made?

Those for whom this amount is a significant amount should think about how to return overpaid tax under the simplified tax system. This often occurs when the tax authority forcibly collects amounts or charges additional amounts, and the taxpayer then challenges these actions through the court and turns out to be right. It is also advisable to return the overpayment when you urgently need to pay a tax of another level, for example, for land or for the property of an organization.

The return procedure is the same as the offset procedure, it is of a declarative nature, and a decision on it is made within 10 days.

The application form is published on the Federal Tax Service website at the link https://www.nalog.ru/rn77/about_fts/docs/6724020/ (Order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8/ [email protected] , Appendix No. 8) .

A taxpayer, when the question arises: “How to return an overpayment of tax under the simplified tax system?” - must first check the budget to make sure there are overpaid funds, and then count or return the overpayment. Tax overpayments are counted against future payments for the same tax or against payments for a tax of the corresponding level. To receive a refund or credit for an overpayment, an application from the taxpayer is required.