How to write a cover letter for documents

There is no single unified form of writing.

Requirements for the preparation of organizational and administrative documentation are described in GOST R 6.30-2003. The requirements of this standard are recommended. How to write a cover letter for documents? Let's start with the basic rules:

- on company letterhead;

- indicating the date and registration number.

Let's take a closer look at a sample cover letter about sending documents, what main sections the text can be divided into and what information should be reflected in them.

| Letter section | Short description | Example |

| Introduction | About sending a response to a claim | |

| Heading | Theme that defines its purpose | Covering letter of submitted documents |

| Appeal | A specific appeal to the manager, preferably addressed, indicating the name and patronymic | Dear Ivan Ivanovich! |

| Purpose of the message | Brief formulation | In response to your claim, I am enclosing confirmation that the stated requirements were met within the time limits specified in the Supply Agreement. |

| Main part | Statement of the essence with summing up and expression of hope, gratitude, etc. | According to the information received from you, there were facts of violation of clauses 2.3 and 3.6 of the Agreement. In turn, I inform you that the components were transferred on time, which is confirmed by the Invoice, and the work was completed on time, which is confirmed by the date of acceptance of the work on the Work Order. I consider the requirements set forth in claim No. 2, sent to us on July 14, 2017, to have been fulfilled in full. I ask you to consider and send information about your decision to us within the period established by law. I express my gratitude to you for using the services of our company, and I hope for further cooperation. |

| Conclusion | List of applications. Polite signature | Applications:

Head, Sidorova Maria Ivanovna. Full name and contact details of the performer. |

Example of a cover letter for documents

Enterprise employees not only have to send such requests to counterparties, but also receive them from them. It makes sense for business clerks to develop a form for an incoming cover letter for documents. It will be required if the counterparty provides the package without explanation. This often happens when collaborating with individuals, but for legal entities this case is no exception. To optimize document flow, the counterparty will be able to fill out the proposed form, which will indicate all the necessary information.

Sample cover letter for transfer of documents. Form designed to be filled out by the counterparty:

Covering letter for documents and its sample

Text of the letter A covering letter, as a rule, is drawn up in the name of the first head of the recipient company or its division. In this case, it is recommended to address “Dear” with the name and patronymic of the manager. If the letter is unaddressed, you can skip the appeal.

The initial phrase of the descriptive part of the letter depends on the organization to which it is sent:

- to a higher organization - “we present to you”;

- to a subordinate organization - “we send to you”;

- to a third-party organization – “we will send it to you.”

This is followed by a description of the purpose for providing the documents and, if necessary, a request for their consideration. If correspondence is sent at the request of an organization, this must be indicated at the beginning of the letter. In addition, you will need to submit an updated form if the policyholder’s accident insurance premium rate changes from the new year, but he will receive a notification about this from the Social Insurance Fund after he reports for the first quarter. Considering the deadlines established for this, such a situation is also possible (clauses 4, 5, 11 of the Procedure for confirming the main type of economic activity of the insured..., approved by Order of the Ministry of Health and Social Development of Russia dated January 31, 2006 N 55). In what form should the updated 4-FSS be submitted? The updated 4-FSS must be submitted in the same form in which the calculation with incorrect information was originally submitted (clause 1.5 of Article 24 of the Law of July 24, 1998 N 125-FZ). By the way, from reporting for 9 months of 2020, policyholders must use the updated Form 4-FSS, since changes were made to it in June 2020 (Order of the Federal Insurance Fund of the Russian Federation dated 06/07/2017 N 275).

Application for reimbursement of FSS expenses: form and sample filling

After company representatives have collected and submitted the required number of documents, the Social Insurance Fund is obliged to transfer the money no later than ten days from the date of submission. In general terms, the process of reimbursement of FSS expenses looks like this.

A letter to the Social Insurance Fund about the authenticity of the sick leave in 2020 is drawn up in free form (this is usually done by the personnel service or the secretary of the organization).

The covering letter is prepared in two printed copies and signed by the manager or other authorized person. Upon receipt by the addressee, one copy is marked with the date of arrival of the documentation and with the signature of the person responsible for receiving the correspondence, and the internal incoming number of the letter is entered in the recipient’s register. The application form can be found in the attachment to the letter of the FSS of Russia No. 02-09-11/04-03-27029 dated December 7, 2016. A sample of filling out this form will help you correctly compose a letter about payment for sick leave.

RUS LLC, represented by Director Petrov Petrovich, acting on the basis of the Charter, informs about the failure to submit reports in Form 4-FSS on time due to technical reasons: problems in the data transmission system via telecommunication channels.

This is a non-commercial document that is often used in business correspondence. The essence of the paper is that the sender undertakes to perform some action. In our case, transfer money to the contractor. These funds are usually used to pay for goods, services, work, or are used to pay off debt.

A unified reporting form put into effect by order of the Social Insurance Fund number 457 in 2020. The current version of the document includes details of charges, penalties, fines, as well as uncleared payments.

Attention! If the mother is deprived of her rights in raising a child (children), then a mark is made in the field about deprivation of motherhood and the full name of the child (children) is indicated.

An additional guideline is provided by the explanations of the Social Insurance Fund of the Russian Federation, a financial and credit institution authorized to manage state social insurance funds. But let's return to our main question of the article - how to fill out an application for FSS reimbursement? So let's talk about this document. Let us immediately make a reservation that there are no exact instructions for writing an application, there are only recommendations and a form that is attached on the official website. You can download the same application form for reimbursement of FSS expenses at the end of our article.

Write a cover letter for FSS submission of documents

Main part Statement of the essence with summing up and expression of hope, gratitude, etc. According to the information received from you, there were facts of violation of clauses 2.3 and 3.6 of the Agreement. In turn, I inform you that the components were transferred on time, which is confirmed by the Invoice, and the work was completed on time, which is confirmed by the date of acceptance of the work on the Work Order. I consider the requirements set forth in claim No. 2, sent to us on July 14, 2017, to have been fulfilled in full. I ask you to consider and send information about your decision to us within the period established by law. I express my gratitude to you for using the services of our company, and I hope for further cooperation. Conclusion List of applications. How to write a cover letter for documents? Let's start with the basic rules:

- on company letterhead;

- indicating the date and registration number.

Let's take a closer look at a sample cover letter about sending documents, what main sections the text can be divided into and what information should be reflected in them. Section of the letter Brief description Example Introduction Brief content About sending a response to the claim Heading Subject defining its purpose Covering letter of transferred documents Appeal A specific appeal to the manager, preferably addressed, indicating the name and patronymic Dear Ivan Ivanovich! Purpose of the message Brief wording In response to your claim, I am enclosing confirmation that the stated requirements were met within the time limits specified in the Supply Agreement. Register of information necessary for the appointment and payment of benefits for temporary disability, pregnancy and childbirth, one-time benefits for women registered in medical institutions in the early stages of pregnancy

- 6. Certificate form - calculating the amount of vacation pay (in addition to annual paid leave) for the entire period of treatment and travel to and from the place of treatment and a sample for filling out the certificate

- 7. Form of decision to refuse to consider documents (information)

- 8. Application form for reimbursement of the cost of a guaranteed list of funeral services and a sample of filling out the application

- 9. Application form for reimbursement of expenses for additional paid days off for one of the parents (guardian, trustee) to care for disabled children and a sample for filling out the application

- 10.

AttentionSubscribe to our channel in Yandex.Zen! Subscribe to the channel Details Business correspondence between business entities (legal entities, individual entrepreneurs) is usually carried out on the letterhead of organizations containing corner stamps with the sender’s details. The signature of the cover letter depends on the type of documents being sent. For example, when sending a copy of a contract or commercial proposal, the letter is traditionally signed by the first manager; if accounting documents are sent - the chief accountant or the head of the financial department, etc. In addition, the letter must indicate the name and contact information of its actual executor - for prompt communication in case of questions regarding the received documents.

How to write a letter to the FSS for clarification

To summarize all of the above, we add that in the case when the transferred funds cannot cover the amount of benefits paid, the required amount of money in the Social Insurance Fund to pay for sick days. This must be done in the FSS department, which is located strictly at the place of registration.

After company representatives have collected and submitted the required number of documents, the Social Insurance Fund is obliged to transfer the money no later than ten days from the date of submission.

In general terms, the process of reimbursement of FSS expenses looks like this.

Naturally, we should also mention the response measures of the Social Insurance Fund of the Russian Federation - their employees have the right to check the legality of your requirements and go to your company for an “audit”.

To create a new department number or change an existing one. Employee Transfer Certificate - Request for reimbursement of employee costs incurred in connection with the transfer of expenses and payment of transferred expenses directly to third parties.

A cash fund transaction is the formal approval of a department's cash fund. Petty Cash Fund Request Form - Petty Cash Fund Request. Request for a refund. This form must be used to refund money that has been paid to the University for fees, tickets, classes, etc.

Sometimes, in order to verify the legality of refunds, employees ask company representatives to provide additional paperwork

When an on-site “audit” occurs, naturally, the ten-day deadline cannot be met. If the result is positive, payment can only be made after verification by the Social Insurance Fund.

Application for reimbursement of FSS expenses

But let's return to our main question of the article - how to fill out an application for FSS reimbursement? So let's talk about this document. Let us immediately make a reservation that there are no exact instructions for writing an application, there are only recommendations and a form that is attached on the official website. You can download the same application form for reimbursement of FSS expenses at the end of our article.

Postal Request - A request to purchase postage for a postage meter or to purchase postage stamps. Quite often the reward account must be corrected retroactively.

If employers and employees were paid unfairly or too much social security contributions, the question arises: what to do to get the money back? The solution is usually billing.

Employers have the right to offset contributions that are incorrectly paid with future contributions. This process, called "billing" under Social Security, is common in the monthly payment of wages and contributions. It is generally managed by payroll programs without much effort.

Due to the fact that there are no standards, employees of the Social Insurance Fund of the Russian Federation accept applications written in free form.

The only important condition is the availability of correct data and company details.

You can familiarize yourself with the data that must be present in the application for reimbursement of FSS expenses by opening the order of the Ministry of Social Development of the Russian Federation, which was issued in 2009. So what is this data:

But be careful: billing requires more than just depositing overpaid amounts with the next deposit check. The trend is being shaped by associations of social insurance funds at the highest level. In the event of unauthorized billing, fees may be overpaid.

Billing and Reimbursement Guidelines. How employers should deal with overpayments of premiums is provided by the highest associations of social insurance funds in the General Principles for the Recovery and Recovery of Unpaid Employment Contributions. It regulates at what time intervals it is permissible, under what conditions.

- First of all, the name and address of the insured

- Registration number

- Specific figure for the required cash payment

- Application creation date

- Stamps and signatures of all necessary employees

I would also like to add that in the application for reimbursement of FSS expenses, it is necessary to clearly and clearly state the fact that the organization requires reimbursement of funds.

Otherwise, without clear wording, the transfer deadlines may drag on indefinitely.

A clear formulation of the purpose of the application is necessary so that the Social Insurance Fund understands you correctly and does not classify you, say, as a company that is asking for money for social payments.

Request for Refund or Billing? The employer decides whether to pay unfairly paid contributions.

Together with the employee, in the form of a request for reimbursement or through payment of the current contribution.

Billing is cheaper for employers because it is usually done automatically through payroll software. But: it can only be canceled within certain periods.

It is not possible to allocate overpaid contributions without restrictions.

Contributions paid in full may only be charged for 6 months and not fully paid for 24 months, i.e. under the deposit verification process.

The deadline is determined after the start of the period covered by the false contributions. The six-month and 24-month periods end with the calendar month preceding the presentation of proof of contribution.

Be extremely careful and vigilant when filling out the field with company expenses. In these columns you write only those monetary figures that you were unable to pay as contributions.

That is, these will be the amounts for which you hope to be reimbursed.

It very often happens that, out of ignorance, people register all benefits there, and employees of the Social Insurance Fund ask to create an application for reimbursement of FSS expenses in a new way. And this, as you may have guessed, is a big waste of time.

Billing Prerequisites. An employer can only pay insurance premiums if:

The employee insists that the employee's contributions be paid in full, that the employee is not notified of the claim by the beneficiary, and that the employee has not received health benefits or unemployment insurance since the beginning of the reimbursement period.

When calculating contributions, it is necessary to ensure that an excessive amount is not taken as the basis for calculating cash payments to the employee.

Attention! Selection excluded. The distribution of contributions is canceled if the annual review was carried out on the pension insurance scheme for the period of compensation or part of the period of compensation. In these cases, you must submit a claim for reimbursement. Alternative: Request a refund.

How long will it take for organizations to transfer the required amount?

Now, according to the logic of our narrative, we must move on precisely to the moment of transferring funds under the application for reimbursement of FSS expenses. We will decide on specific payment terms. As we have already mentioned, payments from the Social Insurance Fund must take place no later than ten days from the date of submission of the application. This is if there are no “audits”.

How long will it take for organizations to transfer the required amount?

If billing is not offered, is not acceptable or, for example, due to expiration of the deadline, fees that were incorrectly paid will be refunded upon application.

An official “claim for reimbursement of unfairly paid health care, pension insurance and unemployment insurance contributions” from social insurance funds can be used for this purpose.

Solidarity for older people. At least 65 years of age or from the age of retirement, if you are declared incompetent, former deportees, disabled people eligible for early retirement before reaching the retirement age, former prisoner of war, or if you have a permanent disability rate of at least 50%.

must be a resident of mainland France or Martinique, Guadeloupe, Guyana or Reunion, at the time of application and for the duration of the supplementary service. The citizenship requirement is not required if you stay in France for more than 6 months in the relevant year.

This is equal to the difference between the annual resource flow, which should not be exceeded, and your resources.

If an inspection is nevertheless ordered, then the payment period for the application for reimbursement of expenses becomes much longer - as much as three months.

Be careful, because in order to appoint a desk “audit” of your company, the Social Insurance Fund does not need any order or instruction.

Roughly speaking, if in the first ten days the money has not been received by your organization, then wait for an inspection from the FSS. Alternatively, you can dial the FSS phone number and find out about the status of your payments immediately, without omissions or vagueness.

Additional disability benefit

This amount cannot exceed the maximum annual amount also established by decree. There is no requirement for citizenship, but regularity of stay is mandatory.

This is true if you stay in France for more than 6 months in the relevant year. .

The amount of the benefit is equal to the difference between the annual flow of resources, which must not be exceeded, and your resources, without exceeding the annual maximum amount, also established by decree.

Restoration by inheritance

The retiree must then reapply.

Specific Solidarity Fund

This additional pension is granted on the first day of the month following the application. It is paid monthly in arrears. The supplement stops being paid.

By the beneficiary's 65th birthday, where the right to the elderly solidarity benefit or supplementary invalidity benefit is open, when the beneficiary marries, declares cohabitation or enters into a civil solidarity pact when resources exceed the ceiling.

Your resources or your family, your family situation, your place of residence. The health fund, managed by the Mario Besusso Foundation, better known as Fasdac, is supported by collective agreements between the heads of commercial companies, transport, hotels, shipping agencies and general warehouses created by the Authority.

in addition to the benefits provided by public service, reimburses health care costs and provides assistance to both retirees and retirees and their families.

How to apply the regional coefficient to benefits

In addition, you will need to submit an updated form if the policyholder’s accident insurance premium rate changes from the new year, but he will receive a notification about this from the Social Insurance Fund after he reports for the first quarter. Considering the deadlines established for this, such a situation is also possible (clauses 4, 5, 11 of the Procedure for confirming the main type of economic activity of the insured..., approved by Order of the Ministry of Health and Social Development of Russia dated January 31, 2006 N 55). In what form should the updated 4-FSS be submitted? The updated 4-FSS must be submitted in the same form in which the calculation with incorrect information was originally submitted (clause 1.5 of Article 24 of the Law of July 24, 1998 N 125-FZ). By the way, from reporting for 9 months of 2020, policyholders must use the updated Form 4-FSS, since changes were made to it in June 2020 (Order of the Federal Insurance Fund of the Russian Federation dated 06/07/2017 N 275).

The Social Insurance Fund of the Russian Federation, in agreement with the Ministry of Labor and Social Development of the Russian Federation, reports the following. According to the current legislation (Federal Law “On State Benefits for Citizens with Children”, Federal Law “On Burial and Funeral Business”), the amounts of state benefits for citizens with children (one-time allowance at the birth of a child, one-time allowance for women registered in medical institutions in the early stages of pregnancy, a monthly allowance for the period of parental leave until the child reaches the age of one and a half years), social benefits for burial and the cost of a guaranteed list of funeral services in regions and localities where regional coefficients for wages are established are determined taking into account these coefficients

ConsultantPlus: note.

Important DECISION Yekaterinburg belongs to the area where the regional coefficient is applied - 1.15 (Resolution of the State Committee for Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions dated 07/02/87 No. 403/20-155 “On the size and procedure for applying regional coefficients to the wages of workers and employees for whom they are not established in the Urals and in manufacturing sectors in the northern and eastern regions of the Kazakh SSR"). Calculation of benefits based on the employee’s earnings in the billing period In order to decide whether it is necessary to apply the provisions of Part 1.1 of Article 14 of Law No. 255-FZ, it is necessary to compare two indicators:

- actual average daily earnings of the employee;

- average daily earnings based on the minimum wage.

This procedure is established in paragraph 2 of the letter of the Federal Social Insurance Fund of the Russian Federation dated March 11, 2011 No. 14-03-18/05-2129. The actual average daily earnings of N.S.

Emerald is equal to 185 rubles. (RUB 135,050. Attention: Numerical examples of calculation of benefits in the article were prepared with the participation of T.M. Ilyukhina, Head of the Department of Legal Support of Insurance in Case of Temporary Disability and in Connection with Maternity of the Legal Department of the Federal Social Insurance Fund of the Russian Federation. Companies pay employees various types of state benefits. Based on the regional coefficient are adjusted:

- temporary disability benefits;

- maternity benefits;

- monthly child care allowance;

- lump sum benefit for the birth of a child;

- a one-time benefit for women registered in medical institutions in the early stages of pregnancy;

- social benefit for funeral.

WE APPLY THE COEFFICIENT TO FIXED BENEFIT SIZES Fixed amounts have been established for a number of benefits. They are shown in the table below.

Reflecting the essence of the request, wording like “I ask you to issue a certificate on the status of settlements for contributions, fines as of ... (indicate the date).” 4. Reflecting the policyholder’s preferences on the method of receiving a response from the Social Insurance Fund:

- directly during a visit to the department;

- by mail.

Date of preparation of the document, full name and signature of the employee who compiled the application. 6. Contacts of the employee who compiled the application. Wording about the purpose of obtaining a certificate on the status of settlements may also be appropriate (for example, this may be confirmation of the absence of debts to the Social Insurance Fund when participating in a tender).

You can download a completed sample request form to the FSS on our portal. Filling out a request form to the Social Insurance Fund: nuances The request form to the Social Insurance Fund must be sent precisely to the division of the Fund that supervises the company submitting the application.

>How to respond to the FSS requirement: sample explanations

ATTENTION.

From December 29, 2017, the forms approved by order of the Federal Insurance Service of the Russian Federation dated November 24, 2017 No. 578 are in effect.

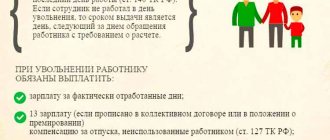

TO EMPLOYEE:

TO EMPLOYER:

Sample letter to the Social Insurance Fund from the policyholder with an incorrectly completed electronic register

Application form for reimbursement of expenses for payment of temporary disability benefits (Appendix No. 3 to Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578)

Form of a certificate calculating the amount of vacation pay (in addition to annual paid leave) for the entire period of treatment and travel to the place of treatment and back (Appendix No. 10 to the Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578)

DOCUMENTS RO FSS:

Form of notification of the submission of missing documents or information (Appendix No. 4 to the Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578)

Form of decision on refusal to assign and pay benefits for temporary disability (Appendix No. 5 to Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578)

Form of decision to refuse to consider documents (information) (Appendix No. 9 to Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578)

LIST OF DOCUMENTS submitted to the territorial body of the FSS of the Russian Federation for the assignment of benefits on paper

"Hotline"

e-mail:

Monday Thursday: 08.30-17.30

Friday: 08.30-16.30

lunch break: 13.00-13.48

Saturday, Sunday - days off

Each business entity interacts with the Social Insurance Fund for the purpose of social protection of the insured and economic interest. In the course of work, the need arises to transmit or request this or that information; for these purposes, it is advisable to issue a cover letter. Compiling a cover letter is not a requirement, but is an unwritten rule of paperwork.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

How to respond to the FSS requirement: sample explanations

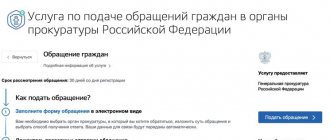

All organizations and individual entrepreneurs with hired employees report to the Social Insurance Fund. The fund reimburses the employer for sick leave expenses, various benefits and provides the right to use benefits. Therefore, FSS specialists carefully check and analyze the reports. During inspections, the FSS may discover discrepancies and send the policyholder a request for explanations. In this article, we will look at typical requests from the Foundation and figure out how to write a response to the request.

If during the desk check the FSS has questions, you will be sent a request to provide explanations and (or) supporting documents. The Foundation sends its request by mail or via telecommunication channels. You can respond to the request in person or through a representative; the response can be sent by registered mail or transmitted via telecommunications channels in the form of electronic documents. The deadline for responding to a request is five days; the requested documents must be submitted within ten days from the date of receipt of the request.

You may receive a requirement to provide explanations as part of a desk audit (Resolution of the Federal Tax Service of the Russian Federation dated May 21, 2008 No. 110) if:

- errors were identified in filling out reports or contradictions between information in documents;

- the reporting claims a benefit for reimbursement from the Social Insurance Fund;

- there is an increase in morbidity among the insurer’s employees;

- preferential tariff applies;

- the procedure for paying insurance premiums, spending funds from compulsory social insurance and/or compulsory social insurance against industrial accidents and occupational diseases has been violated.

Letter about sick leave

An explanatory letter about sick leave is an official document with which the Social Insurance Fund informs employers and representatives of medical institutions about the procedure for filling out, issuing and paying for sick leave certificates. From this article you will learn:

- how to draw up a letter of sick leave sent by the employer to the territorial body of the Federal Social Insurance Fund of Russia;

- how to check the authenticity of a sick leave in 2020.

- how to make a request for reimbursement of expenses for insurance payments for temporary disability from the Social Insurance Fund;

- what regulatory and explanatory documents regulate the procedure for filling out and issuing a certificate of incapacity for work;

- Is it possible to issue a duplicate in case of loss of a certificate of incapacity for work;

We recommend reading: Can guardianship authorities request references from adoptive parents at school?

- the only document that confirms a citizen’s temporary disability.

The employer must know how to correctly enter data into the sick leave form, establish its authenticity and issue a duplicate if the original copy is lost.

Errors were identified in filling out reports or contradictions between information in documents

What the FSS checks: reporting indicators in Form 4-FSS. Checking occurs according to control ratios. The Fund also reconciles the data reflected in the current calculation with the data of the previous period.

What will be required: provide an explanation within five days or submit an updated calculation in Form 4-FSS.

What to do and how to explain: check the indicators specified in the requirement. There are cases when the Social Insurance Fund mistakenly did not reflect received payments in its database. Then you need to write an explanation and attach copies of payment orders. If there is an error in the report due to the fault of the policyholder, then it is necessary to submit an updated calculation.

You can prepare a response to the FSS using the response template:

To the chief specialist of the Sverdlovsk regional branch of the FSS of the Russian Federation Ivanova I.I. From Romashka LLC, TIN 667123456 reg. number 6613000111

In response to your request No. 10 dated August 18, 2015, we explain the following. In the last three months of the reporting period (Q2), insurance contributions were paid for compulsory social insurance in case of temporary disability and in connection with maternity in the amount of 10,000 (Ten thousand) rubles. The listed amounts are reflected in the 4-FSS calculation on line 16 of Table 1. According to the act of reconciliation of settlements with the FSS, a discrepancy was found: the FSS database does not reflect the payment dated May 14, 2015 in the amount of 3,500 (Three thousand five hundred) rubles. Please make the appropriate adjustments.

Appendix: payment order No. 55 dated May 14, 2015

Director of Romashka LLC ___________________ V.V. Petrov

There is an increase in morbidity among the insurer's employees

What the FSS checks: the number of days of incapacity indicated in table 2 of form 4-FSS (column 3, lines 1–6, 12). These figures are compared with the regional average incidence rate.

What will be required: within five days, provide an explanation of the reasons for the increase in morbidity at the enterprise.

What to do and how to explain: write a letter with an explanation. For example, the increase in the incidence rate can be explained by the fact that one of the employees is on sick leave for a long period. If during the analyzed period the sick leave certificates were widespread, it is advisable to attach copies of sick leave certificates.

The FSS may also request copies of work records, because the length of service affects the amount of temporary disability benefits (Article 7 of Federal Law No. 255-FZ of December 29, 2006).

You can prepare a response to the FSS using the response template:

To the chief specialist of the Sverdlovsk regional branch of the FSS of the Russian Federation Ivanova I.I. From Romashka LLC, TIN 667123456 reg. number 6613000111

In response to your request No. 8 dated August 18, 2015, we explain the following. The increase in the number of days of incapacity at Romashka LLC in the second quarter of 2020 was caused by the long-term incapacity of three employees (163 days). To confirm this, we attach copies of certificates of incapacity for work.

Additionally, we inform you that there are no medical workers on the staff of Romashka LLC who could analyze the reasons for the increase in morbidity.

Applications:

1. A copy of certificate of incapacity for work No. 001 002 003 004, issued on 04/12/15 for 140 days.

2. Copies of certificate of incapacity for work No. 001 002 003 007, issued on June 16, 2015 for 13 days.

3. Copies of certificate of incapacity for work No. 001 002 003 009, issued on June 18, 2015 for 10 days.

Director of Romashka LLC ___________________ V.V. Petrov

Checking the authenticity of the certificate of incapacity for work

There are times when an employer doubts the authenticity of a sick leave certificate. In this situation, the policyholder has the right to send a request to check the sick leave certificate to the Social Insurance Fund. If the certificate of incapacity for work is filled out non-standardly, the policyholder may also ask the Fund to check it. The period for assigning sick leave benefits is ten calendar days from the date of its receipt by the accounting department of the enterprise. Therefore, a request to check the certificate of incapacity for work must be submitted immediately so that the Fund has time to give its opinion.

You can prepare a request to the FSS using the request template:

To the chief specialist of the Sverdlovsk regional branch of the FSS of the Russian Federation Ivanova I.I. From Romashka LLC, TIN 667123456 reg. number 6613000111

REQUEST to check the certificate of incapacity for work

An employee of Romashka LLC, Petr Petrovich Belov, provided on June 23, 2015 a certificate of incapacity for work No. 001 002 003 009, issued on June 18, 2015. The certificate of incapacity for work was issued by Polyclinic No. 1, which is located at Ekaterinburg, st. Lenina, 1.

We ask you to conduct an examination of the authenticity of this certificate of incapacity for work.

Please report the results of the inspection in writing to the address: 620000, Ekaterinburg, st. Kirova, 10, office 2.

Application:

Certificate of incapacity for work No. 001 002 003 009, issued on June 18, 2015, – 1 copy. on 1 sheet.

Director of Romashka LLC ___________________ V.V. Petrov

Letter to the FSS

Sample letter of guarantee regarding payment for services

A covering letter to the Social Insurance Fund is often drawn up in two copies and is an outgoing document with an assigned number and date.

The obligation to draw up such a document is not enshrined in law and is assigned to the contractor responsible for a particular area of the document flow.

A letter confirming the authenticity of the sick leave certificate is delivered to the regional office of the Social Insurance Fund along with the original document. If, based on the results of the examination, the form turns out to be fake, it is recommended to request written confirmation of the fact of falsification (useful in case of a legal dispute with the employee who presented the “fake” certificate of incapacity for work).

It is possible to send a covering letter by post, electronically via telecommunication channels, or in printed form in person, usually through the reception desk, where a mark is made on the second copy of receipt.