The Social Insurance Fund issues a reconciliation report for insurance premiums in the form approved by the Social Insurance Fund by order No. 49 dated February 17, 2015. It includes contributions for maternity and injuries. Therefore, dealing with payments to the Social Security Fund is quite simple.

Immediately after submitting the reports, you should clarify the balance of contributions and, if necessary, offset or return the overpayment. To receive a reconciliation report for insurance premium payments to the Social Insurance Fund

(Form 21-FSS), you must write an application to your fund department. The form of such an application is free.

For a sample of filling out a reconciliation report for insurance premium payments, see below.

Why do we need an act of joint reconciliation of calculations for insurance contributions to the Social Insurance Fund?

The reconciliation report for insurance premiums reflects the debt or overpayment, penalties and fines as of the date of reconciliation. It also indicates the amounts debited from the organization’s account, but not credited to the fund, and outstanding payments.

If discrepancies arise based on the results of the reconciliation, their reasons must be clarified. If the organization agrees with the differences, you can sign a reconciliation report for calculations of insurance premiums without disagreement and adjust the data in the accounting. If you do not agree, you should make a note in the act.

The debt that was discovered as a result of the reconciliation of insurance premiums should be repaid as soon as possible. Otherwise, penalties will be charged for each day of delay. But, if there are actually no arrears, they can be canceled.

For example, due to an incorrect BCC, payments were stuck in the unknown. The payment should be clarified, and if the fund does not reset the penalty, a recalculation can be achieved in court (resolution of the Ninth Arbitration Court of Appeal dated March 6, 2014 No. A14-9859 /2013).

Reconciliation goals

Reconciliation allows you to track outgoing deductions and control the formation of debts. It is usually initiated by the payer when there is a likelihood of a conflict with the fund regarding the volume of transferred contributions. It is also needed to detect overpayments as part of liquidation or reorganization. Reconciliation is usually carried out in the presence of these circumstances:

- Reorganization.

- Liquidation.

- The need to track the presence of debt.

- Establishing the amount of overpayments.

- Systematization of information.

- The company plans to participate in government competitions and tenders.

At the end of the event, a reconciliation report is issued. It is an essential document within the financial activities of the enterprise.

Every month the legal entity must make contributions to the fund. If they don't exist, debt will form. Its presence can negatively affect a variety of aspects of activity. These consequences are possible:

- Negative reputation in the market.

- Failure of transactions with counterparties.

- Loss of public investment.

- Negative payment history.

- Judicial debt collection.

- Seizure.

Reconciliation allows you to monitor the status of your payments. It is recommended to carry it out at least once a quarter. This frequency ensures timely tracking of all debts.

FOR YOUR INFORMATION! Regular control allows you to reduce the fiscal burden on the entity in the form of fines and penalties for debts.

IMPORTANT! It is on the basis of the reconciliation report that an application for the refund of tax overpayments is drawn up.

How to fill out a reconciliation report for insurance premium payments. Sample

The form of the act of reconciliation of calculations for insurance premiums provides columns for contributions for maternity and injuries. The company has the right to reconcile each type of contribution separately or two at once. Moreover, some insurance premiums can be offset against others.

The Fund will credit contributions within 10 working days from the date of receipt of the application in Form 22-FSS. But if the company submitted applications before the reconciliation of insurance premiums, then the fund has the right to initiate it itself. Then the fund will offset the amounts within 10 working days after the act is signed by both parties.

If the company does not agree with the fund’s data, it should be noted in the reconciliation report that it agrees “with the disagreements.” For example, if the company does not agree with penalties. After reconciliation, it is necessary to find out the reasons for the discrepancies and eliminate them. For example, if the arrears arose due to an error in the payment order, then it will need to be clarified by submitting an application in free form.

Sample of filling out the act of joint reconciliation of calculations for insurance contributions to the Social Insurance Fund

) performs a fairly wide range of functions. He is in charge of issues related to industrial accidents, birth certificates, registration of sanatorium and resort treatment, as well as maintenance of disabled people.

Finding out the amount of debt through the FSS website

Today, there are several ways in which you can find out the amount of debt in the Social Insurance Fund. In addition to the traditional trip to the local administration of this government body to write a corresponding written request, you can use new modern online services, including the official website of the FSS.

Information on whether all contributions have been paid on time is provided by the territorial department of the Social Insurance Fund

To obtain data on existing debts on social contributions through the Social Insurance Fund website, an employer must:

- go through a simple registration procedure on the site to gain access to the user’s personal account;

- submit an electronic request form;

- expect a response in the form of an electronic report in the user’s personal account.

On average, the answer comes within 1-2 days after sending the corresponding request.

For individuals who are individual entrepreneurs, to check the presence of debt on personal contributions to the Social Insurance Fund, you need to:

- go through the registration procedure on the website to gain access to your personal account;

- make an electronic request;

- wait for a response in electronic report format.

Individuals who want to control the presence of debts in the Social Insurance Fund before retirement can use the previously announced method with registration on the Social Insurance Fund website or register a personal account on the government services website. This resource also provides the opportunity to obtain information about existing debts in the Social Insurance Fund.

Failure to pay monthly contributions to the Social Insurance Fund results in the accrual of fines and penalties, which leads to an increase in the amount of debt to this government body. In addition, fines may be assessed for other reasons. If a person does not know about the fact of imposition of penalties, then he may incur a debt to the social insurance fund of citizens.

If malicious intent is revealed for non-payment of contributions, the person may be fined 40 percent of the amount of the existing debt. Also, if the repayment process is delayed for a long time, there is a possibility that the case will be transferred to court with the subsequent initiation of enforcement proceedings to force the collection of funds from the debtor in favor of the social insurance fund.

Today, there is no longer an urgent need to make a personal visit to various institutions to obtain information about debts to the state budget or other government organizations and funds. So, for example, the official website of the Federal Social Insurance Fund of Russia makes it possible to find out the debt on social payments. This way, everyone can control the amount of debt they have and pay it off.

{amp}gt;Bailiffs - find out the debt by last name through the official website of the FSSP RosDolgi

It is possible to confirm the presence or absence of debts of an individual entrepreneur by means of internal control. The main document by which you can check debts for taxes, payments to the Pension Fund or extra-budgetary funds is the balance sheet. You can see your debts in the accounts receivable columns; their volumes and terms will also be indicated here.

Explanations on accounts receivable, in particular, on the timing when payment should or should have been made, can be found in the accounting statement, which must be attached to the balance sheet.

There are several ways to find out your tax debt:

- Collect together and calculate letters of “happiness” from the tax office, but if the delay was made for a long period, then penalties were calculated, which means the amount needs to be clarified;

- Send a request to the Federal Tax Service and receive a reconciliation report or apply for information in person.

But if you need to obtain information quickly, you can find out the individual entrepreneur’s debt through online services by entering the TIN number. Read more about ways to check debts here.

An entrepreneur is registered for tax purposes even at the stage of registering a company, a company - generally a legal entity, for which a certificate is issued - TIN. It is by the TIN number that you should register on the website of the Federal Tax Service, which will make it possible to check the presence of tax debt at any time in the “Find out the debt” section. There is also a button here that allows you to pay taxes.

The inspection website has a special section - “Electronic services”, which allows you to find out about the absence of tax debts.

So, after going through the simple registration process and entering your TIN data, you can find out information about debts.

Contributions to extra-budgetary funds are also an integral part of the work of small businesses and other legal entities, even if their staff is minimal. These contributions form future payments for maternity leave, sick leave, medical and social insurance.

Checking the debt in this case is as important as tracking down tax underpayments. A similar situation arises when it is necessary to balance the balance, which means reconciling the data of the organization and extra-budgetary funds. By sending a request or personal contact in order to find out the debt to the Pension Fund and receive a reconciliation report, according to which payment will be made.

Issues of debts to the Social Insurance Fund and the Pension Fund should be considered simultaneously, since information on them is reflected in quarterly reports to these funds, and is adjusted according to information from the Pension Fund. Thus, you can find out the debt by contacting the Pension Fund. In this case, instead of the TIN, data from the insurance certificates of the employees on which the payment was made is required.

Issues of debts to the Social Insurance Fund and the Pension Fund should be considered simultaneously.

Thus, quarterly reports to the Social Insurance Fund or the Pension Fund are completely reliable sources of information on contributions. The only drawback is that, just like with taxes, the funds charge penalties, and their amounts are not reflected in the reports. In this case, a written request must be submitted. The Foundation will respond within five days by mail or issue a certificate in person.

Those organizations that submit reports electronically receive information more quickly, which allows you to create requests in the electronic reporting system and receive the necessary information in the shortest possible time. The generated electronic documents are printed and may well become the basis for making payments.

The next option for prompt notification is your personal account, available upon registration on the official Internet resource of the Pension Fund of Russia.

How to request a reconciliation report with the Social Insurance Fund

It is worth noting that the application form as such is not established by law. Important parameters of the appeal are the details of the business entity, the account number of the reconciliation report and the date of the appeal. According to current legislation, a government agency has 5 days to respond to a written initiative to provide information for verification.

An alternative option for contacting regulatory authorities is to use the capabilities of telecommunication channels. The response from the fund may come in the form of a certificate with data on contributions already accrued, as well as fines.

Form 21-FSS RF

A unified reporting form put into effect by order of the Social Insurance Fund number 457 in 2020. The current version of the document includes details of charges, penalties, fines, as well as uncleared payments.

There are three columns for reconciliation. The first is for information provided by the policyholder, the second is for data in the fund’s database, and the third is for clarifying discrepancies.

Most often the form is filled out by hand, but can be reproduced using software.

Application and letter

The application to the FSS should reflect the following points:

- Information about who the request is being sent to (territorial representation);

- Detailed information about who is sending the appeal;

- Document details, date, contacts. Request ;

- Formulation of the request.

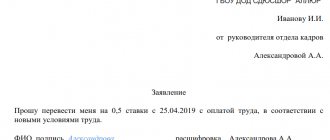

Sample application

Receiving the form

The application form can be downloaded on the official website of the fund, take the document to fill out at the territorial representative office, or download it for free. Industry-wide form of form 22-FSS.

Subjects of the request

Either party can submit an application for reconciliation between legal entities. It would be more correct to first request, check all accruals on the spot, and only then request the act itself.

Process

Advanced accountants today actively use telecommunications. Communication with fund representatives can be established through your personal account after registration.

If a government department has five days to respond to a written request, they usually respond via electronic communication channels on the next business day. This way you can save both time and money on the exchange of correspondence.

Filling Features

There is no need to confuse forms 21-PFr and 21-FSS. You can often find a joint act online that presents data for both departments. In fact, these are two different forms.

Full name of the form: joint statement of reconciliation of insurance premiums.

The form contains columns for accrued contributions for injuries and maternity. Organizations retain the right to verify settlements separately for each type of settlement with an extra-budgetary fund, or to show consolidated data for several types.

Contributions to destinations are credited within 10 working days. The start date of production is counted from the moment when the fund officially received the corresponding application in Form 22-FSS. Often, organizations prefer to submit an application for verification activities before the reconciliation (receipt of the report). This does not prevent state control bodies from independently initiating the issuance of a joint reconciliation act and sending it to the organization that pays insurance premiums. Offset amounts accordingly. In this case, this happens within the same 10 working days.

Updated forms of documents related to the relationship between the payer of insurance premiums in the FSS of Russia (the policyholder) and the body monitoring insurance premiums in the FSS of Russia (the insurer) have been approved.

The table provides a list of document forms approved by the published Order, and also indicates which party fills out which form.

For an accountant, forms from 21 - FSS to 24 - FSS are interesting.

List of document forms regulated by the published Order

:

| Document form | Form name |

| Issued jointly by the premium payer (policyholder) and the control body (insurer) | |

| 21 - FSS of the Russian Federation | “Act of joint reconciliation of calculations for insurance premiums, penalties and fines to the Social Insurance Fund of the Russian Federation” |

| Issued by the premium payer (policyholder) | |

| 22 - FSS of the Russian Federation | “Application for crediting amounts of overpaid insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation” |

| 23 - FSS of the Russian Federation | “Application for the return of overpaid insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation” |

| 24 - FSS of the Russian Federation | “Application for the return of amounts of excessively collected insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation” |

| Issued by the control body (insurer) | |

| 25 - FSS of the Russian Federation | “Decision to offset the amounts of overpaid insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation” |

| 26 - FSS of the Russian Federation | “Decision on the return of amounts of overpaid (collected) insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation” |

| 27 - FSS of the Russian Federation | “Decision on crediting the amounts of excessively collected insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation” |

Emerging nuances ↑

How to request permission for a reconciliation report with the Social Insurance Fund, obtain this document itself and many other questions - all of them are disclosed in special legislative norms.

Quite often, one of the most difficult stages is drawing up a statement of grounds for obtaining the act itself. Questions required for preliminary consideration:

- forming an application;

- sample filling;

- Is it possible to request a FSS reconciliation report through State Services?

Formation of an application

At the moment, in contrast to the reconciliation act itself, an application for its receipt can be drawn up in free form. Moreover, the document itself can be either written by hand or printed using technical means.

Video: reconciliation report if the supplier and buyer are one person

The easiest way is to download a ready-made format from the Internet and enter the appropriate data in the fields. But it is important to remember some significant nuances. First of all, a certain list of data must be present in this act.

Required details include the following:

| Full name of the enterprise | Applicant – indicated in the relevant register |

| Registered | individual tax number; budget classification code; registration reason code |

| In whose name the corresponding application is written | position of a specific person; name of the fund, regional unit; last name, first name and patronymic of the official; name of the petitioning enterprise; registration number of the insurance premium payer; permanent location address; contact information (phone number, email, other) |

| Individual outgoing number | — |

| departure date | The statement itself |

| Title of the document | Request for reconciliation of accounts based on the act |

| In the body of the document | The request is generated directly |

| Signatures of officials are affixed with a transcript | director (executive/general); chief accountant |

It is important to remember that the list of persons entitled to send relevant documents is limited. They are indicated in the list above.

In some cases, it is possible for documents to be submitted by a proxy. But at the same time, for this it will be necessary to have a special power of attorney certified by a notary.

Moreover, along with the power of attorney, you will need to submit a document certifying the identity of the specific representative. Otherwise, the application for the submission of the relevant act will simply not be accepted.

All the nuances associated with submitting an application for an act to the Social Insurance Fund must be studied in advance. Otherwise, you will need to compose it again. Which threatens to waste time.

Sample filling

If for some reason you do not have relevant experience in drawing up an application, it is worth familiarizing yourself with a correctly compiled sample in advance.

Find out how to properly draw up a reconciliation report from the article: sample reconciliation report. What is a reconciliation act, read here.

What is the validity period of the payment order, see here.

Finding it on the Internet on thematic resources will not be difficult. But at the same time, you should only turn to well-proven resources.

Moreover, many samples are available on the official website of the FSS. There is the most up-to-date information on this matter.

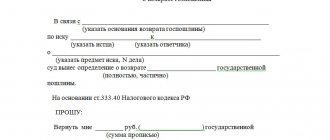

Credit or refund

The object related to the documents considered in our commentary is the amount of insurance contributions (penalties, fines) that the payer of insurance premiums contributed excessively to the budget of the social insurance fund.

In this case, amounts contributed in excess to the FSS of Russia can either be paid by the policyholder himself or collected from him by the territorial branch of the FSS of Russia. In the first case, the “further fate” of excess amounts is regulated by Article 26 of Federal Law 212-FZ on insurance premiums.

According to this rule, the amount of overpaid insurance premiums is subject to:

- offset against future payments of the payer of insurance premiums;

- offset against debt repayment of penalties and fines for offenses provided for by the legislation on compulsory insurance;

- return to the payer of insurance premiums.

The legislation obliges the insurer to inform the payer of insurance premiums about each fact of excessive payment of insurance premiums that becomes known within 10 days from the date of discovery of such a fact.

When an employee of the social insurance fund discovers excess amounts in the payer’s personal account, he invites him to make a reconciliation. This reconciliation is joint, each party reflects its own data. The result will be either confirmation of the overpayment from the payer, or otherwise it will be necessary to submit an updated calculation with correct information on accrued and paid insurance premiums.

Next, the organization submits to the FSS of Russia an application for offset or return of the amount, indicating the purpose of the offset or details for its return. If the payer for any reason has not carried out a reconciliation, the fund employee will independently offset the overpayment.

Reference: an application for offset or refund of the amount of overpaid insurance premiums can be submitted within three years from the date of payment of the amount in question.

Article 27 of Federal Law No. 212-FZ regulates the relationship regarding the offset and return of excess amounts of insurance premiums collected from the payer.

Please note that a refund to the payer’s bank account is made only after repayment of all debts from him to the Federal Insurance Service of Russia, including penalties and fines, regardless of whether the policyholder himself overpaid, or the fund collected these amounts from him independently.

In all cases, refunds are made only at the request of the payer. In case of excessive collection, the refund is carried out with interest accrued from the budget.

Since 2020, all documents (notices of identified overpayments, payer’s application for offset or refund, decision of the Social Insurance Fund authority on offset or refund) can be sent not only in writing, but also in electronic form. This amendment was introduced by Federal Law No. 188-FZ of June 28, 2014. The same law introduced an amendment according to which from now on the Social Insurance Fund, at the request of the payer, has the right to make offsets between the types of insurance that it controls (Part 21, Article 26 of Federal Law No. 212-FZ). As is known, the jurisdiction of the FSS includes:

- compulsory social insurance in case of temporary disability and in connection with maternity;

- compulsory social insurance against industrial accidents and occupational diseases.

How to get a reconciliation report in 2020 and beyond

There are few fundamental differences from the usual procedure. The most important change is that payments will now have to be made to other current accounts - no longer the Social Insurance Fund, but the Federal Tax Service. To apply for reconciliation, you will have to contact the tax office at the place of registration of the legal entity. Further, the algorithm is in many ways similar to what was used for the FSS.

- Submitting an application (the requirements for it remain unchanged).

- Formation of a reconciliation report (this is done by the Federal Tax Service based on the application received). The act is drawn up in two copies and sent to the applicant - the payer.

- Having received the act, the applicant enters his information into it and forwards (hands over in person or electronically) one of the copies to the tax authorities.

- If discrepancies are found, reconciliation continues with the study of supporting documentation. If necessary, adjustments are made to the original act.

- If there were no discrepancies or they were successfully eliminated, the act is signed by both parties (the payer and the representative of the Federal Tax Service). In other words, the parties sign that they agree with the information contained in the act.

- Signatures certify the completion of the reconciliation and approval of the calculations contained in it.

Innovations in forms

According to the published order, it will now be possible to simultaneously reflect information for both types of insurance supervised by the Social Insurance Fund in both the Joint Reconciliation Act (Form 21 - FSS) and in the payer's applications (Forms 22 - FSS, 23 - FSS and 24 - FSS).

In addition to the amendments made to the names of document forms specifying the name of the fund or types of insurance, the main innovation is the introduction of additional columns to indicate data on compulsory accident insurance.

In addition, a number of amendments have been made in order to clarify the details by which credit or refund will be made. Thus, for payers who have opened accounts with the Treasury authorities (state employees), fields have been added to forms 23 - FSS and 24 - FSS to reflect the name of the financial authority and BCC (budget classification code).

All document forms must be filled out in rubles and kopecks. Previously, application forms for refunds 23 - FSS and 24 - FSS were filled out in rubles.

In conclusion, we give examples of filling out new forms.

On April 10 of this year, Magnit LLC carried out a joint reconciliation with the regional branch of the FSS. Based on the results of the reconciliation, the amount of overpayment of insurance premiums in the amount of 12,300.50 rubles for compulsory insurance in case of temporary disability and in connection with maternity was confirmed.

Magnit LLC decided on this amount:

- to be used to pay off debts on compulsory social insurance against accidents at work and occupational diseases (including for arrears of contributions - 2734.50 rubles, penalties - 36.48 rubles); — return the remaining amount to the company’s current account (amount 9529.52 rubles).

In this regard, on April 15, Magnit LLC submitted two applications to the FSS department: on Form 22 - the FSS of the Russian Federation to offset the amounts of arrears on accident insurance and on Form 23 - by the FSS of the Russian Federation to return the overpayment to the company.

Tax consultant I.M. Akinshina

, for the magazine “Regulatory Acts for Accountants”

Regulatory acts with comments

Professional comments on letters from ministries and departments, expert answers to the most difficult questions, updates every day.

The result of the reconciliation with the Pension Fund is the signing of an act of joint reconciliation of calculations for insurance premiums, penalties and fines (Form 21-PFR (Appendix No. 1 to the Resolution of the Board of the Pension Fund of the Russian Federation dated December 22, 2015 No. 511p)).

Purpose of the statement

The purpose of forming a request is to agree on a reconciliation act for mutual settlements between the parties.

For reconciliation acts between counterparties, decryption is requested:

- In order to confirm business transactions, any of the interacting parties can request to sign a reconciliation report.

Since the ability to make transactions without meeting with the counterparty, to send payments without visiting the bank, forms a significant volume of documents received by mail or courier. When preparing accounting and tax reporting, the document allows the accountant to be sure that all documents are reflected in the accounting. - In order to comply with the accounting rules (PBU), adopted by Order No. 34 of the Ministry of Finance of the Russian Federation on July 29, 1998 (as amended on March 26, 2007 No. 26n), which oblige organizations to clarify the volume of property and liabilities before submitting annual reports.

Calculations are classified as mandatory for inventory. - To confirm the fact of the counterparty's debt.

Every creditor wants to be sure that the debtor remembers the debt and is ready to pay. According to the judges, the reconciliation act is not unambiguous evidence of the existence of a debt, but it can become an additional resource in a dispute with the debtor. In addition, the act extends the limitation period - if it exists, the limitation period begins to be calculated not from the date of the transaction, but from the date of signing the act (Resolution of the Presidium of the Supreme Arbitration Court, No. 13096/12 of 02/12/2013).

A request for the current status of settlements with the Federal Tax Service and extra-budgetary funds is made in order to:

- Return of excess funds transferred and stored in the accounts of the inspection or fund of the organization.

- Identification of arrears in taxes and contributions in order to pay off the debt and eliminate the possibility of accrual of fines and penalties.

- Identifying discrepancies in the accounting data of the organization and the fund or inspection in order to identify and correct errors of one of the parties.

A little about reconciliation with the Pension Fund of Russia

Reconciliation of calculations for insurance premiums can be carried out:

- at the initiative of the Pension Fund;

- on the initiative.

The reason for reconciliation may be the fact of excessive payment of insurance premiums (Part 4, Article 26 of the Federal Law of July 24, 2009 No. 212-FZ) or the submission by the payer (Parts 9, 11 of Article 18 of the Federal Law of July 24, 2009 No. 212-FZ) Federal Law).

It is important to note that a joint reconciliation with the Pension Fund is mandatory before drawing up annual financial statements for its correct formation (clause 3, article 11 of the Federal Law dated December 6, 2011 No. 402-FZ, clause 27 of the Regulations, approved by Order of the Ministry of Finance dated July 29. 1998 No. 34n).

Benefits of receiving a reconciliation

Reconciliation of calculations ensures the solution of these problems:

- Review of financial statements. Errors and typos are discovered during the process.

- Streamlining reporting. Reconciliation allows you to prevent a mess in documents and eliminate existing discrepancies.

- Systematization of information. This will prevent underpayments.

The reconciliation procedure can be initiated by the FSS itself. This is also done by systematizing information.

Organizations must make contributions to insurance funds within the deadlines established by law. When preparing reports, it is necessary to verify the data on payments made. To do this, you can use a service such as online reconciliation with the Social Insurance Fund to identify inaccuracies before submitting documents.

Form 21-PFR

The reconciliation report in Form 21-PFR reflects the following data:

- the period for which the reconciliation of insurance premium payments was carried out;

- information on insurance contributions (debt, overpaid amounts, etc.) by type of contribution (for compulsory pension insurance, including additional tariffs, for compulsory health insurance). This information is indicated according to the Pension Fund of Russia and the data of the contribution payer. If there are discrepancies between the data, the amount of such discrepancies is reflected in PFR-21.

If the payer agrees with the information contained in the reconciliation report, then he signs it without disagreement. Otherwise, a “disagreement” entry is made. After which the payer and the Pension Fund branch will have to figure out the reasons for the disagreements that have arisen.

An application to the Social Insurance Fund for reconciliation of calculations - a sample

of it is presented below - can be sent by the policyholder to the fund in free form. What are the specifics of drawing up this document?

What is reconciliation of settlements with the Social Insurance Fund?

In accordance with paragraph 9 of Art. 18 of the Law “On Insurance Contributions” dated July 24, 2009 No. 212-FZ, specialists of the Social Insurance Fund may invite the payer of insurance premiums to conduct a joint reconciliation of the corresponding payments to the budget. At the same time, the law does not prohibit such a reconciliation also on the initiative of the payer himself.

Most often, the initiation of reconciliation by the employer company is due to its desire to avoid disagreements with the Social Insurance Fund regarding the amount of transferred contributions, as well as to clarify the presence of overpayments (debt) during the liquidation or reorganization of the business.

The frequency of this reconciliation is determined by the employer himself - in principle, it can be initiated at any time. In practice, many companies reconcile their calculations with the Social Insurance Fund on a quarterly basis - after sending reports in Form 4-FSS.

Reconciliation of payments to the Social Insurance Fund can be initiated by sending an application to the fund. Its form is not approved or recommended by legal acts, so it can be submitted in any form. Let's consider the structure in which the application can be presented.

Why is reconciliation necessary?

Often, when conducting audits of economic activity, companies need to reconcile data on deductible funds. This makes it possible to control outgoing deductions and ensure that debts do not form.

Reconciliation with the Social Insurance Fund can be carried out for the following reasons:

- during company reorganization

- upon liquidation of the company

- to determine debt

- to determine the amount of overpayments on deductions

- for data systematization

- for the company to participate in state competitions and tenders

The reconciliation report is an important document when conducting economic activity. The legislation establishes the procedure for monthly contributions to various structures. If money from the company does not go to the budget, this can lead to serious consequences.

The resulting debt affects many things. From concluding deals with partners to receiving investments from state-owned companies. A negative payment history may influence the outcome of such decisions.

If a debt is discovered, the company will be given the opportunity to voluntarily pay the due amounts to the fund. Failure to take these actions may lead to litigation. After which the organization’s accounts may be seized, and the necessary funds will be forcibly withdrawn.

To properly control your activities regarding the deductions made, you should arrange reconciliations at least once every 3 months. This will allow you to always be aware of debts and overpayments.

Application to the Social Insurance Fund for reconciliation of calculations: structure of the document

As a guideline when forming this application, you can use any similar document, for example, an application form on the status of settlements with the Federal Tax Service of the Russian Federation for taxes. The corresponding document is given in Appendix No. 8 to the order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n.

The application, which can be drawn up on the basis of a form developed by the Federal Tax Service, reflects:

- information about the recipient of the document - the territorial representative office of the Social Insurance Fund;

- information about the payer of contributions (registration number in the Social Insurance Fund, code of subordination, address, INN, KPP);

- wording reflecting the essence of the request on behalf of the manager);

- date of document preparation, signature of the head of the company, contact details of the requester.

The legislation does not regulate the period within which the FSS must respond to the application. But taking into account the fact that within 10 days from the moment of detection of overpayments on insurance premiums, the fund is obliged to inform payers about this (clause 3 of Article 26 of Law No. 212-FZ), it is legitimate to expect a response from the Social Insurance Fund on the application under consideration within a comparable time frame.

The response of the FSS is drawn up in the form of a statement of reconciliation of calculations, which is drawn up according to the form approved in Appendix No. 1 to the FSS order No. 49 dated February 17, 2015.

Facebook

Checking debt to the FSSP

The Federal Treasury of Russia draws the attention of payers to the fact that the information indicated in field “107” of the payment order when paying taxes differs from what is required to be entered in this field when transferring customs duties.

As of August 6, 2019, amendments to PBU 1/2008 “Accounting Policies of Organizations” come into force. Thus, in particular, it has been established that in cases where federal standards do not provide for a method of accounting for a specific issue, a company can develop its own method.

Expenses for the acquisition of work (services) performed (rendered) by third parties are recognized for “profitable” purposes in the period in which the fact of performing these works (rendering services) is documented. The Ministry of Finance reminded what to consider as the date of such documentary evidence.

Since 2020, the Tax Code of the Russian Federation, as well as the provisions of Federal Law No. 255-FZ of December 29, 2006 (hereinafter referred to as F.), are applied to the procedure for administering social insurance contributions.

Law No. 255-FZ) and Federal Law of July 24, 1998 No. 125-FZ (hereinafter referred to as Federal Law No. 125-FZ). The previous year 2020 will be the last year of application of Federal Law No. 212-FZ.

Taking into account changes in legislation, the policyholder should be aware that debt to the social insurance fund may result from non-payment of insurance premiums (hereinafter referred to as IC) or illegally incurred costs for insurance coverage (hereinafter referred to as IC). Information about the presence or absence of such debt can be provided by the relevant territorial body of the Social Insurance Fund.

Debt verification can be carried out by reconciliation or issuing a certificate of settlement status. Let's consider these methods in more detail.

Taxpayer personal account (individual) 1: find out your debt What do you need to enter? TIN, Last name, First name, Region. What information will I receive?

If the existence of a debt is revealed, reimbursement of the debt to the Social Insurance Fund must occur within the time period specified in the fund’s requirements.

Experts recommend repaying the debt within the specified time frame, since in any case it will be impossible to get away from repaying it, and delaying this process will only lead to the accrual of penalties and fines and, as a result, to an increase in the size of the debt.

The demand sent to the debtor from the FSS contains the exact amount of the debt and accrued fines. The amount of penalties depends on the severity of the violation. Maximum sanctions are provided for deliberate underestimation of the amount payable.

If in the submitted reports the amount of contributions was calculated correctly, but they were not repaid on time, then fines will not be assessed. In this case, a penalty will be charged for each day of delay in payment of the debt.

You can pay your debt using any bank branch. Payment details are specified in the FSS request. It is also possible to pay the debt online using Internet banking or using the electronic services of the State Services website.

According to the new legislation, you may not be allowed to leave the country if you have debts from court cases. It is recommended to regularly check your debt to avoid getting into a difficult situation. Bailiffs seize bank accounts and impose restrictions on travel outside the homeland. Please note that by court decision, you may have a debt to bailiffs if:

- — The traffic police fine was not paid on time

- — Didn’t pay the loan, mortgage, etc.

- — Statement of claim (individual/legal entity) against you

- — Tax evasion

- — Failure to fulfill other debt obligations

The main thing is a ban on any travel outside the country for 3 years. Seizure of all bank accounts and cards. The debtor will be obliged to repay the debt within the specified period; otherwise, the bailiffs will begin the procedure for confiscation of property. In order for citizens to independently find out their debts due to bailiffs and repay them on time, an online debt checking website was created.

Additional topics:

- OKATO where to find out What is OKATO and why is it needed Deciphering OKATO - All-Russian classifier of administrative-territorial divisions. Applies...

- Error 513 FSS Questions and Answers-10 Could not decrypt General decryption error. It is recommended to check the validity of the CA certificate that issued you...

- Find out about the calculation of subsidies How subsidies are provided in 2019 The main condition for the provision of government subsidies is that citizens have no debts...