One of our favorite topics, which can be seen in almost every article, is illegal actions of officials and discrepancies in the legislative framework. We often write about this only for the reason that we are unable to approach it “philosophically” (although, we admit, this would make it easier). However, it is also difficult to avoid this topic for the reason that it is associated with difficulties in communicating with the relevant Departments that regulate our commercial activities. Regularly sorting things out with them is not easy, but, unfortunately, it is simply necessary. And once again we came across a story about how a company was fined for violations of wage payment rules. The accountant understood the situation of the people and, in order not to leave them without money, paid an advance on wages ahead of the deadline established by the collective agreement. What happened and what is the essence of this problem? More on this and more later in our article.

Very simple rules

As you know, the periodicity of wage payment is regulated not only by local acts of the company, but also by Part 6 of Article 136 of the Labor Code of the Russian Federation, which clearly states that it must be paid at least twice a month with a frequency of two weeks. Moreover, there is a letter from the Ministry of Labor dated September 21, 2016 No. 14-1/B-911, where the Agency strongly recommends that companies adhere to the following rule: the advance is paid from the 16th to the 30th (31st) day of the month in which the salary is calculated, and the remainder should be issued to employees from the 1st to the 15th of the next month. Here it is very important not to forget about the frequency of two weeks, because... This is precisely what becomes a stumbling block in the dialogue with inspectors. However, it is not always possible to pay wages on time. Our business life is filled with a huge number of holidays and weekends, which inevitably affects payments. There is also a very clear rule for this, reflected in Part 8 of Article 136, which states that the employer must pay part of the money to employees a day or two earlier if the payment date falls on a weekend or holiday. However, Ministries “forgive” this approach when it comes to “classic” days (Saturday and Sunday). The question is, what should we do if we are talking about the New Year holidays, which last 9-10 days? Our client found himself in a not very pleasant situation precisely because of this. Let's talk about this a little later.

Read the article: “Both laughter and sin. How to fill out a 2-NDFL certificate if there is no money for a salary?

What documents indicate the days of payment of wages?

The employer is obliged to fix a specific schedule for the transfer of salary money in its local regulations (LNA): internal labor regulations (ILR), collective or labor agreement. It is these 3 documents that Art. 136 Labor Code of the Russian Federation.

The wording of this article is designed in such a way that the question often arises: is it necessary to fix salary terms in all of the above documents or is one of them sufficient? The answer to it was repeatedly given by both officials and judges (letter of Rostrud dated March 6, 2012 No. PG/1004-6-1, ruling of the Moscow City Court dated December 24, 2012 No. 4g/5-12211/12).

For information on what to include in an employment contract, read the article “Procedure for concluding an employment contract (nuances).”

According to the explanations, it is enough that the deadlines are fixed in one of those given in Art. 136 Labor Code of the Russian Federation documents. Moreover, according to Rostrud, PVTR is a priority. He explains this by saying that the PVTR is a general document, the norms of which apply to all personnel, while an employment contract regulates relations with a specific employee, and a collective agreement may not be concluded at all.

In order to completely eliminate disputes with inspectors, you can do the following: fix the rules for issuing wages in the PVTR, and add a phrase in labor or collective agreements that refers to the PVTR: “salaries are issued in accordance with clause (here we indicate the clause number of the PVTR) of the rules labor regulations..."

Major misunderstandings

The legislative framework of our state, in particular, the Labor Code of the Russian Federation, does not stipulate the responsibility of the employer, which he must bear in the event of payment of wages ahead of schedule. In turn, there are notes regarding the delay in payments reflected in Part 1 of Article 142 of the Labor Code of the Russian Federation. The problem is that many focus specifically on the lack of records, completely forgetting that the Code of Administrative Offenses of the Russian Federation has a separate article on this subject (Part 1 of Article 5.27), which says the following for certain: “Violation of labor legislation and other regulatory legal acts, containing labor law norms, unless otherwise provided by parts 3, 4 and 6 of this article and article 5.27.1 of this Code, entails a warning or the imposition of an administrative fine on officials in the amount of one thousand to five thousand rubles; for persons carrying out entrepreneurial activities without forming a legal entity - from one thousand to five thousand rubles; for legal entities - from thirty thousand to fifty thousand rubles"

. It follows from this that an accountant needs to be well acquainted not only with the Tax Code and Labor Code of the Russian Federation, but also with the Administrative Code, thanks to which it is possible to easily mitigate problems associated with the payment of wages to employees.

Is it possible to pay wages earlier than the deadlines established by the Labor Code?

Accounting.

Taxes. Audit December 16, 2020 14:03 E-mail About the author of the article Archives of the news agency GARANT

Is it possible to pay wages previously established in paragraph 6 of Art. 136 of the Labor Code of the Russian Federation? Having considered the issue, we came to the following conclusion: Paying wages to an employee earlier than the established deadlines is a violation of labor laws. Rationale for the conclusion: In accordance with part six of Art. 136 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), wages are paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued. Thus, the interval between wage payments should not exceed half a month, that is, 14-16 calendar days, depending on the length of a particular month. It also follows from the above norm that internal labor regulations, employment contracts, and collective agreements must provide for specific dates for the payment of wages to employees. Determining the period for payment of earnings by a period of time, rather than a specific day, does not correspond to this rule (clause 3 of the letter of the Ministry of Labor of Russia dated November 28, 2013 N 14-2-242, decision of the Perm Regional Court dated March 24, 2014 in case N 21-242/2014) . Let us note that the Labor Code of the Russian Federation directly states as a violation only the delay of wages (see part one of Article 142 of the Labor Code of the Russian Federation), but not its early payment. Nevertheless, the analysis of part six of Art. 136 of the Labor Code of the Russian Federation allows us to conclude that payment of wages earlier than the deadlines provided for this will lead to a violation of the requirement established by this norm. Thus, by paying an employee wages earlier than the established date, the employer will violate the provisions of a local regulatory act (internal labor regulations), an employment contract or a collective agreement, which is unacceptable (part two of Article 22, part four of Article 189 of the Labor Code of the Russian Federation). In addition, in the case of early payment of wages, the period of time from the moment of such payment until the next date of payment of wages may exceed half a month, which is a direct violation of the requirements of part six of Art. 136 Labor Code of the Russian Federation. Consequently, payment of wages earlier than the established deadlines will lead to the creation of a situation that does not meet the requirements of Art. 136 of the Labor Code of the Russian Federation, and therefore cannot be legal. Representatives of Rostrud* (1) express a similar opinion. In most cases, this legal approach is shared by judges (see the appeal ruling of the Investigative Committee for Administrative Cases of the Saratov Regional Court dated 04/02/2015 in case No. 33-1840/2015, the decision of the Kirovsky District Court of Saratov, Saratov Region dated 02/05/2015 in case No. 12 -88/2015, decision of the Central District Court of Omsk, Omsk Region dated October 27, 2014 in case No. 2-5879/14, decision of the Novovyatsky District Court of Kirov dated September 27, 2013 in case No. 5-52/2013). In favor of this conclusion, one can cite the position of the Constitutional Court of the Russian Federation, expressed in the ruling of June 24, 2008 N 344-О-О, according to which the norm of part six of Art. 136 of the Labor Code of the Russian Federation is aimed, among other things, at ensuring regular payment of workers. It seems obvious that the payment of wages earlier than the established deadlines and the resulting difference in the duration of the intervals between wage payments do not contribute to ensuring that the employee regularly receives payment for his work and, accordingly, contradicts the legal meaning of the norm in question. At the same time, in judicial practice there are also decisions in which early payment of wages is not considered a violation. For example, the judges came to this conclusion in the decision of the Saratov Regional Court dated June 27, 2020 in case No. 21-396/2016, the decision of the Oktyabrsky District Court of Samara, Samara Region dated March 24, 2015 in case No. 2-1532/2015 , resolution of the Syktyvkar City Court of the Komi Republic dated December 15, 2014 in case No. 5-1827/2014. However, for the reasons stated above, we cannot agree with this point of view. We also note that in the decision of the Oktyabrsky District Court of Arkhangelsk, Arkhangelsk Region dated April 27, 2015 in case No. 2-4027/2015, early payment of wages is recognized as not violating the rights of employees if it is carried out with a corresponding application from the employee. However, in our opinion, the indicated expression of the employee’s will does not give the employer the right to pay wages earlier than the established deadlines. As noted above, the timing of payment of wages is established by internal labor regulations, collective agreement, and employment contract. The employee’s application is not named by the legislator among the documents that can determine the timing of payment of wages. The letter of Rostrud dated May 30, 2012 N PG/4067-6-1 also draws attention to the fact that the presence of an employee’s application cannot be the basis for the employer to set deadlines for paying wages in violation of the requirements of Art. 136 Labor Code of the Russian Federation. The answer was prepared by: Expert of the Legal Consulting Service GARANT Erin Pavel Quality control of the response: Reviewer of the Legal Consulting Service GARANT Sutulin Pavel October 25, 2020 The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service. *(1) See materials: - Question: Is it possible to pay for vacation, for example, on June 20, 2016, ahead of schedule for June, the payment date of which is only 07/05/2016, as well as payment for vacation (provided for by the regulations) in the amount of 2 Are salaries paid on the day the vacation starts or on the day the salary is paid? (Rostrud information portal “Onlineinspection.RF”, October 2020); — Question: Can an employer, at the request of employees, pay wages ahead of the deadline established by the labor regulations? Does the employer have the right to refuse such a request to employees, citing the fact that in this case there will be a violation of the law on his part in terms of paying wages at least every half month, because Will the next payment be due only 17-18 days from the current one (not 15)? We have a council of the labor collective, all employees before the holidays want to receive their salary earlier this month in order to buy... (Rostrud information portal “Onlineinspection.RF”, December 2020). it's time to study!

- January 15, 2020 / Internet “International Standards in Auditing”, Qualification “Specialist in International Standards in Auditing” (IAPBE)

- January 22, 2020 / Internet Taxation of the Russian Federation

- January 25, 2020 / Internet Business fragmentation: legal problems, protection from claims of tax authorities

- January 29, 2020 / Internet Certified chief accountant according to IFRS (IAB). January set

- January 29, 2020 / Internet How to read management reporting. Free webinar.

- February 06, 2020 / Internet Currency regulation and currency control in the Russian Federation, taking into account the latest changes in legislation

- February 11, 2020 / Internet Unscrupulous suppliers: how to maintain tax deductions and prevent violations of laws

- February 13, 2020 / Internet “Business Project Management System”, Qualification “Project management” (IAPBE)

- March 13, 2020 / Internet CIMA Program “Operations Performance Management”. Level P1 (preparation for the May 2018 session)

- January 14, 2020 / St. Petersburg Professional internal auditor: modern organization, management and methodological support (according to the professional standard program “Internal Control Specialist” level 5)

- January 15, 2020 / Moscow Training course “IPFM:IFRS.Basis”

- January 15, 2020 / St. Petersburg Latest changes in international financial reporting standards (IFRS)

More seminars and courses

What about employment contracts?

In theory, an employer can avoid this problem by amending collective agreements with its employees. If a company has an urgent need to pay employees before the usual deadline, then for this reason it is possible to create new employment contracts, where new dates will be specified (and they must be indicated). The only difficulty here is the hassle. Who knows, perhaps one of the director’s subordinates will not agree with the new dates and then he will either have to be fired or forced to agree to new conditions. In any case, this paperwork will have to be dealt with. Among other things, it will not be profitable for the employer to do this if the need to pay wages has arisen for the first and last time. Changing contracts from month to month... Would anyone really want to do this? Plus, during the inspection, GIT inspectors may also have unnecessary questions for you. We believe that this is an extreme and not the best measure to get out of the current situation, but still realistic from a legal point of view.

Don't miss: “In the wake of the labor inspection. 15 personnel errors"

The argument that paying a salary ahead of schedule in favor of the employee will avoid a fine

If the inspector considers paying wages ahead of schedule a violation, try to convince him. This can be done both during the inspection and after (Articles 25.1, 28.2 of the Code of Administrative Offenses of the Russian Federation). Compose a written explanation detailing why early payment of wages is not a violation (sample below).

There were no negative consequences for the employee. Paying wages ahead of schedule does not create problems for the employee, but, on the contrary, improves his situation. In addition, no one forces an employee to withdraw money from the account before the established payday.

The parties fulfilled their obligations ahead of schedule. The Civil Code provides for the possibility of early fulfillment of obligations, except in cases where this is directly prohibited by law (Article 315 of the Civil Code of the Russian Federation). The fact that transferring wages earlier than the deadline accepted by the company does not violate anything is confirmed by the judicial practice of recent months1.

It takes time for the bank to transfer funds from the employer’s current account. Refer to the period during which the bank transfers wages. The credit institution is obliged to transfer the client’s funds no later than the next business day after it receives the payment document (Part 2 of Article 31 of the Law of December 2, 1990 No. 395-1). No commercial bank guarantees that it will be able to transfer salaries in a shorter time frame. Especially if the employee and employer are serviced by different credit institutions.

Budgetary organizations may also refer to the fact that, taking into account the specifics of their work, processing applications for cash expenses from the federal budget can take up to five days. Especially at the end of the year (clause 2.1.1 of the Procedure approved by order of the Treasury of Russia dated October 10, 2008 No. 8n).

If the inspector nevertheless drew up a protocol, then you can file a petition to terminate the proceedings due to the insignificance of the violation (Article 2.9 of the Code of Administrative Offenses of the Russian Federation). This is recognized as an action or inaction that formally contains signs of a violation, but does not threaten protected social relations and does not carry negative consequences.

What they told us

Returning to the story of our client, we would like to make a small note: the accountant just wanted “the best,” but received a reprimand from the director for this...

“Last year, our company was fined 30 thousand rubles for paying wages to employees ahead of schedule. December 30, 2020 was the last working day. In any other months, we pay employees on the 23rd and 7th. It turned out that we paid the advance on time, and gave the rest of the salary earlier, so that they did not have to be “sad” during the New Year holidays and wait for pay after January 10th. The next year we were fined and had to pay it. Of course, the workers don't care about this in any way. I guess they don't even know about it. And I received a reprimand from my director, although he himself was waiting for the money... I think this is a little unfair. It is necessary to make changes to our Labor Code of the Russian Federation and give companies the opportunity to deviate from the general rule once a year. After talking with the inspectors, I was advised to increase the amount of the advance next time, but not to pay the entire month’s salary. Otherwise, in fact, it turns out that we made 3 payments for December, and this is incorrect.”

There is one notable point here - the increase in the advance payment. As is known, its size should not exceed 40% of the employee’s salary. What if they already receive exactly that amount of money on the 23rd of every month? Our interlocutor said that, by general agreement with the employees, they have set the amount of the advance equal to 30%, therefore, it can still be increased. But can this 10% really somehow significantly affect the financial condition of people during the New Year holidays, when, basically, most of people’s income is gray, and the “official” component is minimal? In any case, this could be a good tool for solving the current problem, if we talk about large federal-scale enterprises, where things are more positive with payments.

Express replies

What is considered the day of payment of wages by bank transfer?

The day on which the salary was received on the employee’s bank card. From now on, he can receive his salary and use it at his own discretion.

What document confirms the actual date of payment of wages to the employee?

Employee account statement. Typically, inspectors use payment orders and registers of crediting funds to salary accounts as evidence of violations. This mistake will allow you to successfully challenge the order and fines in court (Articles 26.2, 26.11 of the Code of Administrative Offenses of the Russian Federation).

Is it worth transferring salaries strictly on the established days in order to completely exclude claims from the State Tax Inspectorate?

No, it is better to prepare the necessary payment documents in advance and submit them to the bank in advance. It is risky to send payments on paydays: due to any force majeure situation, employees' salaries will be received with a delay. This is a more serious violation than premature payment (Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

What if the organization sent the payment on time, but the funds arrived on the employee’s card later than the payday?

Compensate employees for delayed wages for each day of delay in the amount of no less than 1/150 of the key rate of the Central Bank of the Russian Federation of the amount not paid on time (Article 236 of the Labor Code of the Russian Federation). The employer is financially responsible for the delay in wages, regardless of whether it is his fault or not.

Important Takeaways

1. The law does not prohibit transferring wages to an employee earlier than established by the employment contract, PVTR or collective agreement. The main thing is that the interval between payments does not exceed half a month. If the gap is larger, the inspector may impose a fine.

2. Pay December salaries as usual on the days established by internal documents. If the interval between the salary for December and January is more than half a month, you can pay part of the amount in December, and the final payment in January.

3. If the inspector finds fault with early pay, prepare a written explanation of why this is not a violation. Refer to the fact that paying wages ahead of schedule does not create problems for the employee, but, on the contrary, improves his situation.

By the way, about the initiative...

But in fact, the accountant proposed a good idea - to give companies the opportunity to pay employees money once a month on a time frame that differs from the standard one. Firstly, it would solve our problem, and, secondly, it would allow employees to enjoy themselves a little more than they usually do. Of course, we have no illusions that the legislator will have a need to move in this direction. They, in fact, do not care who and how celebrates the New Year or any other holiday. What is important is how to replenish the federal budget, and the current state of affairs favors this in every possible way. In general, our officials are not very keen to satisfy the demands and aspirations of business. In many ways, it’s simply not profitable for them. As long as there are all sorts of traps and inconveniences for entrepreneurs, the treasury will be replenished thanks to multimillion-dollar fines throughout the country. Eh, I wish I could find statistics on how much money flows into the state budget from them... It would be very interesting, but, unfortunately, no one will provide such information, because “tax secrets”, you know...

For paying wages ahead of schedule you will be fined 50 thousand

09/17/2017 18,896 Topics: Labor legislation,

In Moscow and St. Petersburg, the State Tax Inspectorate fines organizations and their managers who pay salaries in advance. Regional inspectors are willing to adopt the capital's practice, so it can spread throughout the country. Warn your accountant and plan what to do if the accountant doesn't like your payroll. The article will help you adjust salary payment dates so that no one can find fault, and also reduce sanctions if the inspector decides to fine the company.

How to make changes to documents and set the correct deadlines for paying wages

If for some reason you do not have LNA regulating the timing of salary transfers, they need to be done as quickly as possible. If the necessary LNAs exist, but the dates in them are indicated incorrectly, this should be promptly corrected:

- If possible, redo the document, but only if doing so will not cause inconsistencies with your other documentation.

- In order to change the collective agreement, assemble a commission of representatives of both parties - employees and employer. Document the results of the negotiations between the commission members in an additional agreement, in which you indicate the new salary terms.

- If salary dates were included in employment contracts, you will have to draw up additional agreements for each of them.

- Changes in the terms of payment of wages included in the PVTR are the easiest to formalize - to do this, it is enough to issue an order, which should be familiarized to each employee against signature.

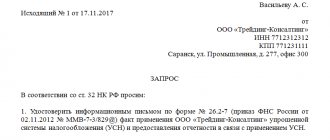

You can see what such an order looks like here:

What should you pay attention to?

When developing a payment schedule, accountants need to provide for the time costs for transferring mandatory tax payments so that the money arrives at the address on time and the company does not incur debts. You should know why part of your earnings is no longer called an advance. Now the accountant will have to calculate taxes from both parts. Previously, the entire amount was also subject to taxation, but the procedure was carried out during payroll. The advance, other charges and taxes were withheld from the total amount. Now these are two independent financial transactions that are connected by the company, the position held and the actual time worked.

Pay your salary in advance: there is no ideal way

From 01/01/2017, insurance premiums in case of temporary disability and in connection with maternity must be paid to the Federal Tax Service. And for reimbursement of benefits, as before, you must contact the Social Insurance Fund. The employee wrote a request to pay him a few months' salary in advance, and the director agreed. The task before you is to understand whether this can be done and how to arrange it. We will immediately dissuade you from formalizing this specifically as the payment of wages for future periods. Many believe that paying wages for future periods is allowed by the Labor Code of the Russian Federation, since it mentions

“unprocessed advance issued on account of wages”

(it is said that this advance, in the absence of objections from the employee, can be withheld from the salary, taking into account the general 20 percent limitation) para.

What about taxes?

The period for transferring personal income tax when paying wages is limited to actual payments and is established by Article 226 of the Tax Code of the Russian Federation. Since the Labor Code of the Russian Federation has indicated that payments to employees consist of two salaries, and the Tax Code of the Russian Federation in Article 223 requires the transfer of final income, the payer will have to decide when in their organization they fully pay the labor of their employees for the month - in the first half or in the second. It is necessary to withhold from all income accrued at the enterprise, and transfer it the next day after payment.

Berator Week “STS in Practice”

If the salary payment day coincides with a weekend or non-working holiday, then the salary should be transferred on the eve of this day (Part 8 of Article 136 of the Labor Code of the Russian Federation). Federal Law No. 272-FZ of July 3, 2020 extended the period for an employee to file a lawsuit against an employer who did not pay wages on time. Previously, an employee to whom the employer owed wages could go to court within three months from the day the employee learned or should have learned that his right was violated.

5904 August 26, 2015

How to distribute the numbers?

The legislator determined that in internal regulatory documents all calculation instructions must be clear; it is not allowed to indicate vague dates. Eg:

- Cannot be reflected - salaries are issued from the 1st to the 3rd or from the 15th to the 20th. You can do it on the 1st of every month and on the 15th.

- The local act excludes the expressions “twice a month” or “every 15 days”, since there are no specific numbers here. Employees must know exactly when they will be paid.

- It is prohibited by law to indicate that payments are made no later than the 2nd and 16th numbers, since there is also no clear position.

Payments can be made at the enterprise's cash desk, but financiers prefer to transfer money to current accounts in a bank with which the organization has entered into a cooperation agreement. To do this, the employee must submit an application for salary transfer to the card.

Is it worth paying your salary early?

- since half a month is a period of time ranging from 14 to 16 days, the time interval between each payment of wages should not exceed the specified duration; In the case under consideration, wages for the first half of the current month are paid on the 20th day, and for the second half - on the 5th day of the next month, which meets the requirements of part six of Art. 136 Labor Code of the Russian Federation. Let us note that the Labor Code of the Russian Federation directly speaks of a violation only of delayed wages (see part one of Article 142 of the Labor Code of the Russian Federation)

What are the consequences of violating wage payment deadlines?

The employer's liability for such violations can be of two types: material and administrative.

Administrative liability applies only if the employer is at fault.

Primary administrative punishment (clause 1 of article 5.27 of the Administrative Code):

- warning or fine of 1,000–5,000 rubles. for officials;

- fine for the culprit - individual entrepreneur - 1,000–5,000 rubles;

- fine for the culprit legal entity - 30,000–50,000 rubles.

Repeated administrative punishment (clause 2 of article 5.27 of the Administrative Code):

- disqualification for 1–3 years or a fine of 10,000–20,000 rubles. for officials;

- fine for the culprit - individual entrepreneur - 10,000–20,000 rubles;

- fine for the culprit legal entity - 50,000–70,000 rubles.

Financial liability (Article 236 of the Labor Code of the Russian Federation) is expressed in monetary compensation for each day of delay, calculated from 1/150 of the key rate of the Central Bank of the Russian Federation of the amount due for payment (minus personal income tax). This is the minimum amount of compensation, but the employer has the right to assign a larger amount. No application from the employee is required to receive it - it must be paid along with the delayed amounts.

IMPORTANT! Maternity compensation is paid regardless of whether the employer is to blame for violating salary deadlines.

In what other cases is the employer liable for financial liability? This publication will tell you.

Online magazine for accountants

However, there will be a clarification that salaries must be paid no later than the 15th of the next month. Specific terms for payment of advance and salary in 2020. as now, it will be possible to indicate in the internal labor regulations, collective or employment agreement. The change will affect the timing of bonus payments from October 3. See “Terms for payment of bonuses under the new wage law: what has changed.” It is worth noting that most employers, in practice, most often pay wages before the 15th of the next month.