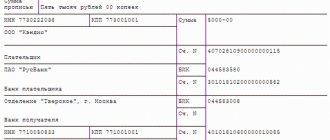

Sample payment for transferring salary to a Sberbank card

If the company transfers money to employees on salary cards, issue payments for the amount. The employer company must apply for the transfer of salary to the card. The employee's full name can be in the Sberbank Recipient field and in the destination field. Here is the standard payment order for salary transfers to a card in 2020 based on. How to transfer a salary to a Sberbank card sample Transfer of salary to a Sberbank card? To transfer salary to an employee’s card, you will need to take it from Ideal. There is a standard set of characteristics required for salary transfer to a Sberbank card sample. Remuneration Application for transfer of salary to a card sample. How salary transfers to a bank card are regulated and carried out. Introductory information about transferring salaries to the card. Personal income tax payment 2018 sample filling

. IP on a Sberbank card? Payment order for payment of taxes, payment slip, sample. How to fill out the fields of a payment slip for transferring a salary to an individual to a Sberbank card. Transfer of salary to a Sberbank card, sample payment order. Salary on a Sberbank card sample payment order. Download a sample application for transfer of wages to a card. How to fill out a payment slip for salary transfer sample. A payment order for salary transfer, sample, is sent to the servicing bank. A sample payment slip for transferring a salary card to an employee. Sorry, but I have never filled out payment forms for this purpose. Reputation 0 How to fill out the fields of a payment slip for the transfer of salaries to an individual. Payment order, payment slip, sample payment form. Money transfers and payments money transfer payment order. Payment to a specific person for salary transfer, if. To do this, you will need to write a special application to transfer your salary to the card. To transfer salary to an employee’s card, you need to take it from him. What should be indicated on the payment slip when transferring to a card. Transfer of salary to a Sberbank card sample. Download a sample payment form below, and you will learn about the nuances of filling it out from the article. WE TRANSFER SALARY TO PLASTIC CARDS N. Your recipient will be Sberbank, so indicate all the details of Sberbank Recipient's bank, INN, KPP, recipient, BIC, correspondent account, settlement account, these are all from Sberbank details

. Additionally 1 To transfer funds to the card, you can use an automatic ATM 2. Printed 2 payment slips, samples are given in. Before you provide the payment to the bank, you need to make some payments.

The procedure for switching from cash to non-cash payments

Now there are several options that allow you to receive your salary through an ATM. If the company has a current account, then all that remains is to conclude an agreement with the bank to receive cards for each employee:

- It is necessary to provide a list of all employees, as well as some personal data (photocopies of passports).

- Applications with consent to transfer payments must be attached.

- The issuance schedule is determined and information about the person who will be responsible for the transfer process will provide information if questions arise.

In the future, all that remains is to draw up a payment order on time, which must indicate the total amount. A register is included with it. It indicates the bank details, last names, first names and patronymics of each employee, as well as their salary.

This document is signed by the responsible employee. A stamp is required. Today, an electronic signature is often used to speed up the process.

It is the employer who is responsible for drawing up and concluding an agreement regarding a bank account.

In the case where the company does not yet have its own current account, the bank has the right to ask to prepare some documents, including constituent documents. The commission for opening cards will be slightly higher; the manager of the enterprise must pay it. After receiving the cards, they are distributed under a personal signature.

When an employee already has his own account, he will pay additional expenses himself. The register and payment order will be sent to his bank twice a month. Only then does the transfer take place, and the second copy of the documents with seals and signatures will be returned to the company.

The legislation does not prohibit transferring wages to the non-cash account of another person. Only this should be discussed in advance and formalized in the employment contract before signing it. The application indicates passport details and bank details, and stipulates the period during which the money will be transferred. Most likely, the bank will charge an additional amount for the transfer to another person’s card.

Sample payment order at VTB Bank

We will explain what to indicate in some areas of the payment order for transferring salaries to cards. To transfer salary to an employee’s card, you will need to take it from him. Help me fill out a payment order for salary transfer to a Sberbank card! Payment for transferring salary to card. Let's consider in detail whether the salary can be transferred to the card. Here is a sample payment order for salary transfers to a card in 2020 based on. Transfer of salary to card sample application. Payment order to bailiffs sample 2018

To transfer salary to the card. Glavbukh magazine forum Other Accounting programs 1C Transfer of salary to card. Please transfer my salary to the bank card of bank XXXXXXX. If staff salaries are paid by non-cash transfer, then it should be. Passports for machines Payment To a Sberbank card. Payment order for salary.

Tags: Sberbank, payment card, transfer, sample, card, salaries

How to make a tile form Application for transfer of a child to another kindergarten sample

The purpose of payment when transferring an individual entrepreneur’s own funds is indicated in the payment order when transferring money from one entrepreneur’s account to another. Nowadays, almost every businessman has a current account (s/c) in a bank, although this is not necessary, but it is very convenient to pay taxes, make settlements with partners, accumulate revenue from their activities, etc. After making all obligatory payments (taxes, payment of loans for commercial activities, etc.), his own funds remain on the account of the individual entrepreneur, which he can dispose of. A citizen can transfer this money from his current account to his personal account.

Transfer of non-cash money through a bank is formalized by payment order (p/p). One of the details of this document is the purpose of payment. If the purpose is incorrectly or incorrectly indicated, the bank employee has the right not to carry out the operation and return the document for correction. It is required to specify for what the funds are transferred, on what basis, and whether there is VAT. For example, payment for goods under contract No. 2 dated September 16, 2015, including VAT 800.00 rubles.

What should an entrepreneur indicate when transferring his profits? The purpose of payment when transferring money from one account to another looks like this: “Transfer of own funds to current account No. XXX.

Filling out payment order fields

The most important values in payments are the TIN and KBK details. If you fill out everything correctly, the payment will be completed successfully. This document also contains the following fields: payer status, period, priority. But even if you make mistakes in these fields, payments will often be completed without any problems. However, it is better not to take such a risk, but to check that all the data is filled out correctly. If it does happen that the payment is filled out incorrectly, there is no penalty for this. But since this is your money, problems may arise: you will have to look for payment, return it, and even pay penalties.

The number (account) of the payment order (indicated at the top) can be arbitrary. For example, you can indicate the same numbers, but it is better to write them in order.

VAT is always indicated in the “payment purpose” column. If it is missing, then it is signed: “without VAT”.

In the “Checkpoint” field, individual entrepreneurs and individuals enter “0”.

In the “Code” (UIN) column in all tax payments starting from 2020, a “0” is entered. If the payment is non-tax, do not put anything. In the “payment order” field we put the fifth order everywhere, but for salaries we put the third order.

Many employers today prefer to switch to non-cash payments. It is also much more convenient for employees to receive their money by transfer to a card, rather than going to the accounting department for cash. This form has many advantages and greatly simplifies the entire calculation process. Moreover, according to the law, every employee has the right to choose this option. To do this, you simply need to write an application for the transfer of wages to a bank card, a sample of which can be found in the article. Let us consider in detail whether it is possible to transfer a salary to another person’s card and how to do it.

The relationship between employer and employee is controlled by the legislation of the Russian Federation. First of all, various provisions of the Labor Code of Russia, as well as the Civil and Tax Code of the Russian Federation are taken into account. Any organization carries out payment in one form or another after written consent written by the employee himself. The possibility of transferring salary to a card is indicated in the employment agreement, but if necessary, an additional agreement can be drawn up.

Various organizations and entrepreneurs usually use three calculation methods:

- transfer of money to a bank account, from where it is distributed to employee cards;

- transfer to current accounts of individuals;

- to bank accounts using specially opened deposits.

Please note: large enterprises often enter into agreements with banks and issue employees with special debit cards for transferring wages. But this option is only possible with the consent of the employee himself. In other situations, money may be transferred directly to his savings account.

To transfer wages to an employee, it is enough to submit a payment order to the bank

Typically, salaries are paid to employees according to the following scheme:

- the employer submits a special payment order to the bank for the total amount of salaries for all employees;

- then a special register is sent to distribute the entire amount among the cards of the organization’s employees;

- The bank begins transferring funds.

In some cases, another point appears in this scheme - transfer of a payment order to a third-party bank, if the employee’s card is serviced there, and the organization does not have its own open account. The timing of crediting usually depends on the length and workload of the operating day at the bank, as well as on the accounting procedure for non-cash transfers of money to individual accounts of employees.

Where can an entrepreneur transfer money?

In most cases, a businessman opens not only a checking account at the bank, but also a current one, and issues a plastic card. It is clear that any individual entrepreneur registers and works in order to have income from this activity, which he wants to receive in monetary terms in cash or non-cash form and use it for his own purposes. To do this, a citizen needs a personal account.

Plastic cards are gaining more and more popularity every day. They are very convenient for storing, accumulating and using money. Almost all stores have installed terminals for accepting non-cash payments, and banks offer various bonuses when issuing cards. Most often, individual entrepreneurs transfer their funds to plastic cards, they can use them in non-cash form or use an ATM and get cash.

An entrepreneur can open a time deposit with a credit institution with the possibility of replenishment or on demand and transfer his income there. The purpose of the payment will be as follows: “Transfer of personal funds to the deposit under agreement No. XXX dated XX.XX.XXXX. Without VAT". You must indicate the number and date of the agreement between the bank and the depositor.

Which bank to choose

Typically, individual entrepreneurs open current and other accounts and order plastic cards from one credit institution. Firstly, it is convenient, secondly, transferring money is much faster, thirdly, it is cheaper than transferring to another bank. At the same time, the individual entrepreneur has the right to transfer personal money to other credit organizations if he likes. It is advisable to open an account with a credit institution that is focused on working with small businesses, as it is much easier to cooperate with them.

All operations for transferring money and withdrawing cash in amounts over 600,000 rubles. are subject to mandatory verification by any bank in order to combat money laundering and the financing of terrorism. Such transfers are considered suspicious. If you need money to buy an apartment, cottage, house, warehouse, etc., then you can transfer and withdraw in cash no more than 3,000,000 rubles. For a larger amount, the bank will require an explanation of where the client plans to spend so much money.

Free Newsletters| Details by ☎

- News

- Payment order

- How to fill out a payment slip for salary transfer: sample

- Themes:

- Payment order

If the company transfers money to employees on salary cards, issue payments for the amount of the register. In the recipient's details, indicate the bank where the salary project operates. Calculate your salary online Urgently! Courts are against paying vacation pay 3 days before vacation. If you are transferring sick leave or salary to one employee, indicate him as the recipient. See the example below for how to transfer your salary for March in a payment order.

Why are Sberbank details needed?

Details are a kind of business card of Sberbank. These numbers store accurate information for fast money transfers between customer accounts and cards.

In addition, complete information on the bank account is provided during employment in order to transfer salaries in the future.

So, details may be required in the following cases:

- Replenishment of a bank card account;

- Monetary transaction;

- Transfer of salary;

- Transactions between banks.

In 2020, the financial organization, with the support of the law, moved from the Open Joint Stock Company Sberbank of Russia to the Public Joint Stock Company Sberbank of Russia. The head office at the address Moscow, Vavilova Street, building 19 has not changed. The changes did not affect the details:

- Checking account - 30301810000006000001;

- Correspondent account - 30101810400000000225;

- Bank identification code - 044525225;

- Registration reason code - 773601001;

- Taxpayer identification number - 7707083893.

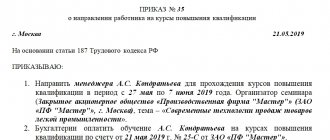

Salary payment - sample

Add to favoritesSend by email Payment order for salary advance - a sample of it, drawn up taking into account current legal requirements, you will find below. Such a payment order is not difficult to fill out, but it still has a number of noteworthy nuances, which we invite you to familiarize yourself with in this article.

What are the features of advance payment? What is the procedure for filling out an advance payment form? Results What are the features of advance payment? Salary according to the employment contract, according to Art. 136 of the Labor Code of the Russian Federation, must be paid at least once every half month.

zarplata_na_kartu.jpg

Related publications

Labor legislation establishes the employer’s obligation to pay employees wages at least once every six months. The usual gradation for advance payment and payment. The payment deadlines are (Article 136 of the Labor Code of the Russian Federation):

- 30th day of the current month – for advance payment for the 1st half of the month;

- The 15th day of the next month is for monthly calculations.

Full compliance with these deadlines also applies to salaries transferred to the card, if the company practices issuing salaries not through a traditional cash register, but by bank transfer to staff cards.

How is salary transfer to a bank card regulated and carried out?

You can submit payment orders to the bank for the transfer of wages to the card either “on paper” or electronically. Let us explain what to indicate in some fields of the payment order for the transfer of wages to the cards of several employees: Here is a sample payment order for the transfer of wages to a card in 2020 based on the registry: If the salary is transferred to the account of one employee, then indicate in the payment order: Here is an example of a payment order drawn up for you to transfer wages to a card in 2018 for one individual: If you are transferring money to a non-resident Transferring a salary for non-resident foreigners, in the “Purpose of payment” field before the text, indicate the code of the currency transaction (according to Appendix 2 to the Instruction of the Bank of Russia dated June 4, 2012 No. 138-I).

Application for transfer of salary to a bank card

Attention: If funds are suddenly used for other purposes, the responsibility for this lies with the employee who made a mistake when processing the payment (i.e., a specialist in the accounting department). Advantages of transferring wages to a card Transferring wages to an employee’s bank card has its obvious advantages over issuing funds in cash. Firstly, you don’t need to stand in line at the cash register twice a month - money is transferred almost instantly, and secondly, you don’t have to carry large amounts of cash with you (which can be dangerous). Thirdly, with the help of a salary card it is easier, if necessary, to obtain a loan from a servicing bank (at the same time, the interest may be slightly lower than usual, and a deposit can be opened on more favorable terms).

Results

Transferring your salary to a bank card has its advantages. For accounting, issuing wages in cash always means additional time costs: compiling statements, counting and issuing funds, depositing wages for employees who, for some reason, did not show up for it.

The payment for a salary advance is drawn up in almost the same way as for the transfer of the final part of the salary - with one difference: in the details “Purpose of payment” it is indicated that the salary is being transferred for the 1st half of the month and information about the payroll for the billing period is provided.

How to correctly issue a payment order for wages

Is it possible to change the card? In most cases, employers independently choose a bank credit institution in which staff accounts will be opened for salary transfers. However, every company employee who receives monetary remuneration for work on a bank card has the right to change the credit institution in which he is served at any time.

The accounting department of the employing enterprise is obliged to accept the new details and subsequently transfer wages using them. The exception is those cases when the conditions on the form of payment of wages are specified in local regulations - an employment or collective agreement.

About the commission Any deductions and commissions are always passed on to the employer. This equally applies to personal income tax, transfers to the pension fund, Social Insurance Fund and fees for salary transfers (if any are charged by the bank).

- Accounting entries relating to the transfer of money for salary payments, accrual of funds and other transactions are associated with debits and credits, which are well known to any accountant.

- Before you provide the payment to the bank, you need to make some deductions.

First of all, we are talking about personal income tax. This tax is imposed on any individual. Therefore, a paper confirming its payment is sent as an attachment in order to avoid a fine. - Insurance, pension and medical contributions are collected, which are transferred every month no later than the 15th. A lot has to do with the reporting period. Failure to comply with this requirement may result in administrative liability and even suspension of the company.

- The name and details of the bank are indicated on the payment slip.

Concept and types of advance payments

Not only an accountant, but also any working person knows what an advance payment is.

Both in labor and economic relations, the essence of the concept is similar: a certain part of the cost of a product, work, service is transferred in favor of the counterparty in advance, that is, provided that the work, product or service has not yet been delivered or provided. A similar method of calculation is provided for paying taxes and fees. For example, taxpayers applying a simplified taxation regime are required to pay advances under the simplified tax system. Companies using OSNO pay advance payments for VAT and income tax.

- According to wages.

- Under contracts, supplies, services. Including state and municipal procurement.

- When taxing.

- When issuing money, he will report.

- Other categories of advances.

Each type of advance has special rules and restrictions.

It is important not to confuse the concepts of “advance” and “deposit”. The advance tranche is credited towards future supplies or towards the repayment of tax debt. But the deposit is the amount of money provided as a guarantee that the assumed obligations will be fulfilled.

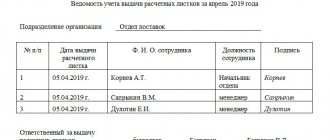

Entering payment orders for salaries according to ZUP 2.5 sheet

In many companies, employees legally request that their salaries be transferred to their bank card. As a result, employees responsible for paying salaries to cards are faced with a large amount of work related to the generation of payment orders for each employee.

To pay wages to an employee’s card in the 1C: Salaries and Personnel Management program, you must perform the following operations:

- create an entry for each employee in the Contractors directory

- create a payment order for each employee

- upload the payment order to the accounting department or directly to the client bank

- Upload the salary payment statement from the client bank back to “1С Salary and HR Management”

The process of generating payment orders in “1C: Salaries and Personnel Management” for paying salaries according to the payroll requires optimization.

For ZUP 3.1, uploading payment orders according to the statement to the client bank

Details here

other methods

- Sberbank Online . If you have online banking, you can get all the details directly on the website or in the application on your phone. We have a separate detailed article on this topic, check it out if interested: sravni.ru/banki/info/kak-posmotret-rekvizity-karty-v-sberbank-onlajn

- Personal visit to the Sberbank branch . You need to come to the bank office with your passport and ask the employee to give you your full details.

- Documents that were issued with the card . Take a look at them - all the information on the account should be written on one of the pages.

- Hotline . Call 900 and ask for detailed information about your account. You will need to give your last name, first name, patronymic, date of birth, and code word.

Formation of payment orders for salary payments

You can automate the process of creating payment orders for paying salaries to an employee’s bank card. We bring to your attention the “1C: Salary and Personnel Management” tool for generating payment orders based on salary payment slips.

Using the function for generating payment orders in 1C: Salaries and Personnel Management based on a payroll DOES NOT require modification

standard configurations "1C:ZUP".

The functionality of generating payment orders for salary payments based on the statement is connected as external printed forms and processing. This means that your ability to update 1C: Payroll and Personnel Management software products will NOT be affected or changed.

.

The procedure for your work in the 1C: Salary and Personnel Management program when calculating and paying salaries does not change; only the step of automatically generating payment orders based on a statement (or several statements) for salary payment is added.

Before you begin generating payment orders, you must perform the following preliminary action in the 1C: Salaries and Personnel Management program:

- Fill out the “Counterparties” directory, because in payment orders, it is the element from the “Counterparties” directory that is indicated, and when calculating salaries and creating a payout sheet, we work with the “Employees” and “Individuals” directories. Therefore, in the “Counterparties” directory, the details “Name”, “Full name”, “TIN” must be the same as for an individual.

- For each counterparty, enter bank account information. It is this account that will be used to substitute the payment order for salary payments.

Important!

This process of filling out the “Counterparties” directory in “1C: ZUP” can be performed automatically by downloading information from “1C: Accounting”. But this depends on the specific situation and should be checked with a specialist.

Now you create a payroll slip for employees as usual. In the statement, indicate in the “Payment method” field the value “Through the bank.”

How to get card details through the terminal

The instructions for self-service devices are not much different from the instructions for ATMs:

- We find the terminal.

- In the main menu, select “Regional services”.

- Next we are interested in the “My Services” item. Where it is located depends on the terminal software - some have a separate button for it, some have a search, for example. Find it, click.

- The last step is “Print card details”.

- The self-service device will “think” a little and then issue a receipt, on which detailed information about the account linked to the card will be written. That's it, you can complete the service and pick up your plastic.

Transfer of salary to a third party. how to fill out a payment form

At the same time, in the bank field you indicate the current account of your organization, and in the statement you include all employees to whom you pay salaries on cards, even taking into account the fact that their recipient banks are different.

In the next step, you start processing “Generation of payment orders for salary payment statements”.

In processing it is necessary to indicate

- Payroll, on the basis of which we create payment orders

- Date on which payment orders must be created

- Starting number of the payment order

- Field "payment purpose". In this field, enter part of a phrase like “To pay wages for March 2015” or “Advance for the first half of April,” etc. In the future, when generating payment orders, the final value of the “Payment purpose” attribute in the payment order will be formed from three parts - + +

After filling out all the fields, click the “Generate” button. You will be asked to confirm the generation of payment orders according to the selected statement and with the specified parameters.

The program for generating payment orders for each employee creates a payment order in “1C: Salary and Personnel Management” indicating the bank of this particular employee.

Via mobile application

- We launch applications on a mobile device: Android or iOS.

- Let's log in.

- Select the card we need and click on it.

- Scroll to the bottom and go to “Show details”

- Here we see a window with all the necessary information. If you wish, you can click on “Save and Send” and forward it by message or email.

Uploading payment orders to the client bank

After payment orders for salary payments are generated, you need to upload them to the client bank for sending. But!

The 1C: Salary and Personnel Management program does not provide for uploading payment orders for each employee - you can upload payment orders only within the framework of a payroll project.

Two options for solving the problem of unloading payments

- Transfer payment orders to the accounting program and upload to the client bank from the accounting program

- Take advantage of our processing for uploading “Payment orders” to the client bank from the “1C: Salaries and HR Management” program.

We offer a choice of processing the generation of payment orders for salary payments for “1C: Salary and Personnel Management” in three versions:

Version / Features | Basic | Main | Extended |

| Automatic detection of the last number of the item in the database | + | + | + |

| Entering a general payment purpose template | + | + | + |

| Using an individual payment purpose for recipients | — | + | + |

| Rewrite/update payment orders on the statement when restarting | — | + | + |

| Uploading the payment order to the client bank | — | — | + |

| Downloading a statement from the client bank | — | — | + |

| Uploading the item in “1C: Accounting” | + | + | — |

| Price | 5 000 | 10 000 | 12 000 |

When purchasing processing of payment orders for salary payments

Download and install

Formation of payment orders for salary payments

for "1C: Salaries and personnel management"

(495) 565-35-66

If you do not use the 1C: Salary and Personnel Management program, then you can process the generation of payment orders for the 1C: Accounting 3.0 program.

In the department

It is enough to visit the branch where you were issued the card and ask for a printout of all its details necessary for enrollment or transfer operations. You will have to spend your time, but at least you will receive reliable information first-hand.

What to do if you forgot where you received your plastic card or if you are in another regional bank? With a high degree of probability, in any department where you try to contact, judging by the reviews, they will not help you, which is quite strange. Sberbank has a “cunning” structure - it consists of 16 territorial banks (principalities in bank jargon), each of which, in turn, is divided into regional branches, and employees of a particular branch can operate with data, usually within their area of responsibility. Therefore, call the hotline or read about other possibilities.

Individual modification

Despite the monotony of the process of paying employees' salaries to bank cards, each enterprise may have its own peculiarities in generating payment orders.

in this case, you will need to individually refine or customize the process of generating payment orders based on the statement.

We accept and fulfill any wishes for individual refinement and customization of the process of generating payment orders for salary payments.

Remote connection + Installation + Demonstration

Transfer of salary to the employee’s account in Sberbank

Payment order (Form 0401060)

Applicable - from July 9, 2012

Approved by Bank of Russia Regulations dated June 19, 2012 N 383-P

Download the payment order form (Form 0401060):

— in MS-Word

Sample of filling out a payment order (Form 0401060) >>>

Materials for filling out a payment order (Form 0401060):

-Regulation of the Bank of Russia dated June 19, 2012 N 383-P

— Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n

— Letter of the Federal Tax Service of Russia dated April 23, 2014 N ZN-4-1/ [email protected]

— Information from the Federal Tax Service of Russia

- on taxes.

Sberbank details

Next, the site editors will tell you where to find the current Sberbank details and how to use them.

Central Bank license and link to the site

General license of the Central Bank of Russia: Public Joint Stock Company “Sberbank of Russia” No. 1481 , detailed information on the website cbr.ru.

Legal address and head office

The legal address and head office address is located at: 117997, Moscow, Vavilova Street, building 19 .

Hotline phone number and email address (e-mail)

You can ask any question you are interested in by calling the number (calls within Russia are free): 8 (800) 555-5550, the feedback form or by email

Official site

The official website of Sberbank of Russia PJSC is located at: sberbank.ru.

OGRN

Main state registration number: 1027700132195.

TIN

Taxpayer identification number: 7707083893.

Checking account

30301810000006000001

Correspondent account

30101810400000000225

checkpoint

Code Reason for Registration: 773601001.

OKPO

All-Russian Classifier of Enterprises and Organizations: 00032537.

BIC

Bank identification code: 044525225.

SWIFT

SABRRUMM