Zero reporting is standard reporting forms that reflect the absence of activity. For example, when there is a company, but there is no activity. In this case, the organization is already registered and is listed as a taxpayer, depending on the chosen regime. Let's figure out what kind of reporting an individual entrepreneur needs to submit if there is zero reporting and how to report to legal entities?

In this situation, a number of questions arise: what constitutes zero reporting, its composition, how to submit zero reporting to the tax office, what sanctions are provided for delay or failure to submit. I’m also concerned about the process of submitting reports: do I need to fill out all the forms or is one sufficient? For example, does an individual entrepreneur on the OSN need to submit a balance sheet with zero reporting? Can the form be submitted by email or must it be submitted on paper? We figured it out and are ready to answer these and other questions.

Zero reporting on OSNO

For firms and entrepreneurs using the common system, the composition of declaration forms and other documents is as follows:

- VAT return must be submitted quarterly by the 25th day following the end of the tax period.

- Income tax return - the document must be submitted quarterly by the 28th day following the end of the tax period.

- Property tax returns must be submitted quarterly by the 30th day following the end of the tax period.

- A single calculation for insurance premiums is to submit reports quarterly by the 20th day following the end of the tax period. Even zero.

- Accounting statements are required to be submitted once a year by March 31.

In the absence of cash flows and the emergence of taxable objects, you can fill out a single simplified declaration, which will replace income tax and VAT reports. It must be sent to the Federal Tax Service by the 20th after the end of the quarter. Individual entrepreneurs that do not have employees do not submit reports to the funds. Thus, the answer to the question “do I need to submit a zero VAT return?” - positive.

Zero reporting on the simplified tax system

Firms and entrepreneurs using the simplified tax system with employees need to submit a zero tax return under the simplified system once a year:

- until March 31 - for companies;

- until April 30 - for individual entrepreneurs.

Zero reporting to the Pension Fund (SZV-M) - until the 15th day of each month and the Social Insurance Fund (4-FSS) - until the 20th day of the month following the quarter. By the way, you can also fill out a single simplified declaration form. This is stated in the letter of the Ministry of Finance dated 08.08.2011 No. AS-4-3 / [email protected] Therefore, zero reporting of individual entrepreneurs on the simplified tax system in 2020 does not have any peculiarities.

The rules for filling out zero reporting on the simplified tax system (for LLC or individual entrepreneur) depend on the selected taxation object. In the simplified mode, there are only two options: income or income minus expenses. Each option has its own nuances for filling out a tax return.

Features for the simplified tax system “Income”:

- It is mandatory to fill out the title page of the zero declaration, as well as sections 1.1 and 2.1.

- Enter information about the taxpayer according to the general rules.

- Submit a zero declaration to the Federal Tax Service at the location of the economic entity.

Features for the simplified tax system “Income minus expenses”:

- The title page, as well as sections No. 1.2 and 2.2 of the zero form, are required to be filled out.

- If the company has separate divisions, then there is no need to file a separate declaration under the simplified tax system.

- If a company has no income, this does not mean that information about the costs incurred need not be included in the zero declaration. Provide information about expenses incurred in accordance with accounting data and/or supporting documents.

How to submit zero reporting

Issues discussed in the material:

- Do I need to submit zero reporting?

- How to submit zero reporting for an individual entrepreneur?

- How to submit zero reporting for an LLC yourself?

- What is the penalty if you do not submit zero reports?

In the course of its work, it is rare that a company can avoid periods when its activities are stopped. This may be due to various reasons - the composition of the management or founders changes, lack of finances for full-time work, the owner may simply take a break for personal reasons. But in accordance with the law, even the complete absence of activity and cash flow does not exempt the company from preparing reports. We will tell you further how to submit zero reporting.

What is zero reporting

Top 3 articles that will be useful to every manager:

- How to choose a tax system to save on payments

- How to minimize taxes and not interest the tax authorities

- How to create an electronic signature quickly and easily

Regardless of whether the company is operating, whether business transactions are being carried out, or whether there is no movement at all, you will still have to submit reports to the Federal Tax Service. Even if your company has just opened and you just haven’t had time to start working yet, if the deadline has come, you will need to submit zero tax reporting. This matter is not as simple as it might seem at first glance.

When drawing up a zero balance, certain rules must be taken into account. In addition, errors must not be made in the documents, otherwise they will not be accepted by the tax office, which equates to a lack of reporting. Consequently, the company will have to pay a fine.

If a company has suspended its activities for any reason or has only recently been operating, then it may not have an accountant on its staff. Typically, in such a situation, the owner maintains his own accounting records. In the absence of special knowledge, errors are often made in documents. Even small shortcomings lead to the tax office returning the papers. Consequently, it will no longer be possible to submit zero reporting on time, which creates problems that will be discussed below.

An inevitable nuisance in this case will be the imposition of a fine. Even if it turns out to be small, no one wants to pay it. The second point, already more serious, is the possibility of blocking the current account. Consequently, the enterprise will not be unable to use its own funds in the bank. There is no need to even talk about how detrimental this will be to business. A newly opened enterprise can finish its work there.

The lack of special skills will almost certainly lead to problems when submitting zero reports. To avoid this, it is best for a novice businessman to seek help from a professional accountant.

https://youtu.be/UhUvUL3e_xE

What is zero reporting?

In accordance with the legislation of the Russian Federation, this is a package of documents of a standard format containing information of a tax, statistical and accounting nature. A taxpayer who is temporarily not carrying out his activities is required to provide these papers to the regulatory authorities.

Indicators for zero reporting are the following factors in the operation of the enterprise:

- The balance sheet currency of the company turns out to be no more than the authorized capital.

- In Form No. 2 – the profit and loss statement – the profit value for the reporting period is zero or negative.

Zero reporting must be submitted by the 30th day of the month following the quarter. In a zero balance sheet, in the absence of enterprise activity, some significant figures are usually still shown. A completely zero balance is surrendered only upon liquidation of the enterprise.

In reporting forms, variable fields are entered with zeros or left blank.

In the absence of activity, zero reporting must be submitted for the following indicators:

- Information on the number of hired personnel (0 people) is provided by enterprises and individual entrepreneurs until the 20th day of the month following registration.

- Value added tax report, if the company or individual entrepreneur is not exempt from it.

- Personal income tax reports are submitted only by individual entrepreneurs using the general taxation system.

- Tax report for the simplified tax system.

- Enterprise income tax report.

Zero values cannot appear in reporting taxes on imputed income. This is due to the fact that the absence of income from an enterprise under such a taxation system automatically terminates its application. Imputed income assumes some positive value in the reports even when operations stop.

If there is no tax base for other mandatory taxes, then there is no need to submit zero reporting for them.

Zero reporting for UTII

As for sending a report without data to UTII, everything is not so simple. The tax office does not accept blank imputed tax reports. On imputation, tax calculation does not depend on income received and expenses incurred. Even if no activity was carried out and the taxpayer was not deregistered, he is required to pay tax and prepare reports.

Therefore, it is unacceptable to take “zero” marks for UTII. Fill out the tax return according to the general rules:

- On the title page of the zero declaration, indicate information about the taxpayer. Indicate the code of the Federal Tax Service to which you are submitting reports.

- Start filling out from the second section. If the company is engaged in several types of activities at once, fill out the section separately for each type.

- If activities are carried out at different registration addresses, then section No. 2 must be filled out separately for each OKTMO.

- Enter the activity code in line 010, according to Appendix No. 5.

- We enter OKTMO in line 030. You can find out the code on the official website of the Federal Tax Service.

- Lines 040–110 are filled with information about the calculation of UTII.

- Column 3 on lines 070–090 should be filled out if the economic entity has just switched to imputation or withdrawn from this taxation regime.

- Fill out Section 3 with the amounts of tax payable. In this case, take into account the amounts of insurance premiums and benefits reflected in section No. 2. Reduce the tax payable by these amounts.

- Please fill out Section 1 at the very end.

The deadline for sending the report is the 20th day of the month following the end of the quarter. Accounting statements and reporting to funds can be submitted as zero.

Zero report on UTII

If we talk about passing the “zero” level for UTII, then everything is not simple. MIFTS will not accept a blank tax report. In this case, the calculation of the tax amount will not depend on profits and costs. Even if no activity was carried out and the taxpayer was not deregistered, he must pay the tax and prepare a report. The deadline for provision is the 20th day after the end of the quarter. Reporting to funds, as well as accounting, will be zero. In accounting, balance sheet lines cannot be empty. The institution has an authorized capital, funds, and property. In the absence of households. transactions during the reporting period, these figures must be reflected in the report.

Zero accounting statements

The composition of the financial reporting forms is approved by Order of the Ministry of Finance No. 66n. key forms:

- Balance sheet.

- Income statement.

- Cash flow statement.

- Statement of changes in equity.

- Report on the intended use of funds.

- Appendixes to the balance sheet.

An important point: when preparing financial statements, you also cannot leave all balance sheet columns empty. The organization has an authorized capital, possibly funds in an account or in the cash register, and some property. If there are no business transactions during the reporting period, these figures should be reflected in the financial statements.

Liquidation balance: “zero” or with numbers

Anyone who has ever encountered liquidation in practice may have wondered which balance sheet to submit at the final stage: the liquidation balance sheet. There are two possible answers to the question: purely practical or legislative-oriented.

The answer comes from practice

Each registration authority (FTS) can provide advice on the liquidation process. In particular, in Moscow the registration authority (MIFNS No. 46) suggests it is better to submit a “zero” balance. In this case, the “better” position is justified by the fact that the registration authority will have fewer questions. It is unlikely that such a position is consistent with the law.

It is worth noting that the issue is of particular relevance in relation to commercial organizations that have an authorized capital. In the case of non-profit organizations, the issue of “zeroing” the liquidation balance sheet does not present any difficulties. The situation with commercial organizations is complicated by the legal requirement for the mandatory presence of an authorized capital.

The answer stems from legislation

The answer to the question posed can be found by assessing the requirements of the Civil Code of the Russian Federation in terms of the liquidation balance sheet and federal laws on business companies (Federal Law on LLC and Federal Law on Joint-Stock Companies).

The only provision regarding the liquidation balance sheet is contained in Art. 63 of the Civil Code of the Russian Federation, according to which the balance sheet is drawn up after the completion of settlements with creditors. There are no more requirements. Moreover, there is no approved form of the liquidation balance sheet.

Consequently, there is no legally established requirement for a “zero” balance. Which refutes the position of the registration authority that it is better to present a “zero” balance.

Confirmation that the balance sheet must contain figures is the requirement of the Civil Code of the Russian Federation and the laws on business companies that companies have authorized capital. The very fact of the existence of an LLC or JSC indicates the presence of authorized capital.

The Civil Code of the Russian Federation, which regulates the liquidation procedure, does not indicate that the authorized capital “disappears” during the liquidation process.

These considerations lead to the conclusion that the authorized capital disappears at the moment of “disappearance” of the company, which can be considered the entry into the register (Unified State Register of Legal Entities) about the termination of the organization’s activities (liquidation).

Then a logical question arises: how can an entry be made in the register about the termination of an organization’s activities if, according to the balance sheet (it is worth noting the liquidation balance sheet, not the accounting balance sheet), the organization has financial indicators in the form of authorized capital and some kind of asset.

This question can be easily answered.

Firstly, the law does not connect liquidation with zero balance sheet figures.

Secondly, the law allows the termination of the activities of an organization with digital indicators. According to the law on registration of legal entities, the registering authority, in the presence of a number of circumstances, may decide to exclude an organization from the register (Article 21.1). In this case, the registration authority is not at all interested in digital indicators. He makes a decision upon the termination of the activities of a legal entity that, at a minimum, has an authorized capital.

Thirdly, according to Art. 17 Federal Law “On Accounting”, the liquidation balance sheet is the basis for drawing up the latest accounting (financial) statements. This article allows the organization to carry out its activities after drawing up the liquidation balance sheet.

The final conclusion can be stated as follows.

From the point of view of the law, the liquidation balance cannot be “zero”. In practice, it is compiled both “zero” and with numbers. The registering authority will “pass” both balances. The main thing is that there is no debt on the balance sheet to counterparties who are not members of the organization (in relation to the authorized capital). That is why the participants receive property upon liquidation of the company only after satisfying the creditors’ claims, and the amount claimed by each participant is equal to its share in the authorized capital.

The use of a specific balance (“zero” or with numbers) depends on the company itself. But we must keep in mind that the liquidation balance sheet with numbers is oriented towards legislation.

Features for Entrepreneurs

Individual entrepreneurs are required to pay insurance premiums for themselves. Even if the business activity of a merchant is suspended, fees will still have to be paid.

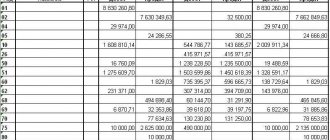

Amount of insurance premiums paid by individual entrepreneurs for themselves:

| Type of insurance coverage | Total income from the entrepreneur's activities | |

| With annual income up to 300 thousand rubles | With annual income of more than 300 thousand rubles | |

| Pension contributions for individual entrepreneurs in 2020 or payments for compulsory pension insurance | 2020 — 29,354 rubles 2020 — 32,448 rubles | In the amount of mandatory payments and an additional 1% of the amount of income exceeding RUB 300,000. There are restrictions. The maximum amount of additional contribution for 2020 is 205,478 rubles, the maximum total amount of contributions to compulsory pension insurance for 2020 is 234,832 rubles. |

| Individual entrepreneur insurance premiums for yourself 2020, in terms of compulsory health insurance | 2020 — 6,884 rub. 2020 — 8,426 rub. | There are no restrictions on compulsory health insurance coverage. |

| Compulsory social insurance | Not paid | |

Important! Insurance premiums paid by individual entrepreneurs for themselves can be taken into account when taxing the simplified tax system or UTII. Accrued contributions reduce taxes payable to the budget.

Do you need a CCP LLC?

According to the new legislation, the use of a new cash register in the form of an online cash register for LLCs is mandatory from July 1, 2020, regardless of the taxation options - simplified tax system or UTII and the type of business, but with minor exceptions: for example, this does not apply to shoe workshops, newsstands, merchants in open markets without special equipment or sellers of various bottled drinks and ice cream. The sale of handicrafts and religious organizations is also on this list; new CCPs may not be used with the permission of regional authorities in hard-to-reach areas, and these are not only areas of the Far North or Far East. The main thing is that in addition to issuing a paper check to the buyer, a modern cash register works with a fiscal data operator (FDO), who sends the most detailed and processed electronic check to the tax office for transparency of the operation. The Federal Tax Service is very serious - penalties for various violations start at 3 thousand rubles and can lead to a complete ban on trade, if the LLC operates without an online cash register at all, you will have to pay at least 30 thousand rubles.

Zero reporting to the Pension Fund

Pension reporting for 2020 consists of only two forms. These are the monthly SZV-M form and the annual SZV-STAZH report. Information from pension reports discloses information about the insured persons: working citizens, as well as their insurance experience.

According to the rules for filling out reporting forms, pension forms should include information about all employees of the company who are in labor or civil relations with the employer. In other words, the reports include those employees with whom employment or civil law contracts have been concluded.

The latest recommendations from officials have adjusted the procedure for filling out forms. Now it is necessary to include in the report all working citizens, regardless of whether a contract has been concluded with them or not. Thus, Article 16 of the Labor Code of the Russian Federation states that labor relations arise from the moment an employee is allowed to perform duties. That is, with actual permission to work. Therefore, the presence of a well-drafted contract does not matter. Information about such an employee should be included in the report.

The opinion of officials towards employees who do not receive wages has also changed. For example, an employee took a long unpaid leave. Information about it is still included in pension reporting. After all, the employment relationship is not interrupted, and the contract is not terminated during the vacation.

IMPORTANT!

If the company’s activities are temporarily suspended, and there are not a single employee on staff, then submit “zeros” in the SZV-M form. In the report, fill in information about the policyholder, indicate the reporting period, but leave the tabular part empty. Submit SZV-M monthly, no later than the 15th day of the month following the reporting month.

Can a director not receive a salary?

Since mandatory insurance contributions are calculated from wages, the question arises: is the company registered, has one director, but there is no salary? Many organizations in which the founder is a director do not pay wages in the absence of activity.

If claims arise from regulatory authorities, you can refer to the letter of the Ministry of Finance dated 09/07/2009 No. 03-04-07-02/13, which states that if an employment contract has not been concluded with the director, then the responsibilities for calculating wages there is no charge. According to Art. 273 of the Labor Code of the Russian Federation, the sole founder cannot conclude an employment contract with himself. Subsequent payments, subject to profit, will be considered dividends. In addition, the Russian Pension Fund believes that submitting a blank SZV-M report in this case is also not necessary.

However, already in 2020, the opinion of officials changed - see Letter of the Ministry of Labor of Russia dated March 16, 2018 N 17-4/10/B-1846. Now in SZV-M a director without a salary must be submitted to the Pension Fund. Consequently, if the company had only the founder, who is also the director, who did not receive a salary, then until 2020 zero reporting was submitted. Now information about the sole founder-director must be sent to the Pension Fund. Moreover, it makes no difference whether an employment or civil contract has been concluded with him and whether there are wages accrued.

IMPORTANT!

SZV-M for the founder - director without salary must be submitted to the Pension Fund. Also include information about the founder if an employment or civil law contract has not been concluded with him.

Zero reporting on the SZV-STAZH form

We will separately outline the requirements for submitting the SZV-STAZH pension form. Does the Pension Fund need zero?

To answer the question, let's look at the structure of the form itself. In general, the report is not intended to send an empty table. For example, when filling out SZV-STAZH electronically, the filling program will not allow you to generate a report without information about the insured persons.

Consequently, the answer to the question “is it necessary to register an annual SZV-STAZH if there is no information” is unambiguous. There is no need to pass zeros. A completely different question is how a company functions without employees or even a founder. Controllers are skeptical about such circumstances.

Officials came to the conclusion that an economic entity cannot function without leadership. Consequently, SZV-STAZH will have to include a founder or director working without salary or contract. The rules are the same as for SZV-M.

Zero reporting to Social Security

It is necessary to submit a quarterly report to the Social Insurance Fund in Form 4-FSS. Also, policyholders are required to annually confirm the main type of economic activity in order to receive tariff discounts.

In both cases, reporting may be zero. That is, if the company did not conduct business, did not receive income, did not make contributions to employees, then there is nothing to reflect in the 4-FSS and confirmation. But even if there is no information, you need to submit zeros to the FSS. There are no exceptions.

We fill out the zero form according to the general rules. We indicate information about the policyholder; the remaining tables and sections of the 4-FSS calculation remain empty.

What happens if you do not send zero reporting?

If the taxpayer does not report on time, he will be fined. Zero reporting of an LLC or individual entrepreneur is no exception. Failure to submit reports will entail sanctions from the tax inspectorate in the form of monetary penalties:

- from the organization - 1000 rubles;

- from officials - from 300 to 500 rubles.

In addition, the Federal Tax Service has the right to block the company’s current account if reports are not submitted within 10 days after the due date.

For failure to submit a zero calculation 4-FSS, Social Insurance provides for similar penalties (Article 15.33 of the Administrative Code):

- the organization will be fined in the amount of 1000 rubles;

- for a responsible official, the fine will be from 300 to 500 rubles.

There are no administrative penalties for failure to provide confirmation of the main type of economic activity. However, you should not count on a reduction in the rate of contributions for injuries. If the company resumes its activities, then contributions from accidents and occupational diseases will be calculated at the maximum rate of 8.5%.

Penalty for failure to submit zero reports to the Pension Fund:

- the form for submitting the report is not followed (the report is submitted on paper, not electronically) - 1000 rubles;

- for an unsubmitted report - 500 rubles for each insured person on the form;

- liability for officials from 300 to 500 rubles.

The procedure for submitting documentation for zero reporting of an LLC to OSNO

Zero reporting of an LLC on OSNO is provided in one of the following ways:

- The declaration on paper in two copies is handed over to a tax official, who must mark the acceptance of the document on one copy and return it. The declaration can be submitted by the owner of the company, one of the founders, authorized to do so by the general meeting or a proxy. The latter must have a power of attorney with him, which contains the signature of either the chief accountant of the organization or the general director.

- On paper by mail. The declaration must be sent by registered mail. It is not necessary to issue a notification, but it is advisable.

- In electronic form using digital signature. The electronic signature is issued by a specialized company.

A prerequisite for submitting reports is the absence of blots and corrections. If they are accepted, the documentation must be completed anew. In this case, a declaration on paper can be filled out on a computer and then printed, or you can make entries manually.

If you do not have the skills to prepare reports, it is advisable to use the services of a professional accountant. This will greatly facilitate the process of filling out documents and submitting them to the relevant authorities.

Why do you need an accountant:

https://youtu.be/b7iM5MLFAn8

How to create and send blank reports?

In the general taxation system, in order to report income tax and VAT, you can fill out a single simplified declaration (SUD). Therefore, when asked whether it is necessary to submit a zero VAT return, we answer that it can be submitted in the EUD form. Organizations and individual entrepreneurs on the simplified tax system can use the same form. The report form and the method of filling it out were approved by letter of the Ministry of Finance dated July 10, 2007 No. 62n, taking into account the standards prescribed in letter dated October 17, 2013 No. ED-4-3/18585. Zero reporting to the Social Insurance Fund is submitted on the updated 4-FSS report form. Only the title page and codes are filled in. Accounting reports can be compiled in abbreviated form: balance sheet and income statement.

Starting from 2014, all VAT reporting must be submitted electronically. Since in order to send reports the company must still purchase software and digital signature, there is no point in submitting the remaining reports in paper form. It's easier to send everything by email. For VAT evaders, zero reporting can be submitted to the tax office and Rosstat both in paper and electronic form, at the discretion of the respondent. You can also use the services of authorized representatives to submit zero reports.

You can generate zero reports in any accounting program or online accounting. For software, zeroing is the simplest task. It is conveniently implemented, for example, in the “My Business” service.

What is a trading fee for an LLC?

LLCs pay trading fees exclusively in the capital's districts - the closer to the center, the more expensive it costs companies to use various retail spaces: markets, pavilions, shops. The sale of goods at retail and wholesale warehouses is also subject to a fee, which is levied quarterly at a fixed rate in each district and is not related to LLC income. Moreover, organizations themselves calculate the amount of the fee and pay according to the rates, but not all: this does not apply to agricultural producers operating on the Unified Agricultural Tax (USAT) and selling their own products. If a company operates on a simplified taxation system (USN) of 6%, then it pays a reduced single tax, if on a “simplified” taxation system of 15%, the amount of the fee can be recorded as expenses, in the mode of the main taxation system (OSNO) you can also save - the trade tax is included in income tax.

Special services for preparing zero reporting

There are many special services for preparing and submitting zero reports electronically. Almost all accounting programs provide this opportunity. Some of them have special tariffs for such a service, some offer to do this completely free of charge, such as 1C: Nulevka. This service will be especially appreciated by individual entrepreneurs who work without an accountant. After all, not only will they not have to spend even a small amount of money for submitting reports without having any income, but they will also not have to delve into what exactly needs to be submitted and when. If you register in the program, it itself will remind you what zero reporting needs to be submitted and will offer to generate the necessary documents. All that is required from the individual entrepreneur is simply to enter your data, IIN, registration address and OKVED code.

After the reports have been generated, they can be sent to recipients directly via the Internet (this service is paid for by all operators, including 1C), or they can be printed and sent to all recipients by mail or delivered in person. In any case, the use of special services significantly saves time and can help not only an individual entrepreneur, but also an experienced accountant who manages several companies and entrepreneurs, some of whom need to pass the “zero” mark. After all, in this case they also will not have to monitor the deadlines of all reports, and also spend extra effort on filling out forms on their own. The service allows you to do this in literally three clicks.