Material aid. What it is?

There is no strict definition of the concept of “material assistance” by law. In general, we can say that material assistance represents some additional payments in cash or in kind to an employee due to his financial difficulties or certain life circumstances.

Since the necessity and obligation of such payments is not fixed anywhere at the legislative level, the employer decides independently whether he has the opportunity and desire to exercise this right. Cases in which an employee can count on financial assistance, its size and frequency of payments are reflected in the labor or collective agreement.

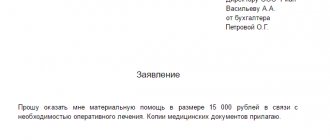

Financial assistance is provided to the employee on the basis of a written order from the director of the organization, in which the amount of payments should be clearly stated in order to avoid future misunderstandings with the tax authorities when checking the correctness of tax calculations.

The company provided financial assistance of less than 4,000 rubles

The company provided financial assistance to employees during the quarter. Each employee received less than 4,000 rubles for six months.

Payments that are only partially exempt from personal income tax must be reflected in the calculation. Material assistance is exempt from tax in an amount that does not exceed 4,000 rubles for the tax period (clause 28 of article 217 of the Tax Code of the Russian Federation).

At the same time, if an employee received less than 4,000 rubles in a year, the company does not submit 2-NDFL for him (letter of the Ministry of Finance of Russia dated 05/08/13 No. 03-04-06/16327). This means that assistance within the non-taxable amount may not be reflected in the calculation. If you fill out the payment in the 6-NDFL calculation, the information for the year will not agree with the 2-NDFL certificates (letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11 / [email protected] ).

For example

For the first half of the year, the company paid salaries to 10 employees - 840,000 rubles, and withheld personal income tax - 109,200 rubles. (RUB 840,000 × 13%). In the second quarter, the company provided financial assistance to employees. Total amount of 100,000 rubles. Assistance to each employee amounted to 3,500 rubles. Therefore, the company did not reflect this payment in the calculation. The company filled out Section 1 as in sample 58.

If the company issues assistance to the employee again, the income may exceed the non-taxable limit. In the period when this happens, reflect in the calculation the amount of assistance that has been issued since the beginning of the year. In this case, write down a deduction of 4,000 rubles in line 030 of the calculation.

Sample 58. How to fill out the calculation if the company provided financial assistance of less than 4,000 rubles:

Top

General procedure for filling out personal income tax-6

Since 2020, the duties of tax agents include submitting to the tax office once a quarter a calculation of accrued income to employees of the enterprise, withheld personal income tax amounts and transfers to the income tax budget (personal income tax form-6).

This form is compiled according to information from the enterprise’s accounting registers.

The calculation consists of 2 sections:

- "General indicators". This part of the report reflects the total amounts of income accrued to all employees, income tax withholding and transfers. The results are reflected on an accrual basis from the beginning of the year;

- “Dates and amounts of income actually received and personal income tax withheld.” This part reflects when income was received and tax was withheld, when it was transferred to the budget, as well as general indicators of income and tax payments for all employees.

There are differences in the rules for filling out these sections. So, in the first part, information is entered on an accrual basis. The second part reflects only indicators related to the last quarter. Therefore, the indicators in these sections may not match.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Deadlines for submitting reports to the tax office

The deadline for submitting the report for 2020 will be reflected in the table.

| Report period | Submission deadline |

| 1st quarter 2020 | Until April 30, 2020 |

| 6 months 2020 | Until July 31, 2020 |

| 9 months of 2020 | Until October 31, 2020 |

| 12 months of 2020 | Until April 1, 2020 |

As a general rule, if the last day of delivery falls on a non-working day, then it is transferred to the next working day. If possible, do not delay submitting the report.

Financial assistance reflected in the report

The following types of financial assistance paid to employees are required to be reflected in the personal income tax-6 report:

- fully subject to income tax. Such amounts are reflected on line 20 of the report;

- fully or partially non-taxable financial assistance listed in Appendix 2. The amounts of such assistance should be indicated in line 20, and the part not subject to personal income tax - in line 30 of the calculation.

The following types of payments fall under the second paragraph:

| Type of financial assistance | Conditions for non-taxation of payments |

| Help for retiring employees | The annual payment cannot exceed 4,000 rubles |

| Help for the disabled | The annual payment cannot exceed 4,000 rubles |

| Assistance with the birth, adoption of a child, and obtaining custody rights | The annual payment cannot exceed 50,000 rubles. A prerequisite is the issuance of funds no later than 12 months after the occurrence of the event |

When financial assistance is subject to personal income tax

For whatever reason, financial assistance is paid, it is included in the income of the employee from whom personal income tax is withheld (clause 1 of Article 212 of the Tax Code of the Russian Federation). Although, some types of financial assistance are fully or partially exempt from taxation.

Thus, personal income tax is not withheld from any financial assistance with a total amount of no more than 4,000 rubles. per year, employees and former employees who resigned upon retirement due to age or disability (clause 28 of article 217 of the Tax Code of the Russian Federation). An employer can pay financial assistance of any size, but 13% tax will have to be withheld from the amount exceeding the limit.

This rule has exceptions when all financial assistance is not subject to personal income tax:

- payment for treatment of an employee or his spouse, children under 18 years of age, parents, as well as payment for medical services provided to former employees who have retired, provided that financial assistance is provided from the employer’s net profit (clause 10 of article 217 of the Tax Code of the Russian Federation);

- one-time financial assistance related to the death of a family member (spouse, parents, children) of an employee, or a retired former employee, as well as financial assistance to family members of a deceased employee (clause 8 of Article 217 of the Tax Code of the Russian Federation);

- amounts paid to victims of natural disasters, other emergency circumstances, or terrorist attacks in Russia (clauses 8.3 and 8.4 of Article 217 of the Tax Code of the Russian Federation); In particular, financial assistance paid to family members of persons who died under these circumstances is not taxed.

Also, financial assistance up to 50,000 rubles is non-taxable. at the birth (adoption) of a child, made to each of the parents before the baby is one year old (in the first year after adoption) (clause 8 of Article 217 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated July 26, 2017 No. 03-04-06/47541).

When the amount of assistance does not exceed 4,000 rubles

Separately, it is worth noting that when material assistance is exempted from income tax, the leading role is played not by the purpose of the payment, but by its amount. The legislation stipulates that in the case of payment of financial assistance in an amount not exceeding 4,000 rubles per recipient per year, income tax is not withheld from such income.

This could be a gift to an employee for some significant event or anniversary. The cases in which such assistance is provided to employees are determined at the discretion of the employer and are fixed in the local labor regulations of the enterprise, a collective or labor agreement.

But if financial assistance exceeds the threshold established by law, then the employer is obliged to withhold personal income tax from the excess amount.

For example, accountant Ivanova M.P. submitted a written statement to the director of the enterprise, in which she stated a request to provide her with financial assistance due to the need for treatment.

Types and conditions for providing financial assistance

Current legislation does not prohibit an employer from providing financial assistance to its employees (hereinafter referred to as financial assistance). In paragraphs 2.2.2.1 section 2 GOST R 52495-2005, approved. Prospect of the Federal Agency for Technical Regulation and Metrology dated December 30, 2005 No. 532-st, contains a definition of material assistance (hereinafter referred to as financial assistance) as a socio-economic service consisting of providing clients with funds, food, sanitation products, etc. .

Financial assistance is one-time in nature and is paid at the request of the employee based on the order of the manager. It can be related, for example:

- with the birth of a child;

- with the death of an employee or a member of his family;

- with treatment;

- with damage caused by a natural disaster;

- with retirement due to disability or age.

Such payments are not included in wages, as they are not of an incentive or compensatory nature. They are aimed at supporting an employee in a difficult life situation.

Date of payment of assistance, withholding and transfer of tax

All indicators are given for convenience in the table:

| date | Cash payments | Payments in kind | Which line of the report shows |

| Date of receipt of income | Day of payment of funds to the employee | Day of distribution of assistance in kind (products, goods, services) | Page 100 |

| Tax withholding date | Personal income tax should be withheld on the day of payment | Personal income tax is withheld from funds paid for other payments, so the date of its withholding will be the day the income is issued to the employee in cash equivalent | Page 110 |

| Tax payment deadline | No later than the next day after the aid is issued to the employee | No later than the next day after the aid is issued to the employee | Page 120 |

Financial assistance in 6-NDFL: how to reflect, example of filling

Any employer can provide financial support to its employees. But if payments are subject to personal income tax, they must be included in the calculation. To understand how to do this correctly, it is useful to consider the most common cases in accounting practice.

Is financial assistance reflected in 6-NDFL?

Information about material remuneration paid is not always entered into 6-NDFL. The need to reflect assistance in the report is related to the purpose and type of payments. In accounting, there is often a mixture of options - a full reflection of the entire amount, partial or no mention of it.

Types of payments that must be shown in the calculation

According to Article 41 of the Tax Code of the Russian Federation, any material incentive, in fact, increases the employee’s income, which means that personal income tax must be deducted from him.

Partial or over-reflection

At the same time, the legislation exempts financial assistance from taxation:

- in an amount not exceeding 4,000 rubles. The reason for issuing the reward does not matter. But if an employee receives an amount exceeding the limit, personal income tax will need to be withheld from it at a rate of 13%;

- in an amount not exceeding 50,000 rubles (for an employee whose family has a child - in the first year after birth or adoption; each parent is entitled to a tax-free payment). This payment must be a one-time payment.

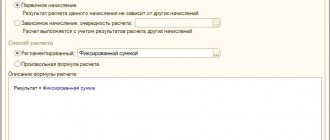

An example of reflecting the amount of financial assistance at the birth of a child in the 1C program: ZUP

What types of financial assistance are not shown in the calculation?

There are several types of material support on which tax is not levied, which means there is no need to reflect these amounts in the calculation. Both the employee himself and his family members can receive assistance. There are many reasons for this - from loss of one’s own health to tragedy in the family. But to receive payments, you must confirm your legal rights.

Table: material payments that are not indicated in 6-NDFL

There are some types of financial assistance that are not taxed, so they do not need to be reflected in the 6-NDFL report

How to enter data on financial assistance in 6-NDFL

All information about financial aid issued, subject to taxation, must be included in the 6-NDFL calculation. The exception is funds accrued but not issued.

In the calculation, there is no need to show non-personal income tax material assistance, which is not named in Appendix No. 2 to the Order of the Federal Tax Service of Russia dated September 10, 2015 No. MMV-7–11 / [email protected]

Indication of the date of actual receipt of funds in the form of financial assistance

To record the correct date of receipt of cash income, you need to look at the Tax Code of the Russian Federation, where the date of its receipt is the day the financial aid is issued. For assistance expressed in kind - the day of direct receipt of income. These dates must be reflected in line 100 of form 6-NDFL.

How to reflect the tax deduction date

The date of tax withholding on material support will be the day the funds are actually issued. If financial assistance is provided in kind, personal income tax is withheld from other income received in cash. In this case, the tax withholding date will be the day the funds are issued. These dates are also reflected in the documents in line 110 of form 6-NDFL.

How to enter information on line 120

Line 120 of form 6-NDFL contains information about the deadline for transferring tax to the budget. Therefore, it indicates the last day on which funds must be transferred from the company’s current accounts. This date is considered to be the working day that follows the day the income was actually issued to the employee.

How to fill out other sections and lines

Reflecting data in other lines of form 6-NDFL has its own characteristics.

What data needs to be entered in section 1

The first section records the entire amount of financial assistance together with personal income tax and separately its non-taxable part. The last lines contain the amount of personal income tax from the financial aid issued.

Information presented in section 2

The second section records all financial assistance issued during the last quarter. If no tax is calculated on it, only the day the assistance was issued and its amount are indicated.

Table: features of filling out when issuing partially non-taxable financial aid

The second section records only the days and data on the amounts of financial assistance received.

Sample of filling out lines for amounts including the amount of calculated personal income tax

In cases requiring personal income tax withholding, the next business day is indicated. Separately, financial assistance is entered along with personal income tax, and in the last line - the amount of tax withheld.

Table: filling out section 2 with personal income tax withholding

Financial assistance issued on the last day of the quarter is reflected in the second section in the next quarter.

An example of full inclusion of financial assistance in 6-NDFL

An employee of Parus LLC, O.P. Suvorov, received an allowance in the amount of 80,000 rubles on the occasion of the birth of a child in the family. Most of the amount, namely 50,000 rubles, is not subject to tax by law.

But taxes will need to be charged on amounts exceeding the limit of 30,000 rubles. Accrual - (80,000 - 50,000) x 13% = 3,900 rubles. Assistance was issued to Suvorov on November 18, 2017.

This option for paying financial assistance is entered into Form 6-NDFL under Section 1 as follows:

- line 010 (bet) - 13;

- line 020 (benefits issued to O.P. Suvorov) - 80,000;

- line 030 (non-taxable share) - 50,000;

- line 040 (personal income tax from the financial assistance of O.P. Suvorov) - 3,900;

- line 070 (amount of tax withheld) - 3,900.

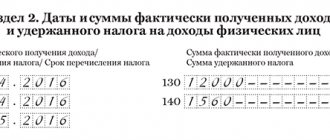

Section 2 of form 6-NDFL will require slightly different filling:

- line 100 (employee O.P. Suvorov’s income was approved) - November 18, 2017;

- line 110 (tax withheld from the benefits of employee O.P. Suvorov) - November 18, 2017;

- line 120 (it is important to transfer the amount no later than this date) - November 19, 2017;

- line 130 (amount of material payments) - 80,000;

- line 140 (tax) - 3,900.

: gratuitous assistance and its reflection in documents

Material payments are the provision of income to an employee, which is in no way affected by the results of his work. It would be wiser to establish the procedure for providing it in a special local act. And if taxes are required to be transferred from payments, it is important to correctly enter the data into the 6-NDFL report.

- Lidiya Ekhontseva

Source: https://ozakone.com/trudovoe-pravo/oplata-truda/materialnaya-pomoshh-v-6-ndfl.html

Reflection of financial assistance for vacation in the report

Often, enterprises have established a procedure for combining annual financial assistance to an employee with vacation pay. This is determined by the organization’s internal regulations governing labor and remuneration issues. When financial assistance is issued simultaneously with vacation pay, then in the 6-NDFL report:

- days of issue, withholding, personal income tax rates will be the same;

- Dates for paying taxes to the budget will vary.

The date of receipt of income for two types will be the day the funds are issued to the employee. The same day will become the date of personal income tax withholding. As for the date of transfer of income tax, they may vary by type of income.

For personal income tax on the amount of vacation pay, the date of transfer of personal income tax will be the last day of the month, and for financial assistance - the day following its issuance. Therefore, in the 6-NDFL report, you need to fill out lines 100-140 in the second section separately for each payment period.

6-NDFL sample 1

Example 2

In 2020, the employer transferred financial assistance to employee Petrov twice: one-time, in connection with the death of his father - 10,000 rubles. (October 16, 2017), and financial assistance for vacation - 5,000 rubles. (01.12.2017).

This material assistance is reflected in 6-NDFL as follows:

- Financial assistance related to the death of a relative, paid in a lump sum, is completely tax-free. This type of deduction is not indicated in the above-mentioned Appendix No. 2 to the order of the Federal Tax Service, therefore the payment to Petrov in the amount of 10,000 rubles. there is no need to reflect it in 6-NDFL.

- The amount of financial assistance for Petrov’s vacation exceeds the permissible limit of non-taxable payment by 1000 rubles. (5000 rub. – 4000 rub.). In Appendix No. 2 to the order of the Federal Tax Service, this type of deduction is indicated under code 503.

Fill out 6-NDFL:

- lines 020 and 130 reflect the amount of “vacation” financial assistance - 5000,

- on line 030 we will show the amount not subject to personal income tax – 4000,

- lines 040, 070 and 140 – 130, the amount of calculated and withheld tax ((5000 rubles – 4000 rubles) x 13%,

- line 100 – 12/01/2017, date of actual receipt of income,

- line 110 – 12/01/2017, personal income tax withholding date,

- line 120 – 12/04/2017, the deadline for transferring personal income tax from financial aid (postponed to the next working day due to it falling on the weekend).

What you need to know about financial assistance

Financial assistance is not only money paid to an employee in order to support him in a difficult life situation or in connection with a special date (anniversary, wedding, death of a close relative).

Also, financial assistance can be provided in the form of work, services or goods (food, personal hygiene products, clothing, etc.). However, the key characteristic of MP is its one-time and one-time nature. That is, the material is not part of the specialist’s salary and does not apply to incentive or compensation payments. The main goal of the MP is to support the citizen in connection with the current circumstances.

Basic rules for filling out the report form

The general rules for filling out the report are standard:

- The report includes data on the amount of accrued wages, personal income tax amounts and deductions

- Marks, corrections, and the use of correction fluid are not allowed.

- The document cannot be printed using duplex printing. Each page is on its own sheet

- If the report is completed manually, then this must be done with a pen with blue or black ink.

- Information in the report is filled in for each OKTMO

- Empty cells in report fields are filled with dashes

Completing section 2

If everything is clear with fields 130-140, the amount of assistance and the tax withheld from it are indicated there, then what dates should be entered in fields 100-120? Let's look at all the fields separately:

- 100 – indicates the day on which financial assistance was received by the employee, regardless of what form it takes;

- 110 – personal income tax is withheld from cash payments on the day of transfer. For financial assistance in the form of products or services, tax is withheld from the next monetary transfer to the employee (but not more than 50% of the amount of income). Moreover, the purpose of the payments does not matter;

- 120 – indicates the day on which the tax must be paid to the treasury by law.

Some employers provide additional payments to annual leave or temporary disability benefits. In 6 personal income tax, such material assistance is shown taking into account certain features.

The dates of income transfer must coincide, as well as the tax withholding date will be the same. Differences arise only when field 120 is filled in.

Attention! The law sets different deadlines for transferring income tax on such payments. For vacation and sick pay, this will be the last day of the month in which the payment was made. For financial assistance – the next day after the funds are transferred to the employee.

Filling examples.

1) Semenov L.I. received financial assistance twice:

- February – 3500 rub.;

- June – 3000 rub.

Although these amounts individually fall within the established non-taxable limit, in total they exceed it by 2,500 rubles (3,500 + 3,000 – 4,000). The tax agent is required to withhold tax from this amount. The first payment will be reflected in the report for the 1st quarter and will not be subject to personal income tax. The half-year report will show the total volume of financial assistance. Personal income tax will be withheld from the amount exceeding the limit.

6 Personal income tax: step-by-step instructions and filling details

Report for the 1st quarter:

Half year report

2) The employee was sent on annual leave in March. The amount of vacation pay amounted to 28,943.50 rubles. The company has an additional payment of 5,000 rubles. The accountant must reflect financial assistance in Form 6 of the personal income tax as follows: