Uniforms for employees - rules for delivery and receipt

A special uniform purchased by an enterprise is its property. In accordance with existing law, the employee undertakes to return

all the uniform in his possession

upon dismissal

. If the working profession does not provide for the gratuitous and unpaid provision of special clothing by the employer, that is, the employee buys and finds it independently and entirely at his own expense, then there is no need to return it.

As a rule, the return of a special uniform is issued in a situation where a worker moves from one enterprise to another or quits altogether. In this case, the form must be submitted individually.

, an entry remains on the issue card, which is issued to the worker.

This fact is displayed as a write-off of special clothing upon dismissal of an employee

and is documented accordingly.

The principle of handing over overalls is not complicated - if the period for wearing a set of uniforms has passed, then the worker has the right to dispose of it as he wants:

- take home;

- exploit further;

- tear into rags.

However, if the wear period for the uniform has not expired, and the person wants to quit, then he will need to return the special uniform to the enterprise by returning it to the warehouse

.

Collective and personal PPE

The service life of personal protective clothing is shorter than that of collective (that is, intended to be worn by more than one person) protective clothing. So, for example, in the laboratory there are several gowns, which employees of the institution must wear when entering the laboratory. In this case, this element of workwear is considered collective

and the norms for its replacement have been greatly increased.

As a rule, the requirements for replacing clothing for performing work are calculated by each individual enterprise independently, taking into account sanitary and hygienic standards.

Thus, clothing is issued and stored in accordance with the law on sanitation and hygiene

, at the same time, a special form may be issued (and, accordingly, surrendered) more often. If this fact is not met, then this is a reason for complaints from employees to higher and controlling organizations.

Important! Both personal and collective items of special uniform are written off in the prescribed manner, and employees must be given a replacement. It is strictly forbidden to begin certain types of work without special uniforms.

Write-off procedure

Write-off of special clothing issued to an employee by the employer occurs only after the cost of the uniform has been justified. Based on its cost, the norms for wearing clothes for work

. But at the same time, they cannot differ for a single day from the legal ones in the direction of longer time; this is contrary to SanPiN and is strictly punished.

If clothing is damaged, completely worn out, or when a worker is fired, the uniform is written off. With this procedure, an act for writing off the workwear

, a sample of which is presented below.

The disposal of special clothing must certainly be documented in the appropriate document, and the norms for receipt are documented in the same way. Analytical accounting is carried out both when an employee leaves, and when moving to another position, and when things are completely worn out.

How is clothing write-off documented?

Registration of the act of write-off of workwear must be carried out officially and documented

. So, write-off of workwear in 1s 8.2 is carried out in a certain way.

The issue of special clothing for use must be documented in a separate document, and it is important that each item issued is taken into account there. It is necessary not only to take into account the full cost of clothing

and each unit issued, but also to create a schedule for issuing new kits.

If an employee resigns, then the workwear is put back on the balance sheet

. It is entered into the program and issued as a separate document. But, if an employee independently purchases a uniform and the employer does not return its cost, the employee should not leave his uniform at the enterprise upon dismissal, since it is not listed on the company’s balance sheet.

When clothing is disposed of upon reference or upon dismissal of a worker, in a document drawn up in the 1C program

, only the number of things is reflected, their cost is not indicated.

Each employee who has received a standard form from the enterprise must return it upon dismissal.

, no matter what form (worn, faded, etc.) it is in.

The standard standards for providing workwear at an enterprise are described in the article.

How to fill out the demand delivery form M11? Read.

) obliges employers to provide free of charge to employees engaged in work:

- with harmful and/or dangerous working conditions;

- in special temperature conditions;

- related to pollution,

workwear, safety footwear and other personal protective equipment (PPE) in order to protect them from adverse factors. Workwear has its own wear period, after which it is written off (if it becomes unsuitable for further use). There may be cases where workwear is written off before the end of its service life. For example, if it has worn out prematurely, was lost, is subject to sale, etc. The decision to write off the workwear is made by the inventory commission. She reflects it in the act for write-off of workwear

.

Providing workers with special clothing

Intersectoral rules for providing workers with PPE were approved by Order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n (hereinafter referred to as Order No. 290n). Based on this document, the employer provides workwear, safety shoes, etc. PPE in accordance with standard standards that establish:

- lists of professions for which special clothing is required;

- types of workwear;

- standards for issuing workwear;

- terms of use (wearing) of workwear.

There are both general standard standards, uniform for all spheres of the economy (for example, approved by the Decree of the Ministry of Labor of Russia dated December 31, 1997 No. 70, Order of the Ministry of Labor of Russia dated December 9, 2014 No. 997n), and standards applied in a specific industry (industry , trade, transport, etc.).

Note!

The employer has the right to establish increased standards for the issuance of workwear, as well as otherwise improve the provision of PPE for employees (for example, reduce the frequency of issuance, replace one type of workwear with another if it protects no worse, etc.). This follows from part 2, and.

The improved procedure for issuing workwear must be enshrined in local regulations based on the results of a special assessment of working conditions. It is usually prescribed in a collective agreement or labor regulations. In this case, the opinion of the trade union, if there is one in the organization, is taken into account. The replacement of workwear provided for by standard industry standards must, in addition, be agreed upon with the regional labor inspectorate.

Remember the three main rules for providing workers with special clothing and other PPE (part 1 and part 3, and):

- the employer purchases workwear at his own expense;

- the employer provides protective clothing to employees free of charge;

- protective clothing (overalls, helmets, gas masks, boots, etc.) must be certified.

An employee has every right not to perform his job duties if the employer has not provided him with appropriate protective equipment. In this case, the latter is obliged to pay for the downtime that arises for this reason (Part 6).

What are the rules for issuing workwear?

The employer must purchase workwear at its own expense and issue it to employees free of charge. This requirement is established in part 3 of article 221 of the Labor Code of the Russian Federation and paragraph 4 of the Rules approved by order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n.

In some cases, workwear can be purchased through contributions to insurance against accidents and occupational diseases.

Overalls, helmets, boots, gas masks and other protective clothing and personal protective equipment must be certified. Therefore, when purchasing them, you need to make sure that they have certificates of conformity. Uncertified personal protective equipment cannot be issued to employees. This follows from part 6 of article 215, part 2 of article 221 of the Labor Code of the Russian Federation and paragraph 8 of the Rules approved by order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n.

If employees are not provided with protective clothing when necessary, they have the right to stop working. In this case, it will not be possible to punish them as part of disciplinary liability. Moreover, the employer is obliged to pay employees for downtime. This is stated in part 6 of article 220 of the Labor Code of the Russian Federation and paragraph 11 of the Rules approved by order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n.

Employees must wear special clothing only during working hours. They have no right to take it outside the workplace. An exception is provided for individual cases when, due to operating conditions, the specified procedure cannot be followed. For example, in logging. Then the overalls can remain with the employee during non-working hours. This is stated in paragraph 27 of the Rules, approved by order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n.

To store workwear, equip special rooms - dressing rooms. Such an indication is in paragraphs 30, 31 of the Rules, approved by order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n.

Issue winter overalls with the onset of cold weather. With the onset of the warm season, it needs to be collected and stored until the next season. At the same time, the standard period for wearing seasonal clothing includes its storage time. You can verify this in paragraph 21 of the Rules, approved by order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n.

For example, this is the procedure provided in Moscow and the Moscow region in electrical production for drivers of electric trolleys during outdoor work in winter. They need to be given an additional jacket with insulation padding. The lifespan of such a jacket is set at 2.5 years. This period includes the time during which the workwear is in storage. Thus, if a jacket was issued to an employee on November 16, 2020, then it must be replaced on May 16, 2020. Such instructions are available in standard industry standards approved by Resolution of the Ministry of Labor of Russia dated December 16, 1997 No. 63, and standard standards approved by Resolution of the Ministry of Labor of Russia dated December 31, 1997 No. 70.

Documentation of the movement of workwear

Accounting for workwear is regulated by Methodological Guidelines approved by Order of the Ministry of Finance of the Russian Federation dated December 26, 2002 No. 135n (hereinafter referred to as Guidelines No. 135n).

- as part of fixed assets or;

- as part of current assets.

If protective equipment is taken into account as a fixed asset, then the following is drawn up:

- when issued to an employee - an act of acceptance and transfer of fixed assets (unified form No. OS-1, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7);

- when written off - an act on the write-off of a fixed asset item (unified form No. OS-4, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7).

If workwear is taken into account as a material, then the following primary documents are used (using the example of unified forms).

| Title of the document | Unified form | |

| number | what document is it approved by? | |

| Upon receipt of workwear at the warehouse and other storage locations | ||

| Receipt order | No. M-4 | |

| When releasing workwear into service from a warehouse and other storage places to departments | ||

| Request-invoice | No. M-11 | Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a |

| Invoice for issue of materials to the side | No. M-15 | |

| Limit fence card | No. M-8 | |

| When issuing workwear to employees and returning it | ||

| Record sheet for the issuance of protective clothing, safety footwear and safety equipment | No. MB-7 | Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a |

| When disposing of workwear as an accounting object | ||

| Act of disposal of low-value and wearable items | No. MB-4 | Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a |

| When writing off workwear as an accounting object | ||

| Act on write-off of low-value and wear-and-tear items | No. MB-8 | Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a |

Do not forget!

Based on Part 4 of Federal Law No. 402-FZ, organizations/individual entrepreneurs have the right to develop their own document forms. It is not necessary to use standardized forms. Or the latter can be modified to suit your needs.

Accounting for workwear in an organization: accounting and tax

If you believe that workwear is issued only to construction workers and factory workers, then take a look at the Standard Standards approved by Order of the Russian Ministry of Labor dated December 09, 2014 No. 997n. Among others, you will see in the list of positions: driver, archivist, computer operator, loader, technician, supply manager, seller of non-food products, which can be in almost any company.

Since the employer is responsible for organizing safe conditions and labor protection, employees must be provided with personal protective equipment. This article will help you organize accounting of workwear in your organization.

The content of the article:

1. Standards for providing workers with special clothing

2. Card for free issue of workwear

3. Postings for accounting of workwear

4. Write-off of workwear in accounting

5. Example

6. Write-off of workwear in tax accounting

7. Accounting for workwear in 1s 8.3

8. Accounting for workwear in an organization using the simplified tax system

9. How to write off workwear that has become unusable

10. Overalls when dismissing an employee

So, let's go in order. If you don't have time to read a long article, watch the short video below, from which you will learn all the most important things about the topic of the article.

(if the video is not clear, there is a gear at the bottom of the video, click it and select 720p Quality)

We will discuss the topic further in the article in more detail than in the video.

Standards for providing workers with special clothing

To whom the employer is obliged to issue special clothing is specified in Articles 212, 221 of the Labor Code of the Russian Federation:

- workers engaged in work with harmful or dangerous working conditions;

- workers engaged in work performed in special temperature conditions or associated with pollution .

The document that regulates the provision of workers with special clothing is the Intersectoral Rules for Providing Workers with Special Clothing, Special Footwear and Other Personal Protective Equipment, approved by Order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n . It establishes requirements for the issuance of personal protective equipment (PPE):

- PPE must undergo certification and declaration of conformity;

- PPE is purchased at the expense of the organization or under a lease agreement for temporary use;

- PPE is issued free of charge according to standard standards and based on the results of a special assessment of working conditions

- An organization, in a local act, can establish its own standards for providing workers with protective clothing that exceed the standard ones, and also replace one type of protective clothing with a similar level of protection.

You can check the standards for providing workers with special clothing for positions available in the staffing table in the following documents :

- Standard standards approved by Order of the Ministry of Labor of Russia dated December 9, 2014 No. 997n - for workers in cross-cutting professions and positions of all types of economic activity;

- Standards for issuing warm work clothes and footwear to employees, approved by Resolution of the Ministry of Labor dated December 31, 1997 No. 70 - according to climatic zones, the same for all sectors of the economy;

- Standard issuance standards approved by Order of the Ministry of Health and Social Development dated April 20, 2006 No. 297 - for certified special high-visibility signal clothing to workers in all sectors of the economy;

- Industry standard standards (for example, in construction, medical, manufacturing activities, banks, housing and communal services, etc.).

- in Section IV of the Report on the special assessment of working conditions (Appendix No. 3 to Order of the Ministry of Labor of Russia dated January 24, 2014 N 33n).

In these documents, for each position and profession, you can find a list of special clothing by type and quantity that should be issued to employees for a year.

The enterprise must approve the list of positions to which special clothing is issued and the issuance standards. This may be an order from the manager or an annex to an employment or collective agreement.

Appendix to the order:

When hiring an employee, the employer must inform the employee about the personal protective equipment they are required to wear. The employee signs that he has read the Rules for Providing Workers with Work Clothing, and the standard standards for issuing PPE corresponding to his profession and position.

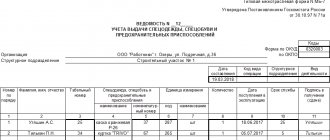

Card for free issue of workwear

When issuing workwear to employees, one should take into account the gender, height and size of the employee, and the nature of his work. To control the standards for the issuance of protective clothing and their service life, a personal record card for the issuance of personal protective equipment for each employee. The form of the card for the free issuance of workwear is approved by the Intersectoral Rules (Order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n).

Intersectoral rules allow maintaining personal cards in paper or electronic form. When filling out a personal registration card for the issuance of PPE in the program, instead of the employee’s signature on receipt, a reference is made to the details of the primary document, which contains the employee’s signature on receipt of PPE (for example, claim invoice M-11).

If PPE is not used by employees all the time, but is required for the duration of certain work, a card for the free issuance of special clothing is issued for them from the island.

documents are usually transferred to the accounting department using standardized forms (approved by Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71a):

- No. MB-2 “Registration card for low-value and wear-and-tear items”;

- No. MB-4 “Act of disposal of low-value and wear-and-tear items” to account for the write-off of workwear that has become unusable;

- No. MB-7 “Registration sheet for the issuance of work clothes, safety shoes and safety devices” - to record the issuance of personal protective equipment to employees for use;

- No. MB-8 “Act for the write-off of low-value and wearable items” - to account for the write-off of worn-out and unsuitable for further use of personal protective equipment.

Organizations themselves can develop similar forms of primary documents for accounting for workwear, taking into account the specifics of the company’s activities and the personal protective equipment issued. For example, an act for writing off workwear may look like this.

Postings for accounting of workwear

Organizations maintain records of protective clothing and other protective equipment in accordance with the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated December 26, 2002 N 135n.

Accounting for workwear in an organization and the accounting account depend on which assets will include PPE. Methodological guidelines propose to take into account special clothing as part of inventories , regardless of the period of use and cost. But the accounting policy can provide for the accounting of work clothes in the organization as part of fixed assets .

Features of accounting and posting for accounting of workwear in the organization in each option are shown in the table.

| Overalls as part of the MPZ | Overalls included in OS | Working clothes for temporary use | |

| Attribution criteria | Regardless of their cost and period of use | The period of use is more than a year and the cost is over 40,000 rubles. (or other established value for recognizing assets as fixed assets) | Receipt of workwear under a rental agreement |

| Workwear accounting account in the organization | 10 “Special equipment and special clothing” | 01 "Fixed assets" | On off-balance sheet account 002 “Inventory assets accepted for safekeeping” |

| Basis (primary documents) | Receipt order f. M-4, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a | Act of acceptance and transfer of OS object f. OS-1, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 N 7 | Transfer and Acceptance Certificate |

| Cost of registration | at actual cost, in the amount of actual costs of acquisition or production | in the assessment provided for in the contract, or in the assessment agreed with their owner | |

| Postings for accounting for the purchase of workwear | Debit 10-10 “Special equipment and special clothing in the warehouse” Credit 60,71,76 – special clothing was capitalized | Debit 08 “Investment in non-current assets” Credit 60,71,76 – personal protective equipment was capitalized Debit 01 “Fixed assets” Credit 08 – personal protective equipment included in fixed assets | Debit 002 “Inventory assets accepted for safekeeping” |

| Normative act | clause 11 of the Methodological guidelines approved by Order of the Ministry of Finance of the Russian Federation dated December 26, 2002 N 135n, Guidelines for the accounting of industrial goods approved by Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n | clause 9 of the Methodological guidelines approved by Order of the Ministry of Finance of Russia dated December 26, 2002 N 135n, PBU 6/01 “Accounting for fixed assets”, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n Letter of the Ministry of Finance of the Russian Federation dated May 12, 2003 No. 16-00 -14/159 | clause 12 of the Guidelines approved by Order of the Ministry of Finance of Russia dated December 26, 2002 N 135n |

Write-off of workwear in accounting

Postings for writing off workwear in accounting will depend on the account in which they were recorded upon receipt.

Option 1. Write-off of workwear recorded as part of the inventory with a period of use of more than 12 months

- the cost of personal protective equipment is written off as expenses linearly over the entire period of use in accordance with clause 26 of the Guidelines

- Debit 10-11 “Special equipment and special clothing in operation” Credit 10-10 “Special equipment and special clothing in warehouse” - special clothing transferred to the employee for temporary use

- Debit 20, 26, 44 Credit 10-11 “Special equipment and special clothing in use” - partial write-off of special clothing in accounting as expenses (monthly during the period of use of PPE)

Option 2. Disposal of workwear as part of industrial equipment with a service life of less than 12 months

- the cost of workwear is expensed at the time of issue to the employee in accordance with clause 21 of the Methodological Instructions. This rule must be enshrined in the organization’s accounting policies for accounting purposes.

- Debit 20, 26, 44 Credit 10-10 “Special equipment and special clothing in warehouse” - write-off of special clothing in accounting as expenses when transferred to an employee

- Accounting for workwear in an organization that is used by employees and written off as expenses can be carried out on the off-balance sheet account “Workwear in use” (clause 23 of the Guidelines).

Option 3. Write-off of the cost of workwear included in fixed assets

- the cost of workwear is expensed through depreciation

- Debit 20,26,44 Credit 02 “Depreciation of fixed assets” - depreciation is calculated on the cost of workwear on a monthly basis during the period of use

Example

On 12/05/2016, at the service station for car repair mechanic Kozlov, we purchased protective clothing: a protective suit made of mixed fabrics, 1 pc. at a price of RUB 4,500.00, gloves 1 pair for RUB 420.00, safety glasses 1 pc. RUR 6,500.00 each, insulated jacket 1 pc. RUR 5,600 each, insulated trousers 1 pc. for 3800.00 rubles, felt boots for 4800.00 rubles.

The overalls were issued to the employee on December 11, 2016. According to approved standards, the period of use of a suit, gloves, glasses is less than 12 months, an insulated jacket, trousers - 30 months, felt boots - 36 months.

05.12.2016

Debit 10-10 “Special equipment and special clothing in warehouse” Credit 60 – 25,620.00 rub. (4500+420+6500+5600+3800+4800) — Workwear posted to the warehouse

11.12.2016

Debit 26 Credit 10-10 – 11420.00 rub. (4500+420+6500) The cost of the suit, gloves, glasses issued to the mechanic was written off as expenses.

Debit 10-11 “Special equipment and special clothing in use” Credit 10-10 – RUB 14,200.00. (5600+3800+4800) — The employee was given an insulated jacket, insulated trousers, felt boots

31.12.2016

Debit 26 Credit 10-11 “Special equipment and special clothing in use” 446.67 rubles. (5600/30+3800/30+4800/36) - Partial write-off of the cost of workwear, the use of which is more than 12 months.

Write-off of workwear in tax accounting

The cost of personal protective equipment can be written off as expenses that reduce the income tax base. But the write-off of workwear in tax accounting is limited by the standards for the free issuance of PPE: standard or approved by the company based on the results of a special assessment of working conditions. This position was expressed by the Ministry of Finance in Letter No. 03-03-06/1/59763 dated November 25, 2014, and No. 03-03-06/4/8 dated February 16, 2012.

For tax purposes, the reflection of workwear depends on its cost and service life:

- As depreciable property:

- Subject to the following conditions: cost more than 100 thousand rubles, period of use more than 12 months;

- Write-off is carried out by calculating depreciation monthly over the useful life

- Included material costs:

- If the period of use is less than 12 months, the cost of the workwear can be any;

- It is expensed at the time of issue to the employee or evenly over the period of operation if this period extends beyond one reporting period for income tax. This procedure is provided for in paragraphs. 3 p. 1 art. 254 Tax Code of the Russian Federation. The option that the organization uses is fixed in the accounting policy for tax purposes.

Accounting for workwear in 1s 8.3

In the 1C program: Accounting 8th edition. 3.0, you can also organize accounting for the receipt, issue and write-off of workwear and other personal protective equipment. For instructions on how to use the program, watch the video.

Accounting for workwear in an organization using the simplified tax system

Accounting for protective clothing on the simplified tax system, as well as on the general system, depends on how protective equipment is taken into account. Since the simplification uses the cash method of recognizing income and expenses, the workwear must be paid for.

If workwear is accounted for as materials, then their cost is included in expenses under the simplified tax system after payment and acceptance for accounting at a time.

When PPE is accepted as the main means, then the accounting of workwear in the organization on the simplified tax system is carried out in accordance with paragraph 3 of Art. 346.16, sec. 4 paragraphs 2 art. 346.17 Tax Code of the Russian Federation. The cost of workwear is included in expenses on the last day of the reporting period in the payment amount.

How to write off workwear that has become unusable

In the event that protective clothing has become unusable and its useful life has not expired, the Guidelines allow for the possibility of writing off such PPE. The decision on the unsuitability of special clothing falls within the competence of the permanent inventory commission (clause 34 of the Guidelines). A commission appointed by order of the head examines the personal protective equipment, determines the reasons for failure, identifies those responsible for damage to the protective clothing, and draws up a write-off report.

that is completely unusable and cannot be restored is subject to write- . The write-off act is transferred to the accounting department. How to write off workwear that has become unusable? The accountant will have to make the following entries:

Debit 94 Credit 10-11 – write-off of workwear that has become unusable at residual value;

According to clause 11 of PBU 10/99, expenses for writing off personal protective equipment that is not suitable for use are included in accounting as part of other expenses in the reporting period to which they relate.

Debit 91-2 Credit 94 - the cost of workwear that has become unusable is reflected in other expenses.

If the commission determines the culprit , then the cost of the protective clothing is attributed to the guilty person (subparagraph “b”, paragraph 28 of the Accounting and Reporting Regulations):

Debit 73 Credit 94 – the cost of workwear is attributed to the guilty person.

Debit 50,51,70 Credit 73 – compensation for damage (deduction from salary) by the culprit.

Debit 91-2 Credit 73 – writing off damage to other expenses if the guilty person is found not guilty by the court.

Overalls when dismissing an employee

The ownership of workwear remains with the organization for the entire period of use. Therefore, when an employee is dismissed or transferred to another position, workwear must be returned to the warehouse. This obligation is provided for in clause 64 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 26, 2002 No. 135n.

The return of workwear in accounting is reflected by the following entries:

- Debit 01 “Fixed assets in warehouse” Credit 01 “Fixed assets in operation” - when accounting for workwear as fixed assets;

- Debit 10-10 Credit 10-11 – at residual value, if workwear included in the inventory is written off evenly over the period of use;

- Accounting entries are not made if the cost of the workwear was written off at a time when issued to the employee. In this case, only quantitative accounting is carried out.

The organization has the right to deduct from the employee’s salary the cost of protective clothing that was not returned upon dismissal or that was lost by the employee. Accounting for the deduction of the cost of workwear upon dismissal of an employee is similar to the procedure discussed in the previous section.

The issuance of workwear to employees does not entail a transfer of ownership, so the employer does not have an object of VAT taxation. Also, the cost of workwear is not recognized by the legislator as employee income, and the cost of the workwear provided is not subject to personal income tax and insurance contributions.

In conclusion, a few words about responsibility. Failure to provide employees with protective equipment may result in a fine of 20 to 30 thousand rubles for officials, and from 130 to 150 thousand rubles for a company (Clause 4 of Article 5.27.1 of the Code of Administrative Offenses of the Russian Federation). Therefore, I ask you not to neglect your responsibility to provide workers with special clothing. And if you have any unanswered questions about accounting for workwear, write in the comments, let's try to find the answer together!

Accounting for workwear in an organization: accounting and tax

Disposal of workwear

Workwear that is no longer owned by an organization (for example, due to loss) or is unsuitable for further use in its activities is subject to write-off (). At the same time, PPE can be written off both after the expiration of the standard wearing period and before its completion.

Note!

The end of the service life is not a basis for writing off workwear. This conclusion follows from. If the PPE is suitable for subsequent use, it is brought into proper condition and issued again to the employee. Only completely unusable and irreparable PPE is written off.

A permanent inventory commission appointed by order of the manager () must determine the unsuitability of protective equipment and make a decision on their write-off. If there is a large amount of work to be done, then working inventory commissions are created.

Before making a decision to write off the commission:

- inspects the workwear, establishes its unsuitability for further use or the possibility (impossibility) and expediency of its restoration;

- determines the reasons for the failure of special clothing;

- identifies persons responsible for the premature failure of protective clothing, makes proposals to management to bring these persons to justice.

Based on the results of the inspection, the commission draws up an act for writing off the workwear

(

sample

below). The company can develop its form independently or take as a basis the standard interindustry form No. MB-8 “Act for write-off of low-value and wear-and-tear items”, approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a.

The commission fills out 2 copies of the act. At the same time, it indicates:

- name of items being written off, their distinctive features, quantity;

- actual cost;

- specified service life;

- date of commissioning;

- reason for write-off;

- other necessary information.

Protective equipment to be disposed of is destroyed (cut, torn, etc.) in the presence of the commission. In addition, written-off workwear can be entered into a warehouse as rags, which can then be used for business purposes or sold. This information also needs to be reflected in the document.

Certificate of write-off of workwear

approved by the manager. Then one copy of the document is transferred to the financially responsible person, the second - to the accounting department, where, on its basis, PPE is written off as accounting objects from off-balance sheet accounts, if, of course, the organization maintains off-balance sheet accounting of workwear ().

Below you can download various versions of the form for the write-off of workwear

in Word and Excel formats. Choose the one that suits you.

Accounting for property at the enterprise, including workwear, is carried out by the accounting department. This happens in accordance with Order of the Ministry of Finance of the Russian Federation dated December 26, 2002 N 135n “On approval of the Guidelines for accounting of special tools, special devices, special equipment and special clothing,” as well as other regulations that regulate the accounting of property in an organization. that are not subject to further use are written off. The procedure for conducting an inventory is determined by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 N 49 “On approval of the Guidelines for the inventory of property and financial obligations.”

Step 1. Create a commission

The manager forms an inventory commission. The commission does not include materially responsible persons who report to the assets subject to inventory.

Step 2: Identifying property that is out of order

The inventory commission examines the clothing and determines its suitability or unsuitability for further use. Items that have expired or cannot be repaired are confiscated. The reasons for the failure of clothing and the persons responsible for this are also identified (if the property was damaged due to someone’s negligence or intentionally). The chairman of the commission prepares a written write-off act.

Step 3: Issue an order

Based on the act, the director of the company issues an order to write off workwear and personal protective equipment.

Step 4: Write off the property

After the manager issues the order, PPE is written off by the inventory commission.

Accounting for workwear as part of materials

The special clothing included in the materials should be reflected on account 10-10 “Special equipment and special clothing in the warehouse” and account 10-11 “Special equipment and special clothing in operation” (clause 11 of the Methodological guidelines approved by order of the Ministry of Finance of Russia dated December 26 2002 No. 135n). For more information about this, see: How to reflect the receipt of materials in accounting.

Reflect the transfer of workwear for use to employees by posting:

Debit 10-11 Credit 10-10

– uniforms were issued to employees for use.

Having given your employees the special clothing included in the materials, you can issue:

- demand invoice in form No. M-11;

- limit-fence card in form No. M-8;

- invoice for the release of materials to the side according to form No. M-15;

- record sheet for the issuance of special clothing according to form No. MB-7.

All these forms are in the instructions, which were approved by Decree of the State Statistics Committee of Russia dated October 30, 1997 No. 71a. The very procedure for their application is established in paragraphs 19 and 20 of the Methodological Recommendations, approved by Order of the Ministry of Finance of Russia dated December 26, 2002 No. 135n.

Reflect the write-off of the cost of workwear by posting:

Debit 20 (23, 25, 26, 29, 44...) Credit 10-11

– the cost of special clothing has been written off.

If you write off the cost of workwear at a time, then do this posting once. If evenly, then do this posting monthly during the established period of its use. For the first time, such an entry must be made in the month when the overalls were actually issued to the employee. Such rules are established in paragraphs 21 and 26 of the Methodological Recommendations, approved by order of the Ministry of Finance of Russia dated December 26, 2002 No. 135n, and paragraph 13 of the Rules approved by order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n.

When writing off the cost of workwear at a time, organize control over its further use. For example, you can keep a record of working clothes in use. If a shortage is identified, it is necessary to recover damages from the culprit. For information on accounting for such an operation, see How to reflect inventory shortages in accounting and taxation.

Reflect the return of workwear to the warehouse upon dismissal or transfer of an employee to another job by posting:

Debit 10-10 Credit 10-11

– the workwear was returned to the warehouse (at residual value).

Make this posting only if you write off the cost of workwear evenly. If the cost of workwear was written off at a time, the return of workwear to the warehouse is not reflected in accounting.

When writing off workwear after the wear period has expired, draw up a report. No unified form has been established. So develop it yourself. The main thing is that the act contains all the necessary details, in addition, the manager must approve it with an order to the accounting policy. This follows from Article 9 of the Law of December 6, 2011 No. 402-FZ and paragraph 4 of PBU 1/2008.

An example of reflecting in accounting transactions for the acquisition, issue and write-off of workwear

In December 2014, Proizvodstvennaya LLC, in accordance with industry standards, purchased for an employee of the main production: - a jacket with an insulating lining (wearing period - 24 months) worth 2832 rubles. (including VAT – 432 rubles); - canvas suit (wearing period - 12 months) costing 1180 rubles. (including VAT - 180 rubles).

In the same month, the organization issued special clothing to the employee.

The accounting policy of “Master” states that workwear costing no more than 40,000 rubles. taken into account in the composition of materials. At the same time, special clothing, the cost of which is no more than 40,000 rubles. and the period of use of which is no more than 12 months is written off as expenses at a time.

The accountant made the following entries in the accounting:

Debit 10-10 Credit 60 – 3400 rub. (2832 rubles – 432 rubles + 1180 rubles – 180 rubles) – special clothing was purchased;

Debit 19 Credit 60 – 612 rub. (432 rubles + 180 rubles) – VAT is taken into account on the cost of workwear;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 612 rub. – accepted for deduction of VAT on the cost of workwear;

Debit 10-11 Credit 10-10 – 3400 rub. – special clothing was issued to the employee;

Debit 20 Credit 10-11 – 1000 rub. – the cost of the canvas suit has been written off.

The Master's accountant writes off the cost of the jacket evenly over 24 months from the date of issue to the employee. Every month since December 2014, he posts:

Debit 20 Credit 10-11 – 100 rub. (RUB 2,400: 24 months) – the cost of the jacket is included in expenses.

Since the standard period for wearing a canvas suit expired in November 2020, the employee was issued a new set. At the same time, the worn canvas suit was written off on the basis of the act. The lined jacket will be retired in November 2020.

Certificate for write-off of workwear, sample

The act of writing off workwear that has become unusable, a sample of which we have prepared, is considered a strict reporting document. At the moment, it is not unified, but there is a standard inter-industry form No. MB-8 “Act for write-off of low-value and wear-and-tear items”, approved by the Decree of the State Statistics Committee of the Russian Federation dated October 30, 1997. No. 71a, which can be used in its preparation.

PPE and uniforms are written off for various reasons (as a result of wear and tear, accidents, employee dismissal, etc.). Sometimes this occurs earlier than the manufacturer's failure date. In this case, the form of the act does not change.

According to paragraph 2 of Article 9 of the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ, the act must include the following sections:

- position and full name manager, his signature with transcript;

- other sections that can be added if necessary.

Title of the document;

date of compilation;

composition of the commission indicating the names and positions of employees;

information about the recovery of material damage and its amount;

grounds for writing off property;

This document can be used when various equipment and other property are worn out.

Responsibilities of commission members

The commission members must take the following actions:

- Inspect the overalls. During the inspection process, it is necessary to determine whether the protective clothing is suitable for its further use, whether it is possible to restore it in case of unsuitability, and whether such restoration is rational.

- Determine what is the reason for writing off clothes that have become unusable.

- To identify the persons through whose fault the protective clothing became unusable and to bring them to justice.

- Determine whether there is a possibility for further use of any parts of the workwear that are subject to write-off.

- Draw up a write-off act and send it to a senior manager for approval.

- To exercise control over the disposal of written-off workwear or its receipt as recyclable materials for the repair of workwear and for rags.

An example of an act of writing off workwear that has become unusable

Norfolk LLC

Act No. 21

For write-off of special protective clothing

Novosibirsk 09/16/2018

The commission (the commission includes a labor protection engineer, a workshop manager or foreman, an accountant or other persons approved by order of the enterprise) established that the following special protective clothing is subject to further write-off due to (the reason is indicated).

Below is a list of protective clothing subject to write-off, indicating the name, quantity, cost and date of issue for individual or collective use, service life and date of write-off.

It should be noted that there is no single sample act for writing off workwear; each enterprise can develop its own form of such an act. But, at the same time, this act refers to strict reporting documents and is subject to mandatory storage. It is on its basis that the legality of writing off workwear or other property is established. Quite often, such documents are used in various corruption schemes, so it is necessary to ensure that all the nuances of write-off established by law are observed.

Order to write off special clothing, sample

The act is submitted for approval to the head of the enterprise, who, after familiarizing himself with it, issues an appropriate order.

Order for decommissioning of workwear, sample 2019

Based on the order, PPE and overalls are written off. They are then subject to disposal.

An act on the write-off of protective clothing at an enterprise is a document that may be required when registering the fact of disposal (destruction) of clothing intended for the personal protection of workers after it has lost its protective functions. A sample act for writing off workwear can be viewed below and downloaded.

Definition, legislation and general procedure

In accordance with Art. 221 of the Labor Code of the Russian Federation, the employer is obliged to provide workers engaged in hazardous work with personal protective equipment, including special clothing. Thus, it is the employer who issues PPE and protective clothing to the employee. Accounting and write-off of workwear (2018) is carried out according to the rules established by the Methodological Instructions approved by Order of the Ministry of Finance No. 135-n of 2002.

The issuance and return of special clothing is documented in an accounting card intended for this purpose, which, however, is not a primary accounting document, and therefore does not have a strictly defined form. The following are used as accounting records (depending on whether clothing is taken into account as a fixed or working asset) when issuing:

- OS acceptance certificate,

- issue record sheet.

In both cases, if the clothing has worn out and lost its ability to protect a person, a document is drawn up according to the rules established in the Methodological Instructions. But first, an inventory is carried out, since this is a necessary condition for recognizing any property of an enterprise as unsuitable for use. The inventory is carried out in accordance with the requirements of Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 N 49 “On approval of the Guidelines for the inventory of property and financial obligations.” A sample act on the write-off of workwear that has become unusable can be downloaded at the end of the article.

Step by step order

Each manufacturer sets an expiration date for the product. And even if the items of workwear are preserved in almost perfect condition at the end of this period, they must be written off in accordance with the above regulations. Thus, their service life is determined by their expiration date.

Algorithm of actions:

- Publish by a permanent commission. If there is a lot of work to be done, working inventory commissions are created, which do not include persons financially responsible for accounting for the values being inspected;

- Determine the quality of inventory items during the inventory process, establish whether things can be used, what are the reasons for the unsuitability of clothing and who is to blame for this (if there are culprits). It is recommended that they be held accountable.

- Based on the results, draw up a written report and send it to the manager.

Then the manager issues an order about the items to be written off. A sample write-off order is presented below.

After this you need:

- destroy valuables (indicate their future fate - for example, they can be capitalized as rags);

- write off the items specified in the documents.

Document details

The sample can be developed independently, using the option proposed by the legislator.

Required details:

- the name of the items that are written off, their characteristics and qualities, quantity;

- actual cost of production;

- service life established by the manufacturer;

- date of commissioning;

- the reason for unsuitability, as a result of which the items are written off;

- other important information.

The sample order for the write-off of workwear for 2020 is no different from the standard document; no changes have been made to the regulatory documents this year.

Providing workers whose work is dangerous or harmful with special clothing is, in accordance with the law, the responsibility of the employer. An employee who is entitled to special clothing, if the employer refuses to provide it, may legally not perform his job duties. At the same time, the employer, in accordance with regulations in the field of regulation of wages, must pay for such forced downtime. The amount of payment for downtime due to a lack of protective clothing cannot be less than 2/3 of the worker’s average earnings. Violation of the law in this direction entails an administrative fine for the employer, and in the event of an accident at the workplace for such a reason, criminal liability.

Since workwear is available at almost every manufacturing enterprise, the accountant often has questions related to accounting for its receipt, issue and write-off. In this article we will look at how work clothes are written off in accounting, what transactions and documents are required for this.

Including workwear in the organization's costs

This procedure is processed in a linear manner. In accounting, the deduction of expenses for workwear is displayed in the debit of funds spent. The company's expenses for repairs or, for example, for the care of work clothes are included in the expenses incurred according to the cost elements.

| Debit | Credit | Sum | Operation | Document |

| 20.01 | 10..1 | Without VAT | Write-off to main production | Write-off act |

| 10..1 | Without VAT | Write-off to auxiliary production | Write-off act |

Providing special clothing for workers

The employer is obliged to provide special clothing, footwear and personal protective equipment to the employee if the professional activity:

- is harmful or dangerous;

- takes place in polluted, severe temperature conditions;

- aimed at eliminating the consequences of natural disasters.

This obligation is recorded in the Labor Code of the Russian Federation and in the Law on Labor Protection. Workwear is purchased with the organization's money, so it belongs to it, and is given to the worker for use. There is no charge for use. Therefore, when a worker quits or is transferred to another place, the workwear he previously received must be returned.

Working clothes are issued according to standards, but in certain cases it is possible to replace one type with another. The main requirement is that the replacement must not reduce worker protection. For example, cotton clothes can be replaced with canvas ones.

What applies to workwear?

Special clothing includes items that are used to protect workers from harmful working conditions. It can be:

- spacesuits;

- special suits;

- vests;

- capes;

- overalls;

- gloves, etc.

In addition to the obligation to provide the worker with personal protective equipment, the employer has the obligation to store, wash, disinfect and repair them.

The list and standards for issuing special clothing are established by law. These norms may be slightly changed by the employer, subject to mandatory agreement with the trade union. Changes to standards are permissible provided that the quality of workwear available at the enterprise is higher than that provided for by standard standards. By agreement with the labor safety inspectorate, it is possible to replace one type of workwear with another. For example, a jumpsuit can be replaced with a robe made of the same fabric.

All protective clothing issued to workers must match their size, height, and working conditions. In addition, it is necessary to take into account the need for certificates for it.

The procedure for issuing workwear

When issuing special clothing, it is necessary to take into account the gender, height and size of the employee. The organization must keep records of workwear, comply with issuance standards, and service life. The day the employee receives the uniform is considered the actual issue and is recorded in a special card, which can be filled out electronically. In addition, there is a list of personal protective equipment that can be issued indicating the wear period “until worn out.” Such personal protection includes:

- balaclava and helmet, helmet;

- headphones and earplugs;

- gloves or mittens to protect against vibration;

- signal vests;

- dielectric shoes, mat or gloves;

- respiratory protection products.

Such protective equipment must be issued with an appropriate labor assessment, also for one-time work for temporary use or as disposable ones (earplugs).

Winter PPE is issued with the onset of the season. To maintain high-quality records of workwear, it is necessary to accept it from the employee at the end of the winter period. In this case, storage is included in the total service life.

Documentation of the movement of workwear

| Operation | Document |

| Issue | Personal clothing registration card. This document is not a primary document, since it does not contain the signature of the employee who issued the workwear |

| Movement | IBP registration card |

| Disposal | Certificate of disposal of IBP |

| Issue | Record sheet for the issuance of protective clothing, safety footwear and safety equipment |

| Write-off | Certificate of write-off of IBP |

Features of write-off of workwear

The procedure for writing off workwear in accounting depends on whether it is classified as inventory or included in fixed assets. As a rule, workwear at an enterprise is included in production inventories. But, if its cost is more than 40,000 rubles, and its service life is more than 1 year, then it can be taken into account as a fixed asset. The criteria for classifying workwear as items or means of labor must be recorded in the accounting policy of the enterprise.

Workwear can be written off as follows:

- linear method according to the useful life (if it exceeds a year);

- immediately upon commissioning (if it is less than a year).

In many organizations, employees are given clothing that is not designed to prevent the adverse effects of the environment on them. It only indicates that the employee belongs to this company or is created in order to comply with the corporate style. Such clothing does not belong to workwear, and its accounting is different.

How to keep records of workwear

The issue and return of protective clothing should be reflected in your personal personal protective equipment issuance card (clause 13 of the Rules approved by order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n).

Depending on the standard period for wearing workwear, you can:

- take it into account as part of materials or as part of fixed assets (letter of the Ministry of Finance of Russia dated May 12, 2003 No. 16-00-14/159);

- write off the cost of workwear included in the materials at a time or evenly over the period of use.

Possible options for accounting for workwear are presented in the table. Fix the chosen option for accounting for workwear in the organization’s accounting policy for accounting purposes.

Advice: If possible, establish a uniform procedure for accounting and tax accounting of workwear. In this case, you will not have temporary differences and deferred tax assets.

In the accounting policy for accounting purposes, write down: “Workwear with a useful life of more than 12 months and a cost of more than 40,000 rubles. accounted for as part of fixed assets. Its cost is repaid by calculating depreciation using the straight-line method. The rest of the workwear is taken into account in the composition of materials. At the same time, workwear whose useful life does not exceed 12 months is written off at a time at the time of its transfer to employees.”

As a result, temporary differences can arise only for workwear with a useful life of more than 12 months and a cost of no more than 40,000 rubles. After all, in tax accounting, an organization has the right to independently determine the procedure for writing off workwear. For example, at a time or evenly over several reporting periods as clothing is issued to employees (subclause 3, clause 1, article 254 of the Tax Code of the Russian Federation).

If you write off workwear in tax accounting as a lump sum, then reflect such expenses in your accounting evenly over the period of use of the workwear.

Reflect the deferred tax liability calculated from the temporary difference by posting:

Debit 68 subaccount “Calculations for income tax” Credit 77

– a deferred tax liability is reflected for the difference in the cost of workwear with a useful life of more than 12 months and a cost of no more than 40,000 rubles.

Every month, as the cost of workwear is written off in accounting, make the following entries:

Debit 77 Credit 68 subaccount “Calculations for income tax”

– the deferred tax liability was repaid from the difference in the cost of workwear with a useful life of more than 12 months and a cost of no more than 40,000 rubles.

Standards for writing off workwear

The legislation establishes standard standards for the issuance of protective clothing. For some sectors of the national economy, for example, the electric power industry, separate limits for the issuance of workwear have been developed.

The employer, on his own initiative, may deviate from the established limit in the following direction:

- reducing the service life of workwear. The rules establish the maximum service life of workwear. It cannot be increased, but it can be reduced;

- replacement of one type of workwear with another, subject to the need for such an action being agreed upon in writing by the labor safety inspectorate;

- issuing special clothing to those employees for whom it is not provided for by law, subject to an assessment of working conditions and agreement with the trade union.

It is impossible to reduce the write-off standards for workwear. If an employee is legally entitled to two pairs of scrubs per year, then one cannot be issued. This will lead to an administrative fine; in case of repeated violation, it may cause the enterprise to be stopped for up to 3 months.

Thus, if an employer sets its own standards for writing off workwear, then they should increase the protection of the employee and increase his provision of protective equipment, but not vice versa.

Write-off of workwear in accounting

At an enterprise, workwear can be classified as both fixed assets and inventories (see →). Therefore, its write-off will be reflected in the accounting accounts differently.

When workwear is classified as inventory, the write-off is reflected as follows:

| Account correspondence | Contents of operation | Note | |

| Debit | Credit | ||

| 20 (23,25,26,29,44) | Cost written off | When workwear is written off at a time, the posting is made once in the month it was issued to the worker. When writing off cost using the straight-line method, the posting is repeated monthly. | |

| 20 (23,25,26,29,44) | The cost is written off by depreciation | When workwear is listed among fixed assets | |

| 02 | 01 | The cost of workwear is written off | When disposing of workwear, when it is listed as a fixed asset |

When writing off the cost of workwear at once, you should monitor its further use using a special statement. If a shortage is discovered, the culprit must compensate for the damage.

Workwear whose service life has expired must be written off by an act. This document can be drawn up in any form if the necessary details are preserved. Its form must be approved by the head of the enterprise in an order to the accounting policy.

Example #1. Accounting for workwear in an organization: postings

The company purchased, as workwear, a jacket with a service life of 2 years for 3,600 rubles (including VAT - 550 rubles) and a cotton suit with a service life of 1 year at a price of 1,000 rubles (including VAT - 153 rubles).

This kit was immediately issued to the employee. The accounting policy of the enterprise states that items worth up to 40,000 rubles are classified as production inventories, and the cost of items whose service life is less than a year can be written off immediately as production costs.

Reflection of the movement of workwear by an accountant:

- Dt 10 Kt60 = 3897 (for the cost of purchased workwear without VAT)

- Dt 19 Kt 60 = 703 (input VAT)

- Dt 68 Kt 19 = 703 (for VAT subject to deduction)

- Dt 10/11 Kt 10/10 = 3897 (when supplying workwear to an employee)

- Dt 20 Kt 10/1 = 847 (for the cost of the suit)

- Dt 20 Kt 10/1 = 127 (the cost of the jacket is written off monthly for 24 months)

Since the overalls have a service life of 1 year, its cost is written off immediately when issued to the worker. The jacket has been used for more than one year, but since its cost did not exceed 40,000 rubles, it is listed as inventory and written off in equal shares over the course of its service.

Example #2. Write-off of workwear (helmets) in accounting

The worker was given a helmet from the warehouse (lifespan 24 months, price 1500 rubles), overalls (lifespan 12 months, price 1300 rubles) and 2 pairs of gloves (lifespan 3 months, unit price 100 rubles).

The following entries need to be made in accounting:

- Dt 10 “Working clothes in operation” Kt 10 “Working clothes in warehouse” = 3000

- Dt 20 kt 10 = 1500 (cost of overalls and gloves included in costs)

- Dt 20 kt 10 = 62.5 (every month for two years in equal shares of the cost of the helmet)

The procedure for writing off workwear included in fixed assets is different. The primary document for processing such operations is.

The write-off in this case is reflected by the following entry:

Debit 02 Credit 01 – work clothes written off

Return from service

Sometimes in practice there are cases when workwear needs to be returned from use. There can be many reasons for this phenomenon, for example, dismissal, sick leave, business trip or transfer of an employee.

A document for the return of their use can be created based on the transfer of materials into operation.

In this case, just like in the previous example, you just need to indicate the quantity. The image below shows an example of the return of one pair of wellington boots.

After posting the document, we see that one pair worth 150 rubles has been written off from account MTs.02. The boots accounting account has changed from 10.11.1 (in service) to 10.10 (in warehouse).