According to the Labor Code of the Russian Federation, every employee has the right to paid rest. The duration of such vacation should not be less than 28 days per year, and for some categories of persons the duration of vacation may be increased. The procedure for registering leave and calculating benefits often raises questions among specialists. We will look in detail at how to correctly post and accrue vacation pay in this article.

Accrued vacation postings

Legal basis

According to the Labor Code, payment of vacation pay must be made three days before the start date of the period. Failure to comply with this obligation will result in a fine for the employer. If for a certain reason the accounting department did not timely accrue benefits, then compensation should be accrued to the employee along with the total amount. This state of affairs is regulated by Article 136. TK. According to the document, payment can be made in two ways:

- by transfer to the employee’s card;

- personal withdrawal of money at the cash register.

The Labor Code states that vacation pay payments are made three days before the start date of the period

The first option is preferable for the employer, as it minimizes the costs of conducting and servicing cash transactions. Moreover, even with non-cash payments, all documents in the accounting department must be drawn up correctly, indicating the cash order posting number and the documentary basis for this.

When hired for a job, an employee opens a bank account and provides the accounting department with details. All payments (including vacation pay) are made to the employee’s single account.

Registration of vacation: accounting and taxation procedures

The Labor Code of the Russian Federation (LC RF) provides for the need to consolidate the order of vacations in the vacation schedule. According to Article 123 of the Labor Code of the Russian Federation, a vacation schedule must be drawn up in all organizations, regardless of the form of ownership, no later than two weeks before the start of the new calendar year. Thus, already on December 16 of each year, the HR department must collect information from employees about the time they are granted vacations. The vacation schedule can be of any form, since the legislation does not contain any requirements for its preparation. The employer must notify the employee of the start time of his vacation no later than two weeks before it begins. Based on the vacation schedule, the manager issues an appropriate order. The employee himself no longer needs to submit an application requesting leave.

When employees go on vacation, an Order (instruction) on granting leave to the employee (Form No. T-6) and a Calculation Note on granting leave to the employee (Form No. T-60) must be drawn up. The forms of these documents are approved by Resolution of the State Statistics Committee of Russia dated 04/06/2001 N 26 “On approval of unified forms of primary accounting documentation for recording labor and its payment.”

Form N T-6 is drawn up by an employee of the personnel department (personnel service) or an authorized person, and then signed by the head of the organization (or his authorized person, who may be the chief accountant).

The future vacationer must be familiar with the signed order and leave his signature on it. Only after this, the HR employee has the right to fill out a Calculation Note on granting leave to the employee (Form N T-60).

The order and note-calculation are transferred to the organization’s accounting department to calculate the average earnings for the vacation.

Based on the order (Form N T-6), entries are made in the employee’s personal card (Form N T-2 or N T-2 GS) (this must be done by an employee of the HR department), as well as in the personal account (Form N T-54 or N T-54a) (this operation is performed by an accountant).

Leave can be granted to an employee in accordance with current legislation, a collective agreement, local regulations of the organization, an employment agreement (contract) (including annual paid, without pay, educational, etc.).

The main requirement of the Labor Code of the Russian Federation is that the employee must have a vacation of at least 28 calendar days. Replacement of this leave with monetary compensation is prohibited, except in cases of dismissal. According to Article 115 of the Labor Code of the Russian Federation, it is allowed to provide an employee with leave for a period of more than 28 calendar days (extended main leave), for example, in cases where the employee did not complete his vacation for the previous pay period. It is also possible that an employee is granted extended leave on account of future billing periods.

Based on the application, the employee can be paid monetary compensation for all unused vacation days. This rule also applies to extended vacations.

Transferring vacation to another time is allowed only in exceptional cases, since the Labor Code of the Russian Federation stipulates that the employer is obliged to provide vacation, and the employee is obliged to take time off. And if the employee’s schedule includes vacation, the employer does not have the right to allow the vacationer to work. The transfer of leave is formalized by an order from the manager, which indicates the basis for the transfer of leave and the period for which the leave is transferred. In any case, the employee must take vacation no later than 12 months after the end of the working year for which it is granted (Article 124 of the Labor Code of the Russian Federation). Failure to provide annual leave for two consecutive years is not permitted.

According to Article 125 of the Labor Code of the Russian Federation, by agreement between the employee and the employer, annual paid leave can be divided into parts. Moreover, at least one part of this leave must be at least 14 calendar days.

If an employee who has not fully worked the pay period goes on vacation, his daily earnings are determined by dividing the amount of accrued wages in the pay period by the number of calendar days per hour worked.

For employees who did not work part of the time due to absenteeism or other reasons, the calculation period for calculating average earnings will be 12 calendar months (from the 1st to the 1st) preceding the vacation. If such an employee has not worked for the organization for 12 calendar months, only the full months (from the 1st to the 1st) worked before going on vacation will be included in the calculation period. If an employee in the billing period, before the billing period and before the onset of vacation did not have days worked or earnings in this organization, the average earnings are determined from the tariff rate of the category assigned to him, official salary, and monetary remuneration.

If the employee did not have days worked or earnings in this organization in the billing period and before the billing period, the average earnings are determined based on the amount of accrued wages and monetary remuneration for the days actually worked before the vacation.

Example. At the enterprise, an employee engaged in the main production goes on partial leave for a period of 14 calendar days. The calculation period for vacation pay is three calendar months. The employee has not fully worked out the pay period. In February, the employee was on leave without pay for 10 days. Salary for January - 15,000 rubles, for February - 10,500 rubles, for March - 15,000 rubles. The employee’s salary for the billing period preceding the employee’s departure on vacation will be 40,500 rubles. (RUB 15,000 + RUB 10,500 + RUB 15,000). To determine the amount of average daily earnings, the specified amount of wages for the billing period must be divided by the average monthly number of calendar days (29.6) in January and March and the number of calendar days in February (18 days) attributable to unworked time.

The average daily earnings will be 524.61 rubles. (40,500 / (29.6 + 29.6 + 18)), the amount of vacation pay is 7344.54 rubles. (RUB 524.61 x 14 days).

According to clause 5 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, expenses for paying annual leave are expenses for the organization for ordinary activities. In accordance with clause 1 of Article 226 of the Tax Code of the Russian Federation, the organization from which the employee received income is obliged to calculate, withhold and pay to the budget the amount of personal income tax. Calculation of personal income tax on income in the form of vacation pay is carried out at a tax rate of 13%. The accrued amount of tax must be withheld from the employee’s income upon actual payment and transferred no later than the day of actual receipt of cash from the bank for the payment of vacation pay.

The transfer of amounts calculated for withholding of personal income tax on average wages in accordance with clause 6 of Article 226 of Chapter 23 of the Tax Code of the Russian Federation must be made no later than the day of actual receipt of cash for wages for the second half of the month. At the same time, on average earnings accrued during the month, payment of this tax must also be made no later than the day of actual receipt of funds for the payment of income for the past month in which vacation pay was accrued and paid. There is no need to pay tax on the days of payment of average earnings for vacation. The amounts of the single social tax in all cases (including from the amounts of average earnings for vacation and in other established cases) in accordance with clause 3 of Article 243 of Chapter 24 of the Tax Code of the Russian Federation must be paid no later than the 15th day of the next month, regardless of dates of actual payment of wages or receipt of funds for wages at a bank institution.

The following entries are made in accounting:

Debit 20, Credit 70 - the amount of vacation pay has been accrued (RUB 7,344.54);

Debit 70, Credit 68 - personal income tax withheld (7344.54 x 13% = 955 rubles);

Debit 70, Credit 50 - vacation pay issued (7344.54 - 955 = 6398.54 rubles);

Debit 20, Credit 69-1-1 - UST accrued (FSS, 4% x 7344.54 = 293.78 rubles);

Debit 20, Credit 69-1-2 - UST accrued (compulsory social insurance against accidents, 0.2% x 7344.54 = 14.69 rubles);

Debit 20, Credit 69-2-1 - UST accrued (federal budget, 28% x 7344.54 = 2056.47 rubles);

Debit 20, Credit 69-3-1 - UST accrued (MHIF, 0.2% x 7344.54 = 14.69 rubles);

Debit 20, Credit 69-3-2 - UST accrued (TFIF, 3.4% x 7344.54 = 249.71 rubles);

Debit 69-2-1, Credit 69-2-2 - the amount of UST in the part payable to the federal budget is reduced by the amount of insurance contributions to finance the insurance part of the labor pension (7344.54 x 11% = 807.90 rubles) ;

Debit 69-2-1, Credit 69-2-3 - the amount of UST in the part payable to the federal budget is reduced by the amount of insurance contributions to finance the funded part of the labor pension (7344.54 x 3% = 220.34 rubles) .

When recalling an employee from vacation, the amount of average earnings for the vacation days used should be recalculated, and the difference between earnings for all vacation days provided and the days actually used should be withheld from the employee. If, in agreement with the employer, the employee requests payment of compensation for the remaining unused vacation days in excess of 28 calendar days, the average earnings are not recalculated.

Example. An employee of the organization was granted annual leave of 28 calendar days from May 1 to May 28, 2003. By agreement with the employee, due to production needs, he was called back from vacation on May 22, 2003.

The amount of average vacation earnings paid to an employee was 8,960 rubles. based on average daily earnings of 320 rubles. (320 rubles x 28 calendar days of vacation = 8960 rubles).

In total, the employee did not use 7 calendar days of vacation from May 22 to May 28 inclusive and used 21 calendar days (from May 1 to May 21 inclusive). The amount of average earnings for actually used vacation days was 6,720 rubles. (21 calendar days x 320 rubles).

Let’s say that for the period from May 23 to May 31, an employee was accrued wages based on the tariff rate, bonuses, additional payments and allowances in the amount of 5,200 rubles. It is due for payment minus the amount of average earnings for unused vacation days in the amount of 2,240 rubles. (7 unused calendar days of vacation x 320 rubles).

When providing unused vacation days in the future, the average earnings are calculated anew according to the new billing period and the payments taken into account in it.

According to clause 7 of Article 255 of the Tax Code of the Russian Federation, for profit tax purposes, expenses for wages retained by employees during vacation are included in the expenses taken into account when calculating the tax base for income tax. Based on clause 1 of Article 210 of the Tax Code of the Russian Federation, the amount of vacation pay received by an employee is included in the tax base for personal income tax. In accordance with clause 1 of Article 236 of the Tax Code of the Russian Federation, the accrued amount of vacation pay is recognized by the employing organization as subject to the unified social tax.

Article 136 of the Labor Code of the Russian Federation establishes that payment for vacation must be made no later than three days before its start.

The most common payments related to employee vacations are vacation pay or wages during vacation and compensation for unused vacation. All specified payments are calculated based on average monthly earnings. The general rules for calculating average monthly earnings are established in Article 139 of the Labor Code of the Russian Federation.

From the estimated time in accordance with the Regulations on the specifics of calculating average wages, approved by Decree of the Government of the Russian Federation of April 11, 2003 N 213, the following are excluded:

holidays and non-working days established by the legislation of the Russian Federation;

days not worked by the employee for which average earnings were paid or retained in accordance with the legislation of the Russian Federation;

days of incapacity for work for which the employee received temporary disability benefits or maternity benefits;

additional paid days off provided to an employee raising a disabled child (Article 262 of the Labor Code of the Russian Federation);

days of vacation without pay on the basis of Articles 128 and 263 of the Labor Code of the Russian Federation;

downtime not due to the fault of the employee, including due to the suspension of the activities of the organization, workshop, or production;

downtime due to a strike in which the employee did not participate, but was not able to perform his work.

O. Stulova

COSMOS-AUDIT LLC

Example of calculating vacation pay

To correctly calculate vacation pay, the accountant calculates the employee’s average daily earnings. The resulting value is multiplied by the duration of rest. Holidays also include weekends. When a public holiday falls during a vacation period, the total duration is increased by the number of such days.

Calculation of the number of days

This also applies to the period of temporary incapacity for work if the LN was issued during vacation. An employee, while on sick leave, must notify the person in charge of the company (or his manager) about the start of the sick leave. Then the subject responsible for filling out the work time sheet makes the appropriate notes in the document.

In order to correctly calculate vacation pay, the accountant excludes from the calculation all payments for travel allowances, additional benefits, bonuses, important assignments, etc. That is, the calculation takes only wages and calculates the average value.

Vacation pay is calculated based on the correct calculation of the number of days

It should also be taken into account that vacation pay is calculated based on average accrued earnings. In a situation where an employee receives their basic salary unofficially, “in an envelope,” the payment will be made according to the documents that are reflected in the accounting statements and from which personal income tax was withheld. According to the Labor Code, an employee is entitled to 28 days of vacation per year, while the employer cannot refuse to take vacation in one part of less than 14 days.

The remaining days, at the request of the employees and in agreement with management, can be divided into several periods throughout the year. Each time, leave is issued through an Order based on an application. According to this statement, benefits are paid.

Most employees are entitled to 28 days of vacation per year

You can read about the basic rules for filling out an application for leave below.

How to apply for leave

The legislation defines a separate category of persons who are entitled to longer rest. Such persons include:

- doctors;

- teachers;

- employees of the Ministry of Internal Affairs;

- military personnel.

Those who work in the Far North are also entitled to additional rest while maintaining benefits. All these days also go towards calculating the total length of service.

Doctors and some other categories of workers are entitled to longer leave

Accounting

The procedure for reflecting in accounting the amounts of compensation for unused vacation upon dismissal depends on whether the organization is a small business or not.

Situation: in accounting, should the accrual of compensation for unused vacation upon dismissal be written off as a reduction in the reserve for vacation pay? The organization is not a small business entity.

Yes need.

Organizations that are not small businesses are required to create a reserve for vacation pay in accounting, that is, recognize estimated liabilities in the form of vacation pay (subparagraph “a”, clause 2, clause 5 of PBU 8/2010, letter of the Ministry of Finance of Russia dated April 19 2012 No. 07-02-06/110).

Compensation for unused vacation should be accrued against a previously recognized provision (previously created reserve). This is explained as follows.

By creating a reserve for vacation pay, the organization recognizes its future obligations with an indefinite period of fulfillment to employees regarding the payment of vacation pay (subclause 4, 8 of PBU 8/2010). In this case, the liability for each employee is calculated based on the number of vacation days to which he is entitled at the time the reserve is created.

Compensation for unused vacation is also calculated based on the number of vacation days to which the employee is entitled at the time of dismissal (Article 127 of the Labor Code of the Russian Federation). Therefore, the amount of expenses for its payment is taken into account when determining the amount of the estimated liability, that is, when forming a reserve for vacation pay.

Thus, the accrual of compensation to an employee for unused vacation is not recognized as an expense of the current period, but is the fulfillment of a previously recognized estimated liability (clause 21 of PBU 8/2010). Consequently, the amount of the estimated liability for vacation pay (reserve) is reduced by the amount of accrued compensation for unused vacation.

Small businesses may not create a reserve for vacation pay (clause 3 of PBU 8/2010, part 4 of article 6 of the Law of December 6, 2011 No. 402-FZ).

If the organization is a small enterprise and decides not to create a reserve for vacation pay, in accounting, include compensation for unused vacation associated with dismissal as part of the expenses for ordinary activities, namely in labor costs (clause 8 of PBU 10/99 ). Reflect the accrual and payment of compensation for unused vacation associated with dismissal with the following entries:

Debit 20 (23, 25, 26, 29, 44...) Credit 70

– compensation has been accrued for unused vacation related to dismissal;

Debit 70 Credit 50 (51)

– compensation for unused vacation related to dismissal was issued from the cash register (transferred to the employee’s bank account).

Vacation pay calculation scheme

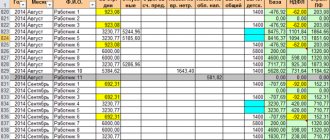

Large enterprises maintain a schedule and record of employee leave, which is compiled for the next calendar year. Such measures are necessary to plan rest for all employees, but without jeopardizing the production process.

Employees notify their direct supervisor of the desire to start and duration of leave. Based on this data, a schedule is drawn up.

Calendar days taken into account when calculating vacation pay

Also, such a schedule helps the accounting department to generate expenses and payment of benefits from the payroll fund in advance. If an employee then declares his desire to take unscheduled leave, then he retains this right. Despite the fact that usually all these situations are agreed upon with management, according to the Labor Code, the employer cannot refuse an employee to take a vacation.

The situation with wage increases deserves special attention. In this case, accounting specialists have a question about how vacation pay should be indexed.

Income tax: accrual method

If the organization uses the accrual method, include the amount of compensation as part of direct or indirect expenses.

If an organization is engaged in the production and sale of products (works, services), determine the list of direct expenses in the accounting policy (clause 1 of Article 318 of the Tax Code of the Russian Federation).

Attention: when approving the list of direct expenses in the accounting policy, remember that dividing expenses into direct and indirect must be economically justified (letter of the Ministry of Finance of Russia dated January 26, 2006 No. 03-03-04/1/60, Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3/2952). Otherwise, tax inspectors may recalculate income taxes.

Thus, compensation accrued to employees directly involved in production should be taken into account as part of direct expenses. Refer to indirect expenses for compensation for unused vacation accrued to the organization's administration.

Compensation that relates to direct expenses should be taken into account when calculating income tax as products are sold, in the cost of which it is taken into account (paragraph 2, paragraph 2, article 318 of the Tax Code of the Russian Federation).

Compensation that relates to indirect expenses should be taken into account when calculating income tax on the last day of the month in which it was accrued (clause 2 of Article 318, clause 4 of Article 272 of the Tax Code of the Russian Federation).

If an organization provides services, then direct costs can be taken into account, as well as indirect ones, at the time of their accrual (paragraph 3, paragraph 2, article 318 of the Tax Code of the Russian Federation).

In trade organizations, compensation for unused vacation is recognized as indirect expenses (paragraph 3 of Article 320 of the Tax Code of the Russian Federation). Therefore, take them into account when calculating income tax in the month in which they were accrued.

An example of how to take into account payment of compensation for unused vacation associated with dismissal. Organization on a general basis (accrual method, does not create a reserve for vacation pay in tax accounting)

LLC "Torgovaya" is engaged in wholesale trade.

Organization manager A.S. Kondratiev resigns on March 11. He is entitled to compensation for unused vacation in the amount of 8,330 rubles.

Kondratiev has no rights to deductions for personal income tax. Personal income tax on compensation amounted to: 8330 rubles. × 13% = 1083 rub.

In March, the Hermes accountant made the following entries:

Debit 96 Credit 70 – 8330 rub. – compensation for unused vacation has been accrued;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 1083 rubles. – personal income tax withheld;

Debit 70 Credit 50 – 7247 rub. (8330 rubles - 1083 rubles) - compensation was paid from the cash register (minus personal income tax).

When calculating income tax for March, the accountant included the entire amount of accrued compensation (RUB 8,330) in current expenses.

Previously, when creating a reserve for vacation pay, a deductible temporary difference and a corresponding deferred tax asset arose in accounting. This happened due to the fact that when creating the reserve, the corresponding expenses were reflected in the accounting, but not in the tax account. When calculating compensation, the opposite situation arises: the amount of compensation is included in expenses in tax accounting, but not in accounting, since it is written off against the reserve. Therefore, the accounting should reflect a partial write-off of the deferred tax asset.

The accountant made the following entry:

Debit 68 Credit 09 – 1666 rub. (RUB 8,330 × 20%) – the deferred tax asset is written off (partially).

An example of how to take into account payment of compensation for unused vacation associated with dismissal. Organization on the general mode (accrual method), refers to small enterprises and does not create a reserve for vacation pay

LLC "Torgovaya" is engaged in wholesale trade.

Organization manager A.S. Kondratiev resigns on March 11. He is entitled to compensation for unused vacation in the amount of 8,330 rubles.

Kondratiev has no rights to deductions for personal income tax. Personal income tax on compensation amounted to: 8330 rubles. × 13% = 1083 rub.

In March, the Hermes accountant made the following entries:

Debit 44 Credit 70 – 8330 rub. – compensation for unused vacation has been accrued;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 1083 rubles. – personal income tax withheld;

Debit 70 Credit 50 – 7247 rub. (8330 rubles - 1083 rubles) - compensation was paid from the cash register (minus personal income tax).

When calculating income tax for March, the accountant included the entire amount of accrued compensation (RUB 8,330) in current expenses.

Salary indexation and accrual of vacation pay

Indexation is a coefficient that is taken into account in calculations. This increase in wages is carried out in order to reduce inflation. The increase in earnings increases by the percentage of inflation and allows the employee not to feel the increase in prices for products and services.

Thanks to indexation, payments are adjusted to inflation and annual price increases

As a rule, indexation is carried out at the beginning of the year and this coefficient should not be confused with a regular salary increase. Indexation is carried out for absolutely all categories of employees, regardless of their length of service, qualifications, or list of job responsibilities.

The enterprise issues an order to carry out such indexation, according to which the accounting department recalculates payments and benefits. Indexation is regulated by Article 134 of the Labor Code of the Russian Federation.

Art. 134 Labor Code of the Russian Federation

By law, indexation at an enterprise is mandatory. Evasion of this rule, untimely implementation or failure to recalculate wages is a direct violation of the law and entails a number of administrative fines.

The salary increase is not mandatory and is carried out at the request of management. This factor depends on the wage fund, the company’s profit, its competitive position in the market, etc.

The procedure for calculating benefits taking into account indexation is prescribed in the Regulation of the Government of the Russian Federation No. 922 dated December 24, 2007.

Decree of the Russian Federation No. 922 of December 24, 2007

According to this resolution, the increase coefficient applies to absolutely all social payments. This document states that at an enterprise where wage indexation has been carried out, vacation payments should also be increased. This ratio applies to all payments made to the employee. The list of such payments includes:

- sick leave;

- vacation pay;

- work outside of school hours, etc.

But the calculation of vacation pay during indexation sometimes raises questions among accountants. How is the accrual made if the promotion was made while the employee was already on vacation?

Sample order for wage indexation

Here you should be guided by a general algorithm. Recalculation is carried out from the day when the indexation order was issued for the enterprise. If the date of the order falls in the middle of the employee’s vacation, then the nearest day of payment of the employee’s salary must be added.

Income tax

When calculating income tax, include compensation in current labor costs (clause 8 of Article 255 of the Tax Code of the Russian Federation). This procedure applies regardless of whether the organization creates a reserve in tax accounting for future expenses for vacation pay (annual remuneration for long service and remuneration at the end of the year) or not. The fact is that it is impossible to write off the amount of compensation for unused vacation upon dismissal from this reserve.

Situation: how to take into account compensation for unused vacation provided under a collective agreement (in excess of that established by law) when calculating income tax?

If the internal documents of the organization provide for the provision of additional vacations to employees (in excess of those established by law), do not take into account the monetary compensation paid in return for such vacations when calculating income tax. The fact is that expenses cannot include the costs of paying for vacations provided on the basis of collective agreements (clause 24 of article 270 of the Tax Code of the Russian Federation, resolution of the Federal Antimonopoly Service of the West Siberian District dated April 11, 2006 No. F04-4099/2005(21317- A27-29)). This means that compensation for such vacations cannot be taken into account when calculating tax. This position is adhered to by the Russian Ministry of Finance in letter dated October 18, 2005 No. 03-03-04/1/284.

Situation: how to reflect when calculating income tax the compensation paid upon dismissal of an employee for vacations not taken by him for two or more years?

Compensation for vacations not taken by an employee for two or more years should be included as expenses when calculating income tax.

This is due to the fact that the organization’s obligation to pay compensation to the resigning employee for all unused vacations is provided for by law (Part 1 of Article 127 of the Labor Code of the Russian Federation). This means that such compensation is included in labor costs (clause 8 of Article 255 of the Tax Code of the Russian Federation). The Ministry of Finance of Russia adheres to the same position in letter dated May 20, 2005 No. 03-03-01-02/2/90.

It should be noted that failure to provide an employee with leave for two consecutive years is prohibited (Part 4 of Article 124 of the Labor Code of the Russian Federation). By doing so, the organization will violate labor laws.

The procedure for reflecting compensation in tax accounting depends on the method of accounting for income and expenses that the organization uses.

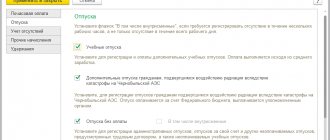

Posting vacation pay in financial statements

It should be said right away that the benefit is reflected in the documents only if the employee is assigned leave with pay.

Features of calculating vacation pay

Posting implies accrual of the amount, and if the leave is issued to the employee at his own expense, then the posting is not made. Despite the fact that, according to the Labor Code, payment of vacation pay is not the same as a regular salary, the algorithm for recording it in financial statements is the same.

Labor Code article on wages

All reporting documentation in the accounting department is maintained according to a single approved standard of Order of the Ministry of Finance No. 94-N dated October 31, 2000.

Order No. 94-N dated October 31, 200

The amount of accrued vacation pay is reflected in credit account 70, and the actual payment is reflected in debit account 70. The 68th debit account must be indicated, which indicates the amount of personal income tax.

Table 1. Registration of entries in the accounting report

| Debit | Credit | Description | Base |

| 96 | 70 | Calculation of benefits | Accrual statement |

| 70 | 68 | Tax withholding | Accrual statement |

| 70 | 50 | Benefit payment | Cash order |

According to the law, an employee can exercise his right to rest after six months of work. In the subsequent period, vacation can be at any time. The only condition remains that one continuous part of it cannot be less than 14 days. If this rule is violated, the company management faces a fine.

The application can be submitted after 6 months

When dismissing an employee, the company is obliged to pay compensation for each day of vacation that was not taken out by the employees. In a situation where the employee, on the contrary, took out a vacation in advance (that is, the calendar period was not fully worked out) and wrote a letter of resignation, the company can withhold the amount paid in the form of vacation pay in advance.

Tax accounting of vacation pay

In tax accounting, the amount of vacation pay is included in labor costs (clause 7 of Article 255 of the Tax Code of the Russian Federation) and is recognized as an expense for profit tax purposes.

In the case of “rolling” vacations from one month to another, according to the Russian Ministry of Finance, the amount of vacation pay should be reflected as follows:

If the company uses OSNO

As part of the expenses of the month in which the vacation falls (Letters of the Ministry of Finance of the Russian Federation dated October 25, 2016 No. 03-03-06/2/62147, dated July 21, 2015 No. 03-03-06/1/41890).

The courts and the Federal Tax Service of the Russian Federation have a different opinion and believe that vacation pay can be recognized as expenses in full in the month in which they were accrued (Resolution of the Federal Antimonopoly Service of the West Siberian District dated December 1, 2008 N F04-7507/2008(16957-A46-15); Resolution of the Federal Antimonopoly Service of the Moscow District dated June 24, 2009 N KA-A40/4219-09).

In 2020, the Federal Tax Service of the Russian Federation issued Letter No. 7-3-04/ [email protected] dated , which also expressed the opinion that the Tax Code of the Russian Federation does not contain rules requiring that vacation pay be taken into account in proportion to the vacation days falling within each reporting period.

Thus, vacation pay is recognized at a time, regardless of the period for which the vacation falls, and is included in expenses in the amount of accrued amounts (clause 4 of Article 272 of the Tax Code of the Russian Federation) when calculating income tax.

Do not forget that in the accounting policy of the enterprise it is necessary to establish the procedure for accounting for vacation pay amounts for tax purposes.

If the company applies the simplified tax system “income minus expenses”

Vacation pay amounts are taken into account on the date of their actual payment, in accordance with clause 2 of Art. 346.17 of the Tax Code of the Russian Federation (Letters of the Ministry of Finance of the Russian Federation dated 02/05/2016 No. 03-11-06/2/5880, dated 11/09/2015 No. 03-11-06/2/64442).

We recommend articles in the Accountant School:

- How to arrange annual leave for an employee: 8 rules for an accountant.

- Calculating vacation pay: 5 mistakes to avoid.

- An example of calculating vacation pay. Vacation pay calculator.

Each employee has the right to annual paid leave, the duration of which is established by the Labor Code of the Russian Federation. Its duration is 28 calendar days. Let's consider the procedure for accruing vacation pay, posting for the payment of vacation pay at the expense of the vacation reserve, as well as posting for accruing vacation pay without a reserve.

Personal income tax and insurance premiums

Regardless of the tax system that the organization uses, withhold personal income tax from compensation for unused vacation associated with dismissal (paragraph 6, clause 3, article 217 of the Tax Code of the Russian Federation).

Personal income tax must be transferred to the budget no later than the day following the day the taxpayer’s income is paid. This is provided for in paragraph 6 of Article 226 of the Tax Code of the Russian Federation.

From compensation for unused vacation associated with dismissal, contributions must be calculated for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases (subparagraph “e”, paragraph 2, part 1, article 9 of the Law of July 24, 2009 No. 212-FZ, paragraph 6, sub-clause 2, clause 1, article 20.2 of the Law of July 24, 1998 No. 125-FZ).

Contributions for compulsory pension (social, medical) insurance must be transferred no later than the 15th day of the next month. And contributions “for injuries” are made on the day established for the payment of wages.