Right to severance pay upon layoff

Provisions of Art. 78 of the labor legislation indicate that an employee who has been laid off has the right to receive severance benefits. Among other things, funds are paid as follows:

- In the first monthly period, which is counted from the moment of termination of the relationship, finances are issued on the last working day.

- Regarding the second month, it was established that only those who do not find a job during this time can receive finance. At the same time, this fact should be confirmed when using the documentation. The authorized bodies will require the provision of a work book. It should not contain a new entry for employment. The payment is made based on the citizen’s application; this must be done at the end of the second month after the layoff. The document is prepared in a free format. Sent to the management of the company where the person previously worked.

- You can receive finance in the third month. In this case, the citizen should also not have a job. The management team of the company and the former employee agree on the timing of the transfer of money.

The legislation does not stipulate deadlines for making payments in the last two situations. For this reason, action should be taken on the basis of an agreement between the former parties to the employment relationship. Often this day is the day the salary or advance payment is issued.

The legislator notes that this type of payment is due to a person for a temporary period during which the citizen is looking for a new job. The reason is that the termination of relations with the previous employer is forced.

In a situation where these provisions apply to persons holding part-time positions, the peculiarity is that the type of benefit in question will not be assigned to him. Then they note that a person does not need time to search for a new place of work.

https://youtu.be/4AwkHi54qYE

How to correctly calculate severance pay for a dismissed employee

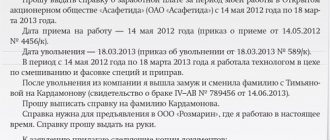

Do you think it's very simple? It turns out not. This issue was recently considered by the Constitutional Court of the Russian Federation. The reason for the consideration was the complaint of V.S. Kormush, an employee of Intaugol JSC in the city of Inta, Komi Republic. On January 1, 2020, this enterprise was liquidated and all employees were dismissed. Upon dismissal, they were paid severance pay.

V.S. Kormush was fired on December 28, 2020, that is, on the penultimate working day of 2020. The dismissal was carried out in strict accordance with the law, on the basis provided for in paragraph 1 of part 1 of Article 81 of the Labor Code of the Russian Federation - in connection with the liquidation of the organization.

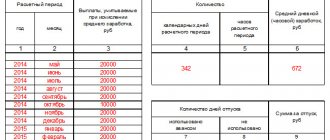

Upon dismissal, the employee was paid severance pay calculated as follows. Her earnings were calculated for the period from December 2020 to November 2020 inclusive (for the 12 months preceding the date of dismissal), it amounted to 489,208 rubles. Then the average daily earnings were calculated by dividing earnings for 12 months by the number of days worked during this period (216), it amounted to 2264.85 rubles. Then the amount of severance pay was calculated, which is paid in the amount of average monthly earnings, by multiplying the average daily earnings by the number of working days according to the production calendar in the monthly period following the date of dismissal - from December 29, 2020 to January 28, 2020 (15 workers days). The amount of severance pay was 33,973 rubles.

Everything was calculated correctly, you say. Let us turn to the “Regulation on the specifics of the procedure for calculating average wages” approved by the Government of the Russian Federation of December 24, 2007 (hereinafter we will call it “Regulations”), on the basis of which average earnings are calculated, and see if there were any violations in calculating the amount of severance pay .

According to paragraph 9 of the Regulations:

Average daily earnings , except in cases of determining average earnings for vacation pay and payment of compensation for unused vacations, are calculated by dividing the amount of wages actually accrued for days worked in the billing period, including bonuses and remunerations, by the number of days actually worked during this period .

So it was calculated. Please note that average daily earnings are calculated as 1 working day, not 1 calendar day .

The same paragraph 9 of the Regulations states:

The average employee’s earnings are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to payment.

It is clear that if we have calculated the average daily earnings for 1 working day, then to calculate the average monthly earnings to be paid, we need to multiply this average daily earnings by the number of working days in the period to be paid.

This is exactly what the employer did. He multiplied the amount of average daily earnings by 15 working days falling during the period from December 29, 2020 to January 28, 2020 (1 working day in December and 14 working days in January). Such a small number of working days in a monthly period is explained by the fact that there are many holidays in January.

This means that, in accordance with the Regulations, the average earnings were calculated correctly.

But V.S. Kormush considered this amount of payment insufficient and unfair. That's how she reasoned. Her average monthly salary for the last year was 46,672 rubles, which means that she should have been paid, on the basis of Article 178 of the Labor Code of the Russian Federation, the average monthly salary , that is, 46,672 rubles, but they paid almost 13 thousand rubles less .

To recover the difference between the “fair” amount in her opinion and the amount paid, V. S. Kormush filed a claim in court, arguing that the presence of holidays in the month for which the average salary is paid (in January 2020) should not reduce the amount average earnings. The Inta City Court of the Komi Republic refused to satisfy the plaintiff’s claim, justifying its refusal with Article 139 of the Labor Code of the Russian Federation and the above-mentioned Regulations. The court decision noted:

Part 4 of Article 112 of the Labor Code of the Russian Federation , which provides that the presence of non-working holidays in a calendar month is not a basis for reducing wages for employees receiving a salary (official salary), is not applicable to controversial legal relations. The provisions of this norm are applied when paying wages during the period of work, and not when determining the amount of severance pay and average earnings retained for employees dismissed during liquidation for the period of employment. This payment by its nature is compensatory, and therefore cannot be calculated according to the rules applied in determining the amount of remuneration.

Based on the foregoing, the court concludes that the defendant reasonably accepted 15 working days for calculating severance pay.

V. S. Kormush did not appeal this decision to the Supreme Court of the Komi Republic, but immediately filed a complaint with the Constitutional Court of the Russian Federation about the inconsistency of the Constitution of the Russian Federation with paragraph 4 of paragraph 9 “Regulations on the specifics of the procedure for calculating average wages,” consisting of one sentence: “ The average employee’s earnings are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to payment.” And the Constitutional Court accepted her complaint for consideration!

In its Resolution No. 34-P of November 13, 2020, the Constitutional Court of the Russian Federation expressed its opinion on this legal dispute. Let us present it very briefly.

The Russian Federation has an obligation to ensure fair conditions for hiring and dismissing an employee who is an economically weaker party in the labor relationship, including adequate protection of his rights and legitimate interests when terminating an employment contract at the initiative of the employer. To implement these tasks, the state establishes special guarantees for dismissal in connection with the liquidation of an organization.

These guarantees include severance pay, the provision and procedure for determining the amount of which are consistent with the requirements of Article 12 of ILO Convention No. 158 of June 22, 1982 “On termination of employment relations at the initiative of the entrepreneur.”

Part one of Article 178 of the Labor Code of the Russian Federation provides that upon termination of an employment contract in connection with the liquidation of an organization, the dismissed employee is paid severance pay in the amount of average monthly earnings, and also retains his average monthly earnings for the period of employment, but not more than two months from the date dismissals (including severance pay).

From the literal meaning of this norm it follows that each employee dismissed for the reasons mentioned in it, along with remuneration (calculation upon dismissal), is guaranteed to receive severance pay in the amount of average monthly earnings.

The amount of severance pay is not payment for any period (past or future) and is paid to the employee upon dismissal. The severance pay is intended to provide the dismissed person with a means of subsistence in an amount no less than the average monthly earnings , calculated on the basis of his salary for the 12 calendar months preceding the dismissal.

Accordingly, the amount of severance pay cannot depend on any circumstances that occurred after the employee’s dismissal.

The rules for determining the amount of average earnings (monthly and daily) established by the Regulations are essentially aimed at creating technical tools that ensure the calculation of earnings in cases established by law, do not have independent significance for the regulation of labor relations and must be applied in a systematic connection with the provisions of the Labor Code of the Russian Federation.

When determining the amount of severance pay based on the Regulations, it is necessary to take into account the requirements of part one of Article 178 of the Labor Code of the Russian Federation. At the same time, the method of calculating average monthly earnings, due to its technical, auxiliary nature, must not only be consistent with the requirements of the law, but also ensure its implementation in strict accordance with the purpose of the payment established by this norm, which, by its legal nature, is one of the guarantees of the implementation of constitutional law for labor.

Otherwise, it would be possible not only to adjust the provisions of the law by by-laws, but also to deteriorate the financial situation of an employee dismissed at the initiative of the employer.

Paragraph 9 of the “Regulations on the specifics of the procedure for calculating average wages” stipulates that the average employee’s earnings are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to payment.

In law enforcement practice, to determine the amount of severance pay for employees dismissed due to the liquidation of an enterprise, the month period after the date of dismissal of the employee is taken into account, based on the number of working days in which the calculation is made.

Based on this interpretation employees subject to dismissal due to the liquidation of an enterprise are placed in a worse position compared to employees who continue to work, whose earnings cannot be reduced depending on the presence of non-working holidays in the paid month.

In addition, employees dismissed on the specified grounds are placed in a different position depending on the date of dismissal and the presence of non-working holidays in the calendar period after dismissal : the amount of severance pay they receive, under the current understanding of paragraph 9 of the Regulations, directly depends on the number of working days in the period after termination of employment agreement. This approach actually leads to determining the amount of severance pay based on a random factor (the number of working and non-working holidays in the month immediately following the dismissal), which is unacceptable in a social legal state.

The constitutional principle of equality presupposes that, under equal conditions, subjects of law should be in an equal position, and means, among other things, a prohibition to introduce such differences in the rights of persons belonging to the same category that do not have an objective and reasonable justification.

It follows from this that all employees dismissed due to the liquidation of the organization, regardless of the date of dismissal, should be provided with state protection on equal terms, the purpose of which is to minimize the negative consequences associated with loss of work. At the same time , regardless of the method of calculating average monthly earnings, severance pay should not be less than the salary that the employee received per month during the working period.

The Constitutional Court of the Russian Federation recognized paragraph four of paragraph 9 of the Regulations as not contradicting the Constitution of the Russian Federation , since it does not imply the possibility of determining the amount of severance pay paid to an employee dismissed in connection with the liquidation of an organization in an amount different from his average monthly earnings, calculated based on the amount of wages he received for 12 calendar months preceding dismissal.

The constitutional and legal meaning of paragraph four of clause 9 of the Regulations identified in the Resolution of the Constitutional Court of the Russian Federation is generally binding, which excludes any other interpretation in law enforcement practice.

Important conclusions follow from this Decision of the Constitutional Court. Although paragraph 4 of clause 9 of the Regulations is not recognized as contrary to the Constitution of the Russian Federation and has not been repealed, it will not be possible to use it when paying severance pay in some cases, because if there are a small number of days in the month after the employee’s dismissal, the calculated amount of severance pay will differ less from average monthly earnings.

In this regard, we can propose the following method for calculating the amount of severance pay: multiply the amount of average daily earnings by the average number of working days in the month of the billing period. In the case of V.S. Kormush, the average number of working days in a month would be 247 / 12 = 20.58 days. Then the amount of severance pay would be equal to 2264.85? 20.58 = 46,611 rubles, that is, it almost coincided with its calculation.

This approach will correspond to the constitutional and legal meaning of paragraph 4 of clause 9 of the Regulations, identified in the Resolution of the Constitutional Court of the Russian Federation, and will not infringe on the rights of employees.

We will continue to consider the most complex and interesting cases of payroll calculation in our blog. Don't switch.

Payment for the second and third months

The provisions of Article 81 of the labor legislation indicate that the transfer of the benefit in question for the initial monthly period is made to all citizens. No exceptions are set here. To receive funds for the next period, you must meet certain conditions:

- the reason for the termination of the relationship is that the staff is being reduced;

- The citizen was unable to find a new place of work within a couple of months.

Payment for the next period is also established, equal to a month. This situation also assumes that the following conditions are met:

- formalization of termination of the contract as a result of layoffs;

- a couple of weeks after the situation in question, the person contacted the Labor Center and was registered as needing work;

- no job was found within a three-month period;

- there is a decision formalized by the employees of the employment center that payment should be provided for the period in question.

A citizen should independently contact the company management to receive payments. It has been established that for the first monthly period, payment is made on the day of termination of the relationship, the remaining periods provide for compliance with the provisions of the documentation.

In particular, for the second month, the presence of an application and a copy of the work book, which states that the person is not re-employed, is taken into account. You will also need to bring an act of identification.

In the third month, you will need to add a solution developed by employment service employees to the above list.

Terms and procedure for payment

At the end of the last working day, settlement transactions and funds are issued. In addition, at the same time, other payments due to the person in accordance with labor legislation are also transferred.

In this situation, there is no need to take certain actions, including no need to write statements. This indicates that the management of the enterprise independently carries out the accrual process and issues funds to the citizen.

For the payment of benefits for the second and third time periods, the date determined by agreement of the parties is taken into account. Often this day is the transfer of funds as wages or advance payments. Another date may also be specified.

Speaking about the procedure for making payments, it is worth pointing out that for the first month, accruals are realized together with the calculation of earnings and other payments. The second and third periods require the provision of a work book, which indicates that the person has not found a new place of work. It is important to note that if a citizen has a job, only the period during which he did not work will be subject to payment.

Payment for the third period is provided on the condition that the person is registered with the relevant authority as unemployed and lacking work. To receive money, you need to obtain a certificate issued by employees of the employment center. For the rest of the time, exceeding three months, funds are issued provided that the person worked in the northern territory.

Specific recommendations for calculations during dismissal

How to calculate compensation upon dismissal

The average salary is variable. The indicator contains the following components:

- days actually worked by the employee;

- total salary received over 12 calendar months.

We must remember that the situation is normal when there is a difference between the days that make up a month and the shifts actually worked. Therefore, the calculation procedure itself gives different results.

For example, if there are 15 working days in January, it is not necessary that all of them will be worked out. You can simply go on vacation, then not a single day will be worked. This time is not countable. In addition, when determining the result, the following amounts are excluded:

- Payments based on rest time.

- Temporary disability benefits.

Data on financial resources should not contain contradictions. Full compliance with all accompanying documentation is important.

The billing period is another important indicator with which wages are correlated. Typically, it is taken to be the 12 months preceding the period when the employment relationship with the employee is terminated. This must be taken into account when making payments.

Easy calculations are not available in every situation. For example, when using the rotation method, problems will not arise if a citizen has worked for a whole year. But what to do if you have incomplete months?

Calculation procedure

To pay the money, you will initially need to make benefit calculations. In this case, the formula applies:

P = H*SZ, where:

P – amount of severance pay;

H – quantitative expression of days that occurs in the month following the day of termination of the employment relationship;

SZ is the average value of the earnings of a dismissed person.

When a citizen has worked the standard time in full during the settlement period, it is established that the average payment cannot be less than 1 minimum wage. This minimum is intended to determine wages.

In a situation where a citizen’s working time is subject to recording in daily terms, the average earnings are determined using a different formula. It is presented like this:

NW = W/BH, where:

SZ – average value of earnings;

Z – the amount of a citizen’s salary for the time worked in the billing period;

BH is a quantitative expression of days actually worked.

It is worth pointing out that the calculation includes bonuses and remuneration.

Types of funds due to a redundant person

So, when dismissing staff due to optimization, the employer is obliged to pay them a certain amount. The legislation provides an exhaustive list of funds due to a redundant person. It includes :

- Remuneration for the period preceding dismissal;

- Severance pay;

- Compensation for unused vacation.

In addition, in such cases, the average salary for the period of job search is assumed. This is not an exhaustive list; it may be supplemented by other payments that are provided for in the agreement between the employer and employee.

Severance pay

In this case, we are talking about payment on the day of dismissal. Severance pay is paid, which is also the average monthly salary for 1 month of unemployment . Its size is calculated based on two values - VAT and the number of working days in the month following the day of dismissal.

You can read more about severance pay upon dismissal due to staff reduction in a special article prepared by our editors.

This payment is due to everyone, including persons employed part-time. The statement that they are already employed and are not entitled to severance pay is erroneous. The calculation for reducing this payment for such persons is carried out on a general basis. Depriving part-time employees of severance pay is illegal.

Vacation amounts

We are talking about compensation for unused vacation. It is due to all those who never rested before dismissal or did not fully use the days provided for this by law.

This applies to cases where premature departure from vacation to work is officially formalized. If an employee was listed as on vacation, but was at work, he will receive compensation only at the discretion of the employer.

The calculation for reducing vacation pay is carried out using the formula SDN × Nday, where the last value is the number of unused vacation days. This payment is due to all laid-off employees who have worked at the enterprise for at least 5.5 months.

Average monthly earnings

If severance pay is due to everyone and is paid on the day of termination of the employment agreement, then the average monthly earnings for the 2nd and 3rd months of unemployment are issued later and are not due to everyone. They will not receive it:

- Part-timers;

- Persons who abuse their rights.

The latter include those who deliberately do not officially register for another job, working part-time somewhere without an entry in the work book. But it is difficult to prove this; in the second month, the average monthly salary is paid in most cases.

A special material has been prepared on the topic of non-payment of wages upon dismissal - we recommend reading it.

It’s more difficult to pay for the next month. It is issued on the basis of a certificate from the social service and provided that the laid-off employee has registered with it in the first 14 days. The service employee may refuse to issue a certificate, without which the average monthly salary for the third month will not be paid. In all cases, these amounts are calculated in the same way as severance pay.

Other compensations according to the Labor Code

In addition to the amounts that are additionally provided for in the agreement between the employee and the enterprise, the law also provides for compensation for early dismissal during layoffs. After notification, management may consider it unnecessary to keep the laid-off personnel at the enterprise and invite them to leave early. For the remainder before the scheduled day of dismissal, compensation in the amount of the average monthly salary must be paid.

What payments are taken into account for calculation purposes?

To establish the amount of average earnings, you will need to determine the period used for the calculation, as well as the total designation of income during this time. The calculation period takes into account a period of 12 months. The year preceding the termination of relations with the employee is taken into account.

For example, when dismissal on the basis in question is made in mid-January 2020, the calculation period should be considered the beginning of January 2020 and the end of December of the same year. Please note that the month in which the relationship is terminated will not be taken into account. The exception is the situation when the reduction is made on the last day of the month.

When calculating the average level of earnings, you will need to establish what time is considered calculated and add up the citizen’s income for the specified period. Everything related to wages is subject to accounting:

- earnings in monetary terms;

- bonuses, reflected as a percentage or a fixed amount, related to work activities;

- various types of incentive payments, which are awarded depending on the results of work.

The charges take into account the regional coefficient, which increases the amounts. However, this value does not apply to all regions of the country. This depends on the region of residence of the citizen and the location of the company where he works.

When calculating the average salary, the following amounts are not taken into account:

- payment of compensatory value, for example, to pay for housing, study;

- social benefits, for example, maternity benefits;

- financial assistance paid on various grounds;

- vacation payments;

- payment for business trip time;

- other accruals that depend on the average wage.

A period of one year is used for calculation. The time preceding the calculations is taken into account. Which benefits will be taken into account is reflected above. There is no need to take into account the time while the person was on or was on a business trip.

Example of calculating severance pay

To understand the situation, you will need to consider a specific example. The citizen was fired due to staff reduction on December 12, 2018. The said day is the last day he worked for the company. The man worked according to a five-day work week. The billing period is allotted 205 days, while the amount of all payments for this time is 150.7 thousand rubles.

It is necessary to take into account the amount of average earnings for the period from the beginning of December 2020 to the end of November 2020. Provided that the collective agreement does not provide for other calculation rules.

In case of reduction, the benefit is paid for the first monthly period following the date of termination of the relationship. From December 13, 2018 to January 12, 2020. It includes 17 days, the average level of earnings will be 776.8 rubles. Then the amount of the benefit will be 13,205 rubles.

How to calculate the funds due upon dismissal?

The main value with which calculations are made when reducing all funds allocated in this case is the average daily earnings (ADE). To calculate it, you must sum up all the payments that the employee received over the last 12 months . This money supply does not include vacation pay, sick leave, and business trips. Salaries, bonuses, bonuses for qualifications and other conditions are summed up.

General information about redundancy payments is described in this article.

Next, the number of working days when the employee performed his duties at the enterprise is calculated. The time he was ill, on vacation, on a business trip, or absenteeism is not counted. The first value is divided by the second, the resulting result is the SDN.

Average salary and its impact on the amount of payments

The main indicator that forms the money supply when calculating the special tax rate is the average salary. It directly affects the amount of payments - the larger it is, the more significant the compensation and severance pay . Employees who agreed to receive part of their salaries in envelopes find themselves hostage to a short-sighted situation. If they are laid off, they expect minor payments, which are significantly lower than their actual average monthly earnings.

What period is included in the calculation?

You need to understand which days are included in the calculation. According to the provisions of Article 178 of the labor law, termination of relations, providing for the reason for staff reduction, provides for the payment of average earnings.

This means that it is necessary to calculate the specified value based on the results of work for the last year worked. Next, the resulting value is multiplied by the number of days during which the person worked in the last month. In the situation under consideration, this is the month that follows the date of termination of the relationship.

For example, when this process has been implemented since mid-March 2020, severance pay is assigned for the period from March 15, 2020 to March 14, 2020. When a citizen works in a five-day week, taking into account holidays, this period will account for 19 working days.

If after the second month the citizen does not find a job, he has the right to receive another payment in the same amount. Then you should take into account the number of days for the next month. For the third monthly period, the payment is the same as accrued for the first month.