Who submits the declaration and when (and is it necessary to submit beer reports)?

The tax return for excise taxes on alcoholic beverages was approved by order of the Federal Tax Service of Russia dated January 12, 2016 No. ММВ-7-3/ [email protected]

The deadline for submitting the declaration is monthly until the 25th day of the month following the month in which transactions subject to excise duty were carried out (clause 5 of Article 204 of the Tax Code of the Russian Federation). It is rented out by producers of alcohol, alcoholic and other alcohol-containing products, which are sold in Russia or exported abroad (Clause 1 of Article 182 of the Tax Code of the Russian Federation).

Beer is a type of alcoholic product, like other drinks with an alcohol content of more than 0.5% (clause 1.1 of the Procedure for filling out the declaration under Order No. ММВ-7-3/ [email protected] ). Therefore, brewing companies selling goods in Russia and abroad also submit the report under consideration.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Should EGAIS users submit an alcohol declaration? Let's consider what the answer to this question depends on.

Tax return on excise taxes on alcohol and other products: deadlines, completion

Official excise tax payers are considered to be enterprises and individual entrepreneurs engaged in various types of activities related to excisable products. When selling or transferring such products, taxpayers are required to fill out and submit tax returns to the tax office.

What is regulated by the excise tax declaration?

The determination of payers and the rules for paying excise tax are regulated by Article 22 of the Tax Code of the Russian Federation. Excise tax payers are considered to be enterprises and individual entrepreneurs that carry out transactions with excisable products (Article 179). The list of such operations is regulated by Article 182.

- The excise tax rate is approved in Art. 193, and the rules and methods for entering data into the tax return - in Art. 80 clause 7. All legal entities and individual entrepreneurs must produce reports in a single form (Article 31, clause 3 of the Tax Code).

- The uniform forms of tax declarations are enshrined in the order of the Ministry of Finance dated November 14, 2006. The rules for submission and deadlines for goods imported into the customs territory of Russia are established by the Customs Rules of the Russian Federation.

Shape and appearance

Page 1 consists of several sections. Section 1. “Amount of excise tax required to be paid”:

- Subsection 1.1. The total amount of tax that must be paid is entered (except for organizations that have permission to conduct operations with gasoline and alcohol).

- Subsection 1.2. An excise tax is being introduced for enterprises whose activities are related to the production and sale of ethyl alcohol and straight-run gasoline.

- Subsection 1.3. Preliminary amount for alcohol and alcohol-containing products for the past tax period.

Section 2. “Methodology for calculating the amount of excise tax.”

- 1 List of types of transactions with excisable products.

- 2 The amount on which the tax deduction is based.

- 3 Tax on excisable products that must be paid.

- 4 Operations related to the sale of excisable products abroad, including the countries of the Customs Union.

- 5 Advance payment for alcohol and alcohol-containing goods, as well as an advance payment for alcohol-containing products that were not used in the past tax period for the production of other products.

Attached to the tax return are several additional forms to fill out. Additional forms are designed for entering the following information:

- The calculated tax base for this type of product.

- The calculated amount of the advance payment.

- The total amount of ethyl or other types of alcohol sold or transferred to other departments for the production of alcoholic and alcohol-containing products.

- The total amount of ethyl alcohol and other types of alcohol produced by this enterprise.

- General information on the supply of alcohol to enterprises producing alcohol-free products.

- Information on gasoline supplies to other enterprises licensed to process it.

- Information on gasoline supplies from organizations licensed to process it.

The applications provide codes for some operations:

- Appendix 1: codes establishing the tax period, submission of an excise tax declaration, forms of reorganization or liquidation of an enterprise, method of submitting a declaration (excluding tobacco products).

- Appendix 2: for the entire list of excisable products, except tobacco and tobacco products.

- Appendix 3: Unit codes.

- Appendix 4: index codes for inclusion in the declaration for all types of products, except tobacco.

- Appendix 5: Codes governing the use of alcohol rates by the manufacturer.

Requirements and rules

Filling out the declaration begins with section 2, since the first section must be completed based on the results of the 2nd section. Each indicator occupies one field, which has several places. The exception is the date or any numbers in the form of decimal fractions.

Section 2.1. Writing the date takes 3 fields in order:

- Day (2 places), month (2 places), year (4 places), separated by dots.

- Month (2 fields), year (4 fields), with a dot between them.

Fractions:

- A proper fraction fits into 2 fields (numerator and denominator), separated by a / or dot.

- The decimal fits into 2 fields separated by a dot; the whole part of the fraction comes before the dot, followed by the fractional part.

Other rules for filling out the declaration:

- Page numbering begins with the title page, which is numbered 01 or 001. This depends on the number of cells for numbering: if there are 2 cells, then 2 numbers are entered, if there are 3 cells, then 3 numbers. For example, the second page is numbered 02 or 002, and the forty-fifth page is numbered 45 or 045.

- All data is entered starting from the first field. When filling out electronically, the data is aligned to the right.

- The fields must be filled out in block capitals in blue, purple or black ink.

- If there is no data to enter, a dash (straight line) is placed right in the middle of the cell.

- If some data does not fill all the spaces in the field, then you need to put a dash in the remaining cells on the right.

- All amounts are given in rubles, balances greater than 50 kopecks are rounded to the nearest ruble, balances less than 50 kopecks. - are discarded.

- The volume is indicated accurate to 3 decimal places.

- When filling out electronically, the Courier New font (16-18) is used.

Sections

Section 1.1 is completed in the following order:

Process for filling out section 1.2:

- 010-025. Filled out in accordance with the previous sections.

- The total amount of excise tax payable by the 25th day of the 3rd month.

- Amounts subject to deduction.

Procedure for filling out section 2:

- 010, 030-040. Indicators of tax increases. Data is entered based on app. 1-3.

- Amounts to receive deductions for goods returned by the purchaser.

- Costs for purchasing raw materials.

- The amount of excise tax on alcohol in the production of wine products.

- The total amount of excise tax when alcohol is used for the manufacture of goods that do not contain alcohol.

- Amounts subject to deduction for the manufacture of products that do not contain alcohol.

- Amounts for the sale of straight-run alcohol.

- Deduction of the amount of excise tax on gasoline made from customer-supplied raw materials.

- 100 is a positive value, 110 is a negative value. The result of adding points 010, 030-040, subtracting 050-093.

Points 020 and 140 are used to enter data on goods exported to the Russian Federation.

Applications

Filling out applications:

- Adj. 1. The base for alcohol-containing products, alcohol, and transport is calculated.

- Adj. 2. Specifically for certain classes of exported products. The total amount is recorded on the last page.

- Appendix 3. The calculation of excisable products within the Russian Federation is carried out, with the exception of ethyl alcohol and transport.

- Adj. 4. Filled out by organizations that have a license for non-alcoholic products.

- Adj. 5. Intended for ethyl alcohol producers, separately for each purchaser of their products.

- Adj. 6-7. Producers of straight-run gasoline record the volume of production and other data.

You can also submit excise tax declarations from us:

An example of filling out an excise tax return

Do EGAIS users submit declarations?

The main purpose of the EGAIS is to monitor the turnover of alcoholic products to ensure the absence of counterfeit goods.

While the Federal Tax Service is focused on tax control of the economic activities of alcohol producers. The declaration under Order No. ММВ-7-3/ [email protected] is intended to inform the tax office about the fact that the manufacturer has carried out operations that are subject to excise tax. If alcoholic products are produced but not sold, then an excisable operation is not created.

Alcohol retailers are also required to connect to the EGAIS system. But they do not need to submit excise tax declarations—including those for beer.

Let's consider a number of nuances that characterize the procedure for filling out an excise tax return.

Read about how to calculate and pay excise taxes in this article.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

The tax base

The tax base is equal to the quantity of goods sold in natural terms, that is, measured in liters. In order to correctly calculate the amount of tax, the Tax Code of the Russian Federation recommends that taxpayer enterprises keep separate records of the tax base for excise taxes, for which tariff rates are determined. For example, alcoholic products need to be “broken down” into wine, champagne, beer, and also taking into account the characteristics of a particular drink. Alcohol containing less than 9% ethyl alcohol is subject to one rate, and alcohol with a high content of ethyl alcohol is subject to another.

If the enterprise does not keep separate records of goods, then a single, highest, rate for this type of excisable goods is applicable to the products. This is regulated by clause 7 of Art. 194 Federal Law No. 117 of 05.08.2000 (as amended on 04.06.2018) Tax Code of the Russian Federation, part 2.

An enterprise can be exempt from paying duties to the tax budget by providing a bank guarantee issued by a bank to the local Federal Tax Service. After submitting the document, the organization has the right not to pay the advance payment.

According to paragraph 11 of Art. 204 Federal Law No. 117 dated 08/05/2000 (as amended on 06/04/2018, as amended on 07/01/2018) of the Tax Code of the Russian Federation, Part 2, a company can present several guarantors at once. The state budget receives large income from excise taxes. That is why it is so important for consumer products.

Why report excise taxes?

Excise taxes were developed as a taxation tool. All producers of consumer goods are required to pay this internal indirect tax. The calculated excise tax is included in the final cost of the product. Excise goods include:

- alcohol;

- tobacco products;

- petrol;

- some imported goods.

Manufacturers are required not only to calculate and pay the excise tax, but also to report on the state of mutual settlements with the budget. Tax reporting on excise duties is submitted to the Federal Tax Inspectorate at the place of registration of the manufacturer. If excisable goods are produced and sold by an individual entrepreneur, he must submit the register to the Federal Tax Service at his place of residence.

The excise declaration is submitted monthly, but only in case of sale of manufactured products. If an enterprise manufactured but did not sell an excisable product, there is no need to submit a report.

Execution of an excise tax return - example of filling out 2016–2017

The occupancy of TD lines depends on the variety of tobacco products and the types of transactions performed with them. Let's consider the option of drawing up a TD by a manufacturer of one type of cigarette, selling its products exclusively on the domestic market.

Example

Tabakprom LLC produces one brand of non-filter cigarettes. Last month, the manufacturer sold 180,000 such products. 1 pack contains 20 cigarettes, maximum retail price (MRP) is 64 rubles.

The following data was used to fill out the TD:

- tax base in kind - 180,000 units;

- estimated cost of cigarettes (RS) based on the MRP:

RS = 64 rub. × 180,000 pcs. / 20 pcs. = 576,000 rub.;

- excise tax rate - 1,250 rubles. for 1,000 pcs. + 12.0% of the estimated cost determined on the basis of the MRP (but not less than RUB 1,680 per 1,000 units);

- calculation formula for the amount of excise tax (A):

A = 180,000 pcs. × 1250 rub. / 1000 pcs. + 576,000 rub. × 12% = 294,120 rub.,

Where:

180,000 pcs. × 1,250 rub. / 1,000 pcs. — calculation of the “tobacco” excise tax at a fixed rate;

576,000 × 12% - calculation of excise tax at an ad valorem rate;

- checking the amount of excise tax (calculated for 1,000 pieces A ≥ 1,680 rubles):

RUB 294,120 / 180,000 pcs. × 1000 pcs. = 1,634 rub. < 1680 rub.;

- amount of excise tax payable: based on the largest of 2 values (from the previous paragraph):

RUB 1,680 / 1000 pcs. × 180,000 pcs. = 302,400 rub.

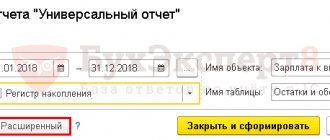

An example of filling out section 2.1 of the TD is shown in the figure:

For this example, in addition to the title page of Section 1 and Section 2.1 in the TD, you will need to fill out Section 2.3 (fill in pages 200–230 in Column 8) and Appendix 2.

Payers of indirect tax - excise tax

Art. 181. The Tax Code of the Russian Federation (part two) lists excisable goods.

Art. 179 of the Tax Code of the Russian Federation identifies excise tax payers:

- organizations

- IP

- persons recognized as taxpayers when moving certain goods across the border of the EAEU

The tax period for excise tax payment is 1 calendar month (until the 25th day of the month following the reporting month).

The declaration is submitted:

- personally

- by post

- via the Federal Tax Service website

| For individual entrepreneurs | Federal Tax Service at the place of registration |

| For legal entities and separate divisions | Federal Tax Service at location |

An increase in excise taxes on tobacco and tobacco products will allow an additional 628.2 billion rubles to be allocated to the federal budget in 2020.

Expert of the Legal Consulting Service GARANT E. Ladnova