New excisable goods

From January 1, 2020, the list of excisable goods has become larger. This is a new version of Art. 181 of the Tax Code of the Russian Federation, introduced sub. “g”, “d”, “f” and “g” art. 1 of the Law of September 29, 2019 No. 326-FZ.

As a result, from 01/01/2020 the following became excisable goods:

- any electronic cigarettes (until 2020 - only disposable ones) and devices for heating tobacco, used to create tobacco vapor inhaled by the consumer by heating tobacco without burning or smoldering (excise duty - 50 rubles per piece);

- grapes, which are used for the production of wines, champagne, liqueurs, wine materials, grape must and other alcoholic beverages produced using full cycle technology (excise tax - 30 rubles per 1 ton);

- beer with strength up to 0.5 degrees inclusive;

- wine materials (intended for the production of distillates), grape and fruit must.

How to calculate the “alcohol” excise tax, knowing its rate

If a businessman produces only one type of excisable ASSP, when calculating the “alcohol” excise tax, he only needs to use the following formula:

A = ORP × SA – VA,

Where:

A is the amount of excise tax on ASSP payable;

ORP - volume of ASSP sold;

CA - excise tax rate for a specific type of ASSP;

VA - excise tax deduction.

If several types of ASSP are produced and different excise tax rates are applied, the above formula for calculating the “alcohol” excise tax becomes more complicated:

A = (ORP1 × CA1 + ORP2 × CA2 + ORP3 × CA3 + ...) – VA,

Where:

ORP1, ORP2, ORP3... - the volume of ASSP sold by its types, for which different excise tax rates are established;

CA1, CA2, CA3... - excise tax rates for the corresponding types of ASSP.

Materials prepared by specialists on our website will tell you about the formulas used in economic and financial calculations:

- “The procedure for calculating accounts receivable - formula”;

- “How to calculate your own working capital (formula)?”;

- “What is the formula and how to calculate profitability?”.

how to calculate the excise tax on alcoholic products in 2016 using the specified formulas in the next section.

Raising rates

There was also an increase in excise taxes from 2020 on some excisable goods. The main reason is inflation. In particular, excise tax rates have been increased on:

- ethyl alcohol sold by organizations that did not transfer the advance payment and did not provide a bank guarantee;

- wines, regardless of protected geographical indication or place of origin;

- beer with strength from 0.5 to 8.6 degrees;

- all types of tobacco products;

- cars with engine power over 90 hp. With.;

- diesel fuel.

This is a new version of Art. 193 of the Tax Code of the Russian Federation, introduced clause 6 of Art. 1 of the Law of September 29, 2019 No. 326-FZ.

KEEP IN MIND

From 2020, rates for wines, including fruit and champagnes, are not differentiated depending on whether a geographical indication or appellation of origin is protected.

So, initially for 2020 the excise tax was 19 rubles. per liter of “unprotected” wine and 5 rubles. per liter of “protected”. But taking into account changes in the Tax Code of the Russian Federation, a single rate for wine has been established - 31 rubles. per liter

The same story with champagne: for 2020 it was 37 rubles. per liter of “unprotected” and 14 rubles. per liter of “protected”. As a result, the flat rate is 40 rubles. per liter

The table below shows all changes in excise tax rates.

| Types of excisable goods | Rate (in % and/or rubles per unit) |

| from January 1 to December 31, 2020 incl. | |

| Ethyl alcohol produced from food or non-food raw materials, including denatured ethyl alcohol, raw alcohol, distillates: | |

| sold to organizations paying an advance payment of excise tax, including imported into the Russian Federation from the territories of member states of the Eurasian Economic Union, which is a product of the Eurasian Economic Union; | 0 rubles per 1 liter of anhydrous ethyl alcohol contained in excisable goods |

| sold to organizations that have certificates provided for in paragraph 1 of Article 179.2 of this Code; | 0 rubles per 1 liter of anhydrous ethyl alcohol contained in excisable goods |

| transferred when performing transactions recognized as an object of excise taxation in accordance with subparagraph 22 of paragraph 1 of Article 182 of this Code; | 0 rubles per 1 liter of anhydrous ethyl alcohol contained in excisable goods |

| sold to organizations that have not fulfilled the obligation to pay an advance payment of excise tax (have not provided a bank guarantee and a notice of exemption from payment of an advance payment of excise tax) and (or) do not have the certificates provided for in paragraph 1 of Article 179.2 of this Code; | 544 rubles per 1 liter of anhydrous ethyl alcohol contained in excisable goods |

| imported into the Russian Federation, not being a product of the Eurasian Economic Union, and also being a product of the Eurasian Economic Union, imported into the Russian Federation from the territories of the member states of the Eurasian Economic Union, provided there is no obligation to pay an advance payment of excise tax (except for the submission of a bank guarantee and notice on exemption from payment of advance payment of excise tax) or failure to fulfill the obligation to pay advance payment of excise tax; | 544 rubles per 1 liter of anhydrous ethyl alcohol contained in excisable goods |

| transferred within the structure of one organization when the taxpayer carries out operations recognized as the object of taxation by excise taxes, with the exception of operations provided for by subparagraph 22 of paragraph 1 of Article 182 of this Code; | 544 rubles per 1 liter of anhydrous ethyl alcohol contained in excisable goods |

| received (posted) by organizations that have certificates provided for in paragraph 1 of Article 179.2 of this Code | 544 rubles per 1 liter of anhydrous ethyl alcohol contained in excisable goods |

| Alcohol-containing products | 544 rubles per 1 liter of anhydrous ethyl alcohol contained in excisable goods |

| Grapes used for the production of wine, sparkling wine (champagne), liqueur wine with a protected geographical indication, with a protected designation of origin (special wine), wine materials, grape must, alcoholic beverages produced using full-cycle technology, sold in the tax period | 30 rubles per 1 ton |

| Wine materials, grape must, fruit must | 31 rubles per 1 liter |

| Alcohol products with a volume fraction of ethyl alcohol over 9 percent (except for beer, wines, fruit wines, sparkling wines (champagne), wine drinks made without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit wort and (or) distillates) | 544 rubles per 1 liter of anhydrous ethyl alcohol contained in excisable goods |

| Alcohol products with a volume fraction of ethyl alcohol up to 9 percent inclusive (except for beer, drinks made from beer, wines, fruit wines, sparkling wines (champagnes), cider, poiret, mead, wine drinks made without the addition of rectified ethyl alcohol, produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) distillates) | 435 rubles per 1 liter of anhydrous ethyl alcohol contained in excisable goods |

| Wines, fruit wines (except for sparkling wines (champagne), liqueur wines) | 31 rubles per 1 liter |

| Wine drinks made without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) distillates | 40 rubles per 1 liter |

| Cider, poire, mead | 22 rubles per 1 liter |

| Sparkling wines (champagnes) | 40 rubles per 1 liter |

| Beer with a standard (standardized) content of ethyl alcohol by volume up to 0.5 percent inclusive | 0 rubles per 1 liter |

| Beer with a standard (standardized) content of ethyl alcohol by volume over 0.5 percent and up to 8.6 percent inclusive, drinks made from beer | 22 rubles per 1 liter |

| Beer with a normative (standardized) content of ethyl alcohol by volume over 8.6 percent | 41 rubles per 1 liter |

| Pipe, smoking, chewing, sucking, snorting, hookah tobacco (except for tobacco used as raw material for the production of tobacco products) | 3172 rubles per 1 kg |

| Cigars | 215 rubles for 1 piece |

| Cigarillos (cigaritas), bidis, kretek | 3055 rubles for 1000 pieces |

| Cigarettes, cigarettes | 1,966 rubles per 1,000 pieces + 14.5 percent of the estimated cost, calculated based on the maximum retail price, but not less than 2,671 rubles per 1,000 pieces |

| Tobacco (tobacco products) intended for consumption by heating | 6040 rubles per 1 kg |

| Electronic nicotine delivery systems, tobacco heating devices | 50 rubles for 1 piece |

| Liquids for electronic nicotine delivery systems | 13 rubles per 1 ml |

| Passenger cars: | |

| with engine power up to 67.5 kW (90 hp) inclusive | 0 rubles for 0.75 kW (1 hp) |

| with engine power over 67.5 kW (90 hp) and up to 112.5 kW (150 hp) inclusive | 49 rubles for 0.75 kW (1 hp) |

| with engine power over 112.5 kW (150 hp) and up to 150 kW (200 hp) inclusive | 472 rubles for 0.75 kW (1 hp) |

| with engine power over 150 kW (200 hp) and up to 225 kW (300 hp) inclusive | 773 rubles for 0.75 kW (1 hp) |

| with engine power over 225 kW (300 hp) and up to 300 kW (400 hp) inclusive | 1317 rubles for 0.75 kW (1 hp) |

| with engine power over 300 kW (400 hp) and up to 375 kW (500 hp) inclusive | 1363 rubles for 0.75 kW (1 hp) |

| with engine power over 375 kW (500 hp) | 1408 rubles for 0.75 kW (1 hp) |

| Motorcycles with engine power over 112.5 kW (150 hp) | 472 rubles for 0.75 kW (1 hp) |

| Automotive gasoline: | |

| not corresponding to class 5 | 13,100 rubles per 1 ton |

| class 5 | 12,752 rubles per 1 ton |

| Diesel fuel | 8835 rubles per 1 ton |

| Motor oils for diesel and/or carburetor (injection) engines | 5616 rubles per 1 ton |

| Aviation kerosene | 2800 rubles per 1 ton |

REFERENCE

Excise duty on wines and fruit wines:

- in 2020 – 31 rub. for 1 liter;

- in 2021 – 32 rubles;

- in 2022 – 33 rubles.

Examples of solving problems for calculating excise taxes

VALUE ADDED TAX

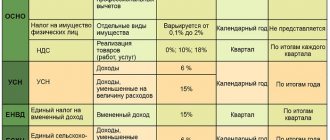

Type of tax.

Value added tax (VAT) is a federal indirect tax, which is a form of withdrawal to the budget of part of the added value created at all stages of production and defined as the difference between the cost of material costs attributed to production and distribution costs.

Subjects of tax.

The following are recognized as VAT taxpayers:

a) organizations;

b) individual entrepreneurs;

c) persons recognized as VAT taxpayers in connection with the movement of goods across the customs border of the Russian Federation.

Tax object.

In particular, the following transactions are recognized as the object of VAT taxation:

1) sale of goods (works, services), as well as transfer of property rights on the territory of the Russian Federation;

2) carrying out construction and installation work for own consumption;

3) transfer of goods for one’s own needs on the territory of the Russian Federation, the costs of which are not deductible when calculating income tax;

4) importation of goods into the customs territory of the Russian Federation.

The tax base.

The tax base for VAT is, in particular, recognized as:

a) proceeds from the sale of goods (work, services), received in cash or in kind, including securities, taking into account excise taxes for excisable goods;

b) the customs value of imported goods, taking into account customs duties and excise taxes.

Tax rates.

There are three main tax rates for VAT taxation.

1. Zero rates apply to goods exported under the customs export regime, as well as to work and services related to the production of these goods.

2. A rate of 10% is applied when selling:

- basic food products, in particular meat and meat products, except for delicatessen, dairy products, eggs, sugar, salt, vegetable oil, bread, flour, seafood and fish products, vegetables, baby food and other goods according to the list specified in the Tax Code RF;

— goods for children, in particular knitwear, clothing and footwear, cribs, mattresses, strollers, stationery and other goods according to the list specified in the Tax Code of the Russian Federation;

- periodicals and book products, as well as editorial and publishing works related to their production, etc.

3. The 18% rate applies to all other goods, works and services, including excisable food products, as well as goods imported into the customs territory of the Russian Federation in the import regime.

Taxable period.

The tax period (including for taxpayers acting as tax agents, hereinafter referred to as tax agents) is established as a quarter.

Tax benefits.

When assessing VAT, the following tax benefits are used:

1) are exempt from VAT, in particular:

— operations for the sale of the most important and vital medical goods, products, equipment according to the list approved by the Government of the Russian Federation;

— medical services provided by budgetary medical institutions;

— services for maintaining children in preschool institutions;

— services of urban passenger transport and suburban transport;

— funeral services;

— educational services of non-profit educational institutions;

— restoration work and services;

— services of cultural and art institutions;

— banking operations (except for collection);

insurance services;

— sale of land, residential buildings and premises;

— services of lawyers, etc.;

2) organizations and individual entrepreneurs are exempt from paying VAT if, when carrying out their activities for the three previous consecutive calendar months, the amount of revenue from the sale of goods (work, services) excluding taxes did not exceed a total of 2 million rubles;

3) tax deductions are used, which give the taxpayer the right to reduce the total amount of VAT to be transferred to the budget by the tax amounts presented to the taxpayer and paid by him, in particular when purchasing goods (work, services) intended for production activities or for resale.

Procedure and deadline for paying tax.

The amount of VAT payable to the budget is calculated at the end of each tax period, taking into account the provided tax benefits. Tax payment is made based on the results of each tax period in equal installments no later than the 25th day of each of the three months following the expired tax period.

Preparation of VAT calculations.

To process transactions subject to VAT, you must use the following documents: invoices, invoice registers, purchase and sales books. Each shipment of goods is issued with an invoice. An invoice is drawn up by the supplier in the name of the buyer in two copies and is a document that serves as the basis for accepting VAT amounts claimed for deduction or reimbursement, paid upon the purchase of goods, works and services. Each enterprise is both a supplier and a buyer, and therefore deals with two types of VAT. The company, as a supplier, maintains a sales book and a log of issued invoices. The sales ledger is intended to determine the amount of VAT on sales of products, works and services. The company, as a buyer, maintains a purchase book and a log of received invoices. The purchase book is intended to determine the amount of VAT when purchasing goods, works and services.

Examples of solving problems for calculating VAT

1. In the dining room they cook porridge with milk. Purchased milk for 260 rubles, cereals for 145 rubles. The cost of all sold porridge made from these products was 528 rubles. Amounts are indicated excluding VAT.

Calculate how much VAT the canteen should transfer to the budget for these operations, taking into account that the VAT rate of 10% was used when purchasing products, and 18% when selling.

| VAT paid | VAT on sales |

| 260*0.10 = 26.00 rub. | 528*0.18 = 95.04 rub. |

| 145*0.10 = 14.50 rub. | |

| Total VAT added: 40.50 rub. | Total VAT: RUB 95.04. |

| VAT payable to the budget: 95.04 – 40.50 = 54.54 rubles. |

2. The Morozko enterprise received fresh vegetables purchased from an agricultural enterprise in the amount of 450,000 rubles. Part of the products worth 200,000 rubles. was packaged and frozen, after which it was sold for 280,000 rubles. to the wholesale seller - the trading company “Optovik”, which sold all products in the amount of 400,000 rubles. The Morozko enterprise processed the remaining part of the vegetable products into canned vegetables and sold them at retail in the amount of 380,000 rubles. All amounts are indicated excluding VAT.

Determine how much VAT should be transferred to the budget of the enterprise “Morozko” and “Wholesaler” for the operations listed above.

Enterprise "Morozko"

| VAT paid | VAT on sales |

| 450,000*0.1 = 45,000 rub. | 280,000*0.18 = 50,400 rub. |

| 380,000*0.18 = 68,400 rub. | |

| Total VAT added: 45,000 rub. | Total VAT: RUB 118,800. |

| VAT payable to the budget: 118,800 – 45,000 = 73,800 rubles. |

Enterprise "Wholesaler"

| VAT paid | VAT on sales |

| 280,000*0.18 = 50,400 rub. | 400,000*0.18 = 72,000 rub. |

| VAT payable to the budget: 72,000 – 50,400 = 21,600 rubles. |

EXCISE

Type of tax.

Excise taxes are a federal indirect tax that is imposed on a limited number of excisable goods, in particular alcohol and tobacco products, cars, gasoline, etc.

Subjects of tax.

The following are recognized as excise tax payers:

1) organizations;

2) individual entrepreneurs;

3) persons recognized as taxpayers in connection with the movement of goods across the customs border of the Russian Federation.

Tax objects.

In particular, the following transactions are recognized as the object of excise taxation:

1) sales of excisable goods by producers of these goods;

2) sales of excisable goods purchased from manufacturers of these goods;

3) import of excisable goods into the territory of the Russian Federation, etc.

The tax base.

When taxing excise taxes, the tax base is determined for each type of excisable product, in particular:

a) as the volume of excisable goods sold or imported into the Russian Federation in natural units when specific (fixed) rates are applied;

b) the cost of excisable goods sold or imported into the Russian Federation excluding excise taxes and VAT when applying ad valorem (interest) rates.

Tax rates.

There are two types of excise tax rates:

a) ad valorem, or percentage, which are set as a percentage of the cost of goods without excise tax;

b) specific, or hard, which are set in rubles to the natural meter of the product.

Taxation of excisable goods is carried out at the rates of Art.

New conditions for issuing reg. evidence

From January 1, 2020, legislators changed the conditions for issuing certificates of registration of organizations dealing with ethyl alcohol. This is a new version of Art. 179.2 Tax Code of the Russian Federation. In particular:

- the list of operations for which certificates are issued has been clarified;

- the requirements for issuing a certificate have been clarified;

- there is no longer a limitation on the validity period of the certificate;

- the list of documents required for issuing a certificate has been changed;

- The rules on suspension and cancellation of licenses by tax authorities have been supplemented.

For example, provision is made for issuing a certificate for the production of alcohol-containing perfumery and cosmetic products in small containers, as well as for the production of pharmaceutical products.

According to paragraph 1 of Art. 3 of Law No. 326-FZ of September 29, 2019, previous certificates issued before January 1, 2020 are valid until their expiration date, but no longer than December 31, 2020.

What counts as implementation?

Goods are considered sold if the ownership of them has passed from the seller to the buyer (Clause 1, Article 39 of the Tax Code of the Russian Federation).

For the purposes of calculating excise taxes, the following operations are considered to be sales:

- gratuitous transfer of ownership of excisable goods or the use of excisable goods with payment in kind (subclause 1, clause 1, article 182 of the Tax Code of the Russian Federation);

- shortage of excisable goods in excess of the norms of natural loss (clause 4 of article 195 of the Tax Code of the Russian Federation).

The right to deduct excise duty has been expanded

From April 1, 2020, organizations that generate electricity and heat from middle distillates have the right to apply an excise tax deduction.

They can obtain a certificate for transactions with middle distillates and, if available, claim a deduction when receiving such distillates as fuel.

Legislators also expanded the composition of technological processes for processing middle distillates. From 2020 these include:

- delayed coking;

- hydroconversion of heavy residues;

- obtaining carbon black by thermal or thermo-oxidative decomposition of middle distillates;

- production of bitumen by oxidation of tar.

Thus, enterprises that perform the listed operations when processing middle distillates can make an excise tax deduction.

In addition, the Tax Code of the Russian Federation clarifies the characteristics of middle distillates.

All this was introduced into the Tax Code of the Russian Federation, Art. 1 and paragraph 5 of Art. 2 of the Law of July 30, 2019 No. 255-FZ.

Excise tax rates on alcoholic products in 2016–2017

Excise tax rates on alcoholic products are specified in Art. 193 Tax Code of the Russian Federation. Excise taxes on alcoholic products for 2016–2017 were established taking into account the indexation provided for in clause 6.2.1 of the Main Directions of Tax Policy for 2020 and the planning period for 2020 and 2017, approved by the Government of the Russian Federation on July 1, 2014.

You will be introduced to other regulatory documents adopted by the Government of the Russian Federation in the tax field in the messages posted on our portal:

- “The government has approved codes for household services”;

- “The government is preparing measures to reduce wage arrears”;

- “The government has clarified the procedure for determining the average daily earnings for calculating benefits.”

When setting the excise tax rates for 2016–2017, the need to slow down the rate of indexation of rates on alcohol and alcohol-containing products (ASP) was taken into account, taking into account the indexation of rates on ASP that was carried out in previous years at a rate faster than inflation.

You can see the alcohol excise tax rates for 2016–2017 in the diagram below.

See also “Reduced excise tax rates - only for Russian wines.”

Read another regulatory document related to “alcohol” excise taxes in the next section.

The right to increased excise tax deduction has been expanded

From April 1, 2020, more organizations have the right to claim an excise tax deduction with a coefficient of 2.

These are enterprises that generate electricity and heat from middle distillates. They are entitled to a deduction when receiving middle distillates as fuel for combustion and energy generation.

Legislators have determined a list of documents that are necessary to confirm the deduction. Among them:

- register of invoices (transfer and acceptance certificates) for the supply of middle distillates as fuel;

- registers for accounting for used fuel and energy supply;

- documents confirming fuel production by type of installation.

And when selling middle distillates for bunkering sea vessels, the amount of deduction must be determined taking into account the new Vdfo coefficient. New norms of paragraph 23 of Art. 200 of the Tax Code of the Russian Federation established the procedure for calculating this coefficient.

These changes introduced sub. “b”, “c” clause 11, sub. “a” clause 12 art. 1, clause 5 art. 2 of the Law of July 30, 2019 No. 255-FZ.

When to charge excise tax

When selling (transferring) excisable goods, accrue excise tax on the day of shipment (transfer) to the buyer (recipient) of the goods (clause 2 of Article 195 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated January 14, 2010 No. 03-07-06/03).

If an organization sells goods at retail, then the date of sale for the purposes of calculating excise taxes is the date of transfer of goods to the division that carries out retail sales (clause 2 of Article 195 of the Tax Code of the Russian Federation).

An exception is the case of the sale of goods pledged if they have been in the possession of the pledgee since the conclusion of the pledge agreement. In this case, excise tax can be charged only after a public auction. This is explained by the fact that when concluding a pledge agreement, goods are transferred to the pledgee not for the purpose of sale (Article 337 of the Civil Code of the Russian Federation).

If the obligation to pay excise duty is related to the discovery of a shortage of goods, the date of sale is the date the shortage was discovered. At the same time, excise tax is imposed on the quantity of missing goods that exceeds the norms of natural loss (clause 4 of Article 195 of the Tax Code of the Russian Federation).

For transactions of transfer of goods produced from customer-supplied raw materials, excise duty is charged on the date of signing the acceptance certificate for such goods (Clause 2 of Article 195 of the Tax Code of the Russian Federation).

Accrue excise tax on all transactions, the date of implementation (transfer) of which relates to the current month (clause 5 of Article 194, Article 192 of the Tax Code of the Russian Federation).

Situation: at what point should excise tax be charged when selling goods through an intermediary?

When selling goods under intermediary agreements, accrue excise tax at the time of transfer of goods to the intermediary.

It is explained this way.

When selling manufactured excisable goods, an object of excise taxation arises (subclause 1, clause 1, article 182 of the Tax Code of the Russian Federation).

The sale of goods is recognized as the transfer of ownership of goods (on a compensated or gratuitous basis) from one person to another (clause 1 of Article 39 of the Tax Code of the Russian Federation). That is, in general, the date of sale is considered to be the date of transfer of ownership.

At the same time, for the purposes of calculating excise taxes, the date of sale of excisable goods is defined as the day of their shipment (transfer) (clause 2 of Article 195 of the Tax Code of the Russian Federation).

Thus, if the terms of the agreement provide for the transfer of ownership, excise duty must be charged on the date of shipment of goods as part of the execution of such an agreement, regardless of the date of transfer of ownership or the date of payment. This conclusion is confirmed by the letter of the Ministry of Finance of Russia dated January 14, 2010 No. 03-07-06/03.

When selling goods through intermediaries, ownership of the goods remains with the manufacturer until they are sold by the intermediary (Clause 1, Article 996, Article 1011 of the Civil Code of the Russian Federation). However, they are transferred to an intermediary for the purpose of their sale, as a result of which ownership from the manufacturer will pass directly to the buyer.

Unified state automated information system

The latest innovation is the mandatory connection to the unified information system EGAIS for everyone who wants to sell strong drinks. And it doesn’t matter retail or on tap. It is thanks to this system that it became possible to carry out strict control of each item of goods. Therefore, starting from 2020, it is prohibited to sell an excise product without connecting to this database. Those caught committing such a violation will be required to pay considerable sums in fines.

How does EGAIS work?

This control system also makes it possible to quickly determine the data of imported receipts: when and by whom it was imported into the country, composition indicators, strength and place of sale. With the help of EGAIS, it has become possible to avoid smuggled goods. For the alcohol business to flourish you need:

- acquire new excise taxes on alcohol;

- connect to EGAIS;

- get a license. And it doesn’t matter what type of business the entrepreneur is in. License permission is mandatory for everyone without exception.

To issue the latter, there is the Federal Service for the Regulation of Alcohol Products. It has branches in Moscow and other large cities of the country. This gives it the advantage of giving it control over producers and buyers even in local markets. Before contacting the service for permission, all legal entities need to collect the relevant documents and fill out an application for its acquisition.

Exception: private entrepreneurs selling beer and drinks can do so without permission, provided they have a permanent retail location.

Experts from the federal service have been reviewing the request for a month. After which, they have the right to refuse a license if there are reasons for this. If a positive decision is made, the document is issued for a maximum of five years.

https://youtu.be/Edc9Qs2yD7E

Calculation examples

Example 1: in 2011 (September) produced 728 liters. alcohol-containing household chemicals, which were packaged in aerosol iron containers. In total, 390 liters were applied. denatured alcohol purchased and paid for during production. Bet = 34 rubles.

Solution:

It is necessary to carry out calculations according to the purchased raw materials:

34 rub./l. * 390 l. = 13,260 rub.

It is necessary to determine the amount of excise tax that is indicated for payment or refund from the budget (rate - 0 rub.):

0 rub. * 728 l. — 13,260 = −13,260 rub.

Thus, the organization will not pay the required amount of tax, because indicators are negative. On the contrary, there is a reduction in excise taxes in the amount of 13,260 rubles.

Example 2: A distillery produces alcohol containing 32% ethanol. In January, 243 liters were produced and sold. products. The tax rate that was in effect during the period of implementation was 191 rubles. Excise tax = 1500 rub.

Solution:

It is necessary to establish the basis of the tax according to alcohol in terms of anhydrous alcohol:

243 * 32% / 100% = 77.76 l.

The excise tax amount will be:

77.76 * 191 rub. = 14,852.16 rubles.

Amount that must be paid to the state:

14,852.16 - 1,500 rub. = 13,352.16 rubles.

Since the excise tax must be paid in equal components in 2 stages, in this case 50% of the amount of 13,352.15 rubles is subject to transfer.

The first payment is made before the 25th of the month following the reporting month, the second - before the 15th of the second month after the reporting month.

You can learn how to check excise stamps in this video.

https://youtu.be/aKrGsDJXPv0

The sale of alcohol brings significant profits to producers and retailers. Its size is formed from many indicators. The price of products is influenced not only by costs and demand, but also by what excise taxes are set on alcohol. It is believed that the burden of paying them is borne by organizations and private entrepreneurs, but in reality it turns out that the price of products simply increases to cover the costs of producers.