Regardless of the form of ownership of the organization, the type of its activity, the name of the documentation, or the place where it was compiled, there are general requirements for the preparation of documents. Previously, clerks relied on standard 6.30-2003 when preparing documents, but relatively recently a new GOST was introduced. What requirements apply when conducting office work and how serious changes the state standard that has been in force for less than a year has made in this area is described in the article.

Definition

Financial documents are all forms of reporting to users and the state, which are formed on the basis of all indicators of the enterprise, possessing reliability, timeliness and openness. These documents allow you to determine the state of affairs in the company and make it possible to adjust the direction of affairs in the right direction. It is on the basis of these documents that the main decisions are made on the reorganization of production, the reduction of certain cost items and changes in planning for the next period. Financial lists of applicants allow government services to conduct inspections in a timely and complete manner, without spending a lot of time and additional finances.

https://youtu.be/gWiJkWuf6Ks

Balance sheet

This is the main and most important financial document of the organization, which allows you to find out the financial situation of the enterprise for the reporting period. This report allows you to find out the profitability of a given enterprise, its efficiency, all items of expenses and income. It consists of:

- Assets. This takes into account resources in any form that are owned by the company. This includes funds that are in various accounts, property, part of production, etc.

- Liabilities. These are debt obligations of the company.

- Own capital. This is the capital of the owners, increased in the process of activity.

It is worth considering that in this document, the asset must always converge with the sum of liabilities and equity. A balance sheet is always prepared as of a specific date and for a specific period. It is a very common practice for the balance sheet in a joint stock company to be used to report to shareholders.

Criteria for selecting fonts when preparing official papers

The criteria for paperwork, the choice of style and type of letters are established by the management organizations. Provided that the corporation is highly developed, large and self-sufficient. All employees who work in such institutions with papers adhere to the rules adopted within the organization.

For a long time, it was secretly customary to draw up official papers in times new roman font. This is due to the fact that the Word text editor was used in the vast majority of cases. In 2008, after the release of a new version of Word, the calibri font became the main type of typing. With the development of computerization, accounting papers are printed mainly in block font. What type and size of font to choose is decided by the employee who creates and designs text documents. If the organization does not have clear requirements for the design of text documents, any acceptable option is used. An indispensable condition is easy perception and preservation of readability.

Gains and losses report

This document of financial activity is considered to be the second most important. It also shows the efficiency of a given enterprise and is also very important for owners and shareholders. This report allows you to determine the direction of the development trend of the enterprise, as well as indicators such as net profit, gross profit, third-party income and the income structure as a whole. The structure of the profit and loss statement is divided into 3 parts:

- Income. This item includes any kind of increase in the company's capital, with the exception of investments by owners.

- Expenses. They include items that reduce the company’s efficiency - various losses, as well as natural costs of the company.

- Gross profit. This is an indicator that is calculated as the difference between revenue and production costs. After this calculation, cost indicators that are not included in the cost are also subtracted.

You can also distinguish between a multi-stage report and a single-stage one. The first includes detailed data, even before calculations. The second represents the final data without taking into account calculations.

What criteria does GOST form for the formation of papers?

GOST does not set strict limits. To create a text file within the framework of the guest order, you must adhere to a standard set of characteristics.

What font is used in GOST documents

The font type is calibri, times new roman. The size of the letters is fourteenth, twelfth size is allowed. The text must be equal in width, each paragraph is indented by one and a half centimeters.

What rules does the guest form in addition to these basic parameters?

- Punctuation marks are separated from words and characters following them by spaces. There is no space before the sign.

- The space between lines of text is set to one and a half. The title, the name of each section or paragraph is separated from the text by an interval of two.

- There are no punctuation marks after the title.

Cash flow statement

This report shows all the ways in which cash flows into and out of the company. This is a financial document that allows you to regulate the activity plan of all participants in the enterprise. Typically, such a report consists of financial, operating and investing activities.

This document is usually calculated using two methods:

- Direct calculation method. This method is also called the cash method. It is based on direct calculations of net gross receipts and expenditures.

- Indirect calculation method. It is based on all transactions that are carried out in a specified period and based on these transactions, a cash flow statement is compiled.

Rules for registration of accounting documentation

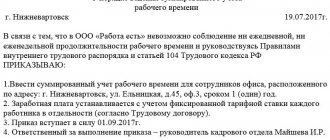

Procedure for preparing cash documents:

- The paper carrier is filled in with a ballpoint pen. You can also use a typewriter. The electronic version involves the use of a computer and printer;

- The chief accountant and cashier have the right to sign cash documents. In the absence of a chief accountant, the manager becomes responsible for the preparation of cash documents;

- a tear-off receipt is invalid without the “Paid” stamp;

- A dash is placed in empty fields.

https://youtu.be/Ip8BI7GrpJ4

Other reporting

- Invoice. This document is issued to the buyer by the seller in order to record the fact of the transaction, as well as to determine VAT. You can select standard and advance. The peculiarity of a standard invoice is that it is sent either along with the goods or after shipment or provision of services. The advance payment is sent with the first prepayment to account for future deliveries.

- Proforma invoice. This is a financial document that is needed to determine the cost of goods when transported across the border. Features include shipping before the transaction is completed, as well as possible differences in price, quantity and total cost compared to the invoice. Does not constitute a basis for payment.

- Invoice. This is the financial document that is most often used in international trading practices. This document is mandatory in international trade. The invoice indicates all the quantitative and qualitative characteristics of the goods, is transferred simultaneously with the goods and indicates the full final cost of the goods and the owner.

- Certificate of origin of the goods. This document is a secure form that certifies the customs control of the Russian Federation or another country. This certificate is needed when importing or exporting goods, to determine the competitiveness of this product relative to domestic producers, as well as to provide possible import benefits.

Rules for using capital font

Capital font is writing in capital letters. When preparing coursework, it is used in the names of structural sections, namely:

- "INTRODUCTION" and "CONCLUSION";

- Buy coursework

“CHAPTER 1”, “CHAPTER 2” and so on; - "BIBLIOGRAPHY";

- "APPLICATION".

On the title page, the name of the educational institution and the expression “COURSE WORK” are also written in capital letters. All other headings, sections and subheadings are formatted using regular font.

Signing financial documents

All of the above documents are not valid without the signature of the responsible person. In financial legislation, the concept of “right of first signature” and “right of second signature” is usually used. The first signature is usually the head of the enterprise, the second chief accountant of the company or the vice president, if such a position exists in the company. The right of the first signature cannot be transferred to the holder of the right of the second signature; one person cannot be the owner of the first and second signature at the same time. A notarized power of attorney can also be issued for the right to sign, but this is done extremely rarely.

Sheet Options

To create standard official documentation, you will need to open the document page and set the following parameters:

- What type of paper: white printing paper.

- Sheet format: a4.

- Book version of the sheet layout.

- Indentation from the sheet borders: on the left 30-35 mm, on the right - from 10 mm, from above and below - from 25 mm.

- The color of the symbols is black.

- The size of characters is at least twelve.

- Which font is calibri or times new roman?

GOST 7.32/2001 establishes requirements for intervals of various values.

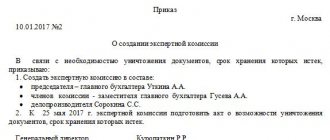

Registration of a power of attorney for the right to sign

If an accountant or manager is absent, then in such cases the right to sign documents is transferred to other employees according to two documents:

- Leader's order. This is a necessary formality if the manager wishes to leave a trusted person in his place. Such an order usually indicates the first or second right of signature transferred to this person, the surname, first name, patronymic of the employee, as well as a list of documents that he can sign under this order. This order usually also contains a sample signature of the employee.

- Power of attorney. In some cases, during negotiations with partners or suppliers, the right to sign is transferred under a power of attorney. The power of attorney also indicates what signature rights are transferred to this employee and what agreements he can enter into on behalf of the company.

The transfer of rights can be temporary or permanent. Temporary transfer of the signature is carried out at the time of vacation, business trip or sick leave of the responsible person. Permanent transfer is carried out with full transfer of authority to another person, for example, when introducing a new position.

Topic: Procedure for preparing accounting documents

Topic: Procedure for preparing accounting documents

1. Document flow system for primary accounting documents

2.Order of registration

1. Document flow system for primary accounting documents

Document flow is the movement of primary accounting documents in accounting, their creation or receipt from other organizations, acceptance for accounting, processing, transfer to the archive. Work related to drawing up a document flow schedule is organized by the chief accountant of the enterprise.

Timely and high-quality execution of primary accounting documents, their transfer within the established time frame for reflection in accounting, is ensured by the persons who compiled and signed these documents. As established by clause 15 of the Regulations on accounting and financial reporting in the Republic of Kazakhstan, the creation of primary accounting documents, the procedure and timing of their transfer for reflection in accounting are carried out in accordance with the document flow schedule approved by the organization.

The document flow schedule is approved by order of the head of the organization; it must be rational, i.e., provide for the optimal number of units and executors that each primary accounting document must go through, and determine the minimum period of its presence in the unit. Each performer is given an extract from the document flow schedule, which lists the documents related to the scope of his activities, the deadlines for their submission and the divisions of the organization to which they are submitted.

2.Order of registration

Taking into account the purpose and circulation environment of documents, document flow can be very roughly divided into: internal and external. The first consists of internal documents, as well as incoming documents received by the enterprise and not subject to return to the sender. The second consists of outgoing documents - they also include those few incoming and internal documents that for some reason must be returned.

Document flow of the enterprise.

For each document in accounting there is its own path of movement, i.e. your document flow. However, for all documents, five main steps are required:

1) drawing up a document at the time of a business transaction in accordance with the requirements for the preparation of documents;

2) transfer of the document to the accounting department, where they control the timeliness and completeness of its submission for accounting processing;

3) verification of accepted documents by an accountant. The verification is carried out in form (checking the completeness and correctness of documents, filling in their mandatory details), in content (checking the legality of documented transactions, the logical linking of individual indicators) and, in addition, includes an arithmetic check;

4) document processing in accounting:

•taxation, or pricing, involves the transfer of natural and labor measures into a generalized monetary measure.

•grouping - selection of documents that are homogeneous in economic content (receipt of goods and materials and expenditure of goods and materials);

•quote - an indication in the primary document of the correspondence of accounts for a specific business transaction arising from the contents of the document;

5) delivery of documents to the archive for storage after compiling accounting registers for them.

Clause 3 of Article 9 of the Law “On Accounting” establishes that the list of persons who have the right to sign primary accounting documents is approved by the head of the organization in agreement with the chief accountant.

According to clause 14 of the Regulations on accounting and financial reporting in the Republic of Kazakhstan, without the signature of the chief accountant or a person authorized by him, monetary and settlement documents, financial and credit obligations are considered invalid and should not be accepted for execution (with the exception of documents signed by the head republican executive body, the features and design of which are determined by separate instructions of the Ministry of Finance of the Republic of Kazakhstan).

The basic rules for organizing document flow are:

-prompt passage of the document, with the least amount of time;

-maximum reduction of document passage instances (each movement of a document must be justified, it is necessary to exclude or limit return movements of documents);

- the order of passage and processing of the main types of documents must be uniform.

Organization of document flow is the rules in accordance with which the movement of documents should occur. The organization of document flow combines the entire sequence of movement of documents in the management apparatus of an organization (institution), all operations for receiving, transmitting, drawing up and processing, sending (and filing) documents for use. Document flow is an important part of office work and information support for management. A clearly organized document flow speeds up the passage and execution of documents in an organization (institution).

Inbox.

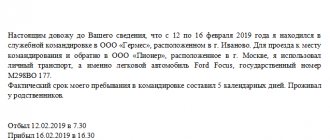

Incoming document - a document received by the institution. Most incoming documents should generate corresponding outgoing documents within a specified time frame. Deadlines may be established by regulations prescribing a particular response time to the corresponding incoming document or may be indicated directly in the incoming document.

Outgoing

. An outgoing document is an official document sent from an institution. Most outgoing documents are the organization's response to incoming documents.

Domestic

. An internal document is an official document that does not go beyond the boundaries of the organization that prepared it.

Document registration is a record of accounting data about a document in the prescribed form, recording the fact of its creation, sending or receipt. Indexation of documents in office work is the affixing of their serial (registration) numbers and the necessary symbols during registration, indicating the place of their execution (drawing) and storage.

Document execution control is a set of actions that ensure timely execution of documents. The organization of control over the execution of documents must ensure their timely and high-quality execution.

Documentary audit

Documentary audit is one of the most common forms of document control in financial law. The main purpose of the audit is to control the complete implementation of the legislation of the Russian Federation in its financial, operational, investment and other activities. It is monitored in terms of the availability and movement of all resources, including financial, material, human, scientific and technical. Documentary audits are carried out by both government agencies and company management on an ongoing and mandatory basis. Main goals:

- Maintaining discipline and detecting violations in the preparation of all forms of financial documents.

- Carrying out prevention in terms of violations of financial discipline.

- Checking the completeness of all financial lists submitted by documents.

- Checking compliance with documents, internal regulations, and financial laws of the country.

- Monitoring the conservation of company resources, as well as control over their consumption.

What are the criteria for creating organization text files?

To create an official document of an organization, you will need to analyze the criteria and style of the organization in creating documentation. In addition, study what standards are fixed by the guest. The document that contains standards and criteria regarding the creation and formatting of official text files is called GOST 2.105/95. Most papers are created in book form and A4 sheet format.

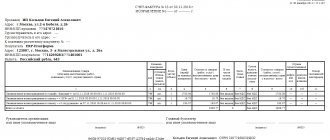

Design rules and text parameters

| Index | Meaning |

| Using fonts in official documents | Calibri, times new novel |

| Character size | 12, 14 |

| Line separator space | 1.5 |

| Number the sheets | In order, except for the title page |

| Borders | Top 20 mm, bottom 20 mm, left 30 mm, right 15 mm. |

The title is centered and highlighted. There is a space of three between the title and the text of the section.