https://youtu.be/Se04jIO1Gr4

NOTE! Due to the introduction of a non-working day regime from March 30 to April 30, 2020, the reporting deadlines for March-May 2020 have been extended by three months (see Government Decree No. 409 dated April 2, 2020). Read more about this here.

Annual reporting, mandatory for LLCs and individual entrepreneurs working under the simplified tax system

Reporting on payment of income to individuals

What else do LLCs submit to the simplified tax system per year?

Results

Features of ANO affecting reporting

The following features of ANO influence the reporting of such companies:

- focus on achieving social goals;

- obtaining material benefits is not a priority;

- activities are regulated by the Civil Code of the Russian Federation, the Tax Code of the Russian Federation and industry legislation;

- there may be associations of individuals;

- the basis of accounting is the targeted revenues of the autonomous non-profit organization, which are necessarily reflected in the reporting;

- submission of reports is established according to deadlines typical for legal entities;

- mandatory content in reporting of information relating to the property of the autonomous non-profit organization, both in monetary and other forms;

- as income, the reporting reflects receipts from participants, voluntary donations, revenue from certain types of work, interest on stocks and bonds, and others;

- to generate reporting, they use data on the balances of property obtained through targeted investments;

- reporting is prepared using documents justifying transactions;

- it is necessary to have confirmation of the property transfer transaction;

- it is necessary to have documents confirming the expenses of the autonomous non-profit organization.

General presentation and composition of accounting statements

Autonomous non-profit organizations (ANO), like others, are required to keep records and submit reports to the authorities annually.

According to legal norms, accounting reports of ANO consist of: (click to expand)

- balance. The difference between this report and commercial organizations is that the “Capital and Reserves” section is replaced by the “Targeted Financing” section. A sample reporting form is presented in the appendix to this article.

- report on the intended use of funds. This report contains information: the amount of financial resources used, the balance of funds at the beginning and end of the period, the amount of receipts;

- An explanatory note is not a mandatory element of reporting. It provides a breakdown of more detailed indicators. The form of such an entry may comply with the recommendations of the Ministry of Finance, but it is also possible to use your own template in the ANO.

Reporting can be submitted both electronically and in paper form.

In general, the reporting structure is formed in accordance with the applicable taxation regime.

Important! When applying the simplified tax system for autonomous non-profit organizations, the responsibility for submitting reports may be assigned to the manager. That is, the chief accountant may not be part of the staff.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Who is given the right to submit simplified accounting reports?

It is established by law who submits simplified financial statements and can conduct simplified accounting, and who does not have such a right (Article 6 of the Federal Law of December 6, 2011 No. 402-FZ). We emphasize that simplified accounting and reporting is the right of the organization, and not an obligation.

IMPORTANT!

Individual entrepreneurs may not keep accounting records at all and not submit financial statements (Clause 2, Article 6 of Federal Law No. 402-FZ).

If ANO is on the simplified tax system

ANO, like other companies, has the right to apply the simplified tax system in two options: 6% or 15%.

The advantages of using the simplified tax system for autonomous non-profit organizations are as follows:

- reduction in the number of reports submitted per year from 41 to 34;

- reports can be submitted without using an electronic signature.

Important! There are two features of using the simplified tax system for autonomous non-profit organizations:

- ANO is allowed to use the simplified tax system even if the share of participation of another person is above 25% (clause 12, clause 3, article 346.12 of the Tax Code of the Russian Federation);

- the use of the simplified tax system is possible even if the cost of fixed assets (non-depreciable) is more than 150 million rubles. (Clause 1.Article 256 of the Tax Code of the Russian Federation).

Example No. 1. ANO “VVV” for the tax period received a profit in the amount of 550 tr. The amount of expenses amounted to 435 tr.

Let’s assume that ANO “VVV” is using the simplified tax system at 15%:

(550 – 435) * 15% = 17.25 tr. – the amount of tax to be paid.

Now let’s define the simplified tax system 6%:

550 * 6% = 33 tr.

Obviously, for VVV LLC the simplified tax system of 15% is more profitable.

Important! Targeted revenues that ANO receives and uses for their intended purpose are not taxed (Part 2, Article 251 of the Tax Code of the Russian Federation). It is necessary to maintain separate records for such forms of income.

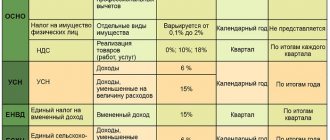

Tax rate

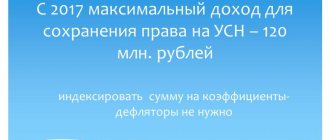

The government does not plan to change the rate for the simplified tax system in 2020: private businesses on the simplified taxation system, as before, will pay 6% on “income”, and after deducting expenses - 15%. At the same time, the law allows for a reduction in established rates at the regional level by 1 and 5 percentage points (respectively).

A reduction in insurance premiums can have a tangible effect. From January 1, the rate for employees will be reduced by 50%, which may contribute to the growth of employment in SMEs. But the conditions for the transition to the simplified tax system in 2020 will remain unchanged:

- income limit no more than 112.5 million rubles. (9 months before filing an application to change the tax form);

- up to 100 hired employees;

- no more than 150 million rubles. cost of fixed assets.

The income limit under the simplified tax system for 2020 has also not changed and should be no more than 150 million rubles.

Amendments to the current law have abolished reduced insurance premiums, which was an unpleasant surprise for entrepreneurs.

Another innovation that SMEs planning to obtain the status of “simplified” is unlikely to be happy with is the abolition of the special tariff. Let us recall that earlier, with an income of 79 thousand rubles. one could count on taxation at a lower rate, but from January 1 this norm will be abolished and if there are employees, you will have to pay a tax of 30%.

Features of tax reporting of ANO using the simplified tax system

Autonomous non-profit organizations submit the same reports to the simplified tax system that are mandatory for all other organizations.

In this case, the simplified tax system declaration is submitted once a year in a simplified form (clause 1 of article 346.12 of the Tax Code of the Russian Federation):

- title page (sheet 01);

- direct tax calculation (sheet 02);

- report on the targeted use of funds received as part of charitable activities, targeted income (sheet 07);

- Appendix No. 1 to the declaration.

The obligation to submit a declaration is not excluded even if the values in it are equal to “0”. In such a situation, a zero declaration is submitted (clause 1 of Article 34619 of the Tax Code of the Russian Federation).

In addition, an autonomous non-profit organization using the simplified tax system is obliged to create a General Book of Income and Expenses (KUDiR) (Article 346.24 of the Tax Code of the Russian Federation).

If an independent non-profit organization is on the simplified tax system, then it does not pay income tax, property tax and VAT. This means there is no need to submit returns for these taxes. The exceptions are as follows:

- for autonomous non-profit organizations that have property subject to taxation at cadastral value (clause 2 of Article 346.11 of the Tax Code of the Russian Federation). The tax must be paid according to the general rules and a declaration must be submitted;

- if the ANO is a tax agent when leasing state property (clause 3 of Article 161 of the Tax Code of the Russian Federation). Tax must be paid according to the general rules and a declaration must be submitted.

Who does not need to submit a declaration under the simplified tax system?

The Ministry of Finance published a special initiative on the Federal Portal of Legal Acts, on the basis of which it is planned to simplify the reporting process for all companies or individual entrepreneurs that use the simplified taxation regime during their work.

Such relief will only apply to taxpayers who use cash register systems during work. In this case, all information about the results of their activities is transmitted through the operator automatically.

The nuances of such innovations include:

- Taxpayers are exempted from the need to prepare and submit a simplified taxation system declaration if they use online cash registers, therefore all information about various transactions is automatically transmitted to the Federal Tax Service;

- online cash registers are usually used only in retail trade;

- such relaxations are due to the fact that the latest cash registers already transmit information to tax inspectors, which they can obtain from the declaration, so tax is calculated without any difficulties;

- Tax authorities can automatically write off the required amount of money to pay tax from the current account of a company or individual entrepreneur, and can also issue a corresponding requirement.

Will the declaration under the simplified tax system be cancelled? Answer in video:

https://youtu.be/0HW5pVCdEG4

Although eliminating the need to submit a declaration simplifies the work of many entrepreneurs, experts are still confident that this will lead to some difficulties and additional questions.

If companies or individual entrepreneurs do not use an online cash register, they will be forced to submit simplified taxation tax declarations under the same conditions.

When the law comes into force

Based on the bill, the changes will be applied from the beginning of 2019.

Therefore, many taxpayers will be able not to submit a return even for 2020, but only on the condition that during this tax period they actually used the online cash register.

The initial exemption will be received by individual entrepreneurs using the simplified tax system “Income”, and only then companies will be able to take advantage of this relaxation.

If an individual entrepreneur or company uses the simplified tax system “Income minus expenses”, then they will still be forced to submit a declaration annually, since by using an online cash register it is impossible to automatically notify tax authorities about various expenses that reduce the tax base

When do you need to submit a declaration to the simplified tax system?

Therefore, for such taxpayers, filing a return is a mandatory process. If companies or individual entrepreneurs did not use the online cash register for the whole of 2020, but for several months, they will still have to submit a declaration.

Is it necessary to have an online cash register when applying for a loan? Find out here.

This is due to the fact that employees of the Federal Tax Service do not have some information about income received.

Reporting to statistical authorities for ANO

Autonomous non-profit organizations prepare statistical reports (clause 1 of article 32 of the Law of January 12, 1996 No. 7-FZ). Among these special forms are:

- 11-short, approved by Rosstat order No. 296 dated July 3, 2015;

- 1- NPO, approved by order of Rosstat dated August 27. No. 535. A sample form is presented in the appendix to the article.

Important! Statistical reporting forms are submitted by the ANO with a deadline limited to April 1 of the post-reporting year.

ANO reporting to the Ministry of Justice

Autonomous non-profit organizations are required to submit reports to the territorial branches of the Ministry of Justice, which are approved by order No. 72 dated March 29, 2010.

Submission of this reporting to the Ministry of Justice allows you to control the fact of the absence of foreigners among the members of the ANO, as well as the absence of foreign sources of funding.

Reporting forms include: (click to expand)

- form oNooo1 - information about managers;

- form oNooo2 – information on options for using ANO property;

- form oНоо1 – the amount of resources received from foreigners and international companies, stateless persons.

The first two forms are filled out by the ANO under the following conditions:

- no assets received from foreigners;

- the founders of the ANO are Russian citizens;

- revenues for the year are less than 3 million rubles.

Deadlines for submitting reports for ANO on the simplified tax system

The deadlines for submitting reports in 2020 are set taking into account weekends and holidays. In this situation, the deadline is postponed to the next working day.

The table shows the deadlines for submitting reports for autonomous non-profit organizations that use the simplified tax system in 2020.

| Report type | Term | |||

| 1st quarter | 2nd quarter | 3rd quarter | 4th quarter | |

| simplified tax system | For LLC – 04/01/2020, for individual entrepreneur – 04/30/2020 | |||

| Property tax | 30.04 | 30.07 | 30.10 | 30.04.2020 |

| Transport tax | 03.02.2020 | |||

| Land tax | 03.02.2020 | |||

| Financial statements | 01.04.2020 | |||

| SZV-M | 15.02 15.03 15.04 | 15.05 15.06 15.07 | 15.08 15.09 15.10 | 15.11 16.12 15.01.2020 |

| 6 personal income tax | 30.04 | 31.07 | 31.10 | 01.04.2020 |

| 4 FSS on paper | 22.04 | 22.07 | 21.10 | 20.01.2020 |

| 4 FSS in electronic form | 25.04 | 25.07 | 25.10 | 27.01.2020 |

| 2 personal income tax | 01.04.2020 | |||

| SZV-experience | 02.03.2020 | |||

| Average headcount | 20.01.2020 | |||

Important! For 2020, a simplified reporting procedure was approved - submitting a simplified taxation system (STS) declaration may not be necessary for individual entrepreneurs and legal entities if they have used online cash registers for a whole year and their tax base is “Income”.

Simplified registration procedure

In addition to the fact that the government did not change the simplified tax system limit for 2020 for LLCs and individual entrepreneurs, leaving it at the same level, a simplified procedure for official registration will be available to such businesses.

To obtain all the necessary documentation, next year you will not have to waste time visiting the tax office, which is not always convenient. Now the entire package of documents will be automatically sent to the company’s email immediately after registering a business. And in order to receive documents in paper form, you will have to submit a separate application, a sample of which can be obtained from the tax office.

Having a seal will also no longer be a prerequisite for carrying out business activities. As the experience of previous years has shown, this was a real problem when it was necessary to certify corrections in the Book of Expenses and Income, which previously could only be done using a seal.

Contrary to numerous forecasts, the government does not plan to abolish the simplified tax system for individual entrepreneurs in 2020. But it is possible that this will be implemented in 2020 if the country’s economy is able to cope with the crisis and demonstrates stable growth dynamics.

Key tax changes from 2020

Limits of individual entrepreneurs on the simplified tax system in 2020 and 2020. Who has the right to apply simplification?

ANO reporting in the absence of activity

In the event that the activities of the autonomous non-profit organization were not carried out for any reason, there is no data on income and expenses, it is necessary to submit the following types of reports with zero indicators, which are reflected in the table below.

| Simplified accounting | · balance sheet; · report on intended use |

| Tax reporting | Declaration according to the simplified tax system |

| Reporting for employees | · 2 personal income taxes; · 6 personal income tax; · SZV-M; · SZV-experience; · ERSV; · 4 FSS |

| Statistical bodies | · Form 1-NKO; · Form No. 11 (short) |

Utility payments: conditions for exempting intermediaries from tax

From January 1, 2020, the new wording will contain subclause 4 of clause 1.1 of Art. 345 Tax Code of the Russian Federation. It exempts intermediaries who accept utility payments from property owners (owners) from paying a single “simplified” tax on the amounts received. Such intermediaries include real estate owners' associations (RTN), homeowners' associations (HOAs), management companies (MCs), housing and other specialized consumer cooperatives. To be exempt from tax, two conditions will need to be met simultaneously. First, TSN, HOA, management company or cooperative has a resource supply agreement (provision of services for the management of municipal solid waste) with a specialized organization. And secondly, TSN, HOA, management company or cooperative directly provides the relevant public services to the owners (owners) of real estate. As we can see, the new norm assumes that the intermediary does not simply organize the provision of services by a specialized company. To obtain the right to exemption from tax on payments received, he must, on his own behalf and for an appropriate fee, accept garbage from the owners (owners) of real estate, or transfer energy resources to them, having previously purchased these services from a specialized organization.

Legally, this approach is absolutely correct. Let us explain why. In a situation where the owners (owners) of real estate receive services directly from a specialized company, and the role of TSN, HOA, management company or cooperative is reduced only to organizational issues (drawing up contracts, collecting money, etc.), it cannot be said at all that the incoming amounts are the proceeds from the sale of services of the TSN, HOA, management company or cooperative. This means that in this case there is no need to apply the provision of subparagraph 4, paragraph 1.1 of Article 346.15 of the Tax Code of the Russian Federation. However, the version of this rule in force until 2020 assumes that in such a situation the intermediary receives revenue, but does not need to include it in income. The new edition of this norm lawfully classifies as revenue only those payments that were received for the direct provision of utility services.

However, in practice, such a legally correct clarification may result in additional difficulties for these organizations. This will happen if the Federal Tax Service requires proof that it is the TSN, HOA, management company or cooperative that provides utility services. And in the absence of such evidence, it will include the received amounts of utility payments in income.

Check the counterparty for signs of a shell company, bankruptcy and the presence of disqualified persons

True, legislators have provided a certain protective mechanism here. Subclause 1 of clause 2 of Article 346.17 of the Tax Code of the Russian Federation has included a provision prohibiting TSN, HOA, management company or cooperative from taking into account as part of material expenses funds transferred in payment for services under contracts with resource supply organizations (waste management operators), if in relation to these funds there was the exemption provided for in subparagraph 4 of paragraph 1.1 of Article 346.15 of the Tax Code of the Russian Federation was applied. In other words, the material costs of a TSN, HOA, management company or cooperative do not include utility payments received from the owner (owner) of the property and transferred to the resource supply organization (waste management operator), if these payments were not taken into account in the income of this intermediary.

This means that as soon as the Federal Tax Service includes the corresponding amounts in income, it will immediately have to take them into account in expenses, which will offset all additional charges. However, it is obvious that this protective mechanism will not work for taxpayers who have chosen “income” as the object of taxation. Therefore, by the end of the year, they need to determine how they will draw up documents confirming the fact that relevant services have been provided to the property owners (owners) directly on behalf of the TSN, HOA, management company or cooperative.

Submit a free notification of the transition to the simplified tax system and submit a declaration under the simplified tax system via the Internet

FAQ

Question No. 1. If an independent non-profit organization does not have a bank account, what reports must be submitted?

Reporting is submitted in a simplified form, consisting of a balance sheet and a report on the intended use of funds.

Question No. 2. Do ANOs need to submit a report on financial results?

The financial results report is not required to be submitted. It can be replaced with a report on the use of funds. It is mandatory only in the following cases:

- ANO received a decent amount of income during the reporting year;

- Profit data does not fully reflect the financial condition of the ANO.

Basic mistakes

Mistake No. 1. Very often, the management of an autonomous non-profit organization believes that having a chief accountant on staff is mandatory. However, this is a mistake, since autonomous non-profit organizations have the right to sign and submit reports directly to the manager.

Mistake No. 2. The mistake is that ANOs using the simplified tax system often believe that they no longer have to pay any taxes other than the simplified tax system. There are exceptions that need to be taken into account:

- property tax is also paid if there is property that is taxed at cadastral value;

- VAT is paid if the ANO is a VAT agent;

- transport tax is also paid if the ANO owns vehicles;

- if you own a plot of land, then you also pay land tax.