Economic crises are shaking the modern world, so all companies and industrial enterprises, without exception, strive to reduce their costs and optimize assets. And in order for debit and credit to match, competent and decent accountants are needed. Businessmen are ready to trust their money only to experienced specialists.

An accountant is a highly responsible position. The financial security of the entire company depends on the professionalism of a cash flow specialist. If an accountant makes errors in reporting, not only he, but also the manager may come to the attention of law enforcement agencies.

What salary does an accountant receive for such responsible work? What are the occupational risks and benefits? Can a person in this profession count on any additional payments and bonuses? How much pension can an accountant expect?

Professional Responsibilities

In order to become a professional accountant, you must obtain a higher education in economics with a major in Accounting. Applicants for this position must have a good understanding of taxation issues, including foreign exchange and customs. You must be able to work in accounting computer programs and know the rules of document flow.

According to the job responsibilities, the accountant is engaged in:

- organization of accounting and financial and economic activities of the organization;

- maintaining tax records;

- compiling accounting, tax and statistical reports and submitting them to tax authorities and funds.

In addition, the accountant must:

- participate in the inventory of equipment and material assets;

- actively interact with banking structures, monitor the movement of funds in the organization’s cash accounts;

- keep strict records of income and expenses received as a result of the economic and financial activities of the enterprise. The need for competent accountants in the labor market in Russia always remains quite high.

Thus, today about 1,200 vacancies remain open in the country. Employers wanted applicants for this position to be responsible, attentive, efficient and friendly.

Qualification and salary

The more qualified an employee is, the higher wages he can expect. Let's look at the basic requirements that large companies place on employees for highly paid positions:

- higher economic education;

- availability of a professional certificate;

- more than 3 years of work experience;

- experience in submitting reports to tax and other authorities;

- knowledge of Russian tax legislation;

- ability to work with the 1C program;

- knowledge of programs: Consultant Plus and Guarantor;

- work with bank clients.

Specialists who meet all the above requirements can count on higher salaries.

However, there are other positions that do not require high qualifications. Young professionals can get a job as an accountant in the area of processing primary documents: preparing acts and invoices, working with expense reports, compiling a book of purchases and sales, and so on. Such duties are usually performed by novice accountants. Both students and young professionals with no experience or with less than one year of work experience can apply for this vacancy. In this case, you do not have to count on high wages. An assistant accountant receives an average of 10,000-18,000 rubles per month. If we talk about the average salary level in Russia, it varies greatly from region to region.

| City | Salary in thousands of rubles per month |

| Moscow | 35-130 |

| Saint Petersburg | 35-90 |

| Vladivostok | 30-85 |

| Volgograd | 15-40 |

| Voronezh | 25-55 |

| Ekaterinburg | 30-90 |

| Kazan | 25-55 |

| Kaluga | 25-55 |

| Krasnodar | 20-65 |

| Krasnoyarsk | 20-60 |

| Krasnoyarsk | 25-45 |

| Nizhny Novgorod | 25-65 |

| Novosibirsk | 25-70 |

| Rostov-on-Don | 20-60 |

| Samara | 20-65 |

| Saratov | 15-40 |

| Sochi | 30-60 |

| Ufa | 20-55 |

| Yaroslavl | 15-75 |

What does an accountant's salary depend on?

Today, accounting professionals are in demand and their work is well paid. However, it should be noted that the salary depends on a number of factors:

experience

Employers can offer young accounting specialists with at least a year of work experience a position with a salary of 15-17 thousand rubles. Moreover, the number of such vacancies is less than 10% of all offers. 30% of employers are ready to provide work to accountants whose experience ranges from 1 to 3 years. They are willing to pay from 24 thousand rubles. And specialists with 3-6 years of experience can count on a salary of 60 thousand rubles.

Place of work

A payroll accountant working on a cruise ship earns 90-120 thousand rubles per month. When a specialist of the same level working in a leading medical company can count on a salary of 64-89 thousand rubles. And the accountant of the company, which is a leading manufacturer of cabinet furniture, receives only 45-50 thousand rubles for his work. monthly.

Tax specialists working in large holdings earn up to 400 thousand per month. But the percentage of such highly paid accountants does not exceed 2-3% of all employees of the corresponding position

Job title

Also, the size of an accountant’s salary is affected by the position held. Thus, a senior specialist earns 62-91 thousand rubles a month, and an ordinary employee earns 30-43 thousand rubles.

How much does a chief accountant earn?

The chief accountant of an enterprise is a very responsible position. Unlike other vacancies, there is only one position of Chief Accountant at each enterprise. Two Chief Accountants cannot work in one organization at the same time.

The salary of the Chief Accountant is comparable to the salary of the Financial Director. Often, these positions are held by one person. The maximum level of income can reach 500,000 rubles per month or even more. The smallest salary starts from 70,000 rubles per month.

Of course, to become a Chief Accountant, it is not enough to simply take accounting courses. To do this, you must have extensive work experience and be sure to have a higher education, preferably economics. Often, the responsibilities of the Chief Accountant include not only accounting and tax accounting, but also knowledge of the basics of budgeting, financial planning and management accounting.

Additional bonuses and benefits

As additional bonuses, the accountant of the large retail chain Magnit is offered:

- bonus for length of service;

- discounted vouchers;

- corporate pension programs;

- congratulatory programs.

The bookmaker's office is looking for a payroll accountant and guarantees as bonuses:

- advanced training courses for specialists at the expense of the company;

- corporate events;

- corporate discounts at dealerships, chain cafes, bakeries, etc.

Is it possible to increase income?

There aren't many ways for accountants to increase their income. Basically, we are talking about finding a part-time job, that is, keeping the entrepreneur’s books on a simplified system. As a rule, this requires a minimum amount of documentation and timely filing of reports. But during the reporting period, an accountant’s income can increase by 3-5 thousand rubles from each client. In addition, an accountant can provide consulting services, maintain his own blog, and tell subscribers about the nuances of legislation and accounting in a particular area.

Finally, the third way to legally increase your income is to learn international IFRS standards. All other things being equal, this will help you find a place with a payment approximately 15-20% above average. In addition, knowledge of a foreign language can often give an increase of 10-15% to your monthly salary if you manage to get a job in a large company. By the way, many specialists want to work in such a company not so much because of the high salary, but because of the solid social package that is offered there.

And, of course, given the constant automation of accounting, the number of accountants will be steadily decreasing, so you need to constantly improve your qualifications by mastering additional skills that will increase your value in the labor market.

What are the salaries of accountants in other Russian cities?

In St. Petersburg, the need for accountants is even lower, with only 135 vacant positions. St. Petersburg finance specialists earn an average of 25-65 thousand rubles. per month. In Yekaterinburg, Irkutsk, Krasnodar, Smolensk, Nizhny Novgorod, Penza and Tyumen, an accountant is promised a salary of 11-41 thousand rubles. per month.

The salary of specialists in Kaliningrad and the Republic of Crimea ranges from 27-45 thousand rubles. In Kamchatka, they are looking for accountants with a salary of 40-55 thousand rubles. the Orenburg have the lowest monthly incomes - 16-28 thousand rubles.

Thus, the average monthly salary in the regions of Russia is 29-31 thousand rubles. This corresponds to the average wages of workers in the country's economy.

Method 2. Master a new area or skill

Accounting is one of the professions that does not tolerate stagnation. To be a sought-after specialist, you need to constantly monitor innovations in the law, develop and learn new things. Accountants who can:

- Work with large volumes of information and use all the possibilities of process automation.

- Maintain management records and help owners see real business performance and company prospects.

- Conduct a comprehensive economic analysis and draw conclusions about each area of the company’s work, make business development forecasts, draw up business plans and financial and economic feasibility studies.

- Maintain accounting in accordance with IFRS and cooperate with international companies.

According to the hh.ru vacancy database, over the past six months, the average salaries of accountants in Russia vary depending on their specialization as follows:

| Specialization | Average salary by specialization, rub. |

| Accounting management | 63 702 |

| Budgeting and planning | 62 242 |

| Planning and economic management | 59 051 |

| Payroll accounting | 41 745 |

| Accounting for invoices and payments | 41 220 |

| Inventory | 39 954 |

| Primary documents | 37 783 |

| Accountant calculator | 37 706 |

Up to 1 million rubles

salary of the chief accountant in a Russian oil and gas holding

From 500 thousand rubles

before taxes are offered to the chief accountant of a development company

400–600 thousand rubles

for this salary they are looking for a chief accountant - ERP strategist

How much do accountants earn abroad?

In the USA, an ordinary accountant earns a little more than 6 thousand dollars (360 thousand rubles) per month. German accounting specialists receive 3.6 thousand euros (250 thousand rubles) for their work, French – 2.7 thousand euros (190 thousand rubles), English – 3.2 thousand pounds (260 thousand rubles). .). This is significantly more than the salaries of Russian colleagues.

Requirements for an accountant

Over the past few years, the requirements for an ordinary accountant have increased significantly. And, of course, each employer may have some additional wishes. But on average, the general requirements can be reduced to the following:

- presence of secondary or higher specialized education,

- thorough knowledge of legislation in the field of not only accounting, but also the industry in which the enterprise operates (for example, everything related to companies engaged in wholesale trade, providing transport services, etc.),

- Russian citizenship,

- proficiency in office programs and at least 1C,

- work experience of at least 2-3 years,

- if the company has foreign trade activities, then the accountant is also required to have knowledge of customs and currency legislation.

However, some large companies may also require knowledge of a foreign language and international accounting standards.

It is clear that employers expect certain personal qualities from an accountant. Typically, if a person is good with a computer and understands current legislation, age does not matter. But some employers want to see a middle-aged woman as an accountant, so that she is no longer distracted from her work by the illnesses of her children or by difficulties with her parents.

An accountant is also required to be composed, attentive, have psycho-emotional endurance, the ability to remain calm in stressful situations, etc.

Retirement

The amount of monthly pension provision for specialists depends on the length of work, the amount of salary and the amount of insurance contributions. Average pensions for this category of employees do not exceed 12-14 thousand rubles.

It is worth noting that an experienced accountant will always find an opportunity to improve their financial level. Today, specialists who have completed their working career are in great demand. They are invited by residents of apartment buildings to audit public utility bills. It is worth noting that retired accountants have significantly reduced the income of management companies. In return, residents saved a lot of money and improved their financial situation.

Today the number of small companies is increasing. Unfortunately, such organizations cannot afford a tax specialist on their permanent staff. Therefore, accountants working remotely have a good opportunity to earn extra money.

There are a huge number of offers on the market for such services for an experienced specialist. Moreover, payment for one-time work is 0.5-10 thousand rubles. An experienced specialist can work with not just one, but several companies at the same time, so their monthly income can reach 50-60 thousand rubles.

Where can an accountant get a job?

Until relatively recently, most large enterprises had a department that dealt exclusively with accounting, that is, the accounting department itself, while small firms were looking for a part-time accountant. Today, there is such a thing as outsourcing, when a company enters into an agreement with a third-party organization that provides accounting services. These outsourcing firms also need experienced accountants, so a good specialist will not be left without work. As a last resort, for the first time he can consider the option of part-time work and recruit several such clients; this is a completely normal and fairly common practice. In this case, you don’t even need to register an individual entrepreneur, you can simply become a self-employed person.

But getting a job at an outsourcing company is no longer so easy. Specialists working there may have clients from a variety of industries, so an accountant needs to have more extensive knowledge, and the requirements for candidates there are much higher.

Both in the accounting department of a large company and in an outsourcing company there are various positions. It is clear that the department is headed by the chief accountant, sometimes he has a deputy. As for ordinary accountants, they may have separate areas of work:

- currency operations,

- settlements with debtors and creditors,

- salary calculation,

- warehouse operations,

- cash transactions.

In some companies, depending on the volume of operations and document flow, there may be positions not only of a cashier, but also of an accountant-auditor, a merchandising accountant, or a calculator. It is clear that a professional is valued in any of the mentioned areas. But most often, recruitment agency specialists advise newcomers to start working in a small company, where one person is involved in all these areas, and then it is easier for him to see and understand the whole picture of accounting. This is useful for those who dream of a career as a chief accountant.

In large companies, an accountant's working day usually takes place exclusively in the office. In small companies, part-time work is practiced, so the accountant works in several companies at the same time, and in the companies that he undertakes to lead, he works according to his schedule.

However, often an accountant’s working day is irregular, especially during the reporting period, and then he has to work overtime.

Reference

The accounting profession is one of the most common and in demand in the modern labor market. It is provided for in the staff of any organization, since the specialist’s responsibilities include:

- maintaining financial, economic, management, tax accounting;

- performing inventory;

- calculation and payment of wages to employees;

- making payments under agreements with counterparties;

- work with banks (Sberbank and other credit organizations);

- tax optimization;

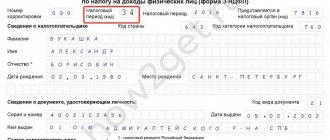

- submission of reports to the Federal Tax Service (FTS);

- accounting for expenses on fuel and lubricants (including the issuance of fuel cards and coupons of PJSC NK Rosneft, gas stations Gazprom or others).

On a note! How to register and activate the Rosneft Family Team card?

Higher education institutions train accountants or economists. To obtain the required diploma, you can choose the following specialties:

- merchandising;

- economy;

- trading business.

The specifics of a company's accounting are determined by its field of activity. They, in turn, influence the formation of a specific list of job responsibilities of accounting employees. In general, their work is regulated by the provisions of accounting and tax legislation.

Figure 3. Study of the Tax Code of the Russian Federation

Important! Instructions for registering in a taxpayer’s personal account.

Responsibility.

Law No. 347-FZ also establishes the responsibility of the manager for non-compliance with the maximum ratio of the average monthly salaries of deputy managers and chief accountants and the average monthly salaries of employees of organizations.

We invite you to familiarize yourself with the Partnership on Faith - this is... What is the Partnership on Faith?

In this regard, in Art. 278 of the Labor Code of the Russian Federation, which provides additional grounds for terminating an employment contract with the head of an organization, two new grounds have appeared:

- non-compliance with what is established by virtue of Art. 145 of the Labor Code of the Russian Federation, the maximum level for the ratio of the average monthly salary of a deputy manager and (or) chief accountant;

- other grounds provided for in the employment contract.