The procedure for writing off PPE

Accounting for property at the enterprise, including workwear, is carried out by the accounting department. This happens in accordance with Order of the Ministry of Finance of the Russian Federation dated December 26, 2002 N 135n “On approval of the Guidelines for accounting of special tools, special devices, special equipment and special clothing,” as well as other regulations that regulate the accounting of property in an organization. Workwear and personal protective equipment (PPE) that are not subject to further use are written off. The procedure for conducting an inventory is determined by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 N 49 “On approval of the Guidelines for the inventory of property and financial obligations.”

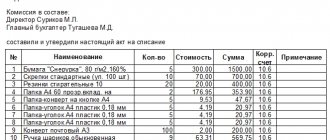

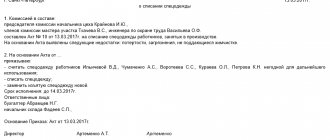

Step 1. Create a commission

The manager forms an inventory commission. The commission does not include materially responsible persons who report to the assets subject to inventory.

Step 2: Identifying property that is out of order

The inventory commission examines the clothing and determines its suitability or unsuitability for further use. Items that have expired or cannot be repaired are confiscated. The reasons for the failure of clothing and the persons responsible for this are also identified (if the property was damaged due to someone’s negligence or intentionally). The chairman of the commission prepares a written write-off act.

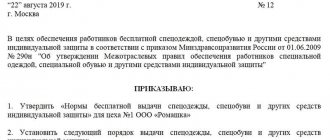

Step 3: Issue an order

Based on the act, the director of the company issues an order to write off workwear and personal protective equipment.

Step 4: Write off the property

After the manager issues the order, PPE is written off by the inventory commission.

Legal grounds

The form intended for registration of write-off of workwear contains a link to the Resolution of the State Statistics Committee. It is indicated here that this is the form recommended for use in this situation. If you carefully read the resolution, you can find out the nuances and situations in which this form should be used.

Clothes can be written off directly only after the organization has carried out an inventory. The document must be prepared in two copies. One copy goes to the accounting department for verification and processing. The second copy remains with the filler, who is responsible for the workwear and its correct write-off.

Form of the act

Since 1997, the mandatory form MB-4 has been used to draw up such an act.

However, today it is not mandatory. Organizations have the right to develop their own form, which must be adopted by the accounting policy. Although practice shows that the standard MB-4 form has not lost its relevance to this day. Almost all companies use a convenient and familiar form. In addition to simplicity, it should be noted the versatility of such a form. It can be used not only when workwear has become unusable. The form is used in case of loss, damage or breakage. Using this form, not only the write-off of clothing is completed. It makes it possible to formally oblige the culprit to compensate for the damage caused.

Where is it used?

The law obliges employers to provide special protective clothing to employees who work in dangerous and hazardous conditions. If the management of an organization refuses to issue special clothing, the employee may not fulfill his direct obligations at all. In this case, the work shift is counted towards him. Essentially, the employee had forced downtime, which was due to the fault of the employer. If the employer refuses to make such a payment, the employee has the right to go to court. But practice shows that it almost never comes to trial. After all, the employer understands that in such a situation he is breaking the law, for which he may incur administrative punishment.

If an employee nevertheless began to fulfill his obligations without special clothing, and an accident happened to him, such situations are considered especially carefully. If it turns out that the presence of special clothing would have prevented the accident, the employer will face criminal liability.

Some companies provide employees with clothing that is used solely to maintain corporate identity. Often special emblems and stripes are used here, indicating that this person is an employee of a particular enterprise. You need to know that such clothing is not special, as it does not have any protective functions. Accordingly, in accounting, such clothing is taken into account somewhat differently.

https://youtu.be/pKOH-yV0Cqo

( Video : “Accounting and tax accounting of workwear. Documents for accounting of workwear”)

The procedure for writing off PPE

Like any property on the balance sheet of an organization, personal protective equipment is registered with the accounting department. If they are not suitable for further use, they must be written off. There is a specific order for this procedure.

Creation of a commission

The head of the organization must issue an order by which members of the inspection team are appointed. They will be the ones who will have to check the PPE, confirming the need to write it off. The commission is prohibited from including employees who are financially responsible for written-off workwear.

Certificate for write-off of workwear, sample

The act of writing off workwear that has become unusable, a sample of which we have prepared, is considered a strict reporting document. At the moment, it is not unified, but there is a standard inter-industry form No. MB-8 “Act for write-off of low-value and wear-and-tear items”, approved by the Decree of the State Statistics Committee of the Russian Federation dated October 30, 1997. No. 71a, which can be used in its preparation.

PPE and uniforms are written off for various reasons (as a result of wear and tear, accidents, employee dismissal, etc.). Sometimes this occurs earlier than the manufacturer's failure date. In this case, the form of the act does not change.

According to paragraph 2 of Article 9 of the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ, the act must include the following sections:

- position and full name manager, his signature with transcript;

- Title of the document;

- date of compilation;

- composition of the commission indicating the names and positions of employees;

- information about the recovery of material damage and its amount;

- grounds for writing off property;

- amount;

- other sections that can be added if necessary.

This document can be used when various equipment and other property are worn out.

Providing workers with special clothing

Intersectoral rules for providing workers with PPE were approved by Order of the Ministry of Health and Social Development of Russia dated June 1, 2009 No. 290n (hereinafter referred to as Order No. 290n). Based on clause 5 of this document, the employer provides workwear, safety shoes, etc. PPE in accordance with standard standards that establish:

- lists of professions for which special clothing is required;

- types of workwear;

- standards for issuing workwear;

- terms of use (wearing) of workwear.

There are both general standard standards, uniform for all spheres of the economy (for example, approved by the Decree of the Ministry of Labor of Russia dated December 31, 1997 No. 70, Order of the Ministry of Labor of Russia dated December 9, 2014 No. 997n), and standards applied in a specific industry (industry , trade, transport, etc.).

Note! The employer has the right to establish increased standards for the issuance of workwear, as well as otherwise improve the provision of PPE for employees (for example, reduce the frequency of issuance, replace one type of workwear with another if it protects no worse, etc.). This follows from part 2 of article 221 of the Labor Code of the Russian Federation, clause 6, clause 7 and clause 35 of Order No. 290n.

The improved procedure for issuing workwear must be enshrined in local regulations based on the results of a special assessment of working conditions. It is usually prescribed in a collective agreement or labor regulations. In this case, the opinion of the trade union, if there is one in the organization, is taken into account. The replacement of workwear provided for by standard industry standards must, in addition, be agreed upon with the regional labor inspectorate.

Remember the three main rules for providing workers with special clothing and other PPE (part 1 and part 3 of article 221 of the Labor Code of the Russian Federation, clause 4 and clause 8 of Order No. 290n):

- the employer purchases workwear at his own expense;

- the employer provides protective clothing to employees free of charge;

- protective clothing (overalls, helmets, gas masks, boots, etc.) must be certified.

An employee has every right not to perform his job duties if the employer has not provided him with appropriate protective equipment. In this case, the latter is obliged to pay for the downtime that arises for this reason (Part 6 of Article 220 of the Labor Code of the Russian Federation, Clause 11 of Order No. 290n).

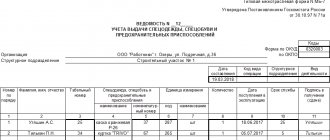

Document preparation

Workwear is written off for various reasons: as a result of wear and tear, accidents, employee dismissal, etc. Based on the results of the inspection, a document is drawn up and signed in two copies by members of the inventory commission operating at the enterprise. Indication of the composition of the commission, as well as the person who approves such paper, is mandatory. We remind you that financially responsible persons are not included in the inventory commissions, but are required to be present during their work.

In the content part, the necessary and mandatory information is:

- Name and nomenclature number of the special equipment.

- Unit of measurement.

- Quantity to be disposed of.

- Unit cost.

- Date of start of operation.

- Established service life.

- Recommended write-off date.

- Reason for departure.

The absence of any of these points may cause the document to be declared invalid and casts doubt on the operations carried out on its basis. The organization has the right to indicate additional information about material assets at its discretion and accounting specifics. The disposal list is summarized in numerical and capital form.

It is important to carefully consider the reason for disposal of clothing. The expiration of the period of use established by the enterprise is not a reason for disposal. If the special clothing is suitable for further use, it could be issued to the employee again. The reason for disposal may be loss or wear and tear.

Discarded clothing is destroyed in the presence of the commission, or is taken to the enterprise warehouse as rags for further use. This information must be reflected in the act. It is also necessary to note the amount of damage recovered from the financially responsible person for the loss of material assets.

Workwear: accounting and write-off 2020

The basis for the disposal procedure is the act of writing off the workwear. It can be developed by the organization independently, taking into account the requirements for document forms that are provided for by Federal Law dated December 6, 2011 No. 402-FZ. But the forms approved at one time by Resolution of the State Statistics Committee of October 30, 1997 No. 71a in terms of content and type remain the most functional. For our purposes, we recommend using the unified act No. MB-8.

The type of independently developed act is established by the accounting policy of the enterprise, as an attachment to the document forms used. It is enough to indicate the MB-8 form in the accounting policy in the list of standard forms. It is important to remember that this act is a strict reporting form. It is on this basis that the correctness of writing off work clothes is checked.

Disposal of workwear: everything you need to know about it

Workwear is considered the most important factor in protecting a worker from all kinds of harmful influences from the outside.

This form is issued upon employment or purchased personally by the employee.

At the same time, the state has clearly established norms for the issuance and write-off norms of workwear .

Uniforms for employees - rules for delivery and receipt

A special uniform purchased by an enterprise is its property. In accordance with the existing law, the employee undertakes to return uniforms in his possession . If the working profession does not provide for the gratuitous and unpaid provision of special clothing by the employer, that is, the employee buys and finds it independently and entirely at his own expense, then there is no need to return it.

As a rule, the return of a special uniform is issued in a situation where a worker moves from one enterprise to another or quits altogether. In this case, the form is submitted individually , leaving a record on the issue card, which is issued to the worker. This fact is displayed as a write-off of special clothing upon dismissal of an employee and is documented accordingly.

The principle of handing over overalls is not complicated - if the period for wearing a set of uniforms has passed, then the worker has the right to dispose of it as he wants:

- take home;

- exploit further;

- tear into rags.

However, if the wear period for the uniform has not expired, and the person wants to quit, then he will need to return the special uniform to the enterprise by returning it to the warehouse .

Collective and personal PPE

The service life of personal protective clothing is shorter than that of collective (that is, intended to be worn by more than one person) protective clothing. So, for example, in the laboratory there are several gowns, which employees of the institution must wear when entering the laboratory. In this case, this element of workwear is considered collective and the standards for its replacement are greatly increased.

As a rule, the requirements for replacing clothing for performing work are calculated by each individual enterprise independently, taking into account sanitary and hygienic standards.

Thus, clothing is issued and handed over to the warehouse in accordance with the law on sanitation and hygiene , while special uniforms may be issued (and, accordingly, handed in) more often. If this fact is not met, then this is a reason for complaints from employees to higher and controlling organizations.

Write-off procedure

Write-off of special clothing issued to an employee by the employer occurs only after the cost of the uniform has been justified. Based on its cost, the norms for wearing clothes for work . But at the same time, they cannot differ for a single day from the legal ones in the direction of longer time; this is contrary to SanPiN and is strictly punished.

If clothing is damaged, completely worn out, or when a worker is fired, the uniform is written off. With this procedure, an act for writing off the workwear , a sample of which is presented below.

The disposal of special clothing must certainly be documented in the appropriate document, and the norms for receipt are documented in the same way. Analytical accounting is carried out both when an employee leaves, and when moving to another position, and when things are completely worn out.