- Date of completion,

full name of the company purchasing the goods,

Write-off act for stationery

Like other materials, office supplies will be accounted for in account 10, and the subaccount is chosen at the discretion of the accountant.

| Purchasing through a supplier | Purchase by reporting employee |

| D 10 K 60 | D 10 K 71 |

Write-off of office supplies: accounting entries

There are three ways to write off office supplies (the chosen method must be fixed in the accounting policy):

- Using the FIFO method (in chronological order of receipt and write-off).

- At average cost.

Calculation takes place

- the weighted assessment method - based on information about the price and number of units of goods at the beginning of the month and all receipts during the billing period;

- using the sliding valuation method - the number of units and the price of office supplies at the beginning of the month and all receipts until the day they are written off.

At the cost of a unit of goods (not advisable in this case). Stationery must be written off at the moment when they are transferred to employees for use (the basis for issuance will be a demand invoice in form M-11 or its own form of a similar document with the company’s details).

| Operation | Accounting entry |

| Stationery supplies were handed over to employees for use | D 26 (44) K 10 |

If in a company that maintains accounting in a simplified manner, office supplies are written off as expenses for ordinary activities immediately upon acquisition, then accounting entries are not needed when issuing items to employees for use. Firms with a simplified taxation regime recognize prices for office supplies as expenses only after payment has been made, if there is an invoice.

At an enterprise under the general taxation regime (OSNO), the prices of office supplies are included in expenses on the day they are transferred to employees, and VAT will be deducted after the receipt of an invoice from the supplier.

Example of writing off office supplies

The HR department needed stationery, they were written off as general business production in the amount of two packages of paper and one box of pencils in the amount of 800 rubles.

| Operation | Amount (rub.) | Reason for write-off | Debit | Credit |

| Payment for office supplies has been received by the supplier. | 800 | Request-invoice | 26 | 10.01 |

Download form 422-APK. Record sheet for the issue (return) of inventory and household supplies

In order to record the issue (issue/return) of household supplies and equipment, the enterprise maintains a statement in Form 422-APK. The document was approved by order of the Ministry of Agriculture of the Russian Federation dated May 16, 2003 N 750. It keeps records of household equipment with a useful life of up to 12 months (based on the adopted accounting policy) within the limits of pre-approved standards. The act is a supporting document for the accepted or released material assets from the warehouse of the enterprise, or their attribution to the costs of the enterprise, company and institution. All household supplies recorded in the form are traditionally divided into groups. Classification allows you to properly organize the accounting of inventory and material assets at the enterprise. Classification of household supplies: • material assets for organizing a limit at the enterprise (written off as production expenses); • household supplies for multiple individual use (written off as expenses); • reusable inventory (written off at the reduced cost of their standard operation); • materials for seasonal use (written off as expenses at a cost calculated on the basis of the remaining operating time of the item in the reporting year). For any movements of material assets recorded in Form 422-APK, it is recommended to promptly carry out control. The statement is compiled in several copies for the recipient and the sender (warehouse manager). Within the time limits prescribed by the document flow standards at the enterprise, the act is submitted to the accounting department, after which it is attached to reports on the movement of material assets in the enterprise.

| Downloads | Size |

| 6.95 kb |

Every office needs office supplies to operate. The person in charge prepares a monthly or quarterly application for their purchase, having ascertained the needs of the employees. An application for the purchase of stationery, the sample of which is not approved at the legislative level, can be drawn up arbitrarily.

Accounting for inventory and household supplies: accounting card, in accounting – Accounting

20.09.2018

Inventory and household supplies are part of the organization’s material and production reserves, used as means of labor.The list of property that relates to inventory and household supplies is not established by law.

In practice, inventory and household supplies are understood as:

– office furniture (tables, chairs, etc.);

– means of communication (telephone, fax);

– electronic equipment (cameras, voice recorders, video cameras, tablets, video recorders, etc.);

– kitchen household appliances (coolers, microwave ovens, refrigerators, coffee machines, coffee makers, etc.);

– equipment for cleaning territories, premises and workplaces (mops, brooms, brooms, etc.);

– fire extinguishing means (fire extinguishers, fire cabinets, etc.);

- lighting;

– toiletries (paper towels, air fresheners, soap, etc.);

– stationery;

— tools and devices;

– tableware and cutlery;

- table linen, sanitary clothing, uniform.

This list contains assets that meet all the characteristics of fixed assets - they last more than 12 months, but do not reach them in cost - 40,000 rubles. Furniture, telephones, electronic equipment, etc.

Such assets can be accounted for as part of inventories and depreciation is not charged on them.

Inventory and HP received at the warehouse is reflected in the debit of subaccount 10-9 Inventory and HP and the credit of account 60 Settlements with suppliers and contractors.

Accounting for inventory located in the warehouse is carried out by name in cards or warehouse accounting books, or in electronic form.

When issuing inventory from the warehouse, a demand invoice is drawn up in form No. M-11.

In this case, the following posting is made: Debit 25 (26, 44) Credit 10-9 – inventory was released from the warehouse, the cost of the inventory was written off as expenses.

Since at the time of transfer to operation the cost of inventory is completely transferred to expenses, these inventory items are no longer listed on the balance sheet. That is, they do not exist in accounting, but in fact they exist.

Since the legislation does not regulate the procedure for accounting for inventory transferred into operation, the organization must develop it independently. For example, in the 1C program, accounting of inventory transferred for operation is kept on an off-balance sheet account.

In order to ensure the safety of inventory and household supplies with a service life of more than 12 months, they are marked with paint, branding or attaching tokens.

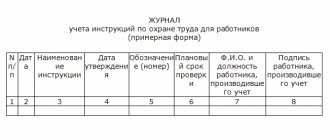

To control the movement of inventory, for each materially responsible person, you can keep a record of inventory and household supplies in use.

Materially responsible persons maintain a statement f. OP-9 or magazine f. OP-19. They record the transfer, return, identification of losses and shortages of tableware and cutlery.

In accordance with the accounting law, enterprises are required to conduct an inventory of material assets at least once a year before drawing up an annual balance sheet.

The inventory of inventory and household supplies in the warehouse is carried out similarly to the inventory of other goods and materials.

Task 5.6. 1) Reflect the results of the soft inventory inventory in the Matching Statement.

Comparison statements are compiled only for property, during the inventory of which deviations from the accounting data were revealed. 2) Identify shortages and surpluses. 3) Carry out offsets between shortages and surpluses.

4) Determine the amount of the final shortfall to be recovered from the financially responsible person.

Certificate of availability of inventory items according to accounting data as of the inventory date

| Quantity, pcs. | Amount, r |

| 1. Waffle towel | |

| 2. Chef's hat | |

| 3. Waiter's apron | |

| 4. Chef's jacket | |

| 5. Chef's pants | |

| 6. Linen-synthetic napkins | |

| 7. Linen tablecloths | |

| 8. Chef's jacket | |

| 9. Linen napkins |

Extract from the inventory list on the actual availability of goods and materials in the warehouse

| Inventory name | Price, r | Quantity, pcs. | Amount, r |

| 1. Waffle towel | |||

| 2. Chef's hat | |||

| 3. Waiter's apron | |||

| 4. Chef's jacket | |||

| 5. Chef's pants | |||

| 6. Linen-synthetic napkins | |||

| 7. Linen tablecloths | |||

| 8. Chef's jacket | |||

| 9. Linen napkins |

Collation statement

| Name of materials | Unit. | Price, r | According to accounting data | Actually | Inventory result | ||

| Shortages | Surplus | ||||||

| Qty | Amount, r | Qty | Sum, | Qty | Amount, r | Qty | Amount, r |

| 1. Chef's hat | PC. | ||||||

| 2. Chef's jacket | PC. | ||||||

| 3. Linen-synthetic napkins | PC. | ||||||

| 5. Chef's jacket | PC. | ||||||

| 6. Linen napkins | PC. | ||||||

| Total | X | X |

Offsets: chef's jacket and chef's jacket; synthetic linen napkins and linen napkins. The final shortfall of 55 rubles is subject to recovery.

Source:

Business inventory in accounting is...

- name of the object and assigned inventory number;

- expected useful life;

- data on the receipt of household supplies (date, quantity, cost);

- information on the issuance of ICP;

- correspondence of accounts, with the help of which the movement of household inventory is reflected;

- balances of low-value assets.

At the bottom, the financially responsible employee who filled out the front side of the card signs. The reverse side of the document is filled out in the event of disposal of household equipment from service. Such a decision is made by a special commission and documented in an act.

What applies to inventory and household supplies?

Based on such documents, the cost of the IPH is included in the costs. Important! Write-off acts must be drawn up separately for different types of household supplies and equipment. Using an inventory and household supplies accounting card A document called a card is a specialized form of primary documentation in the field of accounting.

- receive prompt information about how well the organization and its divisions are provided with the necessary equipment;

- control the movement of each element of the ICP.

Important! An individual company or firm has the right to use the specified sample document or create it independently.

Important: When receiving bedding from a warehouse, the financially responsible person must make sure that all received items have stamps indicating the name of the agricultural organization, the year and month of issue for use.

The financially responsible person is responsible for the use of unstamped bedding. The financially responsible person who has received bedding from the warehouse for use must keep quantitative records of their movement on cards (in books) of warehouse accounting.

Bedding issued to officials who are responsible for their safety are not written off as expenses, but are listed under the accounts of these persons. 300.

What applies to office supplies: list

Stationery supplies are divided into two types:

| Name | Scroll | Description |

| Consumables |

| They have the property of expending, that is, they end after a certain period of time. |

| Items of different times of use |

| Such things wear out, break or get lost. They can't end |

In 1993, Goskomstat Resolution No. 17 approved a specific list of office supplies. In 2014, the all-Russian classifier of products by type of economic activity OKPD 2 was adopted, containing individual items of stationery in different sections.

Types of requests for stationery

A sample application for stationery may have different types, depending on the form of the request:

- external;

- internal.

When it becomes necessary to make an external request from a supplier, the first type of request is drawn up. Usually, in such cases, the form of the document can be found in the annexes of the contract concluded with the supplier.

Internal requests can also be of two types:

- for the purchase of office supplies;

- issuance of office supplies from the warehouse.

If the required products are not in stock, a memo is drawn up asking for permission to purchase the necessary office supplies. As an appendix, a spreadsheet with a list of necessary accessories is attached to it.

How to prepare an internal application for office supplies - sample

The person in charge determines the needs of employees for office supplies. If necessary, an audit is carried out. After this, based on the collected information about the department, an application is drawn up. It means a document that includes a written appeal from the responsible person to the head of the supply department.

Typically, the requirements for a request are:

- Depending on the organization’s policy, the form can be filled out freely or on company letterhead.

- The list of office supplies must be drawn up in the form of a table with a header and the main part. The main part of the table contains the name of the accessory, quantity and unit of measurement. If necessary, you can add an article.

- The details of the head of the department who needs the office and the full name of whom the appeal is being made must be written down.

Some organizations require that the request be made in the form of a memo. At their core, an application and a memo are two different documents that serve one informative function. However, sometimes they are drawn up in the form of a single document, or an appendix with a list of the necessary office supplies is attached to the memo.

How to fill out

A typical card for recording an employee's instrument has two sides. On the front (after the name of the organization and structural unit, as well as the full name of the financially responsible person) information about the equipment issued should be placed:

- his name;

- inventory number;

- useful life;

- information about receipt (when, in what quantity and at what cost);

- similar information about the issue;

- relevant entries (debit and credit);

- data on balances (by quantity and value);

- signature MOL.

If necessary, you can add a column with information about the employee who receives the inventory. This will allow you to track not only the period of use and the degree of wear, but also who is responsible for possible damage or theft.

IMPORTANT!

Form No. 423-APK is most often created for a certain group of means of labor.

The reverse side of 423-APK should only be filled out when it is time to write off a means of production. The initial data must be taken from the conclusion of a specially assembled commission.

Form 423-APK

Internal memo for stationery for purchase: rules for drawing up

An official memo for stationery, a sample of which is also not officially documented, can be drawn up in free form. However, it must contain mandatory information:

- In the upper right corner is written the position and full name in whose name the document is written.

- Who is the note from?

- Document's name.

- The purpose of the document. For example, “for the purchase of materials.”

- Date of registration and registration number.

- The main part of the document contains a request.

- Date of.

- Visa and decryption of the responsible person.

It is allowed to include a table with the necessary office supplies in the memo, or issue it as a separate appendix.

Service memo for stationery, sample for purchase:

What a request for stationery might look like: an example for receiving from a warehouse

An application for the release of office supplies from a warehouse is a spreadsheet document. It must contain the name of the necessary things and their quantity. Typically, applications are typed using a computer and output as a document.

Application example:

Since the law does not establish a specific form for this document, it can be approved by the organization individually.

The sample application for stationery depends on who it is being submitted to. If you are making a request for delivery from a supplier, then the form must be taken from the contract appendix. In all other cases, organizations independently approve the form of such documentation.

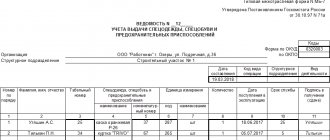

How to fill out the form

The form must be filled out by hand, since it requires so-called live signatures. First of all, you need to indicate the document number, date of completion, name of the organization, OKPO code, structural unit.

Next is a table with the following columns:

- Serial number of the record.

- Full name of the employee to whom the equipment was issued.

- Employee personnel number.

- The name of the issued equipment or household supplies.

- The item number of the issued inventory or household supplies.

- OKI code for units of measurement.

- Name of the unit of measurement.

- Quantity.

- Date of entry into operation of the object.

- Object service life.

- The employee’s signature on receipt or delivery of equipment or household supplies.

At the end of the table, the financially responsible person signs, and his position must also be indicated.

The statements must be submitted to the accounting department along with the documents attached to the reports on the movement of materiel. The deadlines for delivery are established by the company’s document flow.