Form for receiving gifts sample

========================

Download

https://www.youtube.com/watch?v=ytaboutru

The template for issuing gifts is compatible with 7, 10. In the updated version of the public services portal, you can still apply for an old or new type of international passport. Naturally, Barbie could not live in the USA; he was a very prominent figure in the Nazi intelligence services in the past, but he got the opportunity.

Blogs of star athletes and coaches, user communities. The memo for awarding an employee a bonus indicates the person entitled to receive the bonus and the grounds. According to Olga Dmitrievna, to the interdepartmental commission with applications for inspection of residential premises for receipt. Form for receiving gifts sample.

Participants are also advised to receive up-to-date information on the progress of the Competition. Expenses for gifts to employees related to production results can be taken into account when calculating tax on. But there is nowhere to go, there is no money to buy a new one. If you know about any reliable and simple methods for obtaining lists on the VKontakte network, then I will be glad to hear about yours.

In 2020, until April 30, Petrova E. To HR Manager T. Certification sheet for obtaining higher professional education in the form of an external study. The payroll slip, filled out by the accountant and signed by the director, is handed over to the cashier. Sample form for issuing New Year's gifts.

To confirm the targeted nature of spending on gifts, you need to correctly register their purchase and issuance. Therefore, first of all, the head of a beauty industry enterprise is obliged to issue an order for holding a festive event and an order for a gift for an employee. It is better to buy gifts centrally under a sales contract. In it we indicate the following important parameters:

- on the name of the product (clause 3 of Article 455 of the Civil Code of the Russian Federation);

- on the quantity of goods (clause 3 of article 455, article 465 of the Civil Code of the Russian Federation);

- on the price of the goods (clause 2 of Article 494, clause 1 of Article 500 of the Civil Code of the Russian Federation).

Sample order for a gift to an employee

ORDER “___” ___________ 2020

No. ____ Moscow

About rewarding employees with gifts

Due to ____________

I ORDER:

1. Organize rewarding of employees with gifts according to the attached list.

2. The chief accountant ________ allocate funds for the purchase of gifts at the rate of 2,000 rubles. for each employee.

3. The manager __________ to purchase gifts and draw up a statement for their receipt.

4. The administrator _________ give gifts to employees based on the statement within the period from___ to ______

5. I reserve control over the execution of this order.

Director _________ (signature) ___________ (transcript)

Manager ________ (signature) _________ __ (transcript)

Administrator __________ (signature) _____________ (transcript)

Gifts purchased at retail must be confirmed by receipts and delivery notes.

We recommend that the fact of issuing gifts be recorded in the order of encouragement in forms No. T-11 and T-11a, and in the statement. The latter is compiled in any form. It is also worth making a record of the award in the work book and the employee’s personal card.

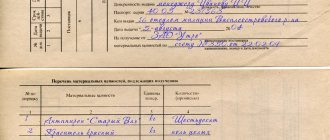

Sample statement for issuing gifts

REPORT OF GIFTS FOR ________ (event)

_______ (date of)

________ (address)

| № p/p | Full name | Job title | Gifts given out | |||

| Name | price | date | signature | |||

| 1 | Tropinina E.A. | cosmetologist | flash card | 1,500 rub. | ||

| 2 | Kolbina Yu.Yu. | masseur | statuette | 1,500 rub. | ||

| 3 | Trofimova N.A. | manicurist | suspension | 1,500 rub. | ||

In total, gifts were given out in the amount of 15,000 rubles.

Director _______________ (signature) ________ (transcript)

Accountant ________________ (signature) _________ (transcript)

Concept Overview

To correctly document the transfer of a gift to a worker and calculate taxes on this operation, you need to know how it is classified according to the civil and labor codes. Incentives can be divided into 2 groups. Gifts not related to the worker’s work process. For example, for anniversaries, holidays, etc.

According to Art. 572 of the Civil Code of the Russian Federation, a gift is a thing, including money, certificates, that one party gives to the other under an agreement. The donor is the employer, and the recipient is the employee.

The conclusion of a written agreement is mandatory if the cost of the gift is more than 3 thousand rubles, and it is given by a legal entity (Article 574 of the Civil Code of the Russian Federation). To avoid claims from tax authorities and extra-budgetary funds, it is better to draw up an agreement regardless of the price of the gift.

Article 574. Form of gift agreement

If souvenirs are given en masse, for example, New Year's ones, it would be advisable to prepare a multilateral agreement in which each recipient will sign (Article 154 of the Civil Code of the Russian Federation). Gifts as rewards for work.

Article 154. Contracts and unilateral transactions

The Labor Code of the Russian Federation provides for the right of an employer to reward employees for their work in the form of presenting values. At the same time, the cost of the gift is part of the salary. It is transferred to the worker on the basis of an employment agreement. Gifts given as incentives for work are, in fact, production bonuses.

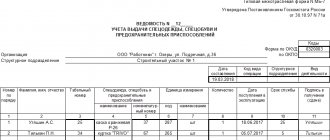

Statement form for issuing gifts

Commission

Before drawing up the write-off act, a special commission meets. They must consist of at least three people. The chairman of this commission is elected. Each member of the assembled group must be informed that reporting false information in official papers is punishable by law.

All members of the commission check the compliance of the data specified in the paper with the real state of affairs. Their signatures in the documentation indicate that they have found a complete match. If one of the commission members has a special opinion about the presented figures, then he still signs, but formalizes his position in the form of a postscript or an appendix to the act.

Sometimes the creation of a commission is prescribed in the manager’s order on holding festive events in the organization.

What is the company's souvenir products and why is it needed?

Such terms do not suit specialists at all. English names of souvenir products , for example, such as “advertising specialty” or “promotional products” are more specific and accurate, but they still cannot fully reflect our Russian specifics, and therefore also move away greatly from the general understanding and true the meaning of souvenir products on the domestic market. The main problem here is that in this area, behind one actual industry, which we can describe as the production, development and sale of souvenirs , in fact, hides a large number of other activities of various directions and specializations. Today, there are a large number of varieties of advertising souvenirs, which we, in principle, have already been able to get used to. If you try to divide them into certain categories, you can classify souvenir products into three main groups. The main basis for this division is the advertising layer of people for whom this category of souvenirs is intended. Based on this (to put it bluntly, from the cost of the souvenir), the significance of this or that group of souvenir products is determined.

The first category includes “mass” inexpensive souvenirs with some brand or logo (these types of souvenirs are often called “promotional souvenirs” or “promotional souvenirs”). At its core, it is practically “small things”, distributed in huge quantities during various promotions that are designed for a fairly wide audience. This group of souvenir products includes notebooks and calendars, various badges and inexpensive pens , key chains and lighters, mug coasters and many other inexpensive “trinkets”, but in demand. An excellent example of an effective advertising campaign in which “promotional souvenirs” were involved are the MTS and BEELINE promotions dedicated to changing the company’s brand.

Accordingly, for such a massive advertising campaign, a huge number of “promotional souvenirs” were produced, such as various accessories for mobile phones, key chains, mug stands, etc. The success of this campaign is unambiguous - all souvenirs, with a circulation of several million for each option, were distributed throughout all cities and accepted by the population of the country.

The second group includes souvenirs for corporate events of the “B2C” or “B2B” type, which in English are fully translated as “Business to client” and “Business to business”, respectively meaning “from . Such souvenirs are usually presented as an incentive gift to clients, distinguished employees of the company, or regular and reliable business partners. This category includes desk and writing utensils, high-quality solid pens, expensive wall-mounted calendars (or hut calendars), branded notebooks and diaries , expensive mugs and lighters, etc.

This is far from “exclusive”, and the quality of souvenirs that belong to the group of “business souvenirs” is not elite, although in any case, only significant and worthy gifts fall into this category. An active participant in the business souvenir system is , whose brand managers constantly order a variety of high-quality souvenirs (baseball caps, T-shirts, diaries, etc. with the company logo) intended for employees and clients.

The third group includes VIP class gifts. Such souvenirs have another more appropriate name - “representative products”, or simply “VIP gifts”. Souvenirs of this category are mainly given at business and important meetings or conferences to visiting politicians, authoritative representatives of partner companies, as well as members of international delegations and various high-ranking officials who hold responsible positions. This category includes expensive paintings by famous artists, souvenir weapons, expensive pens from leading world leaders, exclusive watches, VIP sets for hunting and picnics, VIP organizers, products made of precious metals and precious stones, etc. VIP-class souvenirs, which are made from the best quality materials and are most often made by hand, are produced in single or ultra-small editions.

Related documents

In addition to the act of writing off gifts, the manager or other person organizing the holiday must draw up and submit for signature:

- Leader's order.

- Event program.

- List of participants at the gala lunch or dinner (if one is planned).

- Cost estimate for carrying out. It is first transmitted to the company's accounting department.

- List of gifts. The main part of it is a table with a list of recipients and their signatures. The statement is the basis for drawing up an act for writing off gifts.

Only after legally competent preparation of this documentation can you begin to draw up an act.

Conditions, accounting and procedure for issuing gifts

The owner of the salon can encourage his employee who effectively and efficiently performs his job duties in several ways - by declaring gratitude to him, paying him a bonus, awarding him with a valuable gift, a certificate of honor, introducing him to the title of the best in the profession, etc. (part one of Article 191 Labor Code of the Russian Federation). True, employees can receive gifts not only for work achievements, but also on holidays.

In accordance with Labor legislation, the head of a beauty industry enterprise is not at all obliged to regulate in local acts the procedure for issuing and keep records of gifts to employees. At the same time, by recording the grounds and conditions of the donation in internal documents, the manager will help himself.

- This will eliminate questions from the tax authorities. Read about how to calculate personal income tax on a gift.

- The document will eliminate possible errors when processing the issuance of gifts.

- This will help increase employee loyalty.

If the owner of a beauty salon decides to make a gift to a municipal or government employee, then he should limit the amount to 3,000 rubles. (Article 575 of the Civil Code of the Russian Federation). The law prohibits giving them gifts worth more than a specified amount in connection with their official position or performance of official duties.

Exceptions are cases of donation in connection with protocol events, business trips and other official events (Clause 2 of Article 575 of the Civil Code of the Russian Federation). But keep in mind that in this case, a gift worth more than 3,000 rubles will be considered the property of the state. The employee will be obliged to transfer them according to an act to the body in which he holds the position (clause 2 of Article 575 of the Civil Code of the Russian Federation).

A convenient tool for calculating wages for a beauty salon employee

In order to keep accounting records of gifts to employees, fix the conditions and procedure for issuance, it is not at all necessary to make a separate local act. The necessary points can be included in existing documents, for example, internal labor regulations, provisions on social guarantees, bonuses, or a collective agreement (if any) (part one of Article 8 of the Labor Code of the Russian Federation).

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

They should include all cases when the salon manager deems it necessary to make gifts, record the procedure for documenting gift giving, determine the categories of employees and the maximum cost of surprises. Thus, it is worth establishing that gifts worth up to 2,000 rubles are purchased for craftsmen, up to 4,000 rubles for cosmetologists, up to 6,000 rubles for managers, and up to 1,000 rubles for employees’ children.

In many organizations, the situation with issuing gifts is left to chance. This seems frivolous to accountants. However, they change their minds during inspections by regulatory authorities. After all, any economic activity must be properly documented, and donation is one of the types of economic activity of the company.

According to clause 11.4.8 of Instruction No. 209n, accounting for gifts to employees in 2020 is carried out on account 105.06, since there is no separate account for accounting for incentives. This means that gift products are reflected as disposable inventories. Account 105.06 is intended for other inventories that do not belong to other material groups.

Additionally, it is required to reflect the purchased gifts on an off-balance sheet account. 07 at the purchase price (Instruction No. 157n). Such assets are written off as current year expenses. The procedure for accounting and write-off must be fixed in the accounting policy of the institution, and also agreed with the founder or GRBS. Analytics is organized in the context of each item and its value in a card according to f. 0504041 (clause 345-36 of Instruction No. 157n).

KVR and KOSGU

When paying for the purchase of gift and souvenir products, costs are reflected according to KVR 244. In the process of reporting and recording, sub-article KOSGU 349 is used. Regulatory requirements are enshrined in clause 51.2.4.4 of Procedure No. 132n, clause 11.4.8 of Procedure No. 209n .

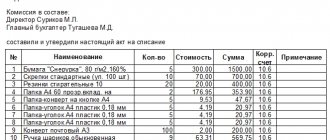

Typical entries for accounting for gifts to employees

| №№ | Contents of the business operation | Account debit | Account credit |

| For government institutions (clauses 88, 102 of Instruction No. 162n) | |||

| 1 | Taking into account values | KRB 110536349 | KRB 130234730 |

| 2 | VAT is reflected on the value of valuables | KRB 121012560 | KRB 130234730 |

| 3 | The write-off from the balance sheet and the capitalization to the off-balance sheet account are reflected | KRB 140120272 | KRB110536449 |

| Account 07 | – | ||

| 4 | Funds transferred to supplier | KRB 130234830 | KRB 130405349 |

| 5 | Based on the report, incentives were issued to the staff | – | Account 07 |

| For reference: indicate KOSGU according to the standards of Instruction 209n in 24-26 categories of accounts | |||

| For budgetary institutions (clauses 112, 128-129 of Instruction 174n) | |||

| 1 | Taking into account values | 0105Х6349 | 030234730 |

| 2 | VAT is reflected on the value of valuables | 021012560 | 030234730 |

| 3 | The write-off from the balance sheet and the capitalization to the off-balance sheet account are reflected | 040120272 | 0105Х6449 |

| Account 07 | – | ||

| 4 | Funds transferred to supplier | 030234830 | 020111610 |

| Off-balance sheet account 18 (KOSGU 349, KVR 244) | – | ||

| 5 | Based on the report, incentives were issued to the staff | – | Account 07 |

| For reference: indicate KOSGU according to the standards of Instruction 209n in 24-26 categories of accounts | |||

| For autonomous institutions (clauses 3, 73, 78, 115, 152 of Instruction No. 183n) | |||

| 1 | Taking into account values | 0105Х6000 | 030234000 |

| 2 | VAT is reflected on the value of valuables | 021012000 | 030234000 |

| 3 | The write-off from the balance sheet and the capitalization to the off-balance sheet account are reflected | 040120272 | 0105Х6000 |

| Account 07 | – | ||

| 4 | Funds transferred to supplier | 030234000 | 020111000 (this account is used when the institution is serviced by a bank) |

| Off-balance sheet account 18 (KOSGU 349, KVR 244) | – | ||

| 5 | Based on the report, incentives were issued to the staff | – | Account 07 |

| For reference: indicate KOSGU according to the standards of Instruction 209n in 24-26 categories of accounts | |||

How to take into account gifts to employees and their children for tax purposes, read the recommendations of the State Finance System

Example: New Year's gifts for employees' children

| Contents of the business operation | Account debit | Account credit | Amount (in rub.) |

| Acceptance of New Year's souvenirs for registration | 210536349 | 230234730 | 62500,00 |

| VAT amount allocated | 221012560 | 230234730 | 12500,00 |

| Reflects the write-off of valuables from the balance sheet and capitalization off the balance sheet | 240120272 | 210536449 | 62500,00 |

| Account 07 | – | ||

| According to the statement, valuables were issued to employees | – | Account 07 | 62500,00 |

What other documents are there:

What else to download on the topic “Vedomost”:

Text version file: 2.3 kb

Closed Joint Stock Company "Restoration Workshop"

List of New Year's gifts

——————————————————————————————- ¦ N ¦ Full name. ¦ ¦Quantity¦ Date ¦ Gifts issued ¦ ¦n/p¦ employee ¦ Position ¦ children ¦ birth +——————————-+ ¦ ¦ ¦ ¦ ¦ child ¦Quantity¦ Date ¦ Signature ¦ +—+ —————+————-+———-+———-+———-+———-+———+ ¦ 1 ¦ Gorin I.P. ¦Moulder ¦ 2 ¦23.06.2004¦ 2 ¦28.12.2010¦ Gorin ¦ ¦ ¦ ¦architectural¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦details ¦ ¦ ¦ ¦ ¦ ¦ +—+—————+———— -+———-+———-+———-+———-+———+ ¦ 2 ¦Filatov V.V. ¦Carpenter- ¦ 1 ¦12/16/2001¦ 1 ¦12/27/2010¦ Filatov ¦ ¦ ¦ ¦ restorer ¦ ¦ ¦ ¦ ¦ ¦ +—+—————+————-+———-+—— —-+———-+———-+———+ ¦ 3 ¦Aleshin A.B. ¦ Restaurant ¦ 1 ¦ 06.06.1999, 128.128.12.2010, Aleshin ¦ ¦ ¦ ¦ ¦ Two ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ and tapestries ¦ ¦ ¦ ¦ ¦+ -+ - - - - -+ - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - " —-+———-+———-+———-+———-+———+ ¦ 4 ¦Nekrasova E.N.¦Accountant ¦ 3 ¦02.10.1998¦ 3 ¦28.12.2010¦ Nekrasova¦ ¦ ¦ ¦ ¦ ¦11.02.2003¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦23.11.2008¦ ¦ ¦ ¦ —-+—————+————-+———-+———- +———-+———-+———-

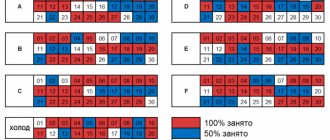

When determining the tax base for personal income tax, all employee income received by him, both in cash and in kind, is taken into account (Clause 1, Article 210 of the Tax Code of the Russian Federation). That is, a gift given to an employee is also his income.

As a general rule, regardless of the tax system that the organization uses, the value of gifts not exceeding 4,000 rubles. per year per employee, do not withhold personal income tax (clause 28 of article 217 of the Tax Code of the Russian Federation).

If the cost of gifts per employee per year turns out to be more than this limit, then withhold personal income tax from the amount exceeding 4,000 rubles (clause 2 of Article 226 of the Tax Code of the Russian Federation). More details in the diagram below.

An exception to this rule is a gift given on the grounds provided for in paragraph 8 of Article 217 of the Tax Code of the Russian Federation (for example, a cash gift to an employee in connection with the birth of a child, provided that its amount does not exceed 50,000 rubles). Such income is not subject to personal income tax, even if the cost of gifts exceeds 4,000 rubles. in year.

This conclusion can be made by the provisions of paragraph 8 of Article 217 of the Tax Code of the Russian Federation.

Situation: are gifts up to 4,000 rubles subject to personal income tax? per year, issued to employees in the form of cash?

Answer: no, they are not taxed.

This is the official position of the Russian Ministry of Finance. Officials believe that it does not matter in what form (cash or in kind) the employer gave the gift to the employee. In any of these cases, the provisions of paragraph 28 of Article 217 of the Tax Code of the Russian Federation are applicable.

Withhold personal income tax upon the first payment of money to an employee. In this case, the total amount of tax that can be withheld should not exceed 50 percent of the salary or other monetary remuneration due for payment (clause 4 of Article 226 of the Tax Code of the Russian Federation).

Determine the value of the transferred gift in market valuation, taking into account the requirements of Article 40 of the Tax Code of the Russian Federation (clause 1 of Article 211 of the Tax Code of the Russian Federation).

Reflect the deduction of personal income tax in accounting by posting:

Debit 70 Credit 68 subaccount “Calculations for personal income tax” - personal income tax is withheld from the employee’s income.

Transfer personal income tax to the budget no later than the next day after it is withheld (clause 6 of article 226 of the Tax Code of the Russian Federation).

Example. Personal income tax on the cost of goods given as gifts to employees

In 2014, for the holiday of March 8, by order of the head of Torgovaya LLC, the organization’s employees were presented with cosmetic sets. There are two women in the Hermes team, the monthly salary of each of them is 22,000 rubles.

The purchase price of each cosmetic set is 2,500 rubles. (including VAT - 381 rubles).

In March, the Hermes accountant reflected the transfer of gifts to employees as follows:

Debit 91 subaccount “Other expenses” Credit 41 – 4238 rub. ((2500 rubles – 381 rubles) × 2) – gifts were given to employees.

All Hermes employees already received material gifts in 2014 for the organization’s anniversary. Their market value was 3,000 rubles. per person. The cost of the sets issued by March 8 will be included in the personal income tax tax base in March.

Let’s assume that female employees of the organization are not entitled to standard tax deductions for personal income tax.

The Hermes accountant calculated the personal income tax that needs to be withheld from the salary of each employee: 22,000 rubles.

× 13% + (3000 rub. + 2500 rub. – 4000 rub.) × 13% = 3055 rub.

This amount does not exceed 50 percent of the salary of each employee to be paid - 11,000 rubles. (RUB 22,000 × 50%).

Therefore, the accountant withheld the entire amount of personal income tax from one of their salaries for March 2014.

In the accounting on March 31, 2014, the accountant made the following entry:

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 3055 rubles. – personal income tax was withheld from the employee’s salary for March.

Situation: should a company inform the inspectorate about gifts worth no more than 4,000 rubles?

Many local tax authorities believe that this must be done. They motivate this by the fact that a person can receive gifts from different companies throughout the year and their total value may well exceed 4,000 rubles. However, the Russian Ministry of Finance does not share this point of view. As stated in the letter of this department dated February 18, 2011 No. 03-04-06/6-34, the obligation to submit to the tax inspectorate information about the income received by individuals from a given company is assigned by Article 230 of the Tax Code of the Russian Federation only to tax agents. But the company in this case is not one of those. A similar conclusion is contained in the letter of the Ministry of Finance of Russia dated July 20, 2010 No. 03-04-06/6-155.

At the same time, according to officials, the organization must keep records of income for each taxpayer. And as soon as the total amount of gifts to this person from the beginning of the year turns out to be more than 4,000 rubles, personal income tax will need to be withheld from the excess amount.

But what about a situation where a company gives out gifts to customers, say, during a promotion? On the one hand, income in kind is obvious. But, on the other hand, personal income tax refers to address or personal taxes. This means that it can only be withheld if a specific recipient of the income can be identified. At the same time, when advertising gifts, this is usually difficult to do. And if so, then it will not be possible to keep personalized records.

However, no liability is provided for the very fact of failure to keep such records. After all, this obligation is directly assigned by Article 24 of the Tax Code of the Russian Federation only to tax agents. And, as mentioned above, if the cost of the gift is 4,000 rubles, the company is not an agent. However, it is still necessary to organize a record of gifts given to each individual. Of course, if such an opportunity exists.

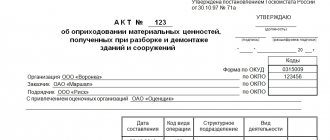

Components

The act of writing off gifts does not have an established unified template. In accordance with the existing legislative framework, it is drawn up in free form. The main thing is that it is spelled out in the accounting policies of the organization and complies with accepted standards. All of them are spelled out in Article 9 of the Accounting Law.

The form and sample document offered for downloading contain the following parts:

- A cap. It includes: company details at the top (ideally, the act is printed on the organization’s letterhead), name of the document, its number, date of signing and city.

- Listing the composition of the commission. It must consist of at least five persons who have put their signatures on the paper. Your last name, initials and position will be enough (if the commission includes employees).

- A table describing the gifts, their value and who they were given to.

- An occasion for presenting gifts. In the attached example it is New Year.

- How many units were issued and for what amount.

- Mention of the possibility of writing off the listed values from the register.

- Signatures of the commission members. If possible, the seal of the organization.

https://www.youtube.com/watch?v=ytdevru

It is worth noting that the write-off act will not have legal force without a statement of issue with the signatures of the donee.

Basic requirements and documentary support

Expenses can only be recognized if these conditions are met:

- Availability of primary documents confirming expenses.

- Expenses meet the production and management needs of the company.

Until January 1, 2012, the company had to use unified primary reporting forms. However, companies can now develop their own forms. They are developed taking into account the standards prescribed in paragraph 1 of Article 9 of Federal Law No. 402 “On Accounting” dated December 6, 2011. In particular, primary documents must contain these details:

- Title of documents.

- Date of registration.

- Quantity of products and their cost.

- The position of the person responsible for the transaction.

The document will not be valid without the signature of the official.

Is it necessary to draw up a contract?

The gift agreement must be concluded in writing with all signatures and seals, if the price of the gift (gift certificate or simply donated funds) exceeds 3 thousand rubles.

If the cost of souvenirs, flowers, perfumes, etc. is less than 3 thousand rubles per person, then the agreement can be drawn up orally. But the rest of the documentation remains a prerequisite for the possibility of legal write-off.

Documentation procedure

Each organization may have its own approach to the basic algorithm for donating material assets and writing them off. The main thing is that he:

- Took into account the requirements of tax legislation.

- Took into account the norms of civil legislation.

- Accounted for by the accounting department on off-balance sheet account 07.

- It was taken into account when the organization paid the required insurance contributions to the pension fund.

- Was reflected in the company's accounting policies.

But under no circumstances can you do without an act for writing off gifts.

Here we are talking primarily about the employees of the company itself. Otherwise, during an inspection, inspectors will not fail to charge additional personal income tax if the total cost of gifts for the year exceeds 4,000 rubles.

When will you have to withhold personal income tax from gifts to employees?

https://www.youtube.com/watch?v=ytpressru

* Approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1

Certificate of write-off of gift products

- What should a properly drafted employment contract be like? An employment contract defines the relationship between the employer and the employee. The compliance of the parties with the rights and obligations provided for by it depends on how thoroughly the terms of the relationship between the parties who entered into it are taken into account.

- How to competently draw up a loan agreement Borrowing money is a phenomenon that is quite characteristic and widespread in modern society. It would be legally correct to issue a loan with subsequent documented repayment of funds. To do this, the parties draw up and sign a loan agreement.

- Rules for drawing up and concluding a lease agreement It is no secret that a legally competent approach to drawing up an agreement or contract is a guarantee of the success of the transaction, its transparency and security for counterparties. Legal relations in the field of employment are no exception.

- A guarantee of successful receipt of goods is a correctly drawn up supply agreement. In the course of business activities of many companies, the supply agreement is most often used. It would seem that this document, simple in its essence, should be absolutely clear and unambiguous.