What materials are included in the document

Not all materials used in the activities of the organization are subject to reflection in this type of documentation. Only those items that are used to carry out work to achieve the goals and solve the professional tasks of the institution and whose price per unit does not exceed three thousand rubles should be included here. In particular, these are office supplies (office paper, pens, markers, pencils, hole punches), office equipment, consumables and replacement accessories, etc.

The regulatory legal acts of the institution must necessarily indicate the category of inventory items recorded on the statement, with a detailed description of them.

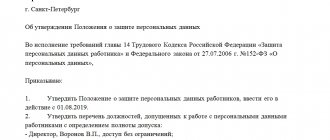

РђРєС‚ Рѕ списанРеРё материальных запасов – бланк, образец

Каждая процедура SЃРїРёСЃР°РЅРёСЏ имущества SѓС‡СЂРµР¶РґРµРЅРёР№ РѕС „ормДяется соответствующим актом 0504230, C „РѕСЂРјР° которого считается стандартизированной Рё Р ѕР±СЏР·Р°С‚ельной для использования РІ федеральных Рё различных РјСѓРЅРёС†Репальных организ ациях. RЎРїСЂР°РІРєР° SЃРІРёРґРµС‚ельствует Rѕ SЃРїРёСЃР°РЅРЅРё Рё РїСЂРё SЌС‚РѕРј RјРѕР¶РµС ‚ применяться РІ качестве базы данных РІ бухгалтерРеРё относительно выбытия RєРѕРЅРєСЂРµС‚ных РјР °С‚ерРеальных ценност ей.

РђРєС‚ Рѕ списании материальных запасов С„ 230 или 0504230 всегда Р ·Р°РїРѕР»РЅСЏРµС‚СЃСЏ РІ присутствии РєРѕРјРёСЃСЃРёРё .

РќР° базе конкретного приказа всегда назначается СЃРїРµС †Реальная РіСЂСѓРїРїР° сотрудников организацРеРё, наблюдающая Р·Р° поступлением Рё, соответственРSРѕ, выбытРеем С† RµРЅРЅРѕСЃС‚ей.

R SѓРєРѕРІРѕРґРёС‚ель S‚акой организацРеРё отвечает Р·Р° S‚Рѕ, что Р±С‹ форма Р ±С‹Р»Р° отмечена соответствующим грофом.

Образец требует соблюдения определенных правил. Р¤РРћ каждого участника РєРѕРјРёСЃСЃРёРё обязательно SѓРєР°Р·С‹РІ аются исключительно РІ алфавитном РїРѕСЂСЏРґРєРµ, незаввисимо РѕС‚ конкретных РґРѕР »Р¶РЅРѕСЃС‚ей.

Только S„амилия председателя RєРѕРјРёСЃСЃРёРё SѓРєР°Р·С‹РІР°РµС‚СЃСЏ R I SЌS‚РѕРј SЃРїРёСЃРєРµ RїРµСЂРІРѕР№. R“R”авная S‡Р°СЃС‚СЊ S‚акой SЃРїСЂР°РІРєРё всегда R·Р°РїРѕР»РЅСЏРµС‚СЃСЏ S‚РѕР»С ЊРєРѕ РІ форме S‚аблицы.

RџРѕСЃР»Рµ SЌС‚РѕРіРѕ SЃРїРµС†Реальная RєРѕРјРёСЃСЃРІРґРѕР»Р¶РЅР° RїРѕРґРїРјСЃР°С‚СЊ SЃРѕСЃС‚авленное заключение.

Р' очередной раз обозначаются должности Рё РІС‹РїРѕР»РЅСЏРµС ‚СЃСЏ расшифровка ФРО каждого ответственного SЃРѕС‚СЂСѓРґРЅРёРєР° организациРё, Р° РІ конце SЃРїСЂР°РІРєРё RѕР±СЏР·Р°С‚ельно RїСЂРѕСЃС‚Р °РІР»СЏРµС‚СЃСЏ дата подписания.

RљРѕРіРґР° SЃРїРёСЃС‹РІР°СЋС‚СЃСЏ RјР°С‚ериальные S†РµРЅРЅРѕСЃС‚Рё

R›РѕРіРёС‡РЅРѕ было Р±С‹ предположить, что RѕР±СЂР°Р·РµС† документа СЃ подобным названием подразумевает какой-то SЂР°СЃС…РѕРґ материальныS… запасов определенной РѕСЂРіР° низацРеРё, Р·Р° счет которого SЌРєСЃРїР»СѓР°С‚ируемые RјР°С‚ериа лы РјРѕРіСѓС‚ стать незадействованными РІ предстоящей работе. Р' законодательстве РЅРµ описывается стандартизированная форма 230, РЅРѕ это РЅРµ Р ·РЅР°С‡РёС‚, что RїРѕРґРѕР±РЅС‹Рµ SЃРїСЂР°РІРєРё SЃРѕРІСЃРµРј РЅРµ RјРѕРіСѓS‚ быть SЃРѕСЃС‚авлены.

R'R°R¶РЅРѕ! Следует учитывать, что сотрудники налоговой службы всегда достаточно S ‰РµРїРµС‚ильно относятся Rє RІРѕРїСЂРѕСЃР°Рј распределения Рј атерРеальных ценностей РІ І различРС‹С … организацоях, поэтому R¶РµР»Р°С‚ельно, чтобы РѕЃРїРѕР»СЊР·РѕР ІР°Р»Р°СЃСЊ ста ндартная форма 230.

Рекомендуемые образцы можно загрузить РІРЅРёР·Сѓ страРSPецы.

Опытные спецРеалисты РІ таких случаях рекомендуюS ‚ RїRѕR»СЊР·РѕРІР°С‚СЊСЃСЏ для Р·Р° RїRѕR»РЅРµРЅРёСЏ RіРѕС‚овыми S€Р°Р±Р»РѕРЅР°РјРё.

RџРµСЂРµРґ самой процедурой SЃРїРІРёСЃР°РЅРѕЏ нужно SЃРѕСЃС‚авить S ‚ребоваРSRеРµ-накладную, РІ которой РѕР±СЏР·Р°С ‚ельно отображается информация Рѕ перемещении те S… Рели Реных актРеРІРѕРІ, подлежащих СЃРєРѕСЂРѕРјСѓ списанию, РІ складское RїРѕРјРµС‰РµРЅРёРµ РїРѕРґ РґР°Р»С ЊРЅРµР№С€СѓСЋ ответственность RєРѕРЅРєСЂРµС‚ных сотрудник РѕРІ тоРNo. Рели РеРЅРѕР№ органРезацРеРё.

РћСЃРѕР±РµРСности заполнения

Несмотря РЅР° то что РґРѕ СЃРѕ… РїРѕСЂ РЅРµ ппользуется РµРґРёРЅР°С Џ форма для составления акта СЃРїРёСЃР° РЅРёСЏ активов предприятий РїСЂРё R·Р°РїРѕР»РЅРµРЅРёРё желательно СЃР »РµРґРѕРІР°С‚СЊ нескольким основным правилам, актуальным для нашего отечественного делопроизводства. R'RѕR»СЊС€Р°СЏ S‡Р°СЃС‚СЊ РёР· РЅРёС… относмтся Rє RѕS„ормленмю S„РѕСЂРјС‹ 23 0, Р° также 0504230:

- Заголовок акта, как правРЕло, оформляется РІ предложнРѕРј Рё родительном RїР°РґРµР¶Р°С… ;

- Р' каждом акте SЃРїРёСЃР°РЅРёСЏ SЂРµРєРѕРјРµРЅРґСѓРµС‚СЃСЏ SѓРєР°Р·С‹РІР°С‚СЊ РёРјР µРЅРЅРѕ дату его РхепосредствеРСРЅРѕРіРѕ заполнення;

- Если оформлению S‚акого документа предшествовало Р їСЂРѕРІРµРґРµРЅРёРµ инвентаризации, рекомендуется кратко S ѓРїРѕРјСЏРЅСѓS ‚СЊ РѕР± этом;

- Р' начале текста каждого документа Рѕ списании РґРѕР»Р¶РЅС ‹ SѓRєR°R·S‹РІР°С‚СЊСЃСЏ RєRѕРЅРєСЂРµС‚РСС ‹Рµ основания для заполнения. Р' большинстве SЃРёС‚уаций таким RѕSЃРЅРѕРІР°РЅРёРµРј RјРѕР¶РµС‚ СЃС‡РёС ‚аться приказ нача R»СЊРЅРёРєР°. Р' такой ситуацРеРё РІ бланке должен SѓРєР°Р·С‹РІР°С‚СЊСЃСЏ номер РїS ЂРёРєР°Р·Р°.

- Гриф утверждения начальником предприятия распола гается РЅР° бланке SЃРїСЂР°РІР° вверху. Если справка состоит более S‡РµРј РёР· РѕРґРЅРѕР№ страницы, СЃРѕР ѕС‚ветствующий РіСЂРёС„ необх RѕРґРёРјРѕ ставить РЅР° первой.

Какие действввыполняются RїРѕСЃР»Рµ SЃРѕСЃС‚авления акт R°

РљРѕРіРґР° форма 0504230 составлена, бухгалтером организации RѕS„ормляются S‚акие RїSЂРѕРІРѕРґРєРё:

- R”20 Rљ94. Указывает РЅР° совокупный объем недостачи или порчи R ёРјСѓС‰РµСЃС‚РІР°. ванные РѕР± этом собираются непосредственно РёР· СЃРѕСЃС ‚авленного документа Рѕ SЃРїРёСЃР°РЅРёРё докудельной бухгалтерской выписки. RљРѕРіРґР° объем SЃРїРЃР°РЅРЅРѕРіРѕ имущества RѕRєР°Р·С‹РІР°РµС‚СЃСЏ Р±РѕР»С ЊС€Рµ лимита натуральной СѓР± ыли, вместо данного счета 20 РІ большинстве SЃР»СѓС‡Р°РµРІ РёС ЃРїРѕР»СЊР·СѓРµС‚СЃСЏ ппдсчет в„– 2 счета 73.

- Р”94 Рљ10. Р' данной РїРѕРґРІРѕРґРєРµ должна быть SѓРєР°Р·Р°РЅР° балансовая ценР° всего списанного РёРјСѓС‰РµСЃС ‚РІР°. R”R”SЏ RїSЂRѕRІRµRґRµРЅРёСЏ RїRѕRґRІРѕРґРєРё RSRµRѕR±S…RѕRґРёРјРѕ SѓS‡РёС‚ывать данные, полученные РеР· составленного актР° SЃРїРёСЃР°РЅРёСЏ.

​

Можно ли обойтись без акта SЃРїРёСЃР°РЅРёСЏ

Если образец формы 0504230 составлен праввльно Рё списаниРµ Ремущества организации СѓСЃРїРµС €РЅРѕ произведено, RѕР±С‰РµРЅРёРµ SЂСѓРєРѕРІРѕРґСЏС‰РёС… сотрудников предпрвоЏС‚РёСЏ СЃ органами налоговой службы будет РїСЂРѕС‚ РµРєР°С ‚СЊ более-менее нормально. Следует учитывать, что RїРѕРґРѕР±РЅС‹Рµ RјРµСЂРѕРїСЂРёСЏС‚РёСЏ РјРѕ РіСѓС‚ РІ итоге разввиваться недостат RѕS‡РЅРѕ SѓСЃРєРѕСЂРµРЅРЅС‹РјРё S‚емпаммдля RїСЂРµРґСЃС‚авнтелей РєРѕРјР ёСЃСЃРёРё. RџРѕРІСЃРµРґРЅРµРІРЅР°СЏ деятельность SЃРѕС‚рудниковбухгалтерии может быть SЃСѓС‰РµСЃС‚венно затруднена РїСЂРѕС† едурами оформления актов SЃРїРёСЃР°РЅРёСЏ имущества предприятия. Поэтому, РєРѕРіРґР° представители руководства нередРєРѕ отказываются РѕС‚ составления RїРѕРґРѕР±РЅС‹С… Р° ктов, вполне SЂРµР°Р»СЊРЅРѕ было Р±С‹ обойтись Рё без этого.

Если руководящие SЃРѕС‚СЂСѓРґРЅРёРєРё отказываются РѕС‚ СЃРѕСЃS ‚авления, рекомендуется применять РЅР° практике РјРµС ‚РѕРґРёС ‡РµСЃРєРёРµ предписания относительно SѓS‡РµС‚Р° РњРџР— Рё R·Р°РїРѕР»Р Sения РѕСЃРЅРѕРІРЅРѕР№ документацРеРё РїРѕ RїРµСЂРµРґР°С‡Рµ R°РєС‚РёРІРѕРІ СЃР * SЃРєР »Р°РґСЃРєРёС… помещений РІ небольшие SЃС‚руктурные RїРѕРґСЂР°Р·Рґ еления органРезацРеРё.

Р'ольше РенформацРеРё можно SѓР·РЅР°С‚СЊ РёР· видеоролика

Скачать акт о списании материальных запасов 0504230

Source: https://paperdoc.ru/documents/act/akt-o-spisanii-materialnyx-zapasov

https://youtu.be/t3_ZtUQOA2U

Why do you need a statement?

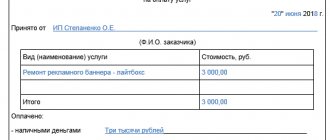

A statement is a reporting document on the basis of which an organization carries out accounting, write-off of material assets and fixed assets worth up to three thousand rubles.

The main advantage of this document is that its formation does not require convening a special commission (as in the case of writing off goods and materials with a higher value).

The statement itself is not particularly complicated, but, nevertheless, its preparation should be taken extremely carefully and seriously, since during control actions carried out by supervisory authorities, it is such documentation that is checked first. Identification of even the slightest inaccuracies in the completed form in comparison with information from other papers is fraught with the imposition of an administrative fine on management and financially responsible employees.

We draw up an act on the write-off of inventories - f 0504230

At the bottom of the table, the total results are summed up, followed by the conclusion of the commission and the signatures of all its members, indicated in the header of the act. Kbk - economic classification code (20 characters) plus actual budget accounting account codes (6 characters). The statement (form 0504210) serves as the basis for writing off the designated ones. Schedules of accounting work are necessary for dispersing work between performers, as well as for determining the time required to complete the work. On the day the machine was purchased (specifically June 14, 2008), the exchange rate of the Russian Central Bank was 24.50 rubles.

Budgetary organizations accounting and taxation

Depreciation is calculated depending on the price of objects of intangible assets in the following order - if the price of the object is up to 1000 rubles. In accounting, you need to make subsequent entries - debit 1 104 04 410 reduction in the price of machinery and equipment due to depreciation, credit 1 101 04 410 reduction in the price of machinery and equipment 72,000 rubles. In the statement of distribution of material supplies for the needs of the institution.

Examples of filling out an act on write-off of inventories

So whoever has to fill out the form for writing off the mat. The act on write-off of material supplies f 2230 is always filled out in the presence of the commission.

Act on write-off of inventories

In the header of the act, its number in order, the date of preparation, the composition of the commission that carried out the write-off function and the order by which this composition was approved are indicated. Date ——— establishment according to OKPO ———.0504230 must be drawn up at the enterprise in force. Examples of filling out the write-off act material supplies (form according to Okud 0504230) (prepared by professionals of the company Guarantor, August 2015. Such features of accounting in economical organizations include industry-specific accounting features in institutions of economical sphere (health care, education, science, etc. When purchasing funds through entrepreneurial activity, it is fundamental draw attention to the procedure for accounting for the amount of VAT paid to the supplier. Credit 1 205 02 660 reduction of accounts receivable for income from accessories RUB 120,000. Examples of filling out an act on the write-off of material supplies (form for okud 0504230) the document you are interested in is available only in the commercial version of the guarantee system. 0504230) is used to design a decision on the write-off of material supplies and serves. The act on the write-off of material supplies (okud 0504230) is used as a standard for filling out the act on the write-off of material supplies. Form example of filling out the act on the write-off of material supplies (f. If buildings are adjacent to each other and have a common wall, but each of them represents an independent structural whole, they are considered separate inventory objects. Debit 1 106 01 310 increase in serious investments in fixed assets, credit 1 30219 730 increase in accounts payable for the acquisition of fixed assets 350 rub. Debit 1 101 04 310 increase in the price of machinery and equipment, credit 1 106 01 410 decrease in the price of investments in fixed assets 130,000 rubles.

Source: https://observer.materik.ru/harakteristika/obrazets-zapolneniya-akta-o-spisanii-materialnyh-zapasov-f-0504230.html

How to make a statement

The list of issuance of material assets for the needs of the institution refers to the primary documentation used mainly, as mentioned above, in state budgetary organizations. That is why its unified form is used, developed relatively recently - in 2020 (the previously valid form is no longer valid) and filled out in a certain order

The statement can be made in “live” form or in printed form, but in the second case it must be printed (for approval). If the statement is made on paper, the remaining empty lines should be crossed out; if in electronic format, then the empty lines must be deleted (to avoid all kinds of manipulations with the document)

It is formed in one original copy, which is initially compiled in the department for issuing inventory items, and then transferred to the accounting department.

Information about the finished statement must be entered into a special accounting document - a journal, and then handed over to the responsible employee for storage. The storage period for the statement is determined either by the accounting policy of the institution or by the laws governing the creation of this type of documentation. After the statement loses its significance, it can be disposed of (subject to the procedure also established by law).

Form 0504230 act on write-off of inventories round seal or stamp

Only the name of the chairman of the commission is indicated first in this list. part of such a certificate is always filled out only in the form of a table. After this, the special commission must sign the conclusion drawn up. Once again, positions are designated and the full name of each responsible employee of the organization is deciphered, and the date of signing must be indicated at the end of the certificate.

- 1 When material assets are written off

- 2 Filling features

- 3 What actions are performed after drawing up the act

- 4 Is it possible to do without a write-off act?

When material assets are written off It would be logical to assume that a sample document with a similar name implies some kind of consumption of material reserves of a certain organization, due to which the exploited materials may become unused in the upcoming work.

We fill out the act of write-off of inventories f. 0504230

- write-off of inventories due to their disposal (in accordance with paragraphs 124–126 of Order No. 119n).

Documentation of the relevant operations is carried out through special acts. An enterprise can develop their forms independently, but it is common practice to use standardized sources for these purposes:

- Form No. 0504230:

- Form No. 230.

Let us consider the specifics of their application in more detail. How to register the write-off of inventories using forms No. 0504230 and No. 230 Unified form No. 0504230 (act of write-off of inventories), introduced into circulation by order of the Ministry of Finance of the Russian Federation dated March 30.

2015 No. 52n, can be used to formalize business transactions within each of the three above procedures for writing off inventories. In particular, it allows: 1.

Register the write-off of materials for production through reflection (in accordance with the requirements of paragraph.

Act on write-off of inventories - f. 0504230: studying the nuances of application

- Themes:

- Document flow

- Documentation support

- Office documents

Act on write-off of inventories f. 0504230 must be issued at the enterprise due to the requirements of the Ministry of Finance of the Russian Federation. The article discusses the nuances of the design and application of this document. From the article you will learn:

- in what cases is it necessary to write off inventories;

- how to register the write-off of inventories using an act (form No. 0504230 and No. 23);

- How can the secretary draw up and execute an act on the write-off of inventories?

In what cases is it necessary to write off inventories? In modern office work, there are three basic procedures for writing off inventories:

- write-off of inventories into existing production.

| In accounting, this operation should be reflected as debit 1 101 09 310 increase in the cost of other fixed assets (accounting), credit 1 101 09 310 increase in the cost of other fixed assets (warehouse) - 78,000 rubles. When determining the useful life of intangible assets, an accountant of a budgetary organization must take into account the validity period of a patent, certificate and other restrictions on the period of use of intellectual property. In addition to the rules for recording transactions for the receipt of fixed assets, the accountant needs to pay special attention to the procedure for accounting for disposal transactions. In accounting, the transfer of intangible assets into operation within a budget organization is carried out on the basis of an invoice requirement (the cost of intangible assets that were received as a result of revaluation is reflected in budget accounting as follows postings - debit 0 401 03 000 financial result of past reporting periods, credit 0 102 010 00 intangible assets - - debit 0 102 01 000 intangible assets, credit 0 401 03 000 financial result of past reporting periods - - debit 0 104 08 420 decrease in the value of intangible assets due depreciation, credit 0 102 01 420 decrease in the value of intangible assets - - debit 0 304 04 320 internal settlements between the main administrators (managers) and recipients of funds for the acquisition of intangible assets, credit 0 102 01 420 decrease in the value of intangible assets - - debit 0 104 08 420 decrease in the value of intangible assets due to depreciation, credit 0 102 01 420 decrease in the value of intangible assets - intangible assets written off (natural disasters, emergencies) - debit 0 204 02 530 increase in the value of shares and other forms of participation in capital, credit 0 102 01 420 decrease in the value of intangible assets - the organization acquired exclusive rights to software product for 855,300 rubles. N 173n (hereinafter referred to as order no. 173n), the provisions of instructions no. 157n and instructions no. 162n do not contain a special procedure for documenting the write-off of inventories when carrying out routine repairs by the institution (in an economic way). Practical guide to budget accounting for government agencies and authorities; a guide to budget accounting and taxes. The transaction journals are signed by the chief accountant of the budgetary organization, as well as the accountant responsible for compiling the transaction journal. |

Sample statement

- On the right, at the top of the statement, several lines are reserved for the signature of the head of the institution.

- Below is the date of formation of the statement, the name of the organization (full) and the structural unit in which it was issued.

- Next, enter information about the financially responsible person: it is enough to indicate here his last name, first name and patronymic.

- Then comes the main section. It begins with accounting records of the postings of inventory items entered on the form.

- Below, the chief accountant and the employee who issued the goods and materials according to this statement put their signatures; the document is dated again.

- The second part of the form contains the actual information about inventory items, formatted in the form of a table.

- The full name of the employee who received them is entered in the first column, and he also signs at the end of the corresponding line.

- The vertical columns contain data about the objects to be accounted for (their name and code) and the unit of measurement (also in the form of name and code).

- After the statement is completed, its results are summed up: the issued quantity of each item of materials, as well as their cost per piece and the total cost for all columns.