Army and experience

After the pension reform, not only the format of accrual of money, but also the very concept of length of service has changed significantly. Previously, we were talking only about work experience, today the key term is insurance. The adjustments also affected military personnel.

Insurance

The insurance period is the periods of time during which contributions to the Pension Fund of the Russian Federation were made for a citizen in favor of a future pension.

This type of length of service is taken into account not only when determining pension payments, but also when paying for sick leave. According to Federal Law 400, military service is included in the insurance period. According to the law, the following periods are counted in the insurance period, in addition to direct official employment:

- Work abroad in the Russian Federation, if the person paid insurance contributions to the Pension Fund or in other situations provided for by law;

- The period of military service, as well as other equivalent service;

- The period of receiving compulsory social insurance benefits during the period of temporary disability;

- The period of care for a child by one of the parents until he reaches the age of 1.5 years. For one child only 18 months are taken into account, and for all children in total no more than 6 years;

- The time when the person received unemployment benefits;

- Time spent on paid public work;

- The period of relocation or resettlement in the direction of the state employment service to another area for employment;

- The period of detention if the validity of the charges brought against him has not been proven. This applies to persons who were unreasonably repressed and subsequently rehabilitated, and the period of serving their sentences in places of imprisonment and exile;

- The period of care of an able-bodied family member for a child with a disability, an adult disabled person of the first group or an elderly person over 80 years of age;

- The time a person spent with their military spouse in a place where there were no employment opportunities. The maximum time period is 5 years;

- Time of residence outside the borders of the Russian Federation in connection with the spouse’s work as a consul or diplomat. The maximum time period is 5 years;

- The period during which persons who were wrongfully prosecuted and subsequently rehabilitated were temporarily suspended from office;

- The period of exercise of powers by the judge.

Some of the periods indicated are subject to restrictions. For example, a military wife will receive a maximum of five years of insurance coverage, even if they lived in the place specified by law for a longer period of time.

Important! In modern Russia, it is the insurance period that is the basis for assigning a pension. It not only gives the right to receive a payment for a certain number of years, but also has an impact on the IPC.

Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”

Labor

Work experience refers to the total number of years when a citizen worked or was engaged in other labor activities in the territory of the Russian Federation.

In accordance with Federal Law 173, military service is counted when adding up years of work experience. As a general rule, continuous work experience is a period of employment when no more than one month has passed between job changes. However, with regard to military service, the rule is that a person must find a job within a year after demobilization. This benefit is based on the fact that after the army you need time to adapt and find a job.

Federal Law of December 17, 2001 No. 173-FZ (as amended on June 4, 2014, as amended on November 19, 2015) “On Labor Pensions in the Russian Federation”

General

General work experience lost its relevance in 2002, when the concept of insurance was introduced.

However, current pensioners formed their content according to this parameter, so it is used when assigning and calculating payments. Military service was part of the OS. The total length of service does not depend on the type of activity, reasons for changing jobs and breaks between jobs. Its calculation is carried out by adding up all periods of employment.

Healthy! The total length of service is taken into account when assigning disability and survivor benefits.

Preferential

Preferential length of service allows for early retirement if a person worked in difficult climatic conditions or in hazardous work. As for military service, it can also fall into the category of drugs if it took place in the Far North or involved armed actions.

By contract

In accordance with the Federal Law, there are two options for military service in the Russian Federation: contract and conscription.

In the first case, since the state pays wages and makes contributions from them to the Pension Fund, the person is credited with the insurance period. In essence, this is a kind of work where the employer is the state. Contract service is a new and developing phenomenon in Russia. To enter the army on a contractual basis, you must meet the following criteria:

- Age from eighteen to forty years;

- Health group A or B, that is, fit for military service;

- Education not lower than secondary vocational.

Persons who were previously in the army can be enrolled in contract service.

Healthy! When concluding a contract, the physical condition of citizens is assessed. Preference is given to candidates with the first category - recommended first. Download for viewing and printing:

Federal Law of March 28, 1998 No. 53-FZ “On Military Duty and Military Service”

By call

When a citizen is called up for military service, there is an important aspect related to the accrual of length of service. It is based on the following rule - if a person worked for at least a month before conscription and deductions were made from this to the Pension Fund, then the period of service will also be counted towards the insurance period. Thus, if a man did not have an official labor relationship before the army, then the period of his stay in the army will not be taken into account when calculating his pension.

Service in the USSR troops

If a person is drafted into the armed forces of the former allied states, then regardless of whether he has employment before the army, he will be credited with both his work history and his insurance record. This exception applies to service in the USSR Navy and border troops.

Is military service officially included in the insurance period?

Starting from 2020, a specialized point system was introduced, according to which pensions are calculated for all Russian citizens, and it is worth noting the fact that the individual pension coefficient has automatically become the main indicator taken into account in all calculations. In other words, the higher your ratio, the more pension benefits you will receive.

For sick leave, until 2007, it was customary to take into account exclusively work experience, but now insurance is used, which must necessarily include military service. The insurance period is taken into account in the standard calendar order, where a year is taken into account for a year, regardless of when exactly he served and in what form he did it - under a contract or conscription.

13-Nov-2019

Do I need to include time in the military in my work experience?

Here is the exact answer to this question, plus answers to the nuances that concern accountants.

For example, should this period be included when calculating sick leave?

General rules for calculating sick pay as a percentage of average earnings depending on length of service: The longer the length of service, the higher the amount of sick pay.

- Is military service included in the total length of service?

- Law No. 76-FZ directly states that time spent in the Armed Forces under a contract is included on the basis of 1 day of service = 1 day of work. This is about general length of service, but payroll accountants often have a more specific question: is military service included in the length of sick leave or not? The procedure for calculating length of service for sick pay is determined by Law No. 4468-1, adopted back in 1993.

- Please note: this proportion changes (1 day of service = 2 days) if the serviceman entered service not under a contract, but as a result of conscription, including by decree signed by the President. The insurance period for sick leave includes: The last point when calculating may raise special questions.

- Special conditions for those who held positions with increased health hazards; this time they receive special service, which is subsequently counted when calculating pensions. The same applies to employees of internal affairs bodies (Law No. 342-FZ). The list of periods is given in order of the Ministry of Social Development No. 91.

- Care should be taken when calculating for workers with specific work histories.

- For example, if an employee was an individual entrepreneur in the period from January 1, 2001 to December 31, 2002 (for two years), then work as an individual entrepreneur during this period does not need to be included in the insurance period for sick leave. But under one condition, if the individual entrepreneur transferred payments to the Social Insurance Fund during this period.

All periods of time when these payments were not made should be excluded. Without exception, persons who held the post of State Duma deputy or clergy (who transferred payments to social services) are subject to compulsory insurance. As we can see, according to the law, time spent in the army is indeed included in the insurance period.

And it is taken into account for calculating benefits in the above proportion (1 day of service = 1 day of service). Let’s say that a worker immediately after the army did not work officially for six months, and was not registered with the labor and employment authorities as unemployed.

The break time should be indicated separately on the certificate of incapacity for work.

- Is it necessary to include the time spent in the USSR army when calculating sick leave?

- Resolution of the Council of Ministers of the USSR No. 252, as amended in 2006, states that service in the army of the Soviet Union is included in continuous service if no more than 3 months have passed between the last day in the army and the day you started at work (or studying at a university or college).

- Women who served in the Armed Forces of the USSR are in a special position when making payments (since they have a disability due to maternity).

- Time devoted to caring for a newborn is counted only if the mother goes to work before the child is 1.5 years old.

This means that before including periods spent in the army, to calculate this type of benefit, you should look into the regulations approved by the organization itself and contracts with employees - it may be stated there that such inclusion is not provided. All partial months must be summed up and converted into full months. If the employee had a break from work and there are two periods, for example, 1 year 8 months. - Is military service included in length of service when calculating other benefits?

For example, the employer has the right to regulate the payment of bonuses for length of service independently (see. Since 2007, the term “continuous service” has become a thing of the past. What to do if there are incomplete months, including periods spent in the Armed Forces? For example, there are balances of 15 for one period of work and 16 days - 31 days. 1 day cannot be equated to a full month, it is discarded. and 2 years 11 months, then they must be added: 3 years 19 months. Thus, the answer to the question is whether time spent is included in army, for the purposes of calculating disability benefits - is unambiguous. In this regard, Russian legislation is loyal, the period of military service is included in the calculation of pensions. - Today, all periods during which labor or other activities “approved” by the state were carried out can be summarized and sick leave can be calculated based on the total period. In neighboring Belarus, for example, the rules are stricter.

- Why should you carefully approach the calculation when calculating sick leave? A refund will be possible only if it can be proven that the benefit recipient provided documents with false information. Time spent in the army, in positions in the Ministry of Emergency Situations, internal affairs bodies or studying at a university is not taken into account.

- Firstly, the Social Insurance Fund may not accept excess amounts for offset; in the future, it will be impossible to recover the overpayment from the employee - this is prohibited (p. You should also carefully approach the transfer of days into enlarged periods (into months and then into years).

- Dear readers, our specialists have prepared this material for you completely free of charge.

- However, the articles talk about typical ways to resolve issues in labor disputes.

But each case is individual and unique.

If you want to find out how to solve your specific problem, please contact the online consultant form.

Or call by phone For residents of Moscow and Moscow Region For residents of St. Petersburg and the region Legislation guarantees any officially working person compensation for temporary loss of ability to work, that is, when going on sick leave.

The amount of the benefit will depend on many factors, including the length of the insurance period.

- Although the concept of continuous work experience is no longer used after the entry into force of the new law, it can be found in 255-FZ.

- In particular, it says that if the continuous length of service before 2007 is greater than the insurance period, a larger value is taken for calculation.

- This may be important for those who have less than 8 years of experience, since even small numbers can affect the amount of the benefit.

- Thus, when a person has worked for 8 years, he will be entitled to 100% benefits, even if he has a gap of several years between jobs.

- Almost every person has been on sick leave at least once in their life.

- A certificate of incapacity for work allows a person to receive compensation in the workplace for the time he was in a medical institution.

- Payments are calculated in accordance with the insurance period.

- Insurance length is an important indicator that directly affects future payments from the employer.

- Here you need to know all the information on calculations and the formation of experience.

- What is this concept and how does it affect the total amount of payments?

- Almost everyone has already encountered the concept of insurance experience.

- Work experience is the period of work of a citizen, including under a contract.

- Special experience is all work activity associated with special conditions, for example, in hazardous production.

- The insurance period is the sum of the entire time for which payments were made to the social fund.

- It is this indicator that is used to determine the size of payments.

- All expenses for sick leave are borne by the Social Insurance Fund, and some are borne by the employer.

- Work experience is the period of work of a citizen, including under a contract.

- This concept was used to calculate pension payments until 2002, before the start of the pension reform.

- The insurance period is the period of time during which payments were made to the Pension Fund and the Insurance.

- The calculation of payments for certificates of incapacity for work is regulated by the Rules, which are approved by Order of the Ministry of Health and Social Development of the Russian Federation dated February 6, 2007 No. 91.

- Such situations include maternity benefits.

- And to calculate the amount of payments, it is necessary to clarify exactly what length of service is needed and what differences there are between them.

- Total length of service is the sum of all time spent in employment.

- This also includes labor relations under a contract, a regular employment contract.

- The insurance period is the sum of the entire time for which payments were made to the social fund.

- It is this indicator that is used to determine the size of payments.

- All expenses for sick leave are borne by the Social Insurance Fund, and some are borne by the employer.

- The latter pays a portion depending on the type of certificate of incapacity for work.

- If it is an employee’s injury, then the first three days are from the employer’s pocket, the rest is from social insurance.

- If an employee’s child falls ill, then compensation comes from the Social Insurance Fund in accordance with Article 3 of Federal Law No. 255.

- This is regulated by Part 1 of Article 9 of Federal Law No. 255.

- This concerns: It is also worth noting that a situation may arise regarding the payment of the minimum benefit calculated from the minimum wage.

- This concept is regulated by Part 6, Article 7, Article 8 of Federal Law No. 255.

- It is noted here: The calculation takes place in accordance with work activity from the calculation of full months and a full annual period.

- It is worth remembering that every 30 days are converted into a full month, and 12 months into a year in accordance with paragraph 2 of the third section of the Calculation Rules.

- If the periods of activity coincide, then only one is included at the applicant’s choice.

- This is regulated by paragraph 22 of the Rules for calculating the insurance period.

- The seller of Premier LLC is on sick leave during the period -.

Admission rules

Military personnel have one advantage over civilians in the length of service accrual format. If the requirements for employment before and after service are met, then the period in the army itself will be calculated in a ratio of one to two, that is, for a day in service two will be added to the length of service.

This rule applies only to conscripts. For those who serve under a contract, the calculation is one to one.

Healthy! If the service took place in extreme conditions and at the time of hostilities, then one day of service will be equivalent to three workdays.

How do the insurance and work experience of a military personnel differ?

Until 2002, pensions were calculated depending on the length of service (the time a citizen officially worked) - and the longer it was, the higher the pension.

Today, in most cases, insurance experience can be considered more relevant.

Today, work experience is taken into account less than insurance

Important ! It is needed both for pension accruals and payment of BL.

Accordingly, for those who served in the army on any basis, it is relevant that their period of service is counted towards their work and insurance experience. It will be taken into account only if the citizen worked both before and after military service.

This applies to both military personnel in the army and those who belong to the National Guard, the Ministry of Emergency Situations and other units, a full list of which is approved in the relevant legislative act (in Article 1 of Law 4468-1).

Article 1 of Law No. 4468-1

When service is not included in the length of service

Periods spent in the army will not be counted toward length of service under two conditions:

- The citizen did not engage in labor activity for which contributions to the Pension Fund were paid immediately before and after service;

- A person applies for a second civil pension, if he has a military pension. That is, years in the army will count toward long-service payments.

Military service does not count against long service, which is used for early retirement; only periods of employment and sick leave are taken into account.

Sick leave calculation

In this case, sick leave is calculated as usual - taking into account the average daily earnings for the last two years. The insurance period is used - army service is included in it in full.

You can consider an example. The man has been working on an official basis for 4 years; before that he served as a conscript. By law, his experience will be 5 years. We need to calculate the average daily earnings. If the length of service is from 5 to 8 years, then the employee can count on 80% compensation for sick leave.

Compensation is calculated as follows:

- For less than 6 years of experience, compensation will be 60%;

- Experience from 5 to 8 years – compensation 80%;

- More than 8 years of experience – 100% compensation.

If a person does not have enough experience, for example, he has only been working for the first year after the army, the minimum wage will be used to calculate sick leave. All these percentages will be calculated from her. The minimum wage is different in different regions, so it is necessary to calculate it individually in each case.

Regional coefficients may apply depending on the region. For example, northern ones - they can increase the cost of wages and sick leave.

Sick leave is paid according to the following scheme: the first three days at the expense of the employer, the rest at the expense of the Social Insurance Fund. The exception is work-related injuries.

https://youtu.be/gwimlje7Ohk

Accounting for service when calculating pensions

Since 2020, the calculation of pension payments in Russia has changed.

The size of the future old-age pension is determined by an individual coefficient related to the amount of wages and the number of years worked. Both indicators are based on contributions to the Pension Fund by the employer, that is, only the official income of citizens is taken into account. As for military service, despite the fact that during this period no contributions are made to the Pension Fund, 1.8 pension points are added for each year of service. This figure is comparable to the average salary of a person at work.

Dismissal from service was until 01/01/2007

In this case, the employee’s continuous length of service must be considered. Simple summation of periods of work under an employment contract and the period of military service is not allowed in this case.

This was confirmed to us by the FSS.

FROM AUTHENTIC SOURCES

“The period of military service of the insured person is included in the insurance period for calculating benefits for temporary disability and in connection with maternity. At the same time, when determining the insurance period, it is necessary to compare the citizen’s continuous work experience before January 1, 2007 and his insurance period before January 1, 2007 ., determined in accordance with the Rules. After this, you should choose shu from two values. If the continuous period of service is longer, the duration of the insurance period after January 1 must be added to the obtained duration.

The algorithm for calculating length of service will be as follows.

STEP 1. Determine the duration of the employee’s continuous work experience as of 01/01/2007.

STEP 2. We determine the duration of the employee’s insurance period as of 01/01/2007, that is, without including military and equivalent service that took place before 01/01/2007.

STEP 3. We compare the duration of the employee’s continuous work experience as of 01/01/2007 with his insurance record:

- The employee’s continuous work experience as of 01/01/2007 is greater than his insurance period, then:

- continuous work experience as of 01/01/2007 is less than or equal to the employee’s insurance service (this is possible only if military service before 01/01/2007 was not included in the continuous work experience as of 01/01/2007 due to a break in such service), then:

This is important to know: How to get a duplicate sick leave certificate

This was confirmed to us by the FSS.

FROM AUTHENTIC SOURCES

“If the continuous work experience as of 01/01/2007 is less than the insurance period, then the period of military service before January 1, 2007 and the duration of the insurance period after January 1 must be added to the obtained length of continuous work experience

ILYUKHINA Tatyana Mitrofanovna FSS RF

Let's look at specific examples of calculating the duration of sick leave.

Example. Calculation of length of service for benefits if the continuous length of service as of 01/01/2007 is greater than the insurance period

/ condition / I.I. Ivanov has been working under an employment contract from 03/01/2006 to the present. Prior to this, on January 31, 2006, he retired from military service. The length of military service at the time of dismissal was 10 years. April 1, 2014 I.I. Ivanov was issued a certificate of temporary incapacity for work due to illness.

/ solution / The algorithm for determining the duration of an employee’s “sick leave” is as follows.

STEP 1. Determine the length of continuous service of the employee as of 01/01/2007. It is 10 years and 10 months (10 years of military service (which are included in the continuous length of service as of 01/01/2007) + 10 months (from March 1 to December 31, 2006) of work under an employment contract until 01/01/2007).

STEP 2. Determine the duration of the employee’s insurance period as of 01/01/2007. She leaves 10 months (from March 1 to December 31, work under an employment contract until 01/01/2007).

STEP 3. Compare the calculated indicators. The length of the employee's continuous service is greater than his insurance period as of the same date. Therefore, we calculate the duration of the employee’s insurance period at the time of the onset of temporary disability using formula (1). It is 18 years and 1 month (10 years and 10 months of continuous experience + 7 years and 3 months (from 01/01/2007 to 03/31/2014) of work under an employment contract after 01/01/2007).

Example. Calculation of length of service for benefits if the continuous length of service as of 01/01/2007 is less than the insurance period

/ condition / A.N. Petrov has been working under an employment contract from 03/01/2006 to the present. Prior to this, on December 31, 2004, he retired from military service. Immediately before military service, he worked under an employment contract for 2 months. The length of military service at the time of dismissal was 10 years. April 1, 2014 A.N. Petrov was issued a certificate of temporary incapacity for work due to illness.

/ decision / The length of service for benefits is determined as follows.

STEP 1. Determine the length of continuous service of the employee as of 01/01/2007. It is 10 months (from March 1 to December 31, work under an employment contract until 01/01/2007. And 10 years of military service and 2 months of work under an employment contract immediately before military service are not included in the continuous length of service as of 01/01/2007, since more than a year passed between leaving the service and starting work).

STEP 2. Determine the duration of the employee’s insurance period as of 01/01/2007. It is 1 year (2 months of work immediately before military service + 10 months of work (from March 1 to December 31, 2006) after dismissal from service until 01/01/2007).

STEP 3. Compare the calculated indicators. The length of an employee’s continuous service as of 01/01/2007 is less than his insurance period as of the same date. Therefore, we calculate the duration of the employee’s insurance period at the time of the onset of temporary disability using formula (2). It is 18 years and 1 month (10 months of continuous service (from March 1 to December 31, 2006) as of 01/01/2007 + 10 years of military service until 01/01/2007 + 7 years and 3 months (from 01/01/2007 to 03/31/2014 - work under an employment contract after 01/01/2007)).

Do not forget that in the line “Insurance period” of the temporary disability certificate, military service before January 1, 2007 does not need to be indicated as a non-insurance period. In the example under consideration, it will look like this.

(1) Indicate the employee’s insurance length, including the period of military service until 01/01/2007.

(2) Just leave these cells blank.

What is important to know

Let's consider several important aspects related to crediting length of service during the period of military service:

- In order for the length of service to be recognized as continuous, a citizen must find employment within a year after the end of service;

- Military service includes both contract and fixed-term service;

- Even if service is interrupted, for example due to illness, the length of service will be continuous.

Attention! Military service may be grounds for early retirement if it took place under extreme conditions.

Why do you need insurance experience?

In labor practice, insurance experience is usually understood as the duration (in total) of work activity when insurance premiums are received for it by the Pension Fund of the Russian Federation.

If we move away from the concept of work activity, then the insurance period of a citizen of the Russian Federation includes the entire period when the corresponding payments and taxes were received for him by the Pension Fund of the Russian Federation.

Such periods of non-work activity include:

- service in the RF Armed Forces;

- stay in military camps where it is impossible to carry out this type of activity (maximum 5 years);

- presence of diplomatic spouses abroad;

- temporary disability with payment of benefits;

- being on the labor exchange with benefits paid;

- period of care for a newborn up to 1.5 years;

- paid community service;

- imprisonment based on proven innocence;

- period of care for disabled people and people over 80 years of age.

All issues related to its accrual and calculation are regulated by such regulatory legal acts as:

- Federal Law No. 27 “On individual (personalized) registration in the compulsory pension insurance system” of 1996;

- Federal Law No. 165 “On the Basics of Compulsory Social Insurance” of 1999;

- Federal Law No. 167 “On compulsory pension insurance in the Russian Federation” of 2001;

- Federal Law No. 173 “On Labor Pensions of the Russian Federation” of 2001;

- Federal Law No. 255 “On Compulsory Social Insurance” of 2006;

- Federal Law No. 400 “On Insurance Pensions” of 2013.

According to the current changes that came into force in 2002, in this area of legislation, two important parameters depend on the amount of insurance experience of a citizen, such as:

- Purpose and amount of pension payments. To receive an old-age pension in 2020, in addition to reaching the established retirement age, a citizen must accumulate 9 years of insurance experience and 13.8 pension points.

- The amount of benefits paid when he goes on sick leave.

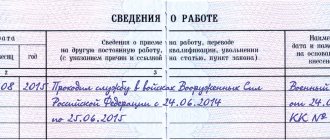

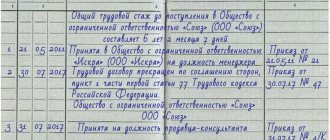

How to confirm army experience

In some cases, persons who served in the army must confirm their presence in the Armed Forces.

It is recommended to do this in advance. When finding a job after the army, when submitting a work book, a person should ask a HR specialist to enter information from the military ID. This procedure will simplify subsequent actions related to the formation of a pension. If the above actions have not been carried out, then you will need to confirm your stay in the army directly with the Pension Fund. To do this, one of the following documents is provided to the department:

- military ID;

- certificate from the commissariat;

- extract from the military unit.

Note that studying at an institution subordinate to the Ministry of Defense is also included in the work experience. This fact is confirmed by a diploma from a university.

Healthy! If you lose documents confirming the fact of being in military service, you should contact the military unit and request a duplicate document or simply an extract from the archives.

There are several important rules related to taking into account length of service during the period of military service. In particular, insurance experience will be added only if there is employment before and after being in the army. This rule does not apply to contract workers, since they receive a salary, their length of service is accrued for the entire period of service. If a person was in difficult climatic conditions or the time of service was during military operations, then he will not only receive the right to early retirement, but one day of service will be equivalent to three working days.

https://youtu.be/u3xmDT6dE4I

How to take military service into account for sick leave

Since 2010, the insurance period for determining the amount of benefits for temporary disability and pregnancy and childbirth, along with periods of work (insurance periods), includes periods of military and equivalent service, for example, service in internal affairs bodies (non-insurance periods

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

From 2007 to 2010, if, taking into account the period of such service, the continuous work experience was greater than the insurance period, it was the continuous work experience that was taken to calculate benefits. In particular, it included:

- military service, if the interval between dismissal from service and entry to work did not exceed

- service in the internal affairs bodies, if the interval between dismissal from service and entry into work did not exceed 3 months, not counting the time of moving to the place of permanent residence

When calculating length of service to determine the amount of benefits, is it now necessary to establish the duration of continuous service of an employee until 01/01/2007, who left service before this date? Or is it enough to simply sum up all the periods included in the “sick leave” period?

The procedure for calculating insurance experience

Accounting for the period of service is carried out according to certain rules established by law.

In this case, its actual calendar duration is included, translated in accordance with the rules of social insurance into entire 30-day months and 12-month years.

Therefore, for military personnel, 1 day of service is equal to 1 insurance day.

Also, one of the mandatory conditions is the citizen’s labor activity before and after service. Wherein:

- To calculate pension payments, according to Federal Law No. 400, such an army period will be included in the length of service only if there is compulsory work activity before service.

- To calculate benefits for temporary disability (sick leave), according to the law in the field of social insurance Federal Law No. 255, previous work activity is not necessary, the main thing is to provide documents confirming the time of service.

Also, position and rank do not influence the inclusion of the army period in the insurance period.

Necessary documents for calculating length of service for sick leave

In order for a serviceman to confirm the fact of serving in the armed forces, he will need to provide a certain list of documents.

These include the following:

- Military ID, which indicates the period and place of service.

- Certificate of demobilization, which is issued by the unit after completion of service.

- Certificates issued by a military medical institution in the event of an injury or illness occurring during service.

- Graduate diploma from a military educational institution.

- Employment history.

With this list, the citizen who has served should contact the personnel department of the place of work. At the same time, a new work book is necessary only for those military personnel who did not carry out labor activities before serving. If he was employed before joining the army, then at the time of service his job must be retained and, accordingly, the work book is also in the personnel department.

Percentage of payment for sick leave depending on length of service

Current legislation stipulates that the amount of benefits for temporary disability due to illness or injury directly depends on the citizen’s length of insurance, i.e. The longer the period of employment, the higher the accrued benefit.

Such social payments represent a certain percentage, which is determined by length of service, of the average wage of a worker.

According to Part 1 of Art. 7 Federal Law No. 255, the amount of the benefit is:

- not less than the minimum wage - with less than six months of experience;

- 60% – with up to five years of experience;

- 80% – with experience from five to eight years;

- 100% – with more than eight years of experience.

The influence of a serviceman's length of service when calculating sick leave

For military personnel, the same percentages apply depending on length of service as for civilian workers.

Period:

- up to 6 months – minimum wage;

- up to 5 years – 60%;

- 5-8 years – 80%;

- from 8 years – 100%.

Therefore, when calculating sick leave benefits, the serviceman’s official insurance record is directly taken into account.

Example of sick pay depending on length of service

Undoubtedly, the amount of temporary disability benefits depends on the insurance period, but to calculate it, the accountant will also need data such as average earnings per working day and the duration of the period of incapacity . In this case, average earnings must be taken into account for the last two years of work.

- Example 1. Citizen Suslov V.I. served a year in the army, and then found a job within 3 months after demobilization and worked for 4 years 3 months 5 days before going on sick leave for 5 days. At the same time, the average earnings over the last two years amounted to 852,000 rubles. The insurance period, which will include the period of military service, is 5 years 3 months, i.e. he is entitled to receive a benefit in the amount of 80% of the average daily wage. The daily wage is 852,000/730 = 1,167 rubles, and the amount of social benefits, taking into account the duration of the sick leave period, is (1,167 * 80%) * 5 = 933.6 * 5 = 4,668 rubles.

- Example 2. Citizen Voronov S.N. served for one year, and then got a job and after 2 months went on sick leave for 10 days. Since it is impossible to calculate his average salary over the past two years, this value is equated to the minimum wage (11,163 rubles in 2020). Also, his insurance period is 1 year 2 months. The daily wage is 11163*24/730 = 367 rubles, and the amount of social benefits taking into account the duration of the sick period is 367*10 = 3670 rubles.