Calculation of temporary disability benefits from the minimum wage

Temporary disability benefits are calculated from the minimum wage in the following cases:

- in the billing period (during the two previous years preceding the insured event) the employee had no earnings,

- the employee's insurance period is less than six months;

Before proceeding directly to calculating the amount of benefits, it is necessary to derive the employee’s actual average daily earnings and compare it with the minimum average daily earnings calculated from the minimum wage adopted in the Russian Federation. Further, if the actual average daily earnings turned out to be lower, then the benefit is calculated from the minimum wage

Minimum average daily earnings = minimum wage (established in Russia) x 24 months. / 730 days

When calculating sick leave for pregnancy and childbirth: minimum average daily earnings = minimum wage (established in Russia) x 24 months.

What does the employer write?

What does the code on the sick leave mean? Deciphering the codes for filling out the temporary disability sheet is carried out in accordance with paragraphs. 58, 61 and 66 of section IX of the Order of the Ministry of Health and Social Development No. 624n.

This act identifies several groups of codes. Each group has its own field in the hospital bulletin:

- code of reason for disability (from 01-15);

- additional code (017-021);

- family connection (38-42);

- violation of the regime (23-28);

- other (31-37);

- conditions for calculating temporary disability benefits (43-51).

The column “subordination code” is not explained in the Order, since it represents the policyholder’s code in the Social Insurance Fund database.

Each of the presented groups has its own characteristics of filling out and cases in which one or another mark must be placed.

Minimum wage for calculating sick leave

/ 730 days or 731 days (if one year was a leap year in the billing period)

The formula for calculating sick leave from the minimum wage looks like this:

minimum average daily earnings, calculated from the minimum wage (established in Russia) x % (depending on length of service) x the number of days of incapacity for work + 15% (regional coefficient).

Percentages depending on length of service

- If the employee has insurance experience exceeding 8 years, then the calculated percentage is 100%

- If the length of service is 5–8 years, then when calculating sick leave it is necessary to multiply by 80%.

- If the experience is less than 5 years - 60%.

Calculation of temporary disability benefits from the minimum wage if the employee’s length of service is less than 6 months

In this case, the minimum average daily earnings is calculated as follows: the minimum wage established for the current year is divided by the number of calendar days in the month in which temporary disability occurs.

If the days of temporary disability extend over a period of more than one calendar month, then the calculation is made for each month separately.

Example

The employee has been working in the organization since October 1, 2020. From November 25, 2020 to December 4, 2020, he was on sick leave. Before working in this organization, I had never worked anywhere.

Benefit for November 5965 / 30 (number of calendar days in November) x 60% x 6 days + 15% (regional coefficient)

Benefit for December 5965 / 31 (number of calendar days in November) x 60% x 4 days + 15% (regional coefficient)

Temporary disability benefit = November benefit + December benefit

The employee works on a part-time or part-time basis

If the employee worked part-time, the benefit should be calculated in proportion to the length of his working time. Let's say the employee's working week is 35 hours. The working week norm is 40 hours.

Let's calculate the average daily earnings taking into account the minimum wage: 6204 (minimum wage for 2020 established in Russia) x 24 / 730 / 40 (standard working week) x 35 (length of the working week)

If the employee worked on a part-time basis, the benefit should be calculated in proportion to the rate. Let's say an employee works at 0.5 rate.

Let's calculate the average daily earnings taking into account the minimum wage: 6204 (minimum wage for 2020) x 24 / 730 x 0.5 (rate)

Next, in both cases, we multiply by the percentage of length of service, the number of days of incapacity for work, and apply the regional coefficient.

In addition, the employer calculates temporary disability benefits based on the minimum wage if:

- the employee violated the hospital regime without good reason or did not show up for an appointment with the doctor on the appointed day,

- the employee was ill due to alcohol, drug, or toxic intoxication. This data can be seen in the line “Cause of incapacity for work” on the certificate of incapacity for work.

Attention ! If the minimum wage changes during the period of incapacity of the employee (an insured event that occurred in 2015 continues in 2020), the minimum wage in force in 2020 is taken for calculation, that is, the minimum wage in force at the beginning of the insured event.

Regional office information

Fund for the Republic of Bashkortostan

To the list "

I am paid benefits based on my earnings, and not on the minimum wage,

During the period of leave, maternity benefits are paid to both working women and students, women military personnel, as well as those dismissed due to the liquidation of the organization and registered with the employment service. Unemployed women are not provided with maternity benefits.

If the days of temporary disability extend over a period of more than one calendar month, then the calculation is made for each month separately.

In Moscow, from January 1, 2020, it is equal to 14,500 rubles, and, starting from April 1, 15,000 rubles. Nevertheless, to calculate sick leave throughout the Russian Federation, a single minimum wage value is applied, valid on the day of the insured event, that is, 5,965 rubles. (Subclause 6, Clause 1, Article 1.2 of Law No. 255-FZ).

The minimum wage for calculating sick leave (2018, 2020, 2020, 2015)

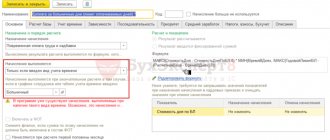

For some employees, nothing changes, and for some, the column “Daily Allowance, taking into account restrictions” appears in the printed version with a “tick”, the value in which is less than in the column “Daily Allowance, taking into account the percentage of payment.” Why? (In both cases, the benefit amount is small and does not exceed the maximum, limited by a constant). Should I check the box or not?

Answer 1c:

By checking the “Limit benefit amount” checkbox, you can limit the amount of benefits accrued. The amount of this limitation is regulated by the constant “Maximum amount of benefit for temporary disability”. Let us clarify that this restriction has nothing to do with the limitation on the amount of benefits accrued at the expense of the Social Insurance Fund in terms of UTII (the size of the monthly wage excluding the Republic of Kazakhstan) according to the Fed. Law No. 190-FZ of December 31, 2002).

You can ADD YOURS

comment, review, question.

More questions and answers on 1C Salary and Personnel 7.7:

Salary 7.7 285 release. In the reference books, I changed the types of deductions 101 and 102 to 1000 rubles and the limit to 280,000...

Reorganization of the enterprise (division into three) from the 10th. How to transfer employees correctly in ZiK? ...

Is it possible to install release 7.70.285 on release 7.70.282 or do you need to do 283, 284 and then 285 in strict order?

When preparing 2NDFL information, a problem arose due to the fact that internal part-time work was registered...

How can I make 01/11/2009 a working date in Zik? I’ve already set holidays, but I don’t know what to do with weekends...

How to upload personal income tax information from the 1C: Salary and Personnel 7.7 program to the “Taxpayer 2008” program...

Adding a comment:

In order for your comment to be published, try to write correctly and to the point.

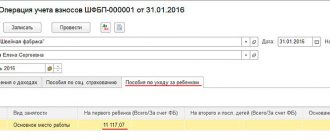

Sick leave in “1C: Accounting” ed. 3.0

“1C: Accounting” is not a salary program, so the calculation of sick leave is simplified here. First we set up:

- Open the section “Salaries and Personnel” – “Directories and Settings” – “Salary Settings” – “Salary Calculation” – check the box “Keep records of sick leave, vacations and executive documents”.

- Go to “Salaries and Personnel” – “Salary” – “All Accruals” – “Create” – “Sick Leave”. We indicate the employee from the “Employees (organizations)” card. We also indicate the number of the certificate of incapacity for work manually. If “1C-Reporting” is connected, click the “Receive from FSS” button (the data is filled in automatically).

- We indicate the reason for the disability and the period of illness. A note about violation of the regime has been added: indicated if violations have been established, for example, non-compliance with the prescribed regime, late attendance for an appointment, going to work without being discharged, etc.

- We indicate the employee’s length of service, from which the percentage of payment is automatically filled in, sick leave is accrued and personal income tax is withheld (Fig. 3).

We looked at the step-by-step settings necessary to fill out and calculate sick leave. If you have any other questions about calculating sick leave, we will advise you for free, order a consultation here.

Be healthy, work in 1C with pleasure!

Calculation of hospital benefits in 2011

In December 2010, Federal Law No. 343-FZ of December 8, 2010 was signed, which amends the Federal Law on Compulsory Social Insurance No. 255-FZ of December 29, 2006 (hereinafter referred to as Law No. 255-FZ). Law N 255-FZ came into force on January 1, 2007 and for three years regulated the conditions, amounts and procedure for providing benefits for temporary disability, pregnancy and childbirth. From January 1, 2010, the scope of this Law expanded: legal relations in the system of compulsory social insurance in case of temporary disability and in connection with maternity were added to the existing range of issues; the Law stipulated the conditions for the appointment and payment of child care benefits . The new year of 2011 brought with it further changes to Law N 255-FZ, related, among other things, to the rules for calculating benefits . Individual entrepreneurs who hire employees are in many ways equivalent to employer-organizations (Article 20 of the Labor Code of the Russian Federation). A businessman who has entered into employment contracts with employees is obliged to pay insurance contributions for compulsory social insurance in case of their temporary disability. The amount of the benefit depends on the insurance length of the insured person (employee).

Our information. The insurance period is the total length of time that insurance premiums have been paid.

The procedure for paying sick leave for caring for a sick child and the procedure for paying benefits to voluntarily insured persons have not changed. The boundaries of the insurance period for sick leave payments remain the same.

Calculation and payment of sick leave in 2020

This example demonstrates well how benefits are calculated:

Example:

Solovyov V.S. temporary disability benefits are paid for the period from February 1 to February 10, 2020 (10 calendar days). Insurance experience of Solovyov V.S. is 8 years. During 2020, the employee received a salary of 770,000 rubles. In 2020, this employee was paid a salary of 800,000 rubles.

We will determine the amount of temporary disability benefits.

1. Determine the amount of wages for the billing period over the previous two years.

For 2020: 770,000 rubles.

For 2020: 800,000 rubles.

For 2020, only earnings in the amount of 755,000 rubles will be included, since the Social Insurance Fund will not reimburse the employer more than the maximum base for calculating insurance premiums. For 2020, payments made to Solovyov should be included in the calculation in full. The maximum base for 2020 is 815,000 rubles.

The payment amounts that should be included in the calculation will be:

755,000 + 800,000 rub. = 1,555,000 rub.

2. We calculate the average daily earnings.

1,555,000/730 = 2,130.14 rubles.

3. We determine the amount of temporary disability benefits.

2,130.14 * 10 = 21,301.4 rubles.

An example of calculating sick leave for child care:

Engineer Nozhkin G.S. was on sick leave to care for a 14-year-old child from March 3, 2020 to March 18, 2020. He brought a sick leave certificate to the organization for payment.

How to pay sick leave to engineer Nozhkin G.S.?

When caring for a sick child or other family member, benefits are paid subject to the restrictions established by Art. 6.7 of Law No. 255-FZ.

Course "Calculations with personnel for remuneration." Payroll calculation, all types of compensation and incentive payments: overtime, weekend work, night work, bonuses. Examples include business trips, sick leave, and other benefits. All cases of calculating average earnings Find out more

Source of sick leave payment

The period of temporary disability , paid at the expense of the entrepreneur (the policyholder) , has been increased from two to three days . If in 2010 the policyholder (hereinafter referred to as the employer) paid for the first two days of sick leave at his own expense, then from 2011 he will pay for the first three days of illness, and only starting from the fourth day, temporary disability benefits will be paid from the funds of the Federal Social Insurance Fund of the Russian Federation ( clause 1, part 2, article 3 of Law No. 255-FZ). This rule does not apply to sick leave for caring for a sick child or family member, during quarantine, or after-care in sanatorium-resort institutions. It applies to benefits that are paid in the event of loss of ability to work due to illness or injury (Clause 2, Article 3 of Law No. 255-FZ).

Example 1. An employee was on sick leave for 10 calendar days from January 11 to January 20, 2011. According to the rules in force in 2010, out of 10 calendar days of sick leave, the first 2 days of illness were paid by the employer, and 8 by social insurance. In 2011, the employer pays for the first 3 days of illness (January 11, 12, 13) at its own expense, and starting from January 14 to January 20 (7 calendar days), sick leave is paid for from the Social Insurance Fund. As before, the merchant pays the employee the entire amount of sick leave, but the amount for 7 calendar days of illness will be reimbursed to the employer by social insurance.

Other causes of disability

- If the reason for the disability is quarantine (when the child goes to kindergarten and there is a quarantine order), then one of the parents is entitled to sick leave. A sick leave certificate can be issued by a doctor only on the basis of an order. It is issued for the entire quarantine period and for the period of contact with infected patients. Days of care are not counted, and they are calculated from length of service.

- If the cause of disability is an injury at work or an occupational disease , then the program establishes 100% payment regardless of length of service. And the “Benefit Limit” is the maximum amount of the monthly insurance payment.

- If the cause of incapacity for work is further treatment in sanatorium-resort institutions, then sick leave will only be paid for 24 days.

- If the cause of disability is prosthetics, this must be confirmed by medical evidence. In this case, the entire period is paid.

And any family member can receive the right to benefits under “Parental Leave”. The right to benefits remains if the vacationer works part-time or from home. The program assigns benefits in the “Personnel” or “Salary” - “Parental Leave” section.

Billing period

The billing period for sick pay has changed. In 2010, it was 12 calendar months preceding the month of the onset of disability.

Our information. The billing period is the period for which payments are taken into account to calculate average earnings when paying the amount of temporary disability benefits.

Since 2011, the billing period is two full years, or 730 days (365 k/day x 2 years) preceding the year of the insured event . Regardless of the month in which the employee fell ill, at the beginning or at the end of the year, when calculating sick leave in 2011, only payments made in 2009 and 2010 are taken into account.

Example 2. An employee was on sick leave for 5 calendar days: from February 7 to February 11, 2011. According to the 2010 rules, the billing period would be taken from February 1, 2010 to January 31, 2011, that is, the last 12 calendar months preceding the month occurrence of an insured event. The new rules establish a settlement period from January 1, 2009 to December 31, 2010, that is, 2 calendar years preceding the year of the insured event.

An increase or decrease in wages in the year in which the employee fell ill does not affect the amount of sick leave. That is, an employee’s earnings in 2011 will affect the amount of his sick leave only in 2012.

Example 3. An employee fell ill in December 2011 (from December 26 to December 30, 2011). The calculation period for determining the benefit amount is taken from January 1, 2009 to December 31, 2010. Payments from 2011 do not need to be taken into account.

It turns out that the average salary for an employee can be calculated once at the beginning of the year and the resulting value can be taken throughout the year. To some extent this will simplify the work.

Rule 730

To determine the amount of benefits that should be paid to the employee, you must first calculate the average daily earnings, and then multiply the resulting value by the number of days of temporary disability . Average daily earnings are determined by dividing the total earnings for the billing period (2 calendar years preceding the year of the insured event) by 730 (clause 3 of Article 14 of Law No. 255-FZ). According to the old rules, average daily earnings were determined by dividing the total earnings for the billing period (12 calendar months preceding the month of the insured event) by the number of calendar days for which earnings were accrued. Now you need to divide by 730. The number of calendar days falling within the period for which wages are taken into account has no significance for calculating benefits since 2011.

Our information. Depending on the insurance period, the benefit is paid in the following amounts based on average earnings: - 100%, if the insurance period is more than 8 years; — 80% if the insurance period is from 5 to 8 years; — 60% if the insurance period is up to 5 years; - not exceeding the minimum wage for a full calendar month, if the insurance period is less than six months.

Example 4. The employee’s total earnings in 2009 amounted to 150,000 rubles, in 2010 - 200,000 rubles. From January 17 to January 21, 2011 (5 calendar days), the employee was on sick leave. Let's determine the employee's average daily earnings to calculate temporary disability benefits. According to the 2010 rules, the average daily earnings are 547.95 rubles. (RUB 200,000 / 365 k/day). The maximum average daily earnings for calculating benefits is 1139.99 rubles. (RUB 415,000 / 365 k/day). Since the employee's average daily earnings do not exceed the maximum amount (547.95 < 1136.99), the benefit would be paid from the amount of actual earnings. The payment would be 2739.75 rubles. (547.95 rub. x 5 k/day), of which 1095.9 rub. (547.95 rubles x 2 k/day), that is, the first two days of illness, the employer would pay at his own expense. The amount for the next three days of illness in the amount of 1643.85 rubles. (547.95 rubles x 3 k/day) the employer would be reimbursed by the Federal Social Insurance Fund of the Russian Federation. According to the rules of 2011, the average daily earnings will be equal to: (150,000 rubles + 200,000 rubles) / 730 = 479.45 rubles. The total amount of the benefit will be 2397.25 rubles. (RUB 479.45 x 5 days). For the first 3 days, the employer will pay 1,438.35 rubles at his own expense. (479.45 rub. x 3 k/day), and 958.9 rub. Social insurance will be reimbursed within 2 calendar days. As you can see, the benefit calculated according to the new rules turned out to be less. In turn, the employer will have to pay a larger amount from his own funds.

Percentage taking into account insurance experience

The amount of temporary disability benefits depends on the length of insurance coverage and the cause of disability. This follows from the provisions of Article 7 of Law No. 255-FZ and Article 9 of Federal Law of July 24, 1998 No. 125-FZ. In the event of an occupational disease or accident at work, the benefit amount is 100 percent of average earnings. To determine the percentage of length of service for the purpose of calculating benefits for illnesses or injuries, the following scale is used:

- Experience up to 5 years – 60 percent;

- experience from 5 to 8 years – 80 percent;

- 8 years of experience or more – 100 percent.

In the case of caring for a sick child, the percentage depends on the age of the child, and on how the treatment is inpatient or outpatient, and on the duration of disability (Article 11.2 of Law No. 255-FZ).

The percentage taking into account the length of service is applied when calculating the daily allowance. You should multiply the greater of the values by it: average daily earnings or minimum average daily earnings.

Average earnings limits

As before, the average earnings cannot exceed a certain amount. Previously, the average daily earnings were considered. It could not exceed the value determined by dividing the maximum base for calculating insurance premiums by 365 (clause 3.1 of Article 14 of Law No. 255-FZ, as amended before January 1, 2011). In 2010, the limit was 415 thousand rubles. (Clause 4, Article 8 of Federal Law No. 212-FZ of July 24, 2009, hereinafter referred to as Law No. 212-FZ). Based on this value, the average daily earnings for calculating benefits should not exceed 1,137 rubles. (415 thousand rubles / 365 days). Now clause 3.1 of Art. 14 of Law N 255-FZ requires comparing average earnings , on the basis of which benefits are calculated, with the maximum value of the base for calculating contributions for the corresponding year . That is, the total amount of payments is taken, and not the average daily value. In this case, each calendar year is considered separately. In 2010, the limit was 415 thousand rubles. For 2009 the same value is adopted.

Example 5. An employee has been working for one businessman for the past few years. In 2009, his earnings amounted to 350,000 rubles, in 2010 - 450,000 rubles. Insurance experience more than 8 years. In 2011, the employee was on sick leave (5 calendar days). Let's determine the amount of the benefit. In 2010, earnings exceeded the limit (450,000 > 415,000), so to calculate the benefit we take into account 415,000 rubles. Earnings for 2009 do not exceed the limit (350,000 < 415,000), which means that earnings for 2009 are taken into account in full. Average earnings for 2 years will be 765,000 rubles. (350,000 + 415,000), average daily earnings are 1,047.95 rubles. (RUB 765,000 / 730). If the insurance period is more than 8 years, the benefit is paid in the amount of 100% of the average earnings, thus, the full amount of the average daily earnings is taken into account (if the experience was less than 8 years, the corresponding percentage would have to be taken from the calculated value). The benefit amount for 5 calendar days will be 5239.75 rubles. (RUB 1,047.95 x 5 k/day).

In 2011, the limit was set at 463 thousand rubles. (Resolution of the Government of the Russian Federation of November 27, 2010 N 933), but this value will be needed when calculating benefits in 2012. Let’s say an employee gets sick in 2012, which means the calculation period for determining the amount of benefits will be 2010 and 2011. The total payment for 2010 will be compared with the limit of 415 thousand rubles, and for 2011 - with the limit of 463 thousand rubles. Please note: when comparing average earnings, you cannot take the total amount of average earnings for 2 years and compare it with the total limit (for benefits paid in 2011, with double the limit). Let's look at example 5. Total earnings for 2 years are 800,000 rubles. (350,000 + 450,000). Doubled limit - 830,000 rubles. (RUB 415,000 x 2 years).

Average earnings for calculating benefits

During the period of parental leave, one of the parents loses their monthly income and cannot earn money. To compensate for lost income, the employee is entitled to child care benefits. This compensation payment is due until the child reaches 1.5 years of age.

In this regard, the coming year 2020 promises a monetary replenishment for recipients of pensions and benefits. Even if the increases are not as large as we would like, it still won’t hurt to familiarize yourself with the updated sizes. New pension amounts for 2019 were published by me in a previous material (see here).

What social benefits depend on the minimum wage and what is the maximum earnings for calculating benefits in 2020 - further in our article.

According to clause 1.1 of Art. 14. The calculated monthly benefit cannot be less than the minimum established by federal law.

Average earnings are the average amount of remuneration for a worker for a specific period of time. This designation can be found in various documents, and it is used in various situations. What social benefits are paid on the basis of the average daily salary, what is the average earnings for calculating benefits and how to calculate it, we will consider in our article.

It is calculated from the number of full months (30 days) and a full year (12 months) in calendar order. Those. First you need to select complete years and complete months.

To make this comparison, you need to calculate the actual earnings for 1 month on average based on income for 2 calculation years. Then compare it with the minimum wage. If the monthly average salary is less, then the established minimum is selected for calculation. If it turns out to be greater, then the calculation of maternity benefits is carried out according to the general rules.

Is it possible to install release 7.70.285 on release 7.70.282 or do you need to do 283, 284 and then 285 in strict order?

But the maximum amount of child care benefits is the same for the entire country and is 24,548.6 rubles in 2020. Various regional coefficients do not apply to it (they can only be used to calculate the minimum benefit). A woman will not receive more than this amount of benefits, regardless of her actual place of residence.

In general, the amount of disability benefits is limited by the maximum value of the base for calculating insurance contributions to the Federal Social Insurance Fund of the Russian Federation (clause 3.2 of Article 14 of the Federal Law of December 29, 2006 No. 255-FZ). It is established annually by federal law. In 2020, this value is equal to 670,000 rubles (Resolution of the Government of the Russian Federation dated December 4, 2014 No. 1316).

Rules and procedure for calculating sick leave based on the minimum wage

When comparing 800,000 rub. < 830,000 rubles, it turns out that the payment is within the framework, and this error will lead to an overestimation of the amount of sick leave, which is unacceptable. You need to compare the total payment for a specific calendar year with the limit established for that year. Now let's talk about the bottom bar. If the average earnings for a full calendar month are lower than the federal minimum wage established on the day the insured event occurred, then the benefit is calculated based on the minimum wage (clause 1.1 of Article 14 of Law No. 255-FZ). You can check whether benefits need to be calculated based on the minimum wage as follows. Currently, the minimum wage is 4,330 rubles. This means that for the billing period (2 years) the employee’s payments must exceed 103,920 rubles. (RUB 4,330 x 24 months). If for two years the employee’s income is less than this amount, then the benefit is paid based on the minimum wage. In addition, this situation is possible if the employee has not worked for a long period or cannot confirm his payments from previous places of work.

Example 6. An employee was hired on January 11, 2011. From February 7 to February 11, 2011 (5 calendar days) he was on sick leave. The employee's total insurance experience is more than 1 year. During the billing period of 2009 and 2010, the employee did not work anywhere, which means that the benefit is calculated based on the minimum wage, that is, the average earnings for each month of the billing period (2 years, that is, 24 months) are taken equal to 4,330 rubles. The benefit amount will be 711.78 rubles. (4330 rub. x 24 months / 730 x 5 k/day).

Example 7. Let's slightly change the conditions of example 6. Let's assume that the employee is registered at half the rate. In this case, we apply a coefficient reflecting the duration of working hours - 0.5. The benefit amount will be 355.89 rubles. (4330 rub. x 24 months / 730 x 0.5 x 5 k/day).

Minimum benefit amount

A situation often arises when an employee had no earnings in the two previous years or the average earnings calculated for this period, calculated for a full calendar month, turned out to be below the minimum wage. In this case, the benefit is calculated from the minimum wage.

Example:

Somova A.A. fell ill on July 25, 2020 and was ill for five calendar days. This employee has been working in the organization since January 9, 2020. Billing period Somova A.A. not processed. Insurance experience 7 months. In the area where this employee works, the regional coefficient is 1.6. The use of the regional coefficient is justified by clause 11(1) of the Regulations on the specifics of the procedure for calculating benefits for temporary disability... (approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375.

(RUB 11,280 X 24 months): 730 days. X 60% x 5 days. * 1.6 = 1,780.08 rub.

The amount of the benefit, even if it is calculated based on the minimum wage, depends on the length of insurance coverage!

Example:

Komova V.N. fell ill on June 30, 2020. On this day, she was granted sick leave. The sick leave was closed on July 11, 2020. The employee’s earnings in 2020 amounted to 56,000 rubles; in 2020 – 89,000 rubles. Komova's insurance experience is 5 years.

How to calculate the benefit that should be paid to V.N. Komova?

1. Determine the average daily earnings.

(56,000 + 89,000) / 730 = 198.63 rubles.

2. Compare the actual average earnings with the minimum.

(11,280 * 24) / 730 = 370.85 rubles. > 198.64 rub.

3. We determine the amount of benefits for 13 days.

370.85 * 13 days * 80% = 3,856.84 rubles.

Payments taken into account

The composition of payments included in the calculation of average earnings has changed. According to the 2010 rules, the average earnings included all types of payments and other remuneration in favor of the employee, which were included in the base for calculating insurance contributions to the Social Insurance Fund of the Russian Federation. The list of payments not taken into account is specified in clause 8 of the Regulations on the specifics of calculating benefits, approved by Decree of the Government of the Russian Federation of June 15, 2007 N 375. This document excluded from the calculation of the average periods when the employee retained the average earnings and, accordingly, payments for this time (vacation, business trips, period of temporary disability). According to the rules of 2011, average earnings include all types of payments and other remuneration in favor of the insured person, for which insurance premiums are charged to the Federal Social Insurance Fund of the Russian Federation . Now the calculation includes vacation pay and travel allowances, for which contributions are calculated. But benefit payments are still not taken into account.

What features need to be taken into account when calculating sick leave for an employee who works part-time?

Mandatory social insurance in case of temporary disability and in connection with maternity is a system of legal, economic and organizational measures created by the state aimed at compensating citizens for lost earnings (payments, rewards) or additional expenses in connection with the occurrence of an insured event. This definition is given in clause 1, part 1, art. 1.2 of the Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.” That is, temporary disability benefits must compensate the sick employee for his earnings.

At the same time, the procedure for calculating sick leave assumes that it is calculated based on the employee’s average earnings for the two calendar years preceding the year the insured event occurred (Part 1, Article 14 of Law No. 255-FZ of December 29, 2006, hereinafter referred to as Law No. 255-FZ). That is, if the onset of the disease occurs in 2020, then the calculation period for sick leave will be the period 2014 - 2020. It is quite obvious that the amount of earnings in both 2014 and 2020 may differ significantly from the remuneration received in 2016. The truth is that the difference does not always work against the employee.

Filling out a sick leave certificate

Let us note several important points that should be taken into account when filling out a sick leave certificate:

- The doctor fills out certain sections, they are indicated in clauses 56 - 63 of the Issuance Procedure and certifies with the seal of the medical institution;

- The doctor has the right not to fill out the line “place of work - name of organization” (especially if the patient cannot correctly name the name of the organization). The employer can enter the name of the organization himself using a black gel, capillary or fountain pen and block letters. You cannot fill out the certificate of incapacity for work with a ballpoint pen or use ink of a different color.

- If the doctor makes a mistake when filling out the form, he must issue a duplicate certificate of incapacity for work (paragraph 5, clause 56 of the Issuance Procedure);

- There are no requirements for the form of seal of a medical organization. The imprint of the seals of medical organizations may contain the text “for sick leave certificates”, “for sick leave certificates” (paragraph 2, paragraph 2 of the letter of the Federal Social Insurance Fund of the Russian Federation dated No. 14-03-18/15-12956).

- For its part, the employer should pay attention to whether the doctor of the medical organization filled out the form correctly. This is important, since the Federal Social Insurance Fund of the Russian Federation will not reimburse expenses if the employer accepts a certificate of incapacity for work filled out in violation of the Issuance Procedure;

- The employer must fill out the sections specified in clauses 64 - 66 of the Issuance Procedure;

- Please note that the presence of technical deficiencies in filling out the certificate of incapacity for work (for example, stamps on the information field, putting spaces between the doctor’s initials) is not a basis for its re-issuance and refusal to assign and pay benefits, if all entries are read (paragraph 5 clause 17 of the letter of the FSS of the Russian Federation dated No. 14-03-18/15-12956).

Calculation of average daily earnings from the minimum wage in 2018

In this part, it can be said that workers whose salaries were reduced in 2020 benefit.

At the same time, those who, for one reason or another, switched to working in 2020, for example, part-time, were less fortunate. The fact is that this can seriously affect the amount of their sick leave.

After all, according to Part 1.1 of Art. 14 of Law N 255-FZ in the event that the insured person had no earnings during the billing period, as well as in the event that the average earnings calculated for this period, calculated for a full calendar month, are lower than the minimum wage established by federal law on the day the insured event occurred , the average salary, on the basis of which sick leave is calculated, is assumed to be equal to the minimum wage. And it is immediately said that if the insured person at the time of the occurrence of the insured event works part-time (part-time, part-time), then the average earnings, on the basis of which benefits are calculated in these cases, are determined in proportion to the working hours of the insured person .

As representatives of the Social Insurance Fund clarified in Letter No. 02-09-14/15-19990 dated November 16, 2020, it is necessary to apply the part-time coefficient when calculating sick leave benefits only when the average employee’s earnings are determined based on the minimum wage. And in other situations, the benefit is calculated in the general manner - based on the employee’s actual earnings in the billing period.

It is possible that this, of course, reflects the purpose of social insurance - compensation for lost earnings, but it is equally obvious that there is no need to talk about fairness in this case. Let's assume that one employee has average earnings for 2014 - 2020. was less than the minimum wage and in 2020 he works part-time. And his colleague did not work at all in 2014 - 2020, but at the time of the onset of illness, also in 2020, he was registered as a full-time worker, although his salary is less than even “half” the salary of the first employee. That is, in fact, in 2020 they earn the same, but in 2014 - 2020. the first one worked, but the second one didn’t. For both one and the second employee, sick leave should be calculated based on the minimum wage, but... The amount of sick leave for an employee who worked in the billing period will be reduced in proportion to the duration of his working hours. And the one who had not worked in the past received benefits calculated based on the full minimum wage.

Fair? Can we say that the goal of compulsory insurance—compensation for lost earnings—has been achieved in this case, given that the employees’ earnings are the same, but the amount of compensation is different, and not in favor of the employee who previously worked and contributions to compulsory social insurance were transferred from his salary ? It seems that in such situations the only correct decision would be to cancel the reduction coefficient, since it contradicts the goals of compulsory social insurance. However, for this to happen, appropriate amendments must be made to Law No. 255-FZ.

How to choose small-sized shoes on the Internet?

This venture is always risky due to the impossibility of virtual fitting.

And mistakes are by no means rare! When you decide to buy shoes online, take the trouble to measure your feet in centimeters. Then make sure there is a size table on the website, where in addition to the size names there is also a corresponding data in centimeters. If there is one, you can try to place an order, after making sure that there is also a return procedure.

Sometimes comments from previous customers who report that the shoes were returned because they were too big or too small can help.

Advice! You can try to stretch slightly tight leather (leatherette does not count) shoes or boots - in a shoe workshop or using stretching agents sold in stores. There are also proven methods: after pouring boiling water inside the shoe, quickly pour it out, wait until it cools down to a comfortable level, put on your shoes and walk around . Sometimes damp newspapers help, stuff the product with it and let it sit until it dries completely. The main thing is not on the battery! Able to increase the volume of boots and alcohol poured into them.