An individual entrepreneur without a current account can pay tax at a bank branch or via the Internet.

To pay, you must correctly fill out all tax payment details. You can generate a receipt in accounting systems or through a free service on the Federal Tax Service website.

If an individual entrepreneur has a current account with a bank, then taxes and contributions must be paid from it. Otherwise, the bank may block the individual entrepreneur’s account. The Central Bank's recommendations state that suspicious clients transfer less than 0.5% of turnover to the tax office. The bank does not check how you calculate taxes. He is guided by the recommendations of the Central Bank. Therefore, if there are no tax payments from the current account, then this is a reason for the bank to block the account.

Filling out a receipt form PD-4

The receipt form PD-4 is filled out manually using a regular fountain pen or online, and then printed.

This approach will help you save time and come to a SberBank branch with a ready-made document for payment. Payment will be accepted if the details are correct and the completed receipt meets the stated requirements.

In the “Payment purpose” field, you can additionally enter data if it is required to determine the payment.

A separate form is provided for each tax or invoice. The form of the banking document is unified and approved by SberBank of the Russian Federation and the Ministry of Taxes. The receipt must include information about the organization that receives the payment:

- Full name with details;

- Municipality code;

- Payment Description;

- Budget classification.

Information about the person making the payment must also be present:

- Full name (without abbreviations);

- Identification and tax number;

- Mailing address;

- The amount of money displayed in rubles and kopecks.

Exceptions for non-cash payments

The bank accepts payments in cash when the person presents an identification document. As an exception, there are bills whose total amount is less than 30 thousand rubles:

- Calculations with budgets by organizations of all levels;

- Payment for government services;

- Payment for housing (utilities, security, etc.);

- Payment of membership fees and alimony.

A receipt in the PD-4sb format is used to credit a sum of money to the state budget. For other cases, receipt PD-4 is used with the same requirements regarding filling out, but it will not include data on budget-type organizations.

Source: https://Dogovory.com/formy/84-kvitancija-forma-pd-4-sberbank-skachat-blank-i-zapolnit.html

Power of attorney for goods and materials

power of attorney to receive goods

Register and get the opportunity to save forms (for auto-filling) of payment receipt forms you created. After registering and saving the form, a list of your saved forms will appear in this place.

Do you want the same PD-4 receipt for your website? Just copy the code to paste it onto the website.

The receipt form of form PD-4 was developed by Sberbank of Russia and approved by the State Tax Service in 1998 (LETTER of Sberbank of the Russian Federation dated 04.24.98 N 01-04-1688, State Tax Service of the Russian Federation dated 04.29.98 N KU-6-09/265 “ABOUT THE NEW FORM PAYMENT DOCUMENT F. N PD-4")

Sberbank receipt form PD-4

The Sberbank receipt form PD-4 is intended for filling out independently when making various types of payments. For the convenience of payers, such a receipt can be downloaded and filled out in advance on a standard form.

What you need to know about the PD-4 form

The need for regular payments in favor of government agencies and organizations makes the Sberbank receipt of the PD-4 form popular among people. Payers actively use downloaded files in DOC, Excel, PDF format for convenience.

What forms of receipt are there?

Receipt PD-4 is a payment document intended for entering data about the payer and, depending on the form, provided to budgetary or non-budgetary organizations.

Sberbank together with the Ministry of Taxes developed a universal form, which was later divided into the following forms:

- PD-4 is a document that is filled out for payments other than budget payments.

- PD-4 sb (tax) - a Sberbank receipt in this form, intended for payment of funds to the budget (duties, taxes).

This division made it possible to reduce some details in the regular PD-4 payment order. KBK, OKTO and some other details remained only in the Sberbank receipt in the PD-4 tax form.

Fill out the receipt form before going to Sberbank - it’s convenient and practical

Where to download the document online

You are used to counting your time and not wasting it, so it’s better to download the payment document in advance online. What free options are there?

We offer you to download free online forms PD-4.pdf and PD-4 sb tax.doc on our website for review and subsequent completion before going to Sberbank.

Please note that on the website of the Federal Tax Service you can only download the PD-4 SB tax receipt form online.

It will also be convenient to download and fill out the receipt according to the given form in the Excel.xls file online.

Contact the tax service website, enter the combination of characters “PD-4” in the search bar and the system will prompt you to follow a link that will allow you to download the receipt form

When filling out a Sberbank payment slip (receipt form PD-4), the recipient's details will be required. These include:

- Full name of the recipient organization;

- TIN;

- Current account number;

- BIC;

- Name of the bank;

- Box number recipient bank account.

When filling out a Sberbank receipt (form PD-4), the sender enters the following data into the form:

- Payment Description;

- Personal account number (code);

- Full name and address.

If you need a Sberbank receipt form in form PD-4, you can fill it out online on the Internet

Afterwards all you have to do is download the receipt or print out the completed form. This makes it possible to quickly issue a payment and edit it if necessary. The number of filled fields is regulated independently. Partial filling by hand is allowed.

Receipt PD-4 of Sberbank is filled out in any convenient way. You can do this before coming to the bank. After payment, the cashier returns the second half of the form with the data indicated on it, indicating the transaction (date, stamp, etc.).

Source: https://bankclick.ru/info/kvitantsiya-sberbanka-formy-pd-4.html

Receipt form and template

The form is not established by law; at the enterprise, forms are drawn up in accordance with current legislation.

It is envisaged to use two types of forms: with a tear-off part, when one remains with the contractor and the second is transferred to the customer, and on a standard sheet - then drawn up in two copies.

The main forms of BSO form the following list:

- tickets;

- tourist packages;

- travel documents;

- receipts;

- coupons;

- subscriptions.

This is not an exhaustive list of forms; enterprises use others, but only with strict adherence to the requirements of Russian rulemaking for cash receipts.

Attention! The developed templates must be approved by an administrative document within the accounting policy of the organization. The order for the main activity must indicate the appointment of an employee responsible for filling out the form and document flow.

What information does it contain?

The completed form contains:

- name of the enterprise with a legal form providing services, its tax identification number and details;

- the title “receipt” in capital letters;

- under it too;

- series and number;

- date of;

- FULL NAME. consumer;

- description and price;

- position, full name, and signature, sealed;

- signature and transcript of the customer, his details.

Let's celebrate! It is unacceptable to fill out the form with illegible handwriting. Nothing can be fixed either. All damaged and incorrectly filled out forms are crossed out and placed in the accounting book for a specific day. The shelf life of the book of forms is at least 5 years from the date of investment of the last BSO.

Receipt for payment Sberbank

How often have you had to waste time at the bank, filling out and re-writing a bunch of forms just to complete one simple transaction? Yes, non-cash payment is much simpler and more convenient when you have a Sberbank Online personal account, but if you yourself have chosen the cash payment route, you will have to write the forms manually, without making mistakes.

We will tell you how to correctly fill out a receipt for payment at Sberbank, what type of forms are used for this operation and what you should pay attention to so that the cashier does not force you to rewrite the form.

Sberbank receipt: form PD 4

Filling out an online payment form on the Internet is quite simple - any system prompts you for the field with an error and allows you to edit the entered data, but when you have a sheet of paper in front of you, there is no room for error.

First of all, you need to take the correct form:

- At Sberbank, a receipt for payment of state duties, taxes, fines and other budget payments is filled out using a special form - PD4-sb;

- Payment for services and invoices for purchases in stores is made using the PD4 form.

Next, no matter how funny it may seem, you need to take the right pen. The Sberbank of Russia form can only be filled out with blue, purple or black paste. Some branches will not accept a document filled out with a gel pen.

How to fill out the PD4 form?

Here is a sample form to fill out with tips:

Most often, this form is used to pay taxes, so let’s look at a more specific example - how to fill out a tax receipt and what to pay special attention to:

- A separate receipt is needed for each tax (since the budget classification of income has different numbering);

- One receipt can only indicate one basis and type of payment;

- Indicate the OKATO code corresponding to the region of your Federal Tax Service (all municipalities have their own codes, in accordance with the territorial division);

- When filling out the KBK code (budget classification code), pay attention to the 14th character: if you pay a tax, enter 1, if a penalty, enter the number 2, if you pay a fine, enter 3;

- The “Payer” field must correspond to the full name of the bank account holder (for example, pay tax for your mother from your account - indicate yourself);

- In the “Purpose of payment” field, you can enter additional information that will help the bank correctly classify the payment, and the tax authority – credit it to the correct account.

Receipt for payment of services sample

31.05.2018

- Creation of Internet banking . After this Internet page has been created, the citizen should perform the following actions:

- Log in to your personal account.

At the same time, he will always need to indicate his password and login; - Indicate the cost of this service;

- Write for which utility service this payment will be made.

- Be sure to check all information provided for correctness. If the citizen has provided all the data correctly, then the “Submit” button is pressed;

- After clicking on this button, the amount on the utility bill will be paid.

In the window that opens, enter the details that can be viewed on a specific receipt;

Filling out receipts for utility bills

- If the management utility company has not specified the estimated period of time, then you need to indicate it yourself. The month is indicated with two digits, and the year is written with four. It is prohibited to correct the information in this section.

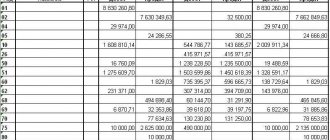

In the section where each type of service is located, the indicators of the accounting nodes are entered and after calculation the payment amount is entered. The total amount is listed below.

They cannot be transported. It is necessary to clearly indicate how many rubles and kopecks are used for payment.

Strict reporting form for individual entrepreneurs 2020: sample

Domestic legal norms, while providing for rules and methods for drawing up the forms described, do not contain mandatory samples for filling out such documents. This circumstance, taking into account the importance and necessity of forming a BSO, may entail risks for individual entrepreneurs associated with violation of the procedure for settlements with consumers.

Receipt for payment for services provided

The receipt for payment for services provided has a receipt and a receipt stub. The receipt stub is marked with a series and number identical to the number and series of the receipt.

For ease of tearing off the spine from the receipt, there is a perforation line. Perforation makes it easy, without much effort, and most importantly, without damaging the printed text, to separate the spine from the receipt.

The tear line is made on an automatic perforating machine.

Receipts for utilities, how long to keep them, which form is relevant

the bills are always the same, sometimes they differ depending on the type of property: in a private house and in an apartment building, different services are usually provided.

So, in some receipts there is an invoice for the intercom, for cleaning the entrance, but the owners of private housing do not pay for these items; they simply are not in their receipts.

At the onset of the summer season, the line “Water” is added, which is relevant only for private houses.

Form of receipt for payment of services

- Name, receipt number (consists of 6 characters), series;

- Name of the contractor (if this is an organization, then the name and legal form, if an individual entrepreneur, then the details of the entrepreneur);

- The form also contains information about the location of the service provider and the TIN assigned to the taxpayer;

- Type of service provided;

- The form of receipt for payment for services must contain the cost of the service and the method of payment (cash or bank transfer);

- The date when the calculation was made and when this document was drawn up;

- The service payment receipt form (BSO) contains an indication of the person who is responsible for filling out the form, his signature, and the company seal (if any).

Have you received a housing and communal services receipt? Find out everything you need to know about this form.

If, during an inspection, damage is suddenly discovered (cracks in the walls, collapse of plaster, etc.), a day should be appointed for partial repair of the damaged areas. If the entrance door to the entrance is damaged, then repair work is also carried out. This is called current repairs.

Receipt for utilities, sample

If there are no meters, there is a fixed tariff for paying for energy resources, which is set by utility services in accordance with the requirements of the Russian government and legal norms. In this case, the size of the fee directly depends on the area of the room and how many people are registered in it. If there is incorrect data, the payer of services may submit a request for recalculation.

Sample receipt for payment for services

- document name – RECEIPT, number and series;

- name of the organization and its legal form, for individual entrepreneurs – full name;

- legal address;

- TIN;

- description of services or works;

- price;

- clarification of the payment method: cash or non-cash;

- date of;

- Full name of the employee, position, signature, seal;

- Full name of the customer, signature;

- if necessary, other details, for example, telephone number and address of the customer.

PRO new building 7 (499) 703-51-68 (Moscow)

The amount that is written off for water supply services can be calculated both according to the indications provided (the number of people living in the apartment) and according to the meter data. Indication of the number of residents registered in a particular apartment is mandatory for all forms.

New form of receipt for utility services 2019

But, be that as it may, for everything that the management company did not check, all the citizens of this house together chipped in and paid for this service to the utility company. Now this order is changing. This amount will be paid directly by the management organization itself.

Training Center Key to Success - additional education in Volgograd

I agree with Andrey - 3 years. The fact is that during this period, your utility companies have the right to go to court with an application to collect payment arrears from you. In this case, the paid receipt you presented to the court will serve as proof of your good faith.

After three years, you have the right to refuse to discuss such a statement in court due to the expiration of the statute of limitations.

Form of new receipts for payment for housing and communal services

Water meters are installed in many apartments today, but heat meters (heat meters) are still new to our country. If you believe the owners of apartments where these devices are installed, such meters allow you to save up to 50% of your budget on heating.

True, the installation of heat meters (heat meters) is very expensive, since in most apartments each battery is connected to its own riser, which means it must be equipped with a separate meter for 5-7 thousand each + the cost of work in the region of 2-4 thousand per meter.

- The old form of receipt for payment of utility services has long needed to be replaced, since the rules for their provision have changed. A sample receipt for payment of utility bills using the new form can be viewed here..

- This innovation will be useful for residents, since in the old-style receipts for payment of housing and communal services there was only one payment amount, and even specialists in the field of housing and communal services can understand how it is redistributed between residents.

PD 4sb tax

Form PD-4sb tax is one of the forms approved in 2001 by the Ministry of Taxes and Duties of the Russian Federation (now its functions are performed by the Federal Tax Service of Russia) and Sberbank (Appendix 2 to the Letter of the Ministry of Taxes of Russia N FS-8-10/1199, Sberbank of Russia N 04-5198 dated September 10, 2001). It was last updated in 2014.

PD 4sb tax is a payment document used to pay taxes and fees, as well as penalties, fines and other payments to the budget by individuals. As well as Form N PD (tax), also approved by a joint Letter of the Ministry of Taxation and Sberbank.

The contents of both forms are very similar. And the Letter directly states that for the taxpayer, transferring money for any of them is equivalent. But there are still differences between them.

Form N PD (tax) is generated by the tax authority, and therefore the 20-digit document index is indicated in its upper part.

This is an individual payment document number, which is registered in a special tax register.

Individuals themselves who do not know the document index and want to pay taxes or fees through a bank can use the PD 4sb form. Instead of the “Document Index” field, it contains the “Identifier” field. In accordance with the general rules for filling out payment documents, it must indicate the UIN - a unique accrual identifier (clause

14 Appendix 5 to the Letter of the Ministry of Taxes and Taxes of Russia N FS-8-10/1199, Sberbank of Russia N 04-5198 dated 09.10.2001). If in the payment document f.

PD 4 sb (tax) the UIN will not be indicated, then the full name of the person and the address of his place of residence or place of stay must be reflected in the form (Explanations of the Federal Tax Service “On the procedure for indicating the UIN when filling out orders for the transfer of funds to pay taxes (fees) into the budget system of the Russian Federation").

When paying amounts at a bank branch, both in form PD (tax) and in form N PD 4sb (tax), a bank employee puts a mark on it confirming the deposit of money for payment, or a check order is issued for the same purposes.

Contents of form PD 4 sb tax

The content of the form largely overlaps with the payment order, which is understandable. PD-4sb should reflect (Appendix 5 to Letter of the Ministry of Taxes of Russia N FS-8-10/1199, Sberbank of Russia N 04-5198 dated 09.10.2001):

- payer details. This is his full name and tax identification number. If there is no TIN, 0 is entered in the corresponding field. The payer status and address must also be indicated;

- recipient's data (recipient's name, INN and KPP of the tax authority administering the payment, KBK, OKTMO);

- information about the payment itself (the basis and type of payment, as well as for what period it is paid).

Source: https://glavkniga.ru/situations/k504195

Advantages of BSO over a cash register and their disadvantages

Pros:

- Easy to purchase and use. There is no need to incur large costs for purchase, maintenance, and maintenance of technical condition, as is the case with a cash register;

- Easy to transport. When performing an on-site service, it is easier to bring forms with you than a cash register;

- Easy accounting. If a document is damaged, you can cross it out, add it to the documentation and draw up a new document. If there is an error in a cash receipt, you must fill out an explanatory statement and obtain a signature from a special commission.

Minuses:

- Strict reporting forms can only be used when providing services to individuals and individual entrepreneurs;

- Filling banks manually is often inconvenient when there are a large number of customers;

- It is necessary to keep strict records and store copies (stubs) of forms for 5 years;

- It is regularly necessary to order forms from a printing house.

Form PD-4sb tax

There are quite a few ways to pay taxes. But one of the most used is still payment during a personal visit to the bank. Paying when visiting a bank has its advantages, and for many it remains the most reliable way to pay taxes.

payment of various payments to the budget. The form was approved by a letter from the Ministry of the Russian Federation for Taxes and Duties (currently the Federal Tax Service of Russia) and Sberbank dated September 10, 2001 No. FS-8-10/1199, 04-5198.

Form PD-4sb is a type of receipt with which a taxpayer can independently pay taxes and fees, penalties, and fines at Sberbank.

The forms are very similar in appearance and content, but have some differences.

Thus, form PD-4 (you can click here) is used for making payments at Sberbank branches, and is a document confirming the fact of accepting payments from individuals.

Receipt PD-4 (download)

There are situations when deadlines are tight: for example, tax payment time is approaching. Payers, fearing not to pay on time, rush to form PD 4 and start filling it out.

When accepting a payment, an employee of a Sberbank branch must check whether all the necessary details of the payment document are filled out in the receipt. And if the payer missed the field required to fill out, the bank employee must return the PD-4sb tax form for additional filling or refilling.

It is worth paying attention that the form must be of a strictly established size. The width of the receipt should be 135 mm (notification - 50 mm, field for filling out information - 85 mm), the height of the form - 145 mm (notification height - 65 mm, receipt - 80 mm).

If you are not sure about the relevance of the form, do not rush and look for where the PD 4 receipts are - Sberbank ensures the production of forms in the required quantity. Accordingly, the receipt can be obtained at any Sberbank branch.

Thus, the PD-4 receipt form will be available at the Sberbank branch.

Filling out form PD-4 sb tax

The receipt is divided into two equal parts that must be filled out. When paying, the bank cashier gives one part to the client, one part of the receipt remains with the bank.

The RF SB receipt PD-4 is filled out as follows: in the first line of the form you need to fill in the name of the payment, then the checkpoint.

Then fill in the tax authority’s TIN and its short name. If you are filling out receipt PD-4, then in the name you must indicate the government agency to which you are transferring the funds. The TIN field is required; if you do not fill it in, your payment will not go through. The TIN field contains 10 characters.

Then the PD-4 form contains a field where you need to enter the OKTMO code - the code that was assigned to the territory in which funds from taxes, fees and other payments are mobilized.

Next, you need to fill in the payee's account number - it consists of 20 digits. The PD-4 tax form is filled out identically, but there are differences: on the PD-4 form at the top there is a field for filling out an identifier (UIN - unique accrual identifier). The PD-4sb tax form has few fields, but when filling out the data you must be careful and avoid mistakes.

Next, you need to fill in the details of the bank in which the recipient's account is located: receipt PD-4 contains fields for filling in the name of the bank in which the account is opened, BIC (bank identification code of the bank, it consists of 9 characters), the correspondent account number of the recipient's bank (column " Cor./sch.”, it consists of 20 characters).

Further, in the PD-4 receipt (form) there is a field for filling in the name of the payment - in it you need to indicate the purpose of the payment being made, for which you are paying money.

If a receipt form PD-4 is filled out, then the following payment purposes can be indicated in this field: “for the issuance or exchange of a passport of a citizen of the Russian Federation”, “for the issuance of a foreign passport”.

If the PD-4 sb tax form is filled out, then the name of the payment will be appropriate.

Form PD-4:

It is difficult to find an individual entrepreneur or an operating company that has not at least once made some payments in favor of third parties. These may be payments for goods supplied, services, loan payments, taxes, etc. But any payment, in addition to the fact that it must be carried out, must be confirmed and documented. And one of these documents is form PD 4.

Form PD 4 is the most popular and in demand form of payment document, which is used by Sberbank and some other financial institutions. This payment document is required in order for the entity to have the opportunity to pay its tax obligations to the federal and regional budgets, its purchases to the seller of goods and other government services.

The receipt can also be used to pay state fees, passport printing services, insurance premiums, and various fines. In other words, this is a universal payment document for individuals and legal entities.

The document can be filled out independently by the payer using the details that he has for payment, directly at the Sberbank branch. There they are also required to provide him with a form for such a document.

But now there are many services that allow you to download the PD 4 form for free, and in addition, create it immediately filled out, taking into account the entered payment details. Simply enter the information in the field provided and click “OK.” The document will be ready in a few seconds.

The following fact should also be noted: until 2001, this form was uniform and was used for absolutely any payments. But after this period, the form of the form was improved, even simplified, and is now presented in three varieties:

- PD4 – the document is used when it is necessary to pay for goods and services;

- PD – used to pay taxes and fees;

- PD-4sb - used if it is necessary to pay a penalty, fine, state duty, etc.

Considering that at the moment few people pay for goods and services using such a receipt, especially for individuals, then the most popular forms of receipt are PD and PD 4 sb.

At the same time, if you carefully look at the form of such receipts, there will be no fundamental difference in the visual presentation of the information. Therefore, the payer often uses the document form that he came across first. Such use will not be considered an error, since the components of the document are the same.

Filling out a receipt

Let us note right away that if you fill out a document by hand, you can only use blue or black ink. The receipt must be filled out without erasures or corrections. The cashier has every right not to accept a document with corrections or ink of the wrong color.

We recommend downloading form PD 4 (receipt form) and filling it out at home on your computer. This option is simpler and minimizes errors.

The document consists of two parts:

- Part 1 – Notice;

- Part 2 – Receipt.

Both parts have identical fields to fill out. And it is necessary to fill in the details in both parts. After the cashier checks that the information is filled out correctly and makes the payment, he will put a stamp on the “Receipt” and give it to the payer. The “Notice” serves as a detachable part and remains in the bank.

Rice. 1 — Sample of filling out the form

- A sample of the completed form is presented below:

- The receipt is a document confirming payment.

- Features of filling out details:

- Recipient. The full name of the recipient of funds is indicated. It is acceptable to use an abbreviated name that appears in other documents. For example, it is not advisable to write “limited liability company” in full; it is acceptable to use LLC;

- Recipient's TIN. It is provided to the recipient of funds upon tax registration of the enterprise. As a rule, such details are provided by the buyer. The TIN for a company must consist of 10 digits, for an individual entrepreneur - 12 digits;

- Checkpoint. Indicated only if the payment is made in favor of a legal entity and not an individual entrepreneur. There is no checkpoint for individual entrepreneurs;

- R/ac. – number of the current account to which the funds will be received. The correctness and correctness of this props is the most important. If you indicate the wrong account or make a mistake in at least one digit, then the money will go to the wrong entity. The current account consists of 20 digits;

- Bank. You must provide the full name of the bank. If the address of the institution is known, you can indicate it;

- BIC is a certain bank classifier, a set of 9 digits. It is assigned to each institution and serves as a kind of activity identifier. For example, when filling out a receipt electronically, it is allowed to indicate the BIC, but not the name and address of the bank itself;

- KBK - filled out only if payment is made for taxes and other payments to the budget;

- Cor. sch. or correspondent account. The payer should not fill it out, since he may not know it. Such an account is indicated either by the bank teller himself, or the account is automatically generated when filling out a receipt online;

- Purpose of payment. The payer indicates what he is paying for. For example, if this is a purchase of goods and services, then simply indicate “purchase” or “payment.” It is acceptable to leave the field blank, except in cases where taxes are paid;

- Payer, address and TIN of the payer. Accordingly, the details of the entity making the payment are entered;

- Amount of payment. Indicated by numbers;

- Amount of services. The bank's commission for services is stated here. The payer, as a rule, does not know the size of this amount.

Source: https://okbuh.ru/valyutnyj-kontrol/forma-pd-4

Sberbank receipt. Form PD-4

Receipt - notification of Sberbank (form PD-4) - a document intended for making government payments: duties, fines (for example, in the traffic police), as well as when using a non-cash form of payment for goods or services.

Payments are accepted by Sberbank branches only if clients present a payment document with the details already filled in.

If the payment is made in cash, then in addition to the payment document, the bank requires the presentation of a document that identifies the citizen. This measure is necessary only in a situation where the payer’s cash amount exceeds 30,000 rubles.

If the amount of funds is less than specified, only a correctly completed receipt in the PD-4 form is sufficient.

Thus, to confirm the acceptance of payments, Sberbank clients are issued a payment document receipt. The PD-4 form consists of two sections, namely, notice and receipt. In general, the notification receipt form contains the following details that must be filled out:

- name of the payee;

- individual tax number of the payment recipient;

- payee's account number;

- name of the payee's form;

- bank identification code;

- correspondent account number of the recipient's bank;

- payment Description;

- payer's personal account code;

- surname, name, patronymic of the payer;

- full address of the payer;

- amount of payment;

- amount of payment for services;

- total payable;

- date of completion of the receipt.

Receipt for payment of taxes, penalties and fines

Taxpayers - individuals pay taxes without opening a bank account. For this purpose, special forms of payment documents (notices) are provided.

As a payment document for paying taxes (fees), penalties and fines to the budget of the Russian Federation, individuals are recommended to use form No. PD (tax), the form of which is approved by a joint letter of the Ministry of Finance and Sberbank of Russia dated March 12, 2007 No. GV-6-10/ [email protected] /07-1142.

Sample of filling out a payment document In a number of cases, tax authorities themselves send taxpayers - individuals receipts already filled out according to the form, along with a notification or demand for tax payment.

For example, owners of privatized apartments receive such letters annually.

All payment receipts generated and sent by the tax authority to taxpayers must be registered in a special register, as evidenced by the individual number consisting of 13 characters indicated in the “Document Index” requisite.

In this case, the taxpayer only needs to fill in the details “Payer (signature)” and “Date”. Also, in the receipt generated by the tax authority, a barcode is applied in a specially designated place. This code contains the necessary information that allows you to further identify the payer and the purpose of the payment.