Classification of balances: static and dynamic

The accounting report of corporations in Form No. 1 is usually divided into two main categories:

- Static – reflecting static data not a specific moment;

- Dynamic – showing the dynamics of changes in individual indicators.

Static balances are formed upon the occurrence of certain events in the company and show information as of a specified date. In such reports it is impossible to carry out an accurate analysis of the dynamics of changes in individual indicators of the company’s activity, therefore such balance sheets are called static.

The most common form of this balance sheet is the annual reporting balance, to which, with rare exceptions, information from the previous period is added.

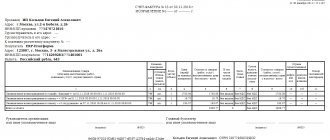

As of the last day of 2020. From the balance sheet, account data is distributed between report items. Ultimately, the total amount of assets must exactly match the amount of liabilities. Such an annual report is subject to submission to regulatory authorities.

Dynamic balances reflect changes in the results and results of a company’s activities over a specific time period. This information is used to develop solutions for managing trade or production processes, depending on the direction of the company’s work. As an example, we should note the turnover sheets and checkerboard turnover balances.

The period for reflecting information in such balances is a month. During this period, interim reporting is not generated, but management is provided with a sufficient amount of information about the movement of the company's assets. The main goal of dynamic balances is to convey reliable information to management to develop a position in solving current problems, the deadline for which is within one month.

Types of balances

Types of accounting balance sheets are the main topic of our article. That is why we will dwell on this issue in more detail. The balance is divided according to different criteria. The most common classification is based on time and completeness of information. Let's look at the first divisions.

By time, the balance sheet is opening, initial, interim, and final. The first type is compiled when an organization is just being created, the existence of a company, society, and so on is affirmed. An opening balance should be prepared every year. Thanks to it, you can find out what result was obtained after a year’s work and the quality of the property. It is called this way because it is compiled at the end of the year, is final for the current year and initial for the next year. An interim balance, also called a test balance, should be drawn up every quarter. It can be adjusted after the end of the financial year. The final, or liquidation, balance sheet is the last in the life cycle of an enterprise. It should be compiled by a commission tasked with compiling an accounting of funds to complete the work of the financial institution. Based on completeness of information, the balance sheet is divided into general and private. This classification of types of balance sheets implies information about property, obligations and rights in the practice of the entire organization. Private contains information about the same data, but only relating to some part of the organization.

Signs of classification of balances

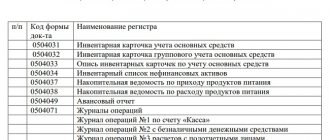

In the course of the development of areas of accounting reporting, the balance sheet was divided into separate components with classification depending on the tasks and goals underlying their preparation. The classification of balances according to various criteria is given in the table:

| Classification sign | Balance name | Design features |

| By period of formation | Initial or introductory | It is prepared once upon the formation of a legal entity; it shows information about property assets that are entered into the company’s Criminal Code in the form of contributions. The accounting of the company begins with the formation of such a report. |

| Current | It is compiled at specified intervals throughout the entire period of the company’s economic activity. | |

| Final | The final balance sheet formed during the reorganization or complete liquidation of a company. | |

| Sanitable | It is drawn up in rather rare, exceptional cases in which the need to introduce bankruptcy procedures against the company is assessed. Such a report allows you to identify the real financial situation of the company and make the right choice - declare bankruptcy or make an attempt to continue operating. | |

| Liquidation | Formed during the liquidation of a company to determine the property to be distributed between the company’s participants and creditors. It is compiled many times during the liquidation procedure - at the beginning, at the end and during the liquidation. | |

| Dividing | Prepared upon the fact of reorganization according to the form of division using indicators of the compiled final balance sheets. | |

| Unifying | Prepared in case of reorganization in the form of affiliation, merger, its formation is based on the final balance sheets. | |

| By sources of formation | Inventory | Compiled after an inventory of the company’s property assets and obligations. |

| Book | The basis for drawing up this balance is the General Ledgers, the indicators of which are taken without preliminary verification during the inventory. | |

| General | Combines the basics of inventory and book balances, which allows you to obtain the most reliable indicators. | |

| By volume of information sources | Individual | It is formed when a formed legal entity is not included in a group of companies and conducts separate business activities. |

| Consolidated | Compiled if a legal entity has a branch network. | |

| Consolidated | It is a set of balance sheets of enterprises that conduct independent activities, but at the same time have close financial relationships. | |

| By area of activity | Balance sheet representing main activity | Reflects the results of activities that correspond to the main direction included in the charter of the enterprise. |

| Balance sheet reflecting the result by type of activity | Reflects results in areas that are not core for the company. | |

| By type of ownership | State | Companies can be created on the basis of various sources of formation of their own funds, depending on which the corresponding classification is made. |

| Municipal | ||

| Collective | ||

| Cooperative | ||

| Private | ||

| By reflected object | Independent balance sheet of the organization | Compiled by a person registered with the state as an independent legal entity. |

| Separate by department | Formed by each individual branch, representative office or other structural unit of the company. | |

| By purpose of analysis | Commercial | Compiled for management and shareholders. In such a form, information is combined for the purposes of correct taxation for each individual tax, which allows you to compare balance sheet and taxable profit. |

| Tax | Formed for submission to the Russian tax authorities. | |

| By cleaning methods | Balance-gross | Represents a balance sheet with regulatory items (depreciation). It is used quite rarely for research work, as well as improving the information functions of the report. |

| Net balance | Does not take into account these regulatory articles. This report is more significant in modern realities; it allows us to assess the actual size of the company’s assets. This is the balance that is currently in force for submission to regulatory authorities. |

Formation of a balance sheet for ongoing operations is mandatory under Russian law for all forms and types of legal entities. Annually, reporting is submitted to tax authorities, as well as to statistical authorities.

When considering balance sheets, the first step is to classify them as dynamic or static.

Static balances (main) are formed on the basis of instantaneous indicators calculated for a specific date.

Dynamic balances (auxiliary) reflect data on the property of an economic entity and the sources of its formation not only according to instantaneous indicators, but also in motion - in the form of interval indicators (turnovers for the reporting period). For example, a checkerboard balance sheet and a turnover sheet.

Based on the time of compilation, the following types of balance sheets are distinguished:

Opening balances.

The opening balance sheet is drawn up at the time of organization of the enterprise (registration of the Charter), and accounting for this business entity begins with it. There are opening balance sheets of newly created enterprises and business units formed on the terms of succession of previously operating ones.

Current balances.

Unlike opening balances, which are compiled only once (at the time of organization of the enterprise), current balances are developed in accordance with the principle of the accounting period periodically throughout the operation of the enterprise and are divided into initial (incoming), intermediate and final (outgoing).

Opening and closing balance sheets are developed at the beginning and end of the financial year. It should be remembered that the outgoing data at the end of the reporting period (year) serves as the initial (input) data at the beginning of the next financial year. Identity of succession data is required.

Interim balances are prepared for periods between the beginning and end of the reporting period. In Russia, interim balance sheets are filled out with totals for the first quarter (for three months), for the six months (for six months) and at the end of the third quarter, i.e. cumulative data for nine months.

Interim balance sheets differ from final balance sheets, on the one hand, by a set of attached reporting forms that reveal individual balance sheet items, and on the other hand, by the sources of the balance sheet (interim balance sheets are based on current (book) accounting data, and final balance sheets, in addition, are confirmed by full inventory data all balance sheet items). Indicators of closing balance sheets most adequately reflect the objects of accounting supervision.

Balance sheets being sanitized.

The need for this type of balance sheet arises only in exceptional cases, when the company is on the verge of bankruptcy (inability to pay debts) and it is necessary to decide on the dilemma: make a decision on liquidation (cessation of business activity) by declaring bankruptcy or try the last chance - to convince creditors of the feasibility deferred payments. To draw up the sanitized balance sheet, independent auditors are involved, who, even before the deadline for drawing up the final balance sheet (i.e. before the end of the financial year), must issue an opinion on the real state of affairs at the enterprise, the amount of the loss incurred, the ways and feasibility of covering it in the future, possible timing of implementation measures aimed at improving the financial condition of the enterprise. Such a balance sheet, as a rule, differs significantly from the reporting balance sheets compiled by the accounting apparatus of the enterprise, since auditors often subject to significant markdowns on balance sheet items that do not correspond to reality.

Liquidation balances.

These balances are compiled during the liquidation of the enterprise and are developed repeatedly:

• at the beginning of the liquidation period (opening liquidation balance sheet);

• during the period of liquidation of the enterprise (interim liquidation balance sheets, their number depends on the duration of the liquidation process, information needs of owners and creditors);

• at the end of the liquidation period (final liquidation balance sheet).

In accordance with the principle of a going concern, upon its liquidation, special rules for assessing the property of a business entity come into force: in the liquidation balance sheet they are reflected not at the book value (historical or replacement) value, but at the price of the possible sale of each asset separately at the time of liquidation.

Separation balance sheets are compiled at the time of division of a large enterprise into several smaller enterprises (structural units) or when one or more structural units of a given enterprise are transferred to another enterprise (in the latter case, the balance sheet is called a transfer balance).

Unification balance sheets are developed when several enterprises are combined (merged) into one enterprise or when one or more structural units are merged into a given enterprise.

Based on the source of compilation, inventory, book and general balance sheets are distinguished.

Inventory balances are compiled only on the basis of the inventory of property, funds in settlements, and liabilities. Inventory is developed in cases where it is necessary to calculate the balancing indicators of the opening balance sheet of an individual private enterprise or state (municipal) enterprise, such as the owner’s capital or authorized capital, as well as when a new enterprise arises on a pre-existing property basis or when the economy changes its form (for example , transforming it from state-owned to joint-stock).

The book balance is based on current accounting data without preliminary verification of book records through inventory.

The general balance sheet is considered the most realistic, since it is based on current accounting (book) records and inventory results that precede the formation of balance sheet items.

Based on the volume of information, there are two types of balance sheets: single and consolidated (or consolidated). Unit balance sheets characterize the activities of only one enterprise.

Summary (or consolidated) balance sheets.

There are two types of consolidated balance sheets depending on the object and the method of their preparation.

Firstly, consolidated balance sheets are developed by ministries and departments, calculating aggregated data for the industry as a whole or for subordinate individual enterprises by simply summing up indicators of the same name and excluding balances for mutual settlements between enterprises within the industry.

Secondly, summary (or consolidated) balance sheets are compiled by the Group (holding, concern), represented by the parent and its subsidiaries. The consolidated balance sheet provides information about the Group as a consolidated enterprise and shows what the parent company's own balance sheet would be if it closed all subsidiaries and directly managed their activities. This balance is compiled not simply by summing up indicators of the same name, but by making the following adjustments.

Based on the object of reflection, balance sheets are divided into independent and separate .

Only business entities endowed with the rights of a legal entity have an independent balance sheet

A separate balance sheet is made up of enterprise divisions (branches, departments, workshops, representative offices, etc.).

Based on the completeness of information reflection, there is a gross (rough) balance and a net (net) balance.

The gross balance sheet includes regulatory items; used for scientific research, improvement of balance information functions, etc.

Net balance sheet is a balance sheet from which regulatory articles are excluded: “Depreciation of fixed assets”, “Depreciation of intangible assets”, etc. In modern conditions, the importance of the net balance sheet has increased, since it allows you to determine the real value of the organization’s assets. Currently, the net balance sheet is the current reporting form.

In addition, a distinction is made between balance and turnover balances.

The balance sheet characterizes the property of an economic entity and the sources of formation of property as of a certain date in monetary value. This type of balance sheet is compiled by the accounting department of an enterprise by displaying account balances. Moreover, accounts with debit balances are reflected in assets, and credit balances are reflected in liabilities. There are no revolutions in it.

The working balance contains data on the movement of property and its sources (debit and credit turnover) for the reporting period, as well as the balances of funds and sources of property at the beginning and end of the period. In its structure it differs from the balance sheet. The current balance sheet is of great importance as an intermediate working document used in the process of drawing up opening, closing and liquidation balance sheets.

By volume of information

There is an individual balance. This is compiled if there is a single organization, using accounting documents that indicate all activities. It should also be understood that there is a summary. It is only necessary for those enterprises that have branches. When reporting of this type is created, it contains the amounts that were received as a result of interaction with other organizations, having nothing to do with this one. The balance sheet shows only those amounts that are ultimately created by summarizing all funds received, both from the entire enterprise and from a subsidiary.

Balance Sheet Analysis

Any company must analyze its balance sheet. This is precisely what is needed in order to draw up correct documentation and get the most out of the enterprise’s efficiency. The analysis of the balance sheet is carried out in several stages. It is necessary to check the dynamics and structure, summarize the stability of the organization in economic terms, draw up the liquidity of the balance sheet, and then find out how solvent the organization is, calculate all assets, conduct business activities, and also generally summarize the financial situation. As a rule, the analysis is created on the basis of the balance sheet, but sometimes it can be prepared using an analytical one, which immediately shows the state of the company at the end and beginning of the year. Thus, types of balance sheet analysis will allow you to accurately understand how well the company is performing, whether it is making a profit or is at a loss.

General classification of balance sheets

The main divisions of balance sheets are described above, but the entire classification does not end there. It should be noted that the belonging of a certain balance to any type is determined using special features that should be analyzed in order to understand the purpose. These may include cleaning methods, reflection of objects, the form of the enterprise, the nature of the activity, the amount of information received, the time indicator and the sources that are used to draw up the balance. This is how the classification of balance sheets occurs. Each type is compiled in order to show the data to people who are interested in reporting. These could be banks, suppliers, and so on. In order to correctly understand the essence of each type of balance sheet, you should consider them in detail.

Horizontal and vertical analysis of the balance sheet

Horizontal analysis is documentation that is presented in percentage form and calculated by summarizing absolute values and relative indicators. Often this type of technique is necessary only when you need to look at the effectiveness of work over several months. The fact is that horizontal analysis is only informative. It displays metrics as percentages and shows how they changed from the beginning to the end of the year. The value of the initial period is taken as 100%. Thanks to this analysis, it is possible to draw conclusions on how to improve or stabilize the company’s condition.