What it is?

The act of acceptance of the transfer of non-residential premises is a document that is an annex to the lease agreement. The act serves as an integral part of the contract, without which the transaction is considered invalid .

The document does not have a unified form, which leaves freedom of action for the parties when drawing it up. However, it is worth considering that failure to comply with the basic requirements for its content may lead to the fact that the concluded document will not have legal force. The acceptance certificate must also be drawn up at the end of the lease period and the return of the premises to the owner.

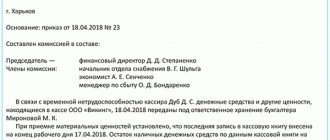

OS Form 1: Sample of correct filling

In case of transfer of a movable object related to fixed assets, a corresponding act is drawn up. In most cases, OS 1 form is used, a sample and instructions for filling out which are discussed in detail in the article.

Blank form OS 1 (excel)

OS form 1 sample filling (excel)

Main purpose

In essence and in form, the document is an act of acceptance and transfer of specific movable objects related to fixed assets. This does not include buildings, industrial structures and other real estate for which there is a special form OS 1a. In addition, the act is not drawn up in relation to the following property objects:

- movable property, the value of which is currently estimated at 3,000 rubles or less;

- movable belonging to the library collection.

Acceptance of fixed assets occurs for various reasons:

- In accordance with the agreements on the acquisition of funds: purchase of equipment, exchange, donation of property, its rental, receipt under a leasing agreement.

- Manufacturing of equipment and putting it into operation for an appropriate fee (for the enterprise’s own needs).

- Disposal of property from the company's fixed assets (similarly - sale, exchange for the benefit of another organization).

In some cases, the entry of property is carried out on the basis of other documents - such situations are prescribed separately in the legislation (there is a separate procedure).

The act is always drawn up in 2 identical copies, which have equal legal force. Often it is accompanied by technical documents that accompany the transferred (acquired) property.

NOTE. Each company has the right to use both a standard form and a document of its own form. The main requirement is that all key information is included (as shown in the form below).

Form and sample 2020

The form consists of 3 pages and looks like this:

A sample of filling out OS 1, which can be used as an example, is presented below. Here is a copy that is completed and intended specifically for the recipient. Accordingly, the deliverer enters information in those columns that are provided specifically for him.

Direct filling and signing depends on the characteristics of the object being transferred to the enterprise. If the production equipment is structurally simple and does not require any installation work, the act is signed immediately at the time of actual purchase. If assembly is required, then installation is carried out first, and only then the act is signed.

Instructions for filling

It should be noted that information is not entered in all columns: it all depends on who exactly the copy belongs to: the receiving or transmitting party.

Page 1

The title page provides the following information:

- Visas are “Approved” by a representative (most often the general director) of the sending and receiving company. Each copy is stamped with appropriate visas – i.e. The 2 documents of the recipient and the sender will be different.

- The print space (MP) is intended for applying the original print. However, the absence of a seal is acceptable if the company does not officially use it in its work.

- Information about the recipient - the abbreviated name of the company, for example, ICS LLC, its details (TIN and KPP).

- Codes for OKUD and OKPO.

- Legal address of the company, indicating the region and postal code.

- Bank details – current account, name and BIC of the bank, correspondent account details.

- The name of the structural unit where the fixed asset was received (for example, a finished goods warehouse).

- The legal basis for the transaction is most often the relevant purchase and sale agreement.

- Document number (usually continuous numbering throughout the year) and date of completion.

- The date when the asset was accepted for accounting is the date the act was drawn up.

- Numbers – inventory, factory, and depreciation group

- The official name of the property (for example, a car model), the manufacturer of this property.

- The location of the object refers to the company (and address) where it was specifically at the time of transfer.

- There are situations when the purchased property is owned by several companies at once. Then filling occurs in accordance with the size of the share in ownership. In addition, it is necessary to put a note about each participant in the share and its size. This information is recorded on page 1 of the form (section “For reference”).

Page 2

The second page requires filling out two sections at once:

- If equipment or other property has already been used as a fixed asset, Section 1 should be completed. It indicates key information about the object that is relevant on the date of its transfer:

- date or year of issue;

- date of official start of operation;

- date of last overhaul;

- number of years and months of the entire period of use;

- useful life data;

- the total cost of wear and tear;

- residual value;

- purchase price (according to agreement).

- The information in section 2 is recorded only by the recipient, and it is filled out only in his copy of the form. All current information on property depreciation is provided:

- the value of the property on the day when it was officially accepted for accounting;

- total useful life (calculated in full months);

- method of calculating depreciation - name of the method and norm.

Also on the second page information is entered with the characteristics of the fixed asset:

- Name;

- quantity;

- a note on the content of precious metals and stones (if any in its composition); in case of absence, dashes are placed in all columns.

If any significant characteristics were not reflected in the tabular part, they are separately written in the lines after the phrase “Other characteristics”.

Page 3

Finally, on page 3 of the form, all data on the commission accepting the fixed asset is filled in:

- The date on which the test result of the property was recorded (usually this is the date the report was issued).

- The result of the tests: a mark “complies” and a mark about possible modifications (required or not required).

- Official conclusion of the receiving committee: usually indicate that the equipment is in working order and suitable for use.

- Next, write down the official names of all technical documents that accompany this equipment (fixed asset).

- Then the following persons put signatures, transcripts of signatures and job titles:

- chairman of the commission (usually the general director);

- the head of the structural unit where this property is supplied (for example, a warehouse manager)

- general accountant who accepts the funds for accounting.

- Finally, a note about the direct reception and transmission of the object is given: each party fills out its own column. The deliverer enters all the information after the word “Passed”, and the receiving organization fills in the data after the word “Accepted”:

- who exactly accepted (position, signature and transcript of the signature);

- the basis for the emergence of the authority of acceptance (power of attorney - number, date, who issued it and to whom);

- who accepted the property for safekeeping (similar to the position, signature and transcript of the signature);

- a note from the chief accountant, which confirms the fact of creating an accounting card, the number of the entry in the inventory book and the date of its compilation (signature and transcript of the signature).

Procedure for drawing up and signing

For different employees (general director, warehouse manager, who accepts the fixed asset for safekeeping, and chief accountant, who registers it), the registration and completion procedure will look different. In general, the sequence of actions is as follows:

- At the preliminary stage, two parties (receiver and deliverer) negotiate to agree on the transfer procedure itself and the legal basis (leasing, purchase, exchange or donation). An appropriate agreement is drawn up, which takes into account the interests of both parties.

- Then comes the actual acceptance stage. It is always carried out not by one person, but by a commission consisting of at least a director, chief accountant and warehouse manager. There may also be technical specialists present who can competently assess the condition of the object and its compliance with the characteristics stated in the technical documentation.

- The act is signed - in each copy, the companies fill out their own columns: the deliverer writes down notes on delivery, the receiver - on acceptance.

- Then the chief accountant of the depositor's side withdraws the funds from account 01.

- And the chief accountant of the receiver, on the contrary, registers the object under account 01.

How to prepare the corresponding accounting entries can be seen below:

Calculation of property tax, as well as accounting for depreciation costs, does not begin immediately, but from the next month (closest to the month when the OS 1 form was filled out). Similarly, for the deliverer, accounting for depreciation and accounting for property taxes ceases from the next month.

NOTE. It can be filled in manually or in printed form. The main condition is the absence of any corrections (including those marked “Corrected to be believed”), blots, errors and inaccuracies. If incorrect information is included, the entire document should be redone, since it relates to primary reporting and is controlled by the relevant authorities.

Is this document always needed or not?

Since the acceptance certificate is the starting point for calculating the lease term, it is a mandatory document. The tenant receives the right to use the area only after signing this document. Simultaneously with the signing of the act, the keys to the rented area are transferred in the number of sets indicated in the act.

Important! A transfer and acceptance certificate is drawn up when renting any premises. Even in cases where the rental period is several months or even days.

Who should compose?

The act is drawn up by one of the parties to the agreement in printed or written form. As a rule, this function is taken on by one of the landlord’s employees, who has an understanding of the rules for filling out such documents, as well as the reflection of information about the technical condition of the premises.

To draw up the act, you should prepare information about:

- the exact physical address of the premises being leased;

- sides – transmitting and receiving the object.

When drawing up the act, you need to have a contract in hand. As a rule, the act indicates only those persons who are the main parties to the agreement. They are the ones who must sign the act. The tenant should be especially careful when drawing up the report, since damage and technical faults that were not discovered before signing the report will have to be corrected independently.

The main subtleties of the act of acceptance and transfer of non-residential premises

There is no single approved template for writing such an act, so it can be written in free form or using a special template. The act is drawn up in two copies - one for each of the interested parties. It can be drawn up on a regular A4 sheet in handwritten or printed form.

The document must indicate the names of the legal entities involved in the agreement, as well as the individual characteristics of the space being sold or leased. These include: cadastral number, area of the premises, address, technical condition. Here you can also include the availability of utilities and other services, such as gas, heating, water, electricity, Internet, elevator, telephone, security, etc. By agreement of the parties, a cadastral passport or other papers (drawings, extracts, diagrams) for the premises can be attached to this document.

General design requirements

The following requirements apply to this document:

- The number of copies must be at least one for each party participating in the transaction.

- Only persons who have the right to do so and who have signed the lease agreement can sign the deed.

- The information in the deed about the transferred non-residential premises must be complete and reliable. All technical faults must be taken into account.

- The date of signing the document must coincide with the actual transfer. Responsibility for any damage falls on the tenant's shoulders from the moment the deed is signed.

Contents of the document

The acceptance certificate must include the following information:

- Number and date of the document (agreement) to which it is an annex. This information is indicated in the upper right corner or in the text.

- The date and city in which it was compiled.

- The name of the document, which includes information about the premises being leased, indicating its exact address.

- Information about the non-residential premises being transferred, indicating its exact area.

- Information about the equipment and machinery transferred along with the areas (if any).

- Information about the state of communications.

- Information about existing defects and damage to the object.

- Full names of the parties involved at the time of transfer of the object.

- Details (for legal entities) and passport data (for individuals).

- Seals and signatures of the parties.

Reference. Non-residential premises can be rented out by both a legal entity and an individual. In the latter case, it is necessary to indicate passport data; a signature with a transcript is sufficient as certification.

Sample act, illustrative example

Let's consider an example of filling out the clauses of the transfer deed of non-residential premises. This template is used when transferring to the tenant. When returning after termination of the rental agreement, use a similar form, which can be downloaded below. The form is divided into several components:

- This sample acceptance and transfer of premises is an annex to the contract, the number of which is written in the upper right corner. The name, city and date of compilation must be indicated.

- Next, fill in information about the representatives of the parties. For legal entities this will be the name of the organization, and for individuals we indicate the last name, first name and patronymic. Next, the full name of the founder or his authorized representative and a document confirming the authority (charter, certificate or passport of a citizen of the Russian Federation).

- Next, general information about the contract and the real estate is written down: name, area, location and cadastral number.

- The main point of the application is the condition of the rented non-residential premises at the time of transfer.

- An assessment (good or satisfactory) is given to the main load-bearing structures of the room: walls, floor, ceiling, windows. If any defects are found, they are described in the acceptance certificate. If necessary, the issue of eliminating detected defects is resolved, if possible. Indicates whether a complete or cosmetic repair is required.

- The property of non-residential premises, which includes furniture and equipment, should be listed. Different properties will have different contents. For example, for an office: office tables, chairs and computers; for a store: refrigeration equipment and shelving; for car service: tire fitting equipment and balancing stand; for the enterprise: extrusion line, overhead crane, etc. If the building is transferred empty, put a dash in this column and write: “there is no movable property.”

- Engineering systems are also listed: electricity supply, heat supply, water supply and sanitation, ventilation and air conditioning, video surveillance, alarm system, etc.

How to write correctly?

When drawing up a certificate of work performed for a lease agreement, you can use one of the examples below as a guide.

To the rental agreement

Appendix No. 1 to lease agreement No. 3 dated March 30, 2018

ACT of acceptance and transfer of non-residential premises located at Kazan, st. Tractornaya, 2nd Telesheva Lane, building 5, building 8

| G. Kazan | 03/31/2018 |

InterStroy LLC, represented by General Director Vladimir Immanuilovich Uspensky, acting on the basis of the Charter, hereinafter referred to as the Lessor, and Petrovskie Khleba LLC, represented by Director Minnullin Insaf Zakiullovich, acting on the basis of the Charter, hereinafter referred to as the Tenant, have drawn up this act about the following:

The Lessor transfers and the Tenant accepts non-residential premises at the address Kazan, st. Traktornaya, 2nd Telesheva Lane, building 5, building 8 with an area of 213 sq. m (two hundred thirteen square meters) on a lease basis.

By this act, each of the parties to the agreement confirms that the obligations of the parties to transfer the non-residential premises have been fulfilled, the Tenant accepted it from the Lessor in the form in which it was at the time of signing this act, the parties have no claims against each other regarding the property being leased, the essence and price of the contract.

This act is drawn up in two copies having equal legal force, one of which is kept by the Lessor, the second by the Tenant.

The keys to the premises were transferred to the Tenant by the Landlord in the amount of 2 (two) sets.

At the time of acceptance and transfer, the premises are in the following technical condition:

- The ceiling, floor and walls are in satisfactory condition, there is no visible damage.

- The windows are made of working PVC structures and are in good condition.

- Electrical appliances - sockets, lamps, switches - are in working condition.

- General condition of the premises: satisfactory, does not require repairs.

DETAILS AND SIGNATURES

Lessor:

InterStroy LLC 420001, Republic of Tatarstan, Kazan, st. Karla Marksa, 8 TIN 501010101, KPP 50111111 account number 40702810800040010323 at VTB Bank in Kazan account number 30108880000000777 BIC 047777777

Lessor:

InterStroy LLC General Director Uspensky Vladimir Immanuilovich m.p.

Tenant:

LLC "Petrovskie Khleb" 420001, Republic of Tatarstan, Kazan, st. Musa Jalilya, 256 INN 502020202, checkpoint 50222222 account number 40702810800040000023 at Sberbank OJSC in Kazan, account number 30107770000000888 BIC 048888888

Tenant:

Petrovskie Khleb LLC General Director Minnullin Insaf Zakiullovich m.p.

To the sublease agreement

The premises can be transferred not only under a lease agreement, but also under a sublease agreement. It is important that the tenant’s right to sublease the premises is stipulated in the agreement with the landlord, that is, the owner of the premises. Otherwise, the concluded agreement will not have legal force.

Appendix No. 1 to lease agreement No. 3 dated March 30, 2018

ACT of acceptance and transfer of non-residential premises located at st. Admiralteyskaya, 2

| G. Novorossiysk | 01/30/2018 |

NovTrans LLC, hereinafter referred to as the “Tenant”, represented by General Director Evgeniy Viktorovich Shaburov, acting on the basis of the LLC Charter, transferred, and Animal World LLC, hereinafter referred to as “Subtenant”, represented by General Director Irakly Sergeevich Kochemasov, acting on the basis of the LLC Charter, accepted for sublease non-residential premises located at Novorossiysk, st. Admiralteyskaya, 2, with a total area of 120 (one hundred twenty) square meters for use as warehouse premises in accordance with agreement No. 158 of sublease of non-residential premises dated January 28, 2018.

The technical condition of the premises is satisfactory and allows it to be used for the purposes specified in clause 1.2. sublease agreements.

Submitted by: Tenant: _____/Shaburov Evgeniy Viktorovich M.P.

Accepted by: Subtenant: ____/Kochemasov Irakliy Sergeevich M.P.

Important! When subleasing premises, it is necessary to indicate that the tenant acts as the lessor. A person accepting non-residential premises under a sublease agreement is a subtenant.

Act OS 1a

June 8, 2014 For fixed assets

When accepting and transferring fixed assets, the commission fills out an act. Unified forms of the act have been developed: OS-1 (for all fixed assets, except buildings), OS-1a (for buildings, structures), OS-1b (for groups of objects). The process of filling out the OS-1 form is discussed in detail. Now let's focus on the OS-1a form. We offer this form below.

If questions arise when drawing up an act of acceptance and transfer of buildings or structures, then we offer instructions for filling out the OS-1a form, in addition, at the end of the article you can fill out the act.

On a note! If equipment that requires installation is accepted for registration, then an act is drawn up in form OS-14, which can be done.

A new fixed asset object is accepted into the enterprise by a commission specially created by the manager, which inspects the object, makes its decision on it, which it writes in the conclusion. When accepting fixed assets for accounting, the commission fills out an acceptance certificate.

Usually there are two acts drawn up: for the transferring party and the recipient. An exception is the presence of several owners of an object, in which case the number of completed copies of the act must be equal to the number of persons interested in the acceptance and transfer.

Sample transfer and acceptance certificate OS-1a:

When filling out the title page of the OS-1a form, you should pay attention to the “state” field. registration of rights to real estate,” this column is only in the act for buildings, structures, the rights to which need to be confirmed, and they are entered into the Unified State Register of Rights. This field indicates the date the rights were entered into this register.

The “for reference” section is intended to be filled out if the building has several owners; the share of each is noted here.

The remaining fields of the title page of form OS-1a are filled out similarly to form OS-1.

Section 1.

The section is notable in that it is filled out only for objects that have been in use. Information is entered into it based on the data of the former owner.

“Actual service life” is the period when the building or structure was used for its intended purpose, and depreciation was calculated on it. Periods of conservation, modernization, and reconstruction are not taken into account, since depreciation is not accrued during these periods.

“Amount of accrued depreciation”—implies accrual from the beginning of operation.

“Residual value” is the original cost excluding accrued depreciation.

“Acquisition cost” is the cost of real estate under the contract.

Section 2.

This section is filled out exclusively by the recipient of the object in his act of acceptance and transfer.

The “initial cost” is formed from the sum of all costs associated with the receipt of a real estate property by the enterprise, minus VAT.

“Useful life” - this period is established according to the Classification of fixed assets; if the object was in operation, then the actual service life specified in the first section must be subtracted from the total useful life established for the object.

“Depreciation” - the enterprise selects a convenient method for calculating depreciation for an object, its name is reflected in column 3, and the depreciation rate calculated in accordance with the chosen method is indicated in column 4.

Section 3.

A specific characteristic for a given object. In particular, if there are jewelry included in the object, they should be reflected in columns 1-5 of the corresponding table in this section.

In addition, the quantitative and qualitative characteristics of the property are noted here (area, number of floors, construction volume, etc.).

When accepting the building, the commission writes a final conclusion on the object in the OS-1a act form.

Technical documentation for the property is attached to the completed transfer and acceptance certificate OS-1a.

Who signs the acceptance certificate for buildings and structures?

First of all, all members of the commission and its chairman put their signatures.

Representatives of the transferring and receiving parties also sign the completed form.

The head of the enterprise that accepted the building for registration approves the act with his signature indicating the current date.

The chief accountant of the transferring party makes a note in the inventory card of the object about its disposal from the enterprise and puts his signature on the act.

In turn, the recipient’s accountant creates an inventory card for the fixed asset, about which he also makes a note in the act and puts his signature on it.

Inventory card form OS-6 can be used, sample inventory book OS-6b.

An example of filling out a certificate of acceptance and transfer of buildings and structures can be seen below.

To write off an object from registration due to moral, physical wear and tear, damage, a write-off act is drawn up in form OS-4, OS-4a or OS-4b. and a sample form OS-4 is possible, OS-4a -.

Form and example of filling

filling out form OS-1a – link.

Form OS-1 – link.

Is it necessary to compose?

It is necessary to draw up a form in the OS-1a form to document the fact of inclusion or exclusion of structures from the list of fixed assets.

The presence of the act proves the implementation of the transfer process to the acquirer and confirms the fulfillment of the obligations specified in the agreement for the acceptance and transfer of real estate.

Accounting staff also recalculate the organization’s property tax on the basis of this document.

If, upon acceptance of the building, non-compliance with construction standards was discovered, the violations must be recorded in the OS-1a act. A correctly executed form can serve as an evidence base in the event of a dispute between the parties to a transaction.

Reasons for preparation

The current legislation outlines a clear procedure for the acceptance and transfer of structures and buildings.

The acceptance of real estate is closely related to their commissioning.

Documents serving as the basis for the conclusion of a special commission on the commissioning of fixed assets:

- a signed purchase and sale agreement, the subject of which is the purchase of real estate, lease, other methods of transferring ownership (how to register fixed assets upon purchase);

- cash purchase and sale transaction;

- contract for the construction of a structure by contract method and its commissioning into operational activities.

- gift agreement upon receipt of the building free of charge;

- documents documenting the contribution to the authorized capital in the form of a structure.

The disposal process is formalized as a result of the sale, exchange, rental of premises with further purchase.

Step-by-step process for creating form blocks

The building acceptance certificate form OS-1a consists of 3 pages that must be filled out.

Page No. 1 of the form is filled out as follows:

- marks approving the transfer and acceptance certificate (issued only by the receiving party of the transaction);

- data of the recipient organization (name of the enterprise, INN, KPP, address, bank details, telephone, OKPO code);

- information about the delivering company (name, INN, KPP, legal address, contact phone number, current account details) is filled in only when transferring an object as a fixed asset; for new buildings, newly created data lines of the OS-1a form are not filled in;

- information indicated in the act form on the right, which reflects in the accounting documentation the date of acceptance and deregistration, the account is indicated in the debit of which the property is accounted for;

- data about the property (name, location address, intended purpose, information about the company that prepared the project, depreciation group number, passports, inventory);

- The column “state registration of rights to real estate” contains information about the number and date of registration of rights to property.

The OS-1a form is assigned a serial number, and the date the form was compiled is recorded.

Then the characteristics of the property being transferred or received, the address of its location, and information about shared ownership (if there are several owners) are written.

The line “foreign currency” must be completed when purchasing property in foreign currency.

Page No. 2 consists of 3 sections:

The first section is filled out by the delivery company; for newly constructed buildings and structures, the section remains blank.

In this section of the second page of the OS-1a form the following is recorded:

- information about the transferred property;

- date of construction and commissioning (overhaul, modernization, reconstruction);

- actual period of use (without taking into account the period of modernization or mothballing of the structure);

- residual value taking into account depreciation;

- the depreciation method used.

It should be taken into account that depreciation is accrued for the entire period of use of the structure; these amounts are entered in the column “amount of accrued depreciation” of the OS-1a form.

“Residual value” is the difference between acquisition cost and depreciation.

The second section of the OS-1a act is drawn up by the receiving party in a specially designated place.

The depreciation of property is sequentially filled in in the transfer and acceptance certificate:

- initial cost of the OS,

- term of use,

- method and rate of depreciation calculation.

The original cost of the building includes the purchase price, reduced by the amount of VAT, but taking into account additional costs. What are the costs of purchasing an OS?

Useful life is the total life minus the operational period.

The third section of the OS-1a act form reflects the individual characteristics of the property and the presence of precious metals.

The final page of the standard form contains the final conclusion of the above information, confirmed by the signatures of the commission members.

When new property is accepted for registration, it is inspected by a commission for the presence of defects; based on the results of the measures taken, an assessment of the condition of the object is given.

If defects are found, then an OS-16 act is drawn up, the form and sample of which can be obtained.

Technical documentation of the building or structure is attached to the transfer and acceptance certificate OS-1a.

Each party to the agreement creates its own commission, which must include at least 2 company representatives. The composition of the commission members is approved by order of the head.

The completed form of the act is signed by each party to the transaction, indicating the details of both enterprises (address, company name, full name of the manager or authorized representative).

When renting premises, the landlord's bank account for rent payment is also indicated.

Form OS-1a is signed by managers acting on the basis of the company’s Charter. Other employees of organizations can also sign their autographs if their right is enshrined in a properly executed power of attorney.

fillings and form

Below we offer a unified form OS-1a and a completed example of a document upon receipt of a building or structure under a purchase and sale agreement.

OS-1a forms - excel.

Sample of filling out the act of acceptance and transfer of a building for sale and purchase:

Important nuances

The act is printed in 2 copies, each enterprise keeps the paper in its documentation.

There are cases when a concluded agreement requires the transfer of several buildings or structures.

Then one act of acceptance and transfer is drawn up, which lists all the data of the transferred property.

When the building is shared ownership by several persons, this fact is also stated in the deed.

The unified OS-1a form contains a mark for stamping. But in accordance with Article 9 (Part 2) No. 402-FZ of December 6, 2011, a seal is not a mandatory requisite on primary documentation.

If any of the organizations (receiving or giving) has officially issued a refusal to use the seal, the stamp is not affixed.

But, on the other hand, for the seller, affixing a seal is a certain additional advantage if the buyer refers to the fact that the document was signed by an unauthorized representative of the company.

If the property is purchased in a store or from an individual, then information about the delivery company is not filled out in the OS-1a form.

When drawing up an acceptance certificate, it is required to indicate the data of the structure that will allow it to be identified: the address of the building’s location, the area of the facility. The details of the concluded lease agreement, purchase and sale agreement, and free use are also indicated.

The form contains fields for filling out information about state registration of rights. The current legislation of the Russian Federation obliges transactions concluded with real estate to undergo state registration.

The text of the act must contain this information. It does not matter what property is being transferred: residential building, non-residential premises. State registration is a mandatory procedure for such transactions.

The transfer of an immovable property from one person to another is always accompanied by the execution of a transfer deed. In the vast majority of cases, the unified OS-1a form is used, which is convenient and complies with the required legal standards.

The form is filled out by both parties to the transaction; the basis for drawing up may be a purchase and sale agreement, lease, donation, or another document that necessarily contains the transfer of rights to buildings from one person to another.

An inventory card drawn up according to the OS-6 form should be created for the received object.

>> Self-instruction book “Accounting from Scratch”