Home page • Blog • Online cash registers and 54-FZ • Online cash registers in 2020

Online cash registers in 2020 are becoming mandatory for everyone. For several years now there has been a gradual transition to the new trading system established by Federal Law 54. 2020 marks the final stage of the transition to online cash registers for individual entrepreneurs and LLCs. The updated trading rules will come into force in the summer. For everyone who falls under 54 Federal Laws, deadlines have been established by which the equipment must be installed.

Special offers for online cash registers

Large selection of equipment according to 54 Federal Laws. All cash desks are at manufacturer prices with an official guarantee. It has become even more profitable to purchase a cash register in our store - there are special offers.

GET AN OFFER IN THE ONLINE CASH CATALOG

Online cash registers: changes in 2020

Legislation regulating trade, payments and cash registers is constantly changing. Thus, amendments are constantly made to 54 Federal Laws, new legislative acts, orders and other laws are issued, which a modern entrepreneur has to constantly monitor in order to be aware of the latest innovations and not face fines. In 2020, there is also the latest news regarding online cash registers: this includes mandatory labeling of goods with digital means of identification, and a VAT rate of 20%. Other large-scale changes are planned for online cash registers in 2020, which will affect the entire market. Multikas specialists closely monitor changes in legislation regarding cash registers - follow the news on our website.

CCP for settlements with accountants and for payments under GPC agreements

When an organization or individual entrepreneur makes payments to an individual under a GPC agreement, it acts as a buyer, and the individual acts as a seller. According to paragraph 1 of Art. 1.2 of Federal Law No. 54-FZ, only organizations and individual entrepreneurs are obliged to use the cash register, but individuals and buyers are not. Accordingly, in such a situation the cash register is not used.

Organizations are not required to use a cash register when paying rent to individuals for real estate.

According to the law, payments in which it is necessary to use cash register systems are considered to be the payment of funds (DC) for goods sold, work performed, services provided. The issuance of wages, financial assistance and other payments, the issuance of DS for reporting, and the return of unspent DS that were issued for reporting are not considered calculations. Therefore, the use of a cash register is also not required.

What's new in the online cash register

The transition to a new type of equipment is not without reason. New devices have a number of differences from old cash registers and fundamentally new functions:

- The fiscal drive is the cash register memory, which replaced the EKLZ. This is a small box with a seal that fits into the device body. The device records on the fiscal drive all information about the transactions carried out: sales, returns, etc., and all data is recorded in encrypted form, i.e. cannot be changed or copied. FN is issued for a certain period. This can be 15 or 36 months depending on the type of business, individual entrepreneur or LLC, and the form of taxation. The terms of use of the drive are established by law and cannot be chosen spontaneously.

- Internet connection - each cash register has the ability to connect to the Internet. The law establishes the mandatory presence of an Internet connection in an online cash register when using it - this is how the name “online cash register” appeared. The Internet in CCP is needed to send information to the tax authorities (this is fiscal data, they are also recorded on the FN) through the OFD. When the Internet is turned off, the cash register will work for up to 30 days, after which it will be automatically blocked.

- OFD - fiscal data operator. This is an intermediary organization that receives information from cash registers and sends it to the Federal Tax Service server. Connection to the OFD is paid and mandatory.

- New functions - new cash registers support wide functionality, which is designed to help the entrepreneur in running his business. This includes collecting statistics on key indicators and inventory accounting. Many cash desks support working with a personal account. It is very comfortable! You can manage your cash register from any browser from anywhere in the world. As a rule, a personal account supports many necessary and useful functions: working with goods, services, prices, purchases, documents, statistical reports and more.

- Simplified registration with the Federal Tax Service - to register a cash register, there is no longer a need to visit the territorial branch with a cash register in your hands. Now the entire procedure takes place via the Internet using an electronic signature key. The registration procedure can be completed either independently or through third-party organizations, but more on that a little later.

- New check format - a new check format has been installed, which is now uniform. The name of the product must now be indicated on the receipt.

- Electronic Receipt to Buyer - Every seller is now required to send an electronic receipt to the buyer upon request. Sending occurs by email or SMS message.

New details for cash receipts

In the summer of 2020, new details will be introduced in checks that are issued between organizations and individual entrepreneurs for cash or non-cash payments (clause “d”, paragraph 15, article 1 of Law No. 192-FZ). These details are intended to identify the buyer in detail. It will be necessary to indicate the name of the organization or full name of the entrepreneur, TIN of the client. If an invoice is issued for settlements, the cash receipt must include details related to the subject of payment (excise tax amount, country code, registration number of the customs declaration).

To make payments using the machine, you must indicate on the receipt the information about the location where the machine will be installed.

When paying out lottery winnings, as well as when receiving an insurance premium (payment), it is necessary to indicate the name of the client or policyholder and his TIN on the check. If there is no TIN, indicate the series and number of the passport.

From January 1, 2020, the receipt will need to indicate information about the product code. For marked goods, this is a unique sequence of symbols presented in the identification tool contained in the KIZ. For other goods, this is the code of the commodity item in accordance with the unified Commodity Nomenclature of Foreign Economic Activity of the EAEU.

Do you need an online cash register?

The question of whether an online cash register is needed in 2020 worries many people. By law, an online cash register is required for all individual entrepreneurs and LLCs, regardless of the form of taxation. Only the transition periods for different categories differ. There are, of course, exceptions to the general rule.

Who can avoid installing an online cash register in 2020:

- All shoe repair shops

- All repair and key making workshops,

- Organizations providing ritual and religious services,

- Sellers of securities,

- Conductors in transport,

- Catering organizations in schools,

- Sellers of unequipped markets,

- Organizations selling printed materials,

- All those selling non-alcoholic drinks on tap, etc.

A detailed list of exceptions can be found in Federal Law 54. In any case, changes to online cash registers will affect many.

Cancellation of online cash registers in 2020 – should we wait or not?

Many wait until the last minute, hoping that the government will change its mind at the last moment. Will online cash registers be canceled in 2020? It's safe to say no. There will definitely be no cancellation. This is a large-scale project in which the government has a strong interest for many reasons. The online cash register is in its own way a smart and powerful tool for business control, increasing tax collection, monitoring many business indicators, as well as financial flows. By introducing online cash registers, the state also sets an important goal - increasing the share of legal business by reducing the volume of counterfeit and counterfeit goods. It will be difficult to sell a fake using the new cash register. Mandatory product labeling will also help with this, which is precisely aimed at product traceability and identifying counterfeits.

Correction check or return receipt?

When calculating at the checkout, various errors may occur that need to be identified and corrected in a timely manner. For this purpose, it is possible to use a correction check or return the receipt. To prevent problems from the tax office, it is better to initially worry about the error in order to eliminate it.

Explanations from the tax office regarding the use of a correction check are ambiguous. It must be used when breaking the law while using CCP. The regulatory authorities do not explain what exactly constitutes a violation of the law. In particular, it will be considered a violation to carry out calculations without using a cash register, for example, due to a power outage, breakdown of a cash register, etc. Let’s consider common errors and ways to solve them.

- The amount on the check is less than what was received, and this was discovered after the customer left. In this case, the actual availability of money is greater than reflected in fiscal data (FD). For inspection authorities, this is unaccounted revenue, which indicates the non-use of the cash register. This entails fines due to non-use of cash registers.

To eliminate this error, it is necessary to draw up a cashier's memo, indicating in it the date, time and reason for the error, due to which unaccounted revenue was generated. Assign the date and number of the document in order to then indicate this information on the basis of the correction check.

The check must contain sufficient information to identify the payment where the error was made. In particular, indicate the fiscal attribute (FP) of the incorrect document.

To adjust settlements made without a cash register, the receipt must contain details corresponding to the settlement (date, name of product, service, work, settlement address). The calculation attribute must indicate “Incoming”, the correction type “Independent operation”.

After the correction check has been entered and sent, you need to send a notification to the tax office at the place of registration and report the discovery and actions to eliminate unaccounted revenue.

- The amount in the check is more than what was received, and this was discovered after the buyer left.

In this case, the revenue is less than reflected in the FD, this leads to a discrepancy between the fact and the accounting - a shortage is formed.

There is no need to generate a correction check in this situation. Exceeding the cash balance does not indicate that the cash register has not been used, which is not a reason for tax audits. To correct the data, just punch the refund check for the missing amount. The cashier who made a mistake must write an explanatory note indicating the reason for the shortage.

- The error in the receipt is discovered in the presence of the buyer.

You can correct the error immediately. To do this, you need to collect the erroneous check from the client and issue a refund check for the entire amount of the incorrect check. Then punch the receipt receipt for the correct amount and then issue it to the buyer. Then the OFD and regulatory authorities receive correct information about revenue.

- The error was discovered after the shifts closed.

According to the law, a correction check must be generated after the opening of the shift, but no later than the closing of the shift. This causes a lot of controversy, since unaccounted revenue is often not revealed immediately, until after the end of the shift. According to comments from tax representatives, punching correction checks for past shifts is not prohibited. The main thing is to indicate on the check the date of the error, which should be recorded in the “Description of correction” detail.

Who needs an online cash register?

Who should install online cash registers in 2020:

- Individual entrepreneurs and LLCs in the service sector with and without employees (all forms of taxation),

- Individual entrepreneurs and LLCs without hired employees in the field of trade and public catering (all forms of taxation).

Transition deadline for individual entrepreneurs July 2020

Thus, 2020 makes online cash registers for individual entrepreneurs mandatory for all categories of business, except for established exceptions. The same applies to organizations. Individual entrepreneurs on UTII, OSN, simplified tax system, patent must install online cash registers before July 1, 2020.

Who received a deferment until July 1, 2021?

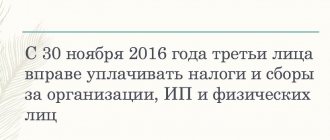

As of July 1, 2019, the next stage of the transition to online technology is completed. From this date, they are required to apply the updated cash register (Law “On Amendments...” dated July 3, 2018 No. 192-FZ, Law “On Amendments...” dated November 27, 2017 No. 337-FZ, see also letter of the Federal Tax Service dated March 22, 2019 No. ED-4-20/5228):

- organizations and individual entrepreneurs under any taxation regime, performing work or providing services to the population (with the exception of the catering industry), subject to the issuance of a BSO;

- Individual entrepreneurs using UTII and PSN, working in the field of trade or catering without employees;

- Individual entrepreneurs without employees, trading using vending machines;

- organizations and individual entrepreneurs when selling travel documents (tickets) and coupons for travel on public transport in the vehicle interior. Here it will be possible to use a remote cash register, and instead of a cash receipt, issue a ticket with a QR code.

In connection with the clarification of the term “settlements”, from 07/01/2019 the use of cash register systems should begin:

- organizations and individual entrepreneurs when making non-cash settlements with individuals (except for settlements using electronic means of payment);

- when providing payment for housing and utilities, including contributions for major repairs;

- when carrying out offset and return of prepayment and (or) advances;

- when providing loans to pay for goods, works, services;

- when providing or receiving other consideration for goods or work.

See also “Online cash registers for individual entrepreneurs - application rules in 2019.”

Attention! The Federal Tax Service has posted on its website the test “Do I need a cash register?”, which will quickly and accurately help you find out whether you need to buy an online cash register by 07/01/2019.

In addition, from July 1, 2019, it will be necessary to include information about the buyer in the receipt in the following cases:

- mutual settlements between legal entities or individual entrepreneurs in cash or by card;

- payment of winnings from lotteries or gambling games;

- acceptance of insurance payment or premium.

Read about the required details on checks here.

The postponement of the implementation of online cash register systems for individual entrepreneurs engaged in providing services, performing work or selling goods of their own production and who do not have employees has been extended until 07/01/2021.

Read more here.

Tax deduction for online cash register

The state understands that the costs of switching to online cash registers are quite high. Businessmen who installed the equipment on time, i.e. before the established deadline, have the right to submit an application for compensation to the territorial branch of the Federal Tax Service of the Russian Federation. Compensation is provided in the form of a tax deduction in the amount of RUB 18,000. for each piece of equipment (cash register). The state provides this opportunity only to entrepreneurs on UTII and a patent, as well as combined forms of taxation, including UTII or a patent. To receive a deduction, you need to provide receipts or other documents confirming the fact of purchasing the cash register, and write an application in the prescribed form.

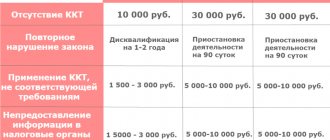

Fines for online cash registers

The law regulates the use of cash registers and also establishes administrative penalties for violations of the law. In this case, the penalties chosen are fines:

- For individual entrepreneurs: No cash register - up to half of revenue; repeated - suspension from work for up to 2 years.

- The cash register does not comply with 54 Federal Laws, it is not registered correctly - 3 thousand rubles.

- The check was not issued - 2000 rubles. (including electronic check).

- Lack of cash register - at least 30,000 rubles; repeatedly - suspension of the LLC’s operation for up to 3 months.

Use of online cash registers from 2020

Each cash register must be connected to the Internet and registered correctly. Before you start working at the cash register, you need to enter the cashiers' data and set up the workplace and access rights. Work at the cash register begins with the opening of the shift and ends with the closing and generation of the Z-report. New cash registers support full and partial refunds, as well as non-cash payments. When purchasing a cash register in our store, you will also receive introductory instructions on how to use the cash register. You can also get consulting and technical support from Multikas.

Online cash register for individual entrepreneurs on PSN from July 1, 2020

Most individual entrepreneurs with a patent are also required to switch to new generation cash registers with an OFD contract and Internet access. This requirement applies to the following business areas:

- cosmetology,

- hairdressing,

- pharmaceuticals and medicine,

- veterinary medicine

- Taxi,

- road and water transportation,

- repair (equipment, instruments, watches, cars, computers, etc.),

- hunting and game management,

- fish farming and fishing,

- production of dairy products,

- rental

Installing an online cash register in 2020 - where to start?

Before installing the cash register, you must first perform a number of sequential actions:

- Direct purchase online cash register,

- Connection to OFD,

- Selecting a fiscal drive,

- Registration of cash register,

- Installation and configuration of the necessary software (if necessary).

After completing all these points, installing a cash register will not be difficult for you. It is worth paying special attention to the registration procedure for cash register equipment due to the increasing frequency of equipment breakdowns during self-registration. It is best to entrust registration to specialists, since performing the procedure yourself, there is a high risk of blocking the fiscal drive, incorrect registration and equipment breakdowns.