When is an inventory required in the Social Insurance Fund?

Providing an inventory to the Social Insurance Fund is necessary if the company has employees who need social benefits. However, what is more important is the direct responsibility of the employer: it is necessary to regularly submit to the Social Insurance Fund all documents that are in one way or another related to the allocation of funds for the payment of insurance claims.

Register of information in the Social Insurance Fund on disability benefits

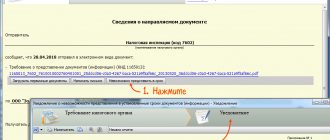

The register is formed to transmit information to the Social Insurance Fund in electronic form. When the document is automatically filled out, it includes all sick leave taken, except for sick leave for work-related injuries and occupational diseases, which were not previously registered in the registers.

Rice. 6

The register form consists of a table of certificates of incapacity for work and several tabs displaying data for a specific sick leave: when the cursor is positioned on a line in the employee table, the right side of the form is filled in with data on the corresponding sick leave.

Thus, the “Insured Person” tab is almost similar to the “Application” tabs on the sick leave sheet that we have already discussed and reflects information about the applicant and the method of transferring benefits. The tabs “Certificate of incapacity for work” and “Certificate of incapacity for work (continued)” are similar to the corresponding tabs of the document “Accrual on sick leave” and inherit the data from there. The “Benefit Calculation” tab contains the data necessary to calculate the benefit amount: sick leave period, insurance period, earnings for two years or average daily earnings, etc.; These bookmarks are also inherited from the sick leave. The “Other” tab contains fields for filling in auxiliary data.

From the document you can print a register of information and an inventory of information and documents.

Who makes it up

Responsibility for compiling a complete list of documents for the Social Insurance Fund falls on the management of the company and the immediate head of a specific department. Such a hierarchy allows you to improve the structure between the Social Insurance Fund and the company, as well as make error-free payments. So, the management collects all the documents and draws up an inventory, using the help of the office, signs and sends it to the Social Insurance Fund.

Reimbursement of benefits from the Social Insurance Fund in 2020

The following indicators should be reflected in the calculation certificate:

- the amount of debt on insurance premiums at the beginning/end of the billing period;

- accrued amount of contributions;

- additional accrued amount of contributions;

- the amount of expenses not taken into account;

- compensation received from the Social Insurance Fund;

- funds of the policyholder spent on social benefits, etc.

filling out the calculation certificate form for FSS reimbursement (doc format). Calculation certificate provided when applying for the allocation of funds. However, the FSS, by internal letter, provided lower-level departments with a sample Calculation Certificate. Application for reimbursement As in the case of the Certificate-Calculation form, there is also no legally approved application form for reimbursement. In the same letter, the FSS recommended a single form of application. It is also published on the websites of FSS branches throughout the country.

Composition of the document

The document, which was approved on December 29, 2020, includes the following information:

- Full information about the policyholder: registration number, department code, etc.

- Main part: a table with the names of employees and their category according to which payments should be made.

- Attachments: attached documents that are necessary to confirm the need for social insurance.

At the end of the inventory there must be the signature of the manager and the seal of the organization.

Video with the procedure for sending documents to the FSS:

https://youtu.be/LoPUPMzxSIc

Regulatory framework and form

When submitting documentation to the territorial Social Insurance Fund (abbreviated as FSS) for assigning various benefits and payments to employees, the accountant must draw up and fill out an inventory of the relevant papers.

A list of applications and documents necessary for the appointment and payment of relevant types of benefits to insured persons is a mandatory register. It is filled out strictly according to the form approved by Order of the Social Insurance Fund No. 578 of November 24, 2017. The list of documents in the FSS (the 2020 form can be downloaded below) is used in an updated form, starting from December 29, 2017.

Rules for filling out an inventory in the Social Insurance Fund

So, now as for the actual filling. First, the register consists of two parts: introductory and tabular. This is important to consider because the first part contains:

- full policyholder number

- subordination code, which is determined in accordance with the registration number and registration with social authorities. insurance

- full information about tax identification number and checkpoint

- name of the organization that sends the inventory

- official name and number of the FSS body to which the shipment is made

After this, the main part begins - the tabular one. It is made of five columns, which contain information regarding:

- type of payment

- full names of documents according to which payment is due

- applications

In addition to the fact that all names must be written in full, in the “Types of payments” it is required to indicate a serial number, which relates to the specific basis of the benefit. So, let's look at each code:

- 1 - temporary impossibility of performing labor

- 2 - pregnancy and, as a result, stay in medical care. institutions

- 3 - hospital registration in the early stages of pregnancy

- 4 - birth of a child

- 5 - maternity leave

- 6 - injury due to an accident and temporary disability

This is where the main part ends and all that remains is to attach and list all the documents that serve as the basis for assigning assistance. The complete register must be signed by the head of the organization, indicating all dates and the organization's seal.

Sample list of documents for the Social Insurance Fund, composition of the document and rules for filling it out

Business lawyer > Accounting > Primary documents > Sample list of documents for the Social Insurance Fund and features of the content of the document

In what cases may a sample list of documents for the Social Insurance Fund be needed and how the procedure is regulated. In addition, the shipping methods and legal framework that governs this process will be indicated below.

When is an inventory required in the Social Insurance Fund?

Providing an inventory to the Social Insurance Fund is necessary if the company has employees who need social benefits. However, what is more important is the direct responsibility of the employer: it is necessary to regularly submit to the Social Insurance Fund all documents that are in one way or another related to the allocation of funds for the payment of insurance claims.

Regulatory framework

Now regarding the regulatory framework governing the filling process. The procedure and basic form are determined by FSS Order No. 578. This is a mandatory norm, because after submitting the document to the fund, it is sent to the appropriate registration package. It is impossible to make payments to insured people based on inventories that are filled out incorrectly and, as a result, not included in the register.

Who makes it up

Responsibility for compiling a complete list of documents for the Social Insurance Fund falls on the management of the company and the immediate head of a specific department. Such a hierarchy allows you to improve the structure between the Social Insurance Fund and the company, as well as make error-free payments. So, the management collects all the documents and draws up an inventory, using the help of the office, signs and sends it to the Social Insurance Fund.

Composition of the document

The document, which was approved on December 29, 2020, includes the following information:

- Full information about the policyholder: registration number, department code, etc.

- Main part: a table with the names of employees and their category according to which payments should be made.

- Attachments: attached documents that are necessary to confirm the need for social insurance.

At the end of the inventory there must be the signature of the manager and the seal of the organization.

with the procedure for sending documents to the FSS:

Rules for filling out an inventory in the Social Insurance Fund

So, now as for the actual filling. First, the register consists of two parts: introductory and tabular. This is important to consider because the first part contains:

- full policyholder number

- subordination code, which is determined in accordance with the registration number and registration with social authorities. insurance

- full information about tax identification number and checkpoint

- name of the organization that sends the inventory

- official name and number of the FSS body to which the shipment is made

After this, the main part begins - the tabular one. It is made of five columns, which contain information regarding:

- all employees who are entitled to payment

- type of payment

- full names of documents according to which payment is due

- applications

In addition to the fact that all names must be written in full, in the “Types of payments” it is required to indicate a serial number, which relates to the specific basis of the benefit. So, let's look at each code:

- 1 - temporary impossibility of performing labor

- 2 - pregnancy and, as a result, stay in medical care. institutions

- 3 - hospital registration in the early stages of pregnancy

- 4 - birth of a child

- 5 - maternity leave

- 6 - injury due to an accident and temporary disability

This is where the main part ends and all that remains is to attach and list all the documents that serve as the basis for assigning assistance. The complete register must be signed by the head of the organization, indicating all dates and the organization's seal.

Features of the accident inventory

In the event of an accident, the Social Insurance Fund can pay all insurance premiums, but the key stage is the recognition by the Social Insurance Fund of such an event as an insured event and, as a result, a production one.

Federal Law No. 125, which has jurisdiction over everything related to insurance, defines an industrial accident as harm to the health of an employee during the performance of work duties. And it is the part “at the time of performance of work duties” that is key, since it frees a person from being directly on the employer’s premises.

Therefore, in order to receive payments from the Social Insurance Fund and draw up an inventory, official registration of all damage is required. Thus, Art. 250 of the Labor Code of the Russian Federation, a complete list of necessary documents is contained in Resolution of the Ministry of Labor of the Russian Federation No. 73.

If we do not take into account all the documents that the employer must prepare, then the investigation and further inventory of the Social Insurance Fund must be supported by materials from specialists monitoring the case.

Moreover, the legislator has every right to conduct additional examinations. Thus, if the opposite is proven - the damage to health was caused in such a way that it does not fall under the insured event - the company management will personally pay compensation.

In this case, the Social Insurance Fund will be exempt from payments to such an employee.

About failure to submit reports

Now regarding missing the reporting deadline. It is regulated by Art. 26.30 Federal Law No. 125, which provides mandatory social services. insurance.

Thus, the amount of the fine will be about 5% of the total number of contributions for every 3 months of the previous period. This rule applies regardless of whether the past months were complete or not.

However, there is a small limitation in the form of maximum percentages of this amount - no more than 30%.

In addition, if the order is violated, a fine of 200 rubles is paid. However, the presence of financial sanctions that relate directly to the organization is not the only thing that can overtake the employer.

A fine can also be imposed on the head of the company and be interpreted as an administrative violation - this will be ensured by Art. 15.33 Code of Administrative Offences. The amount of such a penalty will be up to 500 rubles.

https://youtu.be/hHZl8ZIgsso

These sanctions are imposed on the company regardless of the reason for the delay in delivery: intentionally or through negligence - is not taken into account. However, the legislation defines a number of cases that take into account the impossibility of sending a report in a timely manner (Table 1).

| Article number | Description |

| 26.25 | relieves responsibility if the deadline is missed due to: a natural disaster, lack of control over actions as a result of illness, carrying out clarifications for the fund, etc. |

| 26.26 | provides mitigating circumstances that will help reduce the fine: difficult financial situation, family problems, etc. |

Thus, these are only the main features of the inventory that must be taken into account in the event of an accident and further compensation of all funds.

about reporting deadlines:

For reimbursement

Reimbursement of benefits from the Social Insurance Fund is possible, but it requires first of all determining where the funds were spent. Thus, compensation is allowed exclusively for: sick leave, benefits for pregnant women and child care, as well as for the funeral of an employee.

However, the Social Insurance Fund compensates these benefits only partially and only some fully. And if we consider the reimbursement procedure, it is quite standard; it is necessary:

- Write an application: it contains all the information about the person.

- Prepare a statement of calculation and other documents that are required - determined personally.

- Wait for a full check by the FSS.

- Receive funds.

Despite the simple algorithm of actions, problems often occur when: collecting and completing the required package of documents, correctly drawing up the form, and meeting the deadlines for sending and receiving funds. All this is the direct responsibility of the employer and must be regulated by him throughout the entire procedure until the employee receives the funds.

Shipping methods

There are two main methods for sending a list of documents to the Social Insurance Fund (Table 2).

| Shipping method | Description |

| Electronic | The use of this method implies the presence of special communication channels and the use of an electronic digital signature. Otherwise, sending is not possible. |

| Physical | Sent either by mail or courier. It is mandatory to have a sealed envelope with an inventory of the contents and other means of protecting physical documents. It is also recommended to use registered mail, which is much more reliable, since the sender will be immediately notified that the addressee has received the letter. |

Compliance with all established conditions is also mandatory and does not constitute a benefit if the report does not reach the fund on time.

Sample inventory

Now let's look directly at the sample inventory.

Download document inventory form [68.00 KB]

Now that the main issues regarding the inventory have been sorted out, there is no need to worry about making a number of mistakes in it. However, you need to understand the following: the procedure and rules for filling out may be changed due to amendments to legislation. In this case, only close monitoring will ensure that up-to-date information is always applied.

Select it and press Ctrl+Enter to let us know.

Source: https://PravoDeneg.net/buhuchet/primary/obrazets-opisi-dokumentov-dlya-fss.html

Features of the accident inventory

In the event of an accident, the Social Insurance Fund can pay all insurance premiums, but the key stage is the recognition by the Social Insurance Fund of such an event as an insured event and, as a result, a production one.

Federal Law No. 125, which has jurisdiction over everything related to insurance, defines an industrial accident as harm to the health of an employee during the performance of work duties. And it is the part “at the time of performance of work duties” that is key, since it frees a person from being directly on the employer’s premises.

Therefore, in order to receive payments from the Social Insurance Fund and draw up an inventory, official registration of all damage is required. Thus, Art. 250 of the Labor Code of the Russian Federation, a complete list of necessary documents is contained in Resolution of the Ministry of Labor of the Russian Federation No. 73.

If we do not take into account all the documents that the employer must prepare, then the investigation and further inventory of the Social Insurance Fund must be supported by materials from specialists monitoring the case. Moreover, the legislator has every right to conduct additional examinations. Thus, if the opposite is proven - the damage to health was caused in such a way that it does not fall under the insured event - the company management will personally pay compensation. In this case, the Social Insurance Fund will be exempt from payments to such an employee.

Sample register of sick leave for social security reimbursement

Read more about this in a separate article. What other documents may the Fund require for reimbursement? Having received an application and 4-FSS calculation from the employer, your FSS department, before reimbursing the hospital expenses incurred by this employer, has the right to request documents confirming the legality of such expenses. The fund, for example, may request copies of sick leave, work records, as well as a register of sick leave.

Attention

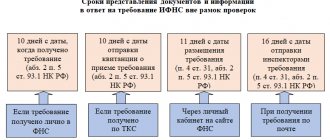

You will find a sample of this document in a separate material. Deadline for reimbursement from the Social Insurance Fund The Fund has 10 days for reimbursement from the date you submit the relevant application and Calculation 4-FSS (Part.

3 tbsp. 4.6 of the Federal Law of December 29, 2006 N 255-FZ). However, if the Social Insurance department decides to conduct an inspection, the period for compensation changes somewhat.

About failure to submit reports

Now regarding missing the reporting deadline. It is regulated by Art. 26.30 Federal Law No. 125, which provides mandatory social services. insurance. Thus, the amount of the fine will be about 5% of the total number of contributions for every 3 months of the previous period. This rule applies regardless of whether the past months were complete or not. However, there is a small limitation in the form of maximum percentages of this amount - no more than 30%.

In addition, if the order is violated, a fine of 200 rubles is paid. However, the presence of financial sanctions that relate directly to the organization is not the only thing that can overtake the employer.

A fine can also be imposed on the head of the company and be interpreted as an administrative violation - this will be ensured by Art. 15.33 Code of Administrative Offences. The amount of such a penalty will be up to 500 rubles.

These sanctions are imposed on the company regardless of the reason for the delay in delivery: intentionally or through negligence - is not taken into account. However, the legislation defines a number of cases that take into account the impossibility of sending a report in a timely manner (Table 1).

Article number

Description

relieves responsibility if the deadline is missed due to: a natural disaster, lack of control over actions as a result of illness, carrying out clarifications for the fund, etc.

provides mitigating circumstances that will help reduce the fine: difficult financial situation, family problems, etc.

Thus, these are only the main features of the inventory that must be taken into account in the event of an accident and further compensation of all funds.

Video about reporting deadlines:

Inventory of transferred documents sample form

Folder.

(The folder indicates: name of the organization, registration number, contact phone number, email address)

2.Inventory

.

(Appendix No. 2 to the Order of the Federal Social Insurance Fund of the Russian Federation dated June 17, 2011 No. 195) I

Benefits assigned by the regional branch and paid directly to the insured person to a personal bank account or by postal transfer

.

1. Temporary disability benefit

:

a) application from the insured person

;

(Appendix No. 1 to Order of the Federal Tax Service of the Russian Federation dated June 17, 201 No. 195)

b) certificate of incapacity for work

In case of temporary disability resulting from an accident at work or an occupational disease, an act on the accident at work (in Form N-1) or a report on the case of an occupational disease (or copies of the investigation materials - if the investigation continues) are additionally submitted. Before submitting these documents, benefits are assigned and paid in accordance with the legislation on compulsory social insurance in case of temporary disability and in connection with maternity. When providing information to the RO for the appointment of benefits for caring for a sick family member, it is recommended to provide:

Form

– a notification containing information about the number of calendar days paid to an employee for temporary disability if it is necessary to care for a sick family member as of 07/01/2012

When providing information to the RO for assigning benefits for caring for a sick child, it is recommended to submit:

Form -

notification containing information about the number of calendar days paid to an employee for temporary disability if necessary to care for a sick child as of 07/01/2012

2. Maternity benefit and one-time benefit for women registered in the early stages of pregnancy:

a ) application from the insured person

;

(Appendix No. 1 to Order of the Federal Tax Service of the Russian Federation dated June 17, 201 No. 195)

b ) certificate of incapacity for work

;

c) a certificate from a medical institution confirming registration in the early stages of pregnancy.

3. One-time benefit for the birth of a child:

a ) application for the assignment of benefits

;

(Appendix No. 1 to Order of the Federal Tax Service of the Russian Federation dated June 17, 201 No. 195)

b) child’s birth certificate

, issued by the civil registry office (ZAGS) Form 24

(original) (either a copy of the child’s birth certificate if issued by a consular office of the Russian Federation, or a copy of another document confirming the birth of a child issued by the competent authority of a foreign state, copies are certified by the employer. If when the insured person directly contacts the territorial body of the FSS of the Russian Federation in the event of termination of activities by the insured and it is impossible to establish his actual location, originals and copies of documents are provided);

c) certificate from place of work

(service, social protection body at the child’s place of residence) of the other parent that the benefit was not assigned - if both parents work (serve), as well as if one of the child’s parents does not work (does not serve) or is studying for full-time education in educational institutions of primary vocational, secondary vocational and higher vocational education and institutions of postgraduate vocational education, and the other parent of the child works (serves) - (

original) ;

d) For persons replacing parents: a copy of the decision to establish guardianship over the child (a copy of the court decision on adoption that has entered into legal force, a copy of the agreement on the transfer of the child to a foster family). The policyholder submits copies of documents certified by him; the insured person, when applying to the territorial body of the FSS of the Russian Federation, submits originals and copies of documents.

4. Monthly child care allowance.

List of documents for continuing the payment of benefits for up to 1.5 years, previously assigned and carried out by the employer before 07/01/2012:

a)

an application for the assignment of benefits from the insured person

(Appendix No. 1 to Order of the Federal Social Insurance Fund of the Russian Federation dated June 17, 2011 No. 195);

b) copy of the order

on provision of parental leave for up to 1.5 years,

certified by the employer;

c) a copy of the certificate from the place of work

(services) of the father (mother, both parents) of the child that he (she, they) does not use the specified leave and does not receive benefits, and if the father (mother, both parents) of the child does not work (does not serve) - a certificate from the social protection authorities at the place of residence of the child’s father or mother about non-receipt of monthly child care benefits - for one of the parents in appropriate cases, as well as for persons actually caring for the child instead of the mother (father, both parents) of the child,

certified by the employer

(When contacting the territorial body of the Federal Social Insurance Fund of the Russian Federation directly of the insured person in the event of termination of activities by the insured and it is impossible to establish his actual location, an original and a copy are provided)

d) Copy of birth certificate

(adoption) of a child being cared for,

certified by the employer;

(When contacting the territorial body of the Federal Social Insurance Fund of the Russian Federation, the insured person must be provided with an original and a copy)

e) Copy of birth certificate (adoption document, death certificate)

one of the previous children,

certified by the employer;

If this document is not submitted, if it is necessary to calculate the benefit in the minimum amount, the minimum amount of the benefit will be applied in the amount corresponding to the first child

.

(When contacting the territorial body of the Federal Social Insurance Fund of the Russian Federation, the insured person must be provided with an original and a copy)

f) A copy of the decision to establish guardianship over the child, certified by the employer;

(When contacting the territorial body of the Federal Social Insurance Fund of the Russian Federation, the insured person must be provided with an original and a copy)

g) Pay slip

benefits up to 1.5 years:

copy certified by the employer;

h) We recommend submitting a list of recipients of the monthly child care allowance for a child up to 1.5 years old (Appendix No. 2), containing information on the timing of payment of the monthly child care allowance for a child up to 1.5 years old in the attached form

.

Form

— list of recipients of monthly child care benefits up to 1.5 years old (Appendix No. 2)

List of documents for assigning benefits for up to 1.5 years for those assigned for the first time after 07/01/2012:

a) application for benefits from the insured person

(Appendix No. 1 to Order of the Federal Tax Service of the Russian Federation dated June 17, 2011 No. 195);

b) copy of the order

on provision of parental leave for up to 1.5 years,

certified by the employer;

c) certificate from place of work

(services) of the father (mother, both parents) of the child that he (she, they) does not use the specified leave and does not receive benefits, and if the father (mother, both parents) of the child does not work (does not serve) - a certificate from the social protection authorities at the place of residence of the child’s father or mother about non-receipt of monthly child care benefits - for one of the parents in appropriate cases, as well as for persons actually caring for the child instead of the mother (father, both parents) of the child, (

original)

;

d) Original and copy of the child’s birth (adoption)

who is being cared for;

e) Original and copy of birth certificate (adoption document, death certificate)

one of the previous children;

If this document is not submitted, if it is necessary to calculate the benefit in the minimum amount, the minimum amount of the benefit will be applied in the amount corresponding to the first child;

f) Original and copy of the decision to establish guardianship over the child;

Documents for the assignment (or continuation of payment) of child care benefits up to 1.5 years old are submitted once. In the future, the employer submits to the RO only information that may affect the payment of this benefit.

:

(information about early return to work, termination of an employment contract during parental leave, etc.)

We recommend that you submit this information on forms.

Blank -

notification of early exit from parental leave

Blank -

notification of termination of an employment contract during the period of parental leave

5. Payment for additional leave of the insured person (in addition to the annual paid leave established by the legislation of the Russian Federation) for the entire period of treatment and travel to the place of treatment and back:

a) application from the insured person;

(Appendix No. 1 to Order of the Federal Tax Service of the Russian Federation dated June 17, 2011 No. 195)

b) certificate-calculation;

(Order of the Federal Insurance Service of the Russian Federation dated June 17, 2011 No. 195)

c) an order from the policyholder to grant the insured person leave (a copy certified by the employer).

II Benefits transferred by the RO to the current account of the policyholder in reimbursement of expenses incurred by him. 1. Reimbursement to the employer for the payment of social benefits for funeral:

a) application of the insured;

(Appendix No. 6 to the Order of the Federal Tax Service of the Russian Federation dated June 17, 2011 No. 195)

b) death certificate issued by the registry office (original).

2. Reimbursement of the insurer's expenses for paying for 4 additional days off for caring for disabled children and people with disabilities from childhood until they reach the age of 18:

a) application of the insurer;

(Appendix No. 7 to the Order of the Federal Tax Service of the Russian Federation dated June 17, 2011 No. 195)

b) a copy of the order to provide additional days off to care for a disabled child (certified by the employer);

III

Reimbursement of the cost of a guaranteed list of funeral services to a specialized funeral service: .

a) statement;

(Appendix No. 8 to the Order of the Federal Tax Service of the Russian Federation dated June 17, 2011 No. 195)

b) death certificate issued by the registry office (original);

c) invoice for payment for services provided (original).

When providing information necessary for the appointment of benefits (temporary disability, pregnancy and childbirth, birth, child care up to 1.5 years, early pregnancy) in the form of electronic registers, paper documents are not provided to the RO; they are stored by the policyholder.

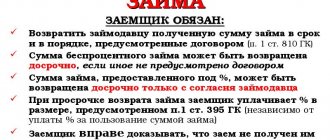

For reimbursement

Reimbursement of benefits from the Social Insurance Fund is possible, but it requires first of all determining where the funds were spent. Thus, compensation is allowed exclusively for: sick leave, benefits for pregnant women and child care, as well as for the funeral of an employee.

However, the Social Insurance Fund compensates these benefits only partially and only some fully. And if we consider the reimbursement procedure, it is quite standard; it is necessary:

- Write an application: it contains all the information about the person.

- Prepare a statement of calculation and other documents that are required - determined personally.

- Wait for a full check by the FSS.

- Receive funds.

Despite the simple algorithm of actions, problems often occur when: collecting and completing the required package of documents, correctly drawing up the form, and meeting the deadlines for sending and receiving funds. All this is the direct responsibility of the employer and must be regulated by him throughout the entire procedure until the employee receives the funds.

One-time benefits from the Social Insurance Fund

Previously in the program, one-time benefits from the Social Insurance Fund:

- in connection with death;

- when registering in the early stages of pregnancy;

- at the birth of a child;

- upon adoption of a child

were registered with a specialized document “Accrual of one-time benefits at the expense of the Social Insurance Fund”. According to the new rules for organizations participating in the pilot project, of the listed benefits, only social benefits for funerals are paid to the employee by the insurer, and then reimbursed by the Social Insurance Fund.

Therefore, the documents “Accrual of one-time benefits at the expense of the Social Insurance Fund” from July 1 are introduced only for registering benefits in connection with death.

Rice. 3

All other benefits at the expense of the Social Insurance Fund will be paid directly by the territorial body of the Fund and, therefore, there is no need to register their accrual in the program. The fact of transfer of a package of documents for the payment of other benefits from the list above is documented in other documents of the Program.

After paying the insured a funeral benefit and calculating insurance premiums for the billing period, the policyholder must submit an application to the Social Insurance Fund for reimbursement of funeral expenses. This is recorded in the Program by a document of the same name. The document is automatically filled in with the data of all accrued funeral benefits, which are reflected in the document “Calculation of Insurance Contributions” (the “Social Insurance Benefits” tab), which were not included in any of the previously submitted documents “Application to the Social Insurance Fund for reimbursement of funeral expenses.”

For each line of the document, you must indicate the status of the benefit recipient by selecting it from the drop-down list. In the header of the document, you must also manually indicate the number of pages in the transferred package of documents - the number of death certificates.

From the document, you can print the application form in accordance with Appendix No. 6 of the Order.

Rice. 4

Shipping methods

There are two main methods for sending a list of documents to the Social Insurance Fund (Table 2).

Shipping method

Description

The use of this method implies the presence of special communication channels and the use of an electronic digital signature. Otherwise, sending is not possible.

Sent either by mail or courier. It is mandatory to have a sealed envelope with an inventory of the contents and other means of protecting physical documents. It is also recommended to use registered mail, which is much more reliable, since the sender will be immediately notified that the addressee has received the letter.

Compliance with all established conditions is also mandatory and does not constitute a benefit if the report does not reach the fund on time.

List of documents in the Social Insurance Fund for reimbursement of benefits from January 1, 2017

Order of the Federal Social Insurance Fund of the Russian Federation No. 381 of September 26, 2020 Despite the fact that compensation for the costs of paying benefits since 2020 has been carried out by the tax authorities, the Federal Social Insurance Fund retained the functions of checking the expenditure of paid insurance contributions. In the article we will consider in detail the cases when you should contact the Social Insurance Fund and the tax office, what documents will be needed, what application forms and certificates have been entered, and whether it is possible to reduce insurance premiums. What documents need to be submitted to the Social Insurance Fund for reimbursement? In 2020, organizations may face confusion: in what cases and which body to apply for reimbursement of benefits. The policyholder submits a package of documents to the Social Insurance Fund for compensation when the occurrence of temporary disability arose before December 31, 2016.

Info

After processing the documents, funds are transferred to the policyholder's account (within three working days). In the case of crediting funds against future periods, the tax officer uses an internal document to reflect the resulting overpayment in the client’s card.

When subsequent contributions are calculated, the amounts will be offset automatically (if necessary, with the possible formation of an underpayment of the current contribution). It is important for the policyholder to remember that if the amount accepted for offset does not coincide with the amount of the contribution, it will be necessary to pay the difference within the period established by law.

It is worth noting that within the framework of the new procedure for interaction between the taxpayer, the FSS department and the tax policyholder, the insurer can apply for compensation to the relevant Federal Tax Service inspectorate. In this case, the Federal Tax Service Inspectorate transfers information about the received application to the Social Insurance Fund department.

Sample inventory

Now let's look directly at the sample inventory.

Now that the main issues regarding the inventory have been sorted out, there is no need to worry about making a number of mistakes in it. However, you need to understand the following: the procedure and rules for filling out may be changed due to amendments to legislation. In this case, only close monitoring will ensure that up-to-date information is always applied.

Noticed a mistake? Select it and press Ctrl+Enter to let us know.

List of documents for reimbursement of sick leave in the Social Insurance Fund 2018

or, if the other parent is not working,

- A copy of a certificate from the social security authorities at the place of residence of the other parent about his non-receipt of benefits for child care under 1.5 years old and a copy of the work record book (or a statement that I am asking to assign benefits without a copy of the work record book, since my husband (wife) ), full name, does not have a work book).

- Documents required for each application.

Second and subsequent appeals

- Certificate of benefits paid (Appendix No. 4).

- Documents required for each application.

If you submit documents simultaneously for reimbursement of several types of benefits, then, regardless of their number, the set of documents required for each application is submitted alone. Help-calculation.

We compile an inventory of documents for the tax office - sample

Documents for tax audit Expand the list of categories Subscribe to a special free weekly newsletter to keep abreast of all changes in accounting: Join us on social media.

networks: VAT, insurance premiums, simplified tax system 6%, simplified tax system 15%, UTII, personal income tax, penalties We send letters with the main discussions of the week > > > Tax-tax January 11, 2020 Inventory of documents for the tax office - a sample of its preparation is proposed in the article - contains the name and number of papers submitted to the Federal Tax Service. How to correctly compile an inventory of documents for the Federal Tax Service?

What should be reflected in it? We will consider the answers to these and other questions further using the example of the inventory for form 3-NDFL.

Ch. 23 of the Tax Code of the Russian Federation contains a list of deductions that allow you to reduce the tax base for personal income tax. The main ones are the following:

- standard;

- social;

- property;

- professional;

- investment.

Find out useful information about deductions from the special one.

When reflecting these deductions in the 3-NDFL report, in order to submit it to the Federal Tax Service, an individual must also draw up a list of documents justifying the expenses incurred by him.

However, the format of this inventory is not regulated. Some tax inspectorates independently choose its type, but this does not prevent the taxpayer from using his own version of the inventory. At the same time, the list of documents submitted to the tax office upon request (according to the sample presented below) must contain all documentation justifying the deduction.

You can download samples of inventories to the tax office on the submission of documents on the most popular deductions among taxpayers - property and social - on our website. The list of documents for transfer to the tax office - a sample will be presented below - for social deductions for treatment includes:

- ;

- ;

- treatment contract;

- a certificate from a medical institution confirming payment for treatment;

- payment documents confirming treatment expenses (receipts, checks, bills, etc.);

- document confirming relationship (with deductions for close relatives);

- marriage certificate (with deductions for husband or wife);

- application for return (if the inventory and application are not summarized).

Is it possible not to attach a 2-NDFL certificate to the 3-NDFL, see. You can download a sample list of documents to the tax office for the specified deduction on the website.

What expenses of an individual fall under the social deduction, read. If the payer wants to take advantage of a property deduction, for example, for the costs of purchasing an apartment under an equity participation agreement (hereinafter referred to as the DDU), he lists in the inventory:

- ;

Find out how to fill out the 3-NDFL declaration for property deduction.

- ;

- DDU;

- Act of Handover;

- payment documents;

- application for distribution of deductions (on joint or common property);

- application for personal income tax refund.

A sample of how to make an inventory of documents for the tax office will help you deal with this issue. Thus, an inventory of property deductions, combined with an application for a deduction, can be downloaded on our website. For information on the property deduction and documents supporting it, see

in publication. The inventory is an important component of the procedure for submitting documents to the Federal Tax Service. It serves as confirmation of the transfer of documents to the tax office, and will also help you avoid re-requesting them in the future.

We advise you to read the latest from the forum