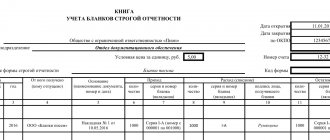

To record transactions and prepare financial statements, small businesses often use Form No. K-1 - a book (journal) for recording the facts of economic activity. This form is relevant for companies that work with a small number of accounting accounts and carry out literally a few (up to 30) transactions per month.

The form of the book was approved by Order of the Ministry of Finance of the Russian Federation No. 64n dated December 21, 1998, which recommends the principles of organizing accounting in small companies. It is the ability to keep records in a simplified version that is valued by businessmen, since in this case, of the many accounting forms and registers, only a book of accounting facts of economic activity can be used in work - a document used to register and reflect the transactions performed.

Features of the K-1 form

So, the book of accounting facts of economic activity can be used by companies that do not produce products or large-scale work with large resource costs.

The book of Form No. K-1 is at the same time a register of analytical and synthetic accounting, on the basis of which it is easy to determine the size of the company’s assets, determine the nature of their sources as of a given date, and it is also possible to draw up the company’s financial statements. The book optimally combines all applicable accounting accounts, on which the amounts for recorded transactions are accumulated.

The enterprise independently chooses the method of maintaining the form: it can draw up a book for recording the facts of economic activity on a monthly basis or keep one book for the entire reporting year, having previously laced it, numbered the pages and certified the last sheet, on which the number of sheets is indicated in words, with a seal (if any) and the signature of the person, carrying out accounting for the company.

Ledger

dic.academic.ru

How does the form of a book of accounting facts of economic activity work?

Form K-1 is filled out using traditional accounting principles. It necessarily reflects the amount of account balances at the beginning of the period or the company’s activities. In the book, adhering to a clear chronology, all transactions of the month are recorded using the double entry method of debit and credit accounts. In column No. 4, the amount is entered for each reflected transaction. To justify the reliability of the recorded transactions, in columns No. 2 and 3, the essence of each of them is explained in detail, indicating the dates, names and numbers of the accounting confirmation “primary document”.

At the end of the month, the accountant calculates the turnover of the accounts, after which the balances are calculated on the last day of the month. The same balance amounts are carried forward to the beginning of the next reporting period.

Such a simplified form is an excellent find for accounting in a small enterprise, especially if it does not have fixed assets, and settlements with partners and contractors exclude the formation of debt. Note that in addition to this form, the accountant maintains a payroll record, personal accounts, and a cash book.

Journal of registration of facts of economic life

for January of this year

| No. | facts of economic life | Account correspondence | Amount, monetary units |

| Debit | Credit | ||

| … | |||

| Total turnover for the period |

Appendix B

(informative)

Analytical accounting card for account 10 “Materials”.

(filled out separately for each type of material: fiberboard, chipboard, plywood, etc.)

Name _________________, price, den. units ______, units measured ______.

| Coming | Consumption | ||||

| FHJ number | quantity | amount, den. units | FHJ number | quantity | amount, den. units |

| Sn | |||||

| Turnover | Turnover | ||||

| Sk |

Appendix B

(informative)

Analytical accounting card

on account 60 “Settlements with suppliers and contractors”

(filled out separately for each supplier: Krasn. DOK, Shelen, etc.)

Name of supplier organization_______________________________________________

| Debit | Credit | ||

| FHJ number | amount, den. units | FHJ number | amount, den. units |

| Sn | Sn | ||

| Turnover | Turnover | ||

| Sk | Sk |

Appendix D

(informative)

Turnover sheet for analytical accounts to account 10 “Materials” for January of the current year

| Name | Unit change | Price, monetary units | Balance as of December 31 of the previous year. | January turnover | Balance as of January 31 of the current year | ||

| debit | credit | ||||||

| quantity | sum | quantity | sum | quantity | sum | quantity | sum |

| Plywood, | m2 | ||||||

| Fiberboard | m2 | ||||||

| etc. | |||||||

| Total | — | — | — | — | — | — |

Appendix D

(informative)

Turnover sheet for analytical accounts to account 60 “Settlements with suppliers and contractors for January of the current year

| Account name | Balance as of December 31 of the previous year. | January turnover | Balance as of January 31 of the current year. | ||

| debit | credit | debit | credit | debit | credit |

| Krasnoyarsk DOK | |||||

| Factory "Shelen" | |||||

| etc. | |||||

| Total |

Appendix E

(informative)

did not you find what you were looking for?

Use the search:

Simple accounting system is a system of accounting without using the double entry method. It is used for accounting on off-balance sheet accounts, and can also be used in cases provided for by law (for example, micro-enterprises and socially oriented non-profit organizations).

Explanation

In accounting, business transactions are reflected using the Double Entry method, when each business transaction is described in pairs of accounting accounts (debit of one account and credit of another). The priority use of this method is indicated by legislation:

Accounting is carried out through double entry in the accounting accounts, unless otherwise established by federal standards (Article 10 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”).

Double entry example

A trading organization sells goods with a cost of 100 rubles at a price of 120 rubles (VAT is not assessed). This business situation is reflected in accounting by the following entries:

120 D 62 “Settlements with buyers and customers” K 90 “Sales” - sales of goods are reflected

100 D 90 “Sales” K 41 “Goods” - the cost of the goods is written off

20 D 90 “Sales” K 99 “Profits and losses” - profit from the sale of goods is identified

At the same time, in some cases, the use of the so-called simple accounting system is permitted - without double entry. Such cases are directly named in the accounting documents. Thus, the Instructions for the Application of the Chart of Accounts indicate that accounting for Off-Balance Sheet Accounts is carried out using a simple system. Point 6.

1. Accounting Regulations “Accounting Policy of the Organization” (PBU 1/2008), approved. Order of the Ministry of Finance of Russia dated October 6, 2008 N 106n indicates that when developing an accounting policy, micro-enterprises and socially oriented non-profit organizations have the right to provide for the maintenance of accounting records using a simple system (without using double entry).

Example

The receipt of property for rent is reflected by the posting (Off-balance sheet account):

Debit 001 for the amount of leased property received.

Additionally

Treatise on Accounts and Records (Luca Pacioli)

An accounting account is an accounting unit that is used for accounting information about homogeneous assets, liabilities, and capital.

The debit side of the ledger account is the left side of the ledger account.

What is a business transaction log and how to fill it out correctly?

Derived from the Latin debet, meaning "he must."

The credit of the ledger account is the right side of the ledger account. Derived from the Latin credit, which means “trust.”

A chart of accounts is a document that contains a list of accounting accounts and the procedure for their application.

Chart of accounts (Document)

Account balance is the final result of an accounting account as of any date.

| business transaction | Amount, rub. |

We fill out a book of accounting facts of economic activity

Task No. 7

Synthetic account 60 “Settlements with suppliers and contractors” has an expanded balance at the beginning of the reporting period:

1) By debit – 100,000 rubles:

— JSC “Astron” — 40,000 rubles;

— JSC “Wind of Change” — 60,000 rubles.

2) On loan – 80,000 rubles. (debt to Zarya LLC)

During the reporting period, the following facts of economic activity were reflected on the account:

| Dt | CT |

| Received funds from customers for sold products into the bank account | 118 000 |

| Materials received from supplier | 25 000 |

| Receivables were paid to suppliers from the current account for materials supplied | 48 000 |

| Materials written off for main production | 25 000 |

| Personal income tax transferred to the budget | 7 900 |

| Receipt of unused accountable amount to the cash desk is reflected | 5 000 |

| The debt on a short-term loan from the current account was repaid | 80 000 |

| Salary accrued to the accountant of the enterprise | 69 000 |

| Personal income tax withheld from employee wages | 7 900 |

| Purchased a fixed asset - a car | 100 000 |

| VAT on the purchased car is reflected | 18 000 |

| A fixed asset - a car - was put into operation | 100 000 |

| fact | Amount, rub. | Dt | CT |

| Materials received from JSC Astron | 60 000 | ||

| Previously paid materials have been received from JSC “Wind of Changes” | 30 000 | ||

| Funds were transferred to Wind of Change OJSC for further supplies of materials | 20 000 | ||

| The debt of JSC Zarya was paid from the current account | 70 000 |

Fill out the journal for recording the facts of economic life and display the expanded final balance using synthetic account 60 “Settlements with suppliers and contractors”

| Midrange 60 – JSC “Astron” | |

| debit | credit |

| Turnover | Turnover |

| Midrange 60 — JSC “Wind of Changes” | |

| debit | credit |

| Turnover | Turnover |

| Midrange 60 – Zarya LLC | |

| debit | credit |

| Turnover | Turnover |

| 60 “Settlements with suppliers and contractors | |

| debit | credit |

| Turnover | Turnover |

Prepare a balance sheet for analytical accounts based on data...

| No./p | Supplier name | Initial balance | Monthly turnover | Final balance | |

| debit | credit | debit | credit | debit | credit |

| 1 | JSC "Astron" | ||||

| 2 | JSC "Wind of Change" | ||||

| 3 | Zarya LLC | ||||

| Total |

SECTION 7

Book of accounting of business transactions. Form No. K-1

Source: https://printscanner.ru/zhurnal-registracii-faktov-hozjajstvennoj-zhizni/

An example of filling out a book of accounting facts of economic activity

Let's figure out how to fill out the registration book using the example of the activities of the Omega LLC enterprise for the month of July. Initial data:

| Accounts | Balances at the beginning of the month in rubles. |

| 50 | 15 000 |

| 51 | 85 000 |

| 84 | 68 000 |

In July 2020, the following operations were carried out:

- Accepted completed work from the contractor in the amount of 16,000 rubles;

- Payment for the work was made in the amount of 16,000 rubles.

- The goods are shipped to the buyer - 20,000 rubles;

- Payment received from the buyer - 20,000 rubles;

- Staff salaries were accrued - 12,000 rubles;

- Contributions to extra-budgetary funds have been accrued and transferred - 3,600 rubles;

- Salary paid - 10,440 rubles;

- Personal income tax withheld and transferred - 1560 rubles.

Let's fill out a book (journal) recording the facts of economic activity:

Accounting under the simplified tax system

From this article you will learn:

- What options for organizing accounting can be used by payers of the simplified tax system?

- In which registers should business transactions be recorded?

- How to keep records without double entry and is it worth doing?

The Russian Ministry of Finance presented Recommendations on the use of simplified methods of accounting and preparation of financial statements (hereinafter referred to as the Recommendations). This document was developed by the Institute of Professional Accountants and Auditors of Russia specifically for small businesses.

Who is a small business in 2020?

The Recommendations are not a normative document. Therefore, you decide for yourself whether it is advisable to use them or not. In this article we will introduce you to the basic simplified accounting techniques recommended by the Russian Ministry of Finance. And you can choose for yourself those recommendations that you find useful. Let’s say right away that the Ministry of Finance offers three possible ways to organize simplified accounting:

- full form of simplified accounting;

- abridged version;

- simple system.

We presented their comparative characteristics in the table.

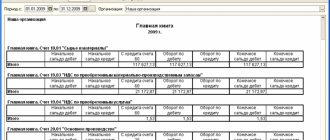

Table. Comparative characteristics of simplified accounting methods

Methods Characteristics Note

| Full form | Accounting is carried out using the double entry method. That is, all transactions are recorded by debit and credit simultaneously using registers: - statements of accounting for fixed assets and accrued depreciation, inventories, cash, settlements with suppliers and personnel, etc.; - summary (chess) statement - it summarizes the information according to the above documents. Based on the “checkerboard”, a turnover sheet is drawn up and the balances as of the last day of the reporting period (month, quarter, year, etc.) are displayed. | Statement forms (forms No. 1 - 9 MP) are given in Appendices 2 - 10 to the Recommendations; A sample of the turnover sheet is presented in the Recommendations section “Full form of accounting” |

| Short form | Business transactions are recorded through a double entry in the Book (journal) of recording the facts of economic life. Along with the Book, a payroll record sheet should be used for settlements with personnel regarding wages. The remaining statements (forms No. 1 - 9 MP) can be used if desired, if the listed forms are not enough | A sample Book (journal) for recording facts of economic life (form No. K-1 MP) is given in Appendix 11 to the Recommendations; form of the statement of accounting of settlements with personnel for wages (form No. 8 MP) - in Appendix 9 |

| Simple system | Simple accounting is carried out without double entry, that is, without reflecting debit and credit amounts at the same time. All transactions are recorded in a special Book (journal) of accounting facts of economic life according to groups of items in the balance sheet and financial performance statement | A sample Book (journal) for recording facts of economic life (form No. K-2 MP) is given in Appendix 12 to the Recommendations |

Full form of simplified accounting

Suitable for: small organizations with a variety of business operations. The full form of simplified accounting actually resembles regular accounting.

Since here, too, all business transactions are accounted for using the double entry method in the appropriate registers. But there are also concessions towards simplified accounting (box below).

Moreover, these relaxations are typical for all accounting methods given in the Recommendations.

| The first difference is the abbreviated chart of accounts. That is, instead of a universal accounting chart of accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, small enterprises can develop their own working plan, combining similar accounting accounts in it. Tips on how to reduce the general chart of accounts are given in paragraphs 3 - 3.2 of the information of the Ministry of Finance of Russia No. PZ-3/2012. Second difference |

Source: https://www.26-2.ru/art/178357-red-buhgalterskiy-uchet-pri-usn

Journal of business transactions

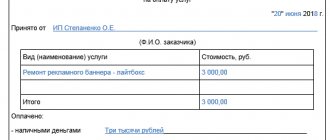

Accurate and up-to-date information on completed household activities. operations are required for the effective management of the company, as well as for tax accounting purposes. The business journal is one of the main accounting documents. Read more about what it is and how it is filled out in this article.

Housekeeping log. transactions is the most complete accounting register. It contains records of all transactions performed by the company during its activities. This document contains a list of all transactions that are reflected in accounting.

The business transaction log reflects almost all changes that occur in the company:

- Changes in the composition and structure of assets;

- Changes in the composition and structure of liabilities;

- Positive and negative changes in the welfare of the company;

- Other changes.

Since the amount of information entered into the journal is quite large, this document is inconvenient for grouping information and conducting analysis. However, if there is a need to track completed transactions over a certain period of time, it is indispensable.

Purpose of the magazine

Documenting business transactions in accounting and considering them together allows the analyst to:

- Conduct a competent analysis of the current situation in the company;

- Supervise financial condition;

- Give a forecast of future changes;

- Draw the necessary conclusions;

- Take measures to optimize the financial health of the company.

Consequently, documenting households. operations and accounting are related. Thanks to them, the legality and transparency of transactions is ensured.

General filling rules

The procedure for documenting business transactions in different companies may be different. However, there are uniform rules that all companies must follow:

- A new entry must be made starting on a new line;

- The journal must reflect every transaction made in the company;

- Numerical information is written in words;

- Transactions are reflected starting from the earliest date and ending with the most recent one.