The organization is on a general taxation system and uses the accrual method. The employee was on sick leave from September 26, 2019 to October 4, 2019. The sick leave arrived on 10/05/2019. What are the accounting entries for calculating temporary disability benefits? What is the period for recognizing this expense in accounting and tax accounting?

Having considered the issue, we came to the following conclusion:

In accounting and tax accounting, expenses for the payment of temporary disability benefits for the first 3 days of illness should be recognized in the period of its accrual (appointment), that is, in October.

Rationale for the conclusion:

As a general rule, temporary disability benefits (hereinafter referred to as benefits) are assigned and paid by the employer (Part 1 of Art.

Articles on the topic (click to view)

- Is sick leave considered income?

- What to do if you have extended sick leave for pregnancy and childbirth

- What to do if your employer does not accept electronic sick leave

- What to do if you are not given sick leave

- How many days does it take for sick leave to arrive from the Social Insurance Fund?

- What to do if the place of work is not indicated on the sick leave

- Are sick leave taken into account when calculating maternity leave?

13 of the Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, hereinafter referred to as Law N 255-FZ). The basis for this is, in particular, a certificate of incapacity for work issued by a medical organization (Part.

5 tbsp. 13 of Law N 255-FZ).

As follows from Part 1 of Art.

15 of Law N 255-FZ, the employer assigns benefits within 10 calendar days from the date the employee applies for it with the necessary documents. For the first 3 days of temporary incapacity for work, the benefit is paid at the expense of the employer, and for the remaining period (starting from the fourth day of temporary incapacity for work) - at the expense of the Social Insurance Fund of the Russian Federation (clause

1 tsp. 2 tbsp.

3 of Law N 255-FZ).

Accounting

The rules for the formation in accounting of information about the expenses of commercial organizations (except for credit and insurance organizations), which are legal entities under the legislation of the Russian Federation, are established by PBU 10/99 “Expenses of an organization.”

In the understanding of clause 2 of PBU 10/99, the expense for the employing organization will be only the amount of benefits paid for the first 3 days of temporary disability. The amount of the benefit, in the part attributable to the Social Insurance Fund of the Russian Federation, is subject to credit to the appropriate settlement account.

The amount of benefits accrued in accordance with current legislation, paid at the expense of the employer, can be attributed in accounting to expenses for ordinary activities (clauses 4, 5, 8 of PBU 10/99).

According to clause 16 of PBU 10/99, expenses are recognized in accounting if the following conditions are met:

the expense is made in accordance with a specific agreement, the requirements of legislative and regulatory acts, and business customs;

the amount of expenditure can be determined;

there is certainty that a particular transaction will result in a reduction in the economic benefits of the entity.

All of the above conditions regarding the benefit are met after the organization receives a certificate of incapacity for work from the employee and calculates the benefit, which can be documented with the appropriate accounting certificate.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

In general, expenses are recognized in the reporting period in which they occurred, regardless of the time of actual payment of funds and other forms of implementation (assuming the temporary certainty of the facts of economic activity) (clause 18 of PBU 10/99).

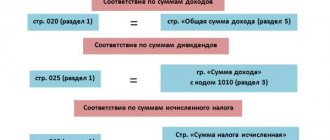

Thus, we believe that expenses in the form of benefits to the organization in this case should be reflected in expenses for October, upon the fact of its assignment (accrual), that is, in October. In this case, the following posting scheme will be used (see the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its use, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n):

Debit 20 (23, 25, 26, 44.) Credit 70 - the amount of benefits for the first 3 days of incapacity for work has been accrued, to be paid at the expense of the organization;

Debit 69 Credit 70 - the amount of benefits paid from the funds of the Federal Social Insurance Fund of the Russian Federation has been accrued.

Corporate income tax

For profit tax purposes, the employer's expenses for paying benefits for the first 3 days of the employee's incapacity for work are classified as other expenses related to production and (or) sales (clause 48.1, clause 1, article 264 of the Tax Code of the Russian Federation).

It should also be taken into account that only documented costs can be taken into account in expenses (clause 1 of Article 252, Article 313 of the Tax Code of the Russian Federation). Accordingly, until the employee receives a certificate of incapacity for work and benefits are calculated, the organization cannot recognize the corresponding amount as expenses.

Thus, we believe that in the case under consideration, expenses in the form of benefits for the first three days of the employee’s illness should be recognized in tax accounting in the period of its appointment (accrual), that is, in October.

We also recommend that you read the following materials:

— Encyclopedia of solutions. Accounting for the employer's expenses for the payment of temporary disability benefits for the first days of illness;

— Encyclopedia of solutions. Employer's expenses for temporary disability benefits for the first days of illness (for profit tax purposes);

— Encyclopedia of solutions. Taxation of benefits paid at the place of work.

Answer prepared by: Expert of the Legal Consulting Service GARANT, Candidate of Economic Sciences Ignatiev Dmitry

This is important to know: For what reason can you take sick leave?

The answer has passed quality control

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.

Features of registration of rolling sick leave

Every officially employed person, in case of injury, illness or other health problems, goes to the clinic at his place of residence to open a sick leave certificate, which is important for both the employee and the employer and is confirmation of absence due to illness.

The law requires each employee to provide sick leave, otherwise absence from work is considered absenteeism. This official form also gives the right to be treated at home and receive benefits during forced “rest.”

https://youtu.be/EJXSC3EsRBM

What is the difference from regular sick leave?

Regular sick leave opens and closes within one month. For example, an employee fell ill on November 5, and went to work on the 15th and provided sick leave, opened on November 5 and closed on November 14. This is a regular sick leave.

If the certificate of incapacity for work is open in one month and closed in another, then this is a rolling sick leave. For example, an employee fell ill on May 28 and returned to work on June 10.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Typically, rolling leave refers to sick leave opened in December and closed in January. But this may also apply to other months of the year.

Month of accrual on sick leave

The employee brought in sick leave for March in the first half of April (before payroll for the month of March was calculated). The period is still open and we issue sick leave in March (so as not to handle absences in March in another way) with payment in April. When we generate reports on insurance premiums and 6 personal income taxes, we see that accrued wages for 6 personal income taxes and insurance contributions are different. In the report on insurance premiums, sick leave accrual was carried out according to the month of accrual (March), and in 6 personal income taxes according to the month of the tax period (April). How can I explain to the Federal Tax Service why the amount of income for personal income tax and for contributions is different? What is the easiest way to keep track of no-shows in our case?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Who can issue a rolling sick leave?

The legislation allows the issuance of sick leave only to licensed medical institutions:

- These can be public clinics or hospitals and private medical centers that have licenses and certificates. Forms must be filled out in accordance with established rules, dates must be accurately and clearly stated.

- The document can also be obtained from a foreign clinic if the employee falls ill during a business trip. In this case, sick leave is issued according to the laws of this country, and upon return it is provided to the personnel department.

The minimum period for which sick leave is opened is 3 days. Even if the employee feels better, he cannot begin his job duties on the second day.

The maximum period for opening a sick leave is a month. If recovery has not occurred during this time, and it is necessary to continue treatment, the head physician of the medical institution gathers a council of doctors, at which the issue of further treatment or closure of sick leave is decided.

Payment period (sick leave)

After the accountant has calculated the sick leave, it must be issued to the employee at the next salary payment. According to the law, there must be two such days in a month - the issuance of an advance payment and the rest of the earnings. On the earliest day, you must transfer the amount of sick leave, from which personal income tax will already be deducted.

If an employee considers that the employer violated the payment deadlines, he has the right to write a complaint to the labor inspectorate, the prosecutor's office, or go to court.

The appeal must state the facts and then provide evidence of the violation; the latter may include:

- A copy of the certificate of incapacity for work;

- A copy of the concluded agreement between the employee and the company;

- Pay slip indicating the amount of sick leave;

- A copy of the payroll or statement of transactions on the salary card;

- Other documents that confirm violation of the payment process.

When will sick leave be issued?

A sick leave certificate will only be issued to a truly sick person (illness or injury). This does not apply to a person under the influence of drugs or alcohol.

The following situations are also possible:

- If a relative is sick and needs care.

- Health problems due to pregnancy.

- Childbirth is coming.

- The person is in quarantine.

Important! If an employee falls ill during vacation, the vacation can be extended after recovery.

How to take into account excluded periods when calculating sick leave

Important

The maximum period within which an employee is required to provide such a form is six months. If it is brought later, it is not subject to accounting and, accordingly, payment. According to the law, the first three days of illness are paid from the employer’s reserves.

All subsequent days, the benefit is sent to the patient’s account from the Social Insurance Fund. This only works if the employee works officially and the company makes mandatory payments to the insurance fund. If an employee falls ill during compensatory leave or paid leave, only sick leave days are counted during this period. The employee will be able to use the allotted time off or vacation after recovery. Transferring sick leave is accrued within 10 days after the form is received by the HR department. Payment for sick leave is made on the next day of payment of wages.

How does payment work?

After recovery, the sick leave is transferred to the accounting department. But no later than six months from the date of termination of the sick leave. Otherwise, benefits will not be accrued.

In accordance with Federal Law No. 255 of 03/09/16, after submitting a certificate of incapacity for work, benefits are accrued within 10 days and issued together with the next salary or advance payment.

Benefit payment calculation

To calculate the payment amount you need to know:

- How many days did the sick leave officially last?

- Official work experience.

- Average wage for one day.

Benefit amount

The amount of the benefit directly depends on the length of service, as well as on the salary of the last two years:

- If the experience is less than 2 years, then provide a certificate from a previous job for correct calculation.

- If the work experience is more than 8 years, then the amount of benefits for one day of sick leave is equal to the average income per day.

- From 5 to 8 years - 80% of average income.

- Up to 5 years - 60% of average income.

- Up to 6 months - payments are calculated according to the minimum wage.

The calculation of rolling sick leave is made using the same formula as for regular sick leave.

The average salary per day is calculated as follows: the annual salary for the two previous years is divided by 730 days. Then it is multiplied by the number of days of sick leave and by a coefficient (0.8; 0.6 or according to the minimum wage).

Let's look at an example

Employee A.A. Petrov provided sick leave, which was opened on December 25, 2020, and closed on January 10, 2020. On January 11, the employee began his official duties. Thus, he was sick for 7 days in December and 10 in January - a total of 17 days.

The amount of his income for the previous 2 years:

- For 2020 - 300 thousand rubles.

- For 2020 - 350 thousand rubles.

Total 650 thousand rubles for two years.

So, the total payment for 17 days of sick leave will be 889 * 17 = 15,113 rubles.

Important! The employee will not receive the entire amount: taxes will be deducted.

How to calculate sick leave benefits in 2020

After returning to work after illness, the employee presents a sick leave certificate. The organization is obliged to assign him a benefit within 10 calendar days from the date of application and pay it on the next day established for payment of wages. According to Article 15 of Law No. 255-FZ.

The benefit is accrued and paid if the employee applies for it no later than six months from the date of starting work. According to Article 12 of Law No. 255-FZ.

You must pay for the entire period of the employee’s incapacity, including weekends and non-working holidays.

In case of illness or domestic injury, benefits for the first three days of incapacity are paid to the employee at the expense of the company, and from the fourth day - at the expense of the Federal Social Insurance Fund of the Russian Federation (Clause 2, Article 3 of the Federal Law of December 29, 2006 No. 255-FZ).

What difficulties arise when paying for temporary sick leave?

Difficulties with calculating and paying for transitional sick leave usually do not arise.

You need to know some nuances:

- A sick leave sheet opened in December and closed after the new year contains at least 2 forms, one of which relates to the new year, and the other to the previous year.

- Sheets can be provided at different times, then payment will be calculated for each form separately.

- If the sick leave is provided with a complete set of forms after the sheet is closed, then the payment will be calculated in the total amount within 10 days from the date of provision of the papers.

How benefits are calculated

According to Federal Law No. 255 of 03/09/2016, transferable sick leave benefits must be accrued within 10 days and payment scheduled for the first upcoming date of salary or advance payment. If the sick leave is transferred to another month, then the accruals are divided and paid for each form separately (if the sick leave contains several sheets). If the employee did not bring the form for sick days that were closed, then the entire payment can be made once, when all the forms are received by the accounting department.

The transferable sick leave benefit must be accrued within 10 days and the payment scheduled for the first upcoming date of salary or advance payment.

It is more difficult if the employee fell ill in December and the doctor extends the certificate of incapacity until January. The New Year holidays are ahead, and the employee will start work only next year. Here, each case is considered individually and everything depends on the day on which the rolling sick leave was transferred to the employer. The employee can do this within 6 months from the date of termination of the sick leave. Therefore, the timing of the calculation and issuance of benefits depends on the sick person. The sooner the employee submits the form to the manager, the fewer problems there will be with entering information into the reporting documents.

Payment for rolling sick leave is made according to the same rules as for simple sick leave. Accrual and payment can be made upon submission of each form or all at once, after complete recovery. The employer should pay attention to the reporting, which must be submitted on time, despite the duration of the sick leave.

Therefore, the calculation period is always taken to be exactly 730 days. Incorrect calculation of the maximum limit for maternity benefits The average monthly earnings, on the basis of which the amount of maternity benefits is calculated, should be calculated by dividing the amount of accountable payments received by the employee for the reporting period by the difference between the number 730 and the number of calendar days in the periods subject to exclusion. Registration of two insured events instead of one In case of a long illness or recovery from an accident, one insured event can be issued with several sick leave certificates. But at the same time, only one should indicate that it is primary, and payment for the first three days is made by the employer.

Transition to electronic sick leave certificates

In 2020, a new federal law No. 86 was issued on the transition from paper sick leave certificates to electronic ones for all medical institutions. This will simplify and speed up the transfer of documents via the Internet to the accounting department and the Social Insurance Fund. The law does not deprive an employee of the right to receive a certificate of incapacity for work in traditional paper form, and in electronic form the papers are sent to the relevant organizations only with voluntary consent.

This is important to know: Who pays sick leave at the enterprise

From July 1, 2020, a smooth transition to electronic hospital clinics and hospitals connected to the Medical Information System began. The sick leave certificate is signed electronically, and the discharged employee is given his number, with which he goes to the accounting department. As soon as the sick leave is closed, at that very second it is transferred to the work organization and the Social Insurance Fund. Using the number in the database, the accountant will find a document with the necessary information for calculating benefits. It is impossible to falsify such a document, since the communication channels through which it is transmitted are reliably protected.

Rolling sick leave is practically no different from regular sick leave, except that it is open in one month and closed in another. You can obtain the document at any licensed medical institution. Calculating and paying disability benefits is not difficult. The only thing you need to be careful with: if you choose a sick leave certificate on paper, then it must be submitted to the accounting department within the time limits established by law.

How quickly the payment will be calculated depends on the employee: the faster the documents are provided, the faster the money will be transferred to the account.

General concepts

Payment in connection with temporary disability is provided to working citizens if they have submitted sick leave within the time period specified in the law. Otherwise, their absence from the workplace will be interpreted as absenteeism, which entails dismissal under the article. Laws governing the rules and principles for granting sick leave include:

- 255 Federal Law of 2006;

- 347 and 624 orders of the Ministry of Social Development.

Attention! Recently, along with the paper version of the certificate of incapacity for work, an electronic form has also been accepted. The issuance of such a document can only be carried out by an organization that has a digital signature.

In which month should you accrue rolling sick leave?

The following are taken into account when calculating:

- From 5 to 8 years - 80% of the daily average income.

- From 8 and above years of work - 100% of average earnings for the previous 2 years.

- Less than 5 years - 60% of average earnings for the previous 2 years.

If the employee’s total insurance experience is less than ½ year, then the calculation is made based on the minimum wage for 1 month. In this case, tax is withheld from the accruals. Personal income tax from sick leave is withheld by the employer in all cases, except for compensation for pregnancy and childbirth.

When performing the calculation, various information is taken into account:

- Average earnings per day, calculated by dividing the total earnings for the previous 2 years by 730 days.

- The total insurance period, assessed by the duration of work with employers paying contributions to OSS.

In this regard, when moving to a new place of work, you will need a special certificate for sick leave (form No. 4-n).

Calculation of sick leave benefits

To determine the amount of sick leave for an employee, the accountant must have the following data:

- about the amount of average daily earnings;

- on the duration of the insurance period (cumulative periods during which contributions to the Pension Fund were made);

- number of days on sick leave (indicated on the certificate of incapacity for work).

The following features are also taken into account:

- if the work experience is less than 2 years, the employee must bring to the accounting department a certificate of employment for earlier periods from previous employers (if he was officially employed);

- if the employee’s work experience is less than six months, the benefit is calculated based on the current minimum wage;

- if the employee’s work experience is less than 5 years, from 5 to 8 years, more than 8 years, the benefit for each day of sick leave is 60%, 80% and 100% of the average daily earnings, respectively.

Sick leave rolling over to the next month payment

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

However, if for some reason it is not possible to submit a document, then by virtue of Part 1 of Art. How to calculate wages if there was sick leave In this case, either the employer’s accounting department refuses to make calculations using such a document, or it is returned by the Social Insurance Fund.

For the employee, this means a new visit to the medical institution and receiving a duplicate. This may take quite a long time.

Unfortunately, the responsibility of medical institutions in the event of such a situation, as well as in the event of a delay in issuing sick leave due to various reasons, has not been established. But the employee has the opportunity to file a civil claim in court if such actions of the doctors led to material damage or moral harm.

You cannot open the sheet “retrospectively”; this is strictly prohibited by law. That is, all previous days of illness on sick leave will not be taken into account, which means they will remain unpaid.

A standard sick leave certificate for incapacity for work is issued for a period of up to 15 days.

When should you apply for sick leave?

The law establishes the exact time frame within which you can apply to your employer for sick pay.

If sick leave was opened due to illness, then the benefit is paid within six months from the date of registration of the document. The same period is set as a limit if sick leave is paid due to caring for a sick relative.

The benefit accrued for sick leave for pregnancy and childbirth must be paid within six months from the date of completion of the relevant leave.

The benefit that is assigned to an employee for caring for a child under 1.5 years of age can be assigned if six months have not yet passed since the date of reaching this age.

Attention! If the established payment period has already passed, then the decision is made by the territorial body of the Social Insurance Fund. He needs to provide evidence that the deadline was missed for a good reason. The list of such reasons is approved by law.

If a pilot Social Insurance Fund project has been implemented in your region, then sick leave, maternity and other payments are transferred directly to the employee who is applying for these payments.

"Transitional" sick leave.

When should benefits be taken into account?

Employee O. Period Benefit amount, rub. Ivanov A.I. From July 24 to July 31 160 From August 1 to August 2 40 Total 200 Petrova E.S. From August 2 to August 31 600 September 600 October 620 November 600 From December 1 to December 5 100 Total 2520 Salaries are paid to employees twice a month: - on the 25th - for the first half of the month (advance); - 14th - final payment for the previous month.

The organization pays contributions to the Fund's budget on a monthly basis.

We assign benefits In general, sick leave benefits are assigned within 10 days from the date of application. If additional documents (information, information) are required to assign benefits, the period for their assignment may be extended to one month.

In the language of an accountant, to assign a benefit is to determine its size and accrue the calculated amount, i.e.

In what month should we record “carrying over” sick leave in 2-personal income tax?

How to take into account the payment of such a benefit to the Social Insurance Fund and will it be possible to reduce the amount of insurance premiums? According to the law, payment of disability benefits is divided into two amounts:

- All subsequent days of sick leave are paid by the Social Insurance Fund if the employee has a medical insurance policy and certain insurance contributions are made for it.

- The first 3 days of sick leave are paid by the employer, and this can be considered an expense.

Payment difficulties are caused by rolling sick leave, which is carried over to the next year (from December to January).

Rolling sick leave (calculation and payment)

For example, an employee went on sick leave on October 4, and returned to the workplace on October 19 (accordingly, the certificate of incapacity for work was opened on October 4, and closed on the 19th). It opens in one month and closes in the next. For example, an employee fell ill and went to the clinic for sick leave on July 20, and began his work duties on August 4. As a rule, a rolling sick leave is one that is open in December and closed in January. But sometimes a certificate of incapacity for work, open and closed in other months, is called transferable. If an employee contacts a medical organization, this does not mean that he will automatically receive a certificate of incapacity for work - it is necessary to undergo an examination so that the fact of the disease is confirmed.

If the doctor does not find any signs of illness, a sick leave certificate is not issued, since there is no reason for this. The same applies to workers who end up in a clinic due to alcohol, drug or toxic intoxication.

Calculation of benefits for sick leave carried over to the next year

A sick leave opened in December (or earlier) and closed in any month of the next year is usually issued on several sheets (at least two). One part of the forms relates to the previous year, and the other to the new year.

An employee may bring the sheets at different times. Then the employer calculates the benefit separately for each form. If the employee brought all the sheets after illness, then the total amount due for the entire period of illness can be paid.

The month for accrual of sick leave will be January or any other month of the year, depending on when the form was brought from the hospital.

To understand how payment for rolling sick leave occurs, let’s look at the example of a sick leave certificate opened in December 2020 and closed in January 2020.

Ivanova I.I. has been working at Luch LLC since 2014. Previously, the citizen had never officially worked anywhere. On December 28, a certificate of incapacity for work was opened. Closing date is January 14th. Since January 15, Ivanova has been working at her workplace.

The sum of all payments during the employee’s work:

- 2014 – 258,000 rubles;

- 2015 – 299,000 rubles;

- 2016 – 318,000 rubles;

- 2017 – 350,000 rubles.

The benefit will be accrued from December to January (from 28 to 14, respectively), that is, in 18 days (4 days in December and 14 in January).

To calculate the amount of rolling sick leave, two years are taken into account: 2020 and 2020. During these years, earnings amounted to: 299,000 + 318,000 = 617,000 rubles.

The average daily income is: 617000/730 = 845.21 rubles. The employee's experience is 4 years. In this case, a coefficient equal to 0.6 (60%) of the average daily payments is applied to daily earnings.

Allowance for one day: 845.21 * 0.6 = 507.13 rubles. Since the duration of sick leave is 18 days, the benefit will be paid in the amount of: 507.13 * 18 = 9,128.34 rubles.

It is important to consider that when calculating disability benefits, deductions in the form of tax payments are taken into account. That is, the employee will receive the amount minus personal income tax.

A medical institution has the right to open a certificate of incapacity for work for a person working at an enterprise if he applies to it in case of illness or injury. According to existing legislation, the employer must pay for this period partly at his own expense, partly at the expense of social insurance funds. The calculation of accruals is carried out by the employer, for this purpose it is convenient to use the sick leave calculator in 2020.

How does the date of payment of sick leave affect personal income tax reporting?

The conflict between calculating personal income tax when calculating temporary disability benefits and clarifying the tax when withholding it creates difficulties for accountants in understanding the results of calculating personal income tax and generating 6-personal income tax reports. It becomes even more difficult if there are grounds for recalculating sick leave.

This is important to know: How is the average salary for sick leave calculated?

Chapter 4 of the Federal Law of December 29, 2006 No. 255-FZ

“On compulsory social insurance in case of temporary disability and in connection with maternity”

regulates the procedure for assigning, calculating and paying benefits for temporary disability.

How to calculate sick leave using an online calculator

Calculation using the calculator occurs in three stages:

- We indicate the sick leave information.

- We enter the amount of earnings for the previous 2 years.

- In the final table we see the result of the calculation, taking into account the insurance period.

The online calculator works taking into account all the new rules for calculating temporary disability benefits. If the average daily earnings are lower, the standard minimum wage will be taken into account in the calculation.

An example of calculating sick leave in 2020

Mikhail Ivanov was on sick leave from May 19 to May 31, 2020 (13 days). M. Ivanov's insurance experience is 6 years. The period for calculating benefits is 2013 and 2014. Let's add up Ivanov's earnings for two years. In 2013, 350,000 rubles were received, in 2014 – 400,000 rubles. Total – 750,000 rubles. We determine what the average daily earnings are: 750,000 / 730 = 1027 rubles. 39 kop. We calculate the amount of the benefit taking into account the length of service (80%): 1027.39 / 100 × 100 = 821.91 rubles. The payment is due: 821.91 × 13 = 10,684 rubles. 83 kopecks

Calculation and payment of sick leave in 2020

The courses are developed taking into account the professional standard “Accountant”. Let us note several important points that should be taken into account when filling out a sick leave certificate: The doctor fills out certain sections, they are indicated in paragraph.

clauses 56 - 63 of the Issuance Procedure and certified with the seal of the medical institution; The doctor has the right not to fill out the line “place of work - name of organization” (especially if the patient cannot correctly name the name of the organization).

The employer can enter the name of the organization himself using a black gel, capillary or fountain pen and block letters.

Content

In case of illness or injury of various nature, an officially employed employee is sent to the clinic. At a medical institution, the local doctor makes a diagnosis and refers you to another specialist for sick leave. This document is very important not only for the sick employee, but also for his employer.

The form is an official confirmation of the onset of the disease. This means that the employee has the right to spend some time at home. During the days of forced “vacation”, the company’s accountant is obliged to calculate the patient’s benefits for the period of incapacity for work.

If an employee wishes to stay at home during illness and has not filed an official sick leave in accordance with the law, days spent off duty will be considered absenteeism and will not be paid.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

If an employee fell ill in one month and began his job duties during that month, then this is a regular sick leave. And if the sick leave ends in the next month or even in the new year, it will be considered rolling (that is, the sick leave goes to another year).

Example. The employee issued a certificate of incapacity for work on March 22, and left on April 9 - this is a rolling sick leave. If the illness lasted from December 25 to January 18, then the recovery period ends in the new year.

Who has the right to issue sick leave to an employee?

To formalize the course of the disease, you must contact:

- To the assigned clinic at your place of residence;

- To a medical institution for which the employee has a voluntary insurance policy (issued through the place of employment).

Not every medical representative has the right to open and close a certificate of incapacity for work.

This right belongs to:

- Municipal hospital workers;

- Doctors of private clinics with a special license;

- Representatives of foreign clinics (this option can be used if you get sick on a business trip while in another country. In this case, sick leave is issued in accordance with all the rules of the host country. At the end of the business trip, present a document on disability to the personnel department).

They will not be able to register a certificate of incapacity for work:

- Health resort workers;

- Representatives of medical examination;

- Doctors who arrived on an ambulance call;

- Employees of the medical office at the enterprise;

- Physiotherapy doctors;

- Medical personnel performing blood collection and transfusion.

The minimum period for which sick leave can be opened is three days. If the next day after feeling unwell you feel significantly better and decide to begin your official duties, you will have to wait another two days or negotiate with management.

Sick leave is opened for a maximum period of one month. This time may be extended. If the attending physician believes that the patient needs long-term treatment, he is referred to the head physician.

The latter assembles a medical commission of experienced doctors who get to know the patient and his medical history. As a result, a decision is made to extend the sick leave or close it.